Professional Documents

Culture Documents

Small and Medium Enterprises As A Base For Restructuring Serbian Economy

Uploaded by

Neko PlusOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Small and Medium Enterprises As A Base For Restructuring Serbian Economy

Uploaded by

Neko PlusCopyright:

Available Formats

FACTA UNIVERSITATIS Series: Economics and Organization Vol. 2, No 3, 2005, pp.

201 - 208

SMALL AND MEDIUM ENTERPRISES AS A BASE FOR RESTRUCTURING SERBIAN ECONOMY UDC 65.017/.018

Goran Milovanovi

Faculty of Economics, University of Ni, 18000 Ni, Serbia and Montenegro

Abstract. The paper shows different theoretical and business approaches to the company's size as well as the fact that the company's cost efficiency is a more important parameter of the companies' differentiation (with respect to the size and/or success) than the property or the achieved business results. Then the paper presents the nature of financial innovativeness of small and medium enterprises. Finally, our managers are suggested to asses continually their production, technological, information and other advantages as well as shortcomings of small and medium enterprises in order to optimize their size and their contribution to the structural transformation of Serbian economy. Key Words: Small Enterprise, Medium Enterprise, Cost Efficiency, Financial Innovativeness, Economy Restructuring

INTRODUCTION Small and medium enterprises (which have a relatively small range of income per a year, a low value of property and a small number of employees) as the most common form of enterprises in many countries are very significant for the development of their market economies. They are adapted at the request of buyers very quickly. They are the main creators of the new working places and they present a vital core of the market economy. Both the management theory and practice in the world at large deal with large enterprises in a big range (first of all, multinational ones). However, it is evident that, with an increase of the property value and real profit in addition to the expansion of technologies and innovations, as well as with market globalization, the average enterprise size has also increased. That is why in the theory and business practice a criteria spectrum for differencing enterprises, according to size and success, is getting wider.

Received May 20, 2005

202

G. MILOVANOVI

The sector of small and medium enterprises in Serbia shows both advantages and failures. Managers have to animate small and medium enterprises, to invest, to innovate business processes, strategies and offers, and to make them capable of fulfilling their obligations towards workers, suppliers, banks and tax institutions. Managers of small and medium enterprises must be proactive; they should show financial innovativeness. Without market-acceptable financial innovativeness small and medium enterprises can bankrupt and thus become a burden for both economy and the whole society. 1. CONCEPTUAL-BUSINESS TREATMENT OF THE ENTERPRISE SIZE The well-known sayings state that "big fishes swallow small ones" and that "mice ate dinosaurs" thus showing that big and small enterprises have both advantages and failures. From these two quoted maxims, the third is made stating that "It is better to be smaller" thus stressing the advantages of big and small enterprises. Independent of different theoretic approaches to the enterprise size interpretation, there is no debate concerning the fact that the most wanted size of an enterprise is the best one. In this case, the enterprise is regarded as the most efficient regarding its costs, that is, if it has minimal costs per product. A success is not a mark of only small or big enterprises. Experiences of many developed countries show that in some market conditions big enterprises have an advantage and, in different market conditions, small enterprises have the advantage. However, the advantages of big and small enterprises are not constant. The size of enterprises must be well controlled, in order to use its advantages efficiently or/and to adapt the size according to changes at the market. If the size of an enterprise is not controlled well (on the base of it) advantages are transformed into failures, and the enterprise works with losses. In the business world, an expanding enterprise is always in fashion. At the beginning of the 20th century, the Ford Company emphasized advantages of mass production so that, in a given period, it decided to produce only black "T" cars. However, such a strategy of the Ford production was based on a wrong supposition stating that all customers had the same requests and taste. The Ford profit was decreasing due to such a production strategy as well as because of an enormous diversification of accompanying activities (building india-rubber plantations, building the railway, petrol-stations, car services, and others) as operating costs were increasing faster than the growth of its incomes (1, p. 38). It can be concluded that the owners of an extremely large enterprise did not like it, regardless of a possible extreme increase. In the twentieth century some theorists were interested in the size of an enterprise. In 1932, Ronal Coase, Nobel-prize winner, wrote papers about the nature of associations of small producers in different industries because of the scale economy. Then R. Coase concluded that the association of producing units, which had been producing large quantities, was a wrong step, just as with the enterprise increased profits on the base of the enterprising function can become decreasing ones. While, at the beginning of the 20th century, the enterprises were increasing by means of diversification, at the beginning of the 21st century they based their growth on the increase of production range in core business. At the beginning of the 21st century, the mes-

