Professional Documents

Culture Documents

Quinn March 2011 Economic Brief

Uploaded by

PAHouseGOP0 ratings0% found this document useful (0 votes)

13 views1 pageFebruary General Fund revenue collections fall short of Department of Revenue estimates by 1. Percent or $20 Million. Corporate tax category was the only major tax category to come in above estimate for the month. Corporation taxes were above estimate by 17 percent or $11 Million.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFebruary General Fund revenue collections fall short of Department of Revenue estimates by 1. Percent or $20 Million. Corporate tax category was the only major tax category to come in above estimate for the month. Corporation taxes were above estimate by 17 percent or $11 Million.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageQuinn March 2011 Economic Brief

Uploaded by

PAHouseGOPFebruary General Fund revenue collections fall short of Department of Revenue estimates by 1. Percent or $20 Million. Corporate tax category was the only major tax category to come in above estimate for the month. Corporation taxes were above estimate by 17 percent or $11 Million.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Pennsylvania House of Representatives

Economic Brief

State Representative Marguerite Quinn

March 2011

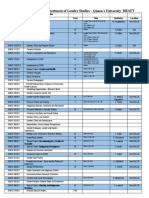

February 2011 General Fund Revenues

fall short of Department of Revenue estimate.

February General Fund revenue collections were short

of Department of Revenue estimates by 1.3 percent or $20

Million.

In February, the corporate tax category was the only

major tax category to come in above estimate for the month.

Corporate taxes were above estimate by 17 percent or $11

Million. Consumption taxes missed projections by 2 percent or

$13 Million and Personal Income Tax collections were 3 percent

or $23 Million under Department of Revenue expectations. EMPLOYMENT STATISTICS

January 2011 Monthly Change

Year-to-date actual collections for all three major tax Labor Force 6.344 Million +18,000*

categories still remain higher than Department of Revenue

year-to-date estimates. Corporation taxes are 7.9 percent Unemployment Rate 8.2% -0.3

or $104 Million above estimate, consumption taxes are 1.4

Total Employment 5.821 Million +30,000*

percent or $88 Million above estimate, and Personal Income

Tax collections are 1 percent or $65 Million over year-to-date 12-Month Growth

expectations. All together, the General Fund is $243 Million or Total Employment +30,000*

1.6 percent over expectations for the year.

Unemployment Rate -0.6

* Includes annual benchmarking adjustments

General Fund Revenue FEBRUARY REVENUE COLLECTIONS

Estimate Actual

Actual Collections

Estimated Collections

Corporation Taxes Corporation Taxes

$68.6 Million $80.3 Million

Consumption Taxes Consumption Taxes

$687.4 Million $673.5 Million

All Other Taxes All Other Taxes

$774 Million $752 Million

Non-Tax Revenue Non-Tax Revenue

$21.2 Million $23.6 Million

District Office

State Representative Marguerite Quinn Harrisburg Office

(215) 489-2126 www.RepQuinn.net (717) 772-1413

You might also like

- Helm March 2011 Economic BriefDocument1 pageHelm March 2011 Economic BriefPAHouseGOPNo ratings yet

- Quinn February 2011 Economic BriefDocument1 pageQuinn February 2011 Economic BriefPAHouseGOPNo ratings yet

- Quinn April 2011 Economic BriefDocument1 pageQuinn April 2011 Economic BriefPAHouseGOPNo ratings yet

- Mustio May 2011 Economic BriefDocument1 pageMustio May 2011 Economic BriefPAHouseGOPNo ratings yet

- Mustio April 2011 Economic BriefDocument1 pageMustio April 2011 Economic BriefPAHouseGOPNo ratings yet

- Helm April 2011 Economic BriefDocument1 pageHelm April 2011 Economic BriefPAHouseGOPNo ratings yet

- June 2011 Economic BriefDocument1 pageJune 2011 Economic BriefPAHouseGOPNo ratings yet

- Brown February 2011 Economic BriefDocument1 pageBrown February 2011 Economic BriefPAHouseGOPNo ratings yet

- Helm May 2011 Economic BriefDocument1 pageHelm May 2011 Economic BriefPAHouseGOPNo ratings yet

