Professional Documents

Culture Documents

Horizontal Balance Sheet

Uploaded by

kathir_petro0 ratings0% found this document useful (0 votes)

40 views2 pages2001 2000 Increase / Decrease over (Rs. In (rs. In 2000 thousands) thousands) Amount % SOURCES OF FUNDS SHAREHOLDERS' FUNDS: Capital Reserves and Surplus LOAN FUNDS: Secured Loans Unsecured Loans TOTAL APPLICATIONS OF FUNDS FIXED ASSETS: Gross Block Less: Depreciation Net Block Capital work-in-progress INVESTMENTS CA, LOANS and ADVANCE

Original Description:

Original Title

Horizontal+Balance+Sheet

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document2001 2000 Increase / Decrease over (Rs. In (rs. In 2000 thousands) thousands) Amount % SOURCES OF FUNDS SHAREHOLDERS' FUNDS: Capital Reserves and Surplus LOAN FUNDS: Secured Loans Unsecured Loans TOTAL APPLICATIONS OF FUNDS FIXED ASSETS: Gross Block Less: Depreciation Net Block Capital work-in-progress INVESTMENTS CA, LOANS and ADVANCE

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

40 views2 pagesHorizontal Balance Sheet

Uploaded by

kathir_petro2001 2000 Increase / Decrease over (Rs. In (rs. In 2000 thousands) thousands) Amount % SOURCES OF FUNDS SHAREHOLDERS' FUNDS: Capital Reserves and Surplus LOAN FUNDS: Secured Loans Unsecured Loans TOTAL APPLICATIONS OF FUNDS FIXED ASSETS: Gross Block Less: Depreciation Net Block Capital work-in-progress INVESTMENTS CA, LOANS and ADVANCE

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

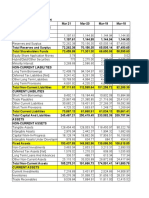

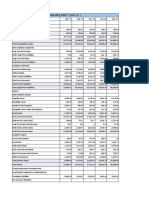

Horizontal Balance Sheet

As at December 31, 2001

Nestle India Ltd.

2001 2000 Increase/ Decrease over

(Rs. in (Rs. in 2000

thousands) thousands) Amount %

SOURCES OF FUNDS

SHAREHOLDERS’ FUNDS:

Capital 9,64,157 9,64,157 0 0.00

Reserves and Surplus 16,88,441 16,15,404 73,037 4.52

26,52,598 25,79,561 73,037 2.83

LOAN FUNDS:

Secured Loans 13,99,082 7,90,061 6,09,021 77.09

Unsecured Loans -- 60,000 (60,000) -100.00

13,99,082 8,50,061 5,49,021 64.59

TOTAL 40,51,680 34,29,622 6,22,058 18.14

APPLICATIONS OF FUNDS

FIXED ASSETS:

Gross Block 70,81,308 67,70,725 3,10,583 4.59

Less: Depreciation 30,04,804 26,44,811 3,59,993 13.61

Net Block 40,76,504 41,25,914 (49,410) -1.20

Capital work-in-progress 1,88,302 48,819 1,39,483 285.71

42,64,806 41,74,733 90,073 2.16

INVESTMENTS 1,04,611 10 1,04,601 10,46,010

CA, LOANS & ADVANCES:

Inventories 21,27,345 20,64,071 63,274 3.07

Debtors 2,92,326 3,11,139 (18,813) -6.05

Cash & Bank balances 41,869 1,01,039 (59,170) -58.56

Loans and Advances 11,33,537 8,72,306 .2,61,231 29.95

35,95,077 33,48,555 2,46,522 7.36

Less: CL & PROVISIONS:

Liabilities 20,09,616 19,22,001 87,615 4.56

Provisions 18,11,336 21,71,675 (3,60,339) -16.59

38,20,952 40,93,676 (2,72,724) -6.66

NET CURRENT ASSETS (2,25,875 (7,45,121) (5,19,246) -69.69

DEFERRED TAX LIA (NET) (91,862) -- (91,862) --

TOTAL 40,51,680 34,29,622 6,22,058 18.14

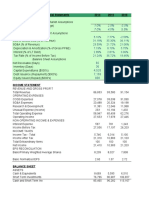

Horizontal P & L A/c

For the year ended December 31, 2001

Nestle India Ltd.

