Professional Documents

Culture Documents

TCS Rate Chart

Uploaded by

cajitenderguptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TCS Rate Chart

Uploaded by

cajitenderguptaCopyright:

Available Formats

Draft for discussion purposes

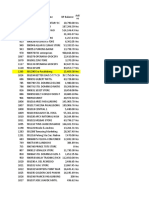

TCS rates applicable for amounts credited / payments made during the financial year ending March 31, 2009

For the period 01/04/2008 to 31/03/2009

Surcharge Effective

Category Rate (%) Cess (%) Definition

(%) rate (%)

Sale of Scrap by Companies having: Every person, being seller shall, at the time of

1 - 3 1.030 debiting of the amount payable by the buyer to the

- Income lesser than/ equal to Rs 10,000,000

account of the buyer or at the time of receipt of such

- Income greater than Rs 10,000,000 1 10 3 1.133 amount from the said buyer in cash or by the issue

of a cheque or draft or by any other mode, whichever

is earlier, collect from the buyer of the goods (eg

Scrap) of the nature specified in section 206C, a

sum equal to the percentage specified of such

amount as Income-tax. Scrape for this purpose

means, waste and scrape from the manufacture ofr

mechanical working of materials which is definitely

not usable as such because of breakage, cutting up,

wear and other reasons.

You might also like

- Sing An TonkDocument175 pagesSing An TonkcajitenderguptaNo ratings yet

- IFRS The Way Forward1692-1695Document4 pagesIFRS The Way Forward1692-1695cajitenderguptaNo ratings yet

- Transition To IFRS 1Document42 pagesTransition To IFRS 1cajitendergupta100% (2)

- SoxDocument13 pagesSoxcajitendergupta100% (2)

- FBT-Calculator FY 2008-09-MasterDocument28 pagesFBT-Calculator FY 2008-09-Mastercajitendergupta100% (11)

- J K Jain's "Vat ReporterDocument19 pagesJ K Jain's "Vat Reportercajitendergupta100% (2)

- Risk Rating The Audit UniverseDocument10 pagesRisk Rating The Audit Universecajitendergupta100% (2)

- TDS Rate ChartDocument2 pagesTDS Rate Chartcajitendergupta100% (72)

- Indirect Taxes Changes Budget 2008Document3 pagesIndirect Taxes Changes Budget 2008cajitendergupta100% (1)

- Direct Tax Compliance CalendarDocument15 pagesDirect Tax Compliance CalendarcajitenderguptaNo ratings yet

- Audit Committees Oversight Responsibilities Post SOXDocument20 pagesAudit Committees Oversight Responsibilities Post SOXcajitendergupta100% (1)

- Comprehensive FBT ChartDocument6 pagesComprehensive FBT Chartcajitendergupta100% (9)

- Compreshensive TDS CHARTDocument5 pagesCompreshensive TDS CHARTcajitendergupta100% (2)

- Transition To IFRS 1Document42 pagesTransition To IFRS 1cajitendergupta100% (2)

- IFRS The Way Forward1692-1695Document4 pagesIFRS The Way Forward1692-1695cajitenderguptaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Course 1 Introduction To SIMS: Student Information Management System (SIMS) Office of The RegistrarDocument28 pagesCourse 1 Introduction To SIMS: Student Information Management System (SIMS) Office of The RegistrarWeijia WangNo ratings yet

- Approved Term of Payment For Updating Lower LagunaDocument50 pagesApproved Term of Payment For Updating Lower LagunaSadasfd SdsadsaNo ratings yet

- Isuzu Libro 2 PDFDocument802 pagesIsuzu Libro 2 PDFjulia_23_22100% (2)

- Manual LubDocument25 pagesManual LubMota Guine InformaçõesNo ratings yet

- Difference Between Offer and Invitation To TreatDocument5 pagesDifference Between Offer and Invitation To TreatBrian Okuku Owinoh100% (2)

- Panasonic Th-42pd50u Chassis Gp8duDocument147 pagesPanasonic Th-42pd50u Chassis Gp8du02ury05No ratings yet

- Data Structures CompleteDocument255 pagesData Structures Completemovie world50% (2)

- Datasheet LG-ICR18650D1 PDFDocument9 pagesDatasheet LG-ICR18650D1 PDFPedro Militao CoboNo ratings yet

- Score Higher On The Ukcat, 5Th Edition - 2019 UpdateDocument2 pagesScore Higher On The Ukcat, 5Th Edition - 2019 UpdateNikki Fish0% (1)

- BAMBUDocument401 pagesBAMBUputulNo ratings yet

- Moodlecloud 24284Document1 pageMoodlecloud 24284Giged BattungNo ratings yet

- Municipal Tax Dispute Over Petroleum Refinery in PilillaDocument5 pagesMunicipal Tax Dispute Over Petroleum Refinery in PilillaDaphne Jade Estandarte PanesNo ratings yet

- Domestic Ro Price List 2021Document6 pagesDomestic Ro Price List 2021den oneNo ratings yet

- Student Boarding House Quality in Term of Health DDocument11 pagesStudent Boarding House Quality in Term of Health DPauline Valerie PacturanNo ratings yet

- NFL 101 Breaking Down The Basics of 2-Man CoverageDocument10 pagesNFL 101 Breaking Down The Basics of 2-Man Coveragecoachmark285No ratings yet

- Set Up A Mail Server On LinuxDocument56 pagesSet Up A Mail Server On Linuxammurasikan6477No ratings yet

- Osisense XX Xx518a3pam12Document6 pagesOsisense XX Xx518a3pam12Paulinho CezarNo ratings yet

- Segment Reporting NotesDocument2 pagesSegment Reporting NotesAshis Kumar MuduliNo ratings yet

- North American Series 4762 Immersion Tube Burners 4762 - BULDocument4 pagesNorth American Series 4762 Immersion Tube Burners 4762 - BULedgardiaz5519No ratings yet

- CMC Internship ReportDocument62 pagesCMC Internship ReportDipendra Singh50% (2)

- Overview of Sharepoint Foundation and Sharepoint Server: Collaboration and Social ComputingDocument15 pagesOverview of Sharepoint Foundation and Sharepoint Server: Collaboration and Social ComputingHarold Vargas MorenoNo ratings yet

- Assessment Task 2Document15 pagesAssessment Task 2Hira Raza0% (2)

- Action Plan Stratcom PDFDocument5 pagesAction Plan Stratcom PDFDaniel SolisNo ratings yet

- Wang Yunshan ReflectionDocument4 pagesWang Yunshan Reflectionapi-286742915100% (1)

- OBURE Understanding How Reits Market WorksDocument3 pagesOBURE Understanding How Reits Market WorksJohn evansNo ratings yet

- Cybersecurity Case 4Document1 pageCybersecurity Case 4Gaurav KumarNo ratings yet

- Doctrine of Repugnancy ExplainedDocument13 pagesDoctrine of Repugnancy ExplainedAmita SinwarNo ratings yet

- DO 178B DetailedDocument25 pagesDO 178B DetailedSenthil KumarNo ratings yet

- PDF-6.2 The Pressurized Water ReactorDocument35 pagesPDF-6.2 The Pressurized Water ReactorJohn W HollandNo ratings yet

- Day Trading Money ManagementDocument8 pagesDay Trading Money ManagementJoe PonziNo ratings yet