Professional Documents

Culture Documents

Sangeeta Udhyog Ltd trial balance analysis

Uploaded by

Vishal KashyapOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sangeeta Udhyog Ltd trial balance analysis

Uploaded by

Vishal KashyapCopyright:

Available Formats

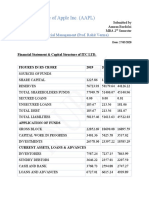

SANGEETA UDHYOG LTD.

The following is the trial balance of Sangeeta Udhyogo Ltd.as on 31st March 2006.

Account Dr. (Rs.) Cr.(Rs.)

Stock, 1st April 2005 14,91,360

Wages 8,77,920

Debtors & Creditors 13,15,200 7,37,760

Furniture 40,000

Purchases & Sales 57,45,680 93,59,200

Carriage inwards 39,280

Returns 1,01,120 78,480

Advance payment of income tax 1,14,320

Bank loan-Secured-Long term 4,00,000

Manufacturing expenses 1,53,920

Interest on loan 36,000

Profit & loss account, 1st April 2005 69,440

Cash in hand 15,360

Leasehold factory building 13,13,680

Plant & Machinery 10,27,200

Loose tools 1,00,000

Carriage outwards 74,080

Share capital 32,00,000

Calls in arrear 8,000

Rates & electricity - factory 1,40,880

Office expenses 64,000

Director's fees & remuneration 96,000

Office Salaries & expenses 1,04,000

Auditor's fees 10,000

Machinery repairs 34,880

Commission 39,120

Bank current account 8,54,880

Preliminary expenses 48,000

TOTAL 1,38,44,880 1,38,44,880

Further Information:

1. The authorised share capital of the company consists of 4,00,000 equity shares of Rs.10 each.

2. The stock was valued at Rs.9,98,720 and loose tools at Rs.80,000.

3. Wages Rs.15,120 and office salaries Rs.9,600 are due.

4. Bank loan was taken on 1-04-2005 on interest @15%p.a.

5. Depreciation is to be provided on:

a) Plant & Machinery @ 14%;

b) Furniture @ 18%.

6. Write off one –third Preliminary Expenses.

7. Provide Rs.68,000 on Debtors for Doubtful Debts.

8. Provide further Rs.24,960 for discount on debtors.

9. Make a provision for income tax @35%.

10. Transfer 10% of net profits to General Reserve.

11. The Directors recommend dividend @10% per annum for the year ended 31st March 2006.

You might also like

- Hood Directors Cut PlaybooksDocument55 pagesHood Directors Cut PlaybooksAlfredNo ratings yet

- Perm Wood Foundation PDFDocument52 pagesPerm Wood Foundation PDFn100% (1)

- Contract of Lease & Receipt Dy TengDocument13 pagesContract of Lease & Receipt Dy TengAnonymous iz9ueFNo ratings yet

- Bpi Family Savings Bank Inc vs. Spouses YujuicoDocument2 pagesBpi Family Savings Bank Inc vs. Spouses YujuicoFlorz Gelarz50% (2)

- Barops CivilDocument484 pagesBarops CivilJordan Tumayan100% (1)

- CIMA F3 SyllabusDocument8 pagesCIMA F3 SyllabusShah KamalNo ratings yet

- Jaga Managing Creativity and Open InnovationDocument22 pagesJaga Managing Creativity and Open InnovationSAURABH YADAVNo ratings yet

- Real Estate MortgageDocument2 pagesReal Estate MortgageRex Traya100% (1)

- ObliCon Case Digests - Amber Gagajena PDFDocument96 pagesObliCon Case Digests - Amber Gagajena PDFNowell SimNo ratings yet

- Shashaank Industries Profit LossDocument6 pagesShashaank Industries Profit LossSrijan SaxenaNo ratings yet

- Thaifoon Restaurant Financial ProjectionDocument8 pagesThaifoon Restaurant Financial ProjectionkudkhanNo ratings yet

- Turnkey Case StudyDocument20 pagesTurnkey Case Studyharsh kumarNo ratings yet

- Divya Electronics financing options analysis for expansion projectDocument1 pageDivya Electronics financing options analysis for expansion projectSanskar VyasNo ratings yet

- Calendar Demand ProblemDocument43 pagesCalendar Demand Problemrahul.iamNo ratings yet

- Tata Motors: Can the Turnaround Plan Improve PerformanceDocument16 pagesTata Motors: Can the Turnaround Plan Improve PerformanceMehdi BelabyadNo ratings yet

- Bharat Hotels RevisedDocument4 pagesBharat Hotels RevisedYagyaaGoyalNo ratings yet

- SwotDocument5 pagesSwotRajput KuldeepNo ratings yet

- Derivatives CIA 3 - Christ UniversityDocument10 pagesDerivatives CIA 3 - Christ UniversityRNo ratings yet

