Professional Documents

Culture Documents

Crown Case Solution

Uploaded by

urmiabirOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Crown Case Solution

Uploaded by

urmiabirCopyright:

Available Formats

CASE SUMMARY:

Challenge:

In February 1969, Walter Bennett, the treasurer of Crown Corporation was faced with the challenge of raising $30 million in funds to complete the construction of an aluminum plant and to fulfill working capital requirements. He has three main funding options for the corporation that will be discussed later in the case. To meet the demands of growing sales and to retain a competitive edge, Crown had to obtain $30 million of funds. This was their only option in terms of meeting their own growth potential. If they did not complete the plant construction and obtain working capital, the company would not be able to increase its production capacity and would then lose the increased sales they could reasonably expect over the next several years.

Goals:

To hold to a $0.70 dividend rate To have a financing plan that will help meet both the short-term and long-term needs of the company.

Historical background:

Crown's sales are evenly divided between casting and aluminum products. The completion of the new plant will increase Crown's capacity by about 85 million pounds per year and increase revenues by $3 to $4 million per year. Crown is constantly threatened with new entrants to the market of fabricated products. The fact that so many small independent companies entered this part of the industry caused prices to drop by 20 percent between late 1961 and late 1963. Demand-supply conditions improved, however, and demand rose by 14 percent between 1961 and 1966. Prices, however, were still depressed. Earnings were erratic ranging from a high of $1.13 in 1959 to a low of $0.34 in 1963. Profits in the industry went from $88 million in 1960 to $230 million in 1966 and Crown's dividends increased from $0.34 per share in 1960 to $2.07 in 1967. 1

Aluminum imports were increasing and it was estimated that supply from foreign manufacturers would be twice the production of American producers. Supply was estimated to exceed demand over the next several years. Analysts suggested the supply could be as much as 9 percent more than the demand over the next few years into the 1970s.

Crown's expected sales growth over the next few years was expected to be between 6 and 8 percent per year.

Funding Options:

There were three major funding options that were available to Mr. Bennett in 1969 to raise $30 million: Equity funding through the sale over a million shares of stock A loan from a consortium of banks at 7.25% percent interest repayable at a rate of $5 million per year beginning in 1970 and ending in1975 Plan to place $30 million subordinated convertible debenture issue with Northern Life Insurance Company, a coupon of 6% and annual debt retirement of 42 million from years 6 through 20years. Each of the options had its advantages and disadvantages. Bennett was more interested in the debt alternatives but he also saw that equity financing could be helpful in future years.

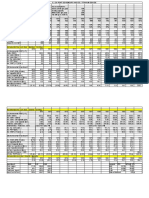

Question 1: Projected Crowns income statements and balance sheets for the years 1969-1972.

Cash Flows Year NWC Change in NWC Dep Capex FCF=ebit+dep-capexchange in nwc 196 8 68.0 0 10.0 0 5.00 86.0 0 42.5 0 52.0 0 3.00 -3.36 -4.00 196 9 74.7 8 6.78 5.00 39.0 0 10.7 8 30.0 0 3.00 -3.36 -4.00 197 0 84.9 5 10.1 7 5.00 32.0 0 5.17 22.0 0 3.00 3.36 4.00 197 1 87.7 3 2.78 5.00 7.00 29.2 2 1972 106.5 0 59.00 5.00 50.00 50.00

Debt/ new equity Deffered taxes interest dividend

0.00 3.00 3.36 4.00

30.00 3.00 -3.36 -4.00

CASH

5.1 4

14. 86

12. 47

24. 86

75.6 4

Debt option Net Sales (growth of 6-8%:given) Operating expense (88% of sales) Operating Income Other expense (income)* EBT Tax at 44%

1969 246

1970 263

1971 282

1972 301

216 30

231 32

248 34

265 36

4.36 25.64 11.28

6.54 25.47 11.20

6.54 27.47 12.08

6.54 29.47 12.96

NI Per share data: EPS Dividend

14.36

14.26

15.38

16.50

1.97 0.70

1.96 0.70

2.11 0.70

2.27 0.70

Income Statement (Debt financing):

Net Sales: In case of Debt financing, net sales increased from $230mil to $246 mil . We also can observe an increasing trend from the year 1969 to 1972.Net Sales are $263 mil, $282 mil and $301 mil in 1970, 1971 and 1972 respectively. Operating Profit: Operating profit increased by $1.5 mil from the year 1968 to 1969.There is a gradual increase in operating profit during 1969-1972.Operating profit is $32 mil, $24 mil & $36 mil in 1970, 1971 and 1972 respectively. Earning Before Tax(EBT): In 1970,EBT slightly increased upto $25.47 mil from $25.64 mil in 1969.EBT is also gradually increasing in 1969-1972. Earnings Per Share(EPS): In 1969, EPS increased to $1.97 from $1.87 in 1968.We can observe a very slight decrease during 1969-1970.EPS again increased in 1971 upto $2.11 and $2.26 in 1972

Historical and Proforma Balance Sheet For debt fin:

Year Cash Marketable securities (7% of sales) Accounts Receivable (15% of sales) Inventories (21% of sales) Other (0.004% of sales) Total current asset Investment in aluminium plants Other net property, plant and equipment other Total assets Liabililities Accounts Payable (6% of sales) Accrued Liabilities (4% of sales) Accrued Taxes (3% of sales) Dividends Payable Current Maturities - long term debt Total Current Liabilities Long Term Debt Deferred Federal taxes (1% of sales) Stock holder's equity Total Liabilities and net 1965 3.00 7.00 20.00 28.00 0.00 58.00 1966 3.00 10.00 23.00 38.00 0.00 74.00 1967 5.00 23.00 35.00 45.00 1.00 109.00 1968 4.00 6.00 42.00 50.00 1.00 103.00 1969 5.00 17.22 36.90 51.66 0.98 111.76 1970 15.00 18.41 39.45 55.23 1.05 129.14 1971 12.00 19.74 42.30 59.22 1.13 134.39 1972 25.00 21.07 45.15 63.21 1.20 155.6

