Professional Documents

Culture Documents

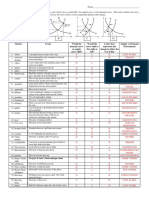

MACRO Practice Test

Uploaded by

Tee_Tee57Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MACRO Practice Test

Uploaded by

Tee_Tee57Copyright:

Available Formats

SAMPLE EXAM - CHAPTER 1 1. What do economists mean when they state that a good is scarce? a.

There is a shortage or insufficient supply of the good at the existing price. b. It is impossible to expand the availability of the good. c. People will want to buy more of the good regardless of price. d. The amount of the good that people would like to have exceeds the supply that is freely available from nature. 2. Economic choice and competitive behavior are the result of a. basic human greed. b. poverty. c. private ownership of resources. d. scarcity. 3. Rationing is a. the allocation of a limited supply of a good or resource among users who would like to have more of it. b. a function that can only be performed by market prices. c. a function that is unnecessary except in cases where markets are used to allocate goods and resources. d. essential only when the price of a product is set above market equilibrium. 4. The expression, "There's no such thing as a free lunch" implies that a. everyone has to pay for his own lunch. b. the person consuming a good must always pay for it. c. costs are incurred when resources are used to produce goods and services. d. no one has time for a good lunch anymore. 5. Which one of the following states a central element of the economic way of thinking? a. Scarce goods are priceless. b. Incentives matter--if the personal cost of a choice increases, individuals will be less likely to choose it. c. The realism of the assumptions is the best test of an economic theory. d. When deciding how to allocate time, the concept of opportunity cost is meaningless. 6. Which of the following is most clearly consistent with the basic postulate of economics with regard to human decision making? a. People will never choose work over leisure.

b. People will buy less gas if the gasoline tax decreases 20 cents per gallon. c. People will buy more orange juice at $2 per gallon than at $1 per gallon. d. People will consume less beef if the price increases from $1 to $2 per pound. 7. Which one of the following is a positive economic statement? a. An increase in the price of butter causes consumers to buy less butter. b. Social conscience demands that we increase the minimum wage. c. Taxes should be raised to halt inflation. d. The sales tax on food should be repealed. 8. The basic difference between macroeconomics and microeconomics is that a. macroeconomics looks at the forest (aggregate markets), while microeconomics is concerned with the individual trees (subcomponents). b. macroeconomics is concerned with policy decisions, while microeconomics applies only to theory. c. microeconomics is concerned with the forest (aggregate markets), while macroeconomics is concerned with the trees (components). d. opportunity cost is applicable to macroeconomics, and the fallacy of composition relates to microeconomics. 9. Economic analysis assumes that a. for the most part, individuals act out of selfish motives, and it is realistic to assume this is always true. b. although individuals are at times selfish and at times altruistic, only their selfish actions may be predicted. c. people are basically humanitarian and their actions are therefore difficult to predict. d. changes in the personal benefits and costs associated with an activity will exert a predictable influence on human behavior. 10. Adam Smith believed that if people were free to pursue their own interests, then a. greed and cheating would prevail in the market. b. less would be produced than if altruism were our guiding principle. c. they would generally be encouraged to produce goods and services that others valued highly (relative to their costs). d. the public interest would be best served, but the interests of employers would be hurt. Answer Key for Chapter 1 Test 1. d 2. d 3. a 4. c 5. b 6. d 7. a 8. a 9. d 10. c

SAMPLE EXAM - CHAPTER 2 1. Which of the following sayings best reflects the concept of opportunity cost? a. "You can't teach an old dog new tricks." b. "Time is money." c. "I have a baker's dozen." d. "There's no business like show business." 2. If an economy is operating at a point inside the production possibilities curve, a. its resources are being wasted. b. the curve will begin to shift inward. c. the curve will begin to shift outward. d. This is a trick question because an economy cannot produce at a point inside the curve. 3. The primary benefit that results when a nation employs its resources in accordance with the principle of comparative advantage is a. an expansion in capital investment resulting from a reallocation of resources away from consumption. b. a larger output resulting from a more efficient use of resources. c. greater equality of income resulting from an increase in the number of workers. d. an increase in the profitability of business enterprises resulting from an increase in capital formation. 4. The price of an airline ticket from Denver to Washington, D.C., is $600. A bus ticket is $150. Traveling by plane takes six hours, compared with 36 hours by bus. Other things constant, an individual would gain by choosing air travel if, and only if, his time were valued at more than a. $6 per hour. b. $8 per hour. c. $10 per hour. d. $15 per hour.

5. Does voluntary exchange create wealth (value)? a. No, exchange does not expand output. b. No, if one person gains, the other party must lose an equal amount.

c. Uncertain, it does when it results in the creation of additional goods and services; otherwise it does not. d. Yes, trade generally permits the trading partners to gain more of what they value; this is why they agree to the terms of the exchange. 6. "Now that Blake paints the broad surfaces and I do the trim work, we can paint a house in three-fourths the time that it took for each of us to do both." This statement most clearly reflects a. the importance of secondary effects. b. the fallacy of composition. c. the law of comparative advantage. d. behavior inconsistent with economizing. 7. Which of the following will most likely occur under a system of clearly defined and enforced private property rights? a. Resource owners will fail to conserve vital resources, even if they expect their scarcity to increase. b. Resource owners will ignore the wishes of others, including others who would like to use the resource that is privately owned. c. Resource owners will fail to consider the wishes of potential future buyers when they decide how to employ privately owned resources. d. Resource owners will gain by discovering and employing their resources in ways that are highly valued by others. 8. Three basic decisions must be made by all economies. What are they? a. how much will be produced; when it will be produced; how much it will cost b. what the price of each good will be; who will produce each good; who will consume each good c. what will be produced; how goods will be produced; for whom goods will be produced d. how the opportunity cost principle will be applied; if and how the law of comparative advantage will be utilized; whether the production possibilities constraint will apply 9. If a firm or a nation desires to maximize its output, each productive assignment should be carried out by those persons who a. have the highest opportunity cost. b. have a comparative advantage in the productive activity. c. can complete the productive activity most rapidly. d. least enjoy performing the productive activity.

