Professional Documents

Culture Documents

09 C 24 Fsa

Uploaded by

Saumya Tripathi0 ratings0% found this document useful (0 votes)

19 views3 pagesOriginal Title

09c24fsa

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views3 pages09 C 24 Fsa

Uploaded by

Saumya TripathiCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 3

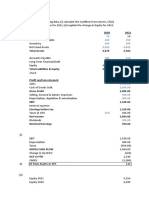

Solved problem 4.

1

Current assets 1,600

Current liabilities 1,000

Minimum current ratio 1.25

Maximum borrowing 1400

Solved problem 4.2

Current ratio 1.4

Acid-test ratio 1.2

Current liabilities 1,600

Inventory turnover ratio 8

Current assets 2,240

Inventories 320

Sales 2,560

Solved problem 4.3

Net profit margin ratio 4%

Current ratio 1.25

Return on net worth 15.23%

Total debt to total assets ratio 0.4

Inventory turnover ratio 25

Solution are the figures in italics in the following statements

Profit and Loss account

Sales 2535.8

Cost of goods sold 1587.9

Operating expenses 700

Profit before interest and tax 247.9

Interest 45

Profit before tax 202.9

Tax provision at 101.4

50%

Profit after tax 101.4

Balance sheet

Net worth 666 Fixed assets

Long-term debt: interest at Current assets

15% 300 Cash

Accounts payable 144 Receivables

Inventory

Total 1110 Total

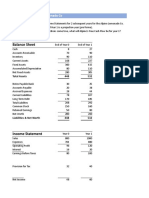

Solved problem 4.4

Rs.in million

Profit & Loss Account for year ending 31st20X1

March 20X0

Net sales 1065 950

Cost of goods sold 805 720

Stocks 600 520

Wages and salaries 120 110

Other manufacturing expenses85 85 90

Gross profit 260 230

Operating expenses 90 75

Depreciation 50 40

Selling and general administration 40 35

Profit before interest and tax 170 155

Interest 35 30

Profit before tax 135 125

Tax 50 45

Profit after tax 85 80

Dividends 35 30

Retained earnings 50 50

Balance sheet as at 31st March 20X1 20X0

Sources of Funds

Shareholders' funds 505 455

(a) Share capital 125 125

(b) Reserve and surplus 380 330

Loan funds 280 260

(a) Secured loans 180 160

(i) Due after 1 year 130 135

(ii) Due within 1 year 50 25

(b) Unsecured loans 100 100

(i) Due after 1 year 60 70

(ii) Due within 1 year 40 30

Total 785 715

Application of Funds

Net fixed assets 550 495

Investments 30 25

(a) Long - term investments 20 20

(b) Current investments 10 5

Current assets, loans and advances 355 333

(a) Inventories 160 138

(b) Sundry debtors 120 115

( c) Cash and bank balances 25 20

(d) Loans and advances 50 60

Less: Current liabilities and provisions 150 138

Net Current assets 205 195

Total 785 715

Current ratio 1.52

Acid-test ratio 0.85

Cash ratio 0.15

Debt-equity ratio 0.55

Interest coverage ratio 4.86

Fixed charges coverage ratio 1.24

Inventory turnover 5.40

Debtors turnover 9.06

Average collection period in days 40.27

Fixed assets turnover 2.04

Total assets turnover 1.42

Gross profit margin 24.4%

Net profit margin 7.98%

Return on assets 11.3%

Earning power 22.7%

Return on equity 17.7%

You might also like

- 4excels On Solved ProblemsDocument2 pages4excels On Solved ProblemsAtushNo ratings yet

- BFN202 Seminar Questions SET1Document3 pagesBFN202 Seminar Questions SET1baba cacaNo ratings yet

- Solved Problem 3.1 Profit & Loss Account For Year Ending 31st MarchDocument65 pagesSolved Problem 3.1 Profit & Loss Account For Year Ending 31st MarchChaitanyaNo ratings yet

- Exercise ProfitabilityDocument2 pagesExercise ProfitabilityPhong Nghiêm TấnNo ratings yet

- Managerial Accounting PPDocument42 pagesManagerial Accounting PPSaurav KumarNo ratings yet