Small and Medium Enterprises as a Base for Restructuring Serbian Economy

203

sage of the business world is the same as it was at the beginning. "Have a controlled growth and become great". The maxim "It is better to be greater" (2) is real, in the sense that bigger enterprises can give higher salaries and better conditions to their workers in order to make progress. The maxim "The smaller is nicer" concerns the people who see a perspective in the autonomy of work and decision-making and small enterprises, first of all, give a chance for it. Managers should pass the test of the cost efficiency before the investors. Enterprises of an optimal size have the highest cost efficiency. In such enterprises costs per product are the lowest. The size of an enterprise is in connection with a character of a product. Producers of airplanes, ships and cars must be large, as they can decrease costs per a product unit together with an increasing production range and they can increase competitiveness. However, small enterprises can also be more efficient as for costs. It is the case with medical services, watch-making production and similar goods and services. In an era of global business the firms that offer a higher value to consumers get a job. Consumers, not competitors, eliminate costs inefficient producers from the market. Market transactions between purchasers and an enterprise determine its size in every industry and on every market segment (3, pp. 40-41). Only managers, who know advantages and failures of small and medium enterprises can manage their size efficiently. The aim of managers, investors, consumers and a community is the optimal (the most efficient as for costs) size of enterprise. 2. HETEROGENEITY OF CRITERIA DETERMINING THE ENTERPRISE'S SIZE The size of enterprise is determined on the basis of many criteria. The most frequently used are: 1) size of assets that is available (shown naturally or as a worth), 2) size of realized results and 3) costs efficiency. Sometimes, the size of an enterprise is determined by a range of factors, which determine its size and the most important among them are market products features and the nature of the business. The size of an enterprise asset is expressed by different criteria. The more important are the number of employees, installed capacities and size of business rooms. The criterion of cost-efficiency is obtained from the relation between the value of engaged property and the realized results. This criterion eliminates the dilemma if a big enterprise is the one that has a big available asset or big realized results. In practice, there are enterprises with big available assets, but with low realized results (there are also opposite cases). The enterprise which engages a property of high value (a big enterprise) and which realizes results (a small enterprise) is cost-inefficient for investors, consumers and community. Therefore, it is, in fact, a small enterprise, taking into account that it is of slight importance for main stakeholders. The market features of products, which an enterprise produces, and the nature of business have dominant effects on the enterprise's size. Big enterprises realize big profits because of their enormous participation in the market and range-economy, they are costefficient and their workers have higher salaries. They are capable to take the most qualified employees from the labor market and to keep them for themselves. Such people give their contribution to the quality of working process and profit height. However, the