10. "The economic wealth of this country is primarily the result of the profit made by some individuals at the expense of others." The person who made this statement a. has failed to comprehend that mutual gains result from specialization and exchange. b. has failed to comprehend the fallacy of composition. c. has failed to understand the significance of the production possibilities constraint. d. has utilized the economic way of thinking; the statement is essentially correct. Answer Key for Chapter 2 Test 1. b 2. a 3. b 4. d 5. d 6. c 7. d 8. c 9. b 10. a SAMPLE TEST QUESTIONS - CHAPTER 3 1. Which of the following would most likely increase the demand for peanut butter? a. a decrease in the price of bread, a good that is often used with peanut butter b. a discovery that the average daily consumption of peanut butter decreases one's life span by 15 years c. crop failures that raise the price of peanuts d. a decrease in the price of all substitute protein products 2. Economic profit is best defined as a. a company's net income as indicated by its accounting statement. b. the difference between the price of a product and the monetary cost of the raw materials used to produce it. c. the difference between the revenue from the sale of a product and the opportunity cost of the resources used to produce it. d. income paid by a business to its owners. 3. The long run is a time period of sufficient length to enable a. producers to alter their use of fixed capital (the size of their plant and equipment). b. producers to alter their output by utilizing labor and raw materials more intensively. c. decision makers to adjust fully to a change in market conditions. d. Both a and c are correct.

4. The number of persons wanting tickets to Super Bowl games is invariably greater than the number of tickets (and seats) available. This is evidence that the price of the tickets is a. higher than the competitive equilibrium price. b. equal to the competitive equilibrium price since the number of tickets bought equals the number sold. c. lower than the competitive equilibrium price. d. higher than the competitive equilibrium price when the demand is inelastic but lower when the demand is elastic. 5. "A reduction in gasoline prices caused the demand to increase. The lower prices led to an increase in demand for large cars, causing their prices to rise." These statements a. are essentially correct. b. contain one error; the lower gasoline prices would cause a reduction in demand for large cars, not an increase. c. contain one error; the lower gasoline prices would increase the quantity of gasoline demanded by consumers, not the demand for large cars. d. contain two errors; the lower gasoline prices would cause the quantity of gasoline demanded (rather than demand for large cars) to increase, and the lower gasoline price would reduce (rather than increase) the demand for large cars. 6. A cold spell in Florida extensively reduced the orange crop, and, as a result, California oranges commanded a higher price. Which of the following statements best explains the situation? a. The supply of Florida oranges fell, causing the supply of California oranges to increase as well as their price. b. The supply of Florida oranges fell, causing the supply of California oranges to decrease and their price to increase. c. The supply of Florida oranges fell, causing their price to increase and the demand for California oranges to increase. d. The demand for Florida oranges was reduced by the freeze, causing an increase in the price of California oranges and a greater demand for them. 7. When a price floor is above the equilibrium price, a. quantity demanded will exceed quantity supplied. b. quantity supplied will exceed quantity demanded. c. the market will be in equilibrium. d. This is a trick question because price floors generally exist below the equilibrium price.

8. If the market price of a good is less than the opportunity cost of producing it, a. the market price of the product will fall in the long run. b. producers will increase supply in the long run. c. resources will flow away from production of the good, causing supply to decline with the passage of time. d. the situation will remain unchanged as long as supply and demand remain in balance. 9. The price of chicken increases as the result of higher beef prices. This indicates that a. chicken and beef are substitutes. b. chicken and beef are complements. c. the market demand for beef is inelastic. d. the market demand for chicken is elastic. 10. The invisible hand principle indicates that competitive markets can help promote the efficient use of resources a. only if buyers and sellers really care, personally, about economic efficiency. b. even when each market participant cares only about getting a "bigger slice of the pie" rather than about the overall efficiency of resource use. c. even if business firms fail to produce goods efficiently. d. if, and only if, businesses recognize their social obligation to keep costs low and use resources wisely. Answer Key for Chapter 3 Test 1. a 2. c 3. d 4. c 5. c 6. c 7. b 8. c 9. a 10. b Additional Sample Test Questions from Chapter 3 1. "A reduction in gasoline prices caused the demand to increase. The lower prices led to an increase in demand for large cars, causing their price to rise." This statement a. is essentially correct. b. contains one error the lower gasoline prices would cause a reduction in demand for large cars, not an increase. c. contains one error the lower gasoline prices would increase the quantity demanded by consumers, not the demand. d. contains two errors the lower gasoline prices would cause the quantity demanded (rather than demand) to increase, and the lower gasoline price would reduce (rather than increase) the demand for large cars.

