Professional Documents

Culture Documents

Tresch Complaint

Uploaded by

JSmithWSJOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tresch Complaint

Uploaded by

JSmithWSJCopyright:

Available Formats

AUSA Terra Reynolds (312) 353-3148 W44444444444444444444444444444444444444444444444444444444444444444444444444444444444444444

AO 91 (REV.5/85) Criminal Complaint

UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF ILLINOIS EASTERN DIVISION UNITED STATES OF AMERICA v. DAVID TRESCH CRIMINAL COMPLAINT CASE NUMBER: UNDER SEAL

I, the undersigned complainant, being duly sworn on oath, state that the following is true and correct to the best of my knowledge and belief. Beginning no later than in or around April 2011 and continuing until on or about June 28, 2012, at Chicago, in the Northern District of Illinois, Eastern Division, defendant did: knowingly devise and intend to devise a scheme to defraud and to obtain money from the Victim Firm by means of false and fraudulent pretenses, representations and promises, and material omissions, and that for the purpose of executing the scheme to defraud, caused to be sent and delivered by the U.S. Postal Service according to direction thereon to the Vendor Firm, PO Box 464, Itasca, IL, 60143 a check dated November 2, 2011 in the amount of $56,250 for work that defendant falsely represented was performed at the Victim Firm, in violation of Title 18, United States Code, Section 1341. I further state that I am a Special Agent with the Federal Bureau of Investigation, and that this complaint is based on the facts contained in the Affidavit which is attached hereto and incorporated herein.

Signature of Complainant A. WESLEY NEVENS Special Agent, Federal Bureau of Investigation Sworn to before me and subscribed in my presence, August 29, 2012 Date at Chicago, Illinois City and State

SIDNEY I. SCHENKIER, U.S. Magistrate Judge Name & Title of Judicial Officer

Signature of Judicial Officer

STATE OF ILLINOIS COUNTY OF COOK

) ) )

SS

I, A. Wesley Nevens, first being duly sworn, state the following under oath: INTRODUCTION 1. I am a special agent of the Federal Bureau of Investigation (FBI) and have been

so employed for approximately 2 years. I am currently assigned to the Chicago Division of the FBI. As part of my assigned duties, I investigate violations of federal criminal law, including violations of Title 18, United States Code, Sections 1341 (mail fraud) and 1343 (wire fraud). 2. The following statements are based on my personal knowledge, conversations

with other law enforcement officers and witnesses, as well as records obtained from various sources. The information contained in this affidavit is submitted for the limited purpose of establishing probable cause to: (a) arrest David Tresch (Tresch); (b) seize funds not to exceed $26,653.94 contained in Itasca Bank checking account x3702, held in the name of Tresch and his wife (the Tresch Itasca account); (c) seize funds not to exceed $203,623.49 contained in Discover online savings account x4693, held in the name of Tresch (the Tresch Discover account); (d) seize one (e) 2011 seize Coleman one 2012 Niagara Chevrolet RV camping trailer van (VIN (VIN

4CG633H10B7227300);

Express

G3500

1GAZG1FG7C1103369); (f) seize one 2011 Cadillac DTS (VIN 1G6KH5E66BU128432); and (g) seize one 2011 Stone Canyon Lodge park model cabin (VIN SCL1399AL). The foregoing accounts, vehicles, and personal property constitute and are derived from proceeds traceable to violations of the mail fraud statute. Because of the limited purpose of this affidavit, it does not contain all of the information that I have gathered during the investigation.

OVERVIEW 3. I submit that evidence, further described below, provides probable cause to

believe that beginning no later than in or around April 2011 and continuing until on or about June 28, 2012, Tresch engaged in a scheme to defraud his former employer (the Victim Firm), by causing the Victim Firm to use the U.S. Postal Service to mail checks totaling nearly $1,000,000 to a third party contractor (the Vendor Firm) for work that Tresch knew the Vendor Firm did not perform. The Vendor Firm then provided Tresch with checks totaling over $850,000 of the money it had fraudulently received from the Victim Firm. Tresch deposited the money he received from the Vendor Firm in various bank accounts, and used funds from those accounts to purchase and make payments on various vehicles. As such, this Affidavit is

submitted in support of a warrant for Treschs arrest, and warrants to seize various bank accounts and vehicles that are property constituting or derived from the proceeds of Treschs violation of the mail fraud statute. FACTS 4. The Victim Firm is a global law firm headquartered in Chicago, Illinois that has

offices in North America, South America, Europe, and Asia. On May 10, 2004, the Victim Firm hired Tresch as a server operations manager in the firms Information Technology (IT) department. On November 21, 2008, the Victim Firm promoted Tresch to the position of Director of Global Operations. On July 1, 2011, Victim Firm promoted Tresch to the position of Chief Information Officer (CIO). On June 28, 2012, the Victim Firm terminated Tresch. At times during his employment, Tresch was responsible for reviewing invoices from, and authorizing payment to, the Vendor Firm that provided the Victim Firm with contract employees.

