Professional Documents

Culture Documents

Ias 2

Uploaded by

Chaudary Usama AnasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ias 2

Uploaded by

Chaudary Usama AnasCopyright:

Available Formats

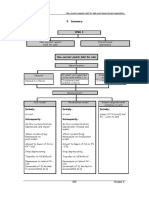

IAS 2 - Inventories

Inventories are assets 1. Held for sale in the ordinary course of business (finished goods), 2. In the production process for sale in the ordinary course of business (work in process), and 3. In form of materials and supplies that are consumed in production process (raw materials). [IAS 2.6] This Standard applies to all inventories, except: (a) Work in progress arising under construction contracts, (IAS 11); (b) Financial instruments (IAS 32 and IFRS 9); and (c) Biological assets related to agricultural activity (IAS 41). [IAS 2.1] Measurement of Inventories Inventories shall be measured at the lower of cost and NRV. [IAS 2.9] NRV = (estimated selling price in ordinary course of business - estimated costs necessary to make sale) [IAS 2.6] NRV for inventories may not equal fair value less costs to sell. Cost of inventories shall include: [IAS 2.10] costs of purchase (include non adjustable taxes, import duties, transport, handling) (Exclude - trade discounts and rebates) [IAS 2.11] costs of conversion {include Fixed (based on normal capacity) & Variable production overheads) [IAS 2.12] and other costs incurred in bringing the inventories to their present location and condition [IAS 2.15] In some limited circumstances borrowing costs (interest) can be included in cost of inventories that meet the definition of a qualifying asset. [IAS 2.17 and IAS 23.4] Inventory cost should not include: [IAS 2.16-2.18] abnormal waste storage costs administrative overheads unrelated to production selling costs foreign exchange differences arising directly on recent acquisition of inventories invoiced in foreign currency The standard cost (based on normal production standards) and retail methods (Sale value gross margin) may be used for the measurement of cost, provided that the results approximate actual cost. [IAS 2.21-22] Inventory items that are not interchangeable, specific costs are attributed to specific individual items of inventory. [IAS 2.23] For items that are interchangeable, IAS 2 allows the FIFO or weighted average cost formulas. [IAS 2.25] The LIFO formula, which had been allowed prior to the 2003 revision of IAS 2, is no longer allowed.

The same cost formula should be used for all inventories with similar characteristics as to their nature and use to the enterprise. For groups of inventories that have different characteristics, different cost formulas may be justified. [IAS 2.25] Service provider shall measure the cost of inventories at the costs of their production (consist of labour and other costs of personnel directly engaged in providing the service, including supervisory personnel, and attributable overheads. Expense Recognition When inventories are sold and revenue is recognized, the carrying amount of those inventories is recognized as an expense (often called cost-of-goods-sold). Any write-down to NRV and any inventory losses are also recognized as an expense when they occur. The amount of any reversal of any write-down of inventories (Sale value increased and stock in hand), arising from an increase in net realizable value, shall be recognized as a reduction in the amount of inventories recognized as an expense in the period in which the reversal occurs. [IAS 2.34] Required Disclosures [IAS 2.36] a. Accounting policy for inventories measurement and cost formula. b. Carrying amount of inventories for each classification; Raw materials, work in progress, and finished goods. c. Carrying amount of inventories carried at fair value less cost to sell (agricultural product at point of harvest IAS 41 ) d. Amount of any write-down of inventories recognized as an expense in the period. e. The circumstances or events that led to the reversal of a write-down of inventories f. Carrying amount of inventories pledged as security for liabilities. g. Amount of inventories recognized as expense during the period.

