Professional Documents

Culture Documents

Fee Schedule

Uploaded by

api-127186411Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fee Schedule

Uploaded by

api-127186411Copyright:

Available Formats

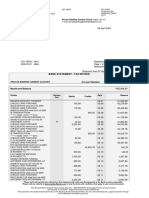

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

Federal Electronic Filing Fee

State Electronic Filing Fee

Self-Prepared Keypunch Fee

MFS Allocation Worksheet

Form 1099-G (Unemployment Comp)

Form 1040

Form 1040 A

Form 1040 EZ

Form 1040 NR (Nonresident Alien)

Form 1040 NR-EZ (Nonresident Alien)

Form 1040 PR (SE Tax for PR)

Form 1040 SS (SE Tax for PR)

Form 1040 X

Form 1040 V

Form 1040 Estimates

Form 1045 (Tentative Refund Appl.)

Schedule A (Itemized Deductions)

Overflow Schedule A

Schedule A Medical Breakdown

Schedule A New Vehicle Worksheet

Schedule A Mortgage Insurance Wks

Schedule A Contribution Worksheet

Schedule A Limitation Worksheet

Schedule A Business Use of Home

Schedule B (Interest & Dividends)

Overflow Schedule B

Schedule C (Business Profit/Loss)

Overflow Schedule C

1

$15.00

$10.00

$2.00

$2.00

$2.00

$40.00

$30.00

$30.00

$40.00

$40.00

$40.00

$40.00

$40.00

$1.00

$10.00

$10.00

$10.00

$1.00

$2.00

$5.00

$2.00

$2.00

$2.00

$2.00

$5.00

$2.00

$40.00

$5.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

Schedule C-EZ

Schedule D (Capital Gains & Loss)

Schedule D Transaction Fee

Capital Gain Tax Worksheet

Schedule D Tax Worksheet

Schedule D Capital Loss Carryover

Schedule D 28% Rate Worksheet

Schedule D Sec 1250 Worksheet

Schedule D Sale of Home Worksheet

Schedule E (Supplemental Income)

Schedule E - IRC Sec 469(c)(7)(A)

Schedule E Property Fee

Schedule EIC (Earned Income Credit)

EIC with No Dependents

EIC Worksheet

Schedule F (Farm Income/Loss)

Overflow Schedule F

Schedule H (Household Taxes)

Schedule J (Farm Income Averaging)

Schedule L (Standard Deduction)

Schedule K-1

Schedule R (Credit for Elderly)

Schedule SE (Self-Employment Tax)

SEP Contribution Worksheet

IRA Worksheet

Student Loan Interest Worksheet

Other Income

Simplified General Rule Worksheet

2

$10.00

$10.00

$2.00

$2.00

$2.00

$5.00

$5.00

$5.00

$5.00

$20.00

$20.00

$10.00

$5.00

$5.00

$5.00

$60.00

$10.00

$30.00

$30.00

$5.00

$2.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$2.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

SSA Worksheet

NOL Carryback Election

Head of Household Worksheet

Exemption Worksheet

Foreign Earned Income Tax Worksheet

Misc. Schedules

Client Form Listing Summary

Form W-2 (Wages and Tax)

Form W-2G (Gambling Winnings)

Form W-2PR Puerto Rico Withholding

Form W-7 (Application for ITIN)

Form W-7SP (Application for ITIN)

Foreign Employer Compensation

Form 1099-C (Cancellation of Debt)

Form 1099-R (Retirement Distrib.)

Form 1310 (Deceased Taxpayer)

Form 1116 (Foreign Tax Credit)

Form 2106 (Employee Bus. Expense)

Form 2120 (Multiple Support Decl)

Form 2210 (Underpayment of Est)

Form 2210F (Underpayment of Est)

Form 2350 (App for Ext when Abroad)

Form 2439 (Shareholder LT Gains)

Form 2441 (Child Care)

Form 2555 (Foreign Earned Inc)

Form 2555-EZ (Foreign Earned Inc)

Form 2848 (Power of Attorney)

Form 3468 (Investment Credit)

3

$2.00

$10.00

$2.00

$2.00

$30.00

$10.00

$2.00

$2.00

$2.00

$2.00

$25.00

$25.00

$10.00

$2.00

$2.00

$2.00

$30.00

$20.00

$20.00

$20.00

$10.00

$10.00

$2.00

$10.00

$10.00

$10.00

$5.00

$5.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

Form 3800 (General Business Credit)

Form 3903 (Moving Expense)

Form 4136 (Fuel Tax Credit)

Form 4137 (Tax on Tips)

Form 4255 (Recap. Investment Cred)

Form 4562 (Depreciation)

Form 4684 (Casualty Loss)

Form 4797 (Sale of Bus Property)

Overflow Form 4797

Form 4835 (Farm Rental)

Overflow Form 4835

Form 4852 (Substitute W-2/1099-R)

Form 4868 (Automatic Extension)

Form 4952 (Investment Int Exempt)

Form 4972 (Tax on Lump Sum Dist)

Form 5329 (Tax on Early Ret Dist)

Form 5405 (First-Time Homebuyer Cr)

Form 5695 (Residential Energy Cr)

Form 5884 (Work Opportunity Credit)

Form 5884-A (Midwestern Employers)

Form 5884-B (New Hire Retention Cr)

Form 6198 (At Risk Limitation)

Form 6251 (Alternative Minimum Tax)

Form 6251 Worksheets

Form 6252 (Installment Sales)

Form 6478 (Alcohol Used as Fuel Cr)

Form 6765 (Cred Increased Research)

Form 6781 (Straddles)

4

$10.00

$10.00

$5.00

$40.00

$2.00

$30.00

$30.00

$40.00

$5.00

$80.00

$2.00

$20.00

$2.00

$20.00

$10.00

$20.00

$10.00

$10.00

$5.00

$5.00

$20.00

$10.00

$10.00

$5.00

$10.00

$10.00

$10.00

$10.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

Form 8082 (Inconsistent Treatment)

Form 8271 (Tax Shelter Reg. Number)

Form 8275 (Disclosure Statement)

Form 8275-R (Regulation Disclosure)

Form 8283 (Non Cash Contrib.)

Form 8379 (Injured Spouse)

Form 8396 (Mortgage Int. Credit)

Form 8453 (E-File Declaration)

Form 8582 (Passive Activity Loss)

Form 8582 Worksheet

Form 8582CR (Passive Act. Credit)

Form 8586 (Low-Income Housing Cr)

Form 8594 (Asset Acquisition Stm)

Form 8606 (Nondeductible IRA)

Form 8609-A (Low-Inc Housing Alloc)

Form 8611 (Low-Inc Housing Recap.)

Form 8615 (Tax for Child under 18)

Form 8689 (Virgin Islands Inc Tax)

Form 8801 (Prior Year AMT Credit)

Child Tax Credit Worksheet

Puerto Rico Child Tax Credit Wks

Form 8812 (Add. Child Tax Credit)

Form 8814 (Parents Election)

Form 8815 (Exclusion of Series EE)

Form 8820 (Orphan Drug Credit)

Form 8821 (Tax Info Authorization)

Form 8824 (Like-Kind Exchanges)

Form 8826 (Disabled Access Credit)

5

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$2.00

$10.00

$2.00

$2.00

$10.00

$2.00

$2.00

$10.00

$2.00

$20.00

$10.00

$10.00

$2.00

$2.00

$20.00

$10.00

$10.00

$10.00

$10.00

$40.00

$10.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

Form 8828 (Federal Mortgage Subs)

Form 8829 (Bus. Use of Home)

Form 8834 (Electric Vehicle Credit)

Form 8835 (Ren Elec Credit)

Form 8839 (Qualified Adoption)

Form 8844 (Empowerment Zone Credit)

Form 8845 (Indian Emplyment Credit)

Form 8846 (Emp. SS Taxes Pd Credit)

Form 8847 (Cont. to Community Cred)

Form 8853 (Medical Savings Account)

Form 8859 (DC Homebuyer Credit)

Form 8861 (Welfare-To-Work Credit)

Form 8862 (EIC Disallowance)

Form 8863 (Education Credit)

Form 8864 (Biodiesel Fuel Credit)

Form 8867 (EIC Checklist)

Form 8874 (New Markets Credit)

Form 8878 (E-File Signature Auth.)