5.

According to the Vendor Firms website, last checked on August 27, 2012, the

Vendor Firm is based in Schaumburg, Illinois and provides personnel and technology to businesses to assist in office automation, web and database development, and general information technology. According to records from the Illinois Secretary of State, the Vendor Firm was based in Itasca, Illinois, incorporated on or about December 11, 2003, and involuntarily dissolved on or about May 14, 2010. 6. Based on records obtained from the Victim Firm, between November 2004 and

March 2011, the Victim Firm paid the Vendor Firm for work performed by the Vendor Firms contract employees. During that time, the Vendor Firm generally submitted monthly invoices to Tresch at the Victim Firm. The invoices typically identified the contract employee by name, the number of hours the contract employee worked, and the hourly rate at which the Vendor Firm billed out the contract employee. Tresch, in turn, requested that the Victim Firm pay the Vendor Firm invoices. 7. Based on records from the Victim Firm, as a result of Treschs requests, between

November 8, 2004 and March 28, 2011, the Victim Firm paid the Vendor Firm approximately $7,798,186.21 for work purportedly performed by the Vendor Firm contract employees. The Victim Firm provided payment to the Vendor Firm by check, which the Vendor Firm deposited into its corporate account at Itasca Bank in Itasca, Illinois (the Vendor Firms corporate account). Based on my review of the Vendor Firms corporate account, between November 2004 and March 2011, over ninety-five percent of the Vendor Firms income came from the Victim Firm. 8. Based on my review of the Vendor Firms corporate account, Treschs Itasca

account and Treschs Discover account, between February 2005 and March 2011, the Vendor 3

Firm paid both Tresch and his wife nearly $1,300,000, over fifteen percent of the money it received from the Victim Firm. The invoices the Vendor Firm submitted to the Victim Firm did not list Tresch or his wife as contract employees. The Victim Firm has no record of Tresch or his wife having worked as contract employees for the Vendor Firm.1 According to

representatives of the Victim Firm, during his employment with the Victim Firm, Tresch never disclosed to the Victim Firm that both he and his wife had a financial interest in the Vendor Firm. 9. Based on my review of the Vendor Firms corporate account and the Tresch

Itasca account, between February 17, 2005 and March 21, 2011, the Vendor Firm paid Tresch approximately $171,900 via check. Between April 24, 2006 and March 2011, the Vendor Firm paid Treschs wife approximately $1,129,521.61 via check. During that time period, the Vendor Firm generally issued a check to Treschs wife every two weeks in amounts ranging from $2,410.46 to $8,839.42. On or about December 14, 2006, the Vendor Firm issued a check to Treschs wife for $31,851.52. In the memo line of the check, the Vendor Firm identified the check as a bonus. Tresch generally deposited the Vendor Firms checks to him and his wife in the Tresch Itasca account.2 10. According to Victim Firm Employee A, he joined the Victim Firm in 2008 as the

Chief Operating Officer (COO) and was tasked, in part, with the responsibility of reducing costs at the Victim Firm. As part of Victim Firm Employee As efforts, he directed that the

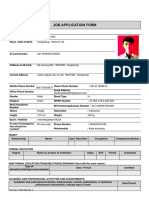

1 On April 8, 2011, Tresch and his wife applied to finance their purchase of a 2011 Coleman Niagra RV Camping Trailer, VIN 4CG633H10B7227300. The transaction is discussed in greater detail below. In the application, Tresch and his wife provided information about their employment under penalty of perjury. Tresch stated that he had worked for the Victim Firm for the previous seven years. Tresch did not disclose any other employment. Treschs wife stated that she was unemployed and left blank the section that asked for previous employer if less than 2 years at present employer.

