Professional Documents

Culture Documents

Micharel

Uploaded by

Christopher MateoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Micharel

Uploaded by

Christopher MateoCopyright:

Available Formats

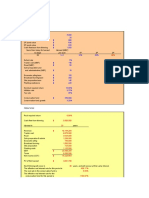

1)Income statement (also referred as profit and loss statement (P&L), statement of financial performance, earnings statement, operating

statement or statement of operations)[1] is a company's financial statement that indicates how the revenue (money received from the sale of

products and services before expenses are taken out, also known as the "top line") is transformed into the net income (the result after all

revenues and expenses have been accounted for, also known as the "bottom line"). It displays the revenues recognized for a specific period,

and the cost and expenses charged against these revenues, including write-offs (e.g., depreciation and amortization of various assets) and

taxes.[1] The purpose of the income statement is to show managers and investors whether the company made or lost money during the period

being reported.

2) While some lines of an income statement rely on estimates or forecasts, the interest expense line is basically a key equation. When

accounting for income tax expense, still, a business can exercise different accounting techniques in support of some of its expenses than it uses

for calculating its chargeable income. The hypothetical amount of taxable income, if generally the accounting methods used were normally

used in the tax return is actually calculated.

4) - INCOME STATEMENT BOND LLC -

For the year ended DECEMBER 31 2007

€ €

Debit Credit

Revenues

GROSS PROFIT (including rental income) 496,397

--------

Expenses:

ADVERTISING 6,300

BANK & CREDIT CARD FEES 144

BOOKKEEPING 3,350

EMPLOYEES 88,000

ENTERTAINMENT 5,550

INSURANCE 750

LEGAL & PROFESSIONAL SERVICES 1,575

LICENSES 632

PRINTING, POSTAGE & STATIONERY 320

RENT 13,000

RENTAL MORTGAGES AND FEES 74,400

TELEPHONE 1,000

UTILITIES 491

--------

TOTAL EXPENSES (195,512)

--------

NET INCOME 300,885

========

5)

You might also like

- Cafe' / Restaurant FinancialsDocument5 pagesCafe' / Restaurant Financialstmir_1No ratings yet

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Marketing Revision BookletDocument18 pagesMarketing Revision BookletGodfreyFrankMwakalinga0% (1)

- Hitungan Kuis 7 Bunyan - Lumber - CaseDocument15 pagesHitungan Kuis 7 Bunyan - Lumber - Caserica100% (1)

- Circular Economy in The Context of Sustainable DevelopmentDocument28 pagesCircular Economy in The Context of Sustainable DevelopmentmiskoscribdNo ratings yet

- Tax 2005 ExamDocument26 pagesTax 2005 ExamleerenjyeNo ratings yet

- Iscal EARDocument311 pagesIscal EARDjalma MoreiraNo ratings yet

- Befa Grand Test 2022Document2 pagesBefa Grand Test 2022cyberdrip1No ratings yet

- Practice QNSDocument2 pagesPractice QNSIan chisemaNo ratings yet

- Payslip-Vishal Kawade-January, 2023-1 PDFDocument1 pagePayslip-Vishal Kawade-January, 2023-1 PDFAditya PLNo ratings yet

- Balance Gral Jun 2022 y 2021Document1 pageBalance Gral Jun 2022 y 2021quinterolerma8No ratings yet

- SAMPLE Capital ExpenditureDocument1 pageSAMPLE Capital ExpenditureAmitNo ratings yet

- 2-3mwi 2004 Dec ADocument13 pages2-3mwi 2004 Dec Aanga100% (1)

- (PER) (PER) (Form 1120) (Feerick) Difference IncomeDocument4 pages(PER) (PER) (Form 1120) (Feerick) Difference Incometom3044No ratings yet

- NIKEDocument2 pagesNIKEDave MendozaNo ratings yet

- For Cite HR 119Document3 pagesFor Cite HR 119prachiNo ratings yet

- Section 8 Financial PlanDocument14 pagesSection 8 Financial PlanRafi MuhammadNo ratings yet

- General Ledgers (Admn Exp) 2011-12.Document207 pagesGeneral Ledgers (Admn Exp) 2011-12.Aamir HussainNo ratings yet

- Taxation (Malaysia) Answers and Marking SchemeDocument8 pagesTaxation (Malaysia) Answers and Marking SchemeHar San LeeNo ratings yet

- Advanced TaxationDocument6 pagesAdvanced TaxationGIVEN N SIPANJENo ratings yet

- Sohar International Bank Saog: Interim Condensed Financial Statements For The Nine Months Ended 30 September 2022Document42 pagesSohar International Bank Saog: Interim Condensed Financial Statements For The Nine Months Ended 30 September 2022Ilai OblivioniNo ratings yet

- Fundamentals Level – Skills Module, Paper F6 (UK) December 2014 Answers Taxation (United Kingdom) - Concise SummaryDocument9 pagesFundamentals Level – Skills Module, Paper F6 (UK) December 2014 Answers Taxation (United Kingdom) - Concise SummaryLatoya JohnsonNo ratings yet