204

G. MILOVANOVI

autonomy of employees in operation is small because of formalizing the managing courses. In small enterprises of the same branch the situation is opposite. As for the nature of job, big enterprises, because of the job complexity, employ qualified workers who require higher salaries. Sophisticated capabilities of the employees decrease costs to the enterprise (supervision costs, wasted time, range of damaged material and equipment and the like). Opposite to that, small enterprises often cannot pay qualified experts and that why they face increasing lost sale costs. According to the Federal Accounting Law small enterprises should fulfill two of the following criteria: 1) average number of workers, on the base of working hours, should be up to 50; 2) annual income should be lower than 8.000 average gross salaries per a month of the employed workers in FRY; 3) average value of assets (at the beginning and at the end of business year) should be lower than 6.000 average gross salaries of people who were employed in FRY. However, although formally, our Federal Accounting Law followed the EU Standards in the sense of taking over the financial criterions for classification of enterprises according to their size. However, if we compare them with the standards of the countries which are the members of OECD, we see that our big firms are "small business" and, as a rule, they realize an income under five millions of dollars per a year. Similar criteria are used to define small and medium enterprises in other European countries. Czechoslovakia is the most interesting. It uses standards of the European Commission (which are recommended by the European Investment Bank and the European Investment Fund) to define small and medium enterprises. The criteria which small and medium enterprises in Czechoslovakia must fulfill are the following: 1) number of employed people, 2) return, 3) sum of accountant balance (balance of accounts), 4) degree of certainty, 5) and degree of independence. The property of big enterprises in a small or medium enterprise must not be higher than 25%. 3. FINANCIAL INNOVATIVENESS OF SMALL AND MEDIUM ENTERPRISES Financial innovativeness is a process in which a manager operates on some new concepts of a financial problem to build his own financial capacities and to achieve competitive advantages, first of all, at the financial market (7, pp. 50-54). Financial innovativeness is in a strong connection with financial creativity that implies a free, imaginative and non-standard opinion about alternative financial sources and placement of resources. The risk of financial management with an enterprise is connected with control of possibility or a chance to be exposed for a monetary loss. Financial innovativeness of management lowers the risk of financial management with the enterprise. An innovative approach in the transition conditions is, for example, that small and medium enterprises, to the extent of their rapid growth, should support, slightly, the credit sources; besides, they should get into alliances better prepared than they are, in fact, now. This approach increases the market value of small and medium enterprises and it also increases the probability of finding funds for development by share emission. A financial innovation in the transition conditions could be also an association of small and medium enterprises to make a collective approach to the shares market. It would make the development of these enterprises easier and to allocate the risk to more

Small and Medium Enterprises as a Base for Restructuring Serbian Economy

205

owners. The solving of financial problems in the range of small and medium enterprises should take into account that there is no entrepreneurship without innovations and creativity. The steps to be taken are the following: financial problems should be defined, financial assumptions developed, financial information collected, data analyzed, brainstorming and decision-making concerning g the solution completed and, finally, the actions undertaken in order to solve some financial problems of the enterprise. The probability of financial problem solution depends on the manager's abilities to invent innovative financial products at the some time, to use the available financial resources efficiently and to adapt themselves to surrounding changes faster than the competitors. Jack Welch says that, if the surrounding changes happen faster than in the enterprise, then its end is very near (8, p. 26). Innovativeness in the financial management of small and medium enterprises is limited by: insufficiency of adequate financial infrastructure, insufficiency of suitable means for firm foundation, insufficiency of law solutions, monopoly presence and insufficiency of skills and knowledge in financial management. Porter considers that financial innovations output is measured by: 1) a value of invested managers or risk capital (venture capital) and 2) a number of new public actions emissions (7, p. 53). In any case, innovations in financial management are directly in a function of growth and development of small and medium enterprises. However, the research that was financed by the CARE International Yugoslavia (7, p. 51), in which 70 small enterprises were included, showed that none of these enterprises did attract managing capital. Neither did it plan any shares emission in the future, as a result of its growth. It shows that our managers in these firms do not learn and do not innovate enough. Unfortunately, the ambience in which small and medium enterprises operated, in 2004, was not stimulating enough for any innovations. There are numerous reasons for such conditions in this sector. Firstly, besides positive estimations of economic reforms (in the region of international reintegration of the country and support of foreign financial institutions, liberalization of one part of the market, stabilization of the dinar course, inflation decreasing, budget decreasing and so on) from abroad, no deeper structural changes were made in the sector, namely those that would affect the growth of investments, employment and export. Secondly, the import lobby was stronger than the exporting one. This was evident in the relations showing that export is worse than import (external trade deficit, in 2004, was $ 5,7 billion). Thirdly, regardless of the stimulating conditions for purchasing the majority part of the social enterprises, only a small number of them were sold under those favorable conditions. Fourthly, the market behavior of the managers of the state-owned enterprises has not changed essentially; neither has it their relation towards the state. Fifthly, numerous social-state enterprises continued to produce losses and to increase debts, but they were fighting strongly to give salaries to their employees. Sixthly, managers of some social enterprises accepted privatization gladly, as the country accepted their obligations (internal and external ones).

