Professional Documents

Culture Documents

Due Diligence Report Sample

Uploaded by

stsuiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Due Diligence Report Sample

Uploaded by

stsuiCopyright:

Available Formats

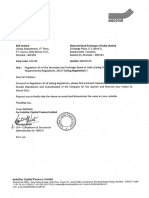

SAMPLE

KESPR Business Advisors

www.kespr.com

Financial Due Diligence Report

Logo [ABC Limited]

Report Date: June 3, 2010

Author's Note:

This report sample shows the detailed information typcialy gathered during due diligence fieldwork for a complex business/organization

and the presentation of that information for our Clients.

Information gathered in this report serves many purposes, such as financial modeling, business valuation and post-transaction integration.

STRICTLY PRIVATE AND CONFIDENTIAL

Financial Due Diligence Report STRICTLY PRIVATE AND CONFIDENTIAL

SAMPLE

[ABC Limited]

Date: June 3, 2010

NOTICE TO READER

KESPR has been engaged by [*] to perform [limited] financial due diligence on [ABC limited] and its subsidiaries.

Our report has been prepared solely for the use of the directors of [*]. This report should not be referred to, in whole or in part, or quoted by expertise or referenced in any manner, or distributed in whole or in part

or copied to any third party without our prior written consent. The scope of the work has been limited to the purpose of our engagement detailed in the engagement letter dated [DATE]

Verification

All material herein was prepared by KESPR based upon information obtained by the company or other sources believed to be reliable. The information contained herein is not guaranteed by KESPR to be

accurate, and should not be considered to be all-inclusive.

Projections

This report may contain statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934,

as amended. The words "may" "would," "will," "expect," "estimate," "anticipate," "believe," "intend," and similar expressions and variations thereof are intended to identify forward-looking statements. Readers are

cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, many of which are beyond KESPR's ability to estimate, forecast or project, and

that actual results may differ materially from those projected in the forward-looking statements as a result of various factors.

Disclaimer on Post-Dated Events

KESPR has no responsibility to update this report for events and circumstances occurring after the date of completion of our field work, which was completed on [DATE].

Limited Review report

Because the scope of our work has been limited by the time available and/or by the information made available to us, you should not rely on our work and our report as being comprehensive as we may not have

become aware of all facts or information that you may regard as relevant. Accordingly, KESPR is not in a position to make a representation, and cannot make a representation as to the sufficiency of these due

diligence procedures for your purposes.

Matters excluded

Areas that were excluded from this due diligence review includes:

- issues of law

- fixed assets and work-in-progress valuation

- intangible assset valuation

- regulatory issues

- other specialist area beyond the expertise of KESPR

You should consider whether to obtain expert advice in relation to these areas.

This report is issued on the understanding you have drawn our attention to all matters of which you are aware concerning the company’s financial position or the proposed transaction which may have an impact

on our report up to the date of signature of the finalized report.

KESPR Business Advisors

Richmond, British Columbia

Canada

Financial Due Diligence Report STRICTLY PRIVATE AND CONFIDENTIAL

SAMPLE

[ABC Limited]

Report Date: June 3, 2010

Report Contents

I Executive Summary

Significant Findings

II Background Information

Company Description

Industry and market trends

Survey of latest economic forecast and news

III Financial Review

1 Cash

2 Working Capital

3 Inventory

4 Fixed Assets

5 Intangible Assets

6 Contingent Liabilities

7 Tax

8 Equity

9 Debt Instruments, bank lines, key terms and conditions

10 Revenue, Cost of Goods Sold, Operating Costs

Market Trends

Customer Contracts

11 Human Resources

Summary of Work Force

Employee Wages, Benefits, Pensions

Union Contracts

12 Insurance

12 Tax

IV Subsequent Events

V Financial Projections

Management's Budget

Appendices

A Legal Entities

B Management Bio

C Organizational Structure

Prepared by KESPR Business Advisory

Financial Due Diligence Report STRICTLY PRIVATE AND CONFIDENTIAL

SAMPLE

[ABC Limited]

EXECUTIVE SUMMARY

Significant Findings:

1. Going Concern

2. Banking Facilities

3. Outstanding Claims Against Company

4. Tax & Other Legal Disputes

Prepared by KESPR Business Advisory

[ABC Limited] SAMPLE

Background Information

COMPANY DESCRIPTION

INDUSTRY DESCRIPTION

MARKET AND COMPETITION

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

Survey of Key Economic Forecasts

2007 2008 2009 2010 F 2011 F

Real GDP Growth Rates

Canada

Royal Bank of Canada 0.5% -2.5% 3.6% 3.5%

Bank of Montreal 2.2% 0.5% -2.5% 3.3% 3.0%

CIBC 2.5% 0.4% -2.5% 2.3% 3.0%

Average 2.4% 0.5% -2.5% 3.1% 3.2%

Median 2.4% 0.5% -2.5% 3.3% 3.0%

2007 2008 2009 2010 F 2011 F

Unemployment

Canada

Royal Bank of Canada 6.1% 8.3% 8.0% 7.2%

Bank of Montreal 6.0% 6.2% 8.3% 8.0% 7.5%

CIBC 6.0% 6.1% 8.3% 8.3% 8.1%

Average 6.0% 6.1% 8.3% 8.1% 7.6%

Median 6.0% 6.1% 8.3% 8.0% 7.5%

2007 2008 2009 2010 F 2011 F

Retail Sales

Canada

Royal Bank of Canada 3.4% -3.0% 6.5% 5.0%

Bank of Montreal

CIBC

Average 3.4% -3.0% 6.5% 5.0%

Median 3.4% -3.0% 6.5% 5.0%

2007 2008 2009 2010 F

Housing Starts

Canada

Royal Bank of Canada 212.0 149.0 189.0 185.0

Bank of Montreal 228.7 211.6 148.9 182.3 178.8

CIBC 228.0 211.0 145.0 180.0 185.0

Average 228.4 211.5 147.6 183.8 182.9

Median 228.4 211.6 148.9 182.3 185.0

2007 2008 2009 2010 F 2011 F

CPI

Canada

Royal Bank of Canada 2.4% 0.3% 1.9% 2.2%

Bank of Montreal 2.1% 2.4% 0.3% 1.8% 1.9%

CIBC 2.1% 2.4% 0.3% 2.0% 2.1%

Average 2.1% 2.4% 0.3% 1.9% 2.1%

Median 2.1% 2.4% 0.3% 1.9% 2.1%

2007 2008 2009 2010 F

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

Survey of Key Economic Forecasts

Recent Major Events

Country Date Headlines

Canada

United States

Other

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

Historical Financial Statements (Summarized)

Balance Sheet Oct 31, 2007 Oct 31, 2008 Oct 31, 2009 [DD Date]

Cash & cash equivalents

Restricted cash

Prepaid expenses & deposits

Accounts receivable

Inventory

Other current assets

Fixed assets, net book value

Land

Buildings

Equipment

Intangible assets

Other assets

Total Assets

Accounts receivable

Other liabilities

Debt, current portion

Debt, long-term portion

Deferred items

Future income tax

Common shares

Preferred shares

Retained earnings

Total Liabilities & Shareholders' Equity

Abbrev: DD = Due dligence

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

Historical Financial Statements (Summarized)

Income Statement Oct 31, 2007 Oct 31, 2008 Oct 31, 2009 [DD Date]

Revenue

Cost of sales

Gross margin

Operating expenses

Depreciation & amortization

Operating profit

Interest expense, net

Unrealized losses (gains)

Foreign exchange losses (gains)

Income before tax

Current taxes

Deferred taxes

Net Income (Loss)

Retained earnings, beginning

Dividends

Adjustments

Retained earnings, ending

Note(s):

[Significant accounting policies]

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

Historical Financial Statements (Summarized)

Cash Flow Schedule Oct 31, 2007 Oct 31, 2008 Oct 31, 2009 [DD Date]

Revenue

Cost of sales

Gross margin

Operating expenses

Working capital

Realized foreign exchange losses (gains)

Cash Flow from Operations

Cash taxes

After-tax cash flow from operations

Cash used in investing:

Equipment purchased

Equipment disposed

Cash used in financing

Principal repayment

Debt borrowing

Interest expense

Interest income

Equity issuance

Dividend payment

Cash surplus (deficit)

Cash, beginning

Cash, ending

Note(s):

1. Cash flow presented on a Direct basis

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

CASH & CASH EQUIVALENTS

(C$ in thousands, unless otherwise indicated)

Commentary:

Date 10/31/2009 4/30/2010

Notes (1)

Cash 1,000 1,254

Restricted Cash x 854

Marketable Securities 527

Total 1,000 2,636

Bank Accounts

Acct No. Institution Type Holder Location Denom Foreign Bal. C$ Bal Rates Term *

01-00545-120 BOM C ABC Limited Vancouver, BC CAD $1,000 0.75% N/A

01-00545-121 BOM S A Limited Richmond, BC CAD $150 1.25% N/A

01-00545-122 BOM S B Limited Victoria, BC USD $100 $104 1.25% N/A

$1,254

Short-term Investments

Certificate No. Institution Type Holder Location Denom Foreign Bal. C$ Bal Rates Term *

