Professional Documents

Culture Documents

ITR-1 filing guide for AY 2012-13

Uploaded by

Manohj ViswanathanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ITR-1 filing guide for AY 2012-13

Uploaded by

Manohj ViswanathanCopyright:

Available Formats

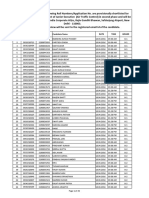

2012-13 ITR-1, PAGE 1

ITR-1 SAHAJ INDIAN INDIVIDUAL INCOME TAX RETURN AY 2012-13

A1 FIRST NAME A2 MIDDLE NAME A3 LAST NAME A4 PERMANENT ACCOUNT NUMBER

A5 SEX

A6 DATE OF BIRTH

A7 INCOME TAX WARD/CIRCLE

;M ale

; Fem ale A8 FLAT/DOOR/BUILDING

A10 AREA/LOCALITY A12 STATE

D D M MY Y YY

A9 ROAD/STREET A11 TOWN/CITY/DISTRICT A13 PINCODE

A14 EMAIL ADDRESS A15 RESIDENTIAL/OFFICE PHONE NO. WITH STD CODE A16 MOBILE NO. A17 Fill only one if you belong to

Others

9

; Government

9

; PSU

A18 Fill only one

Tax Refundable

Tax Payable

Nil Tax Balance

A19 Fill only one

; Resident 9 ; Non Resident

9

; Resident but

not ordinarily resident

A20 Fill only one: filed date-139(4) 9 ; Revised Return-139(5) A21If revised

OR

in response to notice

; Before due date-139(1) 9 ; After due ; 142(1) 9 ; 148 9 ; 153A/153C

and

Receipt Number of Original Return

D D MM Y Y Y Y

Date of Filing Original Return

PART B - GROSS TOTAL INCOME

B1 Income from Salary/Pension

NOTEEnsure to fill Sch TDS1 given in Page 2

Whole-Rupee( `) only. B1 B2 B3

B2 Income from One House Property B3 Income from other sources

NOTE Ensure to fill Sch TDS2 given in Page 2

(-) (-)

7 If showing loss, mark the negative sign in bracket at left

B4 Gross Total Income (B1 + B2 + B3)

PART C - DEDUCTIONS AND TAXABLE TOTAL INCOME

C1 to C13 C13 80U C14 Total Deductions ( Add items C1 to C13 ) C15 Taxable Total Income ( B4 - C14 )

FOR OFFICIAL USE ONLY

B4 (-) C3 80CCD C6 80DD C9 80G C12 80GGC

C1 80C C4 80CCF C7 80DDB C10 80GG

C2 80CCC C5 80D C8 80E C11 80GGA

C14 C15

(-)

S T A M P R E C E IP T N O . H ESEAL, DATE AND SIGNATURE RE

OF RECEIVING OFFICIAL

PERMANENT ACCOUNT NUMBER

2012-13 ITR-1, PAGE 2

PART DTAX COMPUTATION AND TAX STATUS

D1 Tax Payable On Total Income(C15) TOTAL TAX AND CESS ( D1+ D2 ) to D3 D1 D2 D4 Relief u/s 89 to D6 D4 Relief u/s 90/91 Secondary & Higher Education Cess

D3

Balance Tax After Relief ( D3-D4-D5)

D5

D6

Total Tax and Interest (D6+D7) Total

D7 Total Interest u/s 234A/234B/234C Advance Tax Paid to D9 D7 D10 Total Self Assessment Tax Paid to D12 D10

D8 D11

D9

Total Prepaid Taxes ( D9+D10+D11)

Total TDS Claimed

D12

D13 Tax Payable ( D8-D12, If D8>D12) Refund ( D12D8, If D12 >D8 ) to D14 D13 D14 Bank Account Details ( Mandatory in all cases irrespective of refund due or not)

9

D15 D17

Type of account :

; Current

; Savings

D16 MICR CODE D18 Fill only one: Refund by 9 ; cheque

ACCOUNT No.

or

deposited

directly into your bank account

D19 Exempt income only for reporting purposes

VERIFICATION

I, 9 son/ daughter of 9 solemnly declare that to the best of my knowledge and belief, the information given in the return is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to Income-tax for the previous year relevant to the Assessment Year 2012-13. Place

