Professional Documents

Culture Documents

LLP Agreement - Sample 1

Uploaded by

Abhishek SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LLP Agreement - Sample 1

Uploaded by

Abhishek SinghCopyright:

Available Formats

LLP Agreement

THIS Agreement of LLP made at ............ this.................... Day of ...................... 20............

BETWEEN

1. . S/o .. R/o. residing at ..which expression shall, unless it be repugnant to the subject or context thereof, include their legal heirs, successors, nominees and permitted assignees and hereinafter called the FIRST PARTY, and

2. . S/o .. R/o. residing at ..which expression shall, unless it be repugnant to the subject or context thereof, include their legal heirs, successors, nominees and permitted assignees and hereinafter called the SECOND PARTY, and

THAT THEY BOTH SHALL BECOME Partners who shall be Designated Partners on incorporation of the LLP to carry on the partnership business as a Limited Liability Partnership (LLP) registered under the provisions of Limited Liability Partnership Act, 2008 (LLP Act) with a view to shall the profits/losses on the following terms

DEFINATIONSIn this agreement unless the context otherwise requires :-

Accounting year means the financial year as defined in the Limited Liability Partnership Act, 2008.

Act or LLP Act means the Limited Liability Partnership Act, 2008

Business includes every trade, profession service and occupation.

1 / 11

LLP Agreement

Designated Partner means any partner designated as such.

LLP means the limited liability partnership formed pursuant to this LLP Agreement.

LLP Agreement means this Agreement or any supplement thereof determining the mutual right, duties and obligations of the partner in relation to each other and in relation to LLP.

Partner means any person who becomes a partner in the LLP accordance with this LLP Agreement

1. Name: Limited Liability Partnership shall be carried on in the name and style of M/s. LLP and hereinafter called as X.. LLP.

2. Business: The Partnership business shall be __________________until and unless changed as per the mutual decision of all the partners of the LLP at the time of the decision

3. Place of Office: The partnership business shall be carried on at the under mentioned address, which shall also be its registered office.__________________________. The business shall also be carried from such other places as may be mutually decided by the partners from time to time.

4. Duration : The Partnership shall commence from the date of registration of the firm, and shall continue to operate in accordance with the provisions of LLP Act, 2008 and rules framed thereunder, until termination of this agreement with the the mutual consent of all the partners.

5. Contribution: The Contribution of the LLP shall be Rs (Rupees .. only) which shall be contributed by the partners in the following proportions. First Party ..% i.e. Rs .. (Rupees .. only)

2 / 11

LLP Agreement

Second Party % i.e. Rs (Rupees .. only) The further Contribution if any required by the LLP shall be brought by the partners in their profit sharing ratio.

6. Number of Designated Partners: The maximum number of designated partners appointed for the LLP shall be as mutually agreed between the partners initially at the time of incorporation of LLP or as decided by the designated partners of the LLP from time to time unanimously.

7. Sleeping Partners: All the partners other than those appointed as the designated partners of the LLP shall be sleeping partners, and they shall not interfere with the day to day conduct of business of the LLP.

8. Common Seal: LLP shall have a common seal to be affixed on documents as defined by partners under the signature of any of the Designated Partners.

9. Immovable Properties: The immovable properties purchased by the LLP shall be clear, marketable and free from all encumbrances.

10. Audit: The Statement of Accounts and Solvency of LLP mad each year shall be audited by a qualified Chartered Accountant in practice in accordance with the rules prescribed under section 34(3) of the LLP act, 2008, namely, rule 24 of the LLP Rules & Forms, 2008. It shall be the responsibility of the Designated Partners of the LLP to comply with Rule 24 of the rules.

11. Remuneration to Partners: No partners shall be entitled to any remuneration for taking part in the conduct of the LLPs business.

12. Drawings: Each partner may draw out of the partnership funds as drawings from the credit balance of his income account. Such drawls shall be duly accounted for in the yearly settlement of accounts and divisions of profits of the partnership at the end of each financial year.

3 / 11

LLP Agreement

13. Interest on Capital or Loan : Interest at the rate of _____ % per annum on the capital contributed or loan given or credited as given by each of the partners and standing to his credit as on the first day of each calendar month for the previous month out of the gross profits of the partnership business shall be credited in the respective accounts, and such interest shall be cumulative such that any deficiency in one financial year shall be made up out of the gross profits of any succeeding financial year or years.