01-00545-120 RBC CD ABC Limited Vancouver, BC CAD $500 4.00% 12

01-00545-121 Merrill M A Limited Richmond, BC CAD $250 2.00% 15

01-00545-122 AIM GIC B Limited Victoria, BC USD $100 $104 3.75% 23

$854

Restricted Cash

Acct No. Institution Type Holder Location Denom Foreign Bal. C$ Bal Rates Term *

01-00545-120 RBC S A Limited Vancouver CAD $250 0.25% N/A

01-00545-121 Merrill S B Limited Vancouver CAD $150 0.25% N/A

01-00545-122 AIM S C Limited Vancouver EUR $100 $127 0.25% N/A

$527

* Term in months

Note(s):

1. As per audited financial statements

2 Balances as at DD field work date

3. Nature of restricted cash described here

4. Abbreviations:

C = Chequing

S = Savings

CP = Commercial Paper

M = Mutual Fund

GIC = Guaranteed Investment Certificates

CD = Certificate of Deposit

5. Bank Abbreviations

Abbrev Bank Name Bank Contact Telephone

BOM Bank of Montreal

RBC Royal Bank of Canada

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

WORKING CAPITAL

(C$ in thousands, unless otherwise indicated)

Change ($)

Quarterly Period Ended 10/31/2009 1/31/2010 4/30/2010 7/31/2010 1/31/2010 4/30/2010 7/31/2010

Current Assets

Accounts Receivable

Prepaid expenses & deposits

Inventory

Total Current Assets

Current Liabilities

Accounts Payable

Total Current Liabilities

Net Working Capital

Financial Ratios

Liquidity

Current Ratio x x x x

Acid Test Ratio x x x x

Net Sales / Working Capital x x x x

Average Inventory / Working Capital x x x x

Note(s):

1. Ratio formulas:

Current Ratio (Current Assets / Current Liabilities)

Acid Test Ratio: (Current Assets -Inventory/ Current Liabilities)

Net Sales / Working Capital

Average Inventory / Working Capital

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

WORKING CAPITAL

(C$ in thousands, unless otherwise indicated)

Working Capital Details

Accounts Receivable Details

Current (0-30 days) 100 100 100 100 49% 49% 49% 49%

31-60 days 30 30 30 30 15% 15% 15% 15%

61-90 days 25 25 25 25 12% 12% 12% 12%

90+ days 50 50 50 50 24% 24% 24% 24%

Total 205 205 205 205 100% 100% 100% 100%

Top Ten Customers

Customer 1 45 45 45 45 22% 22% 22% 22%

Customer 2 42 42 42 42 20% 20% 20% 20%

Customer 3 38 38 38 38 19% 19% 19% 19%

Customer 4 20 20 20 20 10% 10% 10% 10%

Customer 5 15 15 15 15 7% 7% 7% 7%

Customer 6 10 10 10 10 5% 5% 5% 5%

Customer 7 9 9 9 9 4% 4% 4% 4%

Customer 8 8 8 8 8 4% 4% 4% 4%

Customer 9 7 7 7 7 3% 3% 3% 3%

Customer 10 6 6 6 6 3% 3% 3% 3%

Others 5 5 5 5 2% 2% 2% 2%

205 205 205 205 100% 100% 100% 100%

Provision for Doubtful Accounts

Customer 1

Customer 2

Customer 3

Customer 4

Customer 5

Accounts Payable

Current (0-30 days) 100 100 100 100 49% 49% 49% 49%

31-60 days 30 30 30 30 15% 15% 15% 15%

61-90 days 25 25 25 25 12% 12% 12% 12%

90+ days 50 50 50 50 24% 24% 24% 24%

Total 205 205 205 205 100% 100% 100% 100%

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

INVENTORY

(C$ in thousands, unless otherwise indicated)

Inventory on Hand

Qty Unit Cost Cost

Category 1 Item 1

Item 2

Category 2 Item 3

Item 4

Item 5

Category 3 Item 6

Item 7

Total

Top 10 Sellers, by Revenue This Month YTD Last Year Top 10 Sellers, by Volume This Month YTD Last Year