You might also like

- IAS 2 Summary-MergedDocument19 pagesIAS 2 Summary-MergedShameel IrshadNo ratings yet

- Ias 2Document27 pagesIas 2zainabdevjiani100% (4)

- IAS 2 Inventories PDFDocument12 pagesIAS 2 Inventories PDFViplav RathiNo ratings yet

- IAS 16 PPE NotesDocument3 pagesIAS 16 PPE NotesKatreena Mae Constantino100% (2)

- Scope and exclusions of IAS 39Document11 pagesScope and exclusions of IAS 39Muhammad Qasim FareedNo ratings yet

- Management Accounting (Workbook) PDFDocument85 pagesManagement Accounting (Workbook) PDFRizza azilia kNo ratings yet

- Difference Between GAAP and IFRSDocument3 pagesDifference Between GAAP and IFRSGoutam SoniNo ratings yet

- IAS 40 ICAB QuestionsDocument5 pagesIAS 40 ICAB QuestionsMonirul Islam Moniirr100% (1)

- InventoriesDocument7 pagesInventoriesAl-Sinbad BercasioNo ratings yet

- Ias 12 - Income Taxes DefinitionsDocument4 pagesIas 12 - Income Taxes DefinitionsFurqan ButtNo ratings yet

- Ias 36Document8 pagesIas 36Muhammad MoizNo ratings yet

- Ifrs 5: 9. SummaryDocument14 pagesIfrs 5: 9. SummaryCISA PwCNo ratings yet

- ADL 56 Cost & Management Accounting 2V3Document20 pagesADL 56 Cost & Management Accounting 2V3Deepesh100% (1)

- Cost Accounting ReviewerDocument2 pagesCost Accounting ReviewerHenry Cadano HernandezNo ratings yet

- IAS 16 (CAF5 S18) : (I) (Ii) (Iii) - Rs. in MillionDocument41 pagesIAS 16 (CAF5 S18) : (I) (Ii) (Iii) - Rs. in MillionShameel IrshadNo ratings yet

- IAS 33: Earnings Per ShareDocument15 pagesIAS 33: Earnings Per SharecolleenyuNo ratings yet

- Impairment of Assets NotesDocument23 pagesImpairment of Assets NotesGeorge Buliki100% (1)

- Final Tfa CompiledDocument109 pagesFinal Tfa CompiledAsi Cas JavNo ratings yet

- Level Up - Conceptual Framework ReviewerDocument15 pagesLevel Up - Conceptual Framework Reviewerazithethird100% (1)

- Intangible AssetsDocument24 pagesIntangible AssetsSummer StarNo ratings yet

- Question 3: Ias 23 Borrowing CostsDocument2 pagesQuestion 3: Ias 23 Borrowing CostsAbdul Sami100% (3)

- Cost Terms, Concepts, and ClassificationsDocument45 pagesCost Terms, Concepts, and ClassificationsMountaha0% (1)

- Accounting for Property, Plant and EquipmentDocument42 pagesAccounting for Property, Plant and EquipmentHaseeb ZuberiNo ratings yet

- Topic 6 - ACCA Cash Flow Q SDocument8 pagesTopic 6 - ACCA Cash Flow Q SGeorge Wang100% (1)

- Chapter 6: Accounting For Plant Assets and Depreciation. ContentsDocument46 pagesChapter 6: Accounting For Plant Assets and Depreciation. ContentsSimon MollaNo ratings yet

- An Introduction To Managerial Accounting and Cost Concepts QuizDocument5 pagesAn Introduction To Managerial Accounting and Cost Concepts QuizDebbie DebzNo ratings yet

- CIA PPT Proquest Chapter 3 - CURRENT PURCHASING POWER METHOD PDFDocument28 pagesCIA PPT Proquest Chapter 3 - CURRENT PURCHASING POWER METHOD PDF3dnan alkhanjariNo ratings yet

- ABC Costing Lecture NotesDocument12 pagesABC Costing Lecture NotesMickel AlexanderNo ratings yet

- Ias 7Document13 pagesIas 7Ajinkya MohadkarNo ratings yet

- Absorption & Variable CostingDocument40 pagesAbsorption & Variable CostingKaren Villafuerte100% (1)

- Absorption vs Marginal Costing: Worked ExamplesDocument5 pagesAbsorption vs Marginal Costing: Worked ExamplesSUHRIT BISWASNo ratings yet

- FA IV As at 23 March 2006Document327 pagesFA IV As at 23 March 2006Daniel Kariuki100% (1)

