Professional Documents

Culture Documents

ABC Pilot Paper

Uploaded by

ACCA StudentOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ABC Pilot Paper

Uploaded by

ACCA StudentCopyright:

Available Formats

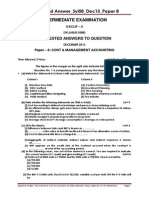

Answer ALL FOUR questions

1 Triple Limited makes three types of gold watch – the Diva (D), the Classic (C) and the Poser (P). A traditional product

costing system is used at present; although an activity based costing (ABC) system is being considered. Details of the

three products for a typical period are:

Hours per unit Materials Production

Labour hours Machine hours Cost per unit ($) Units

Product D ½ 1½ 20 1,750

Product C 1½ 1 12 1,250

Product P 1 3 25 7,000

Direct labour costs $6 per hour and production overheads are absorbed on a machine hour basis. The overhead

absorption rate for the period is $28 per machine hour.

Required:

(a) Calculate the cost per unit for each product using traditional methods, absorbing overheads on the basis of

machine hours. (3 marks)

Total production overheads are $654,500 and further analysis shows that the total production overheads can be

divided as follows:

%

Costs relating to set-ups 35

Costs relating to machinery 20

Costs relating to materials handling 15

Costs relating to inspection 30

Total production overhead 100

The following total activity volumes are associated with each product line for the period as a whole:

Number of Number of movements Number of

Set ups of materials inspections

Product D 175 112 1,150

Product C 115 121 1,180

Product P 480 187 1,670

670 120 1,000

Required:

(b) Calculate the cost per unit for each product using ABC principles (work to two decimal places). (12 marks)

(c) Explain why costs per unit calculated under ABC are often very different to costs per unit calculated under

more traditional methods. Use the information from Triple Limited to illustrate. (4 marks)

(d) Discuss the implications of a switch to ABC on pricing and profitability. (6 marks)

(25 marks)

You might also like

- Optimizing Factory Performance: Cost-Effective Ways to Achieve Significant and Sustainable ImprovementFrom EverandOptimizing Factory Performance: Cost-Effective Ways to Achieve Significant and Sustainable ImprovementNo ratings yet

- Strategic cost accounting assignmentDocument4 pagesStrategic cost accounting assignmentTory IslamNo ratings yet

- Week 4 - Seminar 3 Trimake QuestionDocument1 pageWeek 4 - Seminar 3 Trimake Questionchina xiNo ratings yet

- Activity Based Costing Spring 2020 Answers Final - pdf-1Document20 pagesActivity Based Costing Spring 2020 Answers Final - pdf-1b21fa1201No ratings yet

- Activity Based Costing Spring 2023 With ThoeryDocument12 pagesActivity Based Costing Spring 2023 With ThoeryHafsah AnwarNo ratings yet

- Final Examination Management AccountingDocument5 pagesFinal Examination Management AccountingEmNo ratings yet

- Question 1 ABCDocument1 pageQuestion 1 ABCHunal Kumar MautadinNo ratings yet

- Activity-Based Costing: Question IM 10.1 IntermediateDocument6 pagesActivity-Based Costing: Question IM 10.1 IntermediateZohaib AslamNo ratings yet

- ABC AssignmentDocument3 pagesABC AssignmentSunil ThapaNo ratings yet

- Tutorial Collection 3Document1 pageTutorial Collection 3Arti SinghNo ratings yet

- Non-financial factors when ceasing product lineDocument4 pagesNon-financial factors when ceasing product lineAbhiraj RNo ratings yet

- T5 - Activity-Based Costing - Open Book TeamDocument3 pagesT5 - Activity-Based Costing - Open Book TeamSujib BarmanNo ratings yet

- 602 Assignment 1Document8 pages602 Assignment 1Irina ShamaievaNo ratings yet

- F5 Asignment 1Document5 pagesF5 Asignment 1Minhaj AlbeezNo ratings yet

- ABC MCQ'sDocument10 pagesABC MCQ'sMuhammad FaizanNo ratings yet

- Advanced Management Accounting Assignment AnalysisDocument8 pagesAdvanced Management Accounting Assignment AnalysisDaniel Daka100% (1)

- Intervention ManDocument47 pagesIntervention ManFrederick GbliNo ratings yet

- Multiple Choice THEORY: Choose The Letter of The Correct AnswerDocument4 pagesMultiple Choice THEORY: Choose The Letter of The Correct AnswerMohammadNo ratings yet

- HACC428 Tutorial QuestionsDocument36 pagesHACC428 Tutorial QuestionstapiwanashejakaNo ratings yet

- Activity Based Costing ER - NewDocument14 pagesActivity Based Costing ER - NewFadillah LubisNo ratings yet

- UTM Group Assignment Guide for Cost Accounting CourseDocument5 pagesUTM Group Assignment Guide for Cost Accounting CourseVishnu MenonNo ratings yet