Item 1 $ $ $ Item 1

Item 2 $ $ $ Item 2

Item 3 $ $ $ Item 3

Item 4 $ $ $ Item 4

Item 5 $ $ $ Item 5

Item 6 $ $ $ Item 6

Item 7 $ $ $ Item 7

Item 8 $ $ $ Item 8

Item 9 $ $ $ Item 9

Item 10 $ $ $ Item 10

Top 10 Total Top 10 Total

% of Total Sales % of Total Sales

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

FIXED ASSETS

(C$ in thousands, unless otherwise indicated)

1. Properties, Buildings, Leasehold

Description Cost Acc Amort NBV Account depreciation policy Current Appraised Value

Land

Building

Plant / Factory

Leasehold Improvement

2. Equipment

Description Cost Acc Amort NBV Account depreciation policy Current Appraised Value

Equipment

Machinery

Tools

Vehicles

3. Off Balance Sheet Assets

Description Cost Acc Amort NBV Account depreciation policy Current Appraised Value

Office lease

Equipment lease

Other lease / license etc.

Abbreviation(s):

1. NBV = Net book value

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

FIXED ASSETS

(C$ in thousands, unless otherwise indicated)

Listing Detail

Year of

Current

Manufacture Year Acquisition

FA Category Description Acc Amort NBV Appraised

(if Acquired Cost

Value

applicable)

Land [Address 1]

[Address 2]

Building [Address 1]

[Address 2]

Plant / Factory [Address 1]

[Address 2]

Leasehold Improvement [Address 1]

[Address 2]

Vehicles [Car 1]

[Truck 2]

Equipment [Item 1]

[Item 2]

[Item 3]

Office lease [Address 1]

Equipment lease [Lease 1]

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

INTANGIBLE ASSETS

(C$ in thousands, unless otherwise indicated)

1. Goodwill

[Description of Goodwill and relevant history/anaysis]

2. Customer Contract(s)

Contract

Reference Contract Name Start Date End Date Extensions Key Terms

Rate

3. Lease Commitments

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

CONTINGENT LIABILITIES

(C$ in thousands, unless otherwise indicated)

1. Pension Plan & Other Retirement Benefits

[Plan Description]

2. Product Warranties

3. Pending Lawsuits

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

SHARE CAPITAL, INCLUDING OPTIONS

(C$ in thousands, unless otherwise indicated)

1. Share Capital

Common Shares

Class Par Value Voting Dividend Cumul Dvd Authorized Treasury Issued Outstanding

A

B

C

Total

Preferred Shares

Class Par Value Voting Dividend Cumul Dvd Authorized Treasury Issued Outstanding

A

B

C

Total

1. Description of Unusual shareholders' rights:

> change in control provisions

2. Stock Options

Grant Date Expiry Date Year(s) Number Strike Price Option Rights

Total

3. Warrants

Grant Date Expiry Date Year(s) Number Strike Price Warrant Rights

Total

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

DEBT OBLIGATIONS, INCLUDING NON-ARMS LENGTH TRANSACTIONS

(C$ in thousands, unless otherwise indicated)

1. Bank Revolvers / Line of Credits

No. Institution Facility Orig Bal Availability Fee Interest (%) Reduction Timing (mos) Available Covenants

(%) Facility

001 RBC Revolver 1,000,000 0.25% 1.25% 50,000 6

002 RBC Line of Credits

2. Bank Term Loans

No. Institution Facility Original Terms Curr Bal Covenants

Orig. Bal. End Bal. Amort Period Interest Refinance Date

001 RBC Term Loan

002 RBC Term Loan

003 RBC Term Loan

Total

3. Lease Commitments

No. Institution Facility Original Terms Curr Bal Covenants

Orig. Bal. End Bal. Amort Period Interest Refinance Date

Total

4. Non-arms Length Debt

Due To / From Relationship Amount Interest Terms

Bearing

[Name] Director 100000 3% Demand loan bearing interest of 3% p.a. paid annually.

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

REVENUE

(C$ in thousands, unless otherwise indicated)

Period FY 2007 FY 2008 FY 2009 Q1 2010 Q2 2010 YTD 2010 CAGR

Total Sales Revenue

Sales Revenue Breakdown:

Sales Category 1

Sales Category 1, % of Total

Sales Category 2

Sales Category 2, % of Total

Sales Discussion

Sales Details

Period FY 2007 FY 2008 FY 2009 Q1 2010 Q2 2010 YTD 2010 CAGR

Sales Category 1

Sales Revenue

Sales Qty (units)

Sales Unit Price

Qty Growth

Unit Price Change

Customers

Customer 1

Customer 2

Customer 3

Others

Country/Location/Branch

Location 1

Location 2

Location 3

Others

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

COST OF GOODS SOLD

(C$ in thousands, unless otherwise indicated)

