Professional Documents

Culture Documents

PRO11

Uploaded by

atishdkOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PRO11

Uploaded by

atishdkCopyright:

Available Formats

Loans and advances Dena bank Loans and Advances comprise a very large portion of a banks total assets

and form the backbone of the banks structure. The strength of a bank is thus primarily judge by the soundness of its advances. A wise and prudent policy in regard to advances is considered an important factor inspiring confidence in the depositors and prospective customers of a bank. Advances not only play an important part in gross earnings of banks, but also promote the economic development of the country. All types of business activity including trade, industry and agriculture have to depend on bank finance in one form or the other. Banks by channeling accumulated savings of the nation into productive uses help both the depositors and the borrowers. Banks assist in creating more avenues of employment and thus help raising the standard of living of the people. FORMS OF ADVANCES Structure of loans and advances Loans and Advances Fund based Working capital General Loans/over draft Term finance

Types of charges Pledge: Pledge means bailment or delivery of goods or document of title to goods, by the borrower to the creditor with the intention of creating charge thereon as security for the debt. In the case of sanctioning an advance by way of pledge, the ownership of the security remains with the pledgor (i.e. the person who pledges the security) whereas possession is with the pledgee (i.e. the lender). The possession may be actual or constructive. Hypothecation: This is an equitable charge in the lenders favor over goods. In this case neither ownership nor possession is passed to the creditor. However, the borrower undertakes to convert hypothecation into pledge at a future date when called upon to do so by the creditor. Mortgage: Mortgage is a transfer by the borrower, of his interest in specific immovable property, to the lender, as security for repayment of a debt Assignment:

In the case of an assignment, one person transfers a debt, right or property over an actionable claim to another person. The assignment may be absolute or by way of charge. It may be legal or equitable. The assignee accepts the assignment subject to all equities, if any, of the assignor Set-off: This is a total or partial setting off of a claim which one person has against another, against a counter-claim, which the latter has against the former. Lien: Lien is the right of a creditor who is in possession of goods or securities belonging to his debtor to retain them till the debt is repaid. Lien may be specific, as in the case of bailment, or general, as in the case of bankers general lien. Working capital finance: Loans: In a loan account, the entire amount is paid to the debtor at one time, either in cash or by transfer to his current account. No subsequent debit is ordinarily allowed except by way of interest, incidental charges, insurance premiums, expenses incurred for the protection of the security etc. sometimes, repayment is provide

Small enterprises sector: Direct finance in the small enterprises sector: Manufacturing enterprises: a) Small Manufacturing enterprises: Enterprises engaged in the manufacture/production, processing or preservation of goods and whose investment in plant and machinery (original cost excluding land and building) does not exceed Rs.5crore.

b) Micro (manufacturing) enterprises:

Enterprises engaged in the manufacture/production, processing or preservation of goods and whose investment in plant and machinery (original cost excluding land and building) does not exceed Rs.25lacs irrespective of location of the unit. Service enterprises: a) Small (service) enterprises: Enterprises engaged in providing / rendering services and whose investment in equipment (original cost excluding land and building and furniture, fittings and other items not directly related to the service rendered) does not exceeds Rs.2crore b) Micro (service) enterprises: Enterprises engaged in providing / rendering services and whose investment in equipment (original cost excluding land and building and furniture, fittings and other items not directly related to

the service rendered) does not exceed Rs.10lacs. c) The small micro (service) enterprises shall include small road & water transport operators, small business, professional & self employment person Khadi and village industries sector (KVI): All advances granted to units in the KVI sector, irrespective of their size of all operations, location and amount of original investment in plant and machinery. Such advances will be eligible for consideration under the sub-target (60 percent) of the small enterprises segment within priority sector. Retail trade: Advances granted to retail traders dealing in essential commodities (fair price shops) and consumer cooperative stores, and -Advances granted to private retail traders with credit limits not exceeding re. 20lacs. (As mentioned in RBI circular dated 30th April 2007. Micro credit: - Loans to very small amount (Rs.50000/per borrower) provided by banks either directly or indirectly through SHG/JLG mechanism or to NBFC/MFI for on lending - Loans to poor indebted to informal sector loans to distressed persons (other than farmers) to prepay their debt to noninstitutional lenders, against appropriate collateral or group security.