32.00 28.00 3.00 121.00

29.00 31.00 4.00 138.0

34.00 34.00 4.00 181.00

40.00 42.00 4.00 189.00

39.00 72.00 4.00 226.76

32.00 69.00 4.00 234.14

7.00 94.00 4.00 239.39

50.00 37.00 4.00 246.6

8.00 6.00 4.00 1.00 2.00 21.00 30.00 1.00 69.00 121.00

10.00 7.00 8.00 1.00 2.00 28.00 28.00 2.00 80.00 138.0

13.00 7.00 8.00 1.00 2.00 31.00 56.00 3.00 91.00 181.00

14.00 10.00 6.00 1.00 4.00 35.00 52.00 3.00 99.00 189.00

14.76 9.84 7.38 1.00 4.00 36.98 78.00 2.46 109.00 226.44

15.78 10.52 7.89 1.00 9.00 44.19 69.00 2.63 119.00 234.82

16.92 11.28 8.46 1.00 9.00 46.66 60.00 2.82 130.00 239.48

18.06 12.04 9.03 1.00 9.00 49.13 51.00 3.01 143.00 246.1

worth

Balance Sheet (Debt financing):

Current Assets: Cash increased by $1 mil during 1968-1969.There is a sharp increase by $10 mil in cash during 1969-1970.Again cash decreased upto $12 mil in 1971.In 1972,cash increased upto $25 mil.In case of Marketable securities, we can observe an increasing trend during 1969-1972.In 1969,there was a sharp rise in marketable securities. Accounts receivable decreased moderately from the year 1969 to the year 1969 and had shown a gradual increasing trend during 1969-1972.Inventories also increased from $51.66 mil in 1969 to $63.21 mil in 1972.Total current assets including other current assets are $111.76 mil,$129.14 mil,$134.39 mil,$155.63 mil in 1969,1970,1971 and 1972 respectively. Long term Assets: Investment in aluminum plants slightly decreased to $39 mil from $40 mil during 19681969 and again decreased to $32 mil in 1970.In 1970, it sharply declined upto $7 mil but in 1972 it dramatically increased upto $50 mil.Other net properties, plant and equipment were $72 mil,$69 mil,$94 mil,$37 mil in 1969,1970,1971 & 1972 respectively. Total Assets: Total assets were $226.76 mil , $234.14 mil, $239.39 mil & $246.63 mil in 1969, 1970, 1971 & 1972 respectively. So, total assets increased by $19.87 during 1969-1972 6

Current Liabilities: Accounts payable are $14.76 mil, $15.78 mil, $16.92 mil & $18.06 mil in 1969, 1970, 1971 & 1972.Accrued liabilities are $9.84 mil,$10.52 mil,$11.28 mil & $12.04 mil in 1969, 1970, 1971 & 1972.Accrued taxes increased by $1.65 mil during 19691972.Dividends payable remain constant of $1 mil in these four years. Current maturities of long term debt are $ 4 mil in 1969 & $9 mil in 1970-1972. Total current liabilities are $36.98 mil, $44.19 mil,$ 46.66 mil & $49.13 mil in 1969, 1970, 1971 & 1972 respectively. So, current liabilities increased from $36.98 mil to $49.13 mil during 1969-1972 Long term debt: Long term debt are$78 mil, $69 mil,$60 mil & $51 mil in 1969, 1970, 1971 & 1972.So we can see that initially it showed slightly decreasing trend and had moderately decreased in 1972. Stockholders equity: Stockholders equity increased from $109 mil to $119 mil during 1969-1970 & increased from $130 mil to $143 mil during 1971-1972. Total Liabilities & net worth: Total Liabilities & net worth increased from $226.44 mil to $234.82 mil during 19691970 & increased from $239.48 mil to $246.14 mil during 1971-1972.

Equity Net Sales (growth of 68%:given) Operating expense (88% of sales)

1969 246

1970 263

1971 282

1972 301

216 30

231 32

248 34

265 36

Other expense (.33%) EBT Tax at 44% NI Per share data: EPS Dividend

1.00 29.00 12.76 16.24

1.00 31.00 13.64 17.36

1.00 33.00 14.52 18.48

1.00 35.00 15.4 19.60

1.87 0.7

2.00 0.7

2.13 0.7

2.26 0.7

Income Statement (Equity Financing):

Net Sales: In case of Debt financing, net sales increased from $230mil to $246 million during 1968-1969. We also can observe an increasing trend from the year 1969 to 1972.Net 8

Sales are $263 mil, $282 mil and $301 mil in 1970, 1971 and 1972 respectively. Earning Before Tax(EBT): In 1970, EBT slightly increased up to $31.00 mil from $29.00 mil in 1969.EBT is also gradually increasing in 1969-1972. Earnings per Share (EPS): EPS is also gradually increasing in 1970-1972.It increased from $1.87 mil to $2 mil in 1970 and then again increased to $2.13 mil in 1971.Finally it reached upto $2.26 mil in 1972.