2. "If gasoline sales were taxed, the price of gasoline would rise. Consequently, the quantity demanded of gasoline would decline. As a result of the higher gasoline prices, the demand for fuel-efficient automobiles would increase." This statement is a. essentially correct. b. incorrect; the high gasoline prices would cause the demand for gasoline, not the quantity demanded, to fall. c. incorrect; the statement confuses a change in demand with a shift in supply. d. incorrect; demand and quantity demanded are confused for both gasoline and fuel-efficient cars. 3. "As the price of gasoline rose, consumers decreased their quantity demanded. In addition, the demand for compact cars increased, causing their price to rise." This statement a. is essentially correct. b. contains one error the quantity demanded, not the demand for compact cars, increased. c. contains two errors demand and quantity demanded are confused twice. d. contains one error demand, not quantity demanded, for gasoline decreased. 4. "If gasoline sales were taxed, the price of gasoline would rise. Consequently, the demand for gasoline would decline. As a result of the higher gasoline prices, the demand for fuel-efficient automobiles would increase." This statement is a. essentially correct. b. incorrect; the high gasoline prices would cause the quantity demanded of gasoline, not the demand, to fall. c. incorrect; the statement confuses a change in demand with a shift in supply. d. incorrect; demand is confused with quantity demanded for both gasoline and fuel-efficient cars. 5. If the supply of apples decreases, which of the following will generally occur in a market setting? a. Demand for apples will decrease. b. The quantity demanded will increase. c. The costs of apple producers will decrease. d. The price of apples will increase. 6. If the supply of a good decreases, which of the following will generally occur in a market setting? a. The price of the good will decrease. b. Demand will decrease.

c. The quantity demanded will increase. d. The quantity demanded will decrease. 7. "Lower fuel oil prices in 1986 led to a reduction in demand and lower prices of solar heating units. At the lower price, producers of solar heating units reduced the quantity supplied." This statement is a. false; lower fuel oil prices would increase the demand for and price of solar heating units. b. false; producers of solar units would expand production rather than reduce output if the price of the units fell. c. false; if the demand for solar units fell, the supply of the units would decrease but not the quantity supplied. d. essentially correct. 8. If the demand for a good increases, which of the following will generally occur in a market setting? a. The price of the good will decrease. b. The supply of the good will increase. c. The quantity supplied will increase. d. Producer profits will fall. 9. If the demand for a good decreases, which of the following will generally occur in a market setting? a. The price of the good will increase. b. The supply of the good will decrease. c. The quantity supplied will decrease. d. Producer profits will rise. 10. In a market economy, an increase in demand will generally cause the equilibrium a. price to fall. b. quantity supplied to increase. c. quantity demanded to fall. d. number of firms in the market to decline. 11. A decrease in demand will a. reduce supply. b. increase the quantity traded in the market. c. cause higher prices, although quantity traded in the market will decline. d. lead to a reduction in the quantity supplied.

Answers for Additional Questions for Chapter 3 1. c 2. a 3. a 4. b 5. d 6. d 7. d 8. c 9. c 10. b 11. d SAMPLE TEST QUESTIONS - CHAPTER 4 1. If the United Auto Workers union can obtain a substantial wage increase for auto workers, the price of automobiles will rise. The rise can be attributed to a. a shift to the right in the supply curve for automobiles. b. a shift to the left in the supply curve for automobiles. c. a shift to the right in the demand curve for automobiles. d. a shift to the left in the demand curve for automobiles. 2. When a price floor is above the equilibrium price, a. quantity demanded will exceed quantity supplied. b. quantity supplied will exceed quantity demanded. c. the market will be in equilibrium. d. This is a trick question because price floors generally exist below the equilibrium price. 3. Rent control applies to about two-thirds of the private rental housing in New York City. Economic theory suggests that the below-equilibrium prices established by rent controls would a. redistribute income from tenants to landlords. b. promote a rapid increase in the future supply of housing. c. result in poor service and quality deterioration of many rental units. d. lead to a reduction in housing discrimination against minorities. 4. Which of the following is the most likely result of an increase in the minimum wage? a. an increase in the employment of unskilled workers b. a decrease in the unemployment rate of unskilled workers c. an increase in the demand for unskilled workers d. a decrease in the employment of unskilled workers Answer Key for Chapter 4 Test 1. b 2. b 3. c 4. d

SAMPLE TEST QUESTIONS - CHAPTER 5 1. Which of the following is legally permitted to use coercive force to modify the actions of adults? a. banks b. corporations c. governments d. all of the above 2. As methods of economic organization, the market and the public sector are similar in which of the following ways? a. Income is distributed equally in and by both sectors. b. In both sectors, economic activity is undertaken only when it will result in social gain. c. In both sectors, economic exchange is completely voluntary. d. Someone must cover the cost associated with the provision of scarce goods in both sectors. 3. Which one of the following is a major difference between market and collective economic organization? a. Individuals are motivated by their personal interests when they make market decisions, but they will be motivated primarily by the public interests when they make collective choices. b. Individuals have a strong incentive to acquire information when making private consumption decisions, but voters have little incentive to invest in acquiring information when making political choices. c. Competitive behavior is present when decisions are made in the marketplace, but competition is absent when choices are made collectively. d. For market choices, there will be a one-to-one link between individual consumption and individual payment for a good; this link is also present when choices are made collectively. 4. The cost of government activities equals a. the income transferred to the government in the form of taxation. b. the income that could have been earned by government employees if they had worked in the private sector. c. the difference between government expenditures and tax revenues. d. the sum of the opportunity cost of resources used by the government plus the cost of tax compliance and the excess burden of taxation. 5. Economic efficiency requires a. individuals produce at their maximum level.