State sponsored organization for schedulers castes /scheduled tribes: Advances sanctioned to state sponsored organization for scheduled castes scheduled tribes for the specific purpose of purchase and supply of inputs to and/or the marketing of the outputs for the beneficiaries of these organization. Education: Educational loan should include only loans and advances granted to individuals for educational purpose and not those, granted to institutions and will include all advances granted by banks under special scheme, if any, introduced the purpose. -Loans granted by banks to non-banking financial companies (NBFCs) for on lending to individuals for educational purposes. In both cases, education loan up to Rs.10.00lacs if given for studying in India & up to Rs.20.00lacs if given for studying abroad will be reckoned as priority sector lending. Housing loan: Loans up to Rs.20lac irrespective of location for construction of houses by individuals, excluding loans granted by banks to their own employees. Loans up to Rs.1lac in rural and semi urban and up to rs.2lacs in metro and urban given for repairs to the damaged dwelling units of families. Assistance given to any governmental agency for construction of houses or for slum clearance and

rehabilitation of slum dwellers, subject to a ceiling of Rs.5lacs of loan amount per housing unit. Working capital: The amount required to finance day to day activities are called working capital. The assets and liabilities created during this operating cycle are called current assets and current liabilities The total of current assets is called the gross working capital The excess of current assets over current liabilities are called the working capital gap WCG=CA-CL Fixed assets can not generate income unless they are used with the help of working capital Therefore working capital is considered as the life blood of an enterprise When the banks are approached by enterprises for working capital finance banks have to examine the viability of the project before agreeing to provide WC finance. Banks have to ensure that the project will generate sufficient return on resources invested in it. Non-fund based advances (letter of credit/guarantees) Letter of credit:

Letter of credit can be define as an arrangement by means of which a bank issuing acting at the request of a customer applicant undertakes to pay a third party beneficiary a predetermined amount by a given date according to agreed stipulations and against presentation of stipulated documents. It is an arrangement of making payment against documents. Parties involved: applicant (customer), issuing bank (opening bank), beneficiary (seller), advising bank. Guarantees: It is a commitment extended by a bank on behalf of its borrower to make goods, the loss in the event of non-fulfillment of obligation by the borrower. Two types: Financial guarantees. Performance guarantees. In case credit facilities are granted against the guarantees of other bank , it should be ensured that the proposals are subjected to the usual scrutiny and availability of guarantee should not dilute standards of evaluation Ascertain as to why that bank has not granted credit facility instead of giving guarantee Valuation of securities

Valuation of securities is of very great importance to a banker. On a conservation valuation of the securities, the stipulated margin is maintains and the drawing power/limit determined. A banker has to remain in close touch with the markets to gauge the fluctuation in prices of the securities charged to him. There are a number of methods for valuing securities. Valuation may be based on market value, invoice value or controlled value. In the case of finished goods in a factory, the cost price is taken into account. For immovable property, its conservation sale price forms the basis of valuation. Government securities, shares and debentures: All-important newspapers give market quotation of government securities, share and debentures dealt in on stock exchanges. There is hardly any difficulty in ascertaining the prices of these securities. With some banks there is a practice to fix, from time to time, the maximum amount that may be advanced against any particular government security, share or debenture. Gold and silver bullion: Gold is at present a controlled commodity and banks do not advance against it except to licensed bullion dealers. If such advances are permitted at any time, the price can be verified from the quotation appearing in the

daily newspapers. The quotations for silver are available likewise Seasonal commodities Banks against seasonal commodities like wheat, gram, gur, paddy, or oilseeds on the basis of current market prices or controlled prices whichever may be lower. If market fluctuations are wide, a banker may protect himself by insisting on a higher margin. Finished/manufactured goods in factories: The best mode of valuation of manufactured goods would be on the basis of cost price to the manufacturers if it is lower then the market price. If the cost price cannot be determined, the second best way would be to base the evaluation on the prices at which the manufacturers sells his products to the wholesale dealers less any trade discount allowed on selling prices. For the purpose of verification, the banker may inspect copies of some of the latest invoices at random. In case there is a big slump in the prices of the products of any particular factory, the banker would be well advised to verify the wholesale market prices and value the stocks accordingly. Finished goods with dealers: RECOVERY OF ADVANCES

In whatever form bank advances are granted, they are repayable on demand or at expiry of some fixed period. Bills of exchange discounted are payable on maturity. Overdraft and cash credits are legally repayable on demand, although the bank seldom exercises the right except in circumstances mentioned below. Loans are repayable on the expiry of the periods for which they are granted. In case the loan is repayable in installments and default occurs in the payment of any installment, the entire loan usually becomes immediately recoverable at the option of the bank. Recalling of advances Banks conduct a regular scrutiny of all advances and ensure that timely action is taken in each case either for the continuance of the facility on the existing terms, or with such modification as may be considered necessary, or for the recovery of the amount if it is decided not to continue the facility. Advances are usually recalled under the following circumstances: 1. Death of the borrower or the guarantor. 2. Insolvency of the borrower or the guarantor, or liquidation of the borrowing company. 3. Dissolution of the partnership.