- Case 1Document18 pagesCase 1Amit Kanti RoyNo ratings yet

- Marketing DossierDocument38 pagesMarketing DossierTigran WadiaNo ratings yet

- Indian Electricals Cost SheetDocument1 pageIndian Electricals Cost SheetPratul BatraNo ratings yet

- Problem Set 1 PDFDocument3 pagesProblem Set 1 PDFrenjith0% (2)

- Cost Analysis of Coca-Cola Company - by HakimzadDocument18 pagesCost Analysis of Coca-Cola Company - by HakimzadHakimzad9001 Faisal9001100% (1)

- Q Navin PDFDocument1 pageQ Navin PDFvijaya senthilNo ratings yet

- 3rd PresentationDocument25 pages3rd PresentationArpita MehtaNo ratings yet

- Impairing The Microsoft - Nokia PairingDocument54 pagesImpairing The Microsoft - Nokia Pairingjk kumarNo ratings yet

- Canara Bank Research Report - SWOT and Competitive AnalysisDocument5 pagesCanara Bank Research Report - SWOT and Competitive AnalysisAhana SarkarNo ratings yet

- Optimize capital structure and maximize ROEDocument13 pagesOptimize capital structure and maximize ROESneha Dwivedi100% (1)

- Amtek Auto InustryDocument10 pagesAmtek Auto InustryVedantam GuptaNo ratings yet

- DT, Cem, RadrDocument46 pagesDT, Cem, RadrShivaprasadNo ratings yet

- Modern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingDocument7 pagesModern Pharma Is Considering The Manufacture of A New Drug, Floxin, For Which The FollowingbansalparthNo ratings yet

- VINDY Income Statement and Balance SheetDocument3 pagesVINDY Income Statement and Balance SheetPulkit SethiaNo ratings yet

- Maynard Solutions Ch04Document17 pagesMaynard Solutions Ch04Anton VitaliNo ratings yet

- Cma Tata MotorsDocument25 pagesCma Tata MotorsArchana MishraNo ratings yet

- Swati Anand - FRMcaseDocument5 pagesSwati Anand - FRMcaseBhavin MohiteNo ratings yet

- Working Capital MGTDocument14 pagesWorking Capital MGTrupaliNo ratings yet

- MicroEconomics 2012 Midterms at IIM KozhikodeDocument5 pagesMicroEconomics 2012 Midterms at IIM KozhikodeShri DharNo ratings yet

- Starbucks Case StudyDocument27 pagesStarbucks Case StudyPardeep KapilNo ratings yet

- Nptel Course Financial Management Assignment Ii: Liabilities Rs. (Million) Asset Rs. (Million)Document3 pagesNptel Course Financial Management Assignment Ii: Liabilities Rs. (Million) Asset Rs. (Million)yogeshgharpureNo ratings yet

- Kim FullerDocument3 pagesKim FullerVinay GoyalNo ratings yet

- France TelecomDocument17 pagesFrance Telecomabhi2djNo ratings yet

- Shree Cement Financial Model Projections BlankDocument10 pagesShree Cement Financial Model Projections Blankrakhi narulaNo ratings yet

- A Report On: Analysis of Financial Statements OF Tata Consultancy Services & Maruti SuzukiDocument38 pagesA Report On: Analysis of Financial Statements OF Tata Consultancy Services & Maruti SuzukiSaurabhNo ratings yet

- House Property - IllustrationDocument10 pagesHouse Property - IllustrationAnirban ThakurNo ratings yet

- Expenses Amount: Shashaank Industries Ltd. Profit and Loss Account For The Year Ended 31st March 2006Document6 pagesExpenses Amount: Shashaank Industries Ltd. Profit and Loss Account For The Year Ended 31st March 2006Srijan SaxenaNo ratings yet

- School of Business and Management Christ (Deemed To Be University) BangaloreDocument8 pagesSchool of Business and Management Christ (Deemed To Be University) BangaloreMedha Singh100% (1)

- CH 22: Lease, Hire Purchase and Project FinancingDocument7 pagesCH 22: Lease, Hire Purchase and Project FinancingMukul KadyanNo ratings yet

- FM - Assignment Batch 19 - 21 IMS IndoreDocument3 pagesFM - Assignment Batch 19 - 21 IMS IndoreaskjdfaNo ratings yet

- Swot SoftDocument33 pagesSwot Softpurva_pitre100% (1)

- Chemalite Group - Cash Flow Statement - PBTDocument8 pagesChemalite Group - Cash Flow Statement - PBTAmit Shukla100% (1)

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Capital Structure Analysis of ITC LTDDocument4 pagesCapital Structure Analysis of ITC LTDAnuran Bordoloi0% (1)

- A Study On Leveraged Buyout's in IndiaDocument60 pagesA Study On Leveraged Buyout's in Indiavinodab150% (2)

- EVA Practice SheetDocument17 pagesEVA Practice SheetVinushka GoyalNo ratings yet

- Beta Case Study (Nirbhay Chauhan)Document10 pagesBeta Case Study (Nirbhay Chauhan)Nirbhay ChauhanNo ratings yet