b. only long-lasting, high-quality products be produced. c. income be distributed equally among consumer units. d. all economic activity generating more benefits than costs to individuals in the economy be undertaken. 6. Which of the following correctly describes an external benefit resulting from an individual's purchase of a winter flu shot? a. The flu shot is cheaper than the cost of treatment when you get the flu. b. The income of doctors increases when you get the flu shot. c. The flu shot reduces the likelihood of others catching the flu. d. The flu shot reduces the likelihood you will miss work as the result of sickness; therefore, you will earn more income. 7. Which of the following is the best example of a public good? a. a national system of health care b. the Disney World amusement park c. a flood control project d. telephone service 8. From the viewpoint of economic efficiency, when competitive forces in an industry are weak, market allocation will often a. lead to an excessive supply of the product by firms in the industry. b. lead to product prices that exceed the opportunity cost of production. c. lead to product prices that are too low. d. cause private firms to use inefficient production methods. 9. Which of the following is the best example of an action that imposes an external cost? a. wear and tear on one's car as the result of speeding b. an increase in one's water bill as the result of watering the yard c. deterioration in the environmental quality of a campground as a result of garbage left behind by careless campers d. a rose garden on your property that improves the view available to your neighbors 10. Producers will be most likely to help consumers acquire accurate information at a low cost when a. advertising expenses are considered a fixed cost for tax purposes. b. the producers incur external costs by providing such information to consumers. c. the good produced is a repeat-buy item and sales depend on the satisfaction

of customers. d. the product sold is a near public good. Answers for Sample Test - Chapter 10 1. a 2. a 3. a 4. c 5. d 6. a 7. a 8. b 9. b 10. a

SAMPLE TEST - CHAPTER 11 1. In a single year, a $5 billion tax reduction was accompanied by a $9 billion increase in consumer spending. From a Keynesian view, the most probable explanation for the increase in consumer spending by more than the amount of the tax cut is that a. lower taxes caused government spending to fall, which led to the increase in consumer spending. b. increased consumption spending by those with higher disposable incomes led to higher incomes and still more consumption spending by others. c. the tax cut caused interest rates to fall, thus increasing consumer spending. d. the lower taxes prompted the Federal Reserve to sell U.S. securities, causing both the money supply and consumer spending to increase. 2. Although the economy was in the Great Depression, the Hoover administration followed a fiscal policy of balancing the budget. A Keynesian would have found this policy a. inappropriate because it probably would have depressed economic activity and led to further increases in unemployment. b. appropriate because it probably would have led to a significant increase in the money supply and thereby increased employment. c. inappropriate because it probably would have impaired the ability of monetary policy to end the Depression. d. appropriate because it probably would have stimulated economic activity and helped end the Depression. 3. Suppose U.S. policy makers decide that to stimulate GDP growth, investment must be increased. What is needed, they conclude, is a reallocation of resources away from producing consumer goods and toward producing capital goods. Which of the following policy alternatives would most likely accomplish this objective? a. a reduction in personal income taxes b. a reduction in state sales taxes

c. a tax credit allowance for business investment in capital equipment d. restrictive monetary policy 4. According to the Keynesian view, which of the following would most likely decrease aggregate demand? a. a decrease in tax rates b. a decrease in government expenditures c. an increase in transfer payments d. an increase in the budget deficit 5. Which of the following is an example of an automatic stabilizer? a. Congress legislates lower tax rates to increase consumption and investment. b. Tax rates are increased during a recession to maintain a balanced budget. c. A regressive income tax system reduces tax revenues (as a share of income) as income expands. d. Revenues from the corporate income tax increase sharply during a business boom but decline substantially during a recession, even though no new tax legislation is enacted. 6. Keynesian analysis implies that a planned budget deficit is a. always necessary to ensure full employment. b. proper during slack economic conditions but highly inappropriate if the economy is already operating at capacity. c. of little consequence unless there is a corresponding change in the money supply. d. an effective method of dealing with inflation. 7. The crowding-out effect suggests that a. expansionary fiscal policy causes inflation. b. restrictive fiscal policy is an effective weapon against inflation. c. reduction in private spending resulting from the higher interest rates caused by a budget deficit will largely offset the expansionary impact of a pure fiscal action. d. a budget surplus will cause the private demand for loanable funds, the interest rate, and aggregate demand to fall. 8. Other things constant, an increase in marginal tax rates will: a. decrease the supply of labor and reduce its productive efficiency. b. decrease the supply of capital and reduce its productive efficiency. c. encourage individuals to substitute less desired, tax-deductible goods for more desired, non-deductible goods. d. cause all of the above.

9. The new classical model implies that substitution of debt for tax financing a. increases aggregate demand and exerts a multiplier effect leading to an expansion in real output. b. is highly effective against inflation. c. reduces consumption because it increases both the current and future tax liability of households. d. leaves wealth and therefore aggregate demand unchanged since the debt implies higher future taxes. 10. A balanced budget is present when a. the economy is at full employment. b. the actual level of aggregate spending equals the planned level of spending. c. public sector spending equals private sector spending. d. government revenues equal expenditures. ANSWER KEY FOR SAMPLE TEST - CHAPTER 11 1. b 2. a 3. c 4. b 5. d 6. b 7. c 8. d 9. d 10. d SAMPLE TEST - CHAPTER 13 1. If the required reserve ratio is 10 percent, a bank with a new deposit of $1,000 a. must keep $100 on reserve and can make up to $900 in new loans. b. must keep $200 on reserve and can make up to $800 in new loans. c. must keep $900 on reserve and can make up to $100 in new loans. d. must keep $1,000 on reserve and can make no additional loans. 2. Which one of the following is incorrect regarding money? a. Money is a medium of exchange. b. Money is a store of value. c. Money serves as a unit of account. d. The value of money is dependent on the quantity of gold held by the Federal Reserve. 3. Which of the following are changes altering the nature of money and the usefulness of the money supply figures? a. the widespread holding of U.S. currency outside the country by foreigners b. the increasing availability of stock and bond mutual funds c. the use of debit cards and electronic money d. all of the above