4. Failure to renew the documents sufficiently before the expiry of the period of limitation. The bank cannot afford to wait till the last day when the period of limitations expires 5. Want of satisfactory turnover, or deterioration of the security. 6. Failure to adhere to the terms and conditions of the sanction in spite of the banks repeated requests. 7. Deterioration of the financial position of the party. If it comes to the notice of the bank that the party has committed a fraud. Retail banking products: DENA NIWAS YOJNA HOUSING LOAN SCHEME Eligible Purposes Maximu m limit Maximum repayment period 20 years loan maturity age. Max. 65 years or retirement age whichever is early.

Purchase of new Rs.100la and old (up to 50 cs years) flat/house/construct ion of house/ major extension including home improvement and takeover from other. For purchase of land 75% of sanctioned amount

provided construction is to be completed within 18 months. Undertaking in this respect is to be obtained. Repair, renovation and home improvement. In this case age of building should not be more than 40 years and after repairs remaining life should be at least 25 years.

Rs.5lacs

10 years loan maturity age. Max. 65 years or retirement age whichever is early.

Dena CONSUMER DURABLE LOAN SCHEME Eligible Amount Rs.25000/ Rs.50000/ Rs.100000 /Income criteria Between Rs.>60000 to Rs.75000/-p.a. Between Rs.>75000 to Rs.1.50lac/-p.a. Above Rs.1.50lac p.a. Up front fees Rs.250/Rs.500/Rs.500/-

Repayment period 36 Monthly installments. (Take home salary should not be less than 60% of Gross salary)

Margin- 20% of cost price Rate of interest BPLR + 1% = 13.00% + 1.00% = 14.00% DENA AUTO FINANCE SCHEME Type of Vehicle Brand new two wheelers Brand new cars Income Criteria Above Rs.75000/p.a. Above Rs.1.5lacs/p.a. Eligible Amount Rs.50000/Up front fees Rs.250/-

Rs.8.00lacs Rs.500/(Max.)

Repayment period: 60 monthly installments. (Take home salary should not be less than 60% of gross salary) DENA SUVIDHA PERSONAL LOAN SCHEME Repayme Eligible Income Up front nt amount criteria fees schedule 36 9 times of Gross 1% of months NMI monthly loan income of amount Rs.5000/& above Minimum & Maximum loan amount Rs.15000/& Rs.1.00lacs

Repayment period: Maximum 36 monthly installment. Take home salary should not be less than 60% of gross salary. But where gross salary is Rs.15000/- & above, 40% take home salary is allowed. Direct deduction from salary. DENA SENIOR CITIZEN PERSONAL LOAN SCHEME TO PENSIONERS Eligible amount Maximum 6 months pension or Rs.50000/- whichever is less. Repayment period: In 24 equated monthly installment. . Take home salary should not be less than 60% of gross pension. Direct deduction authority from pension account maintained with the branch. DENA VIDYA LAXMI EDUCATIONAL LOAN SCHEME Eligibility Criteria: Any individual with sufficient repayment capacity. Student where either of the parents is a co borrower.

1.Student: Should be an Indian national. Secured admission to professional / technical courses in India or abroad through entrance test / merit based selection process.

Loan amount Studies in India Max. Rs.10.00lac Studies in abroad Max. Rs.20.00lac

Loan Amount Up to RS>4.00lacs Above RS>4.00lacs

Margin Nil In India 5% and if Abroad 15%

Securities Nil Above Rs.4.00lacs & up to Rs.7.50lacs collateral in the form of third party guarantee. Above Rs.7.50lacs collateral of suitable third party guarantee along with assignment of future income of the student for payment of installment.

DENA RENT SCHEME Eligible person : Term loan to landlords ( individuals, NRIs as per FEMA, Trust, corporate, etc.) of the premises who have given their properties on rental basis to banks, financial institutions, public sector undertaking and reputed companies.

Quantum of loan : 75% of total rental value receivable during the repayment tenure, Minimum Rs.1.00lacs . Maximum Rs.2lacs.

You might also like

- Career Objetive:: ResumeDocument2 pagesCareer Objetive:: ResumeatishdkNo ratings yet

- LED Project of Product and Brand ManagementDocument23 pagesLED Project of Product and Brand ManagementatishdkNo ratings yet

- Family PlanningDocument25 pagesFamily Planningatishdk100% (5)

- Sales OrganizationDocument31 pagesSales OrganizationatishdkNo ratings yet

- PantaloonsDocument17 pagesPantaloonsatishdkNo ratings yet

- 3 R's of SCDocument5 pages3 R's of SCatishdkNo ratings yet

- Questionnaire of TataDocument3 pagesQuestionnaire of TataatishdkNo ratings yet

- 3 R's of SCDocument5 pages3 R's of SCatishdkNo ratings yet

- Hewlett-Pachard (HP) : Marketing Applications & PracticeDocument8 pagesHewlett-Pachard (HP) : Marketing Applications & PracticeatishdkNo ratings yet