Historical and Proforma Balance Sheet For equity fin:

ASSETS Cash Marketable securities (7% of sales) Accounts Receivable (15% of sales) Inventories (21% of sales) Other (0.004% of sales) Total current asset 1965 1966 1967 1968 1969 1970 1971 1972 3.00 3.00 5.00 4.00 5.00 15.00 12.00 25.00 7.00 20.00 28.00 0.00 58.00 10.00 23.00 38.00 0.00 23.00 35.00 45.00 1.00 6.00 42.00 50.00 1.00 17.22 36.90 51.66 0.98 18.41 39.45 55.23 1.05 19.74 42.30 59.22 1.13 21.07 45.15 63.21 1.20

74.00 109.00 103.00 111.76 129.14 134.89 154.63 40.00 42.00 4.00 39.00 72.00 4.00 32.00 90.00 4.00 7.00 93.00 4.00 50.00 66.40 5.00

Investment in aluminium plants 32.00 29.00 34.00 Other net property, plant and equipme 28.00 31.00 34.00 other 3.00 4.00 4.00 Total assets Liabililities Accounts Payable (6% of sales) Accrued Liabilities (4% of sales) Accrued Taxes (3% of sales) Dividends Payable Current Maturities - long term debt Total Current Liabilities Long Term Debt Deferred Federal taxes (1% of sales) Stock holder's equity Total Liabilities and net worth

121.00 138.00 181.00 189.00 226.76 256.14 239.89 276.03

8.00 6.00 4.00 1.00 2.00 21.00 30.00 1.00 69.00

10.00 7.00 8.00 1.00 2.00 28.00 28.00 2.00 80.00

13.00 7.00 8.00 1.00 2.00 31.00 56.00 3.00 91.00

14.00 10.00 6.00 1.00 4.00 35.00 52.00

14.76 9.84 7.38 2.00 4.00 36.98 48.00

15.78 10.52 7.89 2.00 4.00 44.19 44.00

16.92 11.28 8.46 2.00 4.00 46.66 40.00

18.06 12.04 9.03 2.00 4.00 49.13 36.00

3.00 2.46 2.63 2.82 3.01 99.00 139.00 149.00 169.00 173.00

121.00 138.00 181.00 189.00 226.44 256.82 239.48 276.14

Balance Sheet (Equity Financing): Current Assets: Cash increased by $1 mil during 1968-1969.There is a sharp increase by $10 mil in cash during 1969-1970.Again cash decreased upto $12 mil in 1971.In 1972,cash increased upto $25 mil.In case of Marketable securities, we can observe an increasing trend during 1969-1972.In 1969,there was a sharp rise in marketable securities. Accounts receivable decreased moderately from the year 1969 to the year 1969 and had shown a gradual increasing trend during 1969-1972.Inventories also increased from $51.66 mil in 1969 to $63.21 mil in 1972.Total current assets including other current assets are $111.76 mil,$129.14 mil,$134.39 mil,$155.63 mil in 1969,1970,1971 and 1972 respectively. Long term Assets: Investment in aluminum plants slightly decreased to $39 mil from $40 mil during 19681969 and again decreased to $32 mil in 1970.In 1970, it sharply declined upto $7 mil but in 1972 it dramatically increased upto $50 mil.Other net properties, plant and equipment were $72 mil,$90 mil,$93 mil,$66.4 mil in 1969,1970,1971 & 1972 respectively. Total Assets: Total assets were $226.76 mil , $256.14 mil, $239.89 mil & $276.03 mil in 1969, 1970, 1971 & 1972 respectively. So, total assets increased by $49.27 during 1969-1972 Current Liabilities: Accounts payable are $14.76 mil, $15.78 mil, $16.92 mil & $18.06 mil in 1969, 1970, 1971 & 1972.Accrued liabilities are $9.84 mil,$10.52 mil,$11.28 mil & $12.04 mil in 1969, 1970, 1971 & 1972.Accrued taxes increased by $1.65 mil during 19691972.Dividends payable increased by $1 mil during 1968-1969 & remain constant of $2 mil for the next three years. Current maturities of long term debt remain constant of $4 mil during 1969-1972. Total current liabilities are $36.98 mil, $44.19 mil,$46.66 mil & $49.13 mil in 1969, 1970, 1971 & 1972 respectively. So, current liabilities increased from $36.98 mil to $49.13 mil during 1969-1972 10

Long term debt: Long term debt are$48 mil, $44 mil,$40 mil & $36 mil in 1969, 1970, 1971 & 1972.So we can see that initially it showed a decreasing trend during 1969-1972. Stockholders equity: Stockholders equity increased from $139 mil to $149 mil during 1969-1970 & increased from $169 mil to $173 mil during 1971-1972. Total Liabilities & net worth: Total Liabilities & net worth increased from $226.44 mil to $256.82 mil during 19691970 & increased from $239.48 mil to $276.14 mil during 1971-1972.

For subordinated debt Net Sales (growth of 6-8%:given) Operating expense (88% of sales)

1969 246

1970 263

1971 282

1972 301

216 30

231 32 2.80 29.20 12.848 16.35

248 34 2.80 31.20 13.728 17.47

265 36 2.80 33.20 14.608 18.59

Other expense (.33%) EBT Tax at 44% NI Per share data: EPS Dividend

2.80 27.20 11.968 15.23

2.09 0.7

2.25 0.7

2.40 0.7

2.56 0.7

11

Income Statement (subordinated debt financing):

Net Sales: In case of Debt financing, net sales increased from $230mil to $246 mil during 19681969. We also can observe an increasing trend from the year 1969 to 1972.Net Sales are $263 mil, $282 mil and $301 mil in 1970, 1971 and 1972 respectively.