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument32 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAmrita TamangNo ratings yet

- Aud Prob Part 1Document106 pagesAud Prob Part 1Ma. Hazel Donita DiazNo ratings yet

- IFRS 13 Fair Value MeasurementDocument14 pagesIFRS 13 Fair Value MeasurementQamar ZamanNo ratings yet

- IAS 12 Income TaxesDocument54 pagesIAS 12 Income Taxessimiong100% (1)

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document34 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB Cloyd100% (1)

- Standard CostingDocument69 pagesStandard CostingVivek MishraNo ratings yet

- Introduction To Branch Lecture NotesDocument3 pagesIntroduction To Branch Lecture Notespladop100% (1)

- Job Order Costing HandoutsDocument8 pagesJob Order Costing HandoutsHannah Jane Arevalo LafuenteNo ratings yet

- Managerial AccountingDocument59 pagesManagerial AccountingSadraShahid100% (1)

- Saad SB (Q (4+9) ) FinalDocument4 pagesSaad SB (Q (4+9) ) Finalayazmustafa100% (1)

- Chapter 5 - Cost EstimationDocument36 pagesChapter 5 - Cost Estimationalleyezonmii0% (2)

- Practice Questions Inventories # 2 With AnswersDocument9 pagesPractice Questions Inventories # 2 With AnswersIzzahIkramIllahiNo ratings yet

- Advanced Management Accounting Vol.-Ii (Practice Manual) - g2Document532 pagesAdvanced Management Accounting Vol.-Ii (Practice Manual) - g2Anshu Goyal100% (2)

- Advanced Financial Accounting - Slides Lecture 21Document16 pagesAdvanced Financial Accounting - Slides Lecture 21DiljanKhanNo ratings yet

- Transfer PricingDocument35 pagesTransfer PricingsivaNo ratings yet

- Ifrs 9 - Financial Instruments Review QuestionsDocument9 pagesIfrs 9 - Financial Instruments Review QuestionsHamad Sadiq100% (1)

- Module No. 2 Week 2 Acctg. For Business CombinationDocument3 pagesModule No. 2 Week 2 Acctg. For Business CombinationJayaAntolinAyusteNo ratings yet

- IAS 16 Property, Plant and Equipment Accounting DisclosureDocument2 pagesIAS 16 Property, Plant and Equipment Accounting Disclosurefurqan0% (1)

- Manufacturing AccountingDocument15 pagesManufacturing AccountingKanika BakhaiNo ratings yet

- Business Valuations: Exam GuideDocument17 pagesBusiness Valuations: Exam GuideAjay Kumar TakiarNo ratings yet

- Cost Terms, Concepts, and ClassificationsDocument33 pagesCost Terms, Concepts, and ClassificationsKlub Matematika SMANo ratings yet

- A2 Recognition, Measurement, Valuation, and Disclosure PDFDocument7 pagesA2 Recognition, Measurement, Valuation, and Disclosure PDFbernard cruzNo ratings yet

- VAT - MCQ Test Questions by Mahbub SirDocument16 pagesVAT - MCQ Test Questions by Mahbub SirAysha Alam100% (1)

- Cost Management TheoryDocument27 pagesCost Management TheoryKoteshwar Rao100% (2)

- Internal Control Reviewer3Document12 pagesInternal Control Reviewer3Lon DiazNo ratings yet

- IAS16 Defines PPE CostsDocument71 pagesIAS16 Defines PPE CostsmulualemNo ratings yet

- Residual Equity TheoryDocument3 pagesResidual Equity Theorybrix simeonNo ratings yet

- Objective of IAS 2Document4 pagesObjective of IAS 2ManaviPrabhuNo ratings yet

- 1511099786441enterprise Information Systems PDFDocument396 pages1511099786441enterprise Information Systems PDFFortune CA100% (1)

- Terms of TradeDocument3 pagesTerms of TradePiyushJainNo ratings yet

- Balakrishnan MGRL Solutions Ch06Document64 pagesBalakrishnan MGRL Solutions Ch06deeNo ratings yet