- PresentationDocument13 pagesPresentationatishdkNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lembar Jawaban Siswa - Corona-2020Document23 pagesLembar Jawaban Siswa - Corona-2020Kurnia RusandiNo ratings yet

- Tealium - State of The CDP 2022Document16 pagesTealium - State of The CDP 2022David StanfordNo ratings yet

- Invitation to Kids Camp in Sta. Maria, BulacanDocument2 pagesInvitation to Kids Camp in Sta. Maria, BulacanLeuan Javighn BucadNo ratings yet

- Apg-Deck-2022-50 - Nautical Charts & PublicationsDocument1 pageApg-Deck-2022-50 - Nautical Charts & PublicationsruchirrathoreNo ratings yet

- Availability Dependencies EN XXDocument213 pagesAvailability Dependencies EN XXraobporaveenNo ratings yet

- IGNOU Hall Ticket December 2018 Term End ExamDocument1 pageIGNOU Hall Ticket December 2018 Term End ExamZishaan KhanNo ratings yet

- Treasurer-Tax Collector Rewrites Investment Policy: Safety Net GoneDocument36 pagesTreasurer-Tax Collector Rewrites Investment Policy: Safety Net GoneSan Mateo Daily JournalNo ratings yet

- Why The Irish Became Domestics and Italians and Jews Did NotDocument9 pagesWhy The Irish Became Domestics and Italians and Jews Did NotMeshel AlkorbiNo ratings yet

- United BreweriesDocument14 pagesUnited Breweriesanuj_bangaNo ratings yet

- Hippo 3 Use 2020 V1.EDocument2 pagesHippo 3 Use 2020 V1.ECherry BushNo ratings yet

- Security AgreementDocument5 pagesSecurity AgreementGanesh TarimelaNo ratings yet

- Dyesebel 3Document7 pagesDyesebel 3Leachez Bbdear BarbaNo ratings yet

- Yalit - Beowulf AnnotatedDocument6 pagesYalit - Beowulf Annotatedapi-25329773450% (2)

- Innovation Simulation: Breaking News: HBP Product No. 8678Document9 pagesInnovation Simulation: Breaking News: HBP Product No. 8678Karan ShahNo ratings yet

- Annual GPF Statement for NGO TORA N SINGHDocument1 pageAnnual GPF Statement for NGO TORA N SINGHNishan Singh Cheema56% (9)

- Determining Audience NeedsDocument5 pagesDetermining Audience NeedsOrago AjaaNo ratings yet

- What Is The Meaning of Tawheed and What Are Its Categories?Document7 pagesWhat Is The Meaning of Tawheed and What Are Its Categories?ausaf9900No ratings yet

- Preventive MaintenanceDocument2 pagesPreventive Maintenancedoctor_mumairkNo ratings yet

- SOP For Master of Business Administration: Eng. Thahar Ali SyedDocument1 pageSOP For Master of Business Administration: Eng. Thahar Ali Syedthahar ali syedNo ratings yet

- Boundary computation detailsDocument6 pagesBoundary computation detailsJomar FrogosoNo ratings yet

- Fruits and Vegetables Coloring Book PDFDocument20 pagesFruits and Vegetables Coloring Book PDFsadabahmadNo ratings yet

- New Jersey V Tlo Research PaperDocument8 pagesNew Jersey V Tlo Research Paperfvg7vpte100% (1)

- Chapter-10 E-Commerce Digital Markets, Digital GoodsDocument18 pagesChapter-10 E-Commerce Digital Markets, Digital GoodsHASNAT ABULNo ratings yet

- Experienced PM in high efficiency data center implementationDocument2 pagesExperienced PM in high efficiency data center implementationRicardo RendeiroNo ratings yet

- Instant Download Statistics For Business and Economics Revised 12th Edition Anderson Test Bank PDF Full ChapterDocument32 pagesInstant Download Statistics For Business and Economics Revised 12th Edition Anderson Test Bank PDF Full Chapteralicenhan5bzm2z100% (3)

- Risk Register 2012Document2 pagesRisk Register 2012Abid SiddIquiNo ratings yet

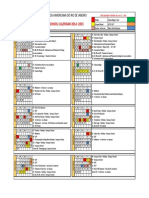

- CalendarDocument1 pageCalendarapi-277854872No ratings yet

- Skanda Purana 05 (AITM)Document280 pagesSkanda Purana 05 (AITM)SubalNo ratings yet

- iOS E PDFDocument1 pageiOS E PDFMateo 19alNo ratings yet

- Mitul IntreprinzatoruluiDocument2 pagesMitul IntreprinzatoruluiOana100% (2)