Particulars 2001 2000 Increase/ Decrease

(Rs. in (Rs. in over 2000

thousands) thousands) Amount %

Domestic sales 1,61,10,845 1,41,19,411 19,91,434 14.10

Exports 30,99,146 26,55,126 4,44,020 16.72

Total sales 1,92,09,991 1,67,74,537 24,35,454 14.52

Less: Excise duty 10,05,165 9,54,528 50,637 5.30

Net sales 1,82,04,826 1,58,20,009 23,84,817 15.07

Materials consumed 82,12,480 72,64,663 9,47,817 13.05

Manufacturing expenses 68,15,588 57,92,513 10,23,075 17.66

Provision for contingencies 1,80,943 2,94,606 -1,13,663 -38.58

Other income (operating) (-) 62,833 (-) 28,318 34,515 121.88

PBDIT 30,58,648 24,96,545 5,62,103 22.52

Depreciation 4,34,740 3,78,640 56,100 14.82

Impairment loss on FA 13,921 33,277 -19,356 -58.17

Deficit on FA sold 33,164 23,289 9,875 42.40

PBIT 25,76,823 20,61,339 5,15,484 25.01

Interest 98,604 1,49,022 -50,418 -33.83

Other Income (nonoperating) (-) 99,488 (-) 78,577 20,911 26.61

PBT 25,77,707 19,90,894 5,86,813 29.47

Provision for IT: 14.91

Current IT 9,25,051 8,05,000 1,20,051 ----

Deferred IT (-) 78,864 --- (-) 78,864 5.12

Total IT 8,46,187 8,05,000 41,187

PAT 17,31,520 11,85,894 5,45,626 46.00

You might also like

- Sample Resignation LetterDocument15 pagesSample Resignation LetterJohnson Mallibago71% (7)

- Deposit Mobilization of Nabil Bank LimitedDocument41 pagesDeposit Mobilization of Nabil Bank Limitedram binod yadav76% (38)

- Money Purse Telugu BookDocument3 pagesMoney Purse Telugu BookAsheervadam Suraboina0% (3)

- Dr. Annasaheb G.D. Bendale Memorial 9th National Moot Court CompetitionDocument4 pagesDr. Annasaheb G.D. Bendale Memorial 9th National Moot Court CompetitionvyasdesaiNo ratings yet

- Axis Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of Axis Bank - BSE: 532215, NSE: AXISBANKDocument2 pagesAxis Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNo ratings yet

- Balance Sheet of WiproDocument3 pagesBalance Sheet of WiproRinni JainNo ratings yet

- ICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- Assignment of Accounting For ManagersDocument17 pagesAssignment of Accounting For ManagersGurneet KaurNo ratings yet

- Part D.2-Vertical AnalysisDocument32 pagesPart D.2-Vertical AnalysisQuendrick Surban100% (1)

- Data of BhartiDocument2 pagesData of BhartiAnkur MehtaNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- Business Valuation Cia 1 Component 1Document7 pagesBusiness Valuation Cia 1 Component 1Tanushree LamareNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsJoydeep GoraiNo ratings yet

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaNo ratings yet

- Balance Sheet: Hindalco IndustriesDocument20 pagesBalance Sheet: Hindalco Industriesparinay202No ratings yet

- Directors Report 2014 PDFDocument14 pagesDirectors Report 2014 PDFgalacticwormNo ratings yet

- VerticalDocument2 pagesVerticalPatricia PeñaNo ratings yet

- Illustration Acc FMDocument22 pagesIllustration Acc FMHEMACNo ratings yet

- Financial Statements and Ratios Flashcards QuizletDocument14 pagesFinancial Statements and Ratios Flashcards QuizletDanish HameedNo ratings yet

- Five Year Finance Summary of Grasim IndustriesDocument12 pagesFive Year Finance Summary of Grasim IndustriesSarva ShivaNo ratings yet

- Jollibee Financial Position OverviewDocument12 pagesJollibee Financial Position OverviewNeil Rey De SagunNo ratings yet

- Jollibee Food Corporation Statement of Financial PositionDocument12 pagesJollibee Food Corporation Statement of Financial PositionNeil Rey De SagunNo ratings yet

- Bibliography and Ane KumaranDocument6 pagesBibliography and Ane KumaranG.KISHORE KUMARNo ratings yet

- Tata SteelDocument10 pagesTata SteelSakshi ShahNo ratings yet

- Asian Paints Balance Sheet and Profit & Loss Statement AnalysisDocument64 pagesAsian Paints Balance Sheet and Profit & Loss Statement Analysissanket patilNo ratings yet

- Financial Analysis of Sun PharmaDocument7 pagesFinancial Analysis of Sun PharmahemanshaNo ratings yet

