Professional Documents

Culture Documents

Apr2007 - Acc106

Uploaded by

doooooogoooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apr2007 - Acc106

Uploaded by

doooooogoooCopyright:

Available Formats

CONFIDENTIAL

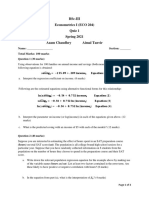

AC/APR 2007/ACC100/105/107/ 111/114/115

UNIVERSITI TEKNOLOGI MARA FINAL EXAMINATION

COURSE COURSE CODE EXAMINATION TIME

: : : :

FINANCIAL ACCOUNTING 1 ACC100/105/107/111/114/115 APRIL 2007 3 HOURS

INSTRUCTIONS TO CANDIDATES 1. 2. This question paper consists of three (3) parts. PART A (10 Questions) PART B (2 Questions) PART C (3 Questions)

Answer ALL questions from all three (3) parts. i) ii) Answer PART A in the Objective Answer Sheet. Answer PART B and PART C in the Answer Booklet. Start each answer on a new page.

3.

Do not bring any material into the examination room unless permission is given by the invigilator. Please check to make sure that this examination pack consists of: i) ii) iii) The Question Paper An Answer Booklet - provided by the Faculty An Objective Answer Sheet - provided by the Faculty

4.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 10 printed pages

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

AC/APR 2007/ACC100/105/107/ 111/114/115

PART A This section consists of 10 multiple-choice questions. Choose the most suitable answer and shade the corresponding alphabets representing the answer in the multiple choice answer sheet provided. 1. A debit item will be: a) b) c) d) Decrease asset Decrease liabilities Increase equity Increase revenue (1 mark) 2. The recording of fixed assets in the balance sheet at its original cost is based on the concept. a) b) c) d) Accrual Materiality Prudence Historical Cost (1 mark) 3. Which of the following is not included as one of the accounting concept? a) b) c) d) Simplicity Consistency Materiality Going-concern (1 mark) 4. Financial accounting reports are prepared primarily a) b) c) d) To value the property of the company To show the value of the shares in the company To help people make decisions about resource allocation To show managers the results of their departments (1 mark) 5. A business had bought fixed asset at a purchase price of RM100,000 each. It is known however that the business will be forced to close down in February 2006, only two months later and the assets are expected to be sold for only RM15,000. Therefore in the balance sheet at 31 December 2005 the assets will therefore be shown at the figure of RM15,000. What was the accounting concept being applied? a) b) c) d) Consistency Accrual Going -concern Materiality (1 mark)

Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL

AC/APR 2007/ACC100/105/107/ 111/114/115

6.

Why do we need to subtract first the provision for doubtful debt before calculating the provision for discount allowed? a) b) c) d) Because that is the formula Because we apply concept of prudence Because we want to decorate our account Because it is obvious that discounts are not allowed on bad debts (1 mark)

7.

Which costs listed below is Capital Expenditure? a) b) c) d) Buying vehicle Paying petrol cost for vehicle A repairs to vehicle Paying road tax for vehicle (1 mark)

8.

On 5 January 2004, Ahmad Enterprise buy fixed asset worth RM50.000. the depreciation of the fixed asset is 5% on reducing balance. What is the Net Book Value of the fixed asset on 2006 if the company's account ended 31 December every year? a) b) c) d) RM45.125 RM47.625 RM42.869 RM47.745 (2 marks)

9.

What is Standing Order? a) b) c) d) Instruction to the bank to pay a certain amount of money at a stated date by the company Permission given to the creditor to obtain the money directly from the bank account Debtors paid directly into the business bank account The money is presented to the bank by the owner (1 mark)

10.

A cheque had been paid to a creditor on 30 January. He banked it at his bank on 31 January but it was not presented to the company's bank until 2 February. This is known as a) b) c) d) Unpresented cheque Uncredited lodgement Dishonoured cheque Bank Reconciliation (1 mark) (Total: 11 marks)

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

AC/APR 2007/ACC100/105/107/ 111/114/115

PARTB QUESTION 1

a)

State the journal entries and the effect on accounting equation for each of the following transactions: i. ii. iii. iv. v. vi. Bought Office Equipment on credit. Sold goods to Daud on credit. Return parts of the goods that was previously bought on credit to Yahya. Motor van repairs being paid by cash. Owner of the business took goods for his personal use. One of the debtors paid the amount that he owed by cheque.

