Professional Documents

Culture Documents

Berkshire Threaded Fasteners Company Case

Uploaded by

smart200Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Berkshire Threaded Fasteners Company Case

Uploaded by

smart200Copyright:

Available Formats

Berkshire Threaded Fasteners Company Case

This analysis examines the income and cost information presented by Berkshire Threaded Fasteners Company from historical and projected perspectives to justify two major decisions: withdrawal of a product line, and reduction of the selling price of another. Furthermore, these decisions will lead into suggestions about the overall strategic approach of the firm. At the beginning of 1974, Berkshire leadership advocates withdrawal of the 300 Series product line. First glance at the income statement for the period ending December 31, 1973 appears to reveal that production of the 300 Series causes substantial overall losses to the firm. However, this is a relevant cost decision. Table 1 illustrates that the withdrawal of the 300 Series product line will affect labor, raw materials, power, and repairs. It will have no affect upon the other costs as they are either allocated across the three product lines or historical costs with no relevance. The result based upon period-end numbers for first six months of 1974 would project an operating income loss of $693,000 instead of $110,000 loss. To withdraw the 300 Series would be a poor decision. Table 1. 300 Series - Selling price $2.75 Drop 300 Series labor $349.00 $0.00 raw materials $404.00 $0.00 power $15.00 $0.00 repairs $5.00 $0.00 rent $95.00 $95.00 Other Factory costs $56.00 $56.00 Total $924.00 $151.00 Selling Expense $239.00 $239.00 General Administration $90.00 $90.00 Depreication $186.00 $186.00 Interest $27.00 $27.00 Total Cost $1466.00 $693.00 Sales(net) $1355.00 $0.00 Profit(loss) -$111.00 -$693.00 Unit Sales 501276 0

As the profit and loss statement for June 30, 1974 indicates, the reduction of the unit sales price of Series 100 from $2.45 to $2.25 would mean that the unit sales price would be below the total unit cost of $2.29. This should mean substantial losses to the bottom line. However, Berkshire must take into account the forecasting for the entire period. If projections are sound then as Table 2 shows, production of an additional 750,000 units at the current unit sales price would essentially cancel out the increase in forecasted operating income for the first half of 1974. Table 2 shows that reduction in unit sales price to $2.25 will indeed create a break-even production quantity of near one million units as projected. This reduction would not increase operating income from the first half, though the overall total for the year would at $92,000. Thus, Berkshire should reduce the unit sales price of the Series 100 product to $2.25. Table 2. 750000 unit sales at $2.45 1000000 unit sales at $2.25 sales 1,837,500.00 2,250,000.00 less Variable cost($1.42/unit) 1,065,000.00 1,420,000.00

Cont. Margine 772,500.00 830,000.00 Less Total Fixed Expense from 1st half. 876,000.00 876,000.00 Net Operating Income -103,500.00 -46,000.00

The decision to reduce the unit sales price of Series 100 is strategically sound. Furthermore, the contribution margin percentages show that 100 Series product line is clearly the most profitable. 100 series 200 series 300 series Selling price per unit $2.45 $2.58 $2.75 Variable cost per unit $1.42 $1.63 $1.85 CM per unit $1.03 $.95 $.90 CM Ratio 42% 37% 33% Berkshire is one eight competitors in a localized market in which demand is inelastic. This price cut should force the competition to either follow suit or get out of the market for this particular product line, depending upon the respective costs of each of their manufacturing processes. This should create additional outputs produced for Berkshire, which would result in new revenues. Furthermore, the firm should continue to work toward improving efficiencies with respect to its 200 and 300 Series, with the goal of increasing contribution margin for each product. This should increase operating income and contribute to a healthy bottom line.

Read Full Essay

You might also like

- Berkshire Threaded FastenersDocument3 pagesBerkshire Threaded FastenersVenkatesh Gopal100% (1)

- Berkshire Threaded Fasteners Co.: Question 1: Drop 300 As of 1/1/74?Document24 pagesBerkshire Threaded Fasteners Co.: Question 1: Drop 300 As of 1/1/74?Yousif100% (1)

- PRICING EXERCISES ANALYSISDocument14 pagesPRICING EXERCISES ANALYSISvineel kumarNo ratings yet

- Group - 9 - Sec - B - IQDM - Merton - Truck - CompanyDocument8 pagesGroup - 9 - Sec - B - IQDM - Merton - Truck - CompanyMANVENDRA SINGH PGP 2019-21 BatchNo ratings yet

- Movie Rental Business PDFDocument6 pagesMovie Rental Business PDFAmir khanNo ratings yet

- MacDocument4 pagesMacalwar_shi262068100% (1)

- Sale Value (5b) Sales Growth 5 (A) & 4 (A) (%) (6b) Sales Growth (6 (A) and 4 (A) (%)Document4 pagesSale Value (5b) Sales Growth 5 (A) & 4 (A) (%) (6b) Sales Growth (6 (A) and 4 (A) (%)SMRITI MEGHASHILANo ratings yet

- Garrick Oil and LubricantDocument4 pagesGarrick Oil and Lubricantritesh singhNo ratings yet

- Merton Truck CompanyDocument16 pagesMerton Truck CompanyAmeeno Pradeep PaulNo ratings yet

- Three Squirrels and A Pile of NutsDocument4 pagesThree Squirrels and A Pile of NutsinmaillanNo ratings yet

- Case Analysis Rosemont Hill Health Center V3 PDFDocument8 pagesCase Analysis Rosemont Hill Health Center V3 PDFPoorvi SinghalNo ratings yet

- ME - End Term Answer KeyDocument7 pagesME - End Term Answer KeyShubham Agarwal50% (2)

- SFRLO SecB Group1 v2Document9 pagesSFRLO SecB Group1 v2Priyanka Kambli100% (1)

- Solution of Rachna BoutiqueDocument5 pagesSolution of Rachna BoutiqueShashank Patel100% (1)

- KCPL's Strategic Options to Overcome ChallengesDocument4 pagesKCPL's Strategic Options to Overcome ChallengesSaikarthik ANo ratings yet

- SectionA Group 3 RAOBDA ReportDocument7 pagesSectionA Group 3 RAOBDA ReportIsha ChaudharyNo ratings yet

- C1 - Rosemont MANAC SolutionDocument13 pagesC1 - Rosemont MANAC Solutionkaushal dhapare100% (1)

- Case Study: RajnigandhaDocument10 pagesCase Study: RajnigandhaUdit Varshney0% (1)

- Session-15 - Process of Business EthicsDocument28 pagesSession-15 - Process of Business EthicsJithu JoseNo ratings yet

- Proctor & Gamble in India:: Gap in The Product Portfolio?Document6 pagesProctor & Gamble in India:: Gap in The Product Portfolio?Vinay KumarNo ratings yet

- EC2101 Practice Problems 8 SolutionDocument3 pagesEC2101 Practice Problems 8 Solutiongravity_coreNo ratings yet

- Assignment 2Document5 pagesAssignment 2Vishal Gupta100% (1)

- CAN Submission-Unilever in India: Hindustan Lever's Project Shakti - Marketing FMCG To The Rural ConsumerDocument3 pagesCAN Submission-Unilever in India: Hindustan Lever's Project Shakti - Marketing FMCG To The Rural ConsumerRitik MaheshwariNo ratings yet

- Ch10solution ManualDocument31 pagesCh10solution ManualJyunde WuNo ratings yet

- Cottle Taylor Student WorksheetDocument6 pagesCottle Taylor Student WorksheetChakri MunagalaNo ratings yet

- Daud Engine Parts CompanyDocument3 pagesDaud Engine Parts CompanyJawadNo ratings yet

- Case Study Analysis - ScorpioDocument8 pagesCase Study Analysis - Scorpiosubhadip100% (1)

- Planning The Product Mix at Panchtantra CorporationDocument14 pagesPlanning The Product Mix at Panchtantra CorporationNRLDCNo ratings yet

- Q3 Management AccountingDocument2 pagesQ3 Management AccountingSHREYA UNNIKRISHNAN PGP 2019-21 BatchNo ratings yet

- Group 4 Symphony FinalDocument10 pagesGroup 4 Symphony FinalSachin RajgorNo ratings yet

- Managing Business Markets - Case Analysis of IndiaMART's GoalsDocument2 pagesManaging Business Markets - Case Analysis of IndiaMART's GoalsCH NAIRNo ratings yet

- Clean RazorDocument7 pagesClean RazorAaryan AgrawalNo ratings yet

- Hospital Supply Inc.Document4 pagesHospital Supply Inc.alomelo100% (2)

- Boots Hair Care AnalysisDocument2 pagesBoots Hair Care AnalysisAmitNo ratings yet

- Boston CreameryDocument11 pagesBoston CreameryJelline Gaza100% (3)

- DMOP Homework 1 Q6Document1 pageDMOP Homework 1 Q6khushi kumariNo ratings yet

- Classic Pen Company Costing Analysis CaseDocument4 pagesClassic Pen Company Costing Analysis CasemokotoNo ratings yet

- ME Problem Set-2Document2 pagesME Problem Set-2Laxman KeshavNo ratings yet

- WorkingGroup - A1 - Ingersoll Rand (A)Document5 pagesWorkingGroup - A1 - Ingersoll Rand (A)Apoorva SharmaNo ratings yet

- Inventory ProblemsDocument6 pagesInventory ProblemsSubhrodeep DasNo ratings yet

- Mid-Term Question Paper Set - 1Document17 pagesMid-Term Question Paper Set - 1Archisha Srivastava0% (1)

- Merton Truck Company - Case AnalysisDocument11 pagesMerton Truck Company - Case AnalysisNagarajNadig71% (7)

- Baldwin Case Analysis - Kanupriya ChaudharyDocument4 pagesBaldwin Case Analysis - Kanupriya ChaudharyKanupriya ChaudharyNo ratings yet

- Managerial Economics Indian School of Business Homework: S B R D B K R KDocument2 pagesManagerial Economics Indian School of Business Homework: S B R D B K R KPriyanka JainNo ratings yet

- Ingersoll Rand Case StudyDocument12 pagesIngersoll Rand Case StudyRockShawNo ratings yet

- Quality Control - Homework 5: Madhava Reddy Yenimireddy - M07579553Document18 pagesQuality Control - Homework 5: Madhava Reddy Yenimireddy - M07579553PraneethGoverdhana75% (4)

- Baldwin Bicycle Company Case AnalysisDocument12 pagesBaldwin Bicycle Company Case AnalysisSamrat KaushikNo ratings yet

- BMW Is The Ultimate Driving MachineDocument2 pagesBMW Is The Ultimate Driving Machinejoumana samaraNo ratings yet

- LP Formulation - Alpha Steels - Hiring Temp Workers To Minimise CostDocument3 pagesLP Formulation - Alpha Steels - Hiring Temp Workers To Minimise CostGautham0% (1)

- Alberta Gauge Company CaseDocument2 pagesAlberta Gauge Company Casenidhu291No ratings yet

- Davey MukullDocument6 pagesDavey MukullMukul Kumar SinghNo ratings yet

- Abhishek 2 - Asset Id 1945007Document3 pagesAbhishek 2 - Asset Id 1945007Abhishek SinghNo ratings yet

- Operations Management-II End Term Paper 2020 IIM IndoreDocument14 pagesOperations Management-II End Term Paper 2020 IIM IndoreRAMAJ BESHRA PGP 2020 Batch100% (2)

- "Sands Corporation": Managerial Communication - IDocument6 pages"Sands Corporation": Managerial Communication - IMUGHALU K YEPTHONo ratings yet

- Case-American Connector CompanyDocument9 pagesCase-American Connector CompanyDIVYAM BHADORIANo ratings yet

- Strategic Cost Management Berkshire Threaded Fasteners Case AnalysisDocument12 pagesStrategic Cost Management Berkshire Threaded Fasteners Case AnalysisAbhiroop SenNo ratings yet

- Bill French Case - FINALDocument6 pagesBill French Case - FINALdamanfromiran0% (1)

- Chapter 7Document10 pagesChapter 7Eki OmallaoNo ratings yet

- Chapter 6 Coverage of Learning Objectives and Relevant DecisionsDocument72 pagesChapter 6 Coverage of Learning Objectives and Relevant Decisionsmanunited83100% (1)

- HorngrenIMA14eSM ch05Document65 pagesHorngrenIMA14eSM ch05manunited83100% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMayank singhNo ratings yet

- Chapter 07 Solutions ManualDocument12 pagesChapter 07 Solutions ManualImroz MahmudNo ratings yet

- @RTA Market PsychologyDocument10 pages@RTA Market PsychologyPerfect Seboke100% (1)

- Vivek Personal Sector-9: Opening Balance 336632.00Document4 pagesVivek Personal Sector-9: Opening Balance 336632.00Nidhi Aggarwal SinghalNo ratings yet

- Hair-Save Unhairing Methods in Leather ProcessingDocument37 pagesHair-Save Unhairing Methods in Leather ProcessingdavidberarNo ratings yet

- Husqvarna/Viking Eden Rose 250C Sewing Machine Instruction ManualDocument48 pagesHusqvarna/Viking Eden Rose 250C Sewing Machine Instruction ManualiliiexpugnansNo ratings yet

- Panamao Rhu 2024 AopDocument206 pagesPanamao Rhu 2024 AopfatimaraaysaNo ratings yet

- Waltham Motors CaseDocument2 pagesWaltham Motors CasetclarkskyNo ratings yet

- Member List 2021 22 (South - Zone)Document33 pagesMember List 2021 22 (South - Zone)Business PartnerzNo ratings yet

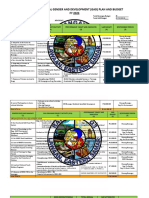

- Barangay Annual Gender and Development (Gad) Plan and Budget FY 2023Document3 pagesBarangay Annual Gender and Development (Gad) Plan and Budget FY 2023Joy Tiozon100% (2)

- Semira - Kuku - Mba 502-3-2 Final Project.Document3 pagesSemira - Kuku - Mba 502-3-2 Final Project.Eric WogbeNo ratings yet

- Acuerdo de Comisión Techking Begatell 2020.11.05Document4 pagesAcuerdo de Comisión Techking Begatell 2020.11.05Jenn medinaNo ratings yet

- Jurnal PerizinanDocument31 pagesJurnal PerizinanRifky RifkyNo ratings yet

- Slide Perkenalan HO v.7 - PaK WelliDocument15 pagesSlide Perkenalan HO v.7 - PaK WelliWahyu NursitahNo ratings yet

- Shampoo BarDocument1 pageShampoo BarrezaNo ratings yet

- Classical Growth Theory PPT 2nd ChapterDocument50 pagesClassical Growth Theory PPT 2nd Chapterchhapoliaa2001No ratings yet

- General Insurance Strategy 2024Document11 pagesGeneral Insurance Strategy 2024Fakhriy Wibowo EdriatamaNo ratings yet

- Final Pre Board Plumbing Design Installation SanitationDocument19 pagesFinal Pre Board Plumbing Design Installation SanitationJahara CanutoNo ratings yet

- Fin Pid GnalDocument113 pagesFin Pid GnalVijay GuptaNo ratings yet

- Subscription Agreement DetailsDocument2 pagesSubscription Agreement Detailsjohn godinezNo ratings yet

- Cost Accounting 2 Answer To Cost Accoutning - CompressDocument36 pagesCost Accounting 2 Answer To Cost Accoutning - CompressjommaetiNo ratings yet

- Basic Engineering Economy PrinciplesDocument10 pagesBasic Engineering Economy PrinciplesCarmela Andrea BuenafeNo ratings yet

- Volume 1 Solids ControlDocument232 pagesVolume 1 Solids ControlFranklin NarvaezNo ratings yet

- Microeconomics BBA Chapter-1,2&3Document261 pagesMicroeconomics BBA Chapter-1,2&3Debjoyti GhoshNo ratings yet

- Historical Development of The Strategic Management ConceptDocument7 pagesHistorical Development of The Strategic Management ConceptPriyaranjan100% (5)

- International Economics 4th Edition Feenstra Solutions Manual DownloadDocument15 pagesInternational Economics 4th Edition Feenstra Solutions Manual DownloadJane Wright100% (22)

- Data & Perhitungan Penjualan Tenaga Listrik Januari 2020Document1 pageData & Perhitungan Penjualan Tenaga Listrik Januari 2020Prameswari TaskushopNo ratings yet

- The Product Strategy PlaybookDocument62 pagesThe Product Strategy PlaybookSachin BansalNo ratings yet

- Acc Report Cirrus Operating CostsDocument17 pagesAcc Report Cirrus Operating CostsDumitruNo ratings yet

- Project 1Document20 pagesProject 1pandurang parkarNo ratings yet