206

G. MILOVANOVI

4. ADVANTAGES AND SHORTCOMINGS OF SMALL AND MEDIUM ENTERPRISES IN SERBIA Small and medium enterprises show a specific kind of enterprising and operating in comparison with "standard" firms. However, the opposite logic that principles, strategy and practice of corporate management apply to small and medium enterprises and that they generate their faster development is not in effect here. The owners of small and medium enterprises are very often their managers too. The creditors always try to get right information about their operating (whether they realize everything via bank account, their plans of development, whether they realize obligations toward state, etc.) in order to affirm their long-term orientation and liquidity. On the other hand, the managers of small and medium enterprises want to sell and collect payment for demands to customers as soon as possible, in order to animate a new business cycle. Practice shows that many small and medium enterprises in Serbia use their bank accounts only to compensate municipal travel expenses, nourishment expenses and similar miniature expenses. Such accounting positions enable accountants to simply compose and present their accounting registers to the Accounting and Payment Institute at the end of a year. The managers of small and medium enterprises present to future investors the Annual Accounting Reports. It happens very often that at the investor's demand the owners of these organizations must deliver evidence of the paid revenues and taxes (income tax, service tax, property tax, excise tax, municipal taxes and so on). According to some research projects, majority of the owners of small and medium enterprises are not experts at accounting and finance and their computer skills and knowledge of computer technology are poor (6). Hardly can they identify the requirements for managers, investments and management information. Accounting evidence and reports of small and medium enterprises very often satisfy requirements of governmental agency only literally. Accounting is not prompt, authentic and realistic. Because of that the accounting registers (sets of balance) are not objective; they do not give a true picture of the real state of their property and dealing results. Managers cannot always base their business decisions on such accounting registers. The most important preferences of small and medium enterprises in Serbia are flexibility, innovation and creativeness. Nevertheless, small and medium enterprises in Serbia are known for little financial strength, lack of managing capabilities, a complicated approach to formal loan resources and to distribution paths, impossibility for developing new technologies and their appliance in practice. Small and medium enterprises in Serbia are known for: Shortage of clearly defined long-term business objectives, The use of profit and redemption as a resource of finances (mostly for new resources recovering), Financing of business activities mostly from their own resources, The use of financial lease as a form of external funds resources, Dependence on suppliers' financing who offer their products on credit and without discount, Very little use of company services for factoring and forfeiting, Preferring to pay in cash, Shortage of financial plans for more than a period of one year, Insufficient use of program for support of enterprising activities,

