Professional Documents

Culture Documents

Sunset Boards Case Study

Uploaded by

Meredith Wilkinson RamirezOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sunset Boards Case Study

Uploaded by

Meredith Wilkinson RamirezCopyright:

Available Formats

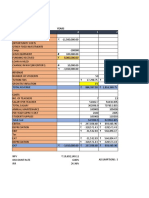

Below are the financial statements that you are asked to prepare.

1. The income statement for each year will look like this:

Income statement

2009 2010

Sales $277,855 $338,688

Cost of goods sold 141,641 178,839

Selling & administrative 27,854 36,355

Depreciation 39,983 45,192

EBIT $68,377 $78,302

Interest 8,702 9,962

EBT $59,675 $68,340

Taxes 11,935 13,668

Net income $47,740 $54,672

Dividends $23,870 $27,336

Addition to retained earnings 23,870 27,336

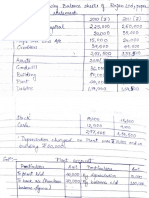

2. The balance sheet for each year will be:

Balance sheet as of Dec. 31, 2009

Cash $20,437 Accounts payable $36,120

Accounts receivable 14,482 Notes payable 16,464

Inventory 30,475 Current liabilities $52,584

Current assets $65,394

Long-term debt $89,040

Net fixed assets $176,400 Owners' equity $100,170

Total assets $241,794 Total liab. & equity $241,794

In the first year, equity is not given. Therefore, we must calculate equity as a plug variable. Since

total liabilities & equity is equal to total assets, equity can be calculated as:

Equity = $241,794 – 89,040 – 52,854

Equity = $100,170

Balance sheet as of Dec. 31, 2010

Cash $30,880 Accounts payable $40,908

Accounts receivable 18,785 Notes payable 17,976

Inventory 41,821 Current liabilities $58,884

Current assets $91,486

Long-term debt $102,480

Net fixed assets $214,184 Owners' equity $144,306

Total assets $305,670 Total liab. & equity $305,670

The owner’s equity for 2010 is the beginning of year owner’s equity, plus the addition to

retained earnings, plus the new equity, so:

Equity = $100,170 + 27,336 + 16,800

Equity = $144,306

3. Using the OCF equation:

OCF = EBIT + Depreciation – Taxes

The OCF for each year is:

OCF2009 = $68,377 + 39,983 – 11,935

OCF2009 = $96,425

OCF2010 = $78,302 + 45,192 – 13,668

OCF2010 = $109,826

4. To calculate the cash flow from assets, we need to find the capital spending and change in net

working capital. The capital spending for the year was:

Capital spending

Ending net fixed assets $214,184

– Beginning net fixed assets 176,400

+ Depreciation 45,192

Net capital spending $ 82,976

And the change in net working capital was:

Change in net working capital

Ending NWC $32,602

– Beginning NWC 12,810

Change in NWC $19,792

So, the cash flow from assets was:

Cash flow from assets

Operating cash flow $109,826

– Net capital spending 82,976

– Change in NWC 19,792

Cash flow from assets $ 7,058

5. The cash flow to creditors was:

Cash flow to creditors

Interest paid $9,962

– Net new borrowing 13,440

Cash flow to creditors –$3,478

6. The cash flow to stockholders was:

Cash flow to stockholders

Dividends paid $27,336

– Net new equity raised 16,800

Cash flow to stockholders $10,536

Answers to questions

1. The firm had positive earnings in an accounting sense (NI > 0) and had positive cash flow

from operations. The firm invested $19,792 in new net working capital and $82,976 in new

fixed assets. The firm gave $7,058 to its stakeholders. It raised $3,478 from bondholders, and

paid $10,536 to stockholders.

2. The expansion plans may be a little risky. The company does have a positive cash flow, but a

large portion of the operating cash flow is already going to capital spending. The company

has had to raise capital from creditors and stockholders for its current operations. So, the

expansion plans may be too aggressive at this time. On the other hand, companies do need

capital to grow. Before investing or loaning the company money, you would want to know

where the current capital spending is going, and why the company is spending so much in

this area already.