14. Business transaction of partner with LLP : A partner may lend money to and transact other business with the LLP, and in that behalf the Partner shall have the same rights and obligations with respect to the loans or other business transactions as a person who is not a Partner.

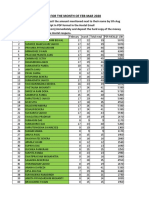

15. Profits : The net profits of the LLP shall be divided in the following proportions:

To the said --------------- ____%

To the said --------------- ____%

16. Losses: The losses of the LLP including loss of capital, if any, shall be borne and paid by the partners in the following proportions:

To the said --------------- ____%

To the said --------------- ____%

17. Bankers: The bankers of the partnership shall be----------- Bank,--------- branch and/or such other bank or banks as the partners may from time to time unanimously agreed upon.

18. Accounting year: The accounting year of the LLP shall be from 1st April of the year to 31st

4 / 11

LLP Agreement

March of subsequent year. The first accounting year shall be from the date of commencement of this LLP till 31st March of the subsequent year.

19. Place of keeping books of accounts: The books of accounts of the firm shall be kept at the registered office of the LLP.

20. Division of Annual profits of LLP: As soon as the Annual Statements of Accounts and Solvency shall have been signed by the Partners and the same duly audited and the auditor rendering his report thereon, the net profits, if any of the LLP business, shall be divided between the partners in the proportion specified in and in accordance with the provisions of this Agreement.

21. Term of validity of deed: Duration of this Agreement shall be ______ years beginning from the date first above mentioned, subject to the condition that this deed may be extended further by mutual consent in writing of the Parties hereto upon such terms and conditions or with such modifications as may be mutually agreed upon between them.

22. Arbitration: In the event of any dispute or differences arising between the parties hereto either touching or concerning the construction, meaning or effect of this Deed or the respective rights and liabilities of the parties hereto, or their enforcement there under, it shall be first settled amicably through discussions between the parties and if not resolved then otherwise referred to the arbitration of a Sole Arbitrator if agreed upon, failing which to the Sole Arbitrator as appointed by the Court in accordance with the provisions of the Arbitration and Conciliation, Act 1996. The arbitration proceedings shall be conducted at New Delhi in English language .

23. Auditors: The Auditors of the firm shall be __________ having their office at _________. T he auditors shall be responsible for all the accounts/taxation related tasks of the firm including but not limited to income tax, VAT, preparation of balance sheet/ assets and liabilities/ profit and loss of the LLP etc.

24. The legal advisors of the firm shall be ______________

5 / 11

LLP Agreement

25. Severability: This deed constitutes the entire understanding/agreement between the parties taking precedence over and superseding any prior or contemporaneous oral or written understanding. Unless otherwise provided herein, this deed can not be modified, amended, rescinded or waived, in whole or part except by a written instrument signed by all the parties to this deed. The invalidity or unenforceability of any terms or provisions of this deed shall not affect the validity or enforceability of the remaining terms and provisions of this deed, which shall remain in full force and effect.

Admission of New Partner

26. The new partner may not be introduced with the consent of all the existing partners. Such incoming partner shall give his prior consent to act as Partner of the LLP.

27. The Contribution of the partner may be tangible, intangible, Moveable or immoveable property and the incoming partner shall bring minimum contribution of Rs

28. Person whose business interests are in conflict to that of the firm shall not be admitted as the Partner.

29. The Profit sharing ratio of the incoming partner will be in proportion to his contribution towards the capital of LLP.

Rights of Partner

30. All the partners hereto shall have the rights, title and interest in all the assets and properties in the firm in the proportion of their Contribution.

31. Every partner has a right to have access to and to inspect the books of accounts of the LLP.

6 / 11

LLP Agreement

32. Each of the parties hereto shall be entitled to carry on their own, separate and independent business as hitherto they might be doing or they may hereafter do as they deem fit and proper and other partners and the LLP shall have no objection thereto provided that the said partner has intimated the said fact to the LLP before the start of the independent business. Provided the business is not in competition to the existing business being carried on by the LLP.

33. On retirement of a partner, the retiring partner shall be entitled to full payment in respect of all his rights, title and interest in the partner as herein provided.

34. Upon the death of any of the partners herein any one of his or her heirs will be admitted as a partner of the LLP in place of such deceased partner.