Example:

JOURNAL ENTRIES DEBIT i) Office Equipment CREDIT Creditor

EFFECT ON ACCOUNTING EQUATION

t/i

Class of account Asset

t/i

Class of account Liability

(15 marks) b) Other than financial difficulties, what are the other two (2) possible reasons that a debtor is not able to settle his/her debt? (2 marks) (Total: 17 marks)

QUESTION 2 (A) The accounting period of Sasa Trading is 31 August 2006. The following balances are extracted from the ledger book of Sasa Trading: At 1 September 2005: Insurance paid in advance RM562 Wages outstanding RM306 Rent receivable, received in advance RM36 During the accounting period, Sasa Trading: Paid for insurance RM1,019 by bank standing order Paid RM15,000 wages, in cash Received RM2,600 rent, by cheque, from the tenant

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

AC/APR 2007/ACC100/105/107/

111/114/115 At 31 August 2006: Insurance prepaid was RM345 Accrued wages was RM419 Accrued rent was RM105 Required: For the year ending 31 August 2006, prepare the following accounts and show the amounts to be transferred to the Profit and Loss account. a) b) b) Insurance account Wages account Rent received account (12 marks)

(B)

a)

State and explain two (2) types of discounts given to a customer. (3 marks)

b)

Distinguish between Straight Line Method and Reducing Balance Method in calculating the depreciation expense. (2 marks) (Total: 17 marks)

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

AC/APR 2007/ACC100/105/107/

111/114/115 PARTC QUESTION 1 The following is the trial balance extracted from the books of Zidane Enterprise as at 31 August 2006. Debit RM Capital Cash at bank Cash in hand Creditors Marketing Expenses Carriage Inwards Debtors Provision for doubtful debt Land & Building (cost) Motor vehicles Accumulated depreciation of motor vehicles - 31 August 2005 Office Equipment (cost) . Accumulated depreciation of office Equipment - 31 August 2005 Discount allowed Rent received Drawings Carriage Outward Commission received General expenses Insurance expenses Long term loan (taken 1 January 2006) Purchases Rent expenses Return inwards Return outwards Sales Stationery expenses Stock as at 1 September 2005 Sundry expenses Wages and salaries Water and electricity 60,000 14,400 25,300 14,400 2,400 25,200 2,520 146,400 92,400 18,480 15,600 3,120 40,800 58,300 5,880 6,000 12,640 4,200 8,520 100,000 92,400 28,800 3,600 3,740 232,500 4,800 44,400 6,240 28,800 9,360 654,600 Credit RM 198,000

654,600

The following information is available: i. ii. Stock as at 31 August 2006 was valued at RM18,000. Interest on loan at 9% per annum had not been paid at 31 December 2006.

CONFIDENTIAL

Hak Cipta Universitl Teknologl MARA

CONFIDENTIAL

AC/APR 2007/ACC100/105/107/ 111/114/115

iii.

Accruals at the end of 31 August 2006 are: Wages and salary Rent Received Insurance RM1,560 RM8.400 RM1.080

iv.

Prepayments at the end of 31 August 2006 are: Commission Received Water and Electricity Rent RM 1,200 RM900 RM5.400

v.

Depreciation were provided using the rates as follows: Motor Vehicles Office Equipment 20% (on Cost) 15% (on Net Book Value)

vi.

RM1,440 to be written off as bad debt and provision for doubtful debt to be decreased by RM840.