You might also like

- FCF 12th Edition Case SolutionsDocument66 pagesFCF 12th Edition Case SolutionsDavid ChungNo ratings yet

- Management Accounting - I (Section A, B &H) Term I (2021-22)Document3 pagesManagement Accounting - I (Section A, B &H) Term I (2021-22)saurabhNo ratings yet

- S&S Air MortgageDocument3 pagesS&S Air MortgageErick Ortega100% (2)

- M&M PizzaDocument1 pageM&M Pizzasusana3gamito0% (4)

- Plan Your Cash Flow and Finances with These ToolsDocument4 pagesPlan Your Cash Flow and Finances with These Toolscialee100% (2)

- Finance Minicase 1 Sunset BoardsDocument12 pagesFinance Minicase 1 Sunset Boardsapi-31397810480% (5)

- Chapter 3: Working With Financial StatementsDocument10 pagesChapter 3: Working With Financial StatementsNafeun AlamNo ratings yet

- Amerbran Company Cash Flow Statement 2001Document1 pageAmerbran Company Cash Flow Statement 2001Jalad Mukerjee100% (1)

- Mercury Athletic Footwear: Joel L. Heilprin Harvard Business School © 59 Street Partners LLCDocument15 pagesMercury Athletic Footwear: Joel L. Heilprin Harvard Business School © 59 Street Partners LLCkarthikawarrierNo ratings yet

- Anandam Manufacturing CompanyDocument9 pagesAnandam Manufacturing CompanyAijaz AslamNo ratings yet

- Accounting Case AnalysisDocument11 pagesAccounting Case Analysissuresh sivadasan0% (1)

- Case Study LeasingDocument3 pagesCase Study LeasingNicolaus Chandra100% (2)

- ST Clement'S School Case Study: YearsDocument8 pagesST Clement'S School Case Study: YearsTin Bernadette DominicoNo ratings yet

- Example of Investment Analysis Paper PDFDocument24 pagesExample of Investment Analysis Paper PDFYoga Nurrahman AchfahaniNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Case 1 Spreadsheet - EI DuPontDocument6 pagesCase 1 Spreadsheet - EI DuPontSamuel BishopNo ratings yet

- Group Work Case 10 Berkshire InstrumentsDocument3 pagesGroup Work Case 10 Berkshire InstrumentsPatrick Alsim100% (4)

- Long-Term and Short-Term Financial Decisions Problems Week 7Document4 pagesLong-Term and Short-Term Financial Decisions Problems Week 7Ajeet YadavNo ratings yet

- Solved The Dijon Company S Total Variable Cost Function Is TVC 50qDocument1 pageSolved The Dijon Company S Total Variable Cost Function Is TVC 50qM Bilal SaleemNo ratings yet

- Analysis For Reeby SportsDocument4 pagesAnalysis For Reeby SportsMohit SrivastavaNo ratings yet

- Gemini Electronics: US LCD TV Giant's Growth & Financial AnalysisDocument1 pageGemini Electronics: US LCD TV Giant's Growth & Financial AnalysisSreeda PerikamanaNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- JHT's SuperMud Four Year System Project Financial AnalysisDocument4 pagesJHT's SuperMud Four Year System Project Financial Analysisanup akasheNo ratings yet

- Mercury Athletic CaseDocument3 pagesMercury Athletic Casekrishnakumar rNo ratings yet

- Clarkson Lumbar CompanyDocument41 pagesClarkson Lumbar CompanyTheOxyCleanGuyNo ratings yet

- Jones Electrical DistributionDocument2 pagesJones Electrical DistributionJeff FarleyNo ratings yet

- Lecture 11 Joan Holtz ADocument3 pagesLecture 11 Joan Holtz Avineetk_39100% (1)

- Grennell Farm Balance Sheet AnalysisDocument6 pagesGrennell Farm Balance Sheet AnalysisMichael TorresNo ratings yet

- Dupont AnalysisDocument5 pagesDupont AnalysisNoraminah IsmailNo ratings yet

- Additional topics in variance analysisDocument33 pagesAdditional topics in variance analysisAnthony MaloneNo ratings yet

- Financial Management Test 2: Answer ALL QuestionsDocument3 pagesFinancial Management Test 2: Answer ALL Questionshemavathy50% (2)