- Vayutel Case StudyDocument10 pagesVayutel Case StudyRenault RoorkeeNo ratings yet

- Cash Flows IIDocument16 pagesCash Flows IIChristian EstebanNo ratings yet

- On Nirma CaseDocument36 pagesOn Nirma CaseMuskaan ChaudharyNo ratings yet

- Rs. RS.: Compass Company Balance Sheet, March 31Document2 pagesRs. RS.: Compass Company Balance Sheet, March 31aditi4garg-10% (1)

- IPO Note: Devyani International Limited's Rs. 1,776-1,838 Cr IssueDocument4 pagesIPO Note: Devyani International Limited's Rs. 1,776-1,838 Cr Issuechinna rao100% (1)

- FAM Text BookDocument2 pagesFAM Text BookSumitNo ratings yet

- Thumbs UpDocument4 pagesThumbs Upwasif ahmedNo ratings yet

- Cost Sheet For The Month of January: TotalDocument9 pagesCost Sheet For The Month of January: TotalgauravpalgarimapalNo ratings yet

- Case Problem 3 Textile Mill SchedulingDocument4 pagesCase Problem 3 Textile Mill SchedulingSomething ChicNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Batch 2-1Document2 pagesBatch 2-1kp7659165No ratings yet

- Lecture 6 - Practice Questions-1Document4 pagesLecture 6 - Practice Questions-1donkhalif13No ratings yet

- Mariano Vs CADocument3 pagesMariano Vs CApapaburgundyNo ratings yet

- Parties Bound by ContractDocument15 pagesParties Bound by ContractRajkumariNo ratings yet

- For Whose Benefit Is The Period Constituted?: General RuleDocument11 pagesFor Whose Benefit Is The Period Constituted?: General RuleIts meh SushiNo ratings yet

- Reply To Motion To Dismiss CH 13 Bankruptcy: Benjamin Levi Jones-NormanDocument5 pagesReply To Motion To Dismiss CH 13 Bankruptcy: Benjamin Levi Jones-Normangw9300No ratings yet

- Smart Platina Assure Brochure FinalDocument12 pagesSmart Platina Assure Brochure Finalsksen007No ratings yet

- Economics of Money and BankingDocument12 pagesEconomics of Money and BankingGhazal HussainNo ratings yet

- Riverwood Apartments - 2009 VADocument252 pagesRiverwood Apartments - 2009 VADavid LayfieldNo ratings yet

- An Analytical Study of Various Policies Related To Personal Financing Services of Icici Bank With Special Reference To Western Uttar PradeshDocument11 pagesAn Analytical Study of Various Policies Related To Personal Financing Services of Icici Bank With Special Reference To Western Uttar PradeshAnubhav SonyNo ratings yet

- Agency Hw1Document9 pagesAgency Hw1YieMaghirangNo ratings yet

- Analyzing Microfinance Institutions in PakistanDocument4 pagesAnalyzing Microfinance Institutions in PakistanNida RazaNo ratings yet

- A Particular Fund, Fund 501.: Requisites of Negotiability An Instrument To Be Negotiable Must Contain An UnconditionalDocument2 pagesA Particular Fund, Fund 501.: Requisites of Negotiability An Instrument To Be Negotiable Must Contain An UnconditionalMichelle Ann AsuncionNo ratings yet

- Bank of America vs. American Realty CorpDocument13 pagesBank of America vs. American Realty CorpJhunjie SabacahanNo ratings yet

- Contract of Bailment: Rights, Duties & TypesDocument2 pagesContract of Bailment: Rights, Duties & TypesNisar KhanNo ratings yet

- WC - Merits and DemeritsDocument23 pagesWC - Merits and DemeritsARUN100% (1)

- RBI keeps repo rate unchanged and other banking newsDocument51 pagesRBI keeps repo rate unchanged and other banking newsunikxocizmNo ratings yet

- The 10 Worst Corporations of 2008Document255 pagesThe 10 Worst Corporations of 2008hasanbNo ratings yet

- Petroleos Mexicanos BD PDFDocument2 pagesPetroleos Mexicanos BD PDFAlecChengNo ratings yet

- Columbus CEO Leaderboard - Commercial Mortgage LendersDocument1 pageColumbus CEO Leaderboard - Commercial Mortgage LendersDispatch MagazinesNo ratings yet

- Civ 2 Full Text To Be DigestedDocument718 pagesCiv 2 Full Text To Be DigestedBrenPeñarandaNo ratings yet

- Velarde V CADocument1 pageVelarde V CARalph Deric EspirituNo ratings yet

- A Comparative Study Between Jet Airways and KingfisherDocument5 pagesA Comparative Study Between Jet Airways and KingfisherKandarp SinghNo ratings yet

- Ask HN - Your Best Passive Income Sources - Hacker NewsDocument35 pagesAsk HN - Your Best Passive Income Sources - Hacker Newsresearch45No ratings yet