35. On the death of any partner, if his or her heir legal heirs opt not to become the partner, the surviving partners shall have the option to purchase the contribution of the deceased partner in the firm.

Duties of Partners

36. Each Partner shall be just and faithful to the other partners in all transactions relating to the LLP.

37. Each partner shall render true accounts and full information of all things affecting the limited liability partnership to any partner or his legal representatives.

38. Every partner shall account to the limited liability partnership for any benefit derived by him without the consent of the LLP of any transaction concerning the limited liability partnership.

39. Every partner shall indemnify the limited liability partnership and the other existing partner for any loss caused to it by his fraud in the conduct of the business of the limited liability partnership.

7 / 11

LLP Agreement

40. In case any of the Partners of the LLP desires to transfer or assign his interest or shares in the LLP he can transfer the same with the consent of all the Partners.

41. No Partner shall without the written consent of other Partners :-

Engage or except for gross misconduct, dismiss any employee of the partnership

Commit to buy any immovable property for the LLP

Sumit a dispute relating to business of LLP business to arbitration.

Assign, mortgage or charge his or her share" in the partnership or any asset or property thereof or make any other person a partner therein.

Engage directly or indirectly in any business competing with that of the limited liability partnership.

Withdraw a suit filed on behalf of LLP.

Admit liability in a suit or proceedings against LLP.

Share business secrets of the LLP with outsiders.

Remit in whole or part debt due to LLP.

8 / 11

LLP Agreement

Go and remain out of station in connection with the business of LLP more than ____ days at a time.

Open a banking account on behalf of LLP in his name.

Draw and sign any cheque on behalf of LLP unauthorisedly in excess of Rs_____________ on its banking account.

Give any unauthorized security or promise for the payment of money on account on behalf of the LLP except in the ordinary course of business.

Draw or accept or endorse unauthorisedly any bill of exchange or promissory note on LLPs account.

Lease, sell, pledge or do other disposition of any of the LLPs property otherwise than in the ordinary course of business.

Do any act or omission rendering the LLP liable to be wound up by the Tribunal.

Derive any profits from any transactions of the LLP or from the use of its name, resources or assets or business connection by carrying on a business of the nature as competes with that of the LLP.

Duties of Designated Partner

42. Devote their whole time and attention to the said partnership business diligently and faithfully by employing themselves in it, and carry on the business for the greatest advantage of the partnership.

9 / 11

LLP Agreement

43. The Designated Partners shall be responsible for the doing of all acts, matters and things as are required to be done by the LLP in respect of compliance of the provisions of this Act including filing of any document, return, statement and the like report pursuant to the provisions of Limited Liability Partnership Act, 2008. 44. Protect the property and assets of the LLP.

45. Upon every reasonable request, inform the other partners of all letters, writings and other things which shall come to their hands or knowledge concerning the business of the LLP.

46. Punctually pat their separate debts to the LLP.

47. The Designated Partners shall be responsible for the doing of all such other acts arising out of this agreement.

Cessation of Existing Partners

48. Partner may cease to be partner of the LLP by giving a notice in writing of not less than ______ days to the other partners of his intention to resign as partner.

49. Majority of Partners can expel any partner in the situation where the partner has been found guilty of carrying of activity/business of LLP with fraudulent purpose or has been found to engage in a business which competes with the business of LLP.

IN WITNESS WHEREOF THIS DEED IS SIGNED BY TE PARTIES HERETO THE DAY, MONTH AND YEAR FIRST ABOVE WRITTEN.

Party of the First Part-----------------------------

Party of the Second Part-----------------------------

10 / 11

LLP Agreement

Witness 1:

Witness 2:.

11 / 11

You might also like

- LLP Agreement PDFDocument6 pagesLLP Agreement PDFNazrin KhairuddinNo ratings yet

- LLP Agreement SpecimenDocument14 pagesLLP Agreement Specimenkishore JoshiNo ratings yet

- Draft of LLP AgreementDocument14 pagesDraft of LLP AgreementNikhil KasatNo ratings yet

- Sample LLP AgreementDocument18 pagesSample LLP AgreementSwarup SarkarNo ratings yet

- LLP Agreement Black SampleDocument7 pagesLLP Agreement Black SampleWoodzNo ratings yet

