Professional Documents

Culture Documents

Calculations

Uploaded by

Luo Bin OngCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculations

Uploaded by

Luo Bin OngCopyright:

Available Formats

Current Assets 2,017,856

1) Current ratio = = = 2.09

Current Liabilities 965,015

Current Assets - Inventories 2,017,856 - 343,717 1,674,148

2) Quick, or acid test ratio = = = = 1.73

Current Liabilities 965,015 965,015

Sales 4,004,738

3) Inventory turnover ratio = = = 11.65

Inventories 343,717

Receivables 453,278 453,278

4) Days sales outstanding (DSO) = = = = 41 days

Annual Sales / 365 days 4,004,738 / 365 10,972

Sales 4,004,738

5) Fixed assets turnover ratio = = = 4.21

Net Fixed Assets 951,064

Sales 4,004,738

6) Total assets turnover ratio = = = 1.35

Total Assets 2,968,920

Total Liabilities 965,015 + 207,389 1,172,404

7) Debt ratio = = = = 39.49%

Total Assets 2,968,920 2,968,920

Earning Before Interest & Taxes (EBIT) 407,958

8) Time-interest-earned (TIE) ratio = = = 28.59

Interest Charges 14,269

EBITDA + Lease Payments (1,381,458 - 858,805) + 0 522,653

9) EBITDA coverage ratio = = = = 36.63

Interest + Principal Payments + Lease Payments 14,269 + 0 + 0 14,269

Net Income Available to Common Stockholders 695,291

10) Profit margin on sales ratio = = = 17.36%

Sales 4,004,738

Earning Before Interest & Taxes (EBIT) 407,958

11) Basic earning power (BEP) ratio = = = 13.74%

Total Assets 2,968,920

Net Income Available to Common Stockholders 695,291

12) Return on total assets (ROA) ratio = = = 23.42%

Total Assets 2,968,920

Net Income Available to Common Stockholders 695,291

13) Return on common equity (ROE) ratio = = = 38.70%

Common Equity 1,796,516

Price per Share Price per Share 1 1

14) Price / Earnings (P/E) ratio = = = = = 0.51

Earnings per Share Net Income / Common Shares Outstanding 695,291 / 357,286 1.95

Price per Share Price per Share 1 1

15) Price / Cash flow ratio = = = = = 0.44

Cash Flow per Share Net Income + Depreciation + Amortization 695,291 + 114,695 + 0 2.27

Common Shares Outstanding 357,286

Market Price per Share Market Price per Share 1 1

16) Market / Book (M/B) ratio = = = = = 0.20

Book Value per Share Total Common Equity 1,796,516 / 357,286 5.03

Common Shares Outstanding

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The History of MoneyDocument30 pagesThe History of MoneyBea Nicole AugustoNo ratings yet

- U.S.a. - The House That No One Lives inDocument52 pagesU.S.a. - The House That No One Lives inMichael McCurdyNo ratings yet

- MOCK UP SOAL UAS AKL II Dan ADV II 2018Document5 pagesMOCK UP SOAL UAS AKL II Dan ADV II 2018Nathalie Christnindita DecidNo ratings yet

- E Math Exam PracticeCh5 8Document4 pagesE Math Exam PracticeCh5 8chitminthu560345No ratings yet

- Balance of Payments: Chapter ThreeDocument16 pagesBalance of Payments: Chapter ThreeiMQSxNo ratings yet

- 04P Other Components of Shareholders EquityDocument7 pages04P Other Components of Shareholders EquityjulsNo ratings yet

- Women Self Help Groups Empowerment StudyDocument0 pagesWomen Self Help Groups Empowerment StudyDrKapil JainNo ratings yet

- Bravo Merchandising Journal Entries For The Month Ending December 31, 2016Document6 pagesBravo Merchandising Journal Entries For The Month Ending December 31, 2016G09 CARGANILLA, Angelika M.No ratings yet

- Pacific Grove Spice Company Case CalculationsDocument11 pagesPacific Grove Spice Company Case CalculationsMinh Hà33% (3)

- 10b Investment Property PDFDocument40 pages10b Investment Property PDFmEOW SNo ratings yet

- Business Valuations Tutorial Questions - MFIDocument11 pagesBusiness Valuations Tutorial Questions - MFIMadu maduNo ratings yet

- Chapter 1 Problems Working PapersDocument5 pagesChapter 1 Problems Working PapersZachLovingNo ratings yet

- Valuation Models Summary: Discounted Cash Flow and Relative Valuation ApproachesDocument47 pagesValuation Models Summary: Discounted Cash Flow and Relative Valuation Approachesarmani2coolNo ratings yet

- Wildcat Capital InvestorsDocument18 pagesWildcat Capital Investorsokta hutahaeanNo ratings yet

- Evolution of Monetary Policy in India Early PhaseDocument15 pagesEvolution of Monetary Policy in India Early PhaseNitesh kuraheNo ratings yet

- Dollarization in LaosDocument43 pagesDollarization in Laosapi-3705874No ratings yet

- ROI, RI, and EVA AnalysisDocument7 pagesROI, RI, and EVA AnalysisAna Leah DelfinNo ratings yet

- India Startup Ecosystem GuideDocument26 pagesIndia Startup Ecosystem GuideRahul MoreNo ratings yet

- A Comparative Study On Tata Consultancy Services LTD and Infosys LTD in The Information Technology IndustryDocument7 pagesA Comparative Study On Tata Consultancy Services LTD and Infosys LTD in The Information Technology IndustryDebasmita Pr RayNo ratings yet

- Wedding Photography and Videography QuotationDocument1 pageWedding Photography and Videography Quotationbhagyashree satamNo ratings yet

- Form OC-10 Appl 4 FRNDocument51 pagesForm OC-10 Appl 4 FRNBenne James100% (4)

- Financial Instruments IAS 32, IfRS 9, IfRS 13, IfRS 7 Final VersionDocument50 pagesFinancial Instruments IAS 32, IfRS 9, IfRS 13, IfRS 7 Final VersionNoor Ul Hussain MirzaNo ratings yet

- Meaning of AccountingDocument50 pagesMeaning of AccountingAyushi KhareNo ratings yet

- B 1 Bank TransactionsDocument16 pagesB 1 Bank TransactionsMahima SherigarNo ratings yet

- Chapter 1 Assignment 1Document9 pagesChapter 1 Assignment 1LADY TEDD PONGOSNo ratings yet

- H14 - Tax RemediesDocument7 pagesH14 - Tax Remediesnona galidoNo ratings yet

- 041924353041-Review Chapter 31Document6 pages041924353041-Review Chapter 31Aimé RandrianantenainaNo ratings yet

- Bouviers 1914 Vol 3 N Cont PDFDocument1,236 pagesBouviers 1914 Vol 3 N Cont PDFDollarking1No ratings yet

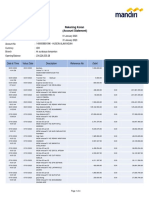

- Rek Koran Mandiri PT HAI Jan-April 2023Document14 pagesRek Koran Mandiri PT HAI Jan-April 2023wahyu suhartonoNo ratings yet

- Module 2a - AR RecapDocument10 pagesModule 2a - AR RecapChen HaoNo ratings yet