- 104 1 11 EconomicBriefDocument1 page104 1 11 EconomicBriefPAHouseGOPNo ratings yet

- May 2011 Economic BriefDocument1 pageMay 2011 Economic BriefPAHouseGOPNo ratings yet

- April 2011 Economic BriefDocument1 pageApril 2011 Economic BriefPAHouseGOPNo ratings yet

- September 2010 Economic BriefDocument1 pageSeptember 2010 Economic BriefPAHouseGOPNo ratings yet

- Quinn August 2010 Economic BriefDocument1 pageQuinn August 2010 Economic BriefPAHouseGOPNo ratings yet

- Quinn June 2010 Economic BriefDocument1 pageQuinn June 2010 Economic BriefPAHouseGOPNo ratings yet

- June 2010 Economic BriefDocument1 pageJune 2010 Economic BriefPAHouseGOPNo ratings yet

- August 2010 Economic BriefDocument1 pageAugust 2010 Economic BriefPAHouseGOPNo ratings yet

- 1 10 EconomicBriefDocument1 page1 10 EconomicBriefPAHouseGOPNo ratings yet

- Malloy2012 2013 Budget Power Point FinalDocument78 pagesMalloy2012 2013 Budget Power Point FinalHelen BennettNo ratings yet

- OregonDocument20 pagesOregonStatesman JournalNo ratings yet

- Roae - 2010-11 State Budget Slide ShowDocument27 pagesRoae - 2010-11 State Budget Slide ShowPAHouseGOPNo ratings yet

- Tax Reform and BudgetDocument13 pagesTax Reform and BudgetDaggett For GovernorNo ratings yet

- 2011 12EnactedBudgetDocument423 pages2011 12EnactedBudgetNick ReismanNo ratings yet

- Free Australia Personal Income Tax Calculator v1.0.2017Document7 pagesFree Australia Personal Income Tax Calculator v1.0.2017Minh Nguyen Vo NhatNo ratings yet

- Pag SegurosDocument16 pagesPag SegurosRenan Dantas SantosNo ratings yet

- Rep. Quinn November 2011 Economic BriefDocument1 pageRep. Quinn November 2011 Economic BriefPAHouseGOPNo ratings yet

- Tallman August 2010 Budget Slide ShowDocument36 pagesTallman August 2010 Budget Slide ShowPAHouseGOPNo ratings yet

- Rep. Quinn December 2011 Economic BriefDocument1 pageRep. Quinn December 2011 Economic BriefPAHouseGOPNo ratings yet

- When 2% Isn't 2%Document4 pagesWhen 2% Isn't 2%rkarlinNo ratings yet

- Tax Cuts and Jobs Act Will Cost $1.5 Trillion - Committee For A Responsible Federal BudgetDocument2 pagesTax Cuts and Jobs Act Will Cost $1.5 Trillion - Committee For A Responsible Federal BudgetTan SoNo ratings yet

- FY 2020 - Revenue Report - 04-30-2020Document8 pagesFY 2020 - Revenue Report - 04-30-2020Russ LatinoNo ratings yet

- Covid 19 BudgetDocument32 pagesCovid 19 BudgetJim ParkerNo ratings yet

- Mar 5 2021 - NASBODocument31 pagesMar 5 2021 - NASBONational Press FoundationNo ratings yet

- Pagseguro Reports First Quarter Results: R$356.9 Million in Net Income Up 15.2% Compared To 1Q19Document17 pagesPagseguro Reports First Quarter Results: R$356.9 Million in Net Income Up 15.2% Compared To 1Q19Bernardo MirandaNo ratings yet

- Fiscal Management Starts at Home 12-08-10Document4 pagesFiscal Management Starts at Home 12-08-10Grant BosseNo ratings yet

- Commission On Government Forecasting and Accountability 4/23 ReportDocument24 pagesCommission On Government Forecasting and Accountability 4/23 ReportRobert GarciaNo ratings yet

- Measuring The Revenue Shortfall 04-19-10Document4 pagesMeasuring The Revenue Shortfall 04-19-10Grant BosseNo ratings yet