On February 17, 2005 and June 28, 2005, the Vendor Firm issued checks to Tresch totaling $16,000. To date, I have been unable to determine where Tresch deposited these particular checks.

Victim Firm no longer use the Vendor Firm or the Vendor Firms contract employees after February 28, 2011. Victim Firm Employee As directive was communicated to Tresch by e-mail prior to February 28, 2011. 11. Between April 21, 2011 and May 2, 2012, the Vendor Firm continued to submit

invoices to Tresch at Victim Firm for work it purportedly performed for Victim Firm after February 28, 2011. Victim Firm Employee B is the Assistant Director of Global IT, and as such is familiar with the work performed in the IT department throughout the Victim Firm. Victim Firm Employee B told me that he reviewed the invoices the Vendor Firm submitted to the Victim Firm between April 21, 2011 and April 3, 2012. Each of the invoices contains a general description of the work that was performed. The invoices do not identify the dates on which the work was performed, the contract employees who performed the work, or the hours the contract employees worked. According to Victim Firm Employee B, Vendor Firm did not perform the work claimed on the invoices. Victim Firm Employee B explained that the work was either not done at all, was performed by internal Victim Firm staff, or performed by another third party vendor. 12. Based on my review of the Victim Firms records, Tresch approved each invoice

the Vendor Firm submitted to the Victim Firm between April 21, 2011 and May 2, 2012. Tresch then requested that the Victim Firm issue a check to the Vendor Firm for each of the invoices. Tresch authorized and requested payment for the foregoing invoices knowing that the Vendor Firm was not permitted to perform work for the Victim Firm after February 28, 2011, and in fact had not performed the invoiced work for the Victim Firm. Tresch engaged in the foregoing

conduct in order to fraudulently obtain a portion of the Vendor Firms profits from its purported work for the Victim Firm. 5

13.

As a result of Treschs requests, between May 2, 2011 and May 9, 2012, the

Victim Firm issued checks totaling approximately $980,000 to the Vendor Firm. Based on my review of the Vendor Firms corporate account, between May 2011 and May 2012, nearly onehundred percent of the Vendor Firms income came from the Victim Firm. Based on my review of the Vendor Firms corporate account, the Tresch Itasca account, and the Tresch Discover account, I believe that the Vendor Firm paid Tresch nearly ninety percent of the funds it received from the Victim Firm between May 2011 and May 2012. 14. More specifically, between May 27, 2011 and May 29, 2012, the Vendor Firm Tresch deposited 10 of the checks totaling

wrote 11 checks totaling $854,250 to Tresch.

$810,250 into the Tresch Discover account. Tresch deposited one check totaling $44,000 into the Tresch Itasca checking account. Between June 6, 2011 and July 6, 2012, Tresch transferred approximately $556,000 from the Tresch Discover account to the Tresch Itasca account. 15. Based on my conversations with Victim Firm Employee C, and e-mails provided

by the Victim Firm, I believe that the Victim Firm mailed the checks it issued to the Vendor Firm. Victim Firm Employee C is employed in the accounting department and is familiar with the Victim Firms practice of mailing checks to vendors. According to Victim Firm Employee C, the Victim Firm typically mails checks within days from the time that they are signed. The checks are typically sent directly to the vendor via the United States Postal Service. According to Victim Firm Employee C, the Victim Firm followed the foregoing practice with respect to the checks it issued to the Vendor Firm.

16.

On several occasions between March 11, 2011 and May 14, 2012, Tresch

instructed his assistant, Victim Firm Employee D, to check on the status of his requests that the Vendor Firm receive payment for the invoices it had submitted to the Victim Firm. For example, on September 15, 2011, at 7:10 a.m., Tresch sent an e-mail to Victim Firm Employee D and asked her to check on invoice #0811011 for [the Vendor Firm]. Based on my review of the invoices the Vendor Firm submitted to the Victim Firm, I believe the invoice to which Tresch referred was the invoice dated August 11, 2011 in the amount of $57,450 for VM Migration Planning, Data Center Services and Backup Design. 17. Later that same day, at 11:35 a.m., Victim Firm Employee D sent an e-mail to