Earnings Before Tax (EBT): In 1970, EBT increased up to $29.20 mil from $27.20 mil in 1969. EBT is also gradually increasing in 1969-1972. Earnings Per Share (EPS): In 1969, EPS increased to $2.09 from $1.87 in 1968. We can observe a slight increase during 1969-1972.

12

Historical and Proforma Balance S heet For S ord ate debt: ub in 1965 1966 1967 1968 Cash 3.00 3.00 5.00 4.00 Marketable securities (7% of sales) 7.00 10.00 23.00 6.00 Accounts Receivable (15% of sales) 20.00 23.00 35.00 42.00 Inventories (21%of sales) 28.00 38.00 45.00 50.00 Other (0.004%of sales) 0.00 0.00 1.00 1.00 Total current asset 58.00 74.00 109.00 103.00

1969 1970 5.00 15.00 17.22 18.41 36.90 39.45 51.66 55.23 0.98 1.05 111.76 129.14

1971 1972 12.00 25.00 19.74 21.07 42.30 45.15 59.22 63.21 1.13 1.20 134.39 155.63

Investment in aluminium plants 32.00 29.00 34.00 40.00 39.00 32.00 7.00 50.00 Other net property, plant and equipment 28.00 31.00 34.00 42.00 72.00 68.00 98.00 46.00 other 3.00 4.00 4.00 4.00 4.00 5.00 5.00 5.00 Total assets 121.00 138.00 181.00 189.00 226.76 234.14 244.39 256.63 Liabililities Accounts Payable (6%of sales) Accrued Liabilities (4%of sales) Accrued Taxes (3%of sales) Dividends Payable Current Maturities - long term debt Total C urren L t iabilities

8.00 10.00 6.00 7.00 4.00 8.00 1.00 1.00 2.00 2.00 21.00 28.00

13.00 7.00 8.00 1.00 2.00 31.00

14.00 14.76 15.78 16.92 18.06 10.00 9.84 10.52 11.28 12.04 6.00 7.38 7.89 8.46 9.03 1.00 1.00 1.00 1.00 1.00 4.00 4.00 4.00 4.00 4.00 35.00 36.98 39.19 41.66 44.13 48.00 44.00 40.00 36.00 30.00 30.00 30.00 30.00 2.46 2.63 2.82 3.01 109.00 119.00 130.00 143.00 226.44 234.82 244.48 256.14

Long Term Debt 30.00 28.00 56.00 52.00 S ubordinate debt Deferred Federal taxes (1%of sales) 1.00 2.00 3.00 3.00 S tock holder's equity 69.00 80.00 91.00 99.00 Total L iabilities an net worth d 121.00 138.00 181.00 189.00

Balance Sheet (Subordinate Debt financing):

Current Assets: Cash increased by $1 mil during 1968-1969.There is a sharp increase by $10 mil in cash during 1969-1970.Again cash decreased upto $12 mil in 1971.In 1972,cash increased upto $25 mil.In case of Marketable securities, we can observe an increasing trend during 1969-1972.In 1969,there was a sharp rise in marketable securities. Accounts receivable decreased moderately from the year 1969 to the year 1969 and had shown a gradual increasing trend during 1969-1972.Inventories also increased from $51.66 mil in 1969 to $63.21 mil in 1972.Total current assets including other current assets are $111.76 mil,$129.14 mil,$134.39 mil,$155.63 mil in 1969,1970,1971 and 1972 respectively. Long term Assets: 13

Investment in aluminum plants slightly decreased to $39 mil from $40 mil during 19681969 and again decreased to $32 mil in 1970.In 1970, it sharply declined upto $7 mil but in 1972 it dramatically increased upto $50 mil.Other net properties, plant and equipment were $72 mil,$68 mil,$98 mil,$46 mil in 1969,1970,1971 & 1972 respectively. Total Assets: Total assets were $226.76 mil , $234.14 mil, $244.39 mil & $256.63 mil in 1969, 1970, 1971 & 1972 respectively. So, total assets increased by $29.87 during 1969-1972 Current Liabilities: Accounts payable are $14.76 mil, $15.78 mil, $16.92 mil & $18.06 mil in 1969, 1970, 1971 & 1972.Accrued liabilities are $9.84 mil,$10.52 mil,$11.28 mil & $12.04 mil in 1969, 1970, 1971 & 1972.Accrued taxes increased by $1.65 mil during 19691972.Dividends payable remain constant of $1 mil in these four years. Current maturities of long term debt remain constant of $ 4 mil in these four years. Total current liabilities are $36.98 mil, $39.19 mil,$ 41.66 mil & $44.13 mil in 1969, 1970, 1971 & 1972 respectively. So, current liabilities increased from $36.98 mil to $44.13 mil during 1969-1972

Long term debt: Long term debts are$48 mil, $44 mil,$40 mil & $36 mil in 1969, 1970, 1971 & 1972.So we can see that it showed decreasing trend during 1969-1972. Subordinate Debt: There are constant subordinate debts of $30 mil in these four years. Stockholders equity: Stockholders equity increased from $109 mil to $119 mil during 1969-1970 & increased from $130 mil to $143 mil during 1971-1972. Total Liabilities & net worth: Total Liabilities & net worth increased from $226.44 mil to $234.82 mil during 19691970 & increased from $244.48 mil to $256.14 mil during 1971-1972.