Period FY 2007 FY 2008 FY 2009 Q1 2010 Q2 2010 YTD 2010 CAGR

Total Cost of Goods Sold

% of Sales

Gross Margin (GM $)

GM %

Cost of Goods Sold Breakdown:

Sales Category 1

Sales Category 1, % of Total

Sales Category 2

Sales Category 2, % of Total

Cost of Goods Sold Discussion

Cost of Goods Sold Details

Period FY 2007 FY 2008 FY 2009 Q1 2010 Q2 2010 YTD 2010

Sales Category 1

Cost of Goods Sold

Qty Sold (units)

Unit Cost

Freight, Insurance

Brokerage

Storage

Total Unit Cost

Gross Margin

Average Mark-up

Suppliers

Supplier 1

Supplier 2

Supplier 3

Others

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

OPERATING COSTS, EXCLUDING WAGES & BENEFITS

(C$ in thousands, unless otherwise indicated)

Period FY 2007 FY 2008 FY 2009 Q1 2010 Q2 2010 YTD 2010

Sales

Wages & Benefits

Advertising & Promotion

Meals & Entertainment

Telephone & Communications

Travel

Marketing

Wages & Benefits

Advertising & Promotion

Telephone & Communications

Travel

Operations

Wages & Benefits

Advertising & Promotion

Telephone & Communications

Travel

Administration

Wages & Benefits

Office

Supplies

General Insurance

Rent

Telephone & Communications

Utilities

Repair & Maintenance

Total Operating Costs

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

Human Resources

Prior Year Current Year

Overview Overview

Department Head Count FTE Total Payroll Department Head Count FTE Total Payroll

Management Management

Operations Operations

Sales & Marketing Sales & Marketing

Administration Administration

Total Total

Total Revenue per Employee Total Revenue per Employee

Total Revenue per Sales & Marketing Employee Total Revenue per Sales & Marketing Employee

Details of Current Year

Management

Name Title Status Ann Salary Hourly Wage Benefits Total Annual Bonus Other Remuneration

[Name] President FT

[Name] CFO FT

[Name] COO FT

Total

Sales & Marketing

Name Title Union [Y/N] Status Ann Salary Hourly Wage Benefits Total Annual Bonus Other Remuneration

[Name] Sales Manager FT

[Name] Sales Rep FT

[Name] Sales Rep FT

Total

Operations

Name Title Union [Y/N] Status Ann Salary Hourly Wage Benefits Total Annual Bonus Other Remuneration

[Name] General Manager FT

[Name] Supervisor FT

[Name] Specialist FT

Total

Administration

Name Title Union [Y/N] Status Ann Salary Hourly Wage Benefits Total Annual Bonus Other Remuneration

[Name] Secretary FT

[Name] Secretary FT

[Name] Secretary PT

Total

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

INSURANCE

(C$ in thousands, unless otherwise indicated)

Description of Insurance Plans

Plan Coverage Details Broker Annual Premium Deductible

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

TAX

(C$ in thousands, unless otherwise indicated)

1. Corporate Income Tax

Tax Entity Country of Tax Number Corporate Tax CCPC? Loss Carry Taxes Tax Unpaid Unpaid Prior Year

Residence Relationship Juridiction Forward Unpaid Dispute? Penalties Interest Taxes

ABC Limited Canada 123 1 BC

A Limited Canada 123 2 Alberta

B Limited Canada 123 2 Manitoba

C Limited Canada 123 2 Ontario

Relationship Code:

1 = Parent

2 = Subsidiary

3 = Associated

3 = Related, but not associated

2. Other Taxes

[HST]

[Payroll]

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

Legal Entities

ABC Limited

A Limited B Limited C Limited

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

Board / Management Bio

Board of Directors

[Name] Chair Bio

[Name] Vice-Chair Bio

[Name] Director Bio

[Name] Director Bio

[Name] Director Bio

Management Team

[Name] President & CEO Bio

[Name] Executive VP & CFO Bio

[Name] VP & COO Bio

[Name] VP & Chief Legal Counsel Bio

[Name] VP Business Development Bio

[Name] VP Human Resources Bio

[Name] VP Marketing Bio

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

[ABC Limited] SAMPLE

Organizational Structure

President/CEO

CFO COO VP, General Counsel

Financial Due Diligence Report

Prepared by KESPR Business Advisory STRICTLY PRIVATE AND CONFIDENTIAL

About KESPR Business Advisory

KESPR specializes in the gathering and analysis of business and financial information to facilitate business acquisitions and divestitures. This process is called

Due Diligence and is a core competency in KESPRs Transaction Services practice.