- Black Hole Futsal & Café Projected Balance SheetDocument9 pagesBlack Hole Futsal & Café Projected Balance Sheetkalpana BaralNo ratings yet

- Itc LTD: Balance Sheet FY17-18 FY16-17 FY15-16Document4 pagesItc LTD: Balance Sheet FY17-18 FY16-17 FY15-16gouri khanduallNo ratings yet

- 02 04 EndDocument6 pages02 04 EndnehaNo ratings yet

- Annextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015Document3 pagesAnnextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015vandv printsNo ratings yet

- BS TATADocument18 pagesBS TATAitubanerjee28No ratings yet

- OVL English Annual Report 19-20-24!11!2020Document394 pagesOVL English Annual Report 19-20-24!11!2020hitstonecoldNo ratings yet

- Tata Steel FinancialsDocument8 pagesTata Steel FinancialsManan GuptaNo ratings yet

- Abans QuarterlyDocument14 pagesAbans QuarterlyGFMNo ratings yet

- 02 06 BeginDocument6 pages02 06 BeginnehaNo ratings yet

- HCL Technologies: Balance Sheet - in Rs. Cr.Document20 pagesHCL Technologies: Balance Sheet - in Rs. Cr.Kuldeep SinghNo ratings yet

- Project Report PDFDocument13 pagesProject Report PDFMan KumaNo ratings yet

- Tvs Motor 2019 2018 2017 2016 2015Document108 pagesTvs Motor 2019 2018 2017 2016 2015Rima ParekhNo ratings yet

- 5 Year Balance Sheet and Profit & Loss DataDocument3 pages5 Year Balance Sheet and Profit & Loss DataJay MogradiaNo ratings yet

- Riel Corporation Comparative Statements of Financial Position December 31, 2015Document2 pagesRiel Corporation Comparative Statements of Financial Position December 31, 2015Rocel DomingoNo ratings yet

- AMD Trend Sheet-CompressedDocument8 pagesAMD Trend Sheet-Compressedpriyathamme.seekerNo ratings yet

- Nations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118Document19 pagesNations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118haffaNo ratings yet

- Ali Asghar Report ..Document7 pagesAli Asghar Report ..Ali AzgarNo ratings yet

- Comparative Balance SheetDocument8 pagesComparative Balance Sheet1028No ratings yet

- Eco Lounge Projected Income StatementsDocument136 pagesEco Lounge Projected Income StatementsJeremiah GonzagaNo ratings yet

- Tata Motors - Strategy - DataDocument17 pagesTata Motors - Strategy - DataSarvesh SmartNo ratings yet

- Part 4 - Topic Part: CSR of IbblDocument38 pagesPart 4 - Topic Part: CSR of IbblfahadNo ratings yet

- Horizontal Analysis of Malayan Flour Mills' Income StatementDocument11 pagesHorizontal Analysis of Malayan Flour Mills' Income StatementIntan HidayahNo ratings yet

- Term Paper Sandeep Anurag GautamDocument13 pagesTerm Paper Sandeep Anurag GautamRohit JainNo ratings yet

- CMA CIA 3 YateeDocument38 pagesCMA CIA 3 YateeYATEE TRIVEDI 21111660No ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDparika khannaNo ratings yet

- Hablon Production Center Statement of Financial Performance For The Years Ended December 31Document41 pagesHablon Production Center Statement of Financial Performance For The Years Ended December 31angelica valenzuelaNo ratings yet

- AK Sun Pharma UM21321Document4 pagesAK Sun Pharma UM21321akarshika raiNo ratings yet

- Tata Motors DCFDocument11 pagesTata Motors DCFChirag SharmaNo ratings yet

- Final Ma Jud Ni FinancialsDocument78 pagesFinal Ma Jud Ni FinancialsMichael A. BerturanNo ratings yet

- Canara Bank Income Statement AnalysisDocument88 pagesCanara Bank Income Statement Analysissnithisha chandranNo ratings yet

- Rs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37Document6 pagesRs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37priyanshu14No ratings yet

- Ratios of HDFC BankDocument50 pagesRatios of HDFC BankrupaliNo ratings yet

- Steel Authority of India Balance Sheet and Profit & Loss AnalysisDocument12 pagesSteel Authority of India Balance Sheet and Profit & Loss AnalysisPadmavathi shivaNo ratings yet

- Recommendation of Advisory CommitteeDocument1 pageRecommendation of Advisory Committeemadhumay23No ratings yet