Small and Medium Enterprises as a Base for Restructuring Serbian Economy

207

Inadequate accomplishment of managers, The use of accounting mostly for inspection of tax obligations, and very rarely for making business decisions, Avoidance of an operative evidence and insufficient use of accounting systems, Rare arrangement of costs on fixed and variable, Fixing products prices and services on the bases of expenses, that is to say, without serious respect of competitors' prices and performances of demand. Small and medium enterprises in Serbia base their own development on their own resources. The admission to long-term bank and other loans has been reduced while only government-conducted programs are still on. Almost one third of bank loans are classified in problematic investments of capital because the enterprises are not capable of refunding them. Very often enterprises do not have profitable projects. The main resources of small and medium enterprises financial problems are a low level of competitive offering, ineffective technology, low productivity of work and incapability to develop and use management skills in an efficient way. The condition for granting bank loans to small and medium enterprises in Serbia means to review their credit capability, purpose, conditions of using and payment of a loan. Loans are intended for a specific restricted assignment and banks confirm the rationality of the loan funds usage. Banks establish an interest rate for every client according to the interest of the National Bank of Serbia, according to its own business politics and business relationship with applicant of a credit. Some Serbian banks give priority to the large firms, because they have bigger profit in credit transaction with them. Bank credits are hardly available to small and medium enterprises; they are followed by more administration and restricted by serious external guarantees. CONCLUSION The experiences of well-developed countries show that the sector of small and medium enterprises is a basic link to the growth and development of their public economy. Disregarding the different criteria for classifying enterprises according to their proportion and accomplishment that could be seen in most popular university textbooks, the assumption that not only large but also small enterprises can be successful. Accordingly, the opinion of some Serbian economists that particularly and exclusively only little enterprises can be successful is wrong. It can be rather claimed that in some market conditions large enterprises do have the potential advantages and in the other market conditions little enterprises have them. However, the approaches to the management of large enterprises cannot be applied to small and medium enterprises at once. The enterprising climate in Serbia is not inclined to small and medium enterprises. Managers concentrate their attention on survival of small and medium enterprises, not on market investigation and implementation of the up-to-date technologies. Moreover, the management shows insufficient financial innovation in the sector of small and medium enterprises in Serbia. This shows, on the top of all, that we can expect the radical transformations to be done in this sector in future.

208

G. MILOVANOVI

REFERENCES

1. Dr Nadica Figar, Downsizing - oblik restrukturiranja preduze}a, Poslovna politika, Beograd, decembar, 2000. 2. Kalleberg, M. van Buren, Is Bigger Better? Explaning The Relationship Between Organization Size and Job Rewards, American Sociological Review, February 1996. 3. D. Guortni, R. Strup, Ekonomija i prosperitet, Institut ekonomskih nauka, Beograd, 1996. 4. Zakon o ra~unovodstvu, Beograd, 2002; Slu`beni list SRJ, br. 46/96 i 60/96. 5. Pasekova M. and Hyblova E. The Financial Management of Small and Medium-Sized Enterprises, Czeck Republic: Tomas Bata Univesity, 2003. 6. Branko Ljuti, Poli R., IT Revizija --most revizije i informacione tehnologije, MBA Press, Beograd, 2002. 7. Milan Vemi, Finansijski rizici i portfolio menadment MSP, Ekonomska politika, novembar, 2003. 8. Thomas Davenport, The Attention Economy, HBS Press, Boston, 2001.

MALA I SREDNJA PREDUZEA KAO OSNOVA ZA RESTRUKTURIRANJE PRIVREDE SRBIJE Goran Milovanovi

U radu se ukazuje na razliit teorijsko-poslovni tretman veliine preduzea kao i na injenicu da je trokovna efikasnost preduzea vaniji parametar za njihovo diferenciranje (prema veliini i/ili uspehu) od veliine imovine i rezultata poslovanja koji ostvaruju. Zatim se prezentira priroda finansijske inovativnosti malih i srednjih preduzea. Konano, naim menaderima se sugerie da stalno ocenjuju proizvodne, tehnoloke, informacione i dr. prednosti i nedostatke malih i srednjih preduzea, kako bi optimizirali njihovu veliinu i njihov doprinos strukturnoj transformaciji srpske privrede. Kljune rei: veliina preduzea, trokovna efikasnost, finansijska inovativnost.