- Draft LLP - AgreementDocument14 pagesDraft LLP - AgreementIzzat Hanif100% (1)

- Deed For PartnershipDocument17 pagesDeed For PartnershipPushpdeep MishraNo ratings yet

- Model LLP AgreementDocument20 pagesModel LLP AgreementSoumitra Chawathe71% (21)

- New LLP FormatDocument13 pagesNew LLP FormatSavoir PenNo ratings yet

- LLP AgreementDocument20 pagesLLP AgreementRohit KariwalaNo ratings yet

- Draft LLP AgreementDocument20 pagesDraft LLP Agreementgthirupal01No ratings yet

- Draft LLP AgreementDocument14 pagesDraft LLP AgreementBalajiNo ratings yet

- Model Limited Liability Partnership AgreementDocument5 pagesModel Limited Liability Partnership AgreementnavinkapilNo ratings yet

- LLP AgreementDocument13 pagesLLP AgreementrockyrrNo ratings yet

- Partnership Agreement (Messrs Fazlina & Partners)Document23 pagesPartnership Agreement (Messrs Fazlina & Partners)Ahmad TaufiqNo ratings yet

- LLP Agreement 1Document21 pagesLLP Agreement 1Jay KewatNo ratings yet

- LLP AgreementDocument32 pagesLLP AgreementRam IyerNo ratings yet

- Share Purchase AgreementDocument78 pagesShare Purchase AgreementCorrentin Ebengke Ntang Brown100% (1)

- Consortium Agreement for Young Women's ProgrammeDocument9 pagesConsortium Agreement for Young Women's ProgrammeShweta DaveNo ratings yet

- Partnership AgreementDocument10 pagesPartnership AgreementJooky LimNo ratings yet

- Draft Exclusive Sales Agent - Broker AgreementDocument4 pagesDraft Exclusive Sales Agent - Broker AgreementLili BethNo ratings yet

- Share Subscription and Shareholders AgreementDocument57 pagesShare Subscription and Shareholders AgreementIshan JavidNo ratings yet

- Sample Subscription AgreementDocument19 pagesSample Subscription AgreementLonny Bernath100% (2)

- Professional Services AgreementDocument9 pagesProfessional Services AgreementK WTNo ratings yet

- Shareholders Agreement Template 2014Document9 pagesShareholders Agreement Template 2014docsivaNo ratings yet

- Indian Partnership Deed FormatDocument9 pagesIndian Partnership Deed Formatpaydy100% (2)

- LLP Agreement DraftDocument9 pagesLLP Agreement DraftABDURAHIMAN IRSHAD PILATHOTTATHILNo ratings yet

- Agreement of Association of PersonsDocument4 pagesAgreement of Association of PersonsnavinkapilNo ratings yet

- Share Purchase Agreement TemplateDocument9 pagesShare Purchase Agreement Templatemahendrakadam2No ratings yet

- Schedule JDocument6 pagesSchedule JSHL50% (2)

- Shares Sale AgreementDocument14 pagesShares Sale AgreementIan Ling100% (1)

- COMPANY TO LLP CONVERSION AGREEMENT ImportantDocument31 pagesCOMPANY TO LLP CONVERSION AGREEMENT ImportantShubham Phophalia100% (2)

- LLP AgreementDocument35 pagesLLP AgreementVijay MelwaniNo ratings yet

- Financial Advisor Consultant AgreementDocument6 pagesFinancial Advisor Consultant AgreementAshwin VargheseNo ratings yet

- Introducers Agreement O.I.L.Ahmedabad and AEC PuneDocument4 pagesIntroducers Agreement O.I.L.Ahmedabad and AEC PunerutujaNo ratings yet

- Partnership DeedDocument4 pagesPartnership DeedShashikant BhosleNo ratings yet

- NCNDA - GenericDocument4 pagesNCNDA - GenericChrisNo ratings yet

- Shareholders Rights AgreementDocument8 pagesShareholders Rights AgreementRocketLawyerNo ratings yet

- IB Agreement BreakdownDocument7 pagesIB Agreement BreakdownMuh TaufandyanNo ratings yet

- LLP Act Guide Explains Limited Liability Partnership RulesDocument7 pagesLLP Act Guide Explains Limited Liability Partnership RulesMaygie KeiNo ratings yet