Form 8879 (E-File Signature Auth.)

Form 8880 (Retirement Credit)

Form 8881 (SEP Startup Credit)

Form 8882 (Childcare Services Cred)

Form 8885 (Health Insurance Credit)

Form 8889 (Health Savings Account)

Form 8891 (Canadian Retirement)

Form 8896 (Low Sulfur Fuel Credit)

Form 8900 (Railroad Maint Credit)

Form 8903 (Domestic Production Ded)

6

$10.00

$40.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$40.00

$10.00

$10.00

$10.00

$2.00

$2.00

$10.00

$10.00

$10.00

$20.00

$20.00

$2.00

$2.00

$2.00

$10.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

Form 8906 (Distilled Spirit Credit)

Form 8907 (Nonconvent. Fuel Credit)

Form 8908 (Energy Eff. Home Credit)

Form 8909 (Energy Eff. Appl Credit)

Form 8910 (Alt Mot Veh Fuel Credit)

Form 8911 (Alt. Fuel Refuel Credit)

Form 8912 (Clean Ren. Energy Cred.)

Form 8917 (Tuition & Fees Deduct.)

Form 8919 (Uncollected SS/Medicare)

Form 8923 (Mine Rescue Training Cr)

Form 8930 (Midwestern Retirement)

Form 8931 (Agri Chemicals Security)

Form 8932 (Empl Differential Wages)

Form 8933 (Carbon Dioxide Seq. Cr)

Form 8936 (Plug-in Electric Motor)

Form 8941 (Health Ins. Premiums)

Form 9325 (E-File Acknowledgement)

Form 9465 (Installment Agreement)

Form 982 (Tax Attributes Reduction)

Depreciation Worksheet

State Depreciation Worksheet

Miscellaneous Statements

Preparer Notes

Regulatory Explanation

Election Explanation

Prior Year Comparison

PTP K-1 Worksheet

Electronic Payment

7

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$20.00

$10.00

$10.00

$10.00

$10.00

$2.00

$10.00

$5.00

$10.00

$10.00

$10.00

$5.00

$5.00

$2.00

$2.00

$2.00

$5.00

$1.00

$2.00

$2.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

Financial Questionnaire

AL Form 40

AL Form 40NR

AL Form 40-ES (Estimates)

CA 540 (Resident)

CA Schedule CA (540)

CA Schedule D (540)

CA Schedule D-1

CA Schedule P (540)

CA Schedule S (540)

CA HOH Attachment

CA Form 3506 (Child Care Credit)

CA Form 3582 (Electronic Voucher)

CA Form 540V (Payment Voucher)

CA Form 3800

CA Form 3805P (5329)

CA Form 3803

CA Form 3526

CA Form 3885A

CA Form 5805 (2210)

CA 540NR (Part Year\Nonresident)

CA Schedule CA (540NR)

CA Schedule D (540NR)

CA Schedule P (540NR)

CA Form 8453

CA Form 8454

CA Estimates

CA Extension to File (Form 3519)

8

$2.00

$10.00

$10.00

$20.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

CA 540X (Amended)

CA 8454 (Opt out of E-file)

CA 8879

CA 3567 (Installment Agreement)

CA Schedule W-2 CG

CA Misc Worksheets

IL Form 1040

IL Schedule CR

IL Schedule G

IL Schedule ICR

IL Schedule M

IL Schedule NR

IL Estimates

IL Payment Voucher

IL Form 1040X (Amended Return)

IL Form 4562 (Depreciation)

IL Form 2210 (Penalties for Ind)

IL Request for Extension

IL Form 1310 (Claim of Refund)

IL Form 1299-C (Claim of Refund)

MA Form 1

MA Form 1 NR/PY

MA Schedule X&Y

MA Schedule Z

MA Schedule B

MA Schedule C

MA Schedule CB

MA Schedule D

9

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$5.00

$1.00

$20.00

$10.00

$10.00

$10.00

$10.00

$10.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

MA Schedule DI

MA Schedule E

MA Schedule E-1

MA Schedule E-2

MA Schedule E-3

MA Schedule NTS-L-NR/PY

MA Schedule R/NR

MA Form PV (Payment Voucher)

MA Form 1-ES (Estimates)

MA Schedule INC

MA Form CA-6 (Amended)

MA Form 8453

MA Form 2210

MA Form M-1310

MA Schedule HC

MA Schedule HC-CS

MA AGI Worksheet

MA Schedule EFO

MD Form 502 (Resident)

MD Form 505 (Non-Resident)

MD Form 505NR (NR Tax Calculation)

MD Form 502CR (Credits)

MD Form 502UP (Underpayment)

MD Form 500DM (Decoupling Mod)

MD Form EL101 (Efile Declaration)

MI Form MI-1040

MI Schedule 1

MI Schedule 2

10

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$1.00

$1.00

$1.00

$1.00

$1.00

$1.00

$1.00

$15.00

$10.00

$10.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

MI Schedule NR

MI Schedule CT (Tuition Credit)

MI Form 4642 (Contributions)

MI Form 4764 (Energy Credit)

MI Form 1040CR (Property Credit)

MI Form 1040CR-2(Veterans/Blind)

MI Form 1040CR-7(Home Heating)

MI Schedule W

MI Form 1040-V

MI Form 1040ES

MI Form 1040CR-5 (Farmland Credit)

MI SCHEDULE CR-5 (Taxes/Allocation)

MI Form 1040D (Cap Gains & Losses)

MI Form 1040H (Apportionment)

MI Form 1310 (Deceased Taxpayer)

MI Form 2210 (Underpayment Pen.)

MI Form 4797 (Sale of Business)

MI Form 8453

MI Form 8839 (Adoption Expenses)

MI Tribal 4013

MI FORM 1040X (Amended Return)

MI Extension of Time to File

MI CF-1040 City Common Form

MI City of Detroit (Resident)

MI City of Detroit (Non-Resident)

MI City of Detroit (Schedule L)

PA Form 40

PA Schedules A/B

11

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$10.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

PA Schedule C

PA Schedule D

PA Schedule E

PA Schedule F

PA Schedule G-S

PA Schedule G-L

PA Schedule G-R

PA Schedule J/T

PA Schedule O

PA Schedule OC

PA Schedule SP

PA Schedule UE

PA Wage & Misc Compensation

PA Form 8453

PA Form 8879

PA Form 40-EST (Estimates)

PA Payment Voucher

PA Form REV-276 (Extension)

PA Form REV-1630 (Underpayment)

PA Local Earned Income Tax

PA PA-1000 (Property\Rent Rebate)

PA PA-1000 Schedule A\B

PA PA-1000 Schedule D\E\F

PA PA-1000 Schedule RC

Business Electronic Filing Fee

Business Cover Page

Business Client Letter

Business Client Invoice

12

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

Form 706

Form 706 Schedule A

Form 706 Schedule A-1

Form 706 Schedule B

Form 706 Schedule C

Form 706 Schedule D

Form 706 Schedule E

Form 706 Schedule F

Form 706 Schedule G and H

Form 706 Schedule I

Form 706 Schedule J

Form 706 Schedule K

Form 706 Schedule L

Form 706 Schedule M

Form 706 Schedule O

Form 706 Schedule P and Q

Form 706 Schedule R

Form 706 Schedule R-1

Form 706 Schedule U

Form 706 Continuation Schedule

Form 709

Form 851 (Affiliations Schedule)

Form 990 (Exempt Organization)

Form 990 Schedule A

Form 990 Schedule B

Form 990 Schedule C

Form 990 Schedule D

Form 990 Schedule E

13

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

Form 990 Schedule F

Form 990 Schedule G

Form 990 Schedule H

Form 990 Schedule I

Form 990 Schedule J

Form 990 Schedule K

Form 990 Schedule L

Form 990 Schedule M

Form 990 Schedule N

Form 990 Schedule O

Form 990 Schedule R

Form 990-EZ (Exempt Organization)

Form 990-T (Exempt Organization)

Form 1041 (Fiduciary)

Form 1041 Schedule D

Form 1041 Schedule D Tax Worksheet

Form 1041 Capital Loss Carryover

Form 1041 Section 1250 Worksheet

Form 1041 28% Gain Worksheet

Form 1041 Schedule I

Form 1041 Schedule K-1

Form 1041 (Sch. K-1 Client Instr)

Form 1041-ES (Estimated Payments)

Form 1041-T

Form 1065 (Partnership)

Form 1065 Schedule B-1

Form 1065 Schedule C

Form 1065 Schedule D

14

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$80.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$80.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

Form 1065 Schedule K-1

Form 1065 Adjusted Basis Worksheet

Form 1065 Schedule M-3

Form 1065 (Sch. K-1 Client Instr)

Form 1065 SE Earnings Worksheet

Form 1120 (Corporation)

Form 1120 Schedule B

Form 1120 Schedule D

Form 1120 Schedule G

Form 1120 Schedule M-3

Form 1120 Schedule N

Form 1120 Schedule O

Form 1120 Schedule PH

Form 1120-H (Homeowners Assoc.)

Form 1120S (S-Corporation)

Form 1120S Schedule D

Form 1120S Schedule K-1

Form 1120S K-1 Basis Worksheet

Form 1120S Schedule M-3

Form 1120S (Sch. K-1 Client Instr)

Form 1120X (Amended Corporation)

Form 2220 (Underpayment of Est)

Form 4626 (Alternative Minimum Tx)

Form 4768 (Appl for Extension)

Form 5500 (Benefit Plans)

Form 5500 Schedule A

Form 5500 Schedule I

Form 5500 Schedule R

15

$15.00

$15.00

$15.00

$15.00

$15.00

$80.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$80.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

Form 5500 Schedule SSA

Form 7004 (Appl for Extension)

Form 8050 (Dir Dep of Refund)

Form 8825 (Rental Real Estate)

Form 8827 (Credit Prior Year AMT)

Form 8868 (Extension for 990)

Form 8878-A (E-file Authorization)

Form 8879-C (E-File Signature)

Form 8879-EO (E-File Signature)

Form 8879-PE (E-File Signature)

Form 8879-S (E-File Signature)

Form 8892 (Extension for 709)

Form 8916-A

AL Form 20 C - (Corporation)

AL Form 20 S - (S Corporation)

AL Form 65 - (Partnership)

AL Form 41 - (Fiduciary)

AL Form FDT-V

AL Schedule K-1 (65\20S)

AL Schedule K-1 (41)

AL Form EOO (E-file Opt Out)

AL Form AL BPT-IN

AL Form AL CAR

AL Form AL CPT

AL Form AL PPT

AL Form BPT-V

AL Form BIT-V

AL Form AL8453-C

16

$15.00

$5.00

$2.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$80.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

AR Form 1100 CT (Corporation)

AR Form 1100S (S Corporation)

AR Form 1050 (Partnership)

AR Form 1002 (Fiduciary)

AR 1100-CO (Check-Off Contrib.)

AR Form AR1100ESCT (Estimates)

AR Form AR1100ESCT (Ext. Payment)

AR Form AR2200 (Underpayment)

AZ Form 120 (Corporation)

AZ Form 120ES (Estimates)

AZ Form 120S (S Corporation)

AZ Form 120S Sch. K-1(NR) (S Corp)

AZ Form 120X (Amended Return)

AZ Form 141AZ (Fiduciary)

AZ Form 165 (Partnership)

AZ Form 165 Sch. K-1 (Part)

AZ Form 165 Sch. K-1(NR) (Part)

AZ Form 220 (Corporation)

AZ Form 141AZ K-1 (Fid)

AZ Form 141AZ K-1(NR) (Fid)

CA Form 100 - (Corporation)

CA Schedule H(100) - (Corporation)

CA Schedule P(100) - (Corporation)

CA Schedule R (Apportionment)

CA Form 3885 - (Corporation)

CA Form 3539 (Corp Extension)

CA Form 3586 (E-file Voucher)

CA Form 100-ES

17

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$80.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

CA Form 8453-C

CA Form 100S - (S-Corporation)

CA Schedules B(100S) - (S-Corp)

CA Schedules C(100S) - (S-Corp)

CA Schedule D(100S) - (S-Corp)

CA Schedule H(100S) - (S-Corp)

CA Schedule K-1(100S) - (S-Corp)

CA Form 565 - (Partnership)

CA Form 3885P - (Partnership)

CA Schedule D(565) - (Partnership)

CA Schedule K-1 (565) - (Part)

CA Form 3538 (565 Extension)

CA Form 3587 (E-file Voucher)

CA Form 8453-P

CA Form 568 - (LLC)

CA Form 3885L - (LLC)

CA Schedule D (568) - (LLC)

CA Schedule K-1 (568) - (LLC)

CA Form 3832 (LLC Consent)

CA Form 3522 (LLC Voucher)

CA Form 3536 (LLC Estimate Fee)

CA Form 3537 (LLC Extension)

CA Form 3588 (LLC E-file Voucher)

CA Form 8453-LLC

CA Form 541 - (Fiduciary)

CA Schedule K-1(541) - (Fiduciary)

CA Form 3885F - (Fiduciary)

CA Schedule D(541) - (Fiduciary)

18

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

CA Form 541-T - (Fiduciary)

CA Form 541-ES

CA Form 3563 (541 Extension)

CO Form 112 (Corporation)

CO Form 112CR (Corporation Credit)

CO Form 112EP (Estimate Coupons)

CO Form DR 158-C (Extension Form)

CO Form 106 (S-Corp & Partnership)

CO Form 106CR (S-Corp Credit)

CO Form 105 (Fiduciary)

CO Form 105EP (Estimate Coupons)

CT Form 1120 (Corporation)

CT Form 1120A (Corp. Income Alloc.)

CT Form 1120 (Corp. EXT)

CT Form 1065/1120SI

CT Form 1065/1120SI (EXT)

CT Form 1041

CT Form 1041- Schedule B

CT Form 1041- Schedule C

CT Form 1041- Schedule FA

DC Form D-20 (Corporation)

DC Form D-20ES (Corp Estimates)

DC Form D-41 (Fiduciary)

DC Form D-41ES (Fid Estimates)

DC Form D-65 (Partnership)

DC Form D-2030P (Payment Voucher)

DC Form FR-127F (Fiduciary Ext)

DC Form FR-128 (Franchise Ext)

19

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

DE Form 1100 - (Corporation)

DE Form 1100EZ (Corporation)

DE Form 1100 EXT (Corp Extension)

DE Form 1100T EST (Corp Estimate)

DE Form 1100S (S-Corporation)

DE Form 1100S Sch A-1 (S-Corp K-1)

DE Form 1100S EXT S-Corp Extension

DE Form 1100P EST (SCorp Estimate)

DE Form 300 (Partnership)

DE Form 300 K-1 Partnership

DE Form 400 (Fiduciary)

FL Form DR-405 (Tangible)

FL Form 1120 (Corp and Franchise)

FL Form 1120ES Corp/Fran Estimates

FL Form 1065 (Partnership)

FL Form 1122 (Subsidiary Corp)

FL Form F-7004 (Extension)

GA Form 600 - (Corporation)

GA Form GA-8453 C

GA Form 602-ES Corporate Estimates

GA Form PV-CORP Payment Voucher

GA Form 600S - (S Corporation)

GA Form GA-8453 S

GA Form 700 - (Partnership)

GA Form GA-8453 P

GA Form 501 - (Fiduciary)

GA Form 500-ES Fiduciary Estimates

GA Form IT-303 (Extension)

20

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

GA IT-560C Corp Extension Voucher

HI Form N-30 (Corporation)

HI Schedule CR

HI Schedule D (Corporation)

HI Schedule D-1

HI Schedule O (Corporation)

HI Schedule P (Corporation)

HI Form N-3 (Estimated Voucher)

HI Form N-301 (Extension)

HI Form N-201V (Corp Voucher)

HI Form N-220 (Underpayment)

HI Form N-35 (S-Corporation)

HI Schedule D (S-Corporation)

HI Schedule K-1 (S-Corporation)

HI Schedule N-4 (S-Corporation)

HI Schedule NS (S-Corporation)

HI Form N-20 (Partnership)

HI Schedule D (Partnership)

HI Schedule K-1 (Partnership)

HI Schedule O & P (Partnership)

HI Form N-40 (Estate)

HI Schedule D (Estate)

HI Schedule K-1 (Estate)

HI Form N-5 (Estimated Voucher)

HI Form N-210 (Estimated Penalty)

IA Form 1120 (Corporation)

IA Form 1120-ES

IA Form 2220

21

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

IA Form 1120-S (S-Corporation)

IA Form 1065 (Partnership)

IA Nonresident K-1's

IA Partner Information Sheet

IA Form 1041 (Fiduciary)

ID Form 41 (Corporation)

ID Form 75 (Fuel Use Report)

ID Form 41ESR (Underpayment)

ID Form 42 (Multistate)

ID Form 44 (Credits\Recapture)

ID Form 41S (S Corporation)

ID Form 65 (Partnership)

ID Form 66 (Fiduciary)

ID Form 41ES (Estimate\Extension)

ID Form Schedule K-1

IL Form 1120 (Corporation)

IL Form 1120ES Estimated Payments

IL Form 505-B (EXT)

IL Form 1120-ST (S-Corporation)

IL Form 1065 (Partnership)

IL Form 1041 (Fiduciary)

IL Schedule K-1-T

IL Schedule K-1-P

IL Schedule B

IN Form IT-20 - (Corporation)

IN Form IT-20S - (S Corporation)

IN Schedule K-1 (IT-20S)

IN Form IT-65 - (Partnership)

22

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$80.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

IN Form IT-41 (Fiduciary)

IN Schedule F

KS Form K-120 (Corporation)

KS Form K-120AS (Apportionment)

KS Form K-220 (Corp Penalty)

KS Form K-120V (Payment Voucher)

KS Form K-120ES Estimated Payments

KS Form K-120S (S Corporation)

KS Form K-41 (Fiduciary)

KY Form 720 - (Corporation)

KY Form 720-ES (Estimated Payment)

KY Form 720S - (S Corporation)

KY Form 720S - (S Corporation K1)

KY Form 765 - (Partnership)

KY Form 765 K-1 (Partnership)

KY Form 765 GP - (Gen. Part.)

KY Business Extension Application

KY Form 741 - (Fiduciary)

KY Form 741 K-1 (Fiduciary)

KY Schedule LLET

LA Form CIFT- 620 (Corp & SCorp)

LA Form CIFT- 620A (Apportionment)

LA Form CIFT- 620ES (Estimates)

LA Form CIFT- Payment Voucher

LA Form CIFT- Schedule P

LA Form IT-565 (Partnership)

LA Form R-6466 (Extension)

LA Form IT-541 (Fiduciary)

23

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

LA Form R-8453C

LA R-6004 (E-File Voucher)

MA Form 355 - (Corporation)

MA Form 355-PV (Payment Voucher)

MA Form 355-ES (Estimates)

MA Schedule A

MA Schedule E

MA Schedule F

MA Schedule B and C

MA Schedule CD

MA Schedule CR

MA Schedule D and E-1

MA Schedule E-2

MA Schedule M-1

MA Schedule RNW

MA Form M-2220

MA Form M-8453C

MA Form 355S - (S-Corporation)

MA Schedule SK-1

MA Schedule S

MA Form 3 - (Partnership)

MA Schedule 3K-1

MA Form M-8453P

MA Form 2 - (Fiduciary)

MA Form 2-PV (Payment Voucher)

MA Form 2-ES (Estimates)

MA Schedule 2K-1

MA Schedule IDD

24

$15.00

$15.00

$80.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

MA Schedule B

MA Schedule B/R

MA Schedule D

MA Schedule E and F

MA Schedule H

MD Form 500 - (Corporation)

MD Form 500 UP

MD Form 500 CR

MD Form 500 MC

MD Form 510 - (S Corp & Part)

MD Form 504 - (Fiduciary)

MD Form EL101B - (Elf Signature)

MD Form EL102B - (Elf Payment Vch)

MD Form 500D (Corp Estimates)

MD Form 504D (Estate Estimates)

MD Form 510D (Part Estimates)

MD Form 500E (Corp Extension)

MD Form 504E (Estate Extension)

MD Form 510E (Part Extension)

ME Form 1120ME (Corporation)

ME Form 2220ME (Estimated Penalty)

ME Form 1120EXT-ME (Extension)

ME Form 1120ES-ME (Estimates)

ME Form 1065ME/1120S-ME

ME Schedule PSI

ME Form 1041ME

ME Schedule A (1041)

ME Schedule NR (1041)

25

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

ME Form 1041ES-ME (Estimates)

ME Form 1041EXT-ME (Extension)

MI Form 4567 (MBT Annual Return)

MI Form 4548 (Estimates)

MI Form 4568

MI Form 4569

MI Form 4570

MI Form 4571

MI Form 4572

MI Form 4573

MI Form 4574

MI Form 4575

MI Form 4576

MI Form 4577

MI Form 4578

MI Form 4582

MI Form 4583 (Simplified Return)

MI Form 4585

MI Form 4587

MI Form 4 (Extension)

MI Business Income Worksheet

MI Gross Receipts Worksheet

MN Form M4 (Corporation)

MN Form M4I (Corporation)

MN Form M4A (Corporation)

MN Form M4-T (Corporation)

MN Schedule EST

MN Schedule AMT

26

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

MN Schedule NOL

MN Schedule DIV

MN Form PV41

MN Form M4R (Activity Report)

MN Form M2 (Estate)

MN Schedule M2MT (AMT Tax)

MN Schedule KF

MN Form PV43

MN Form M3 (Partnership)

MN Schedule KPI

MN Schedule KPC

MN Form PV44

MN Form M8 (S Corporation)

MN Schedule KS

MN Form PV40

MN Form M18 (Estimate-Corp)

MN Form M71 (Estimate-Part)

MN Form M72 (Estimate-Scorp)

MN Form PV80 (Extension-Corp)

MN Form PV81 (Extension-Scorp)

MN Form PV83 (Extension-Part)

MO Form 1120 (Corporation)

MO Schedule MO-FT

MO Schedule MO-MS

MO Form MO-1120ES

MO Form MO-7004

MO Form 1120S (S Corporation)

MO Schedule MO-MSS

27

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

MO Schedule MO-NRS

MO Form 1065 (Partnership)

MO Schedule MO-NRP

MO Form 1041 (Fiduciary)

MS Form 83-105 (Corporation)

MS Form 85-105 (S Corporation)

MS Form 85-132 (Scorp K-1)

MS Form 86-105 (Partnership)

MS Form 86-132 (Part K-1)

MT Form CLT-4 (Corporation)

MT Form CLT-4 Schedule K

MT Form CLT-4 Schedule C

MT Form CLT-4-UT (Underpayment)

MT Form CLT-4S (S Corporation)

MT Form CLT-4S Schedule I

MT Form CLT-4S Schedule II

MT Form CLT-4S Schedule III

MT Form CLT-4S Schedule IV

MT Form SB (Payment Voucher)

MT Form PR-1 (Partnership)

MT Form PR-1 Schedule I

MT Form PR-1 Schedule II

MT Form PR-1 Schedule III

MT Form PR-1 Schedule IV

MT Form CLT-4S/PR-1 Schedule K-1

MT Form FID-3 (Fiduciary)

MT Form FID-3 Schedules B/C

MT Form FID-3 Schedule D

28

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

MT Form FID-3 Schedule E/F

MT Form FID-3 Schedule G/H

MT Form EST-I (Underpayment)

MT Form FID (Payment Voucher)

MT Form FID-3 Schedule K-1

NC Form CD-405 (Corporation)

NC Form CD-479 (Annual Report)

NC Form CD-V (Income Voucher)

NC Form CD-V (Franchise Voucher)

NC Form CD-V (Amended Inc Voucher)

NC Form CD-V (Amended Fran Voucher)

NC Form CD-401S (S Corporation)

NC Form CD-401S (S Corporation K-1)

NC Form D-403 (Partnership)

NC Form D-403 (Partnership K-1)

NC Form D-403TC (Tax Credit)

NC Form D-407 (Fiduciary)

NC Form D-407 (Fiduciary K-1)

NC Form D-407TC (Tax Credit)

NC Form D-410P (Part Extension)

NC Form NC-NA

NC Form NC-425

NC Form NC-419 (Corporate Ext)

NC Form NC-419 (Franchise Ext)

NC Form NC-429 (Estimated Voucher)

ND Form 38 (Fiduciary)

ND Form 38-ES (Estimates)

ND Form 38-EXT (Extension)

29

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

ND Form 38-UT (Underpayment)

ND Form 40 (Corporation)

ND Form 40-ES (Estimates)

ND Form 58 (Partnership)

ND Form 58-ES (Estimates)

ND Form 58-EXT (Extension)

ND Form 60 (S Corporation)

ND Form PWA (Withholding Adj)

ND Form Schedule K-1 (Form 38)

ND Form Schedule K-1 (Form 58)

ND Form Schedule K-1 (Form 60)

NE Form 1120N (Corporation)

NE Form 1120-SN (S Corporation)

NE Form 12N (Agreement)

NE Form 14N (Withhold)

NE Form 1120N-ES (Corp Estimates)

NE Form 1065N (Partnership)

NE Form 1041N (Fiduciary)

NE Form 7004N (Extension)

NH Form BT-SUMMARY

NH Form BET

NH Form DP-80 (Apportionment)

NH Form DP-160 (Schedule CR)

NH Form DP-2210/2220 (Underpayment)

NH Form BT-EXT (Extension)

NH Form NH-1120

NH Schedule R

NH Form DP-120 (Schedule S)

30

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

NH Form DP-9

NH Form NH-1065

NH Form PART-COMP Worksheet

NH Form NH-1041

NJ Form CBT-100 (Corporation)

NJ Form 500 (NOL)

NJ Form CBT-100-V (Voucher)

NJ Form CBT-200-TC (Corp Extension)

NJ Form CBT-150C (Corp Estimates)

NJ Form CBT-100S (S Corporation)

NJ Form CBT-100S (Inactivity)

NJ Form CBT-100S-V (Voucher)

NJ Form CBT-200-TS(SCorp Extension)

NJ Form CBT-150S (SCorp Estimates)

NJ Form NJ-K1 (S Corporation K-1)

NJ Form NJ-1065 (Partnership)

NJ Form NJ-K1 (Partnership K-1)

NJ Form NJ-100 (Filing Fee)

NJ Form PART-200-T (Part Extension)

NJ Form NJ-1041 (Fiduciary)

NJ Form NJ-1041-V (Voucher)

NJ Form NJ-K1 (1041 K-1)

NJ Form NJ-NRA (Bus Allocation)

NM Form CIT-1 (Corporation)

NM Form CIT-CR (Corp Credits)

NM Form CIT-ES (Corp Estimates)

NM Form CIT-EXT (Ext Voucher)

NM Form CIT-PV (Corp Voucher)

31

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

NM Form FID-1 (Fiduciary)

NM Form FID-CR (Fid Credits)

NM Form FID-ES (Fid Estimates)

NM Form FID-EXT (Ext Voucher)

NM Form FID-PV (Fid Voucher)

NM Form PTE (Partnership)

NM Form PTE-CR (Part Credits)

NM Form PTE-D (Owner Information)

NM Form PTE-EXT (Ext Voucher)

NM Form PTE-PV (Part Voucher)

NM Form PTE-TA (NR Agreement)

NM Form PTE-WK (Pass-Through)

NM Form RPD-41096 (Extension)

NY Form CT-3 (Corporation)

NY Form CT-3M (Corporation)

NY Form CT-3S (S Corporation)

NY Form CT-3-S-ATT (S Corporation)

NY Form CT-34-SH(Scorp Shareholder)

NY Form IT-204 (Partnership)

NY Form IT-204-IP (Part Ind K-1)

NY Form IT-204-CP (Part Corp K-1)

NY Form IT-204.1 (Part Corp Sch K)

NY Form IT-204-LL (LLC Filing Fee)

NY Form Y-204 (Yonkers Allocation)

NY Form IT-205 (Fiduciary)

NY Form Y-206 (Yonkers Allocation)

NY Form CT-400-MN (Corp Estimate)

NY Form IT-2106-MN (Fid Estimate)

32

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

NY Form IT-370-PF (Part\Fid Ext)

NY Form CT-5 (Corp Extension)

NY Form CT-5.4 (Scorp Extension)

NY Form NYC-204EZ

NY Form TR-579-CT (Corp Elf Sign)

NY Form TR-579-PT (Part Elf Sign)

NY Form MTA-405 (Commuter Tax)

NY Form MTA-405-ATT

NY Form CHAR500 (Charitable Org)

OH Form FT-1120 (Corporation)

OH Form IT-1041 (Fiduciary)

OH Form FT-1120E/ER/EX

OK Form 512 (Corporation)

OK Form 512S (S Corporation)

OK Form 512S Part 5 (K-1)

OK Form 512SA (NR Agreement)

OK Form 513 (Fiduciary)

OK Form 514 (Partnership)

OK Form 514 Part 5 (Part K-1)

OK Form 514-PT (Composite)

OK Form OW-8-ESC (Estimates)

OR Form 20 (Corporation)

OR Schedule AP (Apportionment)

OR Form 20-V (Payment Voucher)

OR Form 20S (S Corporation)

OR Form 37 (Underpayment)

OR Form 65 (Partnership)

OR Form 41 (Fiduciary Income)

33

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

OR Form 41-V (Payment Voucher)

OR Schedule P (Part Year Trust)

PA RCT-101 (Corporation)

PA RCT-101-X (Corporation Amend)

PA RCT-101-I (Corp Inactive)

PA RCT-106 (Corp Apportionment)

PA REV-853 (Corp Extension)

PA REV-857R (Corp Estimate)

PA 20S\65 (Scorp\Partnership)

PA 20S\65 (Schedule A\B)

PA 20S\65 (Schedule D)

PA 20S\65 (Schedule E)

PA 20S\65 (Schedule M)

PA Schedule RK-1 (Scorp\Part K-1)

PA Schedule NRK-1 (Scorp\Part K-1)

PA Partner\Shareholder Directory

PA Nonresident Ind Directory

PA Nonresident Other Directory

PA 41 (Fiduciary)

PA 41 Payment Voucher (Fiduciary)

RI Form 1120C (Corporation)

RI Form 1120S (S Corporation)

RI Form 1065 (Partnership)

RI Form 1041 (Estate)

RI Schedule CR (Estate)

RI Schedule M (Estate)

SC Form 1120 (Corporation)

SC Form SC8453C

34

$15.00

$15.00

$80.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

SC Form SC1120-CDP

SC Form SC1120-T

SC Form SC1120-TC

SC Form SC1120-V

SC Form 1120S (S Corporation)

SC Schedule SCK-1

SC Form 1065 (Partnership)

SC Form 1041 (Fiduciary)

SC Form 1041ES (Estimated Payments)

TN Form FAE-170 (Franchise Excise)

TX Form 05-158-A (Franchise-Annual)

TX Form 05-158-A (Franchise-Init)

TX Form 05-158-A (Franchise-Final)

TX Form 05-163 (No Tax Due-Annual)

TX Form 05-163 (No Tax Due-Initial)

TX Form 05-163 (No Tax Due-Final)

TX Form 05-164 (Extension-Annual)

TX Form 05-164 (Extension-Initial)

TX Form 05-164 (Extension-Final)

TX Form 05-169 (E-Z COMP-Ann)

TX Form 05-170 (Payment-Annual)

TX Form 05-170 (Payment-Initial)

TX Form 05-170 (Payment-Final)

TX Form 05-158-A (Bank-Fran-Annual)

TX Form 05-158-A (Bank-Fran-Init)

TX Form 05-158-A (Bank-Fran-Final)

TX Form 05-163 (Bank No Tax Due-Ann

TX Form 05-163 (Bank No Tax Due-Int

35

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

TX Form 05-163 (Bank No Tax Due-Fin

TX Form 05-164 (Bank Ext-Annual)

TX Form 05-164 (Bank Ext-Initial)

TX Form 05-164 (Bank Ext-Final)

TX Form 05-170 (Bank Payment-Annual

TX Form 05-170 (Bank Payment-Int

TX Form 05-170 (Bank Payment-Final)

TX Form 05-102-A

UT Form TC-20 (Corporation)

UT Form TC-559 (Estimated Payments)

UT Form TC-20S (S Corporation)

UT Form TC-65 (Partnership)

UT Form TC-544 Part. Pay Voucher

UT Form TC-41 (Estate)

UT Form TC-41A

UT Form TC-41B

UT Form TC-41C

UT Form TC-41G

UT Form TC-41S

UT Form TC-41W

UT Form TC-548 (Est. Est Payment)

UT Form TC-549 (Est. Payment Vouch)

VA Form 500 (Corporation)

VA Schedule 500A (Multistate)

VA Form 500C (Underpayment)

VA Form 500CR (Corporation)

VA Form 500V (Payment Voucher)

VA Form 500CP/CG (Extension)

36

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$80.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

VA Form 500ES (Estimates)

VA Form 500ADJ(Adjustments)

VA Form 500FED(Line Items)

VA Form 8879C

VA Form 502 (Pass Through)

VA Form 502A (Pass Through)

VA Form 502ADJ (Adjustments)

VA Form 502V (Pass Through Voucher)

VA Form 502W (NR Withholding)

VA Schedule VK-1

VA Form 770 (Fiduciary)

VA Form 770/IP/CG (Extension)

VA Form 770ES/CG (Estimates)

VA Form 760-C (Underpayment)

VT Form BA-402 (Apportionment)

VT Form BA-403 (Extension)

VT Form BA-404 (Tax Credits)

VT Form BA-410 (Affiliation)

VT Form BI-471 (Part/S Corp)

VT Form BI-472 (S Corp Sch)

VT Form BI-473 (Part Sch)

VT Form CO-411 (Corporate)

VT Form CO-414 (Corp Estimates)

VT Form FI-161 (Fiduciary)

VT Form WH-435 (Estimates)

VT Schedule K-1VT

WI Form 4 (Corporation)

WI Form 4A-1 (Apportionment)

37

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

WI Form 4BL

WI Form 4N

WI Form 4U (Underpayment)

WI Form 4-ES (Estimated Payments)

WI Form 4-EPV (Electronic Voucher)

WI Form 5 (Corporation)

WI Form 5S (S Corporation)

WI Schedule 5-K1

WI Schedule FC

WI Schedule V

WI Schedule W

WI Schedule Y

WI Form 3 (Partnership)

WI Schedule 3-K1

WI Form 2 (Fiduciary)

WI Schedule CC

WI Schedule 2-K1

WV Form WV/CNF-120 (Corporation)

WV Form WV/CNF-120APT (Apportion.)

WV Form WV/CNF-120 (Sch.P)

WV Form WV/CNF-120ES (Est Payments)

WV Form WV/SPF-100 (SCorp/Part)

WV Form WV/SPF-100APT (Apportion.)

WV Form WV/SPF-100 (Sch.SP)

WV Form WV/SPF-100 (Sch.P)

WV Form WV/SPF-100U (Underpayment)

WV Form WV BAR-0 (WV BAR-0)

WV Form IT-141

38

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

$15.00

CENTRAL TAX & FINANCIAL SERVICES

FEE SCHEDULE

WV Form IT-141 Schedule T

WV Form IT-141 Schedule NR

WV Form IT-141T (Extension)

39

$15.00

$15.00

$15.00

You might also like

- InjunctionDocument3 pagesInjunctionHamid AliNo ratings yet

- Beyond Frontiers: U.S. Taxes for International Self-Published AuthorsFrom EverandBeyond Frontiers: U.S. Taxes for International Self-Published AuthorsRating: 1 out of 5 stars1/5 (1)

- Lien For Credit BureausDocument8 pagesLien For Credit BureausArchive Bey100% (3)

- Lawfully Yours: The Realm of Business, Government and LawFrom EverandLawfully Yours: The Realm of Business, Government and LawNo ratings yet

- Allodial Fee Schedule Earl Julian Lloyd ElDocument5 pagesAllodial Fee Schedule Earl Julian Lloyd Elhoward avigdor rayford lloyd elNo ratings yet

- MACN-A020 - Affidavit of Fact - Writ Discovery (EXELON PECO COMPANY)Document4 pagesMACN-A020 - Affidavit of Fact - Writ Discovery (EXELON PECO COMPANY)akil kemnebi easley elNo ratings yet

- Moor Trust Charter 302 NutimusDocument4 pagesMoor Trust Charter 302 NutimusBaba BeyNo ratings yet

- Quit Claim DeedDocument3 pagesQuit Claim DeedRosetta Rashid’s McCowan ElNo ratings yet

- Nego Letter of Credit ReportDocument7 pagesNego Letter of Credit Reportmelaniem_1No ratings yet

- Cancel Social Security Dissolution Luna LaToya Bey Ex Rel LYDIA SMITHDocument3 pagesCancel Social Security Dissolution Luna LaToya Bey Ex Rel LYDIA SMITHAlahdeen Moroc BeyNo ratings yet

- Affidavit of International Trust of The: Moorish Divine and National Movement of The WorldDocument2 pagesAffidavit of International Trust of The: Moorish Divine and National Movement of The Worldakil kemnebi easley elNo ratings yet

- Example Act of Expatriation JOHN MARK DOE - RecSecDocument1 pageExample Act of Expatriation JOHN MARK DOE - RecSecLaLa BanksNo ratings yet

- Offer in Compromise: Attach Application Fee and Payment Taxpayer Contact Information Section IDocument4 pagesOffer in Compromise: Attach Application Fee and Payment Taxpayer Contact Information Section IFrancis Wolfgang UrbanNo ratings yet

- Rent A Center No Bills Due DevanDocument2 pagesRent A Center No Bills Due DevanErick J. Valentine100% (2)

- MACN-A006 - Affidavit of UCC1 FINANCING STATEMENT Harris County Davis ElDocument7 pagesMACN-A006 - Affidavit of UCC1 FINANCING STATEMENT Harris County Davis Eljavian devonn davis el100% (1)

- Power of Attorney LimitedDocument2 pagesPower of Attorney LimitedRonald Hawkins100% (3)

- Form 2848, Power of Attorney and Declaration of RepresentativeDocument2 pagesForm 2848, Power of Attorney and Declaration of Representativethenjhomebuyer80% (5)

- 2.legal Notice! Name Declaration, Correction Proclamation and Publication.Document2 pages2.legal Notice! Name Declaration, Correction Proclamation and Publication.DesireeNo ratings yet

- How To Apply P-EBTDocument2 pagesHow To Apply P-EBTMorgan BurrellNo ratings yet

- Bill, Exchange, Format, of The Bill, Bill, Omtex ClassesDocument3 pagesBill, Exchange, Format, of The Bill, Bill, Omtex ClassesAMIN BUHARI ABDUL KHADERNo ratings yet

- MACN-A006 - Affidavit of Universal Commercial Code 1 FINANCING STATEMENT LienDocument7 pagesMACN-A006 - Affidavit of Universal Commercial Code 1 FINANCING STATEMENT LienTimothy Manolo ELNo ratings yet

- Pursuant To P.L. 8 Stat. 484Document16 pagesPursuant To P.L. 8 Stat. 484Alahdeen Moroc Bey100% (2)

- Cover Sheet Counter-DeedDocument1 pageCover Sheet Counter-DeedMaster100% (1)

- Cover Letter For Affidavit of Allodial Secured Land Property Repossession Written Statement 04444 With Links LegalDocument1 pageCover Letter For Affidavit of Allodial Secured Land Property Repossession Written Statement 04444 With Links Legalkeith allenNo ratings yet

- Profile Summary Role & ResponsibilitiesDocument2 pagesProfile Summary Role & ResponsibilitiesGurleenNo ratings yet

- Sionya 20160607 0001Document6 pagesSionya 20160607 0001PriyaSiranELNo ratings yet

- IdpDocument6 pagesIdpexousiallcNo ratings yet

- H Res 194Document4 pagesH Res 194KHA-IFA MARTIN100% (1)

- The Home Depot Lien With AutographDocument4 pagesThe Home Depot Lien With AutographBilal Yusef El Abdullah Bey100% (1)

- 1 - Name Declaration Correction and PublicationDocument1 page1 - Name Declaration Correction and PublicationJahi100% (1)

- Affidavit of UCC1 Financial Statement (Katia Saint Fluer)Document13 pagesAffidavit of UCC1 Financial Statement (Katia Saint Fluer)2Pop100% (1)

- Status Correction Social Security Administration RedactedDocument20 pagesStatus Correction Social Security Administration RedactedJoseph TrotterNo ratings yet

- 1 Stat 68-69Document3 pages1 Stat 68-69Cee100% (1)

- MACN-A020 - Affidavit of Fact - Writ Discovery (BEZOS, JEFFREY P CHAIR AMAZON .COM) From John Johnny Easley en Capitis Diminutio NoloDocument3 pagesMACN-A020 - Affidavit of Fact - Writ Discovery (BEZOS, JEFFREY P CHAIR AMAZON .COM) From John Johnny Easley en Capitis Diminutio Noloakil kemnebi easley elNo ratings yet

- EstoppleDocument22 pagesEstoppleskvskvskvskvNo ratings yet

- 2011 1040NR-EZ Form - SampleDocument2 pages2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- Study InfoDocument37 pagesStudy InfoRidalyn AdrenalynNo ratings yet

- FOIA Hauser 2-6-17 ResponseDocument3 pagesFOIA Hauser 2-6-17 ResponseJonah MeadowsNo ratings yet

- SF-181 Ethnicity Forms, Supporting Documents and Confirmations For JaelDocument20 pagesSF-181 Ethnicity Forms, Supporting Documents and Confirmations For JaelTiffany Hamilton100% (7)

- Form 211 - SEC Rule 15c2-11 Proposal - Brenda Hamilton Esq.Document5 pagesForm 211 - SEC Rule 15c2-11 Proposal - Brenda Hamilton Esq.BrendaHamiltonNo ratings yet

- Notice of Default Discharge of Obligation Demand For Reconveyance To Donna Carpenter For First American Title Interlachen LNDocument5 pagesNotice of Default Discharge of Obligation Demand For Reconveyance To Donna Carpenter For First American Title Interlachen LNArmond TrakarianNo ratings yet

- Drafting Legal POADocument10 pagesDrafting Legal POAsandeepdsnluNo ratings yet

- Claim of LienDocument1 pageClaim of LienCheryl MarshallNo ratings yet

- GLASGOW, DANIELLE, S. ®©™ SF181 POSTED December 16th, 2016 A.D.E.Document16 pagesGLASGOW, DANIELLE, S. ®©™ SF181 POSTED December 16th, 2016 A.D.E.Shabazz-El Foundation ©®™No ratings yet

- An ApostilleDocument4 pagesAn ApostilleRochielle Fae CadimasNo ratings yet

- Post Office (Postal Orders/Money Orders), 2015Document1 pagePost Office (Postal Orders/Money Orders), 2015NirpendraNo ratings yet

- Monera Mouna Aarifah Bey Notice of Public Records CorrectionDocument14 pagesMonera Mouna Aarifah Bey Notice of Public Records CorrectionHakim-Aarifah BeyNo ratings yet

- Form 3: United States Securities and Exchange Commission Initial Statement of Beneficial Ownership of SecuritiesDocument1 pageForm 3: United States Securities and Exchange Commission Initial Statement of Beneficial Ownership of SecuritiesJesus Velazquez JrNo ratings yet

- Suretyship Agreement SummaryDocument1 pageSuretyship Agreement SummaryJojo QPNo ratings yet

- New Diagram of FraudDocument1 pageNew Diagram of Fraudakil kemnebi easley elNo ratings yet

- Full Report On Moorish American Baby Girl Mataoka Zodeakus Ameer Bey KidnappingDocument21 pagesFull Report On Moorish American Baby Girl Mataoka Zodeakus Ameer Bey KidnappingAlahdeen Moroc BeyNo ratings yet

- Macn-R000130712 - Affidavit of Written Initial Commercial Code Financing Statement CLECO CORPORATE HOLDINGS LLCDocument6 pagesMacn-R000130712 - Affidavit of Written Initial Commercial Code Financing Statement CLECO CORPORATE HOLDINGS LLCtheodore moses antoine bey100% (1)

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Suhar LinaNo ratings yet

- Affidavit of Levy and Tax Discharge WESTOVER VILLAGE / Noricum Associates Uploaded 4 2023Document5 pagesAffidavit of Levy and Tax Discharge WESTOVER VILLAGE / Noricum Associates Uploaded 4 2023akil kemnebi easley elNo ratings yet

- Cancellation of All Prior Powers of AttorneyDocument1 pageCancellation of All Prior Powers of AttorneyAntwain UtleyNo ratings yet

- Writ of Possession For 9804 Buckingham Drive 99301Document8 pagesWrit of Possession For 9804 Buckingham Drive 99301Kamau Bey100% (2)

- Cancel Power of AttorneyDocument1 pageCancel Power of AttorneyMaryUmbrello-Dressler100% (1)

- Buffalo Mentor HandbookDocument35 pagesBuffalo Mentor Handbookapi-127186411No ratings yet