4. Which of the following is primarily responsible for controlling the money supply in the United States? a. the U.S. Congress b. the Council of Economic Advisors c. the U.S. Treasury d. the Board of Governors of the Federal Reserve System 5. If the Fed wanted to use all three of its major monetary control tools to decrease the money supply, it would a. buy bonds, reduce the discount rate, and reduce reserve requirements. b. sell bonds, reduce the discount rate, and reduce reserve requirements. c. sell bonds, reduce the discount rate, and increase reserve requirements. d. sell bonds, increase the discount rate, and increase reserve requirements. 6. If a decrease in the money supply were desired to slow inflation, the Federal Reserve might a. increase the reserve requirements. b. sell U.S. securities on the open market. c. raise the discount rate. d. buy U.S. securities directly from the Treasury. 7. The Federal Reserve's most frequently used monetary tool is a. the discount rate. b. the reserve requirements. c. moral persuasion. d. open market operations. 8. Suppose the Fed purchases $100 million of U.S. securities from the public. The reserve requirement is 20 percent and all banks have zero excess reserves. The total impact of this action on the money supply will be a a. $100 million decrease in the money supply. b. $100 million increase in the money supply. c. $200 million increase in the money supply. d. $500 million increase in the money supply. 9. A reserve requirement of 20 percent implies a potential money deposit multiplier of a. 4. b. 5. c. 20. d. 25.

10. A bank receives a demand deposit of $1,000. The bank loans out $600 of this deposit and increases its excess reserves by $300. What is the legal reserve requirement? a. 10 percent b. 20 percent c. 60 percent d. 70 percent

ANSWER KEY FOR SAMPLE TEST - CHAPTER 13 1. a 2. d 3. d 4. d 5. d 6. d 7. d 8. d 9. b 10. a SAMPLE TEST - CHAPTER 14 1. Suppose Congress raises taxes and the monetary authorities slow the annual money supply growth from 10 percent to 5 percent. If decision makers accurately anticipate the impact of these policy changes on prices, a. unemployment will rise. b. unemployment will fall. c. there will be no effect on unemployment. d. unemployment will fall if the change in monetary policy dominates, but unemployment will rise if the change in fiscal policy dominates. 2. Which one of the following accurately states the view of activists who favor discretionary stabilization policy? a. The index of leading indicators and other forecasting tools provide policy makers with valuable information that permits them to institute stabilizing changes in macroeconomic policy. b. Since we have only limited ability to forecast the economy, the best policy is to do nothing. c. In recent years, our ability to forecast the economy has improved to the extent that discretionary macroeconomic policy is capable of fine-tuning if policy makers would follow the advice of leading economists. d. The index of leading indicators is unreliable at revealing when an economy is about to enter a recession. 3. Which of the following is an argument against a monetary rule (money supply growth at a constant rate such as 4 percent)? a. Since the lag between when a monetary policy is instituted and when it takes effect is unpredictable, changes in monetary policy are difficult to time.

b. The inability to forecast the economy makes it difficult to time monetary policy. c. A monetary rule would prevent the monetary authorities from taking action to offset abrupt changes in the money velocity. d. Since the index of leading indicators has sometimes provided conflicting information on the economy, it would be difficult to institute a monetary rule. 4. The activists' view that the best policy is one of discretionary intervention into the macroeconomy is most consistent with which of the following views? a. The self-correcting properties of a market economy would work well if they were not disrupted by errors in macropolicy. b. A market economy is unstable because politicians force incorrect policies on the people. c. A market economy is inherently stable. d. The self-correcting properties of a market economy work very slowly. 5. Compared to discretionary monetary policy, which of the following strengthen(s) the case for a monetary rule, such as the expansion of the money supply at a constant rate (perhaps 4 percent)? a. Since the lag between when a monetary policy is instituted and when it exerts its major effect is unpredictable, changes in monetary policy are difficult to time. b. The inability to forecast the economy makes it difficult to time discretionary monetary policy. c. A monetary rule would reduce the likelihood that monetary planners could stimulate an economic boom just prior to a major election. d. All of the above are correct. 6. (I) Since forecasting is an imprecise science, policy makers should not respond to minor economic ups and downs, which may be misleading indicators. Precise fine-tuning is beyond our knowledge and capabilities. (II) Demand stimulus can reduce the rate of unemployment below the natural level for a long time. a. Most economists would agree with I; most economists would agree with II. b. Most economists would disagree with I; most economists would agree with II. c. Most economists would agree with I; most economists would disagree with II. d. Most economists would disagree with I; most economists would disagree with II.