- Principals of Taxation of Partnerships: Tanzania Revenue Authority Institute of Tax AdministrationDocument62 pagesPrincipals of Taxation of Partnerships: Tanzania Revenue Authority Institute of Tax AdministrationMoud KhalfaniNo ratings yet

- Agency AgreementDocument19 pagesAgency AgreementRaymond KohNo ratings yet

- Retirement Deed PartnershipDocument7 pagesRetirement Deed Partnershipchsantosh panda100% (1)

- Shareholder Agreement Template - SingaporeLegalAdviceDocument11 pagesShareholder Agreement Template - SingaporeLegalAdviceJenyYehNo ratings yet

- Letter of Undertaking: Deinco Limited and Biswas Construction Joint Venture, ADocument4 pagesLetter of Undertaking: Deinco Limited and Biswas Construction Joint Venture, ASaief AhmadNo ratings yet

- Memorandum of Understanding For Joint VentureDocument14 pagesMemorandum of Understanding For Joint VentureJagruti NiravNo ratings yet

- Scanned LLP Agreement - Tac SeawaysDocument13 pagesScanned LLP Agreement - Tac SeawaysJoyNo ratings yet

- Stock or Share Swap Agreement (Draft)Document11 pagesStock or Share Swap Agreement (Draft)Inquiry PVM100% (3)

- Partnership Agreement SummaryDocument4 pagesPartnership Agreement SummaryEliana FreireNo ratings yet

- Trading AgreementDocument17 pagesTrading AgreementANo ratings yet

- Call Option Agreement SummaryDocument3 pagesCall Option Agreement SummaryMa. Angelica de Guzman100% (1)

- Limited Liability Partnership Agreement TemplateDocument8 pagesLimited Liability Partnership Agreement Templatesunilpv70100% (1)

- Drafting Shareholders' Agreements ChecklistDocument6 pagesDrafting Shareholders' Agreements ChecklistMarius Angara100% (1)

- Offer To Purchase Assets of Business (Short Form)Document3 pagesOffer To Purchase Assets of Business (Short Form)Legal Forms100% (3)

- Joint Venture Agreement To Construct A SubdivisionDocument3 pagesJoint Venture Agreement To Construct A SubdivisionBeert De la Cruz100% (1)

- Sample Limited Partnership AgreementDocument10 pagesSample Limited Partnership AgreementMaciek Mikrut Gmail100% (1)

- LLP Agreement for Mojeat Food LLPDocument9 pagesLLP Agreement for Mojeat Food LLPuma vermaNo ratings yet

- LLP AgreementDocument7 pagesLLP Agreementrachit mishraNo ratings yet

- LLP Agreement 15 10 2011Document15 pagesLLP Agreement 15 10 2011Mathew JosephNo ratings yet

- LLP AgreementDocument7 pagesLLP Agreementdriver vitaNo ratings yet

- Securites Transactions PSRAODocument69 pagesSecurites Transactions PSRAOAbhishek SinghNo ratings yet

- MANU/DE/0353/1983Document6 pagesMANU/DE/0353/1983Abhishek SinghNo ratings yet

- Form PAS-4Document5 pagesForm PAS-4Abhishek SinghNo ratings yet

- Initiation Notice enDocument4 pagesInitiation Notice enAbhishek SinghNo ratings yet

- Delhi HCDocument33 pagesDelhi HCLive LawNo ratings yet

- In The Supreme Court of IndiaDocument13 pagesIn The Supreme Court of IndiaAbhishek SinghNo ratings yet

- We The PeoplesDocument34 pagesWe The PeoplesAbhishek SinghNo ratings yet

- Peel-Off Lawyers: Legal Professionals in India's Corporate Law Firm Sector Jayanth K. KrishnanDocument40 pagesPeel-Off Lawyers: Legal Professionals in India's Corporate Law Firm Sector Jayanth K. KrishnanAbhishek SinghNo ratings yet

- 20-03 04 Wiley ThomasDocument4 pages20-03 04 Wiley ThomasAbhishek SinghNo ratings yet

- Indian Penal Code With Amendments Comments and Important CitationsDocument324 pagesIndian Penal Code With Amendments Comments and Important CitationssramarmduNo ratings yet

- Kerala SIDCO: Promoting Small Industries in KeralaDocument3 pagesKerala SIDCO: Promoting Small Industries in KeralaVeena S.SNo ratings yet