- ACCT3500 (Fall 20) Answers To Tutorial 3Document7 pagesACCT3500 (Fall 20) Answers To Tutorial 3Mohammad ShabirNo ratings yet

- Activity Based Costing Review QuestionsDocument3 pagesActivity Based Costing Review Questionshome labNo ratings yet

- Suez Canal University Faculty of Commerce Subject: Managerial Accounting - Grade: Four Student Name in Arabic: Question OneDocument2 pagesSuez Canal University Faculty of Commerce Subject: Managerial Accounting - Grade: Four Student Name in Arabic: Question OneTaha ShawkyNo ratings yet

- Chapter 4 QuestionsDocument8 pagesChapter 4 Questionsreicelle vejerano100% (1)

- PM Sect B Test 6Document5 pagesPM Sect B Test 6FarahAin FainNo ratings yet

- Activity Based CostingproblemsDocument6 pagesActivity Based CostingproblemsDebarpan HaldarNo ratings yet

- Assgnment 2 (f5) 10341Document11 pagesAssgnment 2 (f5) 10341Minhaj AlbeezNo ratings yet

- tut 5Document3 pagestut 5Tang TammyNo ratings yet

- Cost 2023-MayDocument6 pagesCost 2023-MayDAVID I MUSHINo ratings yet

- ABC TutotialDocument6 pagesABC TutotialChandran PachapanNo ratings yet

- Cost Accounting SEM VI - A7a647e3 3463 45a2 Aeda 9b11352ea07cDocument11 pagesCost Accounting SEM VI - A7a647e3 3463 45a2 Aeda 9b11352ea07csimran KeswaniNo ratings yet

- Measuring and Managing Process Performance: QuestionsDocument4 pagesMeasuring and Managing Process Performance: QuestionsAshik Uz ZamanNo ratings yet

- Measuring and Managing Process Performance: QuestionsDocument4 pagesMeasuring and Managing Process Performance: QuestionsAshik Uz ZamanNo ratings yet

- Costing Systems ExercisesDocument10 pagesCosting Systems ExercisesRosele CabañelezNo ratings yet

- Mac Midterm ExamDocument5 pagesMac Midterm ExamBEA CATANEONo ratings yet

- Review Problem: Activity-Based Costing: RequiredDocument11 pagesReview Problem: Activity-Based Costing: RequiredTunvir SyncNo ratings yet

- AKUNTANSI MANAJEMEN ABC-ABMDocument54 pagesAKUNTANSI MANAJEMEN ABC-ABMAnonymous yMOMM9bsNo ratings yet

- Activity-based costing testDocument8 pagesActivity-based costing testLey EsguerraNo ratings yet

- ABC Costing Guide for Managerial Accounting ToolsDocument3 pagesABC Costing Guide for Managerial Accounting Toolssouayeh wejdenNo ratings yet

- Fundamentals of Accounting MCQsDocument111 pagesFundamentals of Accounting MCQssrikar dasaradhi100% (2)

- 151 0106Document37 pages151 0106api-27548664No ratings yet

- Suggested Answer - Syl08 - Dec13 - Paper 8 Intermediate ExaminationDocument13 pagesSuggested Answer - Syl08 - Dec13 - Paper 8 Intermediate ExaminationBalaji RajagopalNo ratings yet

- BhaDocument25 pagesBharishu jainNo ratings yet

- Assignment I - OMDocument2 pagesAssignment I - OMnirajrampuriaNo ratings yet

- PM Sunway Test July-Sept 2023 PTDocument11 pagesPM Sunway Test July-Sept 2023 PTFarahAin FainNo ratings yet

- F5-Test1 (Costing)Document7 pagesF5-Test1 (Costing)Amna HussainNo ratings yet

- SA Syl08 Jun2015 P15Document14 pagesSA Syl08 Jun2015 P15Pramod ChoudharyNo ratings yet

- Cost Accounting Exam PaperDocument5 pagesCost Accounting Exam PaperAhmed EltayebNo ratings yet

- Quiz ABCDocument2 pagesQuiz ABCZoey Alvin EstarejaNo ratings yet

- Absorption Costing - Bai Tap Thuc Hanh - EnglishDocument3 pagesAbsorption Costing - Bai Tap Thuc Hanh - EnglishTroyNo ratings yet

- Activity Based Costing Notes and ExerciseDocument6 pagesActivity Based Costing Notes and Exercisefrancis MagobaNo ratings yet

- REVISIONARY TEST PAPER TITLEDocument173 pagesREVISIONARY TEST PAPER TITLEvivek1929No ratings yet

- Waterway Continuous Problem WCPDocument17 pagesWaterway Continuous Problem WCPAboi Boboi50% (4)

- Chapter 5 Limiting Factors and Throughput Accounting: Answer 1Document10 pagesChapter 5 Limiting Factors and Throughput Accounting: Answer 1DOODGE CHIDHAKWANo ratings yet

