Professional Documents

Culture Documents

Multiple Choice at The End of Lecture

Uploaded by

Oriana LiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Multiple Choice at The End of Lecture

Uploaded by

Oriana LiCopyright:

Available Formats

Ch 9 1. Unsophisticated capital budgeting techniques do NOT: A) use net profits as a measure of return.

B) explicitly consider the time value of money. C) take into account an unconventional cash flow pattern. D) examine the size of the initial outlay. 2. Among the reasons many firms use the payback period as a guideline in capital investment decisions are all of the following EXCEPT: A) it is easy to calculate. B) it gives an implicit consideration to the timing of cash flows. C) it is a measure of risk exposure. D) it recognises cash flows which occur after the payback period. 3. The minimum return that must be earned on a project to leave the firm's market value unchanged is all of the following EXCEPT: A) average rate of return. B) discount rate. C) cost of capital. D) opportunity cost. 4. A firm would accept a project with a net present value of zero because: A) the return on the project would be zero. B) the return on the project would be positive. C) the project would enhance the wealth of the firm's owners. D) the project would maintain the wealth of the firm's owners. 5. The __________ is the discount rate that equates the present value of the cash inflows with the initial investment. A) payback period B) internal rate of return C) average rate of return D) cost of capital 6. The underlying cause of conflicts in ranking for projects by internal rate of return and net present value methods is: A) that neither method explicitly considers the time value of money. B) the reinvestment rate assumption regarding intermediate cash flows. C) the assumption made by the NPV method that intermediate cash flows are reinvested at the internal rate of return. D) the assumption made by the IRR method that intermediate cash flows are reinvested at the cost of capital. Ch 10 1. The analysis of project risk can involve the use of any the following EXCEPT: A) sensitivity analysis.

B) psychological analysis C) simulation analysis. D) scenario analysis. 2. The risk-adjusted discount rate (RADR) reflects: A) diversifiable risk B) average rate of return C) the return that must be earned on the given project to compensate the firm's owners adequately according to the project's variability of cash flows. D) the cost of capital 3. A project that has a coefficient of variation greater than zero will have a riskadjusted discount rate (RADR): A) less than the risk-free rate of return. B) equal to the risk-free rate of return. C) not related to the risk-free rate of return. D) greater than the risk-free rate of return. 4. It has been found that the value of the shares of companies whose shares are traded publicly in an efficient marketplace is: A) generally positively affected by diversification, because of the reduction in risk. B) generally not affected by diversification, unless greater returns are expected. C) generally negatively affected by diversification, because of the increase in the required rate of return. D) generally negatively affected by diversification, because of the increase in risk. 5. Mutually exclusive projects with unequal lives should be evaluated using the: A) net present value (NPV). B) annualised net present value approach (ANPV). C) internal rate of return (IRR). D) certainty equivalent (CE) approach. 6. A drawback of the IRR approach to capital rationing is: A) it fails to identify the group of acceptable projects. B) there is no guarantee that the projects accepted will maximise total dollar returns and therefore owners' wealth. C) it fails to incorporate the cost of capital into the analysis. D) it graphs projects in ascending order against total dollar investment. Ch11 1. The four basic sources of long-term funds for the firm are: A) current liabilities, long-term debt, ordinary shares and preference shares. B) current liabilities, long-term debt, ordinary shares and retained earnings. C) long-term debt, ordinary shares, preference shares and retained earnings. D) long-term debt, accounts payable, ordinary shares and retained earnings. 2. The firm's optimal mix of debt and equity is called its:

A) target capital structure. B) maximum book value. C) optimal ratio. D) maximum wealth. 3. Generally, the order of cost, from the least expensive to the most expensive, for long-term capital of a company is: A) preference share capital, retained earnings, ordinary share equity capital, new ordinary share equity capital. B) ordinary share equity capital, preference share capital, long-term debt, short-term debt. C) new ordinary share equity capital, retained earnings, preference share capital, long-term debt. D) long-term debt, preference share capital, retained earnings, new ordinary share equity capital. 4. A firm has issued preference shares at $250 per share par value. The shares will pay a $30 annual dividend per share. The cost of issuing and selling the shares was $8 per share. The cost of preference share capital is: A) 12.4 per cent. B) 7.2 per cent. C) 12 per cent. D) 15 per cent. 5. If a company has an average tax rate of 40 per cent, the approximate annual aftertax cost of debt for a 15-year, 12 per cent, $10,000 par value bond, selling at $9,500, is: A) 12.65 per cent. B) 5 per cent. C) 7.6 per cent. D) 12 per cent. 6. The cost of each type of capital depends on: A) the business risk of the firm. B) the financial risk of the firm. C) the risk-free cost of that type of funds. D) all of the above Ch 13 1. A firm's operating break-even point is sensitive to all of the following variables EXCEPT: A) fixed operating costs. B) sales price per unit. C) variable operating cost per unit. D) interest payment.

2. A firm has fixed operating costs of $10 000 000, the sale price per unit of its product is $25000, and its variable cost per unit is $15 000. The firm's operating break-even point in units is__________ and its break-even point in dollars is: A) 667; $16 675 000 B) 400; $10 000 000 C) 250; $6 250 000 D) 1 000; $25 000 000 3. __________ is the potential use of fixed costs, both operating and financial, to magnify the effect of changes in sales on the firm's earnings per share. A) Operating leverage B) Total leverage C) Financial leverage D) Debt service 4. A firm has fixed operating costs of $650 000, a sales price per unit of $20, and a variable cost per unit of $13. At a base sales level of 500 000 units, the firm's degree of operating leverage is: A) 1.23 B) 1.18 C) 1.07 D) 1.11 5. The cost of debt financing results from: A) the increased probability of bankruptcy caused by debt obligations. B) the costs associated with managers having more information about the firm's prospects than do investors. C) the agency costs of the lenders monitoring and controlling the firm's actions. D) all of the above. 6. In the EBIT-EPS approach to capital structure, a constant level of EBIT is assumed: A) to emphasise the relationship between interest expenses and taxes. B) to ease the calculations of owners' equity. C) to concentrate on the effect of revenue and expenses on capital structure decisions. D) to isolate the impact on returns of the financing costs associated with alternative capital structures. Ch 14 1. In working capital management, risk is measured by the probability that a firm will become: A) technically insolvent. B) liquid. C) less profitable. D) unable to meet long-term obligations. 2. In general, the less working capital a firm has:

A) the lower its risk. B) the less likely are creditors to lend to the firm. C) the lower its level of long-term funds. D) the greater its risk. 3. An decrease in the current asset to total asset ratio has the effects of __________ on profits and __________ on risk. A) a decrease; an increase B) a decrease; a decrease C) an increase; an increase D) an increase; a decrease 4. The economic order quantity method of inventory management: A) minimises the total of order and carrying costs B) is always better than the ABC system. C) is not favoured by financial managers D) none of the above 5. __________ is the amount of assets a credit applicant has available for securing credit. A) Character B) Capital C) Capacity D) Collateral 6. A firm finds that the average collection period has risen from 30 days to 45 days after a relaxation of credit standards. The turnover of accounts receivable has ____________ from ___________ to _____________. A) fallen; 12; 8 B) fallen; 20;12 C) risen; 8; 12 D) risen 12; 20 ch 15 1. The planning and supervision by the firm of the time that elapses between purchase of raw materials and payment to the supplier is called: A) accounts payable management. B) working capital management. C) profitability plan. D) gearing policy. 2 When a firm routinely foregoes all cash discounts it is probably because: A) the firm is in a low-risk position. B) the firm has excessive amounts of current assets. C) the firm is small and lack resources. D) the firm has positive net working capital.