You are required to prepare: a) The Trading, Profit and Loss account / Income Statement for the year ended 31 August 2006. (17 marks) The Balance Sheet as at 31 August 2006. (11 marks) Note: Vertical format is required. (Total: 28 marks)

b)

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

AC/APR 2007/ACC100/105/107/ 111/114/115

QUESTION 2 On 15 July 2006 Era Maju Enterprise received the monthly bank statement for the month of June 2006. The bank statement contained the following details: Date 1 June 4 June 8 June 13 June 13 June 14 June 15 June 16 June 17 June 20 June 21 June 21 June 22 June 23 June 24 June 25 June 26 June 28 June 30 June 30 June Particulars Balance 20230 Cheque Deposit 20231 560712 Cheque Deposit 20222 20232 20233 Cheque Deposit Standing Order Bank Charges 20234 20235 Cheque Deposit Credit Transfer Cheque Returned 20236 Miscellaneous Dividend/Interest Payments RM 97.64 394.70 233.40 100.95 Receipts RM Balance RM

509.00

400.33 70.00 152.36

618.40

160.00 15.00 128.18 185.54

395.60 136.00

395.60 114.54 17.50

13.36

2,106.29 2,008.65 2,403.35 2,169.95 2,069.00 2,578.00 2,177.67 2,107.67 1,955.31 2,573.71 2,413.71 2,398.71 2,270.53 2,084.99 2,480.59 2,616.59 2,220.99 2,106.45 2,088.95 2,102.31

For the corresponding period, Era Maju Enterprise owns records contained the following bank account: Date 1 June 8 June 13 June 18 June 22 June 30 June Details Balance b/d Sales Sales Sales Sales Sales RM 1,705.96 394.70 509.00 618.40 395.60 210.00 Date 3 June 11 June 15 June 16 June 20 June 21 June 28 June 30 June 30 June 3,833.66 Details Electricity Purchases Commission Purchases Purchases Motor Expenses Wages Rent Balance c/d Cheque No. 20230 20231 20232 20233 20234 20235 20236 20237 RM 97.64 233.40 70.00 152.36 118.18 185.54 114.54 220.00 2,642 3,833.66

Note: Further inquiries with the bank confirmed that the bank had correctly entered the amount for cheque number 20234 and cheque number 560712 was wrongly entered by the bank.

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

AC/APR 2007/ACC100/105/107/ 111/114/115

Required: Prepare a bank reconciliation statement as at 30 June 2006: a) The Adjusted Cashbook (bank column only) of Era Maju Enterprise. (8 marks) b) c) The Bank Reconciliation Statement as at 30 June 2006 (7 marks) Explain briefly the main purpose of preparing bank reconciliation statement. (2 marks) (Total: 17 marks)

QUESTION 3 The following ratios relate to Al-Ridha Enterprise: 2005 25% 4.28 6% 1 RM50,000

Gross profit as a percentage of sales Stock turnover Net profit as a percentage of sales Quick ratio (acid test) Stock as at 1 January 2006

AL- RIDHA ENTERPRISE TRADING, PROFIT AND LOSS ACCOUNTS FOR THE YEAR ENDED 31 DECEMBER 2006 RM 200,000 (a) (b) 33,000 5,000 (c)

Sales Less: Cost of goods sold Gross profit Less: Administration expenses Interest expenses Net profit

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

10

AC/APR 2007/ACC100/105/107/ 111/114/115

AL- RIDHA ENTERPRISE BALANCE SHEET AS AT 31 DECEMBER 2006 RM Fixed Asset Current Assets Stock Debtors Less: Current Liabilities Creditors Bank Overdraft RM 92,000

(d) (e) 15,000 10,000

Financed by: Capital Add: Net Profit

100,000 (c)

Required: a) Calculate the missing figures. Show the workings. (8 marks) b) As a shareholder, which profitability ratio i.e. net profit as a percentage of sales or gross profit as percentage of sales would be most important to you? Why? (2 marks) (Total: 10 marks)

END OF QUESTION PAPER

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

You might also like

- Parts: © Flak Cipta Universiti Teknologi MARADocument9 pagesParts: © Flak Cipta Universiti Teknologi MARAClaire FarronNo ratings yet

- MGT162 MGT160Document9 pagesMGT162 MGT160Rijal RsNo ratings yet

- ACC100 Chapter 10Document61 pagesACC100 Chapter 10ConnieNo ratings yet

- Public Bank Berhad - FAQsDocument58 pagesPublic Bank Berhad - FAQsnyxnyxnyxNo ratings yet