- ACCTG 10A - Activity-Based Costing Quiz September 4, 2018Document1 pageACCTG 10A - Activity-Based Costing Quiz September 4, 2018JoeNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Blue Prism Developer Certification Case Based Practice Question - Latest 2023From EverandBlue Prism Developer Certification Case Based Practice Question - Latest 2023No ratings yet

- Make It! The Engineering Manufacturing Solution: Engineering the Manufacturing SolutionFrom EverandMake It! The Engineering Manufacturing Solution: Engineering the Manufacturing SolutionNo ratings yet

- INVESTMENT MANAGEMENT-lakatan and CondoDocument22 pagesINVESTMENT MANAGEMENT-lakatan and CondoJewelyn C. Espares-CioconNo ratings yet

- Service Marketing 3 - (Marketing Mix)Document123 pagesService Marketing 3 - (Marketing Mix)Soumya Jyoti BhattacharyaNo ratings yet

- Eco 411 Problem Set 1: InstructionsDocument4 pagesEco 411 Problem Set 1: InstructionsUtkarsh BarsaiyanNo ratings yet

- Corporate Finance Problem Set 5Document2 pagesCorporate Finance Problem Set 5MANo ratings yet

- 03 BIWS Equity Value Enterprise ValueDocument6 pages03 BIWS Equity Value Enterprise ValuecarminatNo ratings yet

- Zillow 2Q22 Shareholders' LetterDocument17 pagesZillow 2Q22 Shareholders' LetterGeekWireNo ratings yet

- Insak personality test questions and English language examplesDocument5 pagesInsak personality test questions and English language examplesPai YeeNo ratings yet

- Cooperative ManualDocument35 pagesCooperative ManualPratik MogheNo ratings yet

- Dianne FeinsteinDocument5 pagesDianne Feinsteinapi-311780148No ratings yet

- s6 Econ (Public Finance and Fiscal Policy)Document50 pagess6 Econ (Public Finance and Fiscal Policy)juniormugarura5No ratings yet

- Credit Card Response Rates and ProfitsDocument6 pagesCredit Card Response Rates and ProfitskkiiiddNo ratings yet

- Shamik Bhose September Crude Oil ReportDocument8 pagesShamik Bhose September Crude Oil ReportshamikbhoseNo ratings yet

- Jharkhand Govt Gazette Regarding Stipend For LawyersDocument6 pagesJharkhand Govt Gazette Regarding Stipend For LawyersLatest Laws TeamNo ratings yet

- P4 Taxation New Suggested CA Inter May 18Document27 pagesP4 Taxation New Suggested CA Inter May 18Durgadevi BaskaranNo ratings yet

- Impact of The Tax System On The Financial Activity of Business EntitiesDocument6 pagesImpact of The Tax System On The Financial Activity of Business EntitiesOpen Access JournalNo ratings yet

- ST 2 PDFDocument2 pagesST 2 PDFEbenezer SamedwinNo ratings yet

- EY-IFRS-FS-20 - Part 2Document50 pagesEY-IFRS-FS-20 - Part 2Hung LeNo ratings yet

- Delhi Rent Control Act, 1958Document6 pagesDelhi Rent Control Act, 1958a-468951No ratings yet

- 3.1.2 IFM Module2Document18 pages3.1.2 IFM Module2Aishwarya M RNo ratings yet

- 216 - JSAW Annual Report 2013 14Document137 pages216 - JSAW Annual Report 2013 14utalentNo ratings yet

- Excel Worksheet - Session 9 - Sestion CDocument108 pagesExcel Worksheet - Session 9 - Sestion CSOURABH DENo ratings yet

- Document ManagementDocument55 pagesDocument Managementrtarak100% (1)

- Sebi Grade A Exam: Paper 2 Questions With SolutionsDocument34 pagesSebi Grade A Exam: Paper 2 Questions With SolutionsnitinNo ratings yet

- Non-current Liabilities - Bonds Payable Classification and MeasurementDocument4 pagesNon-current Liabilities - Bonds Payable Classification and MeasurementhIgh QuaLIty SVTNo ratings yet

- The Journal of Performance Measurement Table of ContentsDocument12 pagesThe Journal of Performance Measurement Table of ContentsEttore TruccoNo ratings yet

- Entrepreneurial Law NotesDocument70 pagesEntrepreneurial Law NotesPhebieon Mukwenha100% (1)

- Cantabil Retail India Limited Private Equity ReportDocument15 pagesCantabil Retail India Limited Private Equity ReportMayank GugnaniNo ratings yet

- Research Proposal On Challenges of Local GovernmentDocument26 pagesResearch Proposal On Challenges of Local GovernmentNegash LelisaNo ratings yet

- Cash Flow and Financial PlanningDocument64 pagesCash Flow and Financial PlanningKARL PASCUANo ratings yet

- Central Surety and Lnsurance Company, Inc. vs. UbayDocument5 pagesCentral Surety and Lnsurance Company, Inc. vs. UbayMarianne RegaladoNo ratings yet