3. If the amount borrowed decreases, then (all things equal) the effective interest rate will: A) increase. B) decrease. C) be unaffected. D) become unstable. 4. Which of the following parties to creating a bill of exchange is the lender? A) Drawer B) Acceptor C) Endorser D) None of the above 5. All the following characteristics make an item unsuited as collateral EXCEPT: A) perishable. B) specialised C) unstable market price D) desirable physical properties 6. A __________ is a short-term, unsecured loan instrument issued by firms with a high credit standing. A) self-liquidating loan B) line of credit C) revolving line of credit D) promissory note

You might also like

- Quiz#2 - Accounting and FinanceDocument11 pagesQuiz#2 - Accounting and Financew.nursejatiNo ratings yet

- A Case Study On Business Mathematics - Assignment PointDocument2 pagesA Case Study On Business Mathematics - Assignment PointJunior PyareNo ratings yet

- Ross 9e FCF SMLDocument425 pagesRoss 9e FCF SMLAlmayayaNo ratings yet

- Chapter 13 MK 2Document5 pagesChapter 13 MK 2Novelda100% (1)

- Making Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelDocument3 pagesMaking Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelMuhammad abdul azizNo ratings yet

- Chapter 3 Valuation and Cost of CapitalDocument92 pagesChapter 3 Valuation and Cost of Capitalyemisrach fikiruNo ratings yet

- Answers To Chapter 7 - Interest Rates and Bond ValuationDocument8 pagesAnswers To Chapter 7 - Interest Rates and Bond ValuationbuwaleedNo ratings yet

- Cost of Capital: Answers To Concepts Review and Critical Thinking Questions 1Document7 pagesCost of Capital: Answers To Concepts Review and Critical Thinking Questions 1Trung NguyenNo ratings yet

- Lecture 4 Index Models 4.1 Markowitz Portfolio Selection ModelDocument34 pagesLecture 4 Index Models 4.1 Markowitz Portfolio Selection ModelL SNo ratings yet

- Chapter 3 - Tutorial - With Solutions 2023Document34 pagesChapter 3 - Tutorial - With Solutions 2023Jared Herber100% (1)

- Questions Chapter 16 FinanceDocument23 pagesQuestions Chapter 16 FinanceJJNo ratings yet

- NBFI-Course Outline-2020Document2 pagesNBFI-Course Outline-2020Umair NadeemNo ratings yet

- Assignment On: Managerial Economics Mid Term and AssignmentDocument14 pagesAssignment On: Managerial Economics Mid Term and AssignmentFaraz Khoso BalochNo ratings yet

- Banking CompaniesDocument68 pagesBanking CompaniesKiran100% (2)

- Making Investment Decisions With The Net Present Value RuleDocument60 pagesMaking Investment Decisions With The Net Present Value Rulecynthiaaa sNo ratings yet

- Formulae Sheets: Ps It Orp S It 1 1Document3 pagesFormulae Sheets: Ps It Orp S It 1 1Mengdi ZhangNo ratings yet

- Hull-OfOD8e-Homework Answers Chapter 03Document3 pagesHull-OfOD8e-Homework Answers Chapter 03Alo Sin100% (1)

- Analyzing Common Stocks: OutlineDocument30 pagesAnalyzing Common Stocks: OutlineHazel Anne MarianoNo ratings yet

- Baye Chap005Document29 pagesBaye Chap005Sagita SimanjuntakNo ratings yet

- Exam 3 February 2015, Questions and Answers Exam 3 February 2015, Questions and AnswersDocument15 pagesExam 3 February 2015, Questions and Answers Exam 3 February 2015, Questions and Answersben yiNo ratings yet

- Digital Notes Financial ManagementDocument89 pagesDigital Notes Financial ManagementDHARANI PRIYANo ratings yet

- TB Chapter08Document79 pagesTB Chapter08CGNo ratings yet

- TUGASDocument13 pagesTUGASAnas SutrinoNo ratings yet

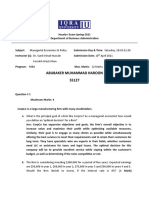

- Abubaker Muhammad Haroon 55127Document4 pagesAbubaker Muhammad Haroon 55127Abubaker NathaniNo ratings yet

- Chapter 7 Asset Investment Decisions and Capital RationingDocument31 pagesChapter 7 Asset Investment Decisions and Capital RationingdperepolkinNo ratings yet

- Cma August 2013 SolutionDocument66 pagesCma August 2013 Solutionফকির তাজুল ইসলামNo ratings yet

- FM Recollected QuestionsDocument8 pagesFM Recollected Questionsmevrick_guyNo ratings yet