7. Which of the following is a good example of an activist stabilization policy designed to head off a recession? a. Congress cuts government expenditures to reduce the budget deficit. b. The Fed reduces money supply growth to increase the value of the dollar in the foreign exchange market. c. Congress reduces tax rates as the result of the index of leading indicators declining for four months in a row. d. All of the above are correct. 8. If restrictive macroeconomic policy will reduce inflation emanating from excess demand, ideally the policy should be undertaken a. when inflation is at its highest. b. when inflation begins to increase. c. before inflation begins to increase. d. about six months after inflation peaks. 9. The index of leading indicators is a(n) a. alphabetical listing of the most popular indicators in the economy for a given month. b. composite index of indicators that provides information on the future direction of the economy. c. measure of the level of aggregate output. d. composite index designed to measure inflation. 10. Under the rational expectations hypothesis, which of the following is the most likely short-run effect of a move to expansionary monetary policy? a. higher prices and no change in real output b. higher prices and real output c. no change in prices and lower real output d. no change in prices or real output ANSWER KEY FOR SAMPLE TEST - CHAPTER 14 1. c 2. a 3. c 4. d 5. d 6. c 7. c 8. c 9. b 10. a SAMPLE TEST - CHAPTER 15 1. Suppose Congress raises taxes and the monetary authorities slow the annual money supply growth from 10 percent to 5 percent. If decision makers accurately anticipate the impact of these policy changes on prices, a. unemployment will rise.

b. unemployment will fall. c. there will be no effect on unemployment. d. unemployment will fall if the change in monetary policy dominates, but unemployment will rise if the change in fiscal policy dominates. 2. Which one of the following accurately states the view of activists who favor discretionary stabilization policy? a. The index of leading indicators and other forecasting tools provide policy makers with valuable information that permits them to institute stabilizing changes in macroeconomic policy. b. Since we have only limited ability to forecast the economy, the best policy is to do nothing. c. In recent years, our ability to forecast the economy has improved to the extent that discretionary macroeconomic policy is capable of fine-tuning if policy makers would follow the advice of leading economists. d. The index of leading indicators is unreliable at revealing when an economy is about to enter a recession. 3. Which of the following is an argument against a monetary rule (money supply growth at a constant rate such as 4 percent)? a. Since the lag between when a monetary policy is instituted and when it takes effect is unpredictable, changes in monetary policy are difficult to time. b. The inability to forecast the economy makes it difficult to time monetary policy. c. A monetary rule would prevent the monetary authorities from taking action to offset abrupt changes in the money velocity. d. Since the index of leading indicators has sometimes provided conflicting information on the economy, it would be difficult to institute a monetary rule. 4. The activists' view that the best policy is one of discretionary intervention into the macroeconomy is most consistent with which of the following views? a. The self-correcting properties of a market economy would work well if they were not disrupted by errors in macropolicy. b. A market economy is unstable because politicians force incorrect policies on the people. c. A market economy is inherently stable. d. The self-correcting properties of a market economy work very slowly. 5. Compared to discretionary monetary policy, which of the following strengthen(s) the case for a monetary rule, such as the expansion of the money supply at a constant rate (perhaps 4 percent)? a. Since the lag between when a monetary policy is instituted and when it

exerts its major effect is unpredictable, changes in monetary policy are difficult to time. b. The inability to forecast the economy makes it difficult to time discretionary monetary policy. c. A monetary rule would reduce the likelihood that monetary planners could stimulate an economic boom just prior to a major election. d. All of the above are correct. 6. (I) Since forecasting is an imprecise science, policy makers should not respond to minor economic ups and downs, which may be misleading indicators. Precise fine-tuning is beyond our knowledge and capabilities. (II) Demand stimulus can reduce the rate of unemployment below the natural level for a long time. a. Most economists would agree with I; most economists would agree with II. b. Most economists would disagree with I; most economists would agree with II. c. Most economists would agree with I; most economists would disagree with II. d. Most economists would disagree with I; most economists would disagree with II. 7. Which of the following is a good example of an activist stabilization policy designed to head off a recession? a. Congress cuts government expenditures to reduce the budget deficit. b. The Fed reduces money supply growth to increase the value of the dollar in the foreign exchange market. c. Congress reduces tax rates as the result of the index of leading indicators declining for four months in a row. d. All of the above are correct. 8. If restrictive macroeconomic policy will reduce inflation emanating from excess demand, ideally the policy should be undertaken a. when inflation is at its highest. b. when inflation begins to increase. c. before inflation begins to increase. d. about six months after inflation peaks. 9. The index of leading indicators is a(n) a. alphabetical listing of the most popular indicators in the economy for a given month. b. composite index of indicators that provides information on the future direction of the economy.

c. measure of the level of aggregate output. d. composite index designed to measure inflation. 10. Under the rational expectations hypothesis, which of the following is the most likely short-run effect of a move to expansionary monetary policy? a. higher prices and no change in real output b. higher prices and real output c. no change in prices and lower real output d. no change in prices or real output ANSWER KEY FOR SAMPLE TEST - CHAPTER 15 1. c 2. a 3. c 4. d 5. d 6. c 7. c 8. c 9. b 10. a

You might also like

- Tut 2 TwoDocument56 pagesTut 2 TwoBraceley & CoNo ratings yet

- Chap 03Document16 pagesChap 03Syed Hamdan100% (1)

- EC102 - Problem Set 1 - Answer KeyDocument19 pagesEC102 - Problem Set 1 - Answer KeyEd ZNo ratings yet

- Law of Demand and SupplyDocument16 pagesLaw of Demand and SupplyRitu RoyNo ratings yet

- CH 8 Test BankDocument61 pagesCH 8 Test BankElizabeth MontelepreNo ratings yet

- Chap 01Document14 pagesChap 01Syed Hamdan100% (1)

- ECON 1550 Assignment 1: Analysis of Graphs, Slopes, Production Possibilities Frontier & MoreDocument19 pagesECON 1550 Assignment 1: Analysis of Graphs, Slopes, Production Possibilities Frontier & Morenekkmatt100% (1)

- Demand NumericalsDocument2 pagesDemand Numericalsmahesh kumar0% (1)

