Professional Documents

Culture Documents

ACCA F2 Labour Costs A

Uploaded by

tracyghl2011Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCA F2 Labour Costs A

Uploaded by

tracyghl2011Copyright:

Available Formats

ACCA F2 Management Accounting

Q9: A manufacturing firm has temporary production problems and overtime is being worked.

The amount of overtime premium contained in direct wages would normally be classed

as which one of the following:

A Direct expenses C Direct labour costs

B Production overheads D Administrative overheads

Q10: A manufacturing firm is very busy and overtime is being worked.

The amount of overtime premium contained in direct wages would normally be classed

as:

A part of prime cost C direct labour costs

B factory overheads D administrative overheads

Q11: A company employs 20 direct production operatives and 10 indirect staff in its manufacturing

department. The normal operating hours for all employees is 38 hours per week and all staff are

paid $5 per hour. Overtime hours are paid at the basic rate plus 50%. During a particular week

all employees worked for 44 hours.

What amount would be charged to production overhead?

A $2,650 C $450

B $2,350 D $300

Direct worker Indirect worker

NT (20 x 38 x 5.00) 3,800 (10 x 38 x 5.00) 1,900

OT: Basic (20 x 6 x 5.00) 600 (10 x 6 x 5.00) 300

OT: Premium (20 x 6 x 2.50) 300 (10 x 6 x 2.50) 150

Total OH: 300 + 1,900 + 300 + 150 = 2,650

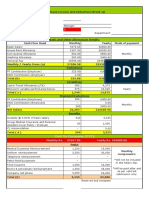

Q12: Gross wages incurred in department 1 in June were $54,000. The wages analysis shows the

following summary breakdown of the gross pay:

Paid to direct labour Paid to indirect labour

$ $

Ordinary time 25,185 11,900

Overtime

• Basic pay 5,440 3,500

• Premium 1,360 875

Shift allowance 2,700 1,360

Sick pay 1,380 300

36,065 17,935

What is the direct wages cost for department 1 in June?

A $25,185 C $34,685

B $30,625 D $36,065

Paid to direct labour Paid to indirect labour

$ $

Ordinary time 25,185 11,900

Labour Costs -1-

ACCA F2 Management Accounting

Overtime

• Basic pay 5,440 3,500

• Premium 1,360 875

Shift allowance 2,700 1,360

Sick pay 1,380 300

36,065 17,935

Total direct labour cost = 25,185 + 5,440 = 30,625

Q13: Employee A is a carpenter and normally works 36 hours per week. The standard rate of pay is

$3.60 per hour. A premium of 50% of the basic hourly rate is paid for all overtime hours worked.

During the last week of October, Employee A worked for 42 hours. The overtime hours worked

were for the following reasons:

Machine breakdown: 4 hours

To complete a special job at the request of a customer: 2 hours

How much of Employee A’s earnings for the last week of October would have been

treated as direct wages?

A $162.00 C $140.40

B $129.60 D $151.20

DLC IDLC

NT (36 x 3.60) 129.60

OT: Basic (4 x 3.60)/ (2 x 3.60) 14.40 7.20

OT: Premium (4 x 1.80)/ (2 x 1.80) 7.20 3.60

151.20 10.80

Total direct wages: 151.20 + 10.80 = 162.00

Labour Costs -2-

You might also like

- MA1 First TestDocument14 pagesMA1 First TestMishael MAKE-UP100% (1)

- F2 Mock1 QuestDocument19 pagesF2 Mock1 QuestHajra Zahra100% (4)

- F2 Mock2 AnsDocument8 pagesF2 Mock2 AnsHajra Zahra0% (1)

- Absorption and Marginal Costing - Additional Question With AnswersDocument14 pagesAbsorption and Marginal Costing - Additional Question With Answersunique gadtaulaNo ratings yet

- FA1Document13 pagesFA1bingbongmylove33% (3)

- Marginal & Absorption CostingDocument6 pagesMarginal & Absorption CostingEman Mirza100% (4)

- Ma1 Test 1Document6 pagesMa1 Test 1shahabNo ratings yet

- Fa1 PilotDocument14 pagesFa1 PilotMuhammad Yousuf100% (3)

- MA2 RevisionDocument27 pagesMA2 RevisionLinh Le100% (2)

- Level 12 Text Update June 20211Document110 pagesLevel 12 Text Update June 20211Swe Zin Thet100% (2)

- F2 - Revision 1Document27 pagesF2 - Revision 1Huyen PhanNo ratings yet

- Paper T4 June 2010 Section A Multiple ChoiceDocument53 pagesPaper T4 June 2010 Section A Multiple ChoiceU Abdul Rehman100% (1)

- Test 1 Ma2Document15 pagesTest 1 Ma2Waseem Ahmad Qurashi63% (8)

- F2 Mock Questions 201603Document12 pagesF2 Mock Questions 201603Renato WilsonNo ratings yet

- (SAPP) F2 ACCA Mock Exam With AnswerDocument16 pages(SAPP) F2 ACCA Mock Exam With AnswerCherLloydNguyenNo ratings yet

