Professional Documents

Culture Documents

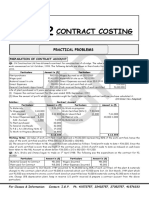

19072comp Sugans Pe2 Costacc Cp9

Uploaded by

vikaschhabria3344Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

19072comp Sugans Pe2 Costacc Cp9

Uploaded by

vikaschhabria3344Copyright:

Available Formats

9

Operating Costing

Question 1

Distinguish between Operating Costing and Operation Costing.

Answer

Operating Costing: It is a method of costing applied by undertakings which provide

service rather than production of commodities. Like unit costing and process costing,

operating costing is thus a form of operation costing.

The emphasis under operating costing is on the ascertainment of cost of rendering

services rather than on the cost of manufacturing a product. It is applied by transport

companies, gas and water works, electricity supply companies, canteens, hospitals, theatres,

school etc. Within an organisation itself certain departments too are known as service

departments which provide ancillary services to the production departments. For example,

maintenance department; power house; boiler house; canteen; hospital; internal transport.

Operation Costing: It represent a refinement of process costing. In this each operation

instead of each process of stage of production is separately costed. This may offer better

scope for control. At the end of each operation, the unit operation cost may be computed by

dividing the total operation cost by total output.

Question 2

(a) What do you understand by Operating Costs? Describe its essential features and state

where it can be usefully implemented.

(b) A chemical factory runs its boiler on furnace oil obtained from Indian Oil and Bharat

Petroleum, whose depots are situated at a distance of 12 and 8 miles from the factory

site. Transportation of Furnace Oil is made by the Company's own tank lorries of 5 tons

capacity each. Onward trips are made only on full load and the lorries return empty. The

filling-in time takes an average 40 minutes for Indian Oil and 30 minutes for Bharat

Petroleum. But the emptying time in the factory is only 40 minutes for all. From the

record available it is seen that the average speed of the company's lorries works out to

24 miles per hour. The varying operating charges average 60 paise per mile covered and

fixed charges give an incidence of Rs. 7.50 per hour of operation. Calculate the cost per

ton mile for each source.

Cost Accounting

9.2

Answer

Operating Costs are the costs incurred by undertakings which do not manufacture any

product but provide a service. Such undertakings for example are Transport concerns,

Gas agencies; Electricity Undertakings; Hospitals; Theatres etc. Because of the varied

nature of activities carried out by the service undertakings, the cost system used is

obviously different from that followed in manufacturing concerns.

The essential features of operating costs are as follows:

(1) The operating costs can be classified under three categories. For example in the

case of transport undertaking these three categories are as follows:

(a) Operating and running charges. It includes expenses of variable nature. For

example expenses on petrol, diesel, lubricating oil, and grease etc.

(b) Maintenance charges. These expenses are of semi-variable nature and

includes the cost of tyres and tubes, repairs and maintenance, spares and

accessories, overhaul, etc.

(c) Fixed or standing charges. These includes garage rent, insurance, road

licence, depreciation, interest on capital, salary of operating manager, etc.

(2) The cost unit used is a double unit like passenger-mile; Kilowatt-hour, etc.

It can be implemented in all firms of transport, airlines, bus-service, etc., and by all firms

of Distribution Undertakings.

Statement showing the cost per ton mile of carrying furnace oil from Indian Oil

and Bharat Petroleum Depots to Chemical Factory

Indian Oil Bharat Petroleum

Rs. Rs.

Variable Cost of Operating

(See working note l)

14.40 9.60

Fixed Charges

(See working note 2)

17.50 9.60

Total Cost 31.90 23.35

Cost per ton-mile 53 paise (Approx.) 58.00 paise (Approx)

Working Notes

Indian Oil Bharat Petroleum

1. Distance of Oil Depots

from Chemical Factory:

Mileage covered under one trip by a lorry

Variable cost of operating @ 60 paise

per mile

12 miles

24 miles

Rs. 14.40

8 miles

16 miles

Rs. 9.60

Operating Costing

9.3

2. Running time of lorries at a speed of 24

m.p.h.

60 minutes 40 minutes

Filling in time 40 minutes 30 minutes

Emptying time 40 minutes 30 minutes

Total time 140 minutes 140 minutes

Fixed charges @ Rs. 7.50 per hour Rs. 17.50 Rs. 13.75

3. Load carried by tank lorries 5 tones 5 tones

Total effective tons-mile 60 40

(12 miles 5 tons) (8 miles 5 tons)

Cost per ton mile =

miles tons effective Total

Cost Total

In the case of Indian Oil

Cost per ton mile = Paise 17 . 53

60

90 . 31 . Rs

=

Similarly, in the case of the Bharat Petroleum

Cost per ton-mile = Paise 38 . 58

40

35 . 23 . Rs

=

Question 3

Write short note on operation costing. (May, 1996, 4 marks)

Answer

Operation Costing: It is defined as the refinement of process costing. It is concerned

with the determination of the cost of each operation rather than the process. In those

industries where a process consists of distinct operations, the method of costing applied or

used is called operation costing. Operation costing offers better scope for control. It facilitate

the computation of unit operation cost at the end of each operation by dividing the total

operation cost by total input units. It is the category of the basic costing method, applicable,

where standardized goods or services result from a sequence of repetitive and more or less

continuous operations, or processes to which costs are charged before being averaged over

the units produced during the period. The two costing methods included under this head are

process costing and service costing.

Question 4

SMC is a public school having five buses each plying in different directions for the

transport of its school students. In view of a large number of students availing of the bus

service, the buses work two shifts daily both in the morning and in the afternoon. The buses

are garaged in the school. The work-load of the students has been so arranged that in the

morning the first trip picks up the senior students and the second trip plying an hour later picks

Cost Accounting

9.4

up the junior students. Similarly in the afternoon the first trip drops the junior students and an

hour later the second trip takes the senior students home.

The distance travelled by each bus one way in 8 kms. The school works 25 days in a

month and remains closed for vacation in May, June and December. Bus fee, however, is

payable by the students for all the 12 months of the year.

The details of expenses for a year are as under:

Driver's salary Rs. 450 per month per driver

Cleaner's salary Rs. 350 per month

(Salary payable for 12 months)

(One cleaner employed for all the five buses)

License fee, taxes etc. Rs. 860 per bus per annum

Insurance Rs. 1,000 per bus per annum

Repairs & Maintenance Rs. 3,500 per bus per annum

Purchase price of bus

(Life 12 years)

Rs. 1,50,000 each

Scrap value Rs. 30,000

Diesel cost Rs. 2.00 per litre.

Each bus gives an average mileage of 4 kms per litre of diesel.

Seating capacity of each bus is 50 students.

The seating capacity is fully occupied during the whole year.

Students picked up and dropped within a range upto 4 kms. of distance from the school

are charged half fare and fifty percent of the students travelling in each trip are in this

category. Ignore interest. Since the charges are to be based on average cost, you are required

to:

(i) Prepare a statement showing the expenses of operating a single bus and the fleet of five

buses for a year.

(ii) Work out the average cost per student per month in respect of

(A) Students coming from a distance of upto 4 kms. from the school and

(B) Students coming from a distance beyond 4 kms. from the school

Answer

SMC Public School

Operating Cost Statement

Per Bus Per Annum Fleet of 5 buses p.a. Particulars Rate

No. Rs. No. Rs.

Driver's salary

Cleaner's salary

450 p.m.

350 p.m.

1

1/5

5,400

840

5

1

27,000

4,200

Operating Costing

9.5

Licence fee, taxes etc.

Insurance

Repairs & Maintenance

Depreciation

Diesel (See Note 1)

Total

Cost per month

No. of students on half fee

basis (see Note 2)

Cost per student (half fee)

Cost per student (full fee)

860 p.a.

1,000 p.a.

3,500 p.a.

10,000 p.a.

860

1,000

3,500

10,000

7,200

28,800

2,400

150

Rs. 16.00

Rs. 32.00

4,300

5,000

17,500

50,000

36,000

1,44,000

12,000

750

Rs. 16.00

Rs. 32.00

Working Notes

1. Calculation of Diesel Cost per bus.

Number of trips of 8 kms. each day 8.