- A Message From The Secretary of The TreasuryDocument26 pagesA Message From The Secretary of The TreasurylosangelesNo ratings yet

- Ey Total State and Local Business TaxesDocument28 pagesEy Total State and Local Business TaxesNoshan OneitoNo ratings yet

- Resultado PagSeguroDocument17 pagesResultado PagSeguroBruno Enrique Silva AndradeNo ratings yet

- Comptroller's Fiscal Update: Year-End Results For State Fiscal Year 2015-16Document16 pagesComptroller's Fiscal Update: Year-End Results For State Fiscal Year 2015-16Nick ReismanNo ratings yet

- Data18 FyDocument66 pagesData18 FyYessica LidiaNo ratings yet

- Rep. Harhart November 2011 Economic BriefDocument1 pageRep. Harhart November 2011 Economic BriefPAHouseGOPNo ratings yet

- Amendment in Tax Laws by Budget 20761Document60 pagesAmendment in Tax Laws by Budget 20761Mukunda BhusalNo ratings yet

- Budget ReportDocument2 pagesBudget Reportchris5056No ratings yet

- 2021.06.02 PAGS 1Q21 Earnings ReleaseDocument23 pages2021.06.02 PAGS 1Q21 Earnings ReleaseRenan Dantas SantosNo ratings yet

- Nepal Tax Fact 2019/20 (2076/77) : Major Taxation Provisions Including Changes by Finance Bill, 2076 (2019)Document40 pagesNepal Tax Fact 2019/20 (2076/77) : Major Taxation Provisions Including Changes by Finance Bill, 2076 (2019)Sameer NiraulaNo ratings yet

- Treasury December 2021 Budget ReportDocument40 pagesTreasury December 2021 Budget ReportAustin DeneanNo ratings yet

- The Fair Tax Plan ExplainedDocument25 pagesThe Fair Tax Plan ExplainedAnchal SaxenaNo ratings yet

- MET Q4 2017 Supplemental SlidesDocument20 pagesMET Q4 2017 Supplemental Slideschicku76No ratings yet

- Nepal Budget and Tax FY 206667Document30 pagesNepal Budget and Tax FY 206667dinesh35851No ratings yet

- The California State Budget and Revenue Volatility: Fiscal Health in A Deficit ContextDocument16 pagesThe California State Budget and Revenue Volatility: Fiscal Health in A Deficit ContextHoover InstitutionNo ratings yet

- Rep. Mustio November 2011 Economic BriefDocument1 pageRep. Mustio November 2011 Economic BriefPAHouseGOPNo ratings yet

- Statutory Accounts For The Full Year Ended 30 June 2020Document118 pagesStatutory Accounts For The Full Year Ended 30 June 2020TimBarrowsNo ratings yet

- 2020.11.18 PAGS 3Q20 Earnings ReleaseDocument17 pages2020.11.18 PAGS 3Q20 Earnings ReleaseRenan Dantas SantosNo ratings yet

- Less Provincial Share 2,590.1 46%: Current DeficitDocument11 pagesLess Provincial Share 2,590.1 46%: Current DeficitAtul SethNo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018From EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No ratings yet

- Rep. Vulakovich's Current Expenses (Updated Through 5/12)Document26 pagesRep. Vulakovich's Current Expenses (Updated Through 5/12)PAHouseGOPNo ratings yet

- Rep. Vulakovich's Current Expenses (Updated Through 4/12Document26 pagesRep. Vulakovich's Current Expenses (Updated Through 4/12PAHouseGOPNo ratings yet

- Rep. Vulakovich's Current ExpensesDocument25 pagesRep. Vulakovich's Current ExpensesPAHouseGOPNo ratings yet

- Rep Emrick 2011 NewsletterDocument2 pagesRep Emrick 2011 NewsletterPAHouseGOPNo ratings yet

- Rep Helm's November 2011 Economic BriefDocument1 pageRep Helm's November 2011 Economic BriefPAHouseGOPNo ratings yet

- Rep. Quinn December 2011 Economic BriefDocument1 pageRep. Quinn December 2011 Economic BriefPAHouseGOPNo ratings yet