14

Question 2: Recommend and defend the financing decisions that Crowns management should make in 1969. Answer 2: Crown already had a $56 million debt issue with several insurance companies, which was contracted in 1967. $26 million of that balance was for refinancing and $30 million was new debt. A $30 million loan in 1969 would further increase their debt to over $80 million. Although there are of advantages associated with the debt financing options like: the interest paid is tax deductible; there is a definite repayment schedule that allows the company to plan; debt repayment has priority over equity contributions; cost of debt is less than cost of equity. The major disadvantage here would be that the debt-to-equity ratio for 1969 will rise to 72% from about 50% in 1969. Due to this high debt to equity ratio, the regulatory agencies scrutinize the company's reports even more intensely. Also as debt will increase the cost of equity will further increase. Equity financing, on the other hand, means more stockholders but there is also a potential for greater growth. Secondly the likelihood of a higher credit rating because the company is not overly indebted; might very likely raise more money than the needed $30 million. Also dividend paid is not a mandatory obligation like interest payment on debt. The disadvantages of equity financing include the fact that dividends will vary according to the company's profit margins; dividends are not deductible as is interest paid on a loan, dividends are paid only after all the other obligations are met and thus, there is no way to guarantee any specific dividend level for investors. If the company takes the loan from the banks or it issues bonds through the insurance company, it will still raise its debt ratio significantly. Total long-term debt would be a remarkable $82 million. The proportion of debt would rise from about 30+ percent to between 40 and 50 percent of the value of the company. That seems like a bad move. Also comparing the three financing options available to Crown based on proforma 15

income statement and balance sheet for 1969 we have:

(all figs in million $) DEBT NI EPS ROA (NI/TA) ROE (NI/Comm. Equi) TIE (EBIT/Int) BEP (EBIT/TA) D/E 14.36 1.97 6.35 EQUITY 16.24 1.87 7.19 SUB DEBT 15.23 2.09 6.74

13.17

11.94

13.97

5.42

8.93

5.81

13.27

13.27

13.27

72%

34%

72%

Based on the above analysis we observe that: Net income and Return on Assets is highest for equity financing in 1969. The Earnings Per Share is higher for both the debt financing options than the equity option because as a firm increases its leverage the risk borne by stockholders increases, so they require a higher return on equity. But the EPS of $1.87 under equity financing is sufficient to maintain the required dividend payout rate of 70 cents per share. The Times interest earned ratio is also the highest for equity financing. Equity financing thus offers a better option at this point in time. Crown is likely to obtain more than the $30 million needed and such financing will keep the debt ratio down while providing greater growth opportunities. Given the situation at the time, including the forecasts for increased revenue in the early 1970s, equity financing would also lead to Bennett's goal of $0.70 cents dividend per share. Q3. Indicate the plan of action that should be set up to meet the companys anticipated finance requirements over the next 35 years, and show why your recommended plan 16

is better suited to the companys needs than viable alternative plans. Ans:3 According to the text, Crown will need $30 million in 1969, $22 million in 1970, and $30 million in 1972. In 1971 Crown has no external financing; the corporation will be able to finance the capital expenditures on their own. The pattern shown is of heavy financing in the first two years then a break year, then another heavy year in '72. The large projected capital expenditures in 1969 and 1970 are a result of the Eastalco project. In 1972 the heavy capital expenditures are for the expansion of the Eastalco project. There was an increase in aluminum prices. The case indicates that there were shortages of aluminum. A large common stock increase could dilute dividends and stock price (holding the dividend rate at $0.70 was a major goal of Mr. Bennett). For a better analysis, we have done ratio analysis of the forecasted years. We have tried to compare the result of ratios taking three financial alternatives discussed in the case.

Debt Ratios Company using debt- financing : Debt/ Total Asset Debt /Total Equity Time Interest Earned Ratio(EBIT/ Interest Charges ) Company using Equity-Financing : Debt/ Total Asset Debt /Total Equity Time Interest Earned Ratio(EBIT/ Interest Charges ) Company using Subordinate- Debt : Debt/ Total Asset Debt /Total Equity Time Interest Earned Ratio(EBIT/ Interest Charges )

1969 0.52 1.08 5.42 1969 0.39 0.63 8.93 1969 0.52 1.08 5.81

1970 0.49 0.97 5.78 1970 0.35 0.61 9.52 1970 0.49 0.97 6.20

1971 0.46 0.84 6.14 1971 0.37 0.53 10.12 1971 0.47 0.88 6.59

1972 0.42 0.72 6.50 1972 0.32 0.51 10.71 1972 0.44 0.79 6.98

Average 47% 81% 6.14X Average 36% 27% 9.82X Average 48% 58% 6.40X

Debt/ Total Asset Ratio: Debt/ Total Asset are percentage of assets financed by 17

long-term and short-term debt. From the above table, we can see that Debt/ Total Asset is highest (48%) when the company used Subordinate Debt. The second option where company has a low debt ratio (36%) if it follow equity financing to raise fund. Creditors prefer low debt ratios because lower the ratio, the greater the cushion against creditors losses in the event of liquidation. The stockholders, in the other hand can get benefit from leverage because it magnifies earnings, thereby increasing the return to stockholders. One point we should keep in mind that too much debt can leads the company to financial difficulty, which eventually can cause bankruptcy. Long Term Debt/ Total Equity: This ratio states that proportion of financing that is debt-related. Crown Company had already issued debt in its past years for its operation and expansion of plants to cover capital needs. It will have 27% debt equity ratio if company raises new equity. From the case, industry average is given 43%. For Crown, both cases long-term Debt/ Equity ratios are higher if the company finance debt or subordinate debt. Therefore Crown can face bankruptcy. Time Interest Earned: This ratio shows us the ability of the firm to meet interest obligations. If the company use equity finance, companyll have higher Time Interest Earned Ratio. Whereas, using debt/ subordinate financing tools result into low ratios (6.14-6.40%). According to the case, industry average is 6.48%. Therefore Crown can cover its interest charges by a margin of safety. But based on the debt ratio and long term debt equity ratios Crown may face difficulties if its attempt to borrow funds.