- BBMA3203 MANAGEMENT ACCOUNTING II (Exam)Document9 pagesBBMA3203 MANAGEMENT ACCOUNTING II (Exam)AnnieNo ratings yet

- Solution Far450 UITM - Jan 2013Document8 pagesSolution Far450 UITM - Jan 2013Rosaidy SudinNo ratings yet

- Course Content Form: Practical Accounting ProceduresDocument2 pagesCourse Content Form: Practical Accounting ProceduresOscar I. ValenzuelaNo ratings yet

- Universiti Teknologi Mara Common Test: Confidential 1 AC/APR 2019/AIS205Document6 pagesUniversiti Teknologi Mara Common Test: Confidential 1 AC/APR 2019/AIS205ZilchNo ratings yet

- Eco 415Document4 pagesEco 415Verne Skeete Jr.100% (1)

- Fin534 Final Exam 1Document12 pagesFin534 Final Exam 1astar531_642_2190610No ratings yet

- Quiz 1 EconDocument3 pagesQuiz 1 EconMahnoorNo ratings yet

- Auditing Common Test with Questions on Independence, Materiality and Audit RiskDocument3 pagesAuditing Common Test with Questions on Independence, Materiality and Audit RiskNur Dina AbsbNo ratings yet

- To Enhance Learner's Understanding of The Disclosure Requirements of Published Financial StatementsDocument10 pagesTo Enhance Learner's Understanding of The Disclosure Requirements of Published Financial StatementsKetz NKNo ratings yet

- 2.BMMF5103 - EQ Formattedl May 2012Document7 pages2.BMMF5103 - EQ Formattedl May 2012thaingtNo ratings yet

- Corporate Governance, Capital Structure and Firm PerformanceDocument64 pagesCorporate Governance, Capital Structure and Firm PerformanceShoaibNo ratings yet

- Eco 415 Apr07Document5 pagesEco 415 Apr07myraNo ratings yet

- Tax 3 RevisionDocument10 pagesTax 3 RevisionSoon Mei QiNo ratings yet

- Intro To AccountDocument3 pagesIntro To AccountZahran Alkhairy AzharNo ratings yet

- Senior Accounting Manager Finance in ST Louis MO Resume Kelly Whitelock SmithDocument2 pagesSenior Accounting Manager Finance in ST Louis MO Resume Kelly Whitelock SmithKelly Whitelock SmithNo ratings yet

- Aud589 Dec2019Document6 pagesAud589 Dec2019LANGITBIRU0% (1)

- Bbmf3123 International Finance: Mds-Wealth-Shrinks-Over-Rm1b-Paper-After-Audit-IssuesDocument8 pagesBbmf3123 International Finance: Mds-Wealth-Shrinks-Over-Rm1b-Paper-After-Audit-IssuesSharon ChinNo ratings yet

- BusinessAdministration 2023 24Document4 pagesBusinessAdministration 2023 24carlos rodriguez100% (1)

- Ms-4 Combined BookDocument380 pagesMs-4 Combined Bookanandjaymishra100% (1)

- Partnership - ExercicesDocument7 pagesPartnership - ExercicesNurul SharizaNo ratings yet

- Cute Exam Paper Set 4Document12 pagesCute Exam Paper Set 4Raja PeriasamyNo ratings yet

- Example Final ExamDocument18 pagesExample Final ExamCj Rightwing MooreNo ratings yet

- Chapter 9 Error and Suspense AccountDocument3 pagesChapter 9 Error and Suspense AccountClaudia WongNo ratings yet

- MIA By-Laws (On Professional Ethics, Conduct and Practice)Document36 pagesMIA By-Laws (On Professional Ethics, Conduct and Practice)Nur IzzahNo ratings yet

- Sample Research PROPOSALDocument48 pagesSample Research PROPOSALNUR ELYANA SHAHEERA SAIFUL LIZANNo ratings yet

- 9706 s16 QP 32 PDFDocument12 pages9706 s16 QP 32 PDFFarrukhsgNo ratings yet

- UntitledDocument13 pagesUntitledGempak GempitaNo ratings yet

- Past Year Acw 482 - Analysis and Development of Accounting Information System June 08Document7 pagesPast Year Acw 482 - Analysis and Development of Accounting Information System June 08Nabila69No ratings yet