- Serco Group PLC: Cash Flow (Indirect) - Annual - Standardised in Millions of GBPDocument4 pagesSerco Group PLC: Cash Flow (Indirect) - Annual - Standardised in Millions of GBPfcfroicNo ratings yet

- Lembar Kerja UkkDocument46 pagesLembar Kerja UkkAmalia YuniarsihNo ratings yet

- ACCOUNTING P1 GR10 MEMO NOV2020 - EnglishDocument6 pagesACCOUNTING P1 GR10 MEMO NOV2020 - EnglishMolemo mabeleNo ratings yet

- d15 Hybrid F7 ADocument6 pagesd15 Hybrid F7 AAizatSafwanNo ratings yet

- Cs2021 Itr FileDocument2 pagesCs2021 Itr FileAbhi RajputNo ratings yet

- Master - 10-8400 Budget Template ANSWERSDocument57 pagesMaster - 10-8400 Budget Template ANSWERSJonathan LeeNo ratings yet

- F7mys 2010 Dec AnsDocument11 pagesF7mys 2010 Dec Ansp7q27hht77No ratings yet

- F7irl 2010 Dec AnsDocument11 pagesF7irl 2010 Dec AnsNghiêm Thị Mai AnhNo ratings yet

- Algu 2022 GaaDocument3 pagesAlgu 2022 GaaSaji JimenoNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Statement of Cash Flows HandoutDocument17 pagesStatement of Cash Flows HandoutCharudatta MundeNo ratings yet

- FarahDocument7 pagesFarahMijan RahmanNo ratings yet

- Accountancy ProjectDocument13 pagesAccountancy Projectt7228572No ratings yet

- SouthWestAirlnesF22 SolutionDocument5 pagesSouthWestAirlnesF22 SolutionFalguni ShomeNo ratings yet

- Quijonez Fashionables Comprehensive Prob Merchandising Solution - XLSX Direct Extension MethodDocument4 pagesQuijonez Fashionables Comprehensive Prob Merchandising Solution - XLSX Direct Extension MethodzairahNo ratings yet

- Valuation: © The Institute of Chartered Accountants of IndiaDocument72 pagesValuation: © The Institute of Chartered Accountants of IndiaNmNo ratings yet

- 6gbr 2006 Dec QDocument9 pages6gbr 2006 Dec Qapi-19836745No ratings yet

- Ans 03 06Document8 pagesAns 03 06samnan123No ratings yet

- Tutorial 4 QAsDocument6 pagesTutorial 4 QAsJin HueyNo ratings yet

- 1658247187MB-103 [O-278]Document7 pages1658247187MB-103 [O-278]Chaithanya ChaithuNo ratings yet

- National Income TestDocument2 pagesNational Income TestVaidehi GhinaiyaNo ratings yet

- Moderna Interiors Worksheet AdjustmentsDocument1 pageModerna Interiors Worksheet AdjustmentsJasminNo ratings yet

- Provisional Tax Calculation For The Financial Year 2010-2011 Name Divyesh Desai ID Pan No. Designation SexDocument3 pagesProvisional Tax Calculation For The Financial Year 2010-2011 Name Divyesh Desai ID Pan No. Designation Sexdivyesh_desaiNo ratings yet

- Completing Acctg Cycle Four Exercises 06mar21Document12 pagesCompleting Acctg Cycle Four Exercises 06mar21Jasmine ActaNo ratings yet

- Tadesse Mengestu Income Statement For The Nine Months Ending April 8, 2023Document9 pagesTadesse Mengestu Income Statement For The Nine Months Ending April 8, 2023Tegene NigussieNo ratings yet

- Income Statment of RideyaDocument4 pagesIncome Statment of Rideyafaizan mughalNo ratings yet

- Pay SlipDocument3 pagesPay Slipsharma_annilNo ratings yet

- Dec 2022Document1 pageDec 2022kumarsanjeevsskNo ratings yet

- Costing SolutionDocument2 pagesCosting SolutionANo ratings yet

- AffidavitDocument1 pageAffidavitcherry lynNo ratings yet

- ITC17Document1 pageITC17Kok yoke KewNo ratings yet

- RAWDocument21 pagesRAWArjay DeausenNo ratings yet

- Tax implications of share listing for investment holding companyDocument15 pagesTax implications of share listing for investment holding companyFakhrul Azman NawiNo ratings yet

- Accruals_and_Prepayments_in_the_FinancialDocument3 pagesAccruals_and_Prepayments_in_the_FinancialRealGenius (Carl)No ratings yet

- 2015 Jun Q-11-13Document3 pages2015 Jun Q-11-13何健珩No ratings yet

- Yearly Payslip PDFDocument1 pageYearly Payslip PDFRupam JhaNo ratings yet

- Sheraton Bangalore August 2019 PayslipDocument1 pageSheraton Bangalore August 2019 PayslipRupam JhaNo ratings yet