Distance travelled per day by a bus: 8 8km / trip = 64 km.

Distance travelled during a month : 64 25 = 1,600 km.

Distance travelled p.a. 1,600 9 = 14,400 km.

(May, June and December being vacation)

Mileage 4 km./litre

Diesel required 14,400/4 = 3,600 litres.

Cost of diesel @ Rs. 2 per litre = Rs. 7,200 p.a. per bus.

2. Calculation of number of students per bus

Bus capacity 50 students.

Half fare 50% i.e. 25 students.

Full fare 50% i.e. 25 students.

Full fare students as equivalent to half fare students i.e. 50 students.

Total number of half fare students. 75 students. per trip

Total number of half fare students in two trips 150 students.

On full fare basis, number of students in two trips 75 students.

Question 5

SHANKAR has been promised a contract to run a tourist car on a 20 km. long route for

the chief executive of a multinational firm. He buys a car costing Rs. 1,50,000. The annual

cost of insurance and taxes are Rs. 4,500 and Rs. 900 respectively. He has to pay Rs. 500

per month for a garage where he keeps the car when it is not in use. The annual repair costs

Cost Accounting

9.6

are estimated at Rs. 4,000. The car is estimated to have a life of 10 years at the end of which

the scrap value is likely to be Rs. 50,000.

He hires a driver who is to be paid Rs. 300 per month plus 10% of the takings as

commission. Other incidental expenses are estimated at Rs. 200 per month.

Petrol and oil will cost Rs. 100 per 100 kms. The car will make 4 round trips each day.

Assuming that a profit of 15% on takings is desired and that the car will be on the road for 25

days on an average per month, what should he charge per round-trip?

Answer

Statement of Operating cost.

Standing charges Per Annum Per Month

Rs. Rs.

Depreciation

Insurance

Taxes

Garage (Rs. 500 12)

Annual repairs

Driver's Salary (Rs. 300 12)

Incidental expenses (Rs. 200 12)

10,000

4,500

900

6,000

4,000

3,600

2,400

31,400 2,616.67

Variable expenses

Petrol and Oil : 4,000.00

(4,000*kms 100

100

1

. Rs . kms )

Total Cost (without commission) 6,616.67

Let X be the total takings per month

Driver's Commission = 10% of X =

10 100

10 X

=

Profit = 15% of X =

20

3

100

15 X

X =

Total takings per month = Total cost + Driver's Commission + Profit

or X = Rs. 6,616.67 +

20

3

100

X X

+

or X 3X/20 X/10 = Rs. 6,616.67

or 67 616 6

20

2 3 20

. , . Rs

X X X

=

Operating Costing

9.7

or 67 616 6

20

15

. , . Rs

X

=

or X =

3

4 67 616 6 . , . Rs

= Rs. 8,822.22

Total number of round trips per month : 25 days 4 round trips per day = 100

Hence the charge per round trip =

100

22 . 822 , 8 . Rs

= Rs. 88.22

* 20 kms. x 2 x 4 x round trips x 25 days = 4,000 kms.

Question 6

The Union Transport Company has been given a twenty kilometer long route to play a

bus. The bus costs the company Rs. 1,00,000. It has been insured at 3% per annum. The

annual road tax amounts to Rs. 2,000. Garage rent is Rs. 400 per month. Annual repair is

estimated to cost Rs. 2,360 and the bus is likely to last for five years.

The salary of the driver and the conductor is Rs.600 and Rs. 200 per month respectively

in addition to 10% of takings as commission to be shared equally by them. The manager's

salary is Rs.1,400 per month and stationery will cost Rs. 100 per month. Petrol and oil cost

Rs. 50 per 100 kilometers. The bus will make three round trips per day carrying on an average

40 passengers in each trip. Assuming 15% profit on takings and that the bus will ply on an

average 25 days in a month, prepare operating cost statement on a full year basis and also

calculate the bus fare to be charged from each passenger per kilometer.

Answer

Union Transport Company

Statement showing Operating Cost of the bus per annum

A. Fixed Charges

Rs.

Manager's Salary 16,800

(Rs. 1,400 12)

Driver's Salary 7,200

(Rs. 600 12)

Conductor's Salary 2,400

(Rs.200 12)

Road Tax 2,000

Cost Accounting

9.8

Insurance 3,000

(3% of Rs. 1,00,000)

Garage rent 4,800

(Rs. 400 x 12)

Stationery 1,200

(Rs. 100 12)

Depreciation 20,000

(Rs. 1,00,000/5 years)

57,400

B. Maintenance Costs

Repairs 2,360

C: Running Charges

Petrol and Oil (36,000 Km* Rs. 50)/100 18,000

Total Cost (A + B + C): 77,760

Add: 10 percent of takings for commission of Driver and

Conductor and 15 percent for desired profit i.e.

25 percent of takings or

3

1

33 percent on Total Cost 25,920

1,03,680

*Calculation of distance covered

(20 Km 2 3 25 12 ) = 36,000 Km per annum

Calculation of bus fare to be charged

Effective Passenger Kilometers: = 14,40,000

(2 20 Km 3 trips 40 passengers

25 days 12 months)

Rate to be charged per kilometer from 7.2 Paise

each passenger (Rs. 1,03,680/14,40,000)

Question 7

A company is considering three alternative proposals for conveyance facilities for its

sales personnel who have to do considerable travelling, approximately 20,000 kilometers

every year. The proposals are as follows:

(i) Purchase and maintain of its own fleet of cars. The average cost of a car is Rs. 1,00,000.

(ii) Allow the executive to use his own car and reimburse expenses at the rate of Rs. 1.60

paise per kilometre and also bear insurance costs.

(iii) Hire cars from an agency at Rs. 20,000 per year per car. The Company will have to bear

costs of petrol, taxes and tyres.

Operating Costing

9.9

The following further details are available:

Petrol Rs. 0.60 per km.

Repairs and maintenance Rs. 0.20 P per km.

Tyre rs. 0.12 P per km.

Insurance Rs. 1,200 per car per annum.

Taxes Rs. 800 per car per annum.

Life of the car: 5 years with annual mileage of 20,000 kms.

Resale value : Rs. 20,000 at the end of the fifth year.

Work out the relative costs of three proposals and rank them.

Answer

Alternative Proposals

I II III

Use of Concern's

Car

Use of own

Car

Use of hire Car

Rs. Rs, Rs.

Re-imbursement

of hire charges (A)

1.60

1

( 20,000/20,000Km)

Fixed Costs: (B)

(Per Car Per Km.)

Taxes (P.a.) 800 0.04

800/20,000 Km.

Depreciation 16,000

5

) 000 , 20 . Rs 000 , 00 , 1 . Rs (

Insurance 1,2000 0.06

_____ ___ (1200/20,000 Km) ___

Total 18,000 0.90 1.06 1.04

(Rs. 18,000/20,000 Km.)

Running & Maintenance Cost

per car per km. (C)

Petrol 0.60 0.60

Repairs and maintenance 0.20

Tyre 0.12 0.12

Cost Accounting

9.10

Total cost: per km. (A + B + C) 1.82 1.66 1.76

Cost for 2,000 Kms. Rs.36,400 Rs. 33,200 Rs. 35,200

(20,000Rs.1.82) (20,000Rs.1.66) (20,000Rs.1.76)

Ranking of alternative

proposals

III I II

Decision: Use of own car by Sales Executives will be the most economical proposal from the

Concern's point of view. Hiring of car, for the use of Sales Executives will be the

IInd best choice and maintaining a fleet of cars for its executives will be the costliest

alternative.

Question 8

Prakash Automobiles distributes its goods to a regional dealer using a single Lorry. The

dealer's premises are 40 kilometres away by road. The lorry has a capacity of 10 tonnes and

makes the journey twice a day fully loaded on the outward journeys and empty on return

journeys. The following information is available for a Four Weekly period during the year

1990:

Petrol consumption 8 kilometers per litre

Petrol cost Rs. 13 per litre

Oil Rs. 100 per week

Driver's wages Rs. 400 per week

Repairs Rs. 100 per week

Garage rent Rs. 150 per week

Cost of Lorry (Excluding Tyres) Rs. 4,50,000

Life of Lorry 80,000 kilometres

Insurance Rs. 6,500 per annum

Cost of Tyres Rs. 6,250

Life of Tyres Rs. 25,000 kilometres

Estimated sale value of Lorry at the end of its life Rs.50,000

Vehicle Licence Cost Rs. 1,300 per annum

Other overhead cost Rs. 41,600 per annum

The Lorry operates on a five day week.