- Operational Analysis Ciara HW2Document3 pagesOperational Analysis Ciara HW2Giang Lê NinhNo ratings yet

- Eco120 108Document10 pagesEco120 108Muhammad AmirulNo ratings yet

- NHCS 2024 Budget OutlookDocument11 pagesNHCS 2024 Budget OutlookBen SchachtmanNo ratings yet

- MR UA KhanDocument1 pageMR UA KhanSeemab Ahmed Kazi100% (1)

- AssignmentValuationTemplate v1.0Document46 pagesAssignmentValuationTemplate v1.0HAMMADHRNo ratings yet

- CVP Analysis Tutorial QuestionsDocument5 pagesCVP Analysis Tutorial QuestionsonaNo ratings yet

- FMT Tafi Federal LATESTDocument62 pagesFMT Tafi Federal LATESTsyamputra razaliNo ratings yet

- Corporate Division/Department of SEBLDocument2 pagesCorporate Division/Department of SEBLSumaya KeYaNo ratings yet

- Chapter 2 Corporate TaxDocument50 pagesChapter 2 Corporate TaxNgNo ratings yet

- Practice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementDocument5 pagesPractice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementAndrewNo ratings yet

- ECO 561 Final Exam Answer - Assignment E HelpDocument7 pagesECO 561 Final Exam Answer - Assignment E HelpAssignmentehelpNo ratings yet

- MGT162 Mar 2012Document9 pagesMGT162 Mar 2012Putra QlateNo ratings yet

- CSC128 CSC415Document11 pagesCSC128 CSC415Izzatul Atiq RosseliNo ratings yet

- SS Mar22 PDFDocument8 pagesSS Mar22 PDFuser mrmysteryNo ratings yet

- DebitCreditAnalysisComparesAccountsYear"TITLE "CashflowStatementAnalyzesPrimeSportsGearCashFlows2013" TITLE "RatioAnalysisComparesGlobalTechFinancialsSalesProfit201213Document7 pagesDebitCreditAnalysisComparesAccountsYear"TITLE "CashflowStatementAnalyzesPrimeSportsGearCashFlows2013" TITLE "RatioAnalysisComparesGlobalTechFinancialsSalesProfit201213shineneigh00No ratings yet

- ISF 1101 Islamic Finance Profit Computation ExamplesDocument5 pagesISF 1101 Islamic Finance Profit Computation ExamplesPrashant VishwakarmaNo ratings yet

- BBSA4103 AnswerDocument15 pagesBBSA4103 AnswerKreatif TuisyenNo ratings yet

- TaxationDocument19 pagesTaxationKen Chia0% (1)

- Fin533 Group AssignmentDocument23 pagesFin533 Group AssignmentAzwin YusoffNo ratings yet

- Question AIS AssignmentDocument4 pagesQuestion AIS Assignmentfaris ikhwanNo ratings yet

- Mid-Term Exam For Cross Cultural ManagementDocument4 pagesMid-Term Exam For Cross Cultural ManagementNhung Phan Nguyễn HồngNo ratings yet

- Understanding Business 12th Edition by Nickles - Test BankDocument53 pagesUnderstanding Business 12th Edition by Nickles - Test BankalishcathrinNo ratings yet

- Offer Letter UnirazakDocument10 pagesOffer Letter UnirazakNorhilwani Mohd RahimNo ratings yet

- Annual Report Analysis of Industrial & Plantation CompaniesDocument2 pagesAnnual Report Analysis of Industrial & Plantation CompaniesNur ImanNo ratings yet

- Forecasting Monthly Rainfall in Cameron HighlandsDocument48 pagesForecasting Monthly Rainfall in Cameron HighlandsJennyne PeipeiNo ratings yet

- FAR100 FAR110-oct2007Document9 pagesFAR100 FAR110-oct2007kaitokid77No ratings yet

- MAY 2023 PATHFINDER - SKILLS LEVELDocument176 pagesMAY 2023 PATHFINDER - SKILLS LEVELBrian DhliwayoNo ratings yet