Our due diligence comprises both the commercial and financial aspects of a transaction and we participate in:

- Pre-deal evaluation

- Transaction evaluation

- Deal structuring

- Negotiations support

- Due diligence field work and findings report

Our primary role is to produce a strong negotiating position and we will work closely with your staff, legal and other advisors, becoming an integral part of your

transaction team. By helping you become aware of all the issues, you will gain the confidence to make decisions and take action.

Our commitment to the success of your acquisition extends beyond deal closing. Leveraging knowledge gained from the due diligence process, we can provide

financial and accounting support and leadership as you embark on integrating business processes and people.

Contact Details:

Phone: +1.604.723.1781

Email: info@kespr.com

www.kespr.com

You might also like

- Legal Case Document Pages 1-44Document44 pagesLegal Case Document Pages 1-44quynhanhle85100% (1)

- Due Dilligence Report-Full ReportDocument2 pagesDue Dilligence Report-Full ReportOladipupo Mayowa Paul100% (1)

- Example Financial Due Diligence Report RedactedDocument26 pagesExample Financial Due Diligence Report RedactedDumas Tchibozo75% (4)

- Due Diligence Report Analysis of Thyrocare Laboratories LtdDocument16 pagesDue Diligence Report Analysis of Thyrocare Laboratories LtdHitesh Jain80% (5)

- Sample Due Diligence Report PDFDocument47 pagesSample Due Diligence Report PDFIbukun Sorinola68% (19)

- Due Diligence Process GuideDocument22 pagesDue Diligence Process Guidejsdior100% (1)

- Due Diligence Report TemplateDocument18 pagesDue Diligence Report Templatequynhanhle85100% (7)

- Legal Due DiligenceDocument4 pagesLegal Due Diligencezeeshanshahbaz50% (2)

- Due Diligence ReportDocument26 pagesDue Diligence ReportLindsay LinNo ratings yet

- Due Diligence in M& ADocument41 pagesDue Diligence in M& AJasmeet Singh AroraNo ratings yet

- EBOS Group Financial Due Diligence ReportDocument4 pagesEBOS Group Financial Due Diligence Reportqing9201100% (1)

- Due Diligence Investigation GuideDocument13 pagesDue Diligence Investigation Guidequynhanhle8550% (2)

- Master Acquisition Due Diligence ChecklistDocument19 pagesMaster Acquisition Due Diligence ChecklistLoretta Wise100% (1)

- FINANCIAL DUE-DILIGENCE REVIEWDocument15 pagesFINANCIAL DUE-DILIGENCE REVIEWprateekkapoor24No ratings yet

- Finance Due DiligenceDocument23 pagesFinance Due Diligencerichaagarwal193100% (2)

- Legal Due Diligence Summary ReportDocument16 pagesLegal Due Diligence Summary Reportquynhanhle85100% (1)

- Financial Due-Dilligence-sample by CrisilDocument37 pagesFinancial Due-Dilligence-sample by CrisilDrNitin Pathak100% (1)

- Due DiligenceDocument5 pagesDue DiligenceKeith Parker100% (3)

- Due Diligence For Private Mergers and AcquisitionsDocument14 pagesDue Diligence For Private Mergers and AcquisitionsMeo U Luc Lac100% (2)

- Financial Due DiligenceDocument10 pagesFinancial Due Diligenceapi-3822396100% (6)

- Due Diligence in Concept With Financial Due DiligenceDocument58 pagesDue Diligence in Concept With Financial Due DiligenceZoya SayyedNo ratings yet

- S7. Due DiligenceDocument40 pagesS7. Due DiligenceJinal VasaNo ratings yet

- Summary of Due Diligence and Valuation ReportDocument8 pagesSummary of Due Diligence and Valuation ReportitechiezNo ratings yet

- Buyer's Side Due Diligence ChecklistDocument4 pagesBuyer's Side Due Diligence ChecklistPERSHINGYOAKLEYNo ratings yet

- LEGAL DUE DILIGENCE - Comprehensive CHK ListDocument28 pagesLEGAL DUE DILIGENCE - Comprehensive CHK Listarskassociates0% (1)

- Legal-Due-Diligence-Guidelines May 2020Document68 pagesLegal-Due-Diligence-Guidelines May 2020Jha Arunima100% (1)

- Legal Due Diligence: An Investors PerspectiveDocument31 pagesLegal Due Diligence: An Investors PerspectiveCorporate ProfessionalsNo ratings yet

- FCPA Due Diligence: Understanding Anti-Bribery RequirementsDocument33 pagesFCPA Due Diligence: Understanding Anti-Bribery RequirementsKiran Laxman ShingoteNo ratings yet