- Role of Financial Management in OrganizationDocument8 pagesRole of Financial Management in OrganizationTasbeha SalehjeeNo ratings yet

- Case Study: Electronics UnlimitedDocument4 pagesCase Study: Electronics UnlimitedFaridaNo ratings yet

- AkuntansiDocument3 pagesAkuntansier4sallNo ratings yet

- S2 G9 Hanson CaseDocument2 pagesS2 G9 Hanson CaseShraddha PandyaNo ratings yet

- ACCT-312:: Exercises For Home Study (From Chapter 6)Document5 pagesACCT-312:: Exercises For Home Study (From Chapter 6)Amir ContrerasNo ratings yet

- Joan HoltzDocument10 pagesJoan HoltzKarlo PradoNo ratings yet

- Cadillac Cody CaseDocument13 pagesCadillac Cody CaseKiran CheriyanNo ratings yet

- Chapter 13 Capital Budgeting Estimating Cash FlowsDocument5 pagesChapter 13 Capital Budgeting Estimating Cash FlowsStephen Ayala100% (1)

- Zumwald CalculationsDocument2 pagesZumwald CalculationsCode HookNo ratings yet

- Amerbran Company A Final1Document6 pagesAmerbran Company A Final1Rio TanNo ratings yet

- Souper Bowl Student CaseDocument6 pagesSouper Bowl Student CaseRajabNo ratings yet

- Chapter 2 Analysis of Financial StatementDocument18 pagesChapter 2 Analysis of Financial StatementSuman ChaudharyNo ratings yet

- Ameritrade Case SolutionDocument34 pagesAmeritrade Case SolutionAbhishek GargNo ratings yet

- DCF Valuation Estimates Stock as Overvalued (40Document2 pagesDCF Valuation Estimates Stock as Overvalued (40Bilal AfzalNo ratings yet

- Minicase - Ratio Analysis at S&S Air Inc.Document4 pagesMinicase - Ratio Analysis at S&S Air Inc.belle crisNo ratings yet

- Amerbran Company Statement of Cash Flows AnalysisDocument1 pageAmerbran Company Statement of Cash Flows AnalysisSakshi YadavNo ratings yet

- Pinetree MotelMP 26 Case - N - Group 4Document5 pagesPinetree MotelMP 26 Case - N - Group 4harleeniitrNo ratings yet

- Percentage of Sales MethodDocument6 pagesPercentage of Sales MethodFrancois Duvenage100% (1)

- Chapter Three CVP AnalysisDocument65 pagesChapter Three CVP AnalysisBettyNo ratings yet

- The Quaker Oats Company and Subsidiaries Consolidated Statements of IncomeDocument3 pagesThe Quaker Oats Company and Subsidiaries Consolidated Statements of IncomeNaseer AhmedNo ratings yet

- Working Capital Problem SolutionDocument10 pagesWorking Capital Problem SolutionMahendra ChouhanNo ratings yet

- Small business cash flow analysisDocument2 pagesSmall business cash flow analysisAgANo ratings yet

- Exercise 5. MiniCase Answer 1Document5 pagesExercise 5. MiniCase Answer 1Linh LinhNo ratings yet

- Case Solutions CH (1-8) II PDFDocument21 pagesCase Solutions CH (1-8) II PDFMajed MansourNo ratings yet

- Cash Flow Analysis of Sunset Boards, Inc. 2008-2009Document3 pagesCash Flow Analysis of Sunset Boards, Inc. 2008-2009phátNo ratings yet

- Build Cumberland Industries 2004 Income StatementDocument4 pagesBuild Cumberland Industries 2004 Income StatementAngel L Rolon TorresNo ratings yet

- CH2 FinmaDocument3 pagesCH2 Finmamervin coquillaNo ratings yet

- Week1 Answers ChYqDocument5 pagesWeek1 Answers ChYqChintya FransiscaNo ratings yet

- DifferenceDocument10 pagesDifferencethalibritNo ratings yet

- Checklist For Statutory Audit of BankDocument9 pagesChecklist For Statutory Audit of BankAayush BansalNo ratings yet