Tresch explaining that the invoice has been posted by accounting for payment. Based on my review of records from the Victim Firm and the Vendor Firms corporate account, I know that on September 15, 2011, the Victim Firm issued a check in the amount of $57,450 to the Vendor Firm at PO Box 464, Itasca, IL 60143. The Vendor Firm deposited the check in its corporate account on September 27, 2011. On September 28, 2011, the Vendor Firm issued a check to Tresch in the amount of $49,500. Tresch deposited the check in the Tresch Discover account. 18. Furthermore, on November 14, 2011, at 1:48 p.m., Victim Firm Employee D e-

mailed Tresch, telling him that she would obtain a copy of the cancelled check [to the Vendor Firm] from aug/sep, forward it to Tresch, and check on status of sep/oct check [to the Vendor Firm]. Later that day, at 3:28 p.m., Victim Firm Employee E, an employee in the accounts payable department, e-mailed Victim Firm Employee D. Victim Firm Employee E attached a copy of a cashed check dated September 29, 2011 issued to the Vendor Firm in the amount of $54,750. The check reflects that the Vendor Firm deposited the check into its corporate account on October 6, 2011. Victim Firm Employee E explained that the other check was just mailed 7

out last Wednesday [November 9, 2011]. So [the Vendor Firm] should have received that one or [are] about to receive it. 19. On November 15, 2011, at 8:48 a.m., Victim Firm Employee D forwarded the

foregoing e-mail correspondence to Tresch. Later that day, at 9:00 a.m., Victim Firm Employee D e-mailed Victim Firm Employee E, saying [the Vendor Firm] received the other check today. Based on my review of records from the Victim Firm and the Vendor Firms corporate account, I believe that the other check to which Victim Firm Employees D and E referred was the November 2, 2011 check in the amount of $56,250 issued to the Vendor Firm at PO Box 464, Itasca, IL 60143. The Vendor Firm deposited the check into its corporate account on November 15, 2011. On that same day, the Vendor Firm issued a check to Tresch in the amount of $48,150. Tresch deposited the check into the Tresch Discover account. 20. According to Victim Firm Employee B, in mid-May 2012 he discovered Treschs

authorization of payment to the Vendor Firm for work it had not performed. Victim Firm Employee B ultimately notified other employees of the Victim Firm of his discovery. As a result, on Monday, June 25, 2012, Victim Firm Employee A, Victim Firm Employee F, and Victim Firm Employee G interviewed Tresch. During the interview, Tresch falsely claimed that he had not received any financial benefit from the Vendor Firm. Tresch claimed that his wife had once received a paycheck from the Vendor Firm for work that lasted a couple of days. Tresch admitted that he had no proof that the Vendor Firm had in fact done the work it claimed in the invoices the Vendor Firm submitted to Tresch at the Victim Firm between April 21, 2011 and May 9, 2012. At some point during the interview, Tresch asked if he was going to jail. At the conclusion of the interview, the Victim Firm placed Tresch on leave.

21.

On June 27, 2012, Tresch had a telephone conversation with Victim Firm

Employee F and Victim Firm Employee G. During the conversation, Tresch stated that his wife was a housewife and had never worked for the Vendor Firm. Tresch claimed that he had worked for the Vendor Firm for one day prior to his employment with the Victim Firm. Tresch asserted that the Vendor Firm had paid him $80 for his work. On June 28, 2012, the Victim Firm fired Tresch by telephone. 22. Based on my review of the Tresch Discover account, the Tresch Itasca account

and other financial records, I believe that the funds contained in the accounts constitute and are derived from proceeds traceable to Treschs violations of the mail fraud statute, and that Tresch used some of the proceeds of his scheme to purchase and/or make payments on the following vehicles. a. According to a representative of Itasca Bank, as of August 29, 2012 at

9:10 a.m., the Tresch Itasca account had a balance of $26,653.94. Since or about August 29, 2011, Tresch deposited approximately $44,000 in proceeds from the scheme into the Tresch Itasca account. In addition, Tresch transferred at least $463,000 in proceeds from the scheme from the Tresch Discover account to the Tresch Itasca account. The government is seeking a warrant to seize funds not to exceed the current balance of $26,653.94 in the Tresch Itasca account. b. According to records received from Discover Financial, as of July 31,

2012, the Tresch Discover account had a balance of $203,623.49. Since on or about August 29, 2011, Tresch deposited approximately $666,250 in proceeds from the scheme into the Tresch Discover account. The government is seeking a warrant to seize funds not to exceed the last known balance of $203,623.49 in the Tresch Discover account. 9

c.