- The Cold War - David G. Williamson - Hodder 2013 PDFDocument329 pagesThe Cold War - David G. Williamson - Hodder 2013 PDFMohammed Yousuf0% (1)

- Internship Report On An Analysis of Marketing Activities of Biswas Builders LimitedDocument45 pagesInternship Report On An Analysis of Marketing Activities of Biswas Builders LimitedMd Alamin HossenNo ratings yet

- Boneless & Skinless Chicken Breasts: Get $6.00 OffDocument6 pagesBoneless & Skinless Chicken Breasts: Get $6.00 OffufmarketNo ratings yet

- Pi MorchemDocument1 pagePi MorchemMd Kamruzzaman MonirNo ratings yet

- Questionnaire Fast FoodDocument6 pagesQuestionnaire Fast FoodAsh AsvinNo ratings yet

- Economics 2nd Edition Hubbard Test BankDocument25 pagesEconomics 2nd Edition Hubbard Test BankPeterHolmesfdns100% (48)

- Manikanchan Phase II Project Information MemorandumDocument15 pagesManikanchan Phase II Project Information Memorandummy_khan20027195No ratings yet

- STIEBEL ELTRON Produktkatalog 2018 VMW Komplett KleinDocument276 pagesSTIEBEL ELTRON Produktkatalog 2018 VMW Komplett KleinsanitermNo ratings yet

- AUH DataDocument702 pagesAUH DataParag Babar33% (3)

- Senior Development and Communications Officer Job DescriptionDocument3 pagesSenior Development and Communications Officer Job Descriptionapi-17006249No ratings yet

- 03 - Review of Literature PDFDocument8 pages03 - Review of Literature PDFDevang VaruNo ratings yet

- Sources of FinanceDocument3 pagesSources of FinanceAero Vhing BucaoNo ratings yet

- Report on Textiles & Jute Industry for 11th Five Year PlanDocument409 pagesReport on Textiles & Jute Industry for 11th Five Year PlanAbhishek Kumar Singh100% (1)

- Voltas Case StudyDocument8 pagesVoltas Case StudyAlok Mittal100% (1)

- Study of Supply Chain at Big BasketDocument10 pagesStudy of Supply Chain at Big BasketPratul Batra100% (1)

- Mineral Commodity Summaries 2009Document198 pagesMineral Commodity Summaries 2009Aaron RizzioNo ratings yet

- 10A. HDFC Jan 2021 EstatementDocument10 pages10A. HDFC Jan 2021 EstatementNanu PatelNo ratings yet

- Espresso Cash Flow Statement SolutionDocument2 pagesEspresso Cash Flow Statement SolutionraviNo ratings yet

- 04 - 03 - Annex C - Maintenance Plan - Ver03Document2 pages04 - 03 - Annex C - Maintenance Plan - Ver03ELILTANo ratings yet

- Dokumen - Tips Unclaimed DividendsDocument107 pagesDokumen - Tips Unclaimed DividendsVM ONo ratings yet

- Currency and interest rate swaps explainedDocument33 pagesCurrency and interest rate swaps explainedHiral PatelNo ratings yet

- International Finance - TCS Case StudyDocument22 pagesInternational Finance - TCS Case StudyPrateek SinglaNo ratings yet

- Practice Problems For Mid TermDocument6 pagesPractice Problems For Mid TermMohit ChawlaNo ratings yet

- Emirates Airlines Pilots Salary StructureDocument6 pagesEmirates Airlines Pilots Salary StructureShreyas Sinha0% (1)

- Jia Chen - Development of Chinese Small and Medium-Sized EnterprisesDocument8 pagesJia Chen - Development of Chinese Small and Medium-Sized EnterprisesAzwinNo ratings yet

- Cobrapost II - Expose On Banks Full TextDocument13 pagesCobrapost II - Expose On Banks Full TextFirstpost100% (1)

- Minnesota Property Tax Refund: Forms and InstructionsDocument28 pagesMinnesota Property Tax Refund: Forms and InstructionsJeffery MeyerNo ratings yet