- Due Diligence BookDocument50 pagesDue Diligence Bookgritad100% (2)

- Due Diligence Closing ChecklistDocument6 pagesDue Diligence Closing Checklistklg.consultant2366No ratings yet

- Template LegalDueDilligence (English)Document27 pagesTemplate LegalDueDilligence (English)Hubertus Setiawan100% (1)

- Comprehensive M&A Due Diligence ChecklistDocument30 pagesComprehensive M&A Due Diligence ChecklistSimon Tseung100% (2)

- Due Diligence CaseDocument25 pagesDue Diligence Caseanon_246713696100% (2)

- Legal Due DiligenceDocument36 pagesLegal Due DiligencevakilarunNo ratings yet

- Due Diligence ChecklistDocument18 pagesDue Diligence ChecklistdanogsNo ratings yet

- Acquisition Due Diligence ChecklistDocument9 pagesAcquisition Due Diligence ChecklistProject ProjectNo ratings yet

- Due DiligenceDocument35 pagesDue DiligenceSonali SinghNo ratings yet

- Due Diligence Report Dun Laoghaire Harbour Company LimitedDocument18 pagesDue Diligence Report Dun Laoghaire Harbour Company LimitedSetiadi MargonoNo ratings yet

- Due Diligence ChecklistDocument12 pagesDue Diligence ChecklistNigel A.L. Brooks100% (1)

- Due Diligence Tools & TechniquesDocument5 pagesDue Diligence Tools & TechniquesKeith ParkerNo ratings yet

- Financial Analysis of Trusted Health Services Private LimitedDocument12 pagesFinancial Analysis of Trusted Health Services Private LimitedAnoop KumarNo ratings yet

- Due Diligence ChecklistDocument6 pagesDue Diligence ChecklistLauren HammondNo ratings yet

- Vendor Due Diligence Audit ProgramDocument4 pagesVendor Due Diligence Audit ProgramElla FlavierNo ratings yet

- Due DiligenceDocument13 pagesDue DiligenceAjayktrNo ratings yet

- AIBI Due Diligence ManualDocument60 pagesAIBI Due Diligence ManualPritesh Roy100% (1)

- PwC Hong Kong Financial Due Diligence Manager RoleDocument6 pagesPwC Hong Kong Financial Due Diligence Manager RolePatrick CheungNo ratings yet

- Legal Due DiligenceDocument9 pagesLegal Due Diligencekavanya suroliaNo ratings yet

- ICAI Jan 30 2016Document34 pagesICAI Jan 30 2016Devasish ParmarNo ratings yet

- How To Do Due Diligence ReportDocument39 pagesHow To Do Due Diligence Reportianlayno50% (2)

- Understanding Term SheetDocument5 pagesUnderstanding Term Sheetgvs_2000No ratings yet

- 50 - Due Diligence Checklist - 1Document6 pages50 - Due Diligence Checklist - 1Nikita ShahNo ratings yet

- Due Diligence The Critical Stage in Acquisitions and Mergers 0-566-08524-0Document296 pagesDue Diligence The Critical Stage in Acquisitions and Mergers 0-566-08524-0Victor Nobiuz100% (3)

- Due Diligence ListDocument7 pagesDue Diligence ListRonald BurrNo ratings yet

- Annual Report 2011Document233 pagesAnnual Report 2011Khalid FirozNo ratings yet

- Indostar: BSE Limited National Stock Exchange of India LimitedDocument49 pagesIndostar: BSE Limited National Stock Exchange of India LimitedAjay BaligaNo ratings yet

- Impact of Basel Accord On Banking Sector of Pakistan Shumaila Samad, Waqar Sadiq, Junaid Iqbal, Amna Saeed, Jazba Gohar ArshadDocument7 pagesImpact of Basel Accord On Banking Sector of Pakistan Shumaila Samad, Waqar Sadiq, Junaid Iqbal, Amna Saeed, Jazba Gohar ArshadShumailaNo ratings yet

- ch06 SM RankinDocument12 pagesch06 SM Rankinhasan jabrNo ratings yet

- Financial Statements Analysis Case StudyDocument17 pagesFinancial Statements Analysis Case StudychrisNo ratings yet

- Solutions Manual: Financial Accounting: Reporting, Analysis and Decision MakingDocument61 pagesSolutions Manual: Financial Accounting: Reporting, Analysis and Decision MakingJeffrey Sanchez Rojas100% (2)