- Total 23,500 23,500Document3 pagesTotal 23,500 23,500Vania DNo ratings yet

- Tutorial 8Document3 pagesTutorial 8Lee HansNo ratings yet

- Engineering Economy Sheet 2: PW, FW, AW AnalysisDocument4 pagesEngineering Economy Sheet 2: PW, FW, AW AnalysisSaudNo ratings yet

- Reach Lby Report Joint Market Analysis Initiative October 2017Document74 pagesReach Lby Report Joint Market Analysis Initiative October 2017paul.vercoustre.reachNo ratings yet

- TOPIC 1 Introduction To International FinanceDocument12 pagesTOPIC 1 Introduction To International FinanceGeorge ChilleNo ratings yet

- Quarterly Income Tax For Corporations and PartnershipsDocument2 pagesQuarterly Income Tax For Corporations and PartnershipsSky LeeNo ratings yet

- Borromeo v. Court of AppealsDocument18 pagesBorromeo v. Court of AppealsRomar John M. GadotNo ratings yet

- GadgetDocument2 pagesGadgetmanish kumarNo ratings yet

- Operating Statements and Balance Sheets for Cartwright Company 2001-2004Document7 pagesOperating Statements and Balance Sheets for Cartwright Company 2001-2004UMMUSNUR OZCANNo ratings yet

- The Importance of Long Term Coating ManagementDocument8 pagesThe Importance of Long Term Coating ManagementDavid RodriguesNo ratings yet

- Contact Details of Tpas: Sr. No. Name of Tpia Name of Contact Person Designation Phone No. Email Id AddressDocument2 pagesContact Details of Tpas: Sr. No. Name of Tpia Name of Contact Person Designation Phone No. Email Id Addressشہزاد نقوی100% (1)

- Foreign Direct Investment: Submitted BY:-Chinmay Kavadiya Shashank Pandey Submitted To: - Proff. Hiral SonkarDocument18 pagesForeign Direct Investment: Submitted BY:-Chinmay Kavadiya Shashank Pandey Submitted To: - Proff. Hiral SonkarShashank PandeyNo ratings yet

- 175 GW Parliamentary Standing Committee March 2021Document118 pages175 GW Parliamentary Standing Committee March 2021Niraj KumarNo ratings yet

- Learning Objective: - To Identify The Uses of The Two Books of Accounts: Journals and LedgersDocument4 pagesLearning Objective: - To Identify The Uses of The Two Books of Accounts: Journals and LedgersGladzangel LoricabvNo ratings yet

- Daftar Induk Tugas AkhirDocument104 pagesDaftar Induk Tugas AkhirMuhammad Haikal HafisNo ratings yet

- Residential Tax Abatement Proposal Presentation (Jan. 2023)Document27 pagesResidential Tax Abatement Proposal Presentation (Jan. 2023)WVXU NewsNo ratings yet

- ZENITH - Catalogue Digital - Mars 2023 - enDocument79 pagesZENITH - Catalogue Digital - Mars 2023 - enDanielNo ratings yet

- AEFARDocument13 pagesAEFAREka MonleonNo ratings yet

- Pim 01 Cat MPP 006 A0 R00Document5 pagesPim 01 Cat MPP 006 A0 R00Mohammed HarrisNo ratings yet

- MI - 1 (45) So Pyay Aung Win (Life Insurance)Document3 pagesMI - 1 (45) So Pyay Aung Win (Life Insurance)Dr. SNo ratings yet

- Designing and Managing Integrated Marketing ChannelsDocument30 pagesDesigning and Managing Integrated Marketing ChannelsHardik MistryNo ratings yet

- "Annex A.1": Current Year AppropriationsDocument14 pages"Annex A.1": Current Year AppropriationsoabeljeanmoniqueNo ratings yet

- AFA Full Question Bank - ANKDocument121 pagesAFA Full Question Bank - ANKknpramodaffiliateNo ratings yet

- Oligopoly Market StructureDocument10 pagesOligopoly Market StructureYash KalaNo ratings yet

- Logistics Operators: Strategic Advantages for Supply Chain ManagementDocument6 pagesLogistics Operators: Strategic Advantages for Supply Chain ManagementAlan Trejo CasalesNo ratings yet

- Makro401 (1)Document11 pagesMakro401 (1)askerow0073No ratings yet

- List of Orange Group Entities by CountryDocument7 pagesList of Orange Group Entities by Countryosama aboualamNo ratings yet

- Bowman Consulting Investors PresentationDocument19 pagesBowman Consulting Investors PresentationArianeNo ratings yet

- Career Compensation Plan IndiaDocument22 pagesCareer Compensation Plan IndiaRaju ReddyNo ratings yet

![1658247187MB-103 [O-278]](https://imgv2-2-f.scribdassets.com/img/document/719949228/149x198/9a40317e4b/1712222700?v=1)