You might also like

- Herbal Sundries Bplan SummaryDocument19 pagesHerbal Sundries Bplan SummaryAbhay KapkotiNo ratings yet

- Confidence IntervalsDocument12 pagesConfidence IntervalsNeko PlusNo ratings yet

- Due - Diligence Checklist - IPO (BOBCAP)Document42 pagesDue - Diligence Checklist - IPO (BOBCAP)vbhammer100% (2)

- Real Property Valuation Methods & TechniquesDocument7 pagesReal Property Valuation Methods & TechniquesLavanya LakshmiNo ratings yet

- Accounting Fundamentals at Bulacan State UniversityDocument129 pagesAccounting Fundamentals at Bulacan State UniversitySarahjane TerradoNo ratings yet

- Financial Valuation Tool For Sustainability Investments - User GuideDocument28 pagesFinancial Valuation Tool For Sustainability Investments - User GuideWilliamNo ratings yet

- Ritzer Weber Rationalization and McDonaldizationDocument19 pagesRitzer Weber Rationalization and McDonaldizationIrina Oana0% (1)

- Ritzer Weber Rationalization and McDonaldizationDocument19 pagesRitzer Weber Rationalization and McDonaldizationIrina Oana0% (1)

- Internationalization and SMEsDocument11 pagesInternationalization and SMEsmohiuddin shojibNo ratings yet

- Basic Financial Accounting and Reporting (Reviewer)Document7 pagesBasic Financial Accounting and Reporting (Reviewer)Keneth Joe CabungcalNo ratings yet

- Industrial Economics and ManagementDocument16 pagesIndustrial Economics and Managementtanu_khangarot67% (3)

- Economies of Scale & Scope: A Comprehensive AnalysisDocument5 pagesEconomies of Scale & Scope: A Comprehensive AnalysisAarti GuptaNo ratings yet

- Chapter 3: Business Formation: Forms of Business (A Short Explanation)Document22 pagesChapter 3: Business Formation: Forms of Business (A Short Explanation)feyeko aberaNo ratings yet

- Industrial Economics Is The Study of FirmsDocument3 pagesIndustrial Economics Is The Study of FirmsRaheel HusainNo ratings yet

- Marketing Knowledge and Strategy For Smes: Can They Live Without It?Document12 pagesMarketing Knowledge and Strategy For Smes: Can They Live Without It?albaricoangelie29No ratings yet

- Types and forms of business organisationsDocument16 pagesTypes and forms of business organisationsAkin MoroNo ratings yet

- Bussiness Chapter 2-1Document13 pagesBussiness Chapter 2-1Bethelhem YetwaleNo ratings yet

- Introduction To Business Environment-pg-1-FinalDocument64 pagesIntroduction To Business Environment-pg-1-FinalAnantha NagNo ratings yet

- Thompson Et Al Week 5 Reading Chapter 3Document30 pagesThompson Et Al Week 5 Reading Chapter 3ghamdi74100% (1)

- Enterprenurship Sumanta SharmaDocument6 pagesEnterprenurship Sumanta SharmaSarita PatidarNo ratings yet

- UGC Approved World University Business TypesDocument8 pagesUGC Approved World University Business TypesMaruf AhmedNo ratings yet

- Chapter 3Document13 pagesChapter 3Elijah IbsaNo ratings yet

- Chapter 3 Entrepreneurship PDFDocument25 pagesChapter 3 Entrepreneurship PDFAfework DessieNo ratings yet

- Benefits of Small FirmsDocument8 pagesBenefits of Small FirmsMichael MwenderaNo ratings yet

- Entreprunership Chapter-2 PDFDocument13 pagesEntreprunership Chapter-2 PDFfitsumNo ratings yet

- Jurnal 7Document18 pagesJurnal 7Yasnia Amira AfraNo ratings yet

- Chapter 3Document10 pagesChapter 3KassahunNo ratings yet

- Enterpreneurship Chapter 3Document27 pagesEnterpreneurship Chapter 3GirmayeNo ratings yet

- Isoquant Curves and Economies of Scale - Managerial EconomicsDocument6 pagesIsoquant Curves and Economies of Scale - Managerial EconomicsMukesh Singh GravitaNo ratings yet

- Paper SME CrisisDocument6 pagesPaper SME CrisisEduardo MundtNo ratings yet

- A_Research_on_Perceptions_of_ManufacturiDocument10 pagesA_Research_on_Perceptions_of_ManufacturiJohn Carlo MendozaNo ratings yet