- White Swans - MontierDocument13 pagesWhite Swans - Montier;lkjfNo ratings yet

- And Distributing Accounting Reports To PotentialDocument41 pagesAnd Distributing Accounting Reports To PotentialREVELNo ratings yet

- MCI Communications Case Study GuideDocument3 pagesMCI Communications Case Study Guidekashanr82100% (1)

- Allison Corporation Acquired All of The Outstanding Voting Stock ofDocument2 pagesAllison Corporation Acquired All of The Outstanding Voting Stock ofAmit Pandey0% (1)

- SMI Trading Techniques PDFDocument14 pagesSMI Trading Techniques PDFVijay VijiNo ratings yet

- 11 Bachrach V SiefertDocument1 page11 Bachrach V SiefertVal SanchezNo ratings yet

- Illustrating Stocks and BondsDocument6 pagesIllustrating Stocks and Bondsraymond galagNo ratings yet

- Ch. 02 Types of FinancingDocument85 pagesCh. 02 Types of FinancingUmesh Raj Pandeya100% (1)

- Third Point Q2 2020 Investor Letter TPOIDocument13 pagesThird Point Q2 2020 Investor Letter TPOIZerohedge100% (1)

- CORPORATION CODE OF THE PHILIPPINES SUMMARYDocument61 pagesCORPORATION CODE OF THE PHILIPPINES SUMMARYBing MendozaNo ratings yet

- Absolute returns in any marketDocument20 pagesAbsolute returns in any marketLudwig CaluweNo ratings yet

- Do You Know Your Cost of CapitalDocument12 pagesDo You Know Your Cost of CapitalSazidur RahmanNo ratings yet

- 072&091-Republic Planters Bank vs. Agana 269 Scra 1Document5 pages072&091-Republic Planters Bank vs. Agana 269 Scra 1wewNo ratings yet

- Peter Low - The Northern Pacific Panic of 1901Document4 pagesPeter Low - The Northern Pacific Panic of 1901Adrian KachmarNo ratings yet

- Herbert Bastian, Luh Putu Wiagustini, Dan Luh Gede Sri Artini. PengaruhDocument15 pagesHerbert Bastian, Luh Putu Wiagustini, Dan Luh Gede Sri Artini. PengaruhCiciliaNo ratings yet

- FIN - Chapter 6 - Cost of Capital - PDFDocument14 pagesFIN - Chapter 6 - Cost of Capital - PDFUtpal BaruaNo ratings yet

- Solved This Semester Hung Lee Took Four 3 Credit Courses at RiversideDocument1 pageSolved This Semester Hung Lee Took Four 3 Credit Courses at RiversideM Bilal SaleemNo ratings yet

- 36 Oct-2022Document57 pages36 Oct-2022Sravan SmartNo ratings yet

- SEC Ruling on Jamiatul Philippine-Al Islamia Share IssuanceDocument2 pagesSEC Ruling on Jamiatul Philippine-Al Islamia Share Issuancejojo50166No ratings yet

- For The Last Round, My Comments Here Are Going To Be Back To BasicsDocument56 pagesFor The Last Round, My Comments Here Are Going To Be Back To BasicsRahul SinghNo ratings yet

- Infineon Technologies Case FMDocument7 pagesInfineon Technologies Case FMArjit Gupta100% (2)

- WWW Papertyari Com Sebi Grade ADocument12 pagesWWW Papertyari Com Sebi Grade ANihal JamadarNo ratings yet

- Co. Ltd. 1901) : Hare AND Hare ApitalDocument16 pagesCo. Ltd. 1901) : Hare AND Hare ApitalNavya BhandariNo ratings yet

- JPM Singapore BanksDocument80 pagesJPM Singapore BanksBreadNo ratings yet

- International Business The Challenge of Global Competition 13th Edition Ball Solutions ManualDocument11 pagesInternational Business The Challenge of Global Competition 13th Edition Ball Solutions Manuallegacycoupablemf2100% (33)

- Stock Market English 1Document5 pagesStock Market English 1Moustapha DjitteNo ratings yet

- CSR342 PDFDocument440 pagesCSR342 PDFSam LitzNo ratings yet

- Corporate Governance in China - Key Features and ReformsDocument71 pagesCorporate Governance in China - Key Features and ReformsIlya YasnorinaNo ratings yet

- Bursa MalaysiaDocument63 pagesBursa MalaysiaNajihah ZahirNo ratings yet

- The Capital Market Represents The Market of The Financial Long-Term TitlesDocument9 pagesThe Capital Market Represents The Market of The Financial Long-Term TitlesDaiva ValienėNo ratings yet