Professional Documents

Culture Documents

Expansion in United States

Uploaded by

Vipul PatelOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Expansion in United States

Uploaded by

Vipul PatelCopyright:

Available Formats

Expansion in United States Hana Financial views global expansion as one of its key growth drivers over the

next few years. Integral to this expansion is obtaining a strong foothold in the U.S. market. Strategically, there are a few distinct options to break into the foreign market: establish branches under the Hana Bank brand, develop a joint venture with an established player in the market, or acquire majority ownership in a current player. Each of the options entails risks and benefits. The U.S. commercial banking market is extremely competitive with a relatively low concentration of market share. There are only four large U.S. banks that have over 5% market share in the industry: Wells Fargo 12.8%, JPMorgan Chase 10%, Bank of America 6.1%, and Citigroup 5.3%. The remaining market is fragmented across regional banks, and small national banks. A few of the key success factors in this industry are brand recognition, economies of scale through M&A activities, and client access through strong branch and ATM networks. Hanas ability to compete with the currently established U.S. banks through branch and location acquisition seems unlikely to lead to a successful entry strategy into the market. While the company has had recent experience developing economies of scale through M&A in its takeover of KEB, the large capital requirements required to build a strong brand presence and develop an efficient branch network eliminates this as a viable option. The second option for Hana Financial is to develop a joint venture with an established U.S. bank. The primary difficulty in implementing this strategy is finding a partner willing to establish the relationship and assist Hanas entry into the competitive industry. It is highly unlikely that Hana will find such a partner, as a large majority of the benefit of the relationship would be realized by Hana alone. The most promising of strategy entry option for Hana Financial is the acquisition of a current player in the industry. The most logical move is to target banks that cater to Korean-Americans in cities and regions with large Korean populations such as Los Angeles and Northern California. The characteristics of Korean-American consumers in these regions is well suited for Hana to make an entry into this market. Korean-American banks specialize in providing commercial banking services to Koreans living in high density, primarily Korean language regions of cities. Market share is relatively consolidated in this niche market, with the largest, BBCN Bancorp which was a merger of Nara Bancorp and Center Financial Corp in December 2011, holding about 30% share of commercial loans. A few other players are Wilshire Bancorp, Hanmi, and Saehan Bancorp. Additionally, consumers are more loyal to their current bank and are more interested in maintaining their relationships rather than searching for the lowest cost option. High savings rates and low charge-offs are additional positive characteristics of the Korean-American banking customers. Hana Financial has already recognized the strategy that will lead to success through their 51% acquisition of Saehan Bancorp in February 2012. Hana begins their entry into the U.S. market well behind their competition, with $563 million in assets and 10 branches compared to BBCNs nearly $5 billion in assets and over 40 branches. However, the banks expertise in developing economies of scales through M&A and launch of strong brand, product, and promotion strategies, the company is likely to foster strong relationships in the Korean-American community.

It is recommended that Hana Financial Group acquire 100% of Saehan Bancorp and establish crosspromotional activities between the parent and subsidiary units such as credit cards, Korean exchange investment access, and insurance products.

Sources: http://www.businesswire.com/news/home/20111130006594/en/Nara-Bancorp-CenterFinancial-Complete-Merger-Equals

http://brileyco.com/news_media/entry/analyst_joe_gladue_comments_on_koreatown_ban ks_management

http://labusinessjournal.com/news/2012/feb/10/south-korean-bank-take-majoritystake-saehan-banco/

Analyst Perspective. BBCN Bancorp. Morningstar Equity Research. Thomson Research Website.

Jose, Eben. Commercial Banking in the US. IBISWorld Industry Report 52211. IBISWorld Website. Feb. 2012. http://msbapps05.marshall.usc.edu:2391/industryus/default.aspx?indid=1288

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Statement Dec 22 XXXXXXXX7921Document9 pagesStatement Dec 22 XXXXXXXX7921Chandan KumarNo ratings yet

- 3 Money CreationDocument10 pages3 Money CreationEleine AlvarezNo ratings yet

- Dr. Sutan Emir-ICWIEF 2020 PDFDocument17 pagesDr. Sutan Emir-ICWIEF 2020 PDFMuhamad Arif RohmanNo ratings yet

- Full Download Bank Management Koch 8th Edition Test Bank PDF Full ChapterDocument36 pagesFull Download Bank Management Koch 8th Edition Test Bank PDF Full Chapterexosmosetusche.mmh69100% (17)

