Professional Documents

Culture Documents

Ambit Portfolio

Uploaded by

Pearl Motwani0 ratings0% found this document useful (0 votes)

66 views2 pagesOriginal Title

Ambit+Portfolio

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

66 views2 pagesAmbit Portfolio

Uploaded by

Pearl MotwaniCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

OUR PORTFOLIO OF 48 "GOOD AND CLEAN" STOCKS

Bloomberg code Company Prices (Rs) Mkt cap (US$ mn)

Performance

8-Mar-11 5-May-11 (%) 8-Mar-11

BATA IN Equity BATA INDIA LTD 346 428 23.6 494

WHIRL IN Equity WHIRLPOOL OF INDIA LTD 231 279 20.8 651

HPCL IN Equity HINDUSTAN PETROLEUM CORP 322 387 20.3 2,421

MRPL IN Equity MANGALORE REFINERY & PETRO 61 72 17.9 2,383

MCLR IN Equity MCLEOD RUSSEL INDIA LTD 228 265 16.1 555

MRF IN Equity MRF LTD 6,017 6,930 15.2 567

ABBAP IN Equity ALSTOM PROJECTS INDIA LTD 518 588 13.5 771

TRP IN Equity TORRENT PHARMACEUTICALS LTD 524 590 12.6 984

TTAN IN Equity TITAN INDUSTRIES LTD 3,453 3,884 12.5 3,401

HH IN Equity HERO HONDA MOTORS LTD 1,500 1,683 12.2 6,646

APTY IN Equity APOLLO TYRES LTD 61 69 12.1 685

IOCL IN Equity INDIAN OIL CORPORATION LTD 310 347 12.0 16,711

EXID IN Equity EXIDE INDUSTRIES LTD 138 154 11.2 2,609

BIOS IN Equity BIOCON LTD 322 355 10.2 1,430

NFCL IN Equity NAGARJUNA FERTILIZERS & CH 27 30 9.9 258

TTCH IN Equity TATA CHEMICALS LTD 326 357 9.4 1,844

REDI IN Equity REDINGTON INDIA LTD 77 84 9.3 679

SRCM IN Equity SHREE CEMENT LTD 1,741 1,900 9.2 1,346

BHARTI IN Equity BHARTI AIRTEL LTD 332 361 8.5 28,026

NEST IN Equity NESTLE INDIA LTD 3,785 4,100 8.3 8,102

BOS IN Equity BOSCH LTD 6,085 6,581 8.2 4,242

APNT IN Equity ASIAN PAINTS LTD 2,509 2,682 6.9 5,341

ITC IN Equity ITC LTD 172 183 6.2 29,479

IDEA IN Equity IDEA CELLULAR LTD 62 66 6.1 4,549

ATD IN Equity AREVA T&D INDIA LTD 252 265 5.5 1,335

TCOM IN Equity TATA COMMUNICATIONS LTD 210 221 5.1 1,330

POL IN Equity POLARIS SOFTWARE LAB LTD 185 195 5.0 408

GLXO IN Equity GLAXOSMITHKLINE PHARMACEUTIC 2,162 2,265 4.8 4,065

BRIT IN Equity BRITANNIA INDUSTRIES LTD 348 363 4.4 922

HCLI IN Equity HCL INFOSYSTEMS LTD 104 105 0.8 503

TMX IN Equity THERMAX LTD 600 600 (0.1) 1,588

DABUR IN Equity DABUR INDIA LTD 99 99 (0.2) 3,840

GRASIM IN Equity GRASIM INDUSTRIES LTD 2,313 2,299 (0.6) 4,709

MSIL IN Equity MARUTI SUZUKI INDIA LTD 1,258 1,243 (1.2) 8,069

DRRD IN Equity DR. REDDY'S LABORATORIES 1,610 1,590 (1.2) 6,045

MRCO IN Equity MARICO LTD 132 130 (1.6) 1,798

PIHC IN Equity PIRAMAL HEALTHCARE LTD 467 459 (1.8) 2,167

SIEM IN Equity SIEMENS INDIA LTD 858 840 (2.1) 6,421

UTCEM IN Equity ULTRATECH CEMENT LTD 1,026 1,003 (2.2) 6,242

TTMT IN Equity TATA MOTORS LTD 1,162 1,134 (2.4) 15,211

ICEM IN Equity INDIA CEMENTS LTD 92 89 (2.4) 624

CCRI IN Equity CONTAINER CORP OF INDIA LTD 1,183 1,149 (2.9) 3,415

RIL IN Equity RELIANCE INDUSTRIES LTD 985 950 (3.6) 71,518

OFSS IN Equity ORACLE FINANCIAL SERVICES 2,058 1,955 (5.0) 3,833

RBXY IN Equity RANBAXY LABORATORIES LTD 451 428 (5.0) 4,214

HUVR IN Equity HINDUSTAN UNILEVER LTD 283 268 (5.1) 13,688

BJAUT IN Equity BAJAJ AUTO LTD 1,395 1,280 (8.2) 8,959

TECHM IN Equity TECH MAHINDRA LTD 738 653 (11.5) 2,064

Equal weighted returns 5.4

Mkt cap weighted returns 2.6