Profitability Ratios Company using debt- financing : ROA ROE Company using Equity-Financing : ROA ROE Company using Subordinate- Debt : ROA ROE

1969 6.33 13.17 1969 7.16 11.68 1969 6.72 13.97

1970 6.09 11.98 1970 6.78 11.65 1970 6.98 13.74

1971 6.42 11.83 1971 7.70 9.61 1971 7.15 13.44

1972 6.69 11.54 1972 7.10 11.33 1972 7.24 13.00

Average 6.38% 12.13% Average 7.19% 11.07% Average 7.02% 13.54%

Return on Assets: ROA tell us asset utilization in producing returns. From the above 18

table, we can see that ROA of Equity Finance provides us 7.19%. Crown will have low returns (6.38% and 7.02%) using debt financing and subordinate financing. It is because Crown had already taken debt in past years. Moreover, issuing more debt will cause Crown higher use of debt. Return on Equity: Return on Equity shows us effectiveness of equity investment in producing returns. The rate of return of the stock holder decreases when Crown raised fund by issuing more equity. ROE is highest (13.54%) when company uses subordinate debt.

Other Ratios Company using debt- financing : Book Value Per Share Earning Per Share Company using Equity-Financing : Book Value Per Share Earning Per Share Company using Subordinate- Debt : Book Value Per Share Earning Per Share

1969 14.99 1.97 1969 19 1.87 1969 14.99 2.09

1970 16.36 1.96 1970 20 2.00 1970 16.36 2.25

1971 17.87 2.11 1971 23 2.13 1971 17.87 2.40

1972 19.66 2.27 1972 24 2.26 1972 19.66 2.56

Average 17.22 2.08 Average 21.66 2.07 Average 17.22 2.33

Book Value per Share: When Company using Equity Financing Book value per share is highest than company using debt financing and subordinate debt . Earnings Per Share: The price earnings ratios shows how much investors are willing to pay per dollar of reported profits. Earnings Per share are highest when the company used subordinate- Debt. From the case, we have seen that Crown has low earning per share compared to other companies in the same industry. This gives us indication that other companies have high growth prospect than Crown. Therefore Crown could be a riskier firm compare to other companies in the industry. Crown is in an extremely volatile and sensitive industry. The degree of business risk 19

attributable to this industry is relatively high. As Crown expands, they will leave themselves more vulnerable to risk. Although, an equity issue can dilute dividends to below Mr. Bennett's $0.70 dividend rate. This in turn could cause stock price to drop to levels in the low 20's. Either of the financing alternatives via debt could leave Crown unable to make large debt payments in the event that any of the listed outcomes (above) become reality. In the event that Crown is unable to meet debt payments, they could sell off some of their operations. Another possible alternative is to issue more common stock. This common stock issue could cause stock prices to drop and Mr. Bennett could possibly have to sacrifice his goal of maintaining the $0.70 dividend rate. Overall, looking at the ratio analysis result, we would suggest Crown to go for equity financing. There were some limitations in the cases such as follows: Projected sales increases of 6-8% could be overestimated. Aluminum consumption could go down. The industry rate of expansion (14%) could be too much for the increase in the rate of demand (9%). The term loan offered may be too difficult to pay even in the event of normal earnings in years '70 and '72 due to large capital expenditures. Recession Competition from the large steel industry may affect the much smaller aluminum industry's sales. These are some of the things that could go wrong for the Crown corporation. The events that would affect Crown the most would be overestimated sales estimates or inability to make debt payments caused by any of the following; drop in consumption, too much industry expansion, recession, mining operations are unable to produce enough to meet production needs, etc.. Other than these problems that could occur Crown's new projects could fail to meet expectations.

Recommendation

To prevent against increases in aluminum prices due to shortage, Crown could increase it's mining holdings. Currently Crown estimates producing a surplus of aluminum in years after 1970. If these estimates hold true, then Crown will not have to worry about 20

price increases for a few years. However, if Crown's fabricating plant continues to increase consumption at this rate a future problem could arise if Crown would have to purchase aluminum again. Crown currently holds a lot of industry risk due to aluminum operations. Crown could explore new markets to diversify risk.

21

You might also like

- Mti Case AnalysisDocument6 pagesMti Case AnalysisHimanshu TulshyanNo ratings yet

- Analysis of Nicholson Company financial statements and valuation 1967-1976Document8 pagesAnalysis of Nicholson Company financial statements and valuation 1967-1976venkat1105No ratings yet

- Sweet Dreams Inc. Case AnalysisDocument13 pagesSweet Dreams Inc. Case Analysisdontcare3267% (3)

- Accounting Textbook Solutions - 50Document19 pagesAccounting Textbook Solutions - 50acc-expertNo ratings yet

- Group BDocument10 pagesGroup BHitin KumarNo ratings yet

- O.M. Scott - Sons CompanyDocument31 pagesO.M. Scott - Sons Companysultan altamashNo ratings yet

- Essar Steel Defaults on Debt RepaymentDocument17 pagesEssar Steel Defaults on Debt RepaymentMona SwainNo ratings yet

- CH 02Document31 pagesCH 02singhsinghNo ratings yet

- EVFTA's Effect on Vietnam Textile Industry-đã Chuyển ĐổiDocument26 pagesEVFTA's Effect on Vietnam Textile Industry-đã Chuyển ĐổiHữu Phúc ĐỗNo ratings yet

- Ontario Machinery Ring Problem DefinitionDocument11 pagesOntario Machinery Ring Problem DefinitionGarfield Luc'No ratings yet