- Examiner's Report - FA2 PDFDocument40 pagesExaminer's Report - FA2 PDFSuy YanghearNo ratings yet

- Ma2 Specimen j14Document16 pagesMa2 Specimen j14talha100% (3)

- Marginal Costing vs Absorption Costing Profit ReconciliationDocument4 pagesMarginal Costing vs Absorption Costing Profit ReconciliationFareha Riaz100% (2)

- MA1 Mock 2 School of Business & Management AbbottabadDocument19 pagesMA1 Mock 2 School of Business & Management AbbottabadShamas 786No ratings yet

- FA2 Kaplan Exam KitDocument232 pagesFA2 Kaplan Exam Kit465jgbgcvfNo ratings yet

- Ma2 Mock ExamDocument13 pagesMa2 Mock Examsaad shahidNo ratings yet

- FIA MA1 Course Exam MOCK 3 QuestionsDocument12 pagesFIA MA1 Course Exam MOCK 3 QuestionsBharat Kabariya67% (3)

- Ma 2 AccaDocument18 pagesMa 2 AccaRielleo Leo67% (3)

- FA1 NotesDocument270 pagesFA1 Notesdaneq80% (10)

- Review QsDocument92 pagesReview Qsfaiztheme67% (3)

- Chapter 21Document4 pagesChapter 21Rahila RafiqNo ratings yet

- Ma1 Mock Test 1Document5 pagesMa1 Mock Test 1Vinh Ngo Nhu83% (12)

- F2 MockDocument23 pagesF2 MockH Hafiz Muhammad AbdullahNo ratings yet

- MA2 CGA Sept'11 ExamDocument21 pagesMA2 CGA Sept'11 ExamumgilkinNo ratings yet

- CH 4 - Relevant Costing Principles ICAP Questions and SolutionDocument35 pagesCH 4 - Relevant Costing Principles ICAP Questions and SolutionMuhammad AzamNo ratings yet

- MA1 MOCK EXAM ANSWERSDocument11 pagesMA1 MOCK EXAM ANSWERS138.Mehreen “79” Faisal100% (1)

- ACCA F1 Accountant in Business Solved Past Papers 0207 PDFDocument137 pagesACCA F1 Accountant in Business Solved Past Papers 0207 PDFKanwaljit Singh Jolly67% (3)

- F2 Mock1 AnsDocument8 pagesF2 Mock1 AnsHajra ZahraNo ratings yet

- MA1 (Mock 1)Document16 pagesMA1 (Mock 1)Shamas 786No ratings yet

- Examiner's Report: MA2 Managing Costs & FinanceDocument3 pagesExaminer's Report: MA2 Managing Costs & FinanceLabeed AhmadNo ratings yet

- Labour-PQDocument7 pagesLabour-PQRomail QaziNo ratings yet

- FA1 Bank ReconciliationDocument4 pagesFA1 Bank Reconciliationamir100% (1)

- Fa2 Specimen j14Document16 pagesFa2 Specimen j14Shohin100% (1)

- Cat/fia (Ma2)Document12 pagesCat/fia (Ma2)theizzatirosli50% (2)

- F3 Mock Exam Practice Test (3 Pairs 110 QS) Q - SDocument49 pagesF3 Mock Exam Practice Test (3 Pairs 110 QS) Q - SIngyin Khine67% (6)

- Process CostingDocument83 pagesProcess CostingMohammad MoosaNo ratings yet

- ACCA ExerciseDocument23 pagesACCA ExerciseIndriyanti Krisdiana100% (1)

- MA 1 Mock Exam QuestionDocument4 pagesMA 1 Mock Exam QuestionAbdul Gaffar100% (1)

- ACCA F2 FormulasDocument1 pageACCA F2 Formulasabstract_art111740% (5)

- Solutions to labour cost problemsDocument9 pagesSolutions to labour cost problemsKartik aminNo ratings yet

- Scenario ADocument10 pagesScenario ADandyNo ratings yet

- Assignment No.5: Cost Accounting: Multiple Choice-TheoreticalDocument4 pagesAssignment No.5: Cost Accounting: Multiple Choice-Theoreticalklare cordovaNo ratings yet

- CompensationDocument1 pageCompensationDandyNo ratings yet

- Answer Chapter 4Document10 pagesAnswer Chapter 4Dela Cruz, Michelle Mae U.No ratings yet

- ACCT223 AY 21 22 Mid-Term AnswersDocument5 pagesACCT223 AY 21 22 Mid-Term AnswersLIAW ANN YINo ratings yet

- Chapter 3 Assignment Cost AccountingDocument2 pagesChapter 3 Assignment Cost AccountingSydnei HaywoodNo ratings yet

- The Central Valley Company Has Prepared Department Overhead Budgets For BudgetedDocument4 pagesThe Central Valley Company Has Prepared Department Overhead Budgets For BudgetedElliot RichardNo ratings yet

- Process CostingDocument5 pagesProcess Costingideasim31996No ratings yet

- BSG Decisions Report on Workforce Compensation and TrainingDocument1 pageBSG Decisions Report on Workforce Compensation and TrainingBust everyNo ratings yet