- Tracking Market GammaDocument11 pagesTracking Market Gammadeepak777100% (1)

- Fundamental Analysis Project.Document82 pagesFundamental Analysis Project.Ajay Rockson100% (1)

- Bank Mandiri ProfileDocument2 pagesBank Mandiri ProfileTee's O-RamaNo ratings yet

- Auditing and Assurance Services A Systematic Approach 10th Edition Messier Test Bank 1Document62 pagesAuditing and Assurance Services A Systematic Approach 10th Edition Messier Test Bank 1willie100% (36)

- Cir Vs Metro Star SuperamaDocument2 pagesCir Vs Metro Star SuperamaDonna TreceñeNo ratings yet

- Hybrid Agreement Business Project Management ReportDocument45 pagesHybrid Agreement Business Project Management Reportandrei4i2005No ratings yet

- Cashback Redemption FormDocument1 pageCashback Redemption FormPapuKaliyaNo ratings yet

- Chapter 11 Walter Nicholson Microcenomic TheoryDocument15 pagesChapter 11 Walter Nicholson Microcenomic TheoryUmair QaziNo ratings yet

- Business Plan 1. Executive SummaryDocument2 pagesBusiness Plan 1. Executive SummaryBeckieNo ratings yet

- Home Activity 3Document6 pagesHome Activity 3Don LopezNo ratings yet

- Fabm2: Quarter 1 Module 1.2 New Normal ABM For Grade 12Document19 pagesFabm2: Quarter 1 Module 1.2 New Normal ABM For Grade 12Janna Gunio0% (1)

- BMWDocument52 pagesBMWDuje Čipčić100% (3)

- Cantabil Retail India Limited Private Equity ReportDocument15 pagesCantabil Retail India Limited Private Equity ReportMayank GugnaniNo ratings yet

- Leadership in Change Management Group WorkDocument11 pagesLeadership in Change Management Group WorkRakinduNo ratings yet

- Questionnaire ThesisDocument3 pagesQuestionnaire ThesisAnonymous 0kDzzBgr15No ratings yet

- Truth in Lending Act Requires Disclosure of Finance ChargesDocument3 pagesTruth in Lending Act Requires Disclosure of Finance Chargesjeffprox69No ratings yet

- Westmont Bank VS Dela Rosa-RamosDocument2 pagesWestmont Bank VS Dela Rosa-RamosCandelaria QuezonNo ratings yet

- Analyze datesDocument31 pagesAnalyze datesHussain AminNo ratings yet

- Teaching Market Making with a Game SimulationDocument4 pagesTeaching Market Making with a Game SimulationRamkrishna LanjewarNo ratings yet

- Credit History PDFDocument6 pagesCredit History PDFSohaib ArshadNo ratings yet

- Low Cost Housing Options for Bhutanese RefugeesDocument21 pagesLow Cost Housing Options for Bhutanese RefugeesBala ChandarNo ratings yet

- Document ManagementDocument55 pagesDocument Managementrtarak100% (1)

- Marriott's History from Root Beer Stand to Global Hotel GiantDocument25 pagesMarriott's History from Root Beer Stand to Global Hotel GiantNaveen KumarNo ratings yet

- Consistent Compounders: An Investment Strategy by Marcellus Investment ManagersDocument27 pagesConsistent Compounders: An Investment Strategy by Marcellus Investment Managersvra_pNo ratings yet

- Coforge LimitedDocument215 pagesCoforge LimitedJaydev JaydevNo ratings yet

- I 1065Document55 pagesI 1065Monique ScottNo ratings yet

- Technopreneurship in Small Medium EnterprisegrouptwoDocument50 pagesTechnopreneurship in Small Medium EnterprisegrouptwoKurt Martine LacraNo ratings yet

- Yodlee User Guide PDFDocument211 pagesYodlee User Guide PDFy2kmvrNo ratings yet

- 227 - Unrebutted Facts Regarding The IRSDocument5 pages227 - Unrebutted Facts Regarding The IRSDavid E Robinson100% (1)

- Travis Kalanick and UberDocument3 pagesTravis Kalanick and UberHarsh GadhiyaNo ratings yet