- Questio Bank Managerial EconomicsDocument12 pagesQuestio Bank Managerial EconomicsSarthak Bhargava67% (3)

- Chapter 4 Financing Decisions PDFDocument72 pagesChapter 4 Financing Decisions PDFChandra Bhatta100% (1)

- Chapter 19 - Financing and ValuationDocument49 pagesChapter 19 - Financing and Valuationnormalno100% (1)

- BKM Chapter 7Document43 pagesBKM Chapter 7Isha0% (1)

- How To Write A Ratio AnalysisDocument2 pagesHow To Write A Ratio AnalysisLe TanNo ratings yet

- Chap009 - FinalDocument39 pagesChap009 - FinalJhonGodtoNo ratings yet

- CH 12. Risk Evaluation in Capital BudgetingDocument29 pagesCH 12. Risk Evaluation in Capital BudgetingN-aineel DesaiNo ratings yet

- Chapter 06: Dividend Decision: ................ Md. Jobayair Ibna Rafiq.............Document62 pagesChapter 06: Dividend Decision: ................ Md. Jobayair Ibna Rafiq.............Mohammad Salim Hossain0% (1)

- Chapter 24 - Professional Money Management, Alternative Assets, and Industry EthicsDocument48 pagesChapter 24 - Professional Money Management, Alternative Assets, and Industry Ethicsrrrr110000No ratings yet

- Forecasting of Financial StatementsDocument9 pagesForecasting of Financial StatementssamaanNo ratings yet

- Capital Budgeting MethodsDocument3 pagesCapital Budgeting MethodsRobert RamirezNo ratings yet

- Financial Management:: Risk and Return - Capital Market TheoryDocument56 pagesFinancial Management:: Risk and Return - Capital Market TheoryBen OusoNo ratings yet

- R35 Credit Analysis Models - AnswersDocument13 pagesR35 Credit Analysis Models - AnswersSakshiNo ratings yet

- Answers To End-of-Chapter Questions - Part 2: SolutionDocument2 pagesAnswers To End-of-Chapter Questions - Part 2: Solutionpakhijuli100% (1)

- Chap 11 Problem SolutionsDocument46 pagesChap 11 Problem SolutionsNaufal FigoNo ratings yet

- Lecture 7 Adjusted Present ValueDocument19 pagesLecture 7 Adjusted Present ValuePraneet Singavarapu100% (1)

- Fins2624 Online Question Bank CH 15Document28 pagesFins2624 Online Question Bank CH 15AllenRuan100% (3)

- Answers To Midterm 3040ADocument12 pagesAnswers To Midterm 3040ApeaNo ratings yet

- Chapter 11 - Cost of Capital - Text and End of Chapter QuestionsDocument63 pagesChapter 11 - Cost of Capital - Text and End of Chapter QuestionsSaba Rajpoot50% (2)

- Working Capital Practice SetDocument12 pagesWorking Capital Practice SetRyan Malanum AbrioNo ratings yet

- Corporate Finance QuizDocument8 pagesCorporate Finance QuizAditya SinghNo ratings yet

- End of Chapter Exercises: SolutionsDocument4 pagesEnd of Chapter Exercises: SolutionsMichelle LeeNo ratings yet

- Chapter 2Document17 pagesChapter 2jinny6061100% (1)

- Introduction to Accounting and Business FundamentalsDocument147 pagesIntroduction to Accounting and Business Fundamentalsannie100% (1)

- Chapter 7 Chap SevenDocument11 pagesChapter 7 Chap SevenRanShibasaki50% (2)

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Question Bank-MCQ FM&CF (KMBN, KMBA 204)Document27 pagesQuestion Bank-MCQ FM&CF (KMBN, KMBA 204)Amit ThakurNo ratings yet

- FM MCQsDocument58 pagesFM MCQsPervaiz ShahidNo ratings yet

- Sample of The Fin320 Department Final Exam With SolutionDocument10 pagesSample of The Fin320 Department Final Exam With Solutionnorbi113100% (1)