- SEC Ruling on Ruby Industrial Corporation Stockholder DisputeDocument27 pagesSEC Ruling on Ruby Industrial Corporation Stockholder DisputeRyan ChristianNo ratings yet

- Chapter OneDocument84 pagesChapter OneChin Odilo AsherinyuyNo ratings yet

- CYPRUS - National Assessment of Money Laundering and Terrorist Financing RisksDocument118 pagesCYPRUS - National Assessment of Money Laundering and Terrorist Financing Risksru4realcy_838983986No ratings yet

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

- Supply of MoneyDocument13 pagesSupply of MoneyNonit Hathila100% (1)

- Name Change Authorization: Fax Cover SheetDocument5 pagesName Change Authorization: Fax Cover SheetDaniel CastroNo ratings yet

- Statement - 601721-99277832 - 18-12-2021-18-03-2022 3Document12 pagesStatement - 601721-99277832 - 18-12-2021-18-03-2022 3Tharuka FernandoNo ratings yet

- PDF DocumentDocument2 pagesPDF DocumentRanger SidahNo ratings yet

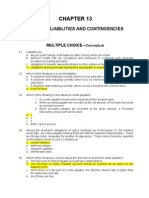

- Intermediate Accouting Testbank ch13Document23 pagesIntermediate Accouting Testbank ch13cthunder_192% (12)

- CV - GF Apr'10 - NorefDocument3 pagesCV - GF Apr'10 - NorefGembongNo ratings yet

- Internship Report On SME Banking of Jamuna Bank Limited: Submitted ToDocument68 pagesInternship Report On SME Banking of Jamuna Bank Limited: Submitted ToMahmud HossainNo ratings yet

- 86627745680Document4 pages86627745680scottjames419sugardaddyNo ratings yet

- Project Management Project (Toy Manufacture)Document27 pagesProject Management Project (Toy Manufacture)✬ SHANZA MALIK ✬0% (2)

- HDFC Bank Statement SummaryDocument3 pagesHDFC Bank Statement SummaryNanu PatelNo ratings yet

- ASTRID A. VAN DE BRUG v. PHILIPPINE NATIONAL BANKDocument33 pagesASTRID A. VAN DE BRUG v. PHILIPPINE NATIONAL BANKFaustina del Rosario100% (1)

- Summer Project Report On Comparative Analysis of Broking Companies and Financial Performance of Edelweiss Broking LTDDocument71 pagesSummer Project Report On Comparative Analysis of Broking Companies and Financial Performance of Edelweiss Broking LTDSatyendraSinghNo ratings yet

- Terms of Reference GCF GEFF Green SME Loan Facility ConsultantDocument10 pagesTerms of Reference GCF GEFF Green SME Loan Facility ConsultantAhmedKhaledSalahNo ratings yet

- Audit Deliverables For Simply Soups PDFDocument15 pagesAudit Deliverables For Simply Soups PDFLeah Wingert100% (1)

- TAB 2 - ATMS Software Requirements Specifications v1.0.0Document43 pagesTAB 2 - ATMS Software Requirements Specifications v1.0.0MahadiNo ratings yet

- Managing Customer Relationships For Profit: The Dynamics Of: Storbacka, Kaj Strandvik, ToreDocument12 pagesManaging Customer Relationships For Profit: The Dynamics Of: Storbacka, Kaj Strandvik, ToreVirendra KumarNo ratings yet

- Indo-Nepal Remittance User ManualDocument21 pagesIndo-Nepal Remittance User ManualShuvajoyyyNo ratings yet

- An Ephemeral Study On Contribution of Exim Bank India in Export Financing 2017 - Verma-ReevaDocument3 pagesAn Ephemeral Study On Contribution of Exim Bank India in Export Financing 2017 - Verma-ReevaChris JasabeNo ratings yet

- Financial Institutions, Markets, & Money, 10 Edition: Power Point Slides ForDocument56 pagesFinancial Institutions, Markets, & Money, 10 Edition: Power Point Slides Forsamuel debebeNo ratings yet

- Auditing and AssuranceDocument14 pagesAuditing and AssurancePrincess Vie RomeroNo ratings yet

- Use of Graphic OrganizersDocument107 pagesUse of Graphic OrganizersJoel ValdezNo ratings yet

- 6th Semester Entrepreneurship Chapter 10Document36 pages6th Semester Entrepreneurship Chapter 10Subekshya ShakyaNo ratings yet