- Of Bangladesh: Determinants and Remedial Measures: Financial Distress in Small and Medium Enterprises (SME)Document16 pagesOf Bangladesh: Determinants and Remedial Measures: Financial Distress in Small and Medium Enterprises (SME)Yasmine MagdiNo ratings yet

- Transcendent Strategies, A New Vision To Managing The Petroleum BusinessDocument5 pagesTranscendent Strategies, A New Vision To Managing The Petroleum BusinessMarcelo Varejão CasarinNo ratings yet

- Chapter 2Document13 pagesChapter 2Bethelhem YetwaleNo ratings yet

- Assignment 2Document12 pagesAssignment 2Nguyễn Ngọc MaiNo ratings yet

- Unit 1 - Chapter 3 - Size of Business 2023Document11 pagesUnit 1 - Chapter 3 - Size of Business 2023Blanny MacgawNo ratings yet

- Entrepreneurship-CHAPTER THREEDocument10 pagesEntrepreneurship-CHAPTER THREESyerwe Gkjl GdfNo ratings yet

- Sisay Lenegano PeropozaleDocument30 pagesSisay Lenegano PeropozaleBetelhem EjigsemahuNo ratings yet

- Chapter 3 # 4Document41 pagesChapter 3 # 4sami damtewNo ratings yet

- IEM Lab: Economies of ScaleDocument14 pagesIEM Lab: Economies of ScalePrakhar GuptaNo ratings yet

- Chapter 3Document62 pagesChapter 3Muluken AschaleNo ratings yet

- Impact of Accounting Information Systems on Organizational Effectiveness in SMEsDocument9 pagesImpact of Accounting Information Systems on Organizational Effectiveness in SMEsPranit MayekarNo ratings yet

- Multinational Corporations: Good or Bad?Document2 pagesMultinational Corporations: Good or Bad?Mehwish MurtazaNo ratings yet

- Supply Theory-Benefits of Large FirmsDocument3 pagesSupply Theory-Benefits of Large FirmsMensonNo ratings yet

- Monograph On Micro, Small and Medium Enterprises (Msmes) : The Institute of Cost & Works Accountants of IndiaDocument21 pagesMonograph On Micro, Small and Medium Enterprises (Msmes) : The Institute of Cost & Works Accountants of IndiaSsNo ratings yet

- Enter CH 2Document27 pagesEnter CH 2adane ararsoNo ratings yet

- SMMDocument7 pagesSMMSenor84No ratings yet

- Managerial Economics Term PaperDocument6 pagesManagerial Economics Term Paperafdtnybjp100% (1)

- Kinds of Economic Decision / How Economic Analysis Is Useful in Managerial Decision MakingDocument5 pagesKinds of Economic Decision / How Economic Analysis Is Useful in Managerial Decision MakingHITESH BANGERANo ratings yet

- The Role of Small and Mediun Sized Enterprices in The Dutch EconomyDocument24 pagesThe Role of Small and Mediun Sized Enterprices in The Dutch EconomyJonathanNo ratings yet

- My Booklet On ProductionDocument15 pagesMy Booklet On ProductionÇhäpz ÏsmäNo ratings yet

- Tutorial 10 SolutionsDocument2 pagesTutorial 10 Solutionsmerita homasiNo ratings yet

- Week 1 Chapter 1: Strategic Management and Strategic CompetitivenessDocument7 pagesWeek 1 Chapter 1: Strategic Management and Strategic CompetitivenessRosalie Colarte LangbayNo ratings yet

- Competitiveness and Profitability Being Affected by The ConstantlyDocument8 pagesCompetitiveness and Profitability Being Affected by The ConstantlyweipingchongNo ratings yet

- Business Igcse SummaryDocument92 pagesBusiness Igcse SummarymilyconteNo ratings yet