- Two Years Ago, A Company Purchased A Machine. Curr... PDFDocument3 pagesTwo Years Ago, A Company Purchased A Machine. Curr... PDFkamran0% (1)

- CTC BreakupDocument2 pagesCTC BreakupbaluNo ratings yet

- Tugas Individu - Chapter 7 - Appendix 7ADocument7 pagesTugas Individu - Chapter 7 - Appendix 7Avidia2000No ratings yet

- Practice Question Paper: Performance CategoryDocument3 pagesPractice Question Paper: Performance CategoryAnjaliNo ratings yet

- CH 8 HW SolutionsDocument7 pagesCH 8 HW SolutionsThanh ThảoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Haris HRMDocument11 pagesHaris HRMM.K.J M.K.JNo ratings yet

- RA 9433 - IRR - Magna Carta For Public Social WorkersDocument17 pagesRA 9433 - IRR - Magna Carta For Public Social Workersdantemayor92% (73)

- Research On The Different Approaches in Management and OrganizationDocument18 pagesResearch On The Different Approaches in Management and OrganizationFakerPlaymakerNo ratings yet

- Atal Pension YojanaDocument2 pagesAtal Pension YojanaRaj KumarNo ratings yet

- Machinary Cost: Monthly Labour Expandatures For General ShiftDocument7 pagesMachinary Cost: Monthly Labour Expandatures For General ShiftAnand BabuNo ratings yet

- Workman Compensation Act: ObjectivesDocument17 pagesWorkman Compensation Act: ObjectivesfahadNo ratings yet

- Sonco Vs NLRCDocument3 pagesSonco Vs NLRCMonikoNo ratings yet

- Coimbatore - LWF NIL - Form C - Sep - 2022Document1 pageCoimbatore - LWF NIL - Form C - Sep - 2022Pragnaa ShreeNo ratings yet

- Employer-Employee Relationship Between Loggers and Timber FirmDocument7 pagesEmployer-Employee Relationship Between Loggers and Timber Firmnat_wmsu2010No ratings yet

- Kinds of Employees & Special WorkersDocument7 pagesKinds of Employees & Special WorkersAlex Belen83% (6)

- ICM-HRM Exam Preparation Class Answer For Question No: 5: (Trade Union)Document2 pagesICM-HRM Exam Preparation Class Answer For Question No: 5: (Trade Union)Zaw Ye MinNo ratings yet

- CABANILLA JEEPNEY ASSEMBLY SHOPDocument10 pagesCABANILLA JEEPNEY ASSEMBLY SHOPkristel jadeNo ratings yet

- Harris Todaro ModelDocument10 pagesHarris Todaro ModelKrishnaNo ratings yet

- Holiday Pay Rules for Regular and Special HolidaysDocument5 pagesHoliday Pay Rules for Regular and Special Holidaysjudie menesesNo ratings yet

- Chapter 7Document6 pagesChapter 7jobhihtihjrNo ratings yet

- Measuring Concrete Work 1Document19 pagesMeasuring Concrete Work 1Akbar RafeekNo ratings yet

- Case DigestDocument59 pagesCase DigestJani LucasNo ratings yet

- HR Job Evaluation GuideDocument21 pagesHR Job Evaluation Guidesaurav prasadNo ratings yet

- 457 (1) - HR Outsourcing in IndiaDocument86 pages457 (1) - HR Outsourcing in IndiaNitu Saini100% (1)

- Argumentative eDocument3 pagesArgumentative eReina Jhoana Sasot Manguerra100% (1)

- Department of Labor: 38Document89 pagesDepartment of Labor: 38USA_DepartmentOfLaborNo ratings yet

- XAT Decision Making 2008-12 SolutionsDocument6 pagesXAT Decision Making 2008-12 SolutionsPartha Pratim SarmaNo ratings yet

- Pension Plan Basics Chapter SummaryDocument18 pagesPension Plan Basics Chapter SummaryHoyin SinNo ratings yet

- Disney Rulebook 04-08 (PDF Library)Document81 pagesDisney Rulebook 04-08 (PDF Library)davecnewsNo ratings yet

- Question Bank (G scheme) Management Unit Test IDocument25 pagesQuestion Bank (G scheme) Management Unit Test IShruti Yendhe100% (1)

- Guide to Solving Economics Entrance ExamsDocument109 pagesGuide to Solving Economics Entrance ExamsGilliesDaniel50% (2)

- Revenue Regulations No 3-98Document9 pagesRevenue Regulations No 3-98Anonymous MikI28PkJcNo ratings yet

- HR Manager Job Description BMLDocument2 pagesHR Manager Job Description BMLmasthan6yNo ratings yet

- Statutory Compliance Guide - Details of All Acts and Labour LawDocument10 pagesStatutory Compliance Guide - Details of All Acts and Labour LawMuthu ManikandanNo ratings yet

- Md. Nawshad Pervez Senior Vice President (Head) Human Resources Square Hospitals LTDDocument29 pagesMd. Nawshad Pervez Senior Vice President (Head) Human Resources Square Hospitals LTDAmitNo ratings yet