- Tutorial Questions Chap. 13a (Topic 5 - Leverage & Capital Structure)Document2 pagesTutorial Questions Chap. 13a (Topic 5 - Leverage & Capital Structure)hengNo ratings yet

- Johnson & JohnsonDocument5 pagesJohnson & JohnsonAngela100% (1)

- SDOT BudgetDocument15 pagesSDOT BudgetWestSeattleBlogNo ratings yet

- FA - Abercrombie and Fitch Case StudyDocument17 pagesFA - Abercrombie and Fitch Case Studyhaonanzhang100% (2)

- Q2 2022-23 GDP EstimatesDocument8 pagesQ2 2022-23 GDP EstimatesRepublic WorldNo ratings yet

- Problem Sheet 7ADocument3 pagesProblem Sheet 7AMuztoba AliNo ratings yet

- Mercury AthleticDocument9 pagesMercury AthleticfutyNo ratings yet

- September 2021 Casino Revenue DataDocument14 pagesSeptember 2021 Casino Revenue DataWJZNo ratings yet

- Case 1 Ocean Carriers Spreadsheet AnswerDocument9 pagesCase 1 Ocean Carriers Spreadsheet Answerpiyush aroraNo ratings yet

- Capital Budgeting Methods and Cash Flow AnalysisDocument42 pagesCapital Budgeting Methods and Cash Flow AnalysiskornelusNo ratings yet

- Darabont DecisionDocument36 pagesDarabont DecisioneriqgardnerNo ratings yet

- Entertainment Industry Statistics and Financial DataDocument12 pagesEntertainment Industry Statistics and Financial DatakevinfuryNo ratings yet

- Assignment 5Document4 pagesAssignment 5Sachin A Khochare67% (3)

- Land User Application HMDADocument4 pagesLand User Application HMDAvmandava0720No ratings yet

- WhirlpoolDocument18 pagesWhirlpoolSaleemleem2qNo ratings yet

- PolarSports Solution PDFDocument8 pagesPolarSports Solution PDFaotorres99No ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisAreti SatoglouNo ratings yet

- Cafe Monte BiancoDocument21 pagesCafe Monte BiancoWilliam Torrez OrozcoNo ratings yet

- Kodak Bankruptcy AffidavitDocument96 pagesKodak Bankruptcy AffidavitrachbarnhartNo ratings yet

- Willison TowerDocument2 pagesWillison TowerOdiseGrembiNo ratings yet

- Ocean Carriers - Case (Final)Document18 pagesOcean Carriers - Case (Final)Namit LalNo ratings yet

- This Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)Document52 pagesThis Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)mehar noorNo ratings yet

- Innocents Abroad - Currencies and International Stock ReturnsDocument112 pagesInnocents Abroad - Currencies and International Stock ReturnsGragnor PrideNo ratings yet

- Glo Bus ExperienceDocument2 pagesGlo Bus ExperienceRachael Sudan100% (1)

- Year Wise Performance of Handloom Mark SchemeDocument1 pageYear Wise Performance of Handloom Mark SchemeVashishta VashuNo ratings yet

- FM Aaj KaDocument15 pagesFM Aaj Kakaranzen50% (2)

- Titanium Dioxide and Super Project Prof. Joshy JacobDocument3 pagesTitanium Dioxide and Super Project Prof. Joshy JacobSIDDHARTH SINGHNo ratings yet

- Instructions:: FINA 6216 ASSIGNMENT 1: Asset Allocation (25 Points)Document8 pagesInstructions:: FINA 6216 ASSIGNMENT 1: Asset Allocation (25 Points)Mathew SawyerNo ratings yet

- Eskimo Pie Case 2006Document10 pagesEskimo Pie Case 2006Luiz EduardoNo ratings yet

- 001 The State of South Carolina - SDocument49 pages001 The State of South Carolina - Smeghnakd697625% (4)

- Economic Impacts of Global Warming - A Reality and NOT A HoaxDocument39 pagesEconomic Impacts of Global Warming - A Reality and NOT A HoaxDipesh BhimaniNo ratings yet

- The Solow Model Unleashed-XLS-EnGDocument13 pagesThe Solow Model Unleashed-XLS-EnGSumeet MadwaikarNo ratings yet

- Sure Cut SheersDocument7 pagesSure Cut SheersEdward Marcell Basia67% (3)

- EPBM 5 FA QuestionDocument6 pagesEPBM 5 FA QuestionBhaskar BasakNo ratings yet

- Finance Project - Group 5Document15 pagesFinance Project - Group 5BabaNo ratings yet

- Nintendo Wii Marketing PlanDocument13 pagesNintendo Wii Marketing PlanAzlan PspNo ratings yet

- Case 3 - Starbucks - Assignment QuestionsDocument3 pagesCase 3 - Starbucks - Assignment QuestionsShaarang BeganiNo ratings yet

- CaseDocument4 pagesCaseDavut AbdullahNo ratings yet

- Case 3 Nikki 111Document6 pagesCase 3 Nikki 111Mahmudur Rahman TituNo ratings yet

- Financial Report Shows 7.2% Growth in Quarterly EarningsDocument14 pagesFinancial Report Shows 7.2% Growth in Quarterly EarningsAvinesh PillaiNo ratings yet

- Econ7073 2021.S1Document76 pagesEcon7073 2021.S1RebacaNo ratings yet

- Ceat, 11th January, 2013Document12 pagesCeat, 11th January, 2013Angel Broking100% (2)

- Case Synopsis Movie Exhibition IndustryDocument2 pagesCase Synopsis Movie Exhibition IndustryChaterina ManurungNo ratings yet