- Schedule Rates For 2009-10Document5 pagesSchedule Rates For 2009-10vinujohnpanicker80% (5)

- Big data: The frontier for innovation, competition, and productivityDocument20 pagesBig data: The frontier for innovation, competition, and productivityBhavnita Naresh100% (2)

- 2023 Internal Audit Plan For The CrewDocument4 pages2023 Internal Audit Plan For The CrewLateef LasisiNo ratings yet

- Adobe Scan 07-Feb-2024Document2 pagesAdobe Scan 07-Feb-2024randomstuffytb36No ratings yet

- Good Money After Bad Harvard Case Doc MDDocument3 pagesGood Money After Bad Harvard Case Doc MDRickNo ratings yet

- Chapter Six Strategic Control and EvaluationDocument68 pagesChapter Six Strategic Control and EvaluationbutwalserviceNo ratings yet

- Condo Concepts GuideDocument3 pagesCondo Concepts GuideChris Quijano AyadeNo ratings yet

- 2022 - 02 - 03 Revision in Rates of NSSDocument10 pages2022 - 02 - 03 Revision in Rates of NSSKhawaja Burhan0% (2)

- The Non-Historic View of CapitalismDocument170 pagesThe Non-Historic View of CapitalismondoleftNo ratings yet

- Sara Lee Vs MacatlangDocument11 pagesSara Lee Vs MacatlangEuneun BustamanteNo ratings yet

- Paper 3 Workbook Answers - EconomicsDocument65 pagesPaper 3 Workbook Answers - EconomicsNihaarika GopinathNo ratings yet

- South African Airways v. CIRDocument3 pagesSouth African Airways v. CIRHailin Quintos67% (3)

- Nature of Accounting Mind MapDocument12 pagesNature of Accounting Mind MapJared 03No ratings yet

- Account Statement: Customer Cash PositionDocument5 pagesAccount Statement: Customer Cash PositionrizkyNo ratings yet

- IBM TemplateDocument9 pagesIBM Templategfgdfg7579No ratings yet

- AC Transit Annual Report 1963-1964Document20 pagesAC Transit Annual Report 1963-1964AC Transit HistorianNo ratings yet

- Cat Level Di (Solution) Www.Document25 pagesCat Level Di (Solution) Www.aravind174No ratings yet

- 4al10cv041 Shahanas TDocument1 page4al10cv041 Shahanas TSantosh GoudarNo ratings yet

- CV Dody WORDDocument1 pageCV Dody WORDaimanbahadiNo ratings yet

- As ISO IEC 17010-2003 General Requirements For Bodies Providing Accreditation of Inspection BodiesDocument8 pagesAs ISO IEC 17010-2003 General Requirements For Bodies Providing Accreditation of Inspection BodiesSAI Global - APACNo ratings yet

- Study of Evaluation & Selection of A New Seat Manufacturing Project Using Capital Budgeting Techniques at Lear Automotive India Pvt. LTDDocument22 pagesStudy of Evaluation & Selection of A New Seat Manufacturing Project Using Capital Budgeting Techniques at Lear Automotive India Pvt. LTDkrishna100% (1)

- Brian Wheeler3Document2 pagesBrian Wheeler3stasgoyerNo ratings yet

- Hero FinCorp Ltd. 24th AGM NoticeDocument88 pagesHero FinCorp Ltd. 24th AGM Noticesuraj ManNo ratings yet

- Ubp FaqDocument47 pagesUbp FaqManojit SarkarNo ratings yet

- 1.2 Introduction To Labour Economics and Personnel EconomicsDocument5 pages1.2 Introduction To Labour Economics and Personnel EconomicsSayfullahKhanNo ratings yet

- Mess Bill Hostel Students ICT BhubaneswarDocument2 pagesMess Bill Hostel Students ICT BhubaneswarAnkita PriyadarsiniNo ratings yet

- Finishes (Wall Tiles & Screeding)Document10 pagesFinishes (Wall Tiles & Screeding)Ler Kai HuiNo ratings yet

- SMEs Guide to IFRS for SMEsDocument130 pagesSMEs Guide to IFRS for SMEsDharren Rojan Garvida AgullanaNo ratings yet

- SD FX Excel - Sample File: Option ClassesDocument11 pagesSD FX Excel - Sample File: Option ClassesFranc GrošeljNo ratings yet