Professional Documents

Culture Documents

Taxation-II Dec 2012 (1) - ICAB Question

Uploaded by

Monir1236Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation-II Dec 2012 (1) - ICAB Question

Uploaded by

Monir1236Copyright:

Available Formats

TAXATION-II

Time allowed-2 hours Total Marks-100 [N.B.- Figures in the margin indicate full marks. Question must be answered in English. Examiner will take account of the quality of language and of the way in which the answers are presented. Different parts, if any, of the same question must be answered in one place in order of sequence] Marks 1. Write short notes on the following in relation to I.T.O 1984: (a) Assessment on the basis of report of a Chartered Accountant: u/s 83 AAA (b) Carry forward of loss under the head Capital Gains: u/s 40. (c) Revisional power of the commissioner of Taxes: u/s 121A. (d) Interest payable by the government on delayed refund: u/s 151. (e) Rent free accommodation Rule:338 Discuss in details regarding the insertion of new section 82C in place of existing section 82C termed as final discharge of tax liability by the Finance Act 2011. RFL Co. Ltd. owns and maintains 10 tea estates in Chittagong. It sells the tea after processing in its manufacturing plans within the estates. For the financial year ending December 31, 2010 it has produced the following information: Taka Opening stock of tea (Valued at the net sales prices) 80,00,000 Closing stock of tea (Valued at the net sales prices) 90,00,000 Sales (30% domestic,70% export) 12,40,00,000 Sales of bamboos and other bushes 20,00,000 Sales of old shade and other trees 90,00,000 Common expenditure apportioned between agriculture and business on the basis of workers employed are: Agriculture Business Taka Taka Manufacturing expenses 7,50,00,000 1,60,00,000 Administrative expenses 50,00,000 80,00,000 Besides, selling expenses of Tk.18,60,000 have been incurred during the year. Depreciation on plant and machinery, furniture, factory and office buildings including banglows have been included in above manufacturing expenses of Tk.80,00,000 and Tk.20,00,000 relate to agriculture and business respectively. The company spent Tk.30,00,000 during the year to bring new areas under its cultivation while nothing has been spent on replacement of bushes. It is company policy to capitalize those expenditure. There are no other inadmissible expenses. Tax WDV of fixed assets are as follows: Agriculture Business Taka Taka Banglows and other structure 2,30,00,000 1,50,00,000 Plant and machinery 3,50,00,000 6,90,00,000 Furniture, Equipment etc. 30,00,000 60,00,000 Vehicles and Tanks 1,05,00,000 60,00,000 Tubewell 23,00,000 ----Pacca Irrigation works 8,00,000 ---Pucca pumping machine 30,00,000 ----Calculate the taxable income of RFL Co. Ltd. for the relevant assessment year assuming that it has no brought forward agriculture or business losses but has unabsorbed depreciation of Tk.2,44,00,000 under the head agriculture. 10

2. 3.

10

25

(Please turn over)

4.

-2Mr. X an employee of a limited company, received the following salaries and allowances during the income year ended 30 June, 2009. Taka 1. Basic Salary 4,20,000 2. House Rent allowances 2,00,000 3. Festival Bonus equal to two months basic salary 70,000 4. Leave encashment Salary 35,000 5. Conveyance allowance 24,000 6. Contribution to Recognized Provident fund @ 8% 33,600 7. Servant Wages 24,000 8. Children education allowance 60,000 9. Leave fare assistance 50,000 10. Banglow utilities 25,000 Compute excess perquisite u/s 30 (e) for the assessment year 2009-2010. (a) A refund of tax becomes due to an assessee on reduction of total income in appeal filed by him, but the Deputy Commissioner of Taxes does not take any action to make the refund. What are the remedies open to the assessee? (b) Discuss on modes of recovery by the Tax recovery Officer. (c) A Private Limited Company is wound up but tax assessed on the company remains unpaid. Discuss the personal liabilities of the Directors of the Company in respect of the unpaid tax of the company. State the provision of law for tax clearance certificate required for persons leaving Bangladesh. What penalties can be imposed for: (a) Failure to the file return u/s 75: (b) Failure to pay Taxes u/s 74: (c) For furnishing inaccurate particulars of income (a) Define Input Tax. What are the conditions to be met for claiming input tax? (b) Discuss the Special Treatment of Specified Input tax and the penalty for false declaration for Input Tax. Bata Shoe Co. Ltd. incurred the following transactions in September 2010: Raw materials aggregating to Tk.5,00,000 were purchased on September 5, 2010, VAT on the same paid and the VAT chalan along with the goods were received on September 10, 2010. Shoes delivered to customers in the month at approved price as follows: September 08, 2010 Tk.3,00,000 September 09, 2010 Tk. 2,00,000 September 10, 2010 Tk.5,00,000 September 15, 2010 Tk.6,00,000 The following deposits were made to the Govt. Exchequer through treasury chalan: September 07,2010 Tk. 20,000 September 12,2010 Tk.30,000 September 15,2010 Tk.70,000 Balance of deposit at September 01,2010 in VAT- 18 was Tk.50,000. You are required to: Enter the above transactions in VAT 18 of the company;

10

5.

4 6

6. 7.

5 5 6

8.

6 5 8

9.

------THE END-------

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- AprilDocument6 pagesAprilcindy pecañaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Qantas Airways: Name: Institution Affiliation: DateDocument8 pagesQantas Airways: Name: Institution Affiliation: DatePhuong NhungNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Doing Business in The UkDocument20 pagesDoing Business in The UkMalena BerardiNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Item Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptDocument1 pageItem Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptGustu LiranNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chapter 5 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document33 pagesChapter 5 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- April 2023 The Bill ElectricityDocument1 pageApril 2023 The Bill ElectricityAbdul Raheem OfficialNo ratings yet

- Account Activity: Mar 18-Apr 19, 2011Document3 pagesAccount Activity: Mar 18-Apr 19, 2011Yusuf OmarNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Service Charges and FeesDocument11 pagesService Charges and FeesajmalNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- HDFC Bank Deposit Online Receipt FormatDocument1 pageHDFC Bank Deposit Online Receipt FormatAjay Ajay67% (6)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Prelim Exam-Business Tax - Set BDocument3 pagesPrelim Exam-Business Tax - Set BRenalyn Paras0% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Tax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacDocument2 pagesTax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacBhavnaben PanchalNo ratings yet

- Inv-0058 Ayyappa AgenciesDocument1 pageInv-0058 Ayyappa AgenciesSRIKAR DHANOORINo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- ACC 111 Chapter 7 Lecture NotesDocument5 pagesACC 111 Chapter 7 Lecture NotesLoriNo ratings yet

- Quiz Chapter 2 Statement of Comprehensive IncomeDocument13 pagesQuiz Chapter 2 Statement of Comprehensive Incomefinn mertensNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Dinner For Kirsten GillibrandDocument2 pagesDinner For Kirsten GillibrandSunlight FoundationNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

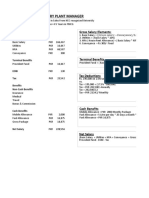

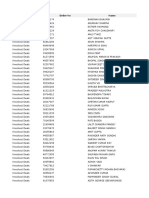

- Shoe Factory Plant Manager: Gross Salary ElementsDocument2 pagesShoe Factory Plant Manager: Gross Salary ElementsSukaina SalmanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Online Shoppers 30 Lack DataDocument18 pagesOnline Shoppers 30 Lack DataSuvojit MondalNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Electricity Tax Interest Payment Electricity Tax Interest Payment Electricity Tax Interest PaymentDocument1 pageElectricity Tax Interest Payment Electricity Tax Interest Payment Electricity Tax Interest PaymentaaanathanNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 02 PDF MergedDocument36 pages02 PDF MergedarpanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PR 7 Diagnostic ExamDocument8 pagesPR 7 Diagnostic ExamMendoza Ron NixonNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Printable Receipt Pizza DeliveryDocument1 pagePrintable Receipt Pizza DeliveryNestor FloresNo ratings yet

- Series 7 Watch BillDocument1 pageSeries 7 Watch BillVedans FinancesNo ratings yet

- GrubhubDocument3 pagesGrubhubBig TeenzNo ratings yet

- Welcome To HDFC Bank NetBankingDocument2 pagesWelcome To HDFC Bank NetBankingGAURAV MISHRANo ratings yet

- Surya YasaDocument2 pagesSurya YasaAh MuhayNo ratings yet

- The Trial Balance of Steve Mentz Cpa Is Dated March PDFDocument1 pageThe Trial Balance of Steve Mentz Cpa Is Dated March PDFAhsan KhanNo ratings yet

- Hotel Confirmation TemplateDocument2 pagesHotel Confirmation TemplateantonytechnoNo ratings yet

- CIR v. PAL (Ortega)Document5 pagesCIR v. PAL (Ortega)Peter Joshua OrtegaNo ratings yet

- Retained EarningsDocument7 pagesRetained EarningsSelena SevvinNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Income and Business TaxationDocument24 pagesIncome and Business TaxationFerdinand Carlos B. DadoNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)