- Emu LinesDocument22 pagesEmu LinesRahul MehraNo ratings yet

- Asian Paints (Autosaved) 2Document32,767 pagesAsian Paints (Autosaved) 2niteshjaiswal8240No ratings yet

- Tata Power Balance SheetDocument2 pagesTata Power Balance Sheetakankshakhushi12No ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Business Research Methods: MeasurementDocument23 pagesBusiness Research Methods: Measurementkathir_petroNo ratings yet

- Web SurveyorDocument24 pagesWeb Surveyorkathir_petroNo ratings yet

- Job CostingDocument26 pagesJob Costingkathir_petroNo ratings yet

- CVP AnalysisDocument39 pagesCVP AnalysisTapas TiwariNo ratings yet

- Universal Principles of Biomedical EthicsDocument16 pagesUniversal Principles of Biomedical EthicsMEOW41100% (3)

- Drug Free Workplace Act PolicyDocument8 pagesDrug Free Workplace Act PolicyglitchygachapandaNo ratings yet

- BANKERS INDEMNITY INSURANCE POLICY WORDING (Com)Document12 pagesBANKERS INDEMNITY INSURANCE POLICY WORDING (Com)maddy honeyNo ratings yet

- Articles of Association 1774Document8 pagesArticles of Association 1774Jonathan Vélez-BeyNo ratings yet

- Annual ReportDocument110 pagesAnnual ReportSarwan AliNo ratings yet

- Income of other persons included in an assessee's total income under Sections 60 to 65Document9 pagesIncome of other persons included in an assessee's total income under Sections 60 to 65Smiksha SmikshaNo ratings yet

- Identity Theft WebquestDocument2 pagesIdentity Theft Webquestapi-256439506No ratings yet

- English 7 AnnexeDocument4 pagesEnglish 7 AnnexeTASOEUR1234567890No ratings yet

- NaMo Case StudyDocument4 pagesNaMo Case StudyManish ShawNo ratings yet

- Godisnjak PFSA 2018 Za WebDocument390 pagesGodisnjak PFSA 2018 Za WebAida HamidovicNo ratings yet

- COMPLETING YOUR IRC FORM C TAX RETURNDocument31 pagesCOMPLETING YOUR IRC FORM C TAX RETURNDanielNo ratings yet

- WEC13 01 Que 20220111Document32 pagesWEC13 01 Que 20220111Mike JACKSONNo ratings yet

- The Queen of The Pirate Isle by Harte, Bret, 1836-1902Document18 pagesThe Queen of The Pirate Isle by Harte, Bret, 1836-1902Gutenberg.orgNo ratings yet

- Income Statement and Related Information: Intermediate AccountingDocument64 pagesIncome Statement and Related Information: Intermediate AccountingAdnan AbirNo ratings yet

- TDW Pipeline Pigging CatalogDocument135 pagesTDW Pipeline Pigging CatalogShaho Abdulqader Mohamedali100% (1)

- School EOEDocument1 pageSchool EOEMark James S. SaliringNo ratings yet

- Chapter Two: A Market That Has No One Specific Location Is Termed A (N) - MarketDocument9 pagesChapter Two: A Market That Has No One Specific Location Is Termed A (N) - MarketAsif HossainNo ratings yet

- Tax Invoice for 100 Mbps Home InternetDocument1 pageTax Invoice for 100 Mbps Home Internetpriyank31No ratings yet

- Philippine Citizenship Denied Due to Absence After Filing PetitionDocument6 pagesPhilippine Citizenship Denied Due to Absence After Filing Petitionalyssa bianca orbisoNo ratings yet

- Script FiestaDocument5 pagesScript FiestaLourdes Bacay-DatinguinooNo ratings yet

- 14th Finance CommissionDocument4 pages14th Finance CommissionMayuresh SrivastavaNo ratings yet

- Executive Order No. 01-s-2023 (BDC)Document2 pagesExecutive Order No. 01-s-2023 (BDC)kencyrilachasNo ratings yet

- SEMESTER-VIDocument15 pagesSEMESTER-VIshivam_2607No ratings yet

- Schnittke - The Old Style Suite - Wind Quintet PDFDocument16 pagesSchnittke - The Old Style Suite - Wind Quintet PDFciccio100% (1)

- Titan MUX User Manual 1 5Document158 pagesTitan MUX User Manual 1 5ak1828No ratings yet

- s3 UserguideDocument1,167 pagess3 UserguideBetmanNo ratings yet