According to Illinois Secretary of State records, on or about April 8, 2011,

Tresch purchased a 2011 Coleman Niagara RV Camping Trailer, VIN 4CG633H10B7227300 (the Coleman Niagara RV). Based on financial records pertaining to the transaction, Tresch financed the purchase price of the Coleman Niagara RV, $11,075, through North Shore Bank of Brookfield, Wisconsin. Beginning in or around June, 2011, Tresch caused regular monthly online payments for the Coleman Niagara RV to be made from the Tresch Itasca account to North Shore Bank. In March 2012, Tresch retired the loan on the Coleman Niagara RV by submitting a check to North Shore Bank drawn on the Tresch Itasca account in the amount of $10,549.98. d. According to Illinois Secretary of State records, on or about April 5, 2012,

Tresch purchased a 2012 Chevrolet Express G3500 van, VIN 1GAZG1FG7C1103369 (the Chevrolet van). Records from the Tresch Itasca account reflect that on April 5, 2012, Tresch wrote a check to Castle Chevrolet in the amount of $36,425.52. The memo line on the check has the word van. Based on the foregoing, I believe that Treschs check to Castle Chevrolet was payment for the Chevrolet van. e. According to Illinois Secretary of State records, on or about May 4, 2011,

Tresch purchased a Stone Canyon Lodge park model cabin, VIN SCL1399AL (the Stone Canyon Lodge mobile home). Stone Canyon Lodge's web site, last checked on August 27, 2012, shows the Stone Canyon Lodge mobile home to be a prefabricated housing unit on wheels. Records for the Tresch Itasca account reflect that on January 28, 2011, Tresch caused a wire transfer of $12,000 to be sent to Stone Canyon Lodge. The records further reflect that on May 4, 2011, Tresch caused a wire transfer to be sent to Stone Canyon Lodge in the amount of $29,100. Based on the foregoing, I believe that Tresch caused the wire transfers to be sent to Stone 10

Canyon Lodge as payment for the Stone Canyon Lodge mobile home. To date, I have been unable to determine if Treschs wire transfers to Stone Canyon Lodge constituted payment in full for the Stone Canyon Lodge mobile home. f. According to Illinois Secretary of State records, on or about September 1,

2011, Tresch purchased a 2011 Cadillac DTS Premium, VIN 1G6KH5E66BU128432 (the Cadillac DTS). Based on my review of the Tresch Itasca account, Tresch financed at least part of his purchase of the Cadillac DTS US Bank of Oshkosh, Wisconsin. Between October 2011 and June 2012, Tresch caused monthly online payments of $710 for the Cadillac to be made from the Tresch Itasca account to US Bank. g. The Tresch Itasca account, the Tresch Discover account, the Coleman

Niagara RV, the Chevrolet van, the Stone Canyon Lodge mobile home, and the Cadillac DTS constitute and are derived from proceeds traceable to violations of the mail fraud statute.

11

CONCLUSION 23. Based upon the information set forth above, there is probable cause to believe that

Tresch knowingly devised and intended to devise a scheme to defraud, and to obtain money from the Victim Firm, by means of false and fraudulent pretenses, representations and promises, and material omissions, and that for the purpose of executing the scheme to defraud knowingly caused to be sent and delivered by the United States Postal Service according to direction thereon to the Vendor Firm, PO Box 464, Itasca, IL, 60143 a check dated November 2, 2011 in the amount of $56,250 for work that defendant falsely represented was performed at the Victim Firm, in violation of Title 18, United States Code, Section 1341. Further, there is probable cause to believe that the Tresch Itasca account, the Tresch Discover account, the Coleman Niagara, the Chevrolet van, the Stone Canyon Lodge mobile home, and the Cadillac DTS are subject to seizure and forfeiture civilly pursuant to 18 U.S.C. 981(a)(1)(c), 981(b)(1), and 28 U.S.C. 2461(c) .

