Professional Documents

Culture Documents

Project Appraisal Methods

Uploaded by

Uday SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Appraisal Methods

Uploaded by

Uday SharmaCopyright:

Available Formats

Concept of appraisal

Appraisal is the evaluation of the ability of the project to succeed. The project evaluation is done after the feasibility study of the project has been completed. The objective of the appraisal is simply to study & compare the possible feasible project & select the best that meets the objectives of the project. Project appraisal is carried out in a systematic & scientific manner because it determines the success & failure of the projects.

S. K. Chatterji, Appraisal is a tool of management when by the executive is able to focus his attention on specific aspects & areas of operation with a view to ensuring that the actual performance confirms as closely as possible to establish goals. Broadly, the following type of appraisal may be undertaken while evaluating an investment proposal: (method of project Evaluation) 1. Market appraisal : 2. Economic appraisal 3. Technical appraisal 4. Managerial appraisal 5. Environmental appraisal 6. Financial appraisal Tools of Project Analysis & Evaluation/ Project Appraisal Project appraisal is concerned with evaluating the overall ability of the feasible project to succeed. Numerous tools & techniques are used for the project appraisal. The commonly used tools & techniques of the project appraisal are: 1. Cost-benefit analysis 2. Capital budgeting techniques 3. Financial analysis 1. cost-benefit Analysis The most popular methods of project appraisal & evaluation are to consider the cost benefit analysis of different project & then select involving lesser cost & yielding greater benefits. It evaluates the overall economic impact of project. It is used to ascertain whether or not a specific project should be undertaken. It is also used to ascertain which project should be selected out of many projects.

Cost benefit analysis is an analytical tool in decision making which enables a systematic comparison to be made between the estimated cost of undertaking a project & the estimated value & benefits which may arise from the operation of such project. Cost benefit analysis can be used both for private & public projects. For private projects, CBA examines profitability or projects ability to earn net profit to the investors. For public projects, CBA examines social profitability or projects contribution to national economy by achieving goals of economic growth, social development, income redistribution, poverty reduction, employment generation etc.

2. Capital budgeting decision Capital budgeting techniques are used to make capital investment decisions especially for investment in fixed assets. A wide variety of techniques have been suggested to judge the worth wholeness of investment project. Generally, non-discounted & discounted cash flow techniques are applied for the appraisal of project.

Non-discounted a. Ranking by inspection: selecting by ranking project on basis of time, returns and investment b. Payback period: It measures the period of time required for the cost of a project to be recovered from the earnings of the project. c. Accounting Rate of Return Method:This method is considered better than pay-back period method because it considers earnings of the project during its full economic life. This method is also known as Return On Investment (ROI). Discounted a. Internal rate of return(IRR): It is discounted cash flow techniques. The trial & error method is used to find the discount rate which equates the PV of cash outflows & cash inflows to zero. IRR is the rate of return where either NPV is zero or total PV(TPV) is equal to NCO. If IRR is greater than the required rate of return, the project is acceptable. b. Net present value (NPV): The difference of present value of cash inflow & PV of cash outflow is the net present value. If the PV of the total benefits is higher than the PV of the total costs, the project is acceptable. The NPV must be positive. c. Profitability index (PI): Profitability Index is the ratio of present value of expected future cash inflows and Initial cash outflows or cash outlay. It is also used for ranking the projects in order of their profitability. It is also helpful in selecting projects in a situation of capital rationing.

3. Financial analysis of development project A development project is a public project. It is generally sponsored by the government. The funding of a development project in most cases is through foreign aid. The financial analysis of a development project is concerned with its financial sustainability. Under the financial analysis, the following factors are included:

a. Capital requirements: The funding requirements of the project are assessed as to their adequacy. The need & requirement of financial resources should be determined. b. Sources of funds: The reliability of the sources of funds to finance the development project is assessed. d. Projected cash flow: The projected cash flow is examined to assess the projects capacity to meet financial obligation. e. Accounting & reporting system: The adequacy & reporting system is assessed. The capacity to claim reimbursement on time is also assessed. f. Profitability: Revenue & expenditure forecasts are examined to access the projects profitability.

Analysis of financial statement

You might also like

- Esbm 3Document29 pagesEsbm 3Devendra ChaudharyNo ratings yet

- PM - Unit 4Document12 pagesPM - Unit 4DibyeshNo ratings yet

- Project Appraisal MethodsDocument15 pagesProject Appraisal MethodsAndrew GomezNo ratings yet

- Project Selection and AppraisalDocument25 pagesProject Selection and AppraisalPooja KumariNo ratings yet

- Part BDocument26 pagesPart BpankajNo ratings yet

- Project AppraisalDocument3 pagesProject AppraisalnailwalnamitaNo ratings yet

- Capitalbudgeting 1227282768304644 8Document27 pagesCapitalbudgeting 1227282768304644 8Sumi LatheefNo ratings yet

- Ms 52Document17 pagesMs 52Rishi BawejaNo ratings yet

- Sourav Sasmal ProjectDocument10 pagesSourav Sasmal ProjectSourav SasmalNo ratings yet

- SIFD 1st UnitDocument6 pagesSIFD 1st UnitRaaji BujjiNo ratings yet

- Project Formulation and Appraisal MethodsDocument11 pagesProject Formulation and Appraisal MethodsnadiaNo ratings yet

- Project AppraisalDocument19 pagesProject AppraisalSagar Parab100% (2)

- Unit 4 4.3 Investment Decisions Profile of The ProjectDocument19 pagesUnit 4 4.3 Investment Decisions Profile of The ProjectAntony antonyNo ratings yet

- Development Planning and Project Anlysis LLDocument18 pagesDevelopment Planning and Project Anlysis LLTeddy DerNo ratings yet

- Ba05 Group 4 - BSMT 1B PDFDocument31 pagesBa05 Group 4 - BSMT 1B PDFMark David100% (1)

- IGNOU MBA Project ManagemntDocument27 pagesIGNOU MBA Project ManagemntAmit SharmaNo ratings yet

- Capital Budgeting Decision Is An Important, Crucial and Critical Business Decision Due ToDocument7 pagesCapital Budgeting Decision Is An Important, Crucial and Critical Business Decision Due ToGaganNo ratings yet

- Module 2Document7 pagesModule 2Harsh PatelNo ratings yet

- Budget EstimateDocument5 pagesBudget EstimateJoraine RobinsonNo ratings yet

- Project Appraisal & New Venture AnalysisDocument39 pagesProject Appraisal & New Venture Analysisstudyquora.inNo ratings yet

- Capital Budgeting Guide for Project SelectionDocument7 pagesCapital Budgeting Guide for Project SelectionVic CinoNo ratings yet

- Project ReportDocument3 pagesProject Reportrajwindersangwan1No ratings yet

- Key Steps in Project AppraisalDocument4 pagesKey Steps in Project Appraisaljaydeep5008No ratings yet

- Chapter 3 Project AppraisalDocument23 pagesChapter 3 Project Appraisaljonathan josiahNo ratings yet

- Capital Budgeting Methods ExplainedDocument27 pagesCapital Budgeting Methods Explaineddurgesh dhumalNo ratings yet

- 4 Project FormulationDocument8 pages4 Project FormulationFahadNo ratings yet

- Financial Justification of ProjectsDocument5 pagesFinancial Justification of ProjectsDilippndtNo ratings yet

- UU-Project Chapter 3Document74 pagesUU-Project Chapter 3Kiya Tesfaye100% (1)

- Assignment - Capital BudgetingDocument9 pagesAssignment - Capital BudgetingSahid KarimbanakkalNo ratings yet

- MAS 10 Capital BudgetingDocument9 pagesMAS 10 Capital BudgetingZEEKIRA100% (1)

- Epm PresentationDocument12 pagesEpm PresentationVinay RawatNo ratings yet

- Project FormulationDocument9 pagesProject FormulationSHIVPRATAP SINGH TOMARNo ratings yet

- Project Selection (CH 4) : Dr. James J. Jiang University of Central FloridaDocument21 pagesProject Selection (CH 4) : Dr. James J. Jiang University of Central FloridaRadhakrishnan RbNo ratings yet

- Unit 2-Feasibility & Financial AppraisalDocument24 pagesUnit 2-Feasibility & Financial Appraisalkhanfaiz4144No ratings yet

- Product ManagementDocument12 pagesProduct Management39SEAShashi KhatriNo ratings yet

- PM Assignment 1 SolvedDocument7 pagesPM Assignment 1 SolvedRahul GoswamiNo ratings yet

- Capital Budgeting Notes (MBA FA - 2023)Document10 pagesCapital Budgeting Notes (MBA FA - 2023)kavyaNo ratings yet

- VCE Summer Internship Project Finance ModellingDocument9 pagesVCE Summer Internship Project Finance ModellingvedantNo ratings yet

- Project Feasibility MethodsDocument6 pagesProject Feasibility MethodsLuo ZhongNo ratings yet

- Project MGT Mod 3Document16 pagesProject MGT Mod 3rahulking219No ratings yet

- NPV vs IRR Debate in Capital Budgeting DecisionsDocument11 pagesNPV vs IRR Debate in Capital Budgeting Decisionsglobalaims examsNo ratings yet

- Project Selection Guide: Key Factors, Methods & Best PracticesDocument6 pagesProject Selection Guide: Key Factors, Methods & Best Practicesvishal kalyaniNo ratings yet

- M4 - M2 - Capital Budgeting and Risk AnalysisDocument39 pagesM4 - M2 - Capital Budgeting and Risk Analysisarvind sharmaNo ratings yet

- Module 2 - Analysis and Techniques of Capital BudgetingDocument42 pagesModule 2 - Analysis and Techniques of Capital Budgetinghats300972No ratings yet

- Types of Feasibility StudyDocument9 pagesTypes of Feasibility StudyBikash Ranjan SatapathyNo ratings yet

- 22 Capital Rationing and Criteria For Investment AnalysisDocument10 pages22 Capital Rationing and Criteria For Investment AnalysisManishKumarRoasanNo ratings yet

- Chapter 4Document34 pagesChapter 4abbasamir2998100% (1)

- LESSON 2 and 3 Project Analysis and AppraissalDocument32 pagesLESSON 2 and 3 Project Analysis and Appraissalwambualucas74No ratings yet

- Capital Budgeting Process 1Document41 pagesCapital Budgeting Process 1Manjunatha Swamy VNo ratings yet

- Kathmandu University project evaluation summaryDocument6 pagesKathmandu University project evaluation summarySijan BhandariNo ratings yet

- Chapter-I Introduction To Project Budget: Capital Budgeting TechniquesDocument3 pagesChapter-I Introduction To Project Budget: Capital Budgeting TechniquesvishanthNo ratings yet

- Capital Budgeting Data CollectionDocument20 pagesCapital Budgeting Data CollectionalanNo ratings yet

- HUMA APM ASiGNMENTDocument6 pagesHUMA APM ASiGNMENThu mirzaNo ratings yet

- Capital BudgetingDocument64 pagesCapital BudgetingNiaz AhmedNo ratings yet

- Unit II - EntrepreneurshipDocument58 pagesUnit II - EntrepreneurshipchitrarustogiNo ratings yet

- Fin650 Lectures 1-2Document64 pagesFin650 Lectures 1-2Arif H JewelNo ratings yet

- Capital BudgetingDocument36 pagesCapital BudgetingShweta SaxenaNo ratings yet

- Finance, Assignment Investment - Appraisal - Decision - MakingDocument12 pagesFinance, Assignment Investment - Appraisal - Decision - MakingPritam Kumar NayakNo ratings yet

- An Analysis of Interest Rate Spread in Nepalese Commercial BankDocument12 pagesAn Analysis of Interest Rate Spread in Nepalese Commercial BankUday Sharma33% (9)

- Bank Reconciliation StatementDocument8 pagesBank Reconciliation StatementUday SharmaNo ratings yet

- An Analysis of Interest Rate Spread in Nepalese Commercial BankDocument12 pagesAn Analysis of Interest Rate Spread in Nepalese Commercial BankUday Sharma33% (9)

- Presentation 1Document16 pagesPresentation 1Uday SharmaNo ratings yet

- Battelle Analyzing Solutions For Grand Lake St. Marys: Greater Mercer County Community CalendarDocument12 pagesBattelle Analyzing Solutions For Grand Lake St. Marys: Greater Mercer County Community CalendarmcchronicleNo ratings yet

- Bonds by Alan BrazilDocument86 pagesBonds by Alan BrazilAnuj SachdevNo ratings yet

- Bachelor (Hons) Accounting: Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreDocument26 pagesBachelor (Hons) Accounting: Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreNadiah Atiqah Nor HishamudinNo ratings yet

- Equity Research: Fundamental Analysis For Long Term InvestmentDocument5 pagesEquity Research: Fundamental Analysis For Long Term Investmentharish kumarNo ratings yet

- Business Valuation ExercisesDocument12 pagesBusiness Valuation Exercisesanamul haqueNo ratings yet

- Report On The Observance of Standards and Codes (ROSC) : IndonesiaDocument48 pagesReport On The Observance of Standards and Codes (ROSC) : IndonesiaPriyance NababanNo ratings yet

- Individual Assign - Ibf301 - Ib17b01 - Su23Document3 pagesIndividual Assign - Ibf301 - Ib17b01 - Su23Quỳnh Lê DiễmNo ratings yet

- FedEx UPS Case StudyDocument31 pagesFedEx UPS Case Studysyahiirah.ariffin0% (1)

- NISM All 1 To 12Document107 pagesNISM All 1 To 12Aakhazhya MNo ratings yet

- Chapter 5 NewDocument44 pagesChapter 5 NewMuhammad Khairul Rafiq Bin Md RafieeNo ratings yet

- Six PMs Describe How They Read The News 2016 June 102 PDFDocument24 pagesSix PMs Describe How They Read The News 2016 June 102 PDFsusan_hoover2915No ratings yet

- Chapter Review and Self-Test Problem: 692 Part SevenDocument15 pagesChapter Review and Self-Test Problem: 692 Part SevenRony RahmanNo ratings yet

- Task 2 Citi Bank Market Summary For ClientDocument4 pagesTask 2 Citi Bank Market Summary For ClientNishaal GoundarNo ratings yet

- Summer Internship Report On SharekhanDocument59 pagesSummer Internship Report On SharekhanKanika LohanNo ratings yet

- Guggenheim ComplaintDocument165 pagesGuggenheim ComplaintWho's in my Fund100% (1)

- FNCE 391/891 - Corporate Restructuring: Course IntroductionDocument38 pagesFNCE 391/891 - Corporate Restructuring: Course IntroductionJoseph SmithNo ratings yet

- FM AssignmentDocument12 pagesFM AssignmentNurul Ariffah100% (1)

- Discussion Questions and Problems - 1Document3 pagesDiscussion Questions and Problems - 1qiuNo ratings yet

- Summer Training Project Report On India Bulls TarunDocument44 pagesSummer Training Project Report On India Bulls TarunTRAUN KULSHRESTHA100% (25)

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Stocks and Their Valuation ExerciseDocument42 pagesStocks and Their Valuation ExerciseLee Wong100% (2)

- Working Capital ManualDocument203 pagesWorking Capital ManualDeepika Pandey0% (1)

- Successful Traders Size Their PositionsDocument73 pagesSuccessful Traders Size Their PositionsNguyen Vo100% (3)

- Acc101 Ia Nguyen Thi Thanh Thuy Hs171230 Mkt1715Document6 pagesAcc101 Ia Nguyen Thi Thanh Thuy Hs171230 Mkt1715Nguyen Thi Thanh ThuyNo ratings yet

- Finance ManagementDocument2 pagesFinance ManagementSakib ShaikhNo ratings yet

- Understanding Cash and Cash EquivalentsDocument43 pagesUnderstanding Cash and Cash EquivalentsMarriel Fate CullanoNo ratings yet

- Behavioral Finance at Jpmorgan - ReportDocument2 pagesBehavioral Finance at Jpmorgan - Reportapi-2521386310% (1)

- A, B, C - Specialised Accounting - 2Document15 pagesA, B, C - Specialised Accounting - 2محمود احمدNo ratings yet

- HihiDocument20 pagesHihiCath OquialdaNo ratings yet

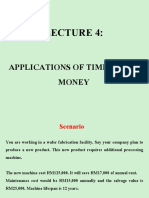

- Lecture 4 2016 - RamzanDocument33 pagesLecture 4 2016 - RamzanQed VioNo ratings yet