- Rep. Vulakovich's Current Expenses (Updated Through 3/12)Document26 pagesRep. Vulakovich's Current Expenses (Updated Through 3/12)PAHouseGOPNo ratings yet

- January 2012 Economic BriefDocument1 pageJanuary 2012 Economic BriefPAHouseGOPNo ratings yet

- Rep. Tobash December 2011 Economic BriefDocument1 pageRep. Tobash December 2011 Economic BriefPAHouseGOPNo ratings yet

- Denlinger January 2010 ExpensesDocument1 pageDenlinger January 2010 ExpensesPAHouseGOPNo ratings yet

- Rep. Boback Letter - Shickshinny Borough - Wells Fargo BankDocument2 pagesRep. Boback Letter - Shickshinny Borough - Wells Fargo BankPAHouseGOPNo ratings yet

- Rep Helm's November 2011 Economic BriefDocument1 pageRep Helm's November 2011 Economic BriefPAHouseGOPNo ratings yet

- Rep. Adolph December 2011 Economic BriefDocument1 pageRep. Adolph December 2011 Economic BriefPAHouseGOPNo ratings yet

- Rep. Brown November 2011 Economic BriefDocument1 pageRep. Brown November 2011 Economic BriefPAHouseGOPNo ratings yet

- Rep Helm - January 2010 ExpensesDocument1 pageRep Helm - January 2010 ExpensesPAHouseGOPNo ratings yet

- Rep. Quinn November 2011 Economic BriefDocument1 pageRep. Quinn November 2011 Economic BriefPAHouseGOPNo ratings yet

- Rep. Helm October 2011 ExpensesDocument2 pagesRep. Helm October 2011 ExpensesPAHouseGOPNo ratings yet

- Rep. Helm September 2011 ExpensesDocument2 pagesRep. Helm September 2011 ExpensesPAHouseGOPNo ratings yet

- Bloom March 2011 Monthly ExpensesDocument1 pageBloom March 2011 Monthly ExpensesPAHouseGOPNo ratings yet

- Rep. Brown November 2011 Economic BriefDocument1 pageRep. Brown November 2011 Economic BriefPAHouseGOPNo ratings yet

- Bear January 2010 ExpensesDocument1 pageBear January 2010 ExpensesPAHouseGOPNo ratings yet

- Rep. Mustio November 2011 Economic BriefDocument1 pageRep. Mustio November 2011 Economic BriefPAHouseGOPNo ratings yet

- Rep. Harhart November 2011 Economic BriefDocument1 pageRep. Harhart November 2011 Economic BriefPAHouseGOPNo ratings yet

- Rep. Adolph November 2011 Economic BriefDocument1 pageRep. Adolph November 2011 Economic BriefPAHouseGOPNo ratings yet

- Rep Helm's November 2011 Economic BriefDocument1 pageRep Helm's November 2011 Economic BriefPAHouseGOPNo ratings yet

- Rep Helm's November 2011 Economic BriefDocument1 pageRep Helm's November 2011 Economic BriefPAHouseGOPNo ratings yet

- Rep. Tobash November 2011 Economic BriefDocument1 pageRep. Tobash November 2011 Economic BriefPAHouseGOPNo ratings yet

- Hickernell March 2010 ExpensesDocument1 pageHickernell March 2010 ExpensesPAHouseGOPNo ratings yet

- Bear January 2010 ExpensesDocument1 pageBear January 2010 ExpensesPAHouseGOPNo ratings yet

- Education in The Face of Caste: The Indian CaseDocument13 pagesEducation in The Face of Caste: The Indian CaseParnasha Sankalpita BhowmickNo ratings yet

- The Four Fold TestDocument4 pagesThe Four Fold TestGeneva Bejasa Arellano100% (3)

- PS21 - Final PaperDocument8 pagesPS21 - Final PaperAlby SabinianoNo ratings yet

- People VS LupacDocument2 pagesPeople VS LupacannlaurenweillNo ratings yet

- Summary Ra9344Document6 pagesSummary Ra9344kathleenNo ratings yet

- Why Is Everyone Playing Games With MuslimsDocument4 pagesWhy Is Everyone Playing Games With MuslimsMoinullah KhanNo ratings yet