_______________________________ A. Wesley Nevens, Special Agent Federal Bureau of Investigation

SUBSCRIBED and SWORN TO before me this day of August, 2012

_______________________________ Sidney I. Schenkier United States Magistrate Judge

-12-

You might also like

- Gov Uscourts TXSD 833220 135 0Document23 pagesGov Uscourts TXSD 833220 135 0JSmithWSJNo ratings yet

- Declaration of Jonathan A Mitchell in S - MG Declaration-1Document6 pagesDeclaration of Jonathan A Mitchell in S - MG Declaration-1JSmithWSJNo ratings yet

- 2nd Amended Disclosure Statement Disclosure - Main DocumentDocument109 pages2nd Amended Disclosure Statement Disclosure - Main DocumentJSmithWSJNo ratings yet

- Order Approving Dewey Disclosure StatementDocument18 pagesOrder Approving Dewey Disclosure StatementJSmithWSJNo ratings yet

- 11th Cir OrderDocument8 pages11th Cir OrderJSmithWSJNo ratings yet

- Greenberg Hunton Suarez ComplaintDocument172 pagesGreenberg Hunton Suarez ComplaintJSmithWSJNo ratings yet

- 655 - Disclosure Statement Relating To The Chapter 11 Plan of LiquidationDocument188 pages655 - Disclosure Statement Relating To The Chapter 11 Plan of LiquidationJSmithWSJNo ratings yet

- Togut Motion To Approve Hearing To Be Determi - Main DocumentDocument19 pagesTogut Motion To Approve Hearing To Be Determi - Main DocumentJSmithWSJNo ratings yet

- PCP Jewel ClaimsDocument11 pagesPCP Jewel ClaimsJSmithWSJNo ratings yet

- Dewey & LeBoeuf Amended Plan Filed Dec. 31Document115 pagesDewey & LeBoeuf Amended Plan Filed Dec. 31bankrupt0No ratings yet

- PCP ApprovalDocument27 pagesPCP ApprovalJSmithWSJNo ratings yet

- PCP Partner Names and AmountsDocument5 pagesPCP Partner Names and AmountsJSmithWSJNo ratings yet

- LegalZoom Rocket Lawyer ComplaintDocument62 pagesLegalZoom Rocket Lawyer ComplaintJSmithWSJNo ratings yet

- 11th Cir OrderDocument8 pages11th Cir OrderJSmithWSJNo ratings yet

- United States Court of Appeals For The Second Circuit Summary OrderDocument4 pagesUnited States Court of Appeals For The Second Circuit Summary OrderJSmithWSJNo ratings yet

- Steve Davis Objection To MotionDocument17 pagesSteve Davis Objection To MotionJSmithWSJNo ratings yet

- Unsecured Creditors Committee in Support of PCPDocument9 pagesUnsecured Creditors Committee in Support of PCPJSmithWSJNo ratings yet

- Second Supplemental Order Re Cash CollateralDocument6 pagesSecond Supplemental Order Re Cash CollateralJSmithWSJNo ratings yet

- Unsecured Creditors Committee in Support of PCPDocument9 pagesUnsecured Creditors Committee in Support of PCPJSmithWSJNo ratings yet

- Ad Hoc Committee Objections To PCP - Main DocumentDocument28 pagesAd Hoc Committee Objections To PCP - Main DocumentJSmithWSJNo ratings yet

- Official Committee of Former Partners Objection To PCPDocument25 pagesOfficial Committee of Former Partners Objection To PCPJSmithWSJNo ratings yet

- Zauderer Partner Group Statement Supporting PCP StatementDocument4 pagesZauderer Partner Group Statement Supporting PCP StatementJSmithWSJNo ratings yet

- Otillar Memorandum of Law 8-20-12Document32 pagesOtillar Memorandum of Law 8-20-12JSmithWSJNo ratings yet

- Judge Pauley Decision Re Thelen and Unfinished BusinessDocument21 pagesJudge Pauley Decision Re Thelen and Unfinished BusinessJSmithWSJNo ratings yet

- CA State Bar OpinionDocument19 pagesCA State Bar OpinionJSmithWSJNo ratings yet

- QUinn Fees Exhibit ADocument2 pagesQUinn Fees Exhibit AJSmithWSJNo ratings yet

- Debtors Motion For Entry of Order Approving PCPDocument25 pagesDebtors Motion For Entry of Order Approving PCPJSmithWSJNo ratings yet

- Apple Fee Request May 7 2012Document25 pagesApple Fee Request May 7 2012JSmithWSJNo ratings yet

- July Monthly Operating Report Corporate - MG Operating ReportDocument63 pagesJuly Monthly Operating Report Corporate - MG Operating ReportJSmithWSJNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Surplus Economy: and The Battle of BrandingDocument8 pagesThe Surplus Economy: and The Battle of Brandinga4yNo ratings yet

- 00 PKNS Selbiz 2023 DeckDocument6 pages00 PKNS Selbiz 2023 DeckAkbar GinanjarNo ratings yet