D MM Y Y Y Y

SIGN HERE

If the return has been prepared by a Tax Retur n Preparer (TRP) give further details as below Name of the TRP TRP PIN [ 10 Digit ] Amount to be paid to TRP

9 9

TRP Signature

Sch IT - DETAILS OF ADVANCE TAX AND SELF ASSESSMENT TAX PAYMENTS

BSR CODE(col.i) DATE OF DEPOSIT(col.ii)

9

CHALLAN NO(col.iii)

9 9

TAX PAID(col.iv)

R1 9 R2 9 R3 9 R4 9 R5 9

D Y D Y D Y D Y D Y

D M M Y YY Y D M M Y YY Y D M M Y YY D MM Y Y D MM Y Y

fill within Sch IT

NOTE (1) Enter the totals of Advance Tax and Self Assessment Tax in D9 and D10 (2) Continue in Supplementary Schedule IT if you cannot

Sch TDS1 - DETAILS OF TAX DEDUCTED AT SOURCE FROM SALARY [As per Form 16 issued by

Employer(s)]

S 1 S 2 S

TAN(col.i)

9 9

NAME OF THE EMPLOYER(col.ii)

9

INCOME UNDER SALARY(col.iii) TAX DEDUCTED(col.iv)

9

NOTE(1) Enter the total of column (iv) of Sch TDS1 and column (vi)of Sch TDS2 in D11

cannot fill within Sch TDS1

(2) Continue in Supplementary Schedule TDS1 if you

3 Form

Sch TDS2 - DETAILS OF TAX DEDUCTED AT SOURCE FROM INCOME OTHER THAN SALARY [As per

16A issued by Deductor(s)]

TAN(col.i) DEDUCTED (col.v)

9 9

NAME OF THE DEDUCTOR (col.ii)

AMT OUT OF CLAIMED THIS (colvi) (v) YR

9 9

UNIQUE TDS CER. NO (col.iii)

DEDUCTED YEAR (col.iv) TAX

T 1 T2 T3 T4

YYYY YYYY YYYY YYYY

NOTE(1) Enter the total of column (iv) of Sch TDS1 and column (vi)of Sch TDS2 in D11

fill within Sch TDS2

(2) Continue in Supplementary Schedule TDS2 if you cannot

You might also like

- ITR 1 Sahaj in Excel Format For A.Y 2011 12 Financial Year 2010 11Document8 pagesITR 1 Sahaj in Excel Format For A.Y 2011 12 Financial Year 2010 11Modin HorakeriNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument12 pagesITR-2 Indian Income Tax Return: Part A-GENMankamesachinNo ratings yet

- File ITR-1 Form for Individuals with Income from Salary and InterestDocument6 pagesFile ITR-1 Form for Individuals with Income from Salary and InterestManjunath YvNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument12 pagesITR-3 Indian Income Tax Return: Part A-GENmehtakvijayNo ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- ITR-V Acknowledgement for AY 2014-15Document1 pageITR-V Acknowledgement for AY 2014-15mohan11pavanNo ratings yet

- Income Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDocument6 pagesIncome Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDesh PremiNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- SAHAJ ITR-1 FORM FOR INDIVIDUALS WITH INCOME FROM SALARY/PENSION, HOUSE PROPERTY, OTHER SOURCESDocument7 pagesSAHAJ ITR-1 FORM FOR INDIVIDUALS WITH INCOME FROM SALARY/PENSION, HOUSE PROPERTY, OTHER SOURCESrajshri58No ratings yet

- 2011 - ITR2 - r6Document33 pages2011 - ITR2 - r6Bathina Srinivasa RaoNo ratings yet

- Itr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearDocument7 pagesItr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearVarun ChhabraNo ratings yet

- Tax ReturnDocument7 pagesTax Returnsyedfaisal_sNo ratings yet

- Assessment Year Sahaj Indian Income Tax ReturnDocument1 pageAssessment Year Sahaj Indian Income Tax ReturnAnit SharmaNo ratings yet

- Akhtar Tax ReturnDocument7 pagesAkhtar Tax Returnsyedfaisal_sNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument10 pagesITR-2 Indian Income Tax Return: Part A-GENNeeraj AgarwalNo ratings yet

- SUGAM ITR-4S Presumptive Business Income Tax ReturnDocument11 pagesSUGAM ITR-4S Presumptive Business Income Tax ReturncachandhiranNo ratings yet