BSE500 index 7,076 7082 0.1

Portfolio alpha (equal weighted) 5.35

BSE200 index 2,261 2252 (0.4)

Portfolio alpha (equal weighted) 5.85

Source: Bloomberg, Ambit Capital Research

Note: This portfolio has been constructed specifically with high immunity from inflation ("good") and relatively strong accounting quality ("clean") in

mind

You might also like

- MSCI India Index Closing at 1987.98Document16 pagesMSCI India Index Closing at 1987.98bhusanNo ratings yet

- Dividend YieldDocument112 pagesDividend YieldHarsh AgarwalNo ratings yet

- ICICI Pru Balanced Fund - (G) ::::::::: GraphDocument13 pagesICICI Pru Balanced Fund - (G) ::::::::: GraphVivek GusaniNo ratings yet

- Best Stocks To Buy in India For Long Term in 2017 - GetMoneyRichDocument4 pagesBest Stocks To Buy in India For Long Term in 2017 - GetMoneyRichPalanisamy BalasubramaniNo ratings yet

- Latest Market Prices of Indian Companies by SectorDocument16 pagesLatest Market Prices of Indian Companies by SectorNitesh TripathiNo ratings yet

- Rakesh Jhunjhunwala's stock holdingsDocument2 pagesRakesh Jhunjhunwala's stock holdingsneotroniks2853No ratings yet

- Suraj SirDocument93 pagesSuraj SirAjinkya GuravNo ratings yet

- NIFTY Midcap 150 Jan2022Document6 pagesNIFTY Midcap 150 Jan2022Arati DubeyNo ratings yet

- Assignment No. 1Document4 pagesAssignment No. 1priye250No ratings yet

- NIFTY 50 Nov2020Document2 pagesNIFTY 50 Nov2020Games ZoneNo ratings yet

- JM Midcap Oct 30Document1 pageJM Midcap Oct 30yugendhar janjiralaNo ratings yet

- Book 1Document174 pagesBook 1rourkela.amit3345No ratings yet

- HDFC Equity Fund Outperforms Benchmark ReturnsDocument8 pagesHDFC Equity Fund Outperforms Benchmark Returnsshreedhar mohtaNo ratings yet

- Constituents of Nifty 50 Index and their WeightageDocument2 pagesConstituents of Nifty 50 Index and their WeightagenomihNo ratings yet

- NIFTY Midcap 50 Apr2020Document2 pagesNIFTY Midcap 50 Apr2020amitNo ratings yet

- NIFTY Smallcap 50 Jan2022Document2 pagesNIFTY Smallcap 50 Jan2022Arati DubeyNo ratings yet

- Sr. No. Symbol Company Name Market Capitalisation (In Lakhs)Document12 pagesSr. No. Symbol Company Name Market Capitalisation (In Lakhs)Anish ShahNo ratings yet

- Sr. No. Symbol Company Name Market Capitalisation (In Lakhs)Document23 pagesSr. No. Symbol Company Name Market Capitalisation (In Lakhs)bhagvat saseNo ratings yet

- Adress Book 2Document5 pagesAdress Book 2DOPE RIDERSNo ratings yet

- Ethical Fun9Document1 pageEthical Fun9Nitish KumarNo ratings yet

- Equity Portfolio Performance Overview: 1st JUL - 5th JUL, 2019Document2 pagesEquity Portfolio Performance Overview: 1st JUL - 5th JUL, 20194D EngineeringNo ratings yet

- Bse Listed Top 100 Compnies-2586jDocument4 pagesBse Listed Top 100 Compnies-2586jsriguruNo ratings yet

- Franklin India Bluechip Fund portfolio breakdownDocument1 pageFranklin India Bluechip Fund portfolio breakdownAatish TNo ratings yet

- Best Profitable StockDocument2 pagesBest Profitable Stockalkulith89No ratings yet

- NIFTY Midcap 100 constituents and weightageDocument4 pagesNIFTY Midcap 100 constituents and weightageArati DubeyNo ratings yet

- 01-04-2020 Bse 200 52LDocument18 pages01-04-2020 Bse 200 52LSach PaNo ratings yet