- Models of Corporate Governance: Different Approaches ExplainedDocument25 pagesModels of Corporate Governance: Different Approaches Explainedvasu aggarwalNo ratings yet

- The WedgeDocument20 pagesThe WedgeRebecca SpencerNo ratings yet

- Greeces Elusive Quest For Security ProviDocument14 pagesGreeces Elusive Quest For Security ProviDImiskoNo ratings yet

- Law of ContractsDocument3 pagesLaw of Contractsyuvasree talapaneniNo ratings yet

- Tijam v. Sibonghanoy G.R. No. L-21450 April 15, 1968 Estoppel by LachesDocument5 pagesTijam v. Sibonghanoy G.R. No. L-21450 April 15, 1968 Estoppel by LachesethNo ratings yet

- BIR Ruling (DA-670-07) Lotto OutletDocument3 pagesBIR Ruling (DA-670-07) Lotto OutletMonica Soriano100% (2)

- 3M's Commitment to Diversity, Inclusion and EquityDocument5 pages3M's Commitment to Diversity, Inclusion and EquitySri VastavNo ratings yet

- Incorporation - Real Estate BrokerageDocument15 pagesIncorporation - Real Estate BrokerageSabrina S.100% (2)

- Bohol Transport Secretary's CertificateDocument2 pagesBohol Transport Secretary's CertificaterbolandoNo ratings yet

- Yrasuegi v. PALDocument1 pageYrasuegi v. PALRon DecinNo ratings yet

- Unit AssessmentDocument2 pagesUnit AssessmentTeacher English100% (1)

- Gonzalez Elena Critical AnalysisDocument5 pagesGonzalez Elena Critical Analysisapi-535201604No ratings yet

- 1 SMDocument9 pages1 SMHimahi RecNo ratings yet

- OCDE Building Competitive Regions Strategies and Governance - UnlockedDocument141 pagesOCDE Building Competitive Regions Strategies and Governance - UnlockedD'Arjona ValdezNo ratings yet

- Case Digest Wages To Attorneys FeeDocument28 pagesCase Digest Wages To Attorneys FeeJefferson Maynard RiveraNo ratings yet

- 3 Dario Vs Mison, G.R. No. 81954, 08 August 1989Document124 pages3 Dario Vs Mison, G.R. No. 81954, 08 August 1989Chiang Kai-shekNo ratings yet

- Taxation LAW Cases: GIFT TaxDocument9 pagesTaxation LAW Cases: GIFT TaxZebulun DocallasNo ratings yet

- The Work First Fellowship - January NewsletterDocument6 pagesThe Work First Fellowship - January NewsletterAshley PutnamNo ratings yet

- INSULAR HOTEL EMPLOYEES UNION-NF vs. WATERFRONT INSULAR HOTEL DAVAODocument5 pagesINSULAR HOTEL EMPLOYEES UNION-NF vs. WATERFRONT INSULAR HOTEL DAVAOMalen Roque SaludesNo ratings yet

- God39s Century Resurgent Religion and Global Politics SparknotesDocument3 pagesGod39s Century Resurgent Religion and Global Politics SparknotesScottNo ratings yet

- A-A-L-M-, AXXX XXX 585 (BIA Oct. 22, 2015)Document3 pagesA-A-L-M-, AXXX XXX 585 (BIA Oct. 22, 2015)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Butler Judith Deshacer El Genero 2004 Ed Paidos 2006Document23 pagesButler Judith Deshacer El Genero 2004 Ed Paidos 2006Ambaar GüellNo ratings yet

- Course Offerings With Options 2019-20 400 Level Changes JuneDocument3 pagesCourse Offerings With Options 2019-20 400 Level Changes JuneYunuo HuangNo ratings yet

- Philippine Telegraph v. NLRC, GR No. 118978 May 23, 1997Document6 pagesPhilippine Telegraph v. NLRC, GR No. 118978 May 23, 1997Ashley Kate PatalinjugNo ratings yet