- Nontariff Trade Barriers Study GuideDocument9 pagesNontariff Trade Barriers Study GuideChi IuvianamoNo ratings yet

- Microeconomics NotesDocument8 pagesMicroeconomics Notesenis oppaiNo ratings yet

- BBA 1st Semester SyllabusDocument12 pagesBBA 1st Semester SyllabusBinay Tiwary80% (5)

- Differential AnalysisDocument6 pagesDifferential AnalysisGina Mantos GocotanoNo ratings yet

- Demand Side PolicyDocument15 pagesDemand Side PolicyAnkit Shukla100% (1)

- Supply and Demand Problems KEYDocument2 pagesSupply and Demand Problems KEYowaisNo ratings yet

- Chap 05Document16 pagesChap 05Syed Hamdan0% (2)

- Eco-Elasticity of DD & SPDocument20 pagesEco-Elasticity of DD & SPSandhyaAravindakshanNo ratings yet

- Chap 06Document12 pagesChap 06Syed Hamdan50% (2)

- Liquidity Preference As Behavior Towards Risk Review of Economic StudiesDocument23 pagesLiquidity Preference As Behavior Towards Risk Review of Economic StudiesCuenta EliminadaNo ratings yet

- Chapter 5Document16 pagesChapter 5tahir destaNo ratings yet

- Unilag MSC Economics SAMPLEDocument3 pagesUnilag MSC Economics SAMPLEbdian100% (2)

- Final Exam ReviewDocument19 pagesFinal Exam ReviewJeromy Rech100% (1)

- Macroeconomics Unit QuizDocument9 pagesMacroeconomics Unit QuizRoxie Dickson-Lee100% (1)

- Problem 1Document5 pagesProblem 1Son DinhNo ratings yet

- Why Study Money, Banking, and Financial MarketsDocument25 pagesWhy Study Money, Banking, and Financial MarketsAhmad RahhalNo ratings yet

- R35 Credit Analysis Models - AnswersDocument13 pagesR35 Credit Analysis Models - AnswersSakshiNo ratings yet

- WIKI - The Statement of Cost of Goods SoldDocument5 pagesWIKI - The Statement of Cost of Goods SoldHanna GeguillanNo ratings yet

- Micro Assignment 2 - Utility, Consumer SurplusDocument5 pagesMicro Assignment 2 - Utility, Consumer SurplusDarlene HarrisNo ratings yet

- Uts 4Document16 pagesUts 4raine zapantaNo ratings yet

- PreFinal Quiz (Monopoly)Document2 pagesPreFinal Quiz (Monopoly)Thirdy SuarezNo ratings yet

- PS 7Document9 pagesPS 7Gülten Ece BelginNo ratings yet

- Chap 04Document16 pagesChap 04Syed Hamdan100% (1)

- Elasticity of DemandDocument38 pagesElasticity of DemandimadNo ratings yet

- Basic Accounting Equation ExplainedDocument4 pagesBasic Accounting Equation ExplainedArienayaNo ratings yet

- 3 Levels of ProductDocument5 pages3 Levels of ProductImelda WongNo ratings yet

- SM 2021 MBA Assignment Forecasting InstructionsDocument3 pagesSM 2021 MBA Assignment Forecasting InstructionsAmit Anand KumarNo ratings yet

- Chapter 11Document158 pagesChapter 11nikowawa100% (1)

- Monopolistic Competition and OligopolyDocument30 pagesMonopolistic Competition and Oligopolyhang veasnaNo ratings yet

- EC101 Revision Questions - Graphical Analysis - SolutionsDocument10 pagesEC101 Revision Questions - Graphical Analysis - SolutionsZaffia AliNo ratings yet

- Measuring Economic Activity: GDP, NDP, and Related ConceptsDocument8 pagesMeasuring Economic Activity: GDP, NDP, and Related ConceptsVivek KumarNo ratings yet

- Circular Flow of EconomyDocument19 pagesCircular Flow of EconomyAbhijeet GuptaNo ratings yet

- Econ 101 Intro to Basic ConceptsDocument4 pagesEcon 101 Intro to Basic ConceptsRudolph FelipeNo ratings yet

- Managerial Economics Ch3Document67 pagesManagerial Economics Ch3Ashe BalchaNo ratings yet

- Chapter 06 - Behind The Supply CurveDocument90 pagesChapter 06 - Behind The Supply CurveJuana Miguens RodriguezNo ratings yet

- Capital Structure Theory 2Document39 pagesCapital Structure Theory 2sanjupatel333No ratings yet

- Maximizing Utility Through Consumer ChoicesDocument21 pagesMaximizing Utility Through Consumer ChoicesValerie Jane EncarnacionNo ratings yet

- Assignment Fall 2019 OldDocument8 pagesAssignment Fall 2019 Oldshining starNo ratings yet

- Quiz Acctng 603Document10 pagesQuiz Acctng 603LJ AggabaoNo ratings yet

- CHP 2Document5 pagesCHP 2Mert CordukNo ratings yet

- Appendix 5 - Geometrical Analysis of Consumer EquilibriumDocument8 pagesAppendix 5 - Geometrical Analysis of Consumer EquilibriumStevenRJClarkeNo ratings yet

- ADM3318 Sample Questions and AnswersDocument11 pagesADM3318 Sample Questions and AnswersClair LaurelleNo ratings yet

- Basic Documents Used in International TradeDocument3 pagesBasic Documents Used in International TradeAMIT GUPTANo ratings yet