Required:

(a) A statement to show the total cost of operating the vehicle for the four weekly period

analysed into running costs and fixed costs.

(b) Calculate the vehicle cost per kilometer and per tonne kilometer.

Operating Costing

9.11

Answer

(a) Prakash Automobiles' Statement of Operating Cost of the Vehicle

(For the four weekly period)

Running Costs Rs.

Petrol Cost 5,200

(Refer to Note 1)

Oil expenses 400

Driver's wages 1,600

Repairs 400

Tyre Cost 800

(Refer to Note 2)

Depreciation 16,000

(Refer to Note 3)

Total running cost (A) 24,400

Fixed Costs

Garage rent 600

Insurance 500

(Refer to Note 4)

Licence Cost 100

(Refer to Note 5)

Other Overhead 3,200

(Refer to Note 6)

Total Fixed Cost (B) 4,400

Total Cost (A + B 28,800

(b) Cost per Kilometre 9 . Rs

200 , 3

800 , 28 . Rs

=

Cost per tonne Kilometre = 80 . 1 . Rs

tonne 10 . km 600 , 1

800 , 28 . Rs

=

Working Note

1. Total distance travelled = 80 km. (distance traveled in 1 trip)

by lorry in 4 weeks 2 trips 20 days.

= 3,200 km.

Total consumption of petrol

in 4 weeks = litre

km

km ,

400

8

200 3

=

Petrol cost (for 4 weeks) = 400 litres Rs. 13.

Cost Accounting

9.12

= Rs. 5,200

2. Total distance travelled in

4 weeks = 3,200 km.

Tyre Cost (for 4 weeks) =

. km 000 , 25

km 200 , 3 250 , 6 . Rs

= Rs. 800

3. Cost of Lorry = Rs. 4,50,000

Estimated sales value of lorry

at the end of its life = Rs. 50,000

Life of lorry = 80,000 km

Depreciation (for 4 weeks) = km ,

,

, . Rs , , . Rs

200 3

000 80

000 50 000 50 4

= Rs. 16,000

4. Insurance (for 4 weeks) = weeks 4

weeks 52

500 , 6 . Rs

= Rs. 500

5. Licence Cost (for 4 weeks) = weeks 4

weeks 52

300 , 1 . Rs

= Rs.100

6. Other overheads (for 4 weeks) = weeks 4

weeks 52

600 , 41 . Rs

= Rs. 3,200

Question 9

Mr. X owns a bus which runs according to the following schedule:

(i) Delhi to Chandigarh and back, the same day.

Distance covered: 150 kms, one way

Number of days run each month: 8

Seating capacity occupied 90%

(ii) Delhi to Agra and back, the same day.

Distance covered : 120 kms. One way

Number of days run each month: 10

Seating capacity occupied 85%

(iii) Delhi to Jaipur and back, the same day

Distance covered: 270 kms. one way.

Operating Costing

9.13

Number of days run each month: 6

Seating capacity occupied 100%

(iv) Following are the other details:

Cost of the bus Rs. 6,00,000

Salary of the driver Rs. 2,800 p.m.

Salary of the Conductor Rs. 2,200 p.m.

Salary of the part-time Accountant Rs. 200 p.m.

Insurance of the bus Rs. 4,800 p.a.

Diesel consumption 4 kms per litre Rs. 6 per litre

Road tax Rs. 1,500 p.a.

Lubricant oil Rs. 10 per 100 kms.

Permit fee Rs. 315 p.m.

Repairs and maintenance Rs. 1,000 p.m.

Depreciation of the bus @ 20% p.a.

Seating capacity of the bus 50 persons.

Passenger tax is 20% of the total takings. Calculate the bus fare to be charged from each

passenger to earn a profit of 30% on total takings. The fares are to be indicated per passenger

for the journeys:

(i) Delhi to Chandigarh

(ii) Delhi to Agra

(iii) Delhi to Jaipur

Answer

Working Notes

(1) Total running Kms per month:

Km. per

trip

Trips per

day

Days per

month

Km. per

month

Delhi to Chandigarh

Delhi to Agra

Delhi to Jaipur

150

120

270

2

2

2

8

10

6

2,400

2,400

3,240

8,040

Cost Accounting

9.14

(2) Passenger Kms. per month:

Total seats

available

per month

Capacity

utilized

% Seats

Km.per

trip

Passenger

Kms. per

month

Delhi to Chandigarh & Back

(50 seats 2 trips 8 days)

800 90 720 150 1,08,000

Delhi to Agra & Back

(50 seats 2 trips 10 days)

1,000 85 850 120 1,02,000

Delhi to Jaipur & Back

(50 seats 2 trips 6 days)

600 100 600 270 1,62,000

Total 3,72,000

Operating Cost Statement (per month)

Fixed Costs: Rs. Rs.

Salary of Driver

Salary of Conductor

Salary of the part-time accountant

2,800

2,200

200

Depreciation (Rs.6,00,000

12

1

100

20

) 10,000

Insurance (Rs.4,800 1/12) 400

Road Tax (Rs. 1,500 1/12) 125

Repairs and maintenance 1,000

Permit Fee 315 _____

Total fixed expenses 17,040

Variable Costs

Diesel (

. Kms

. Kms ,

4

040 8

Rs. 6)

12,060

(Refer to working note 1)

Lubricant Oil ( 10 . Rs

. Kms 100

. Kms 040 , 8

)

804

(Refer to working note 1)

Total Cost per month 29,904

Profit and passenger tax together accounts

for 50% of total taking p.m. or 100% of cost

29,904

______

Total takings 59,808

Passenger tax (20% of takings) 11,961.60

Profit (30% of takings) 17,942.60

Operating Costing

9.15

Rate per passenger Km. = 1607741 . 0

000 , 72 , 3 . Rs

808 , 59 . Rs

= passenger Km.

(Refer to working note 2) or (Re. 0.16 say)

Fare to be charged

Delhi to Chandigarh, per passenger = 150 Kms. 0.16 = Rs. 24

Delhi to Agra, per passenger = 120 Kms. 0.16 = Rs. 19.20

Delhi to Jaipur, per passenger = 270 Kms. 0.16 = Rs. 43.20

Question 10

A Mineral is transported from two mines 'A' and 'B' and unloaded at plots in a Railway

Station. Mine A is at a distance of 10 kms, and B is at a distance of 15 kms. from railhead

plots. A fleet of lorries of 5 tonne carrying capacity is used for the transport of mineral from the

mines. Records reveal that the lorries average a speed of 30 kms. per hour, when running and

regularly take 10 minutes to unload at the railhead. At mine 'A' loading time averages 30

minutes per load while at mine 'B' loading time averages 20 minutes per load.

Drivers' wages, depreciation, insurance and taxes are found to cost Rs. 9 per hour

operated. Fuel, oil, tyres, repairs and maintenance cost Rs. 1.20 per km.

Draw up a statement, showing the cost per tonne-kilometer of carrying mineral from each

mine. (Nov. 2000, 8 marks)

Answer

Statement showing the cost per tonne-kilometer of

carrying mineral from each mine

Mine A

Rs.

Mine B

Rs.

Fixed cost per trip

(Driver's wages, depreciation, insurance

and taxes)

A: 1 hour 20 minutes @ Rs. 9 per hour 12

B: 1 hour 30 minutes @ Rs. 9 per hour 13.50

(Refer to working note 1)

Running and maintenance cost:

(Fuel, oil, tyres, repairs and

maintenance)

A: 20 kms Rs. 1.20 per km. 24

B: 30 kms. Rs. 1.20 per km. ___ 36.00

Cost Accounting

9.16

Total cost per trip 36 49.50

Cost per tonne km 0.72 0.66

(Refer to working note 2) (Rs.36/50 tonnes kms) (Rs.49.50/75 tonnes kms)

Working notes

Mine A Mine B

1. Total operated time taken per trip

Running time to & fro 40 minutes 60 minutes

|

|

.

|

\

|

kms 30

utes min 60

. kms 20

|

|

.

|

\

|

kms 30

utes min 60

. kms 30

Unloading time 10 minutes 10 minutes

Loading time 30 minutes 20 minutes

Total operated time 80 minutes or 90 minutes or

1 hour 20 minutes 1 hour 30 minutes

2. Effective tones kms 50 75

(5 tonnes 10 kms) (5 tonnes 15 kms.)

Question 11

An article passes through five hand operations as follows:

Operation No. Time per article Grade of worker Wage rate per hour

1

2

3

4

5

15 minutes

25 minutes

10 minutes

30 minutes

20 minutes

A

B

C

D

E

Re. 0.65

Re. 0.50

Re. 0.40

Re. 0.35

Re. 0.30

The factory works 40 hours a week and the production target is 600 dozens per week.

Prepare a statement showing for each operation and in total the number of operators required,

the labour cost per dozen and the total labour cost per week to produce the total targeted

output. (May 1996, 7 marks)

Answer

Statement showing total number of operators required; the labour cost per dozen

and the total labour cost per week to produce targeted output under each operation.

Operation No. No. of operators

required *

Labour cost of 600 dozens

per week

Rs.

Labour cost per

dozen

Rs.

1 45 1,170

(45 40 0.65P)

1.95

(Rs. 1,170/600)

Operating Costing

9.17

2 75 1,500

(7540 0.50p)

2.50

(Rs. 1,500/600)

3 30 480

(30 40 0.40p)

0.80

(Rs.480/600)

4 90 1,260

(90 40 0.35p)

2.10

(Rs. 1,260/600)

5 60 720

(60 40 0.30 p)

1.20

(Rs. 720/600)

300 5,130 8.55

* Working Note

Operation No. No. of operators required

1

60

15

40

12 dozens 600

= 45

2

60

25

40

12 dozens 600

= 75

3

60

10

40

12 dozens 600

= 30

4

60

30

40

12 dozens 600

= 90

5

60

20

40

12 dozens 600

= 60

Question 12

A truck starts with a load of 10 tonnes of goods from station P. It unloads 4 tonnes at

station Q and rest of the goods at station R. It reaches back directly to station P after getting

reloaded with 8 tonnes of goods at station R. The distances between P to Q, Q to R and then

from R to P are 40 kms, 60 kms, and 80 kms, respectively. Compute 'Absolute tonne-km' and

'Commercial tonne-km'. (May, 1995, 4 marks)

Answer

Absolute tonnes-kms = 10 tonnes 40 kms + 6 tonnes 60 kms.

+ 8 tonnes 80 kms.

= 1,400 tonnes kms.

Commercial tonnes-kms = Average load Total kilometers travelled

= kms 180 tonnes

3

) 8 6 10 (

+ +

Cost Accounting

9.18

= 8 tonnes 180 kms

= 1,440 tonnes-kms

Note: It may be noted that while calculating the absolute tonnes kms, the travel between

any two stations is considered individually, while in the case of commercial tonne-

kms, the trip is considered as a whole.

Question 13

EPS is a Public School having 25 buses each plying in different directions for the

transport of its school students. In view of large number of students availing of the bus

service, the buses work two shifts daily both in the morning and in the afternoon. The buses

are garaged in the school. The workload of the students has been so arranged that in the

morning, the first trip picks up senior students and the second trip plying an hour later picks up

junior students. Similarly, in the afternoon, the first trip takes the junior students and an hour

later the second trip takes the senior students home.

The distance travelled by each bus, one way is 16 kms. The school works 24 days in a

month and remains closed for vacation in May and June. The bus fee, however, is payable by

the students for all the 12 months in a year.

The details of expenses for the year 2003-2004 are as under:

Driver's salary payable for all the 12 in month. Rs. 5,000 per month per drive.

Cleaner's salary payable for all the 12 months Rs.3,000 per month per cleaner

(one cleaner has been employed for every five buses).

Licence Fees, Taxes etc. Rs. 2,300 per bus per annum

Insurance Premium Rs. 15,600 per bus per annum

Repairs and Maintenance Rs. 16,400 per bus per annum

Purchase price of the bus Rs. 16,50,000 each

Life of the bus 16 years

Scrap value Rs. 1,50,000

Diesel Cost Rs. 18.50 per litre

Each bus gives an average of 10 kms per litre of diesel. The seating capacity of each bus

is 60 students. The seating capacity is fully occupied during the whole year.

The school follows differential bus fees based on distance traveled as under:

Operating Costing

9.19

Students picked up and

dropped within the range of

distance from the school

Bus fee Percentage of students

availing this facility

4 kms

8 kms

16 kms

25% of Full

50% of Full

Full

15%

30%

55%

Ignore interest. Since the bus fees has to be based on average cost, you are required to

(i) Prepare a statement showing the expenses of operating a single bus and the fleet of 25

buses for a year.

(ii) Work out average cost per student per month in respect of:

(a) Students coming from a distance of upto 4 kms from the school.

(b) Students coming from a distance of upto 8 kms from the school; and

(c) Students coming from a distance of upto 16 kms from the school

(May, 2004, 10 marks)

Answer

(i) EPS Public School

Statement showing the expenses of operating a single bus and the fleet of 25

buses for a year

Particulars Per bus

per annum

(Rs.)

Fleet of 25 buses

per annum

(Rs.)

Running costs : (a)

Diesel

(Refer to working note 1)

Repairs & maintenance costs: (B)

Fixed charges:

Driver's salary

Cleaners salary

Licence fee, taxes etc.

Insurance

Depreciation

Total fixed charges: (C)

Total expenses: (A+B+C)

56,832

16,400

60,000

7,200

2,300

15,600

93,750

1,78,850

2,52,082

14,20,800

4,10,000

15,00,000

1,80,000

57,500

3,90,000

23,43,750

44,71,250

63,02,050

Cost Accounting

9.20

(ii) Average cost per student per month in respect of students coming from a distance

of:

a) 4 kms. from the school

(Rs. 2,52,082 / 354 students 12 months)

(Refer to working note 2)

Rs. 59.34

b) 8 kms from the school

(Rs. 59.34 2)

Rs. 118.68

c) 16 kms from the school

(Rs. 59.34 4)

Rs. 237.36

Working notes:

1. Calculation of diesel cost per bus:

No. of trips made by a bus each day 4

Distance travelled in one trip both ways 32 kms

(16 kms 2 trips)

Distance traveled per day by a bus 128 kms

(32 kms 4 shifts)

Distance traveled during a month 3,072 kms

(128 kms 24 days)

Distance traveled per year 30,720 kms

(3,072 kms 10 months)

No. of litres of diesel required per bus per year 3,072 litres

(30,720 kms / 10 kms)

Cost of diesel per bus per year Rs. 56,832

(3,072 litres Rs. 18.50)

2. Calculation of number of students per bus:

Bus capacity of 2 trips 120 students

1/4

th

fare students 18 students

(15% 120 students)

fare 30% students (equivalent to 1/4

th

fare students) 72 students

Full fare 55% students (equivalent to 1/4

th

fare students) 264 students

Total 1/4

th

fare students 354 students

Operating Costing

9.21

Question 14

A transport company has a fleet of three trucks of 10 tonnes capacity each plying in

different directions for transport of customer's goods. The trucks run loaded with goods and

return empty. The distance travelled, number of trips made and the load carried per day by

each truck are as under:

Truck No. One way

Distance Km

No. of trips

per day

Load carried

per trip / day

tonnes

1

2

3

16

40

30

4

2

3

6

9

8

The analysis of maintenance cost and the total distance travelled during the last two years is

as under

Year Total distance

travelled

Maintenance Cost

Rs.

1

2

1,60,200

1,56,700

46,050

45,175

The following are the details of expenses for the year under review:

Diesel : Rs. 10 per litre. Each litre gives 4 km per litre of

diesel on an average.

Driver's salary : Rs. 2,000 per month

Licence and taxes : Rs. 5,000 per annum per truck

Insurance : Rs. 5,000 per annum for all the three vehicles.

Purchase Price per truck : Rs. 3,00,000 Life 10 years. Scrap value at the

end of life is Rs. 10,000.

Oil and sundries : Rs. 25 per 100 km run.

General Overhead : Rs. 11,084 per annum

The vehicles operate 24 days per month on an average.

Required

(i) Prepare an Annual Cost Statement covering the fleet of three vehicles.

(ii) Calculate the cost per km. run.

(iii) Determine the freight rate per tonne km. to yield a profit of 10% on freight

(Nov., 2001, 10 marks)

Cost Accounting

9.22

Answer

(i) Annual Cost Statement of three vehicles

Rs.

Diesel 3,36,960

(Refer to working note I)

(1,34,784 kms / 4 km) Rs. 10)

Oil & sundries 33,696

(1,34,784 kms/100 kms) Rs. 25

Maintenance 39,696

(Refer to working note 2)

{(1,34,784 kms 0.25P) + Rs. 6,000}

Drivers' salary 72,000

(Rs. 2,000 12 months) 3 trucks

Licence and taxes 15,000

Insurance 5,000

Depreciation 87,000

(Rs. 2,90,000/10 years) 3 trucks

General overhead 11,084

Total annual cost 6,00,436

(ii) Cost per km. run

Cost per kilometer run =

annually travelled kilometre Total

vehicles of t cos annual Total

(Refer to working note 1)

= 4548 . 4 . Rs

Kms 784 , 34 , 1

436 , 00 , 6 . Rs

=

(iii) Freight rate per tonne km (to yield a profit of 10% on freight)

Cost per tonne km. =

annum per . kms tonnes effective Total

vehicles three of t cos annual Total

(Refer to working note 1) = 143 . 1 . Rs

kms 312 , 25 , 5

436 , 00 , 6 . Rs

=

Freight rate per tonne km. = Rs. 1.27

10

9

143 . 1 . Rs

|

.

|

\

|

Operating Costing

9.23

Working notes:

1. Total kilometre travelled and tonnes kilometre (load carried) by three trucks in one

year

Truck

number

One way

distance in

kms

No. of trips Total

distance

covered in

km per day

Load carried

per trip / day

in tonnes

Total

effective

tonnes km

1

2

3

Total

16

40

30

4

2

3

128

160

180

468

6

9

8

384

720

720

1824

Total kilometre travelled by three trucks in one year 1,34,784

(468 kms 24 days 12 months)

Total effective tonnes kilometre of load carried by three trucks during one year 5,25,312

(1,824 tonnes km 24 days 12 months)

2. Fixed and variable component of maintenance cost:

Variable maintenance cost per km =

travelled distance in Difference

cost e maintenanc in Difference

=

kms 700 , 56 , 1 kms 200 , 60 , 1

175 , 45 . Rs 050 , 46 . Rs

= Rs. 0.25

Fixed maintenance cost = Total maintenance costVariable maintenance cost

= Rs. 46,050 1,60,200 kms 0.25

= Rs. 6,000

Question 15

Global Transport Ltd. charges Rs. 90 per ton for its 6 tons truck lorry load from city 'A' to

city 'B'. The charges for the return journey are Rs.84 per ton. No concession or reduction in

these rates is made for any delivery of goods at intermediate station 'C'. In January 1997 the

truck made 12 outward journeys for city 'B' with full load out of which 2 tones were unloaded

twice in the way of city 'C'. The truck carried a load of 8 tons in its return journey for 5 times

but once caught by police and Rs.1,200 was paid as fine. For the remaining trips the truck

carried full load out of which all the goods on load were unloaded once at city 'C'. The distance

from city 'A' to city 'C' and city 'B' are 140 kms and 300 kms respectively. Annual fixed costs

and maintenance charges are Rs. 60,000 and Rs. 12,000 respectively Running charges spent

during January, 1997 are Rs. 2,944.

Cost Accounting

9.24

You are required to find out the cost per absolute ton-kilometre and the profit for January,

1997 (May, 1997, 12 marks)

Answer

Operating Cost and Profit Statement

M/s Global Transport Ltd.

(during January, 1977)

Rs.

Fixed Costs 5,000

(Rs. 60,000/12)

Maintenance charges 1,000

(Rs. 12,000/12)

Running charges 2,944

Total operating cost 8,944

Cost per absolute ton km 0.20

(Rs. 8,944/44,720 absolute tons kms)

(Refer to working note 3)

Net revenue received 12,168

(Refer to working note 4)

Less: Total operating cost 8,944

Profit 3,224

Working Notes

1. Outward journeys:

(i) From city A to city B:

10 journey 300 kms 6 tons = 18,000 tons kms

(ii) From city A to city C:

2 journeys 140 kms 6 tons = 1,680 tons kms.

(iii) From city C to city B:

2 journeys 160 kms 4 tons = 1,280 tons kms

Total: = 20,960 tons kms

2. Return journeys:

(i) From city B to city A:

5 journeys 300 kms 8 tons. = 12,000 tons kms

6 journeys 300 kms 6 tons = 10,800 tons kms

Operating Costing

9.25

(ii) From city B to city C:

1 journey 160 kms. 6 tons = 660 tons kms.

Total = 23,760 tons kms

3. Total absolute tonnes kms of outward and return journeys:

(Refer to working notes 1 and 2) = 20,960 tons kms + 23,760 tons km

= 44,720 tons, - kms.

4. Net revenue received during January, 1997:

12 trucks + 6 tons Rs. 90 6,480

(from city A to city B)

5 trucks 8 tons Rs. 84 3,360

(from city B to city A)

6 trucks 6 tons Rs. 84 3,024

(from city B to city A)

1 truck 6 tons Rs. 84 504

(from city B to city C)

Total revenue 13,368

Less: Fine paid 1,200

Net revenue received 12,168

Question 16

A transport service company is running five buses between two towns which are 50 kms

apart. Seating capacity of each bus is 50 passengers. The following particulars were obtained

from their books for April, 1998:

Rs.

Wages of drivers, conductors and cleaners 24,000

Salaries of office staff 10,000

Diesel oil and other oil 35,000

Repairs and Maintenance 8,000

Taxation, Insurance etc. 16,000

Depreciation 26,000

Interest and other expenses 20,000

1,39,000

Cost Accounting

9.26

Actually, passengers carried were 75 percent of seating capacity. All buses ran on all days of

the month. Each bus has made one round trip per day.

Find out the cost per passenger km. (Nov., 1998, 10 marks)

Answer

Operating cost statement for the month of April, 1998

Amount

Particulars

Rs. Rs.

A. Standing charges

Wages of drivers, conductors and cleaners

Salaries of office staff

Taxation, insurance etc.

Interest and other expenses

24,000

10,000

16,000

20,000 70,000

B. Running & maintenance cost

Repairs and maintenance

Diesel oil and other oil

Depreciation

8,000

35,000

26,000 69,000

Total cost : (A+B) 1,39,000

Cost per passenger Km. 0.2471

(Rs. 1,39,000/5,62,500 passenger kms)

(Refer to working note)

Working note

Passenger Kms.: No. of Buses Distance in Seating Percentage No. of days

one round capacity seating in a month

trip per day available capacity

in each actually

bus used in

each bus

= 5 Buses 50 Kms. 2 50 passengers 75% 30 days = 5,62,500 Kms.

Question 17

In order to develop tourism, ABCL airline has been given permit to operate three flights in

a week between X and Y cities (both side). The airline operates a single aircraft of 160 seats

capacity. The normal occupancy is estimated at 60% through out the year of 52 weeks. The

one-way fare is Rs. 7,200. The cost of operation of flights are:

Operating Costing

9.27

Fuel cost (variable) Rs. 96,000 per flight

Food served on board on non-chargeable basis Rs. 125 per passenger

Commission 5% of fare applicable for all booking

Fixed cost:

Aircraft lease Rs. 3,50,000 per flight

Landing Charges Rs. 72,000 per flight

Required:

(i) Calculate the net operating income per flight.

(ii) The airline expects that its occupancy will increase to 108 passengers per flight if

the fare is reduced to Rs. 6,720. Advise whether this proposal should be

implemented or not. (3+2=5 marks)

Answer

No. of passengers 16060/100 = 96 Rs Rs.

(i) Fare collection 967,200 6,91,200

Variable costs:

Fuel 96,000

Food 96125 12,000

Commission 5% 34,560

Total variable Costs 1,42,560

Contribution per flight 5,48,640

Fixed costs: Lease 3,50,000

Crew 72,000 4,22,000

Net income per flight 1,26,640

(ii) Fare collection 1086,720 7,25,760

Variable costs:

Fuel 96,000

Food 108125 13,500

Commission @ 5% 36,288

Contribution 5,79,972

There is an increase in

contribution by Rs. 31,332.

Hence the proposal is

acceptable

Cost Accounting

9.28

Question 18

A Club runs a library for its members. As part of club policy, an annual subsidy of upto

Rs. 5 per member including cost of books may be given from the general funds of the

club. The management of the club has provided the following figures for its library

department.

Number of Club members 5,000

Number of Library members 1,000

Library fee per member per month Rs. 100

Fine for late return of books Re. 1 per book per day

Average No. of books returned late per month 500

Average No. of days each book is returned late 5 days

Number of available old books 50,000 books

Cost of new books Rs. 300 per book

Number of books purchased per year 1,200 books

Cost of maintenance per old book per year Rs. 10

Staff details No. Per Employee

Salary per month (Rs.)

Librarian 01 10,000

Assistant Librarian 03 7,000

Clerk 01 4,000

You are required to calculate:

(i) the cost of maintaining the library per year excluding the cost of new books;

(ii) the cost incurred per member per month on the library excluding cost of new books;

and

(iii) the net income from the library per year.

If the club follows a policy that all new books must be purchased out of library

revenue (a) What is the maximum number of books that can be purchased per year

and (b) How many excess books are being purchased by the library per year?

Also, comment on the subsidy policy of the club. (May 2007, 10 Marks)

Operating Costing

9.29

Answer

Computation of total revenue

No. of library members No 1,000

Library fees per month Rs. 1,00,000

Late fees per month (500 5 1) Rs. 2,500

Total Revenue per month Rs. 1,02,500

Total Revenue per annum (1,02,500 12) Rs. 12,30,000

Computation of total cost

Staff details No. Salary per

month

Total cost

Rs. Rs.

Librarian 1 10,000 10,000

Assistant Librarian 3 7,000 21,000

Clerk 1 4,000 4,000

Total Staff cost per month 35,000

Total Staff cost per year (35,000 12) 4,20,000

No. Cost per book

Books maintenance cost 50,000 Rs. 10 5,00,000

Total maintenance cost per annum

excluding cost of new books (4,20,000 +

5,00,000)

9,20,000

Cost incurred per library member per annum

(Rs. 9,20,000/1,000) Rs. 920

Cost incurred per member per month on the library

excluding cost of new books (920/12) Rs. 76.67

Cost incurred per club member per annum

(9,20,000/5,000) Rs. 184

Cost incurred per club member per month (184/12) Rs. 15.33

Net income from the library per annum

(12,30,000 9,20,000) Rs. 3,10,000

Cost per new book Rs. 300

Maximum number of new books per annum

(3,10,000/300) No. 1033.333

Cost Accounting

9.30

Present number of books purchased No. 1200

Excess books purchased (1200 1033.333) No. 166.6667

Subsidy being given per annum Rs. 50,000

Subsidy per library member per annum (50,000/1,000) Rs. 50

Subsidy per club member per annum (50,000/5,000) Rs. 10

Comment:

The club is exceeding its subsidy target to members by Rs. 45 (Rs. 50 5) per library

member and Rs. 5 (Rs. 10 5) per club member.

Question 19

A company runs a holiday home. For this purpose, it has hired a building at a rent of Rs.

10,000 per month alongwith 5% of total taking. It has three types of suites for its

customers, viz., single room, double rooms and triple rooms.

Following information is given:

Type of suite Number Occupancy percentage

Single room 100 100%

Double rooms 50 80%

Triple rooms 30 60%

The rent of double rooms suite is to be fixed at 2.5 times of the single room suite and that

of triple rooms suite as twice of the double rooms suite.

The other expenses for the year 2006 are as follows:

Rs.

Staff salaries 14,25,000

Room attendants wages 4,50,000

Lighting, heating and power 2,15,000

Repairs and renovation 1,23,500

Laundry charges 80,500

Interior decoration 74,000

Sundries 1,53,000

Provide profit @ 20% on total taking and assume 360 days in a year.

You are required to calculate the rent to be charged for each type of suite.

(May 2007, 10 Marks)

Operating Costing

9.31

Answer

(i) Total equivalent single room suites

Nature of suite Occupancy Equivalent single

room suites

Single room suites 100 360 100% = 36,000 36,000 1 = 36,000

Double rooms suites 50 360 80% = 14,400 14,400 2.5 = 36,000

Triple rooms suites 30 360 60% = 6,480 6,480 5 = 32,400

Total 1,04,400

(ii) Statement of total cost:

Rs.

Staff salaries 14,25,000

Room attendants wages 4,50,000

Lighting, heating and power 2,15,000

Repairs and renovation 1,23,500

Laundry charges 80,500

Interior decoration 74,000

Sundries 1,53,000

25,21,000

Building rent 10,000 12 + 5% on total taking 1,20,000

+ 5% on takings

Total cost 26,41,000 + 5% on

total takings

Profit is 20% of total takings

Total takings = Rs. 26,41,000 + 25% of total takings

Let x be rent for single room suite

Then 1,04,400 x = 26,41,000 + 25% of (1,04,400 x)

or 1,04,400 x = 26,41,000 + 26,100 x

or 78,300 x = 26,41,000

or x = 33.73

Cost Accounting

9.32

(iii) Rent to be charged for single room suite = Rs. 33.73

Rent for double rooms suites Rs. 33.73 2.5 = Rs. 84.325

Rent for triple rooms suites Rs. 33.73 5 = Rs. 168.65

Question 20

A transport company has 20 vehicles, which capacities are as follows:

No. of Vehicles Capacity per vehicle

5 9 tonne

6 12 tonne

7 15 tonne

2 20 tonne

The company provides the goods transport service between stations A to station B.

Distance between these stations is 200 kilometres. Each vehicle makes one round trip

per day an average. Vehicles are loaded with an average of 90 per cent of capacity at

the time of departure from station A to station B and at the time of return back loaded

with 70 per cent of capacity. 10 per cent of vehicles are laid up for repairs every day.

The following informations are related to the month of October, 2008:

Salary of Transport Manager Rs. 30,000

Salary of 30 drivers Rs. 4,000 each driver

Wages of 25 Helpers Rs. 2,000 each helper

Wages of 20 Labourers Rs. 1,500 each labourer

Consumable stores Rs. 45,000

Insurance (Annual) Rs. 24,000

Road Licence (Annual) Rs. 60,000

Cost of Diesel per litre Rs. 35

Kilometres run per litre each vehicle 5 Km.

Lubricant, Oil etc. Rs. 23,500

Cost of replacement of Tyres, Tubes, other parts etc. Rs. 1,25,000

Garage rent (Annual) Rs. 90,000

Transport Technical Service Charges Rs. 10,000

Electricity and Gas charges Rs. 5,000

Depreciation of vehicles Rs. 2,00,000

Operating Costing

9.33

There is a workshop attached to transport department which repairs these vehicles and

other vehicles also. 40 per cent of transport managers salary is debited to the workshop.

The transport department is charged Rs. 28,000 for the service rendered by the

workshop during October, 2008. During the month of October, 2008 operation was 25

days.

You are required:

(i) Calculate per ton-km operating cost.

(ii) Find out the freight to be charged per ton-km, if the company earned a profit of 25

per cent on freight. (November 2008 8 marks)

Answer

(i) Operating Cost Sheet

for the month of October, 2008

Particulars Amount

(Rs.)

A. Fixed Charges:

Managers salary:

100

60

30,000 Rs.

18,000

Drivers Salary : Rs. 4,000 30 1,20,000

Helpers wages : Rs. 2,000 25 50,000

Labourer wages : Rs. 1,500 20 30,000

Insurance :

12

24,000 Rs. 2,000

Road licence :

12

60,000 Rs. 5,000

Garage rent:

12

90,000 Rs. 7,500

Transport Technical Service Charges 10,000

Share in workshop expenses 28,000

Total (A) 2,70,500

B. Variable Charges:

Cost of diesel 12,60,000

Lubricant, Oil etc. 23,500

Cost Accounting

9.34

Depreciation 2,00,000

Replacement of Tyres, Tubes & other parts 1,25,000

Consumable Stores 45,000

Electricity and Gas charges 5,000

Total (B) 16,58,500

C. Total Cost (A + B) 19,29,000

D. Total Ton-Kms. 18,86,400

E. Cost per ton-km. (C/D) 1.022

(ii) Calculation of Chargeable Freight

Cost per ton-km. Rs. 1.022

Add: Profit @ 25% on freight or 33% on cost Re. 0.341

Chargeable freight per ton-km. Rs. 1.363 or Rs. 1.36

Workings:

1. Cost of Diesel:

Distance covered by each vehicle during October, 2008 = 200 2 25 90/100 = 9,000 km.

Consumption of diesel = litres. 36,000

5

20 9,000

=

Cost of diesel = 36,000 Rs. 35 = Rs. 12,60,000.

2. Calculation of total ton-km:

Total Ton-Km. = Total Capacity Distance covered by each vehicle Average Capacity Utilisation

ratio.

= ( ) ( ) ( ) ( ) | |

( )

2

70% 90%

9,000 20 2 15 7 12 6 9 5

+

+ + +

= ( ) 80% 9,000 40 105 72 45 + + +

= 262 9,000 80%.

= 18,86,400 ton-km.

You might also like

- 1 Working CapitalDocument63 pages1 Working CapitalDeepika Mittal50% (2)

- Tough LekkaluDocument42 pagesTough Lekkaludeviprasad03No ratings yet

- Study Note 5.2 (353-378)Document26 pagesStudy Note 5.2 (353-378)s4sahith100% (1)

- Chap 12 PDFDocument15 pagesChap 12 PDFTrishna Upadhyay50% (2)

- Marginal CostingDocument10 pagesMarginal Costinganon_672065362No ratings yet

- Home Work Fire Insurance ClaimDocument21 pagesHome Work Fire Insurance ClaimHetvi Vora80% (5)

- Practical Problems and Break-Even Analysis for Various CompaniesDocument7 pagesPractical Problems and Break-Even Analysis for Various Companieshrmohan8667% (3)

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFDocument28 pagesCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU NNo ratings yet

- Bos 28432 CP 10Document45 pagesBos 28432 CP 10hiral dattaniNo ratings yet

- DEPARTMENTAL ACCOUNTSDocument17 pagesDEPARTMENTAL ACCOUNTSAyush AcharyaNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Receivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearDocument6 pagesReceivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearJC Del MundoNo ratings yet

- Study Note 4.4 Page (264-289)Document26 pagesStudy Note 4.4 Page (264-289)s4sahith75% (24)

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Operating CostingDocument13 pagesOperating CostingJoydip DasguptaNo ratings yet

- Process & Operation CostingDocument96 pagesProcess & Operation Costinganon_67206536240% (5)

- Investment Accounts PDFDocument35 pagesInvestment Accounts PDFRam Iyer80% (10)

- Process Costing 2.1Document41 pagesProcess Costing 2.1Sixson FrancisNo ratings yet

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNo ratings yet

- Unit - 4: Amalgamation and ReconstructionDocument54 pagesUnit - 4: Amalgamation and ReconstructionAzad AboobackerNo ratings yet

- Chapter 4: LeverageDocument15 pagesChapter 4: LeverageSushant MaskeyNo ratings yet

- Chapter 12 Service CostingDocument3 pagesChapter 12 Service CostingMS Raju100% (1)

- Cost Sheet PDF - 20210623 - 142101Document10 pagesCost Sheet PDF - 20210623 - 142101Raju Lal100% (1)

- Cost Sheet PreparationDocument25 pagesCost Sheet PreparationShiva AP100% (2)

- Cost & Finance RTP Nov 15Document41 pagesCost & Finance RTP Nov 15Aaquib ShahiNo ratings yet

- Capital Gains IllustrationDocument15 pagesCapital Gains IllustrationSarvar PathanNo ratings yet

- Accounting from Incomplete Records: Trading and Profit Loss StatementDocument21 pagesAccounting from Incomplete Records: Trading and Profit Loss StatementbinuNo ratings yet

- Contract Costing: Practical ProblemsDocument28 pagesContract Costing: Practical ProblemsHarshit Aggarwal79% (14)

- Compiler CAP II Cost AccountingDocument187 pagesCompiler CAP II Cost AccountingEdtech NepalNo ratings yet

- Consolidated Balance Sheets of Holding and Subsidiary CompaniesDocument11 pagesConsolidated Balance Sheets of Holding and Subsidiary CompaniesMr. 360No ratings yet

- Account Past Questions Compilation (2009june - 2020 Dec.)Document246 pagesAccount Past Questions Compilation (2009june - 2020 Dec.)Prashant Sagar Gautam100% (2)

- Reconciliation of Cost and Financial Accounts PDFDocument14 pagesReconciliation of Cost and Financial Accounts PDFvihangimadu100% (2)

- Amalgamation Dec 2020Document46 pagesAmalgamation Dec 2020binu100% (2)

- 18 Chapter4 Unit 1 2 Hire Purchase and Instalment PaymentDocument17 pages18 Chapter4 Unit 1 2 Hire Purchase and Instalment Paymentnarasimha_gudiNo ratings yet

- Module 6Document50 pagesModule 6rohit saini100% (3)

- Hire Purchase Notes 10 YrDocument80 pagesHire Purchase Notes 10 YrLalitKukreja100% (2)

- Problems On Interest Calculation P: (A) When Rate of Interest and Total Cash Price Are GivenDocument9 pagesProblems On Interest Calculation P: (A) When Rate of Interest and Total Cash Price Are GivenSubham Jaiswal100% (2)

- Cost Acc Nov06Document27 pagesCost Acc Nov06api-3825774No ratings yet

- 5 Accounting Problems On RoyaltiesDocument16 pages5 Accounting Problems On RoyaltiesHakim JanNo ratings yet

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- 2 Insurance F PDFDocument42 pages2 Insurance F PDFjashveer rekhi17% (6)

- Leverage Notes by CA Mayank Kothari SirDocument48 pagesLeverage Notes by CA Mayank Kothari Sirbinu100% (2)

- Labour: (A) (B) (C) (D) (E)Document40 pagesLabour: (A) (B) (C) (D) (E)Sushant MaskeyNo ratings yet

- Home Work Section Working CapitalDocument10 pagesHome Work Section Working CapitalSaloni AgrawalNo ratings yet

- Overheads PracticalDocument37 pagesOverheads PracticalSushant Maskey100% (1)

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- Problems From Unit - 5Document8 pagesProblems From Unit - 5jeganrajrajNo ratings yet

- 7948final Adv Acc Nov05Document16 pages7948final Adv Acc Nov05Kushan MistryNo ratings yet

- What is TDS? Advance Tax and ProblemsDocument8 pagesWhat is TDS? Advance Tax and ProblemsNishantNo ratings yet

- Contract Costing 4 Problems and SolutionDocument9 pagesContract Costing 4 Problems and Solutioncnagadeepa50% (4)

- Problems On Working CapDocument25 pagesProblems On Working Capamazing19inNo ratings yet

- Contract CostingDocument60 pagesContract Costinganon_67206536267% (6)

- Budgetory Control Flexible Budget With SolutionsDocument6 pagesBudgetory Control Flexible Budget With SolutionsJash SanghviNo ratings yet

- CA Foundation past exam bills of exchange questionsDocument14 pagesCA Foundation past exam bills of exchange questionsMadhan Aadhvick0% (1)

- Pre-Incorporation Profits and LossesDocument37 pagesPre-Incorporation Profits and LossesGokarakonda Sandeep100% (1)

- Chapter 8 Operating CostingDocument13 pagesChapter 8 Operating CostingDerrick LewisNo ratings yet

- Operating CostingDocument22 pagesOperating CostingNeelabh Kumar50% (2)

- Mcom Ac Paper IIDocument86 pagesMcom Ac Paper IIrckadam1850% (6)

- SERVICE COSTING (Operating Costing)Document13 pagesSERVICE COSTING (Operating Costing)Vandana SharmaNo ratings yet

- Accounting Standard 9Document13 pagesAccounting Standard 9MANJEET PANGHALNo ratings yet

- As 8 NewDocument1 pageAs 8 Newapi-3705877No ratings yet

- Sources of FinanceDocument10 pagesSources of Financeanon_672065362No ratings yet

- Scope and Objectives of Financial ManagementDocument3 pagesScope and Objectives of Financial Managementanon_672065362No ratings yet

- Accounting Standards As5newDocument9 pagesAccounting Standards As5newapi-3705877No ratings yet

- 18413compsuggans PCC FM Chapter5Document6 pages18413compsuggans PCC FM Chapter5Vikas SinghNo ratings yet

- As 2 - Valuation of InventoriesDocument9 pagesAs 2 - Valuation of InventoriesRohit KumbharNo ratings yet

- Depreciation & Inventory ValuationDocument9 pagesDepreciation & Inventory ValuationDeepak KohliNo ratings yet

- As 4 Contingencies and Events Occuring After The Balance Sheet DateDocument9 pagesAs 4 Contingencies and Events Occuring After The Balance Sheet Dateanon_672065362No ratings yet

- 1 As Disclouser of Accounting PoliciesDocument6 pages1 As Disclouser of Accounting Policiesanisahemad1178No ratings yet

- Tools of Financial Analysis & PlanningDocument68 pagesTools of Financial Analysis & Planninganon_672065362100% (1)

- Everage: Sales (S) 90,000 90,000 3000 Units at Rs. 30/-Per Unit 15 Per Unit 45,000 45,000Document20 pagesEverage: Sales (S) 90,000 90,000 3000 Units at Rs. 30/-Per Unit 15 Per Unit 45,000 45,000anon_67206536260% (5)

- Inancing Ecisions: Unit - I: Cost of Capital Answer Weighted Average Cost of CapitalDocument15 pagesInancing Ecisions: Unit - I: Cost of Capital Answer Weighted Average Cost of Capitalanon_672065362No ratings yet

- Investment DecisionsDocument10 pagesInvestment Decisionsanon_672065362No ratings yet

- Method of Costing (I)Document8 pagesMethod of Costing (I)anon_672065362No ratings yet

- Time Value of MoneyDocument2 pagesTime Value of Moneyanon_672065362No ratings yet

- Financial Analysis and PlanningDocument29 pagesFinancial Analysis and Planninganon_672065362No ratings yet

- Cost Reduction & Cost ControlDocument4 pagesCost Reduction & Cost Controlanon_672065362No ratings yet

- Inter-Firm ComparisonDocument5 pagesInter-Firm Comparisonanon_672065362100% (1)

- Cost AuditDocument10 pagesCost Auditanon_672065362No ratings yet

- Uniform CostingDocument8 pagesUniform Costinganon_672065362100% (1)

- Contract CostingDocument60 pagesContract Costinganon_67206536267% (6)

- Joint Products & by ProductsDocument56 pagesJoint Products & by Productsanon_67206536267% (3)

- Process & Operation CostingDocument96 pagesProcess & Operation Costinganon_67206536240% (5)

- Chapter 5 Activity Based CostingDocument64 pagesChapter 5 Activity Based CostingPANUMSNo ratings yet

- Cost Accounting (Records) RulesDocument5 pagesCost Accounting (Records) Rulesanon_672065362No ratings yet

- Job Costing & Batch CostingDocument9 pagesJob Costing & Batch Costinganon_672065362100% (3)

- Non-Integrated, Integrated & Reconciliation of Cost and Financial AccountsDocument107 pagesNon-Integrated, Integrated & Reconciliation of Cost and Financial Accountsanon_67206536267% (3)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesFrom EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesRating: 5 out of 5 stars5/5 (1631)

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessFrom EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessRating: 4.5 out of 5 stars4.5/5 (327)

- The War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesFrom EverandThe War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesRating: 4.5 out of 5 stars4.5/5 (273)

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessFrom EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessRating: 5 out of 5 stars5/5 (456)

- SUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)From EverandSUMMARY: So Good They Can't Ignore You (UNOFFICIAL SUMMARY: Lesson from Cal Newport)Rating: 4.5 out of 5 stars4.5/5 (14)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsFrom EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsRating: 4.5 out of 5 stars4.5/5 (708)

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsFrom EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsRating: 4.5 out of 5 stars4.5/5 (382)

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessFrom EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessNo ratings yet

- Make It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningFrom EverandMake It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningRating: 4.5 out of 5 stars4.5/5 (55)

- Summary of 12 Rules for Life: An Antidote to ChaosFrom EverandSummary of 12 Rules for Life: An Antidote to ChaosRating: 4.5 out of 5 stars4.5/5 (294)

- How To Win Friends and Influence People by Dale Carnegie - Book SummaryFrom EverandHow To Win Friends and Influence People by Dale Carnegie - Book SummaryRating: 5 out of 5 stars5/5 (555)

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaFrom EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaRating: 4.5 out of 5 stars4.5/5 (266)

- Summary of Slow Productivity by Cal Newport: The Lost Art of Accomplishment Without BurnoutFrom EverandSummary of Slow Productivity by Cal Newport: The Lost Art of Accomplishment Without BurnoutRating: 1 out of 5 stars1/5 (1)

- Summary of Supercommunicators by Charles Duhigg: How to Unlock the Secret Language of ConnectionFrom EverandSummary of Supercommunicators by Charles Duhigg: How to Unlock the Secret Language of ConnectionNo ratings yet

- Summary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsFrom EverandSummary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsNo ratings yet

- Essentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessFrom EverandEssentialism by Greg McKeown - Book Summary: The Disciplined Pursuit of LessRating: 4.5 out of 5 stars4.5/5 (187)

- We Were the Lucky Ones: by Georgia Hunter | Conversation StartersFrom EverandWe Were the Lucky Ones: by Georgia Hunter | Conversation StartersNo ratings yet

- Designing Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeFrom EverandDesigning Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeRating: 4.5 out of 5 stars4.5/5 (61)

- Summary of Bad Therapy by Abigail Shrier: Why the Kids Aren't Growing UpFrom EverandSummary of Bad Therapy by Abigail Shrier: Why the Kids Aren't Growing UpRating: 5 out of 5 stars5/5 (1)

- Book Summary of The Subtle Art of Not Giving a F*ck by Mark MansonFrom EverandBook Summary of The Subtle Art of Not Giving a F*ck by Mark MansonRating: 4.5 out of 5 stars4.5/5 (577)

- The 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageFrom EverandThe 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageRating: 4.5 out of 5 stars4.5/5 (329)

- Steal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeFrom EverandSteal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeRating: 4.5 out of 5 stars4.5/5 (128)

- Summary of Atomic Habits by James ClearFrom EverandSummary of Atomic Habits by James ClearRating: 5 out of 5 stars5/5 (168)

- Crucial Conversations by Kerry Patterson, Joseph Grenny, Ron McMillan, and Al Switzler - Book Summary: Tools for Talking When Stakes Are HighFrom EverandCrucial Conversations by Kerry Patterson, Joseph Grenny, Ron McMillan, and Al Switzler - Book Summary: Tools for Talking When Stakes Are HighRating: 4.5 out of 5 stars4.5/5 (97)

- The Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindFrom EverandThe Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindRating: 4.5 out of 5 stars4.5/5 (57)

- Blink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingFrom EverandBlink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingRating: 4.5 out of 5 stars4.5/5 (114)

- Summary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursFrom EverandSummary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursNo ratings yet

- Psycho-Cybernetics by Maxwell Maltz - Book SummaryFrom EverandPsycho-Cybernetics by Maxwell Maltz - Book SummaryRating: 4.5 out of 5 stars4.5/5 (91)