- Stern Corporation Balance Sheet AdjustmentsDocument4 pagesStern Corporation Balance Sheet AdjustmentsYessy KawiNo ratings yet

- Year Market Winner Wwbid Wwqty Lfwbid Lfwqty Lfcbid LfcqtyDocument72 pagesYear Market Winner Wwbid Wwqty Lfwbid Lfwqty Lfcbid LfcqtyQuỳnh Anh NguyễnNo ratings yet

- Cooper Industries' Potential Acquisition of Nicholson File CompanyDocument12 pagesCooper Industries' Potential Acquisition of Nicholson File CompanyLutful Kabir71% (7)

- Case For Individual EssayDocument2 pagesCase For Individual EssayksnganNo ratings yet

- Trade Promotion and Economic Development in Korea: Suneel Gupta Associate Professor GHS - IMR, KanpurDocument33 pagesTrade Promotion and Economic Development in Korea: Suneel Gupta Associate Professor GHS - IMR, KanpurRahul VishnoiNo ratings yet

- Sachs 1979 Wage Profits and M Acroeconomic AdjustmentDocument54 pagesSachs 1979 Wage Profits and M Acroeconomic AdjustmentjerweberNo ratings yet

- 0810 - GDP - Nipa - Series 1929 - 2010Document25 pages0810 - GDP - Nipa - Series 1929 - 2010KHAIRUNISANo ratings yet

- FAQ On Cordros Money Market FundDocument3 pagesFAQ On Cordros Money Market FundOnaderu Oluwagbenga EnochNo ratings yet

- Article On Investors Awareness in Stock Market-1Document10 pagesArticle On Investors Awareness in Stock Market-1archerselevatorsNo ratings yet

- TB - Chapter08 Stocks and Their ValuationDocument80 pagesTB - Chapter08 Stocks and Their ValuationMarie Bernadette AranasNo ratings yet

- Final Project On Engro FinalDocument27 pagesFinal Project On Engro FinalKamran GulNo ratings yet

- Method of Bank ValuationDocument12 pagesMethod of Bank Valuationhariyanto9999No ratings yet

- Martin ZweigDocument6 pagesMartin Zweigpemiddleton0% (1)

- Debtors Turnover RatioDocument7 pagesDebtors Turnover RatiorachitdedhiaNo ratings yet

- R29 CFA Level 3Document12 pagesR29 CFA Level 3Ashna0188No ratings yet

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- 1Document21 pages1DrGeorge Saad AbdallaNo ratings yet

- IFMP Mutual Fund Distributors Certification (Study and Reference Guide) PDFDocument165 pagesIFMP Mutual Fund Distributors Certification (Study and Reference Guide) PDFPunjabi Larka100% (1)

- 16 Financial Ratios To Determine A Company's Strength and WeaknessesDocument5 pages16 Financial Ratios To Determine A Company's Strength and WeaknessesOld School Value88% (8)

- Chapter 3 ExaminationDocument4 pagesChapter 3 ExaminationSurameto HariyadiNo ratings yet

- Book Value Per Share Problem 1Document3 pagesBook Value Per Share Problem 1XXXXXXXXXXXXXXXXXXNo ratings yet

- Exam Report June 2011Document5 pagesExam Report June 2011Ahmad Hafid HanifahNo ratings yet

- SMBU How To Find and Trade Stocks in Play PDFDocument17 pagesSMBU How To Find and Trade Stocks in Play PDFkabhijit04100% (3)

- Warren-Buffett/: INTRINSIC VALUE (1996, Berkshire Hathaway's Letter To Shareholders)Document7 pagesWarren-Buffett/: INTRINSIC VALUE (1996, Berkshire Hathaway's Letter To Shareholders)Raunaq SinghNo ratings yet

- Mergers & AcquisitionDocument29 pagesMergers & AcquisitionKunal Chaudhry100% (1)

- Trading With The PitchforkbDocument2 pagesTrading With The PitchforkbAnonymous sDnT9yuNo ratings yet

- HK-Listed Heng Fai Enterprises Sells Singapore Properties For S$53.9 Million (HK$328.8 Million) To SGX Catalist-Listed OELDocument2 pagesHK-Listed Heng Fai Enterprises Sells Singapore Properties For S$53.9 Million (HK$328.8 Million) To SGX Catalist-Listed OELWeR1 Consultants Pte LtdNo ratings yet

- Mindtree 08 09Document3 pagesMindtree 08 09muthusubaNo ratings yet

- AC503 - Finals Reviewer 2Document10 pagesAC503 - Finals Reviewer 2Ashley Levy San PedroNo ratings yet

- Bittman TradingIndexOptionsDocument77 pagesBittman TradingIndexOptionsKeerthy Veeran100% (1)

- CH 09Document14 pagesCH 09Salman ZafarNo ratings yet

- Valuation of Financial AssetsDocument39 pagesValuation of Financial Assetspartha_biswas_uiuNo ratings yet

- Ifm Chapter 6 Financial OptionsDocument47 pagesIfm Chapter 6 Financial Optionsminhhien222No ratings yet

- Team Health Stock ReportDocument59 pagesTeam Health Stock ReportDennis LiNo ratings yet

- Infosys - A Benchmark of Corp GovernanceDocument3 pagesInfosys - A Benchmark of Corp GovernanceshobhitgoelNo ratings yet

- JPM Introduction To FX OptionsDocument76 pagesJPM Introduction To FX OptionsDulguun BayNo ratings yet

- Exam40610 Samplemidterm AnswersDocument8 pagesExam40610 Samplemidterm AnswersPRANAV BANSALNo ratings yet