- FInal Project Report IOB 1Document52 pagesFInal Project Report IOB 1Jain NirmalNo ratings yet

- Economies & Diseconomies of Scale ExplainedDocument5 pagesEconomies & Diseconomies of Scale ExplainedsamNo ratings yet

- Week 2 7: Changing Perspective On CompetitivenessDocument23 pagesWeek 2 7: Changing Perspective On Competitivenessjessa mae zerdaNo ratings yet

- Week 2 7: Changing Perspective On CompetitivenessDocument5 pagesWeek 2 7: Changing Perspective On CompetitivenessGum MyNo ratings yet

- Macro EconomicsDocument6 pagesMacro EconomicsCharl CentNo ratings yet

- Challenges of Industrial Production in LDCsDocument13 pagesChallenges of Industrial Production in LDCsCHORE SYLIVESTERNo ratings yet

- 2008 TPJC H2 Economics Prelim Exam AnswersDocument53 pages2008 TPJC H2 Economics Prelim Exam AnswersChristabel TanNo ratings yet

- Emma Research PropasalDocument17 pagesEmma Research Propasalomara reddingtonNo ratings yet

- BRAN Merged MergedDocument301 pagesBRAN Merged MergedDivya VanwariNo ratings yet

- The Positive Impact of VollyballDocument6 pagesThe Positive Impact of VollyballAhmed MidoNo ratings yet

- 04 Partea I Cap 1englDocument6 pages04 Partea I Cap 1englDana Andreea StanNo ratings yet

- SamplingGuide Ch2 WebDocument4 pagesSamplingGuide Ch2 WebNeko PlusNo ratings yet

- Multistage SamplingDocument14 pagesMultistage SamplingNeko PlusNo ratings yet

- Comparitive Efficiency of Sampling Plans (Pages 1-100) PDFDocument100 pagesComparitive Efficiency of Sampling Plans (Pages 1-100) PDFNeko PlusNo ratings yet

- Some Basic Ideas of Sampling PDFDocument24 pagesSome Basic Ideas of Sampling PDFNeko PlusNo ratings yet

- Consumer Behavior in Relation With CultureDocument27 pagesConsumer Behavior in Relation With CultureAdam WockeezNo ratings yet

- DP Ls 701 Organization Theory Summer 2014Document9 pagesDP Ls 701 Organization Theory Summer 2014Neko PlusNo ratings yet

- Chap 04Document29 pagesChap 04Sandhya RawoojeeNo ratings yet

- 00 EMC2013 ImpresumDocument13 pages00 EMC2013 ImpresumNeko PlusNo ratings yet

- Some Basic Ideas of Sampling PDFDocument24 pagesSome Basic Ideas of Sampling PDFNeko PlusNo ratings yet

- Austrian MethodologyDocument18 pagesAustrian MethodologyNeko PlusNo ratings yet

- Prerequisite: LSE - 07 Organization Theory: An Interdisciplinary Approach About This UnitDocument2 pagesPrerequisite: LSE - 07 Organization Theory: An Interdisciplinary Approach About This UnitNeko PlusNo ratings yet

- Kadirov VareyDocument9 pagesKadirov VareyNeko PlusNo ratings yet

- Skeptical ShoppersDocument53 pagesSkeptical ShoppersNeko PlusNo ratings yet

- 10 1 1 195 39Document37 pages10 1 1 195 39Neko PlusNo ratings yet

- Bms ArtikelDocument9 pagesBms ArtikelNeko PlusNo ratings yet

- Ltu DT 0501 SeDocument361 pagesLtu DT 0501 SeNeko PlusNo ratings yet

- Perceptions of Sustainable Marketing Management by Export Companies in SerbiaDocument14 pagesPerceptions of Sustainable Marketing Management by Export Companies in SerbiaNeko PlusNo ratings yet

- Warfare Strategy in The Battle For The MindDocument3 pagesWarfare Strategy in The Battle For The MindNeko PlusNo ratings yet

- Uