Professional Documents

Culture Documents

SMU BBA Semester 4 Spring 2012 Drive Solved Assignments

Uploaded by

Rajdeep KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SMU BBA Semester 4 Spring 2012 Drive Solved Assignments

Uploaded by

Rajdeep KumarCopyright:

Available Formats

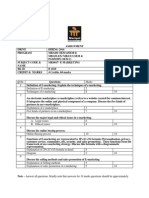

Spring/Feb 2012 BBA Semester 4 BB0017 Financial Reporting Assignment Set- 1 (30 Marks)

Q1. Which stakeholders require financial reports and why? Classification of Users of Financial Statements The various users of financial statements are classified and detailed as follows: Users of Accounting Information Accounting reports are designed to meet the common information needs of most decision makers. These decisions include when to buy, hold or sell the enterprise shares. It assesses the ability of the enterprise to pay its employees, determine distributable profits and regulate the activities of the enterprise. Investors and lenders are the most obvious users of accounting information. a) Investors: Investors may be broadly classified as retail investors, high net worth individuals, Institutional investors both domestic and foreign. As chief provider of risk capital, investors are keen to know both the return from their investments and the associated risk. Potential investors need information to judge prospects for their investments. b) Lenders: Banks, Financial Institutions and debenture holders are the main lenders and they need information about the financial stability of the borrower enterprise. They are interested in information that would enable them to determine whether their borrower has the capability to repay the loans along with the interest due on it. They also use the information for monitoring the financial condition of the borrowers. They may stipulate certain restrictions (known as covenants) such as upper limit on the total debt borrowed from all sources or ask for additional security etc. Short term lenders (trade creditors) who provide short term financial support need information to determine whether the amount owing to them will be paid when due and whether they should extend, maintain or restrict the flow of credit. c) Regulators, Rating Agencies and Security Analyst: Investors and creditors seek the assistance of information specialist in assessing prospective returns. Equity analyst, bond analyst and credit rating agencies offer a wide range of information in the form of answering queries on television shows, providing trends in business newspapers on a particular stock, offer valuable information in seminars, discussion groups, meetings and interviews. Security analyst obtain valuable information including insider information by means of face-to-face meetings with the company officials, visit their premises and make constant enquiry using emails, teleconference and video conference. Firms build a good rapport with such type of information seekers to gain visibility in the market.

d) Management: Management needs information to review the firms short term solvency and long term solvency. It has to ensure effective utilization of its resources, profitability in terms of turnover and investment. It has to decide upon the course of action to be taken in future. Management may also be interested in acquiring other business which is undervalued. When managers receive a commission or bonus related to profit or other accounting measures, they have a natural interest in understanding how those numbers are computed. Further when faced with a hostile takeover attempt, they communicate additional financial information with a view to boosting the firms stock price. e) Employees, Trade Union and Tax authorities: Employees are keen to know about the general health of the organization in terms of stability and profitability. Current employees have a natural interest in the financial condition of the firm as their compensation will depend on the financial performance of the firm. Potential employees may use financial information to find out the future prospects of the firm. Trade unions use financial reports for negotiating wage package, declaration of bonus and other benefits. Tax authorities need information to assess the tax liability of the firm. f) Customers: Customers have an interest in the accounting information about the continuation of company especially when they have established a long term involvement with or are dependent on the company. For Eg. Car owners, buyers of white goods, electronic gadgets, depend on the manufacturer for warranty service support, continued supply of spare parts. The sales of Matiz car was badly affected due to the abrupt closure of Daewoo Motors. g) Government and regulatory agencies: Government and the regulatory agencies require information to obtain timely and correct information, to regulate the activities of the enterprise if any. They seek information when tax laws need to be amended, to provide institutional support to the lagging industries. The regulatory agencies use financial reports to take action against the firm when appropriate returns are not filed in time or when the returns fails to provide true and fair position of the business or to take appropriate action against the firm when complaints / misappropriation are being lodged. Stock exchange has a legitimate interest in financial reports of publicly held enterprise to ensure efficient operation of capital market. h) The Public: Every firm has a social responsibility. Firms depend on local economy to meet their varied needs. They may get patronage from local government in the form of capital subsidy, cheap land or tax sops in the form of tax holidays for certain period of time. Prosperity of the enterprise may lead to prosperity of the economy both directly and indirectly. Growth in software industry in Bangalore, Karnataka State, led to boom in housing sector, education sector, entertainment sector, travel sector and tourism sector in and around Bangalore. Published financial statement assist public by providing information about the trends and recent developments of the firm. Brief List of Users of Financial Statements

1. Existing equity investors and lenders, to monitor their investments and to evaluate the performance of management.

2. Prospective equity investors and lenders, to decide whether or not to invest. 3. Investment analysts, money managers, and stockbrokers, to make buy/sell/hold recommendations to their clients. 4. Rating agencies (such as Moody's, Standard & Poor's, and Dun & Bradstreet), to assign credit ratings. 5. Major customers and suppliers, to evaluate the financial strength and staying power of the company as a dependable resource for their business. 6. Labor unions, to gauge how much of a pay increase a company is able to afford in upcoming labor negotiations. 7. Boards of directors, to review the performance of management. 8. Management to assess 9. Corporate raiders, to seek hidden value in companies with under priced stock. 10. Competitors, to benchmark their own financial results. 11. Potential competitors, to assess how profitable it may be to enter an industry. 12. Government agencies responsible for taxing, regulating, or investigating the company. 13. Politicians, lobbyists, issue groups, consumer advocates, environmentalists, think tanks, foundations, media reporters, and others who are supporting or opposing any particular public issue the company's actions affect. 14. Actual or potential joint venture partners, franchisors or franchisees, and other business interests who need to know about the company and its financial situation.

Q.2 Write a brief note on the investment details required in the B/S. Balance Sheet shows the sources from which funds currently used to operate the business have been obtained (i.e. liabilities and owners equity) and the types of property and property rights, in which these funds are currently locked up (i.e. assets). Balance Sheet may be considered as a summarised sheet of balances remaining in the books of accounts, after the preparation of the Profit and Loss Account. Thus a Balance Sheet can be rightly called as a statement of position of an enterprise, as it indicates what the business owns and what it owes on a particular date. The things that the business owns are called Assets and the various sums of money that it owes are called liabilities (including that of the owners). The term Balance Sheet comes from the fact that the total assets must be equal to total liabilities, they balance each other. The liabilities side shows the various sources from which money was made available for the assets and the assets side shows the way those funds were employed in the business. As we have seen earlier, a balance sheet is so called because its two sides must always balance, i.e., the assets must be equal to the liabilities plus owners funds. This can be expressed in the form of an equation. Assets = Liabilities + net Capital

Classification of Assets and Liabilities The assets and liabilities are classified and listed under different heads in the Balance Sheet. Similar assets and similar equities or liabilities are grouped together on the basis of their nature and characteristics in order to make comparison of items within a group or category simpler. Some of the more commonly used categories are as under: Liabilities Proprietor Funds Long-term Liabilities Current Liabilities Other Liabilities Classification of Assets 1) Fixed Assets Fixed Assets are called long-term assets. They do not flow through the cash cycle of business within one year or the normal operating cycle. They are major sources of revenue to the business. They do not vary day in and day out due to routine business transactions. They are intended for long-term use in the business. They are called bundle of future services or Sunk Costs. Assets Fixed Assets Current Assets Other Assets

The group of fixed assets consist of the following: a) Land. b) Buildings. c) Plant and Machinery. d) Transportation Equipment, e) Furniture, f) Other long-term Assets. g) Intangible Assets such as patents, copyrights, goodwill, etc.

Classification of Fixed Assets a) Tangible movable assets b) Tangible immovable assets and c) Intangible assets a) Tangible movable assets are the assets which can be seen, touched and moved from one place to another place. Plant and machinery, furniture and fixtures, transportation equipments etc. are tangible movable assets. b) Tangible immovable assets are the assets which can be seen and touched but cannot be moved from one place to another place. Such assets include land, buildings, mines, oil wells, etc. c) Intangible assets are the assets which cannot be seen and touched. However, their existence can only be imagined such as patents, trade marks, copyrights, goodwill, etc. Their existence is very important for the business. Intangible assets have several characteristics. Characteristics of an Intangible Asset Intangible Asset a) Enables business managers to attain the goals of profitability. b) Is long term in nature, and whose benefit is available to the business for more than the current accounting period. c) Has a determinable acquisition cost, except in the case of self generated assets.

d) Is used in conducting business activities, and e) Provides certain rights or privileges to the business. Fixed assets are presented in the Balance Sheet at cost or as Gross block less accumulated depreciation to date. Gross Block less depreceation is called as net fixed assets or Net Block of depreciable fixed assets. 2) Investments Investments may be short-term and long-term. Short-term investments are marketable securities and they represent temporary investments of idle funds. These investments can be disposed off by the company at its own will at any time. Investments are shown at cost. Cost includes brokerage, fees and all other expenses incurred on acquisition of investments. However, the market value is shown by way of a note to Balance Sheet. Long-term investments are held for long time. They are required to be held by the very nature of business. Here the intention of the investor is to retain the securities for a longer period of time. For example, a company engaged in generating electricity may be required to hold the bonds of the Electricity Board. These bonds are retained by the company so long as the company uses electric power. 3) Current Assets and Quick Assets Current Assets Current Assets include cash, assets that are likely to become or converted into cash, or assets that are otherwise consumed in the normal process or within one year from the balance sheet date (or within the normal operating business cycle, if it is longer than one year) and the cash thus generated is available to pay current liabilities. Current assets are not intended for long-term use in business. Current assets represent employment of money by the company on a short-term basis. They are also called Circulating Assets as one item becomes another; they circulate within the group. For example, cash becomes raw material when material is purchased, material becomes finished goods, and finished goods become cash or debtors when sold and so on. Usually, the following assets are classified as current assets: a) Cash balance, b) Bank balance c) Short term investments d) Debtors e) Inventory (Stock of Raw materials, semi-finished goods, finished goods, stores and spares)

f) Expenses paid in advance. In fact, total current assets are known as Gross Working Capital. Current assets less current liabilities are known as net working capital. Quick Assets These assets are known as near cash assets. In other words, quick assets are those which can be converted into cash quickly. Therefore, they are also known as liquid assets. Cash and bank balances are the most liquid assets, Debtors and cash advances can be converted into cash at a short notice. Therefore, they are also regarded as quick assets. Marketable investments can be converted into cash, fall into the category of quick assets. Inventory does not fall in this category of quick assets, since it cannot be converted into cash quickly, as material is to be converted into saleable goods and then only they should be sold. If sale is on credit, there is a further delay in realization. Quick assets are current assets less inventories and prepaid expenses. Nature of Current Assets 1. Cash on hand Cash in the balance sheet includes coins, currency, cheques, pay orders, money on deposit in banks, postage stamps, stamp papers, etc. 2. Bank balances As per the requirements of Indian Companies Act, 1956, bank balance has to be disclosed in the balance sheet as under:

Bank Balances: a) With scheduled banks. b) With others.

Q3. From the internet or from other sources find an Annual Report of a listed company and list out in sequence the content titles, the schedules and the annexure. Write a brief note on why do you think they are required.

Remaining answers are available in the full assignments.

For full assignments contact us:

Global Education

Rajdeep: 098662 48187 / 077958 40110

Email: support@smuassignments.com / global.education_smu@yahoo.in Website: www.smuassignments.com

The diagonally marked watermark (Sample Assignment of smuassignments.com) will not appear in the paid assignments.

You might also like

- 597183Document2 pages597183Smu DocNo ratings yet

- Sample MBA Sem2 Fall 2015Document4 pagesSample MBA Sem2 Fall 2015Rajdeep KumarNo ratings yet

- Project Guidelines For BBA - SMUDocument9 pagesProject Guidelines For BBA - SMURahul DewanNo ratings yet

- 597183Document1 page597183Smu DocNo ratings yet

- Sample SMU MBA Sem4 Fall 2015Document4 pagesSample SMU MBA Sem4 Fall 2015Rajdeep KumarNo ratings yet

- Solved Assignments of SMU BBA Semester 1 Spring 2015Document4 pagesSolved Assignments of SMU BBA Semester 1 Spring 2015Rajdeep KumarNo ratings yet

- Sample SMU MBA Sem3 Fall 2015Document4 pagesSample SMU MBA Sem3 Fall 2015Rajdeep KumarNo ratings yet

- Solved Assignments of SMU BBA Semester 3 Spring 2015Document3 pagesSolved Assignments of SMU BBA Semester 3 Spring 2015Rajdeep Kumar0% (1)

- BBA203 Financial AccountingDocument3 pagesBBA203 Financial AccountingRajdeep KumarNo ratings yet

- Solved Assignments of SMU MBA Semester 3 Spring 2015Document4 pagesSolved Assignments of SMU MBA Semester 3 Spring 2015Rajdeep KumarNo ratings yet

- BBA201 Research MethodsDocument1 pageBBA201 Research MethodsRajdeep KumarNo ratings yet

- Solved Assignments of SMU BBA Semester 2 Spring 2015Document3 pagesSolved Assignments of SMU BBA Semester 2 Spring 2015Rajdeep KumarNo ratings yet

- SMU BBA Semester 2 Summer 2014 AssignmentDocument4 pagesSMU BBA Semester 2 Summer 2014 AssignmentRajdeep KumarNo ratings yet

- Solved Assignments of SMU MBA Semester 2 Spring 2015Document4 pagesSolved Assignments of SMU MBA Semester 2 Spring 2015Rajdeep KumarNo ratings yet

- Solved Assignments of SMU MBA Semester 1 Spring 2015Document3 pagesSolved Assignments of SMU MBA Semester 1 Spring 2015Rajdeep KumarNo ratings yet

- Solved Assignments of SMU MBA Semester 4 Summer 2014 Are Available.Document3 pagesSolved Assignments of SMU MBA Semester 4 Summer 2014 Are Available.Rajdeep KumarNo ratings yet

- Solved Assignments of SMU MBA Semester 4 Spring 2015Document3 pagesSolved Assignments of SMU MBA Semester 4 Spring 2015Rajdeep KumarNo ratings yet

- Solved Assignments of SMU MBA Semester 3 Summer 2014 Are Available.Document4 pagesSolved Assignments of SMU MBA Semester 3 Summer 2014 Are Available.Rajdeep KumarNo ratings yet

- Solved Assignments of SMU MBA Semester 1 Summer 2014 Are Available.Document4 pagesSolved Assignments of SMU MBA Semester 1 Summer 2014 Are Available.Rajdeep KumarNo ratings yet

- Solved Assignments of SMU MBA Semester 2 Summer 2014 Are Available.Document4 pagesSolved Assignments of SMU MBA Semester 2 Summer 2014 Are Available.Rajdeep KumarNo ratings yet

- Solved Assignments of SMU BBA Semester 1 Summer 2014 Are Available.Document4 pagesSolved Assignments of SMU BBA Semester 1 Summer 2014 Are Available.Rajdeep KumarNo ratings yet

- SMU MBA Semester 1 Spring 2014 Solved AssignmentsDocument3 pagesSMU MBA Semester 1 Spring 2014 Solved AssignmentsRajdeep KumarNo ratings yet

- SMU BBA Semester 5 Spring 2014 Solved AssignmentsDocument4 pagesSMU BBA Semester 5 Spring 2014 Solved AssignmentsRajdeep KumarNo ratings yet

- SMU MBA Semester 3 Spring 2014 Solved AssignmentsDocument4 pagesSMU MBA Semester 3 Spring 2014 Solved AssignmentsRajdeep KumarNo ratings yet

- SMU MBA Semester 2 Spring 2014 Solved AssignmentsDocument3 pagesSMU MBA Semester 2 Spring 2014 Solved AssignmentsRajdeep KumarNo ratings yet

- SMU BBA Semester 1 Spring 2014 AssignmentsDocument3 pagesSMU BBA Semester 1 Spring 2014 AssignmentsRajdeep KumarNo ratings yet

- MK0017Document2 pagesMK0017Rajdeep KumarNo ratings yet

- SMU MBA Semester 4 Spring 2014 Solved AassignmentsDocument3 pagesSMU MBA Semester 4 Spring 2014 Solved AassignmentsRajdeep KumarNo ratings yet

- MK0018Document2 pagesMK0018Rajdeep KumarNo ratings yet

- SMU MBA Sem1 Summer 2013 Sooved AssignmentDocument4 pagesSMU MBA Sem1 Summer 2013 Sooved AssignmentRajdeep KumarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Vapor Sensor: Installation GuideDocument12 pagesVapor Sensor: Installation GuideShalvaTavdgiridzeNo ratings yet

- Cummins 6cta8.3 Engine Spare Parts CatalogDocument11 pagesCummins 6cta8.3 Engine Spare Parts CatalogChen CarolineNo ratings yet

- Citizen PTR Receipt (2023-2024)Document1 pageCitizen PTR Receipt (2023-2024)AnmolBansalNo ratings yet

- Piaggio Liberty 100 Indonesia MY 2011 (EN)Document179 pagesPiaggio Liberty 100 Indonesia MY 2011 (EN)Manualles67% (3)

- 2022 HeadformsDocument2 pages2022 Headformsachrafkaniki11No ratings yet

- NSCP CoeDocument6 pagesNSCP CoeMichael CardenasNo ratings yet

- 48V100 DatasheetDocument2 pages48V100 Datasheetmrashid286100% (1)

- MS E-603 07/21_V1 High Performance Epoxy CoatingDocument1 pageMS E-603 07/21_V1 High Performance Epoxy CoatingchengkkNo ratings yet

- Faiq ResumeDocument3 pagesFaiq ResumeFoudziah SarinNo ratings yet

- 900 Old Koenig Package - Vertical PDFDocument30 pages900 Old Koenig Package - Vertical PDFmichael zNo ratings yet

- Cash Reserve Ratio: Economics Project by Ayush Dadawala and Suradnya PatilDocument14 pagesCash Reserve Ratio: Economics Project by Ayush Dadawala and Suradnya PatilSuradnya PatilNo ratings yet

- DRDO recruitment for scientists in remote areasDocument7 pagesDRDO recruitment for scientists in remote areasselva mechNo ratings yet

- Dow Corning Success in ChinaDocument24 pagesDow Corning Success in ChinaAnonymous lSeU8v2vQJ100% (1)

- EN - 1.2 Introduction To Entrepreneurship TestDocument4 pagesEN - 1.2 Introduction To Entrepreneurship TestMichelle LiwagNo ratings yet

- International Tax Transfer Pricing MethodsDocument17 pagesInternational Tax Transfer Pricing MethodsAshish pariharNo ratings yet

- IGCSE Syllabus Checklist - ICT (0417)Document15 pagesIGCSE Syllabus Checklist - ICT (0417)Melissa Li100% (1)

- Skse ReadmeDocument3 pagesSkse ReadmeJayseDVSNo ratings yet

- En PLC InterfaceDocument2 pagesEn PLC InterfaceBsd FareedNo ratings yet

- 03 - TechVision Digital Transformation RequiresDocument25 pages03 - TechVision Digital Transformation RequiresPaulo DantinoNo ratings yet

- Gear Box ReportDocument39 pagesGear Box ReportNisar HussainNo ratings yet

- ABI BrochureDocument2 pagesABI BrochureMartin EscolaNo ratings yet

- Saleslist 5Document43 pagesSaleslist 5scribd495No ratings yet

- Work Based Career Episodes 3Document3 pagesWork Based Career Episodes 3Ajith JohnsonNo ratings yet

- OBLICON REVIEWER Article 1162Document1 pageOBLICON REVIEWER Article 1162Oh SeluringNo ratings yet

- Bus. Plan Template EditedDocument4 pagesBus. Plan Template EditedLovely magandaNo ratings yet

- SPE-176481-MS Deep Water Reservoir Characterization and Its Challenges in Field Development Drilling Campaign, Kutei Basin, Indonesia-A Case StudyDocument16 pagesSPE-176481-MS Deep Water Reservoir Characterization and Its Challenges in Field Development Drilling Campaign, Kutei Basin, Indonesia-A Case StudyDian KurniawanNo ratings yet

- Geology 554 - Interpretation Project Big Injun Sand, Trenton/Black River Plays, Central Appalachian Basin, WV Lab Exercise-Part 3Document17 pagesGeology 554 - Interpretation Project Big Injun Sand, Trenton/Black River Plays, Central Appalachian Basin, WV Lab Exercise-Part 3Abbas AbduNo ratings yet

- Chapter 03 - Coding in The SAPScript EditorDocument25 pagesChapter 03 - Coding in The SAPScript EditorLukas CelyNo ratings yet