- Anchoring Script For SeminarDocument3 pagesAnchoring Script For Seminarvikramsinghnikhil79% (61)

- Case Study 1 (BCG)Document4 pagesCase Study 1 (BCG)Ekrem SafakNo ratings yet

- Municipality of Tampilisan - ZN: Responsibily Center Accounts and Explanations Account Code PR Debit CreditDocument7 pagesMunicipality of Tampilisan - ZN: Responsibily Center Accounts and Explanations Account Code PR Debit CreditMary Jane Katipunan CalumbaNo ratings yet

- Homepreneurs A Vital Economic ForceDocument9 pagesHomepreneurs A Vital Economic ForceDavid MarchNo ratings yet

- Applied Value Investing (Duggal) FA2016Document3 pagesApplied Value Investing (Duggal) FA2016darwin12No ratings yet

- Integrated Approach of Material ManagementDocument14 pagesIntegrated Approach of Material ManagementShashidhar KasturiNo ratings yet

- Rising Star - Senco Gold Ltd.Document22 pagesRising Star - Senco Gold Ltd.deepaksinghbishtNo ratings yet

- Online Shopping Habits and Attitudes of UNP StudentsDocument12 pagesOnline Shopping Habits and Attitudes of UNP StudentsReotutar, Michelle Angela T.No ratings yet

- The use of Lean Six-Sigma tools in improving a manufacturing companyDocument14 pagesThe use of Lean Six-Sigma tools in improving a manufacturing companyMilena Brondani BergalliNo ratings yet

- Sales Management NotesDocument8 pagesSales Management NotesDisha MathurNo ratings yet

- Sales ReviewerDocument32 pagesSales ReviewerbjhbkjbkjNo ratings yet

- Annual Report - 2020 - Indomobil SuksesDocument436 pagesAnnual Report - 2020 - Indomobil SuksesaldoNo ratings yet

- jl-18 Bmt1018 TH Sjt626 Vl2017181002984 Reference Material I Exim 04bDocument15 pagesjl-18 Bmt1018 TH Sjt626 Vl2017181002984 Reference Material I Exim 04bPulkit JainNo ratings yet

- GST Question BankDocument14 pagesGST Question BankrupalNo ratings yet

- Job Application FormDocument3 pagesJob Application Formdodi maulanaNo ratings yet

- Telangana eDistrict Managers GuideDocument21 pagesTelangana eDistrict Managers GuideAbhandra ChaudharyNo ratings yet

- Chapter 1 - Introduction To Cost AccountingDocument34 pagesChapter 1 - Introduction To Cost AccountingGlaiza Lipana PingolNo ratings yet

- Chr08 Investment AnalysisDocument4 pagesChr08 Investment AnalysisfarrukhazeemNo ratings yet

- Cateora18ePPt Ch02 Final 7-19-19 AccessibleDocument38 pagesCateora18ePPt Ch02 Final 7-19-19 Accessiblenguyễn dũngNo ratings yet

- MGT80002 - Session 2A - Strategy Concept and MeaningsDocument18 pagesMGT80002 - Session 2A - Strategy Concept and MeaningsWizky OnNo ratings yet

- Quality management system overviewDocument2 pagesQuality management system overviewKarol FernandezNo ratings yet

- The Metrocentre Partnership Report and Financial Statements For The Year Ended 31 December 2019Document37 pagesThe Metrocentre Partnership Report and Financial Statements For The Year Ended 31 December 2019Roshan PriyadarshiNo ratings yet

- Organisational Study of Hyundai Motors" (Desk Reserach During Covid-19 Pandemic)Document60 pagesOrganisational Study of Hyundai Motors" (Desk Reserach During Covid-19 Pandemic)Nischal PrasannaNo ratings yet

- TDS Rates Chart for FY 2011-12Document2 pagesTDS Rates Chart for FY 2011-12Anirudha PangarkarNo ratings yet

- Smart Platina Plus One PagerDocument3 pagesSmart Platina Plus One PagerGAURAHARI PATRANo ratings yet

- ISIP4112 ILMU PENGANTAR EKONOMI INISIASI 5 Struktur PasarDocument32 pagesISIP4112 ILMU PENGANTAR EKONOMI INISIASI 5 Struktur Pasarmanik suciNo ratings yet

- Ep 9187343Document2 pagesEp 9187343shafiq khanNo ratings yet