- Form Itr-4 SugamDocument9 pagesForm Itr-4 SugamAccounting & TaxationNo ratings yet

- Itr 3Document58 pagesItr 3Anurag SharmaNo ratings yet

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeNo ratings yet

- INDIAN INCOME TAX RETURN FOR SALARY AND HOUSE PROPERTY INCOMEDocument6 pagesINDIAN INCOME TAX RETURN FOR SALARY AND HOUSE PROPERTY INCOMEKuldeep HoodaNo ratings yet

- Indian Numbering SystemDocument8 pagesIndian Numbering SystemelangomduNo ratings yet

- Sugam: (Please See Instruction)Document10 pagesSugam: (Please See Instruction)SUBHASH CHANDRANo ratings yet

- Itr3 EnglishDocument45 pagesItr3 EnglishYogita SoniNo ratings yet

- Tax computation and deductionsDocument9 pagesTax computation and deductionsAkshay Kumar SahooNo ratings yet

- ITR Form-1 (Sahaj)Document1 pageITR Form-1 (Sahaj)NDTVNo ratings yet

- Form PDF 767221760080722Document13 pagesForm PDF 767221760080722Gaurav AtwalNo ratings yet

- Form PDF 340519100221221AVTPC0987CDocument8 pagesForm PDF 340519100221221AVTPC0987Csmadvocate049No ratings yet

- Form PDF 114320560260722Document9 pagesForm PDF 114320560260722DeepNo ratings yet

- Return ChallanDocument20 pagesReturn Challansyedfaisal_sNo ratings yet

- Form PDF 910494870311222Document9 pagesForm PDF 910494870311222Navin DongreNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENmohitsharma1996No ratings yet

- Itr V AcknowledgementDocument1 pageItr V Acknowledgementshivkumara27No ratings yet

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986No ratings yet

- ITR Form 1Document7 pagesITR Form 1gj29hereNo ratings yet

- 2016 Itr4 PR3Document165 pages2016 Itr4 PR3TejasNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENAvani GadaNo ratings yet

- Form PDF 774514440031122Document9 pagesForm PDF 774514440031122krishna salesNo ratings yet

- Summary of Tax Deducted at Source: TotalDocument2 pagesSummary of Tax Deducted at Source: Totaladithya604No ratings yet

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNo ratings yet

- 11111HHDocument6 pages11111HHKelly Tan Xue LingNo ratings yet

- 2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - RecordsDocument42 pages2014 GUTHRIE SHEET METAL, INC Form 1120 Corporations Tax Return - Recordsellen guthrie100% (1)

- File ITR-1 online in minutes with pre-filled dataDocument3 pagesFile ITR-1 online in minutes with pre-filled datathakurrobinNo ratings yet

- Form PDF 240892210050821Document8 pagesForm PDF 240892210050821anushkaenterprises75No ratings yet

- Itr4 PreviewDocument10 pagesItr4 PreviewSK TOYFIK ALINo ratings yet

- 2015 Itr1 PR3Document18 pages2015 Itr1 PR3shubham sharmaNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNishant VermaNo ratings yet

- Form PDF 688428240311221Document10 pagesForm PDF 688428240311221bhoomika rathodNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- LicenseDocument1 pageLicensePierre Jean BaptisteNo ratings yet

- BillDesk Payment GatewayDocument2 pagesBillDesk Payment GatewayManohj ViswanathanNo ratings yet

- AAi Atc NotificationDocument12 pagesAAi Atc NotificationvijayNo ratings yet

- AAI Junior Executive Interview ShortlistDocument25 pagesAAI Junior Executive Interview ShortlistManohj ViswanathanNo ratings yet

- Assistant Professor Application & DetailsDocument8 pagesAssistant Professor Application & DetailsRobertBellarmineNo ratings yet

- Itr-1 SahajDocument5 pagesItr-1 SahajPallab DasNo ratings yet

- Informix-4Gl: C Compiler Version Rapid Development System Interactive DebuggerDocument31 pagesInformix-4Gl: C Compiler Version Rapid Development System Interactive DebuggerManohj ViswanathanNo ratings yet

- Khalifa MushrifDocument1 pageKhalifa MushrifMoidutty NuchiyadNo ratings yet

- Hotel-Invoice-Template 2Document1 pageHotel-Invoice-Template 2dinakaranNo ratings yet