- Ratio AnlysDocument5 pagesRatio AnlysVi PhuongNo ratings yet

- Thegodfather CF Student CdADocument8 pagesThegodfather CF Student CdAPablo MichavilaNo ratings yet

- FAWCM - Cash Flow 2Document29 pagesFAWCM - Cash Flow 2Jake RoosenbloomNo ratings yet

- Corporate Valuation & Value Creation Excel Spreadsheets For Solved ProblemsDocument11 pagesCorporate Valuation & Value Creation Excel Spreadsheets For Solved Problemsbipin kumarNo ratings yet

- Accounting: Making Sound Decisions: Non-Current AssetsDocument2 pagesAccounting: Making Sound Decisions: Non-Current AssetsAniruddha Rantu40% (5)

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNo ratings yet

- FRS 107 Ie 2016BBDocument10 pagesFRS 107 Ie 2016BBAmelia RahmawatiNo ratings yet

- Income Statement (INR 2013 2014 Balance Sheet (INR MN) 2013: For The Period Ending 31st December As On 31st December.Document3 pagesIncome Statement (INR 2013 2014 Balance Sheet (INR MN) 2013: For The Period Ending 31st December As On 31st December.Sathyanarayana GNo ratings yet

- Prepare Profit & Loss Account and Balance Sheet With The Help of Information Given in The Trial BalanceDocument4 pagesPrepare Profit & Loss Account and Balance Sheet With The Help of Information Given in The Trial BalanceEntertainment StatusNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- Illustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial InstitutionDocument9 pagesIllustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial InstitutionjohnNo ratings yet

- Analysis of Financial Statements: Centre For Financial Management, BangaloreDocument29 pagesAnalysis of Financial Statements: Centre For Financial Management, BangaloreDimple PandeyNo ratings yet

- Chapters ExcelDocument121 pagesChapters ExcelRohan VermaNo ratings yet

- Sb Fm 2 Practical Sem 5 - CopyDocument39 pagesSb Fm 2 Practical Sem 5 - CopySohan KhaterNo ratings yet

- Ratio Analysis Problems-1Document10 pagesRatio Analysis Problems-1Aditya DalviNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Financial Statements, Taxes, and Cash Flow: Centre For Financial Management, BangaloreDocument22 pagesFinancial Statements, Taxes, and Cash Flow: Centre For Financial Management, BangaloreDimple PandeyNo ratings yet

- Subsidiary and Sub SubsidiaryDocument3 pagesSubsidiary and Sub SubsidiaryNipun Chandula WijayanayakaNo ratings yet

- Evaluating Financial PerformanceDocument31 pagesEvaluating Financial PerformanceShahruk AnwarNo ratings yet

- FRS - 7 - Ie - (2016)Document9 pagesFRS - 7 - Ie - (2016)David LeeNo ratings yet

- FCFF 1 Aayush ParasharDocument7 pagesFCFF 1 Aayush Parasharaayush.5.parasharNo ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- MMZ ACCOUNTANCY SCHOOL: 15 Mark Questions on Preparing Simple Consolidated Financial StatementsDocument7 pagesMMZ ACCOUNTANCY SCHOOL: 15 Mark Questions on Preparing Simple Consolidated Financial StatementsSerena100% (1)

- UntitledDocument11 pagesUntitledKhang ĐặngNo ratings yet

- CR Inter QuestionsDocument22 pagesCR Inter QuestionsRichie BoomaNo ratings yet

- Financial Statement AnalysisDocument2 pagesFinancial Statement AnalysisHimanshu KumarNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - BlankDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Blank155- Salsabila GadingNo ratings yet

- CORPORATE REPORTING Icag PDFDocument31 pagesCORPORATE REPORTING Icag PDFmohedNo ratings yet

- 02 Profits, Cash Flows and Taxes - StudentsDocument25 pages02 Profits, Cash Flows and Taxes - StudentslmsmNo ratings yet

- Fin Mid Fall 2020Document2 pagesFin Mid Fall 2020Shafiqul Islam Sowrov 1921344630No ratings yet