- Veterans Court ProtocolDocument100 pagesVeterans Court Protocolapi-127186411No ratings yet

- Vhea Guide For The Iccoa Aa WebsiteDocument11 pagesVhea Guide For The Iccoa Aa Websiteapi-127186411No ratings yet

- Vash Update 2013Document1 pageVash Update 2013api-127186411No ratings yet

- Developing Strategic Community Alliances Vhea WebsiteDocument12 pagesDeveloping Strategic Community Alliances Vhea Websiteapi-127186411No ratings yet

- Volunteer Coordination English SpanishDocument16 pagesVolunteer Coordination English Spanishapi-127186411No ratings yet

- Vhea Aa TemplateDocument4 pagesVhea Aa Templateapi-127186411No ratings yet

- Purpose of Vhea NFPDocument3 pagesPurpose of Vhea NFPapi-127186411No ratings yet

- Volunteer Coordination English SpanishDocument16 pagesVolunteer Coordination English Spanishapi-127186411No ratings yet

- Vhea Iccoa FinalDocument2 pagesVhea Iccoa Finalapi-127186411No ratings yet

- NFP Guide IllinoisDocument12 pagesNFP Guide Illinoisapi-127186411No ratings yet

- 7756 Carpenter 4 - 2 Bedroom Apts AvailDocument2 pages7756 Carpenter 4 - 2 Bedroom Apts Availapi-127186411No ratings yet

- Green Lightbulb W TreesDocument30 pagesGreen Lightbulb W Treesapi-127186411No ratings yet

- Summer Youth Employment ProgramsDocument141 pagesSummer Youth Employment Programsapi-127186411No ratings yet

- Lafayelle Increasing Growth - Management TrainingDocument21 pagesLafayelle Increasing Growth - Management Trainingapi-127186411No ratings yet

- Para What Is Bimeecs Website ReadyDocument8 pagesPara What Is Bimeecs Website Readyapi-127186411No ratings yet

- Boom or BustDocument3 pagesBoom or Bustapi-127186411No ratings yet

- Summer Youth Employment ProgramsDocument141 pagesSummer Youth Employment Programsapi-127186411No ratings yet

- Civic Engagement As A Jobs Creation Tool PlusDocument24 pagesCivic Engagement As A Jobs Creation Tool Plusapi-127186411No ratings yet

- Eta Form 9061Document4 pagesEta Form 9061api-127186411No ratings yet

- Jobs Bill Ojt BriefDocument8 pagesJobs Bill Ojt Briefapi-127186411No ratings yet

- Wotc Conditional Certification Form 9062Document4 pagesWotc Conditional Certification Form 9062api-127186411No ratings yet

- State and Local Planning For Ojt OutreachDocument4 pagesState and Local Planning For Ojt Outreachapi-127186411No ratings yet

- 8850 Wotc Tax FormDocument2 pages8850 Wotc Tax Formapi-127186411No ratings yet

- Eligibility - Common DocsDocument1 pageEligibility - Common Docsapi-127186411No ratings yet

- Ojt OverviewDocument1 pageOjt Overviewapi-127186411No ratings yet

- Kiw - Latest Version 2Document18 pagesKiw - Latest Version 2api-127186411No ratings yet

- Kiw Ojt Questionnaire June 2011Document2 pagesKiw Ojt Questionnaire June 2011api-127186411No ratings yet

- Ojt Training Referral Template 20101025Document2 pagesOjt Training Referral Template 20101025api-127186411No ratings yet

- Ojt Questions AnswersDocument1 pageOjt Questions Answersapi-127186411No ratings yet

- E StampDocument1 pageE StampUmer ShaukatNo ratings yet

- 2 Share FileDocument4 pages2 Share FileVictor Lo Dastek Unichip100% (1)

- Kapi & Clarke: Chartered AccountantsDocument2 pagesKapi & Clarke: Chartered AccountantsNiño Jay Mortiz BandicoNo ratings yet

- Commercial Invoice TemplateDocument2 pagesCommercial Invoice TemplatedukuhwaruNo ratings yet

- Amendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORDocument45 pagesAmendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORTitan KNo ratings yet

- Discover Asia International Travel and Tours Updated Travel PackagesDocument14 pagesDiscover Asia International Travel and Tours Updated Travel PackagesdiscoverasiaintlNo ratings yet

- 6 April 2023Document7 pages6 April 2023mapondaglodiNo ratings yet

- Vestal 5 ScheduleDocument2 pagesVestal 5 ScheduleRohan ChopraNo ratings yet

- Financial Accounting Ii Sample QuizDocument2 pagesFinancial Accounting Ii Sample QuizThea FloresNo ratings yet

- CDBDocument35 pagesCDBAnonymous eLy0WHoJN5No ratings yet

- Shinhan Bank Vietnam Korea Be Inspired Visa Platinum Credit CardDocument5 pagesShinhan Bank Vietnam Korea Be Inspired Visa Platinum Credit CardVan Hoi NguyenNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit CardsRahulNo ratings yet

- Tax Invoice TemplateDocument1 pageTax Invoice Templatebigboss2276623No ratings yet

- INCOTERMS 2020 Rules Short - TFG - Summary PDFDocument20 pagesINCOTERMS 2020 Rules Short - TFG - Summary PDFaryanNo ratings yet

- Bol GT7Document1 pageBol GT7AMAR1980No ratings yet

- Adyen Pricing Overview 08022013Document13 pagesAdyen Pricing Overview 08022013Aleksandar TasevNo ratings yet

- MBA Tuition & Fees - Yr-2023 University Canada WestDocument11 pagesMBA Tuition & Fees - Yr-2023 University Canada WestSayem SadatNo ratings yet

- Shyam Babu Ticket PDFDocument1 pageShyam Babu Ticket PDFRanjeet KushwahaNo ratings yet

- Activity 4 Bank Reconciliation PDFDocument4 pagesActivity 4 Bank Reconciliation PDFSharmin ReulaNo ratings yet

- GP Mobil Bill-Dec-19Document69 pagesGP Mobil Bill-Dec-19biddut782No ratings yet

- Your Vodafone Bill: Amount DueDocument1 pageYour Vodafone Bill: Amount DueBeyza GemiciNo ratings yet

- Dawn M Rios 701 Walnut Ave MENA AR 71953-3039 Genesis Fs Card Services PO BOX 23030 Columbus GA 31902-3030Document4 pagesDawn M Rios 701 Walnut Ave MENA AR 71953-3039 Genesis Fs Card Services PO BOX 23030 Columbus GA 31902-3030Lilith MarieNo ratings yet

- Penyelesaian KASUS 2 PEBDocument13 pagesPenyelesaian KASUS 2 PEBArldiIshmanRachmanNo ratings yet

- Customer Satisfaction Towards PAYtm ServicesDocument53 pagesCustomer Satisfaction Towards PAYtm ServicesVignesh Kumar Voleti69% (13)

- New Balance $10,195.04 Minimum Payment Due $102.00 Payment Due Date 10/23/22Document11 pagesNew Balance $10,195.04 Minimum Payment Due $102.00 Payment Due Date 10/23/22Rahul SharmaNo ratings yet

- All Tally TheoryDocument21 pagesAll Tally Theoryvijay024088% (17)

- Ground Access For IGI Airport, Delhi: Planning and Challenges Dileep Dixit, AuthorDocument11 pagesGround Access For IGI Airport, Delhi: Planning and Challenges Dileep Dixit, AuthoranuNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument27 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignaturemohitchakarnagarNo ratings yet

- ESCOM Prepaid Tokens Report PDFDocument1 pageESCOM Prepaid Tokens Report PDFDavieNM62% (13)

- Inv#27-0119 - PhoenixDocument1 pageInv#27-0119 - PhoenixNitesh RokadeNo ratings yet