- Capital Budgeting FM2 AnswersDocument17 pagesCapital Budgeting FM2 AnswersMaria Anne Genette Bañez89% (28)

- Fin622 McqsDocument25 pagesFin622 McqsIshtiaq JatoiNo ratings yet

- Chap 012Document39 pagesChap 012lunara_sNo ratings yet

- College of Accountancy & FinanceDocument5 pagesCollege of Accountancy & FinanceCecille GuillermoNo ratings yet

- PAS 33-Earnings Per ShareDocument26 pagesPAS 33-Earnings Per ShareGeoff MacarateNo ratings yet

- How To Write A Essay For KidsDocument7 pagesHow To Write A Essay For Kidsyeuroqaeg100% (2)

- Shares and DebenturesDocument45 pagesShares and DebenturesAkshit KumarNo ratings yet

- Auditing Problems AP 007 to 010 SolutionsDocument6 pagesAuditing Problems AP 007 to 010 SolutionsSerena Van der WoodsenNo ratings yet

- Section B QuestionsDocument130 pagesSection B QuestionsJohn DoeNo ratings yet

- Problems: Set B: InstructionsDocument2 pagesProblems: Set B: InstructionsflrnciairnNo ratings yet

- Valuation of Bonds and DebenturesDocument10 pagesValuation of Bonds and DebenturescnagadeepaNo ratings yet

- The Handwritten Notes: New Syllabus Module-5Document65 pagesThe Handwritten Notes: New Syllabus Module-5Ankit GargNo ratings yet

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokNo ratings yet

- (Solved) A Firm Has Determined Its Optimal Capital Structure Which Is... - Course HeroDocument4 pages(Solved) A Firm Has Determined Its Optimal Capital Structure Which Is... - Course HeroPauline EchanoNo ratings yet

- How leverage affects firm valueDocument5 pagesHow leverage affects firm valuevinneNo ratings yet

- U 1 - Financial StatementsDocument20 pagesU 1 - Financial Statementsbashaer abubakrNo ratings yet

- Share Capital and SharesDocument8 pagesShare Capital and SharesmathibettuNo ratings yet

- Certificate in Securities Ed16Document366 pagesCertificate in Securities Ed16Tim XUNo ratings yet

- Corporation Law (Midterm)Document11 pagesCorporation Law (Midterm)honnelyNo ratings yet

- Quiz 5Document7 pagesQuiz 5Vivienne Rozenn Layto0% (1)

- Relationship between MPS and MPCDocument31 pagesRelationship between MPS and MPCJay SmithNo ratings yet

- ACCA F4 Corporate and Business Law Solved Past PapersDocument130 pagesACCA F4 Corporate and Business Law Solved Past Paperslucky334No ratings yet

- Capital Structure - SumsDocument3 pagesCapital Structure - Sumsmeet daftaryNo ratings yet

- Viva Voice - 3 Year 13 November 2021 Labour Law: Research ObjectivesDocument18 pagesViva Voice - 3 Year 13 November 2021 Labour Law: Research ObjectivesAshwanth M.SNo ratings yet

- Making Choices: The Method, Marr, and Multiple Attributes: Graw HillDocument139 pagesMaking Choices: The Method, Marr, and Multiple Attributes: Graw HillFebrianti AyuNo ratings yet

- Practice ProblemsDocument7 pagesPractice ProblemsJOJKONo ratings yet

- Ind AS 33 HandoutDocument4 pagesInd AS 33 HandoutSiddhika AgrawalNo ratings yet

- Chap015 QuizDocument22 pagesChap015 QuizJuli Yuill-ZiembowiczNo ratings yet

- DFDocument1 pageDFJanesene Sol0% (1)

- Final Corpo Midterm CoverageDocument29 pagesFinal Corpo Midterm CoverageRedd ClosaNo ratings yet

- Final IBF (Numerical) Chapter 2, 5 & 15Document13 pagesFinal IBF (Numerical) Chapter 2, 5 & 15Imtiaz SultanNo ratings yet

- 5rd Batch - AP - Final Pre-Boards - EditedDocument11 pages5rd Batch - AP - Final Pre-Boards - EditedKim Cristian Maaño100% (1)