- Production and Cost Theory ExplainedDocument65 pagesProduction and Cost Theory ExplainedHiran KumarNo ratings yet

- Study Questions 1 (GDP)Document7 pagesStudy Questions 1 (GDP)Syed Karim100% (1)

- Discounts, Markup and MarkdownDocument3 pagesDiscounts, Markup and MarkdownYannaNo ratings yet

- N. Gregory Mankiw: Powerpoint Slides by Ron CronovichDocument36 pagesN. Gregory Mankiw: Powerpoint Slides by Ron CronovichTook Shir LiNo ratings yet

- Answers To Key QuestionsDocument22 pagesAnswers To Key Questionsmk1357913579100% (2)

- ECO402 Solved MCQs in One FileDocument47 pagesECO402 Solved MCQs in One FileAb DulNo ratings yet

- ECO402 MCQs ExplainedDocument47 pagesECO402 MCQs ExplainedEmran0% (2)

- Eco402-Midterm Solved McqsDocument5 pagesEco402-Midterm Solved McqsNoor VirkNo ratings yet

- Self Tests Second EditionDocument36 pagesSelf Tests Second EditionAchiever KumarNo ratings yet

- Indirect Taxation in ZimbabweDocument3 pagesIndirect Taxation in ZimbabwechandyNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument9 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionCHAU Nguyen Ngoc BaoNo ratings yet

- Ecomm Buissnes PlanDocument10 pagesEcomm Buissnes PlanztgaffNo ratings yet

- Costanalysis 100202064231 Phpapp02Document39 pagesCostanalysis 100202064231 Phpapp02tarunadurejaNo ratings yet

- Fabozzi CH 32 CDS HW AnswersDocument19 pagesFabozzi CH 32 CDS HW AnswersTrish Jumbo100% (1)

- Options-Open-Interest-Analysis-Stocks-and-Indices - Trading TuitionsDocument7 pagesOptions-Open-Interest-Analysis-Stocks-and-Indices - Trading TuitionsgpNo ratings yet

- Basics of Derivatives StrategiesDocument66 pagesBasics of Derivatives Strategiesnikomaso tesNo ratings yet

- Colgate MaxFresh Global Brand Roll Out Marketing & Management Strategy For China and MexicoDocument25 pagesColgate MaxFresh Global Brand Roll Out Marketing & Management Strategy For China and MexicoStella Dacuma Schour100% (8)

- NUENO QUELCH - Mass Marketing of LuxuryDocument8 pagesNUENO QUELCH - Mass Marketing of LuxuryElita H.No ratings yet

- Growth Strategies in BusinessDocument4 pagesGrowth Strategies in BusinessShweta raiNo ratings yet

- POM Individual AssignmentDocument4 pagesPOM Individual AssignmentWita SaraswatiNo ratings yet

- Maverick Capital Q4 2016Document13 pagesMaverick Capital Q4 2016superinvestorbulleti100% (2)

- The Skinny On Forex TradingDocument113 pagesThe Skinny On Forex TradingnobleconsultantsNo ratings yet

- Vouching of TransactionsDocument7 pagesVouching of Transactionsanon_882394540No ratings yet

- Importance of Studying Consumer BehaviorDocument13 pagesImportance of Studying Consumer BehaviorAnjanine Busalpa FernandezNo ratings yet

- Jimma University MSc in Accounting & Finance programDocument63 pagesJimma University MSc in Accounting & Finance programyosephworkuNo ratings yet

- Covered Bonds - IntroductionDocument15 pagesCovered Bonds - IntroductionEtoileBrilliantNo ratings yet

- AR PLX 2019 Final PDFDocument133 pagesAR PLX 2019 Final PDFKim Yến VũNo ratings yet

- Bond Payable Problems SolutionsDocument3 pagesBond Payable Problems SolutionsNhel AlvaroNo ratings yet

- TESLA-financial Statement 2016-2020Document18 pagesTESLA-financial Statement 2016-2020XienaNo ratings yet

- National Institute of Fashion Technology Case Study: Levi's Jeans Brand RevivalDocument12 pagesNational Institute of Fashion Technology Case Study: Levi's Jeans Brand Revivalomgan1042No ratings yet

- Financial ManagementDocument318 pagesFinancial ManagementSravan Kumar0% (1)

- Brand Asset Valuator ModelDocument5 pagesBrand Asset Valuator ModelRajan MishraNo ratings yet

- d424 HlsummaryDocument16 pagesd424 HlsummaryNathalie NaniNo ratings yet

- Accountancy DK Goel 2019 For Class 11 Commerce Accountancy Chapter 3 - Books of Original Entry JournalDocument1 pageAccountancy DK Goel 2019 For Class 11 Commerce Accountancy Chapter 3 - Books of Original Entry JournalGurtej DeolNo ratings yet

- How to Prepare a Segmented Income Statement to Make Business DecisionsDocument8 pagesHow to Prepare a Segmented Income Statement to Make Business DecisionsjaneperdzNo ratings yet

- Telemarketing PPT Made by Arsalan and AradhakDocument13 pagesTelemarketing PPT Made by Arsalan and AradhakAndrewNo ratings yet

- Todd Berger 2010 ResumeDocument2 pagesTodd Berger 2010 Resumetodd_bergerNo ratings yet

- BCG Winning After The Storm Feb 2011 Tcm80-71194Document42 pagesBCG Winning After The Storm Feb 2011 Tcm80-71194Uy KravNo ratings yet

- Factors Influencing Plant LocationDocument20 pagesFactors Influencing Plant Locationsivasundaram anushan100% (7)