- TM 4 - Earning ManagementDocument27 pagesTM 4 - Earning ManagementRifqa aulia nabylaNo ratings yet

- Accounting Multiple Choice Questions & Answers: Answer: CDocument2 pagesAccounting Multiple Choice Questions & Answers: Answer: CManan Gupta43% (7)

- Burger King Case StudyDocument18 pagesBurger King Case StudymostafaazmyNo ratings yet

- Fsa 06Document36 pagesFsa 06ferahNo ratings yet

- Solutions of Cash Flow Statement QuestionsDocument7 pagesSolutions of Cash Flow Statement QuestionsSuvana YasminNo ratings yet

- ADVACTDocument4 pagesADVACTMariel Princess100% (2)

- Dangote Cement's financial charges and tax cut into profit as sales revenue grows slowlyDocument16 pagesDangote Cement's financial charges and tax cut into profit as sales revenue grows slowlygregNo ratings yet

- ACCT 210-Fall 21-22-Revision Sheet - FinalDocument3 pagesACCT 210-Fall 21-22-Revision Sheet - FinalAndrew PhilipsNo ratings yet

- Ia2 16 Accounting For Income TaxDocument55 pagesIa2 16 Accounting For Income TaxJoyce Anne Garduque100% (1)

- Difference Between Cost Audit and Financial AuditDocument6 pagesDifference Between Cost Audit and Financial Auditfahad haxanNo ratings yet

- Acctg1205 - Chapter 4 PROBLEMSDocument6 pagesAcctg1205 - Chapter 4 PROBLEMSElj Grace BaronNo ratings yet

- CH 1Document19 pagesCH 1Chiheb DzNo ratings yet

- Acca f9 and p4 Answers To Reinforcing Questions p4Document80 pagesAcca f9 and p4 Answers To Reinforcing Questions p4Calvince OumaNo ratings yet

- BSc Accounting and Finance Mock Exam 1Document12 pagesBSc Accounting and Finance Mock Exam 1Suyash DixitNo ratings yet

- Section 1 : Mastering Depreciation Testbank Solutions Depreciation On The Financial Statements V. Tax ReturnDocument4 pagesSection 1 : Mastering Depreciation Testbank Solutions Depreciation On The Financial Statements V. Tax ReturnSamuel ferolinoNo ratings yet

- Walmart vs Amazon: Long-Term Investment Case for WalmartDocument20 pagesWalmart vs Amazon: Long-Term Investment Case for WalmartEduardo TomasNo ratings yet

- LeveragesDocument41 pagesLeveragesSohini ChakrabortyNo ratings yet

- Solutions To Chapter 6 Valuing StocksDocument12 pagesSolutions To Chapter 6 Valuing Stockshung TranNo ratings yet

- Introduction to accounting and business decision makingDocument9 pagesIntroduction to accounting and business decision makingRaju SubediNo ratings yet

- MGT45 Fall 2013 HWDocument27 pagesMGT45 Fall 2013 HWTrevor Allen HolleronNo ratings yet

- Payment Voucher DetailsDocument18 pagesPayment Voucher DetailsHtoo Htoo KyawNo ratings yet

- Calculate Payback Period, NPV-Chapter 2Document13 pagesCalculate Payback Period, NPV-Chapter 2Khuetu NguyenhoangNo ratings yet

- How Debt Leverage Affects CPK's Financial MetricsDocument14 pagesHow Debt Leverage Affects CPK's Financial MetricsLâm Thanh Huyền Nguyễn100% (1)

- Non-Current Assets Held For Sale Discontinued OperationsDocument32 pagesNon-Current Assets Held For Sale Discontinued Operationsnot funny didn't laughNo ratings yet

- MOD 1 - Introduction On Cost AccountingDocument10 pagesMOD 1 - Introduction On Cost Accountingzach thomasNo ratings yet

- AFS MCQsDocument43 pagesAFS MCQsNayab KhanNo ratings yet

- Financials GlossaryDocument248 pagesFinancials GlossarySaif Al MutairiNo ratings yet

- Annual Report ECII 2016Document158 pagesAnnual Report ECII 2016No RainaNo ratings yet

- Account Equation 4Document3 pagesAccount Equation 4mohitvishnoiNo ratings yet