- Analyze financial statements and construct cash flow statementDocument14 pagesAnalyze financial statements and construct cash flow statementMirkan OrdeNo ratings yet

- Analysis of Financial StatementDocument10 pagesAnalysis of Financial StatementAli QasimNo ratings yet

- IB Bussiness Management Financial Statements Layout GuideDocument2 pagesIB Bussiness Management Financial Statements Layout GuideBhavish Adwani100% (1)

- 5110WA7 FinancialsDocument1 page5110WA7 FinancialsAhmed EzzNo ratings yet

- Fin Q2Document6 pagesFin Q2Pulkit SethiaNo ratings yet

- Class Handout-2Document3 pagesClass Handout-2AdityaDhruvMansharamaniNo ratings yet

- Jenga Inc Solution Year 1 Year 2: © Corporate Finance InstituteDocument2 pagesJenga Inc Solution Year 1 Year 2: © Corporate Finance InstitutePirvuNo ratings yet

- Midterm Excel Worksheet - OlivieriDocument14 pagesMidterm Excel Worksheet - OlivieriEmanuele OlivieriNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Exhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1Document121 pagesExhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1DrSwati BhargavaNo ratings yet

- Assignment 2 - Financials of Boru Vaahana (PVT) LTD.: Current AssetsDocument2 pagesAssignment 2 - Financials of Boru Vaahana (PVT) LTD.: Current AssetsRukshani RefaiNo ratings yet

- Jenga Inc Solution: Strictly ConfidentialDocument3 pagesJenga Inc Solution: Strictly Confidentialanjali shilpa kajal100% (1)

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- Spring 2022 - FIN621 - 1Document7 pagesSpring 2022 - FIN621 - 1Entertainment StatusNo ratings yet

- Statement of Financial Position As at 31st March 2015Document52 pagesStatement of Financial Position As at 31st March 2015Shameel IrshadNo ratings yet

- Chapter 4 Problems Evaluating A Firm'S Financial PerformanceDocument22 pagesChapter 4 Problems Evaluating A Firm'S Financial Performancerony_naiduNo ratings yet

- Solution Alpine DataDocument4 pagesSolution Alpine DataShalabh DongaonkarNo ratings yet

- DW CorpDocument20 pagesDW CorpAlejo valenzuelaNo ratings yet

- ABC Income Statement (Millons) 2018: Short Term InvestmentsDocument20 pagesABC Income Statement (Millons) 2018: Short Term InvestmentsAlejo valenzuelaNo ratings yet

- Jenga Inc Exercise: Strictly ConfidentialDocument3 pagesJenga Inc Exercise: Strictly Confidentialanjali shilpa kajal100% (1)

- Chapter 2 Discussion Questions Rev 0Document6 pagesChapter 2 Discussion Questions Rev 0Hayley SNo ratings yet

- Problem 1.5ADocument5 pagesProblem 1.5ANavinNo ratings yet

- Shareholders' Funds Reserves and SurplusDocument10 pagesShareholders' Funds Reserves and SurplusBalaji GaneshNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- 92810qtexamnov RevisedDocument1 page92810qtexamnov RevisedabhimussoorieNo ratings yet

- Economic TimesDocument2 pagesEconomic TimesabhimussoorieNo ratings yet

- Money Supply: Economics ProjectDocument9 pagesMoney Supply: Economics ProjectabhimussoorieNo ratings yet

- Measurement of Money SupplyDocument5 pagesMeasurement of Money SupplyabhimussoorieNo ratings yet

- PepsiDocument44 pagesPepsiabhimussoorieNo ratings yet

- Janome DC6030 Sewing Machine Instruction ManualDocument56 pagesJanome DC6030 Sewing Machine Instruction ManualiliiexpugnansNo ratings yet

- 2016 Mustang WiringDocument9 pages2016 Mustang WiringRuben TeixeiraNo ratings yet

- Testbanks ch24Document12 pagesTestbanks ch24Hassan ArafatNo ratings yet

- Create a seat booking form with Google Forms, Google Sheets and Google Apps Script - Yagisanatode - AppsScriptPulseDocument3 pagesCreate a seat booking form with Google Forms, Google Sheets and Google Apps Script - Yagisanatode - AppsScriptPulsebrandy57279No ratings yet

- Urodynamics Griffiths ICS 2014Document198 pagesUrodynamics Griffiths ICS 2014nadalNo ratings yet

- Major Bank Performance IndicatorsDocument35 pagesMajor Bank Performance IndicatorsAshish MehraNo ratings yet

- Investigatory Project Pesticide From RadishDocument4 pagesInvestigatory Project Pesticide From Radishmax314100% (1)

- Distinguish Between Tax and FeeDocument2 pagesDistinguish Between Tax and FeeRishi Agarwal100% (1)

- Instagram Dan Buli Siber Dalam Kalangan Remaja Di Malaysia: Jasmyn Tan YuxuanDocument13 pagesInstagram Dan Buli Siber Dalam Kalangan Remaja Di Malaysia: Jasmyn Tan YuxuanXiu Jiuan SimNo ratings yet

- Corn MillingDocument4 pagesCorn Millingonetwoone s50% (1)

- Identifying The TopicDocument2 pagesIdentifying The TopicrioNo ratings yet

- ROM Flashing Tutorial For MTK Chipset PhonesDocument5 pagesROM Flashing Tutorial For MTK Chipset PhonesAriel RodriguezNo ratings yet

- Planview Innovation Management Maturity Model PDFDocument1 pagePlanview Innovation Management Maturity Model PDFMiguel Alfonso Mercado GarcíaNo ratings yet

- PW CDocument4 pagesPW CAnonymous DduElf20ONo ratings yet

- Easa Ad Us-2017-09-04 1Document7 pagesEasa Ad Us-2017-09-04 1Jose Miguel Atehortua ArenasNo ratings yet

- 2002, Vol.86, Issues 4, Hospital MedicineDocument221 pages2002, Vol.86, Issues 4, Hospital MedicineFaisal H RanaNo ratings yet

- The Product Development and Commercialization ProcDocument2 pagesThe Product Development and Commercialization ProcAlexandra LicaNo ratings yet

- Device Interface Device Type (Router, Switch, Host) IP Address Subnet Mask Default GatewayDocument2 pagesDevice Interface Device Type (Router, Switch, Host) IP Address Subnet Mask Default GatewayRohit Chouhan0% (1)

- Fong vs. DueñasDocument2 pagesFong vs. DueñasWinter Woods100% (3)

- Computer Portfolio (Aashi Singh)Document18 pagesComputer Portfolio (Aashi Singh)aashisingh9315No ratings yet

- Henny Penny 500-561-600 TM - FINAL-FM06-009 9-08Document228 pagesHenny Penny 500-561-600 TM - FINAL-FM06-009 9-08Discman2100% (2)

- Lady Allen On Froebel Training School, Emdrup, CopenhagenDocument5 pagesLady Allen On Froebel Training School, Emdrup, CopenhagenLifeinthemix_FroebelNo ratings yet

- Robocon 2010 ReportDocument46 pagesRobocon 2010 ReportDebal Saha100% (1)

- 5505 SW 138th CT, Miami, FL 33175 ZillowDocument1 page5505 SW 138th CT, Miami, FL 33175 Zillowlisalinda29398378No ratings yet

- SWOT Analysis of Solar Energy in India: Abdul Khader.J Mohamed Idris.PDocument4 pagesSWOT Analysis of Solar Energy in India: Abdul Khader.J Mohamed Idris.PSuhas VaishnavNo ratings yet

- Artificial IseminationDocument6 pagesArtificial IseminationHafiz Muhammad Zain-Ul AbedinNo ratings yet

- Restructuring Egypt's Railways - Augst 05 PDFDocument28 pagesRestructuring Egypt's Railways - Augst 05 PDFMahmoud Abo-hashemNo ratings yet

- Lanegan (Greg Prato)Document254 pagesLanegan (Greg Prato)Maria LuisaNo ratings yet

- Boiler Check ListDocument4 pagesBoiler Check ListFrancis VinoNo ratings yet

- Domingo V People (Estafa)Document16 pagesDomingo V People (Estafa)Kim EscosiaNo ratings yet