- DividendDocument15 pagesDividendAnitha RajendranNo ratings yet

- Sr. No. Symbol Company Name Market Capitalisation (In Lakhs)Document3 pagesSr. No. Symbol Company Name Market Capitalisation (In Lakhs)niraj sharmaNo ratings yet

- Sr. No. Symbol Company Name Market Capitalisation (In Lakhs)Document3 pagesSr. No. Symbol Company Name Market Capitalisation (In Lakhs)Syed FaisalNo ratings yet

- TOP100Document3 pagesTOP100Chandra ShekarNo ratings yet

- EQ8SID - Daily Fund Values 050424Document1 pageEQ8SID - Daily Fund Values 050424seeme55runNo ratings yet

- History of ReplacementsDocument167 pagesHistory of Replacementsvishalsharma8522No ratings yet

- Ark Israel Innovative Technology Etf (Izrl) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Israel Innovative Technology Etf (Izrl) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Romano 1No ratings yet

- NIFTY Next 50 Nov2020Document2 pagesNIFTY Next 50 Nov2020Games ZoneNo ratings yet

- Group 11 CF-2 Assignment (24-3-23)Document6 pagesGroup 11 CF-2 Assignment (24-3-23)Ankit RajNo ratings yet

- April 30, 2020: Constituents of NIFTY Smallcap 100Document4 pagesApril 30, 2020: Constituents of NIFTY Smallcap 100amitNo ratings yet

- April 30, 2020: Constituents of NIFTY 100Document4 pagesApril 30, 2020: Constituents of NIFTY 100amitNo ratings yet

- Pricetiming - Alpha ListDocument1 pagePricetiming - Alpha Listdodda1981No ratings yet

- Small Cap FundDocument1 pageSmall Cap Fundshailendra.goswamiNo ratings yet

- CMIE Annual Finance Data for Tobacco CompaniesDocument107 pagesCMIE Annual Finance Data for Tobacco CompaniesShilpi KumariNo ratings yet

- Advanced Excel Assignments - NDCDocument672 pagesAdvanced Excel Assignments - NDCajayrajachoosNo ratings yet

- NIFTY Midcap 150 ConstituentsDocument6 pagesNIFTY Midcap 150 ConstituentsamitNo ratings yet

- Equity Portfolio Oct10Document62 pagesEquity Portfolio Oct10akchatNo ratings yet

- Top constituents of NIFTY50 Value 20 indexDocument1 pageTop constituents of NIFTY50 Value 20 indexArati DubeyNo ratings yet

- Adress Book 3Document6 pagesAdress Book 3DOPE RIDERSNo ratings yet

- List of Stocks - R0Document2 pagesList of Stocks - R0vokxlulraoyytwmrrcNo ratings yet

- Portfolio Creation With Indian StocksDocument24 pagesPortfolio Creation With Indian StocksTILAK PAI 1827731No ratings yet

- Template Portfolio Disclosure - February 2018-DerivativeDocument1 pageTemplate Portfolio Disclosure - February 2018-DerivativeReedos LucknowNo ratings yet

- Telecom Regulatory Authority of India: Financial Analysis DivisionDocument11 pagesTelecom Regulatory Authority of India: Financial Analysis Divisionbhanu.garg4243No ratings yet

- Current Ratio, Return on Equity, Debt to Equity Ratio, Asset Growth, and Dividend Payout Ratio of CompaniesDocument11 pagesCurrent Ratio, Return on Equity, Debt to Equity Ratio, Asset Growth, and Dividend Payout Ratio of CompaniesPande GunawanNo ratings yet

- NIFTY Smallcap 100 Jan2022Document4 pagesNIFTY Smallcap 100 Jan2022Arati DubeyNo ratings yet

- Stock Screener144529Document48 pagesStock Screener144529Deependra YadavNo ratings yet

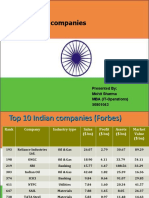

- Top 5 Indian Companies: Presented By: Mohit Sharma MBA (IT-Operations) 50801043Document18 pagesTop 5 Indian Companies: Presented By: Mohit Sharma MBA (IT-Operations) 50801043Manu SharmaNo ratings yet

- Small Cap Fun7Document1 pageSmall Cap Fun7kumarsaurabhprincyNo ratings yet

- Tata Investment Corporation List of Investments: Company Shares Held Value (CR) CMP SectorDocument13 pagesTata Investment Corporation List of Investments: Company Shares Held Value (CR) CMP SectorNIKO LAURENo ratings yet

- Cartrade Tech Limited: (Formerly Known As MXC Solutions India Private Limited)Document4 pagesCartrade Tech Limited: (Formerly Known As MXC Solutions India Private Limited)Prashant barodiyaNo ratings yet

- PSB Note Aug'21Document18 pagesPSB Note Aug'21Raj Kothari MNo ratings yet

- Daftar Saham Syarian Dan Total Saham Di BEI 2 Juni 2022Document369 pagesDaftar Saham Syarian Dan Total Saham Di BEI 2 Juni 2022Nur AriniNo ratings yet

- Fund Manager Wise - Sep 2010Document54 pagesFund Manager Wise - Sep 2010Pranav GokhaleNo ratings yet

- MagnoliasDocument135 pagesMagnoliascitysearchdirectoryNo ratings yet

- Provisional List PDFDocument74 pagesProvisional List PDFShubham RajputNo ratings yet

- RSI WMA EMA Master, Technical Analysis ScannerDocument8 pagesRSI WMA EMA Master, Technical Analysis Scannerdilip2904No ratings yet

- Week of Nov. 6 (Total Viewers)Document1 pageWeek of Nov. 6 (Total Viewers)AdweekNo ratings yet

- JD v3.1 Tirunelveli Loan Agency 2022 23Document65 pagesJD v3.1 Tirunelveli Loan Agency 2022 23RajaGopalNo ratings yet

- Nifty Midcap 100 ListDocument6 pagesNifty Midcap 100 ListRoyal Moktan0% (1)

- Mail DirectoryDocument4 pagesMail DirectoryAman DubeyNo ratings yet

- Lista BanciDocument306 pagesLista BancihdsetanhdsetaNo ratings yet

- Pharmaceutical Products: SL No Company Contact Person Contact Number Email IdDocument19 pagesPharmaceutical Products: SL No Company Contact Person Contact Number Email IdManjunath N SNo ratings yet

- Testo Worldwide OverviewDocument4 pagesTesto Worldwide OverviewSebastián JanavelNo ratings yet

- Consolidated GSTR - 2A RecoDocument181 pagesConsolidated GSTR - 2A RecokhusbooNo ratings yet

- POP Detials 090323Document6 pagesPOP Detials 090323Dr.Milan MehtaNo ratings yet

- Newgrade2021 - HP Android ComDocument9 pagesNewgrade2021 - HP Android ComToriq Jan100% (1)

- MIB2 HIGH – MHI2/Q Password ListDocument31 pagesMIB2 HIGH – MHI2/Q Password ListPedja GPS100% (1)

- Gen Set Application ChartDocument1 pageGen Set Application ChartarkapowerblrNo ratings yet

- Thermax lubrication scheduleDocument4 pagesThermax lubrication scheduleNguyễn Thanh LâmNo ratings yet

- RBI Defaulter List 30.09.2010Document868 pagesRBI Defaulter List 30.09.2010tiwariparveshNo ratings yet

- Request/Suggestions Courtesy of BadofiladaDocument35 pagesRequest/Suggestions Courtesy of BadofiladaPcnhs SalNo ratings yet

- REL670 Reference ListDocument28 pagesREL670 Reference ListRaharjo YakinNo ratings yet

- Fig 06-31-55 - 12900-A Vertical-Stabilizer Rib Station: Sheet 1Document2 pagesFig 06-31-55 - 12900-A Vertical-Stabilizer Rib Station: Sheet 1Franco GomezNo ratings yet

- Pharma Companies 177Document8 pagesPharma Companies 177Narendra ParthNo ratings yet

- GAILGas ExistingCNGStationsDocument6 pagesGAILGas ExistingCNGStationsMANOJNo ratings yet

- CompaniesDocument39 pagesCompaniessakthivel59241No ratings yet

- List of Stocks - EquitylistDocument107 pagesList of Stocks - Equitylistkavita shettyNo ratings yet

- North Based EPC ContractorDocument13 pagesNorth Based EPC Contractorsaurabhsingh1No ratings yet

- Cio Data BaseDocument41 pagesCio Data BaseNilesh100% (1)

- Safety Barrier - Single Aisle FamilyDocument7 pagesSafety Barrier - Single Aisle FamilySa Be MirNo ratings yet

- Directory of Licenced Commercial Banks Authorised NOHCs Jan 2023Document19 pagesDirectory of Licenced Commercial Banks Authorised NOHCs Jan 2023Ajai Suman100% (1)

- BNI Transactions History - June 2021Document7 pagesBNI Transactions History - June 2021Irvan KurniawanNo ratings yet

- OI SpurtsDocument22 pagesOI SpurtsBallNo ratings yet