- Indicative Taxnet Profile: Personal InformationDocument4 pagesIndicative Taxnet Profile: Personal InformationAbdul WadoodNo ratings yet

- Webb Corporation Prepares Financial Statements in Accordance With Ifrs SelectedDocument2 pagesWebb Corporation Prepares Financial Statements in Accordance With Ifrs SelectedHassan JanNo ratings yet

- Tax Information SlipsDocument5 pagesTax Information SlipsTarynNo ratings yet

- Business Taxation: History of Income Tax Law in PakistanDocument26 pagesBusiness Taxation: History of Income Tax Law in PakistanMUHAMMAD UMARNo ratings yet

- Notes Dalton Case StudyDocument1 pageNotes Dalton Case StudyAMNo ratings yet

- 73 CIR v. Ayala SecuritiesDocument3 pages73 CIR v. Ayala SecuritiesAnthony ChoiNo ratings yet

- Summer Internship ReportDocument47 pagesSummer Internship ReportBijal Mehta43% (7)

- New Exchange/Segment Activation Request Form: To, Angel Broking LimitedDocument2 pagesNew Exchange/Segment Activation Request Form: To, Angel Broking LimitedasdfNo ratings yet

- Chapter 11 MCQs On Set Off and Carry Forward of LossessDocument11 pagesChapter 11 MCQs On Set Off and Carry Forward of LossessSonu SinghNo ratings yet

- CPA Review School of The Philippines Manila General Principles of Taxation Dela Cruz/De Vera/LlamadoDocument10 pagesCPA Review School of The Philippines Manila General Principles of Taxation Dela Cruz/De Vera/LlamadoAbraham Marco De GuzmanNo ratings yet

- Payslip TitleDocument1 pagePayslip TitleBharat YadavNo ratings yet

- CIR v GENERAL FOODS INC. Test of ReasonablenessDocument2 pagesCIR v GENERAL FOODS INC. Test of ReasonablenessiptrinidadNo ratings yet

- Basic Features of Value Added Tax (VAT) For ItesDocument24 pagesBasic Features of Value Added Tax (VAT) For ItesDebashishDolonNo ratings yet

- Skyquad Electronics Pay Slip TitleDocument2 pagesSkyquad Electronics Pay Slip Titlerahul rahulNo ratings yet

- CIR Vs PetronDocument2 pagesCIR Vs PetronfranzadonNo ratings yet

- PAYE/USC Statement of Liability for 2019Document2 pagesPAYE/USC Statement of Liability for 2019Viorica Zaporojan IascerinschiNo ratings yet

- TAX05 - First Preboard ExaminationDocument13 pagesTAX05 - First Preboard ExaminationMIMI LANo ratings yet

- Sales Tax Invoice for Sindh Police OpsDocument5 pagesSales Tax Invoice for Sindh Police OpsHamza NajamNo ratings yet

- CAF06PrinciplesofTaxation STDocument366 pagesCAF06PrinciplesofTaxation STSajid Ali100% (1)

- Chapter 4 - TaxesDocument28 pagesChapter 4 - TaxesabandcNo ratings yet

- Abdullah Anti Fire Corporation: QuotationDocument1 pageAbdullah Anti Fire Corporation: QuotationDistinctive learningNo ratings yet

- VALUE ADDED TAX Notes From BIRDocument30 pagesVALUE ADDED TAX Notes From BIREmil BautistaNo ratings yet

- IRS Assigns EIN for Home Repair BusinessDocument2 pagesIRS Assigns EIN for Home Repair BusinessDawson BanksNo ratings yet

- RI22507945 - Dec 28 2022 - 183245Document2 pagesRI22507945 - Dec 28 2022 - 183245vijayNo ratings yet

- Coca-Cola Co. 2019 Net Income of $8.92BDocument2 pagesCoca-Cola Co. 2019 Net Income of $8.92BDBNo ratings yet

- Unit Details Sale ConsiderationDocument1 pageUnit Details Sale ConsiderationcubadesignstudNo ratings yet

- Class 2 - Aggregation, Set Offs and Carry ForwardDocument27 pagesClass 2 - Aggregation, Set Offs and Carry ForwardTomy MathewNo ratings yet

- Reimbursement Expense Receipt (RER)Document6 pagesReimbursement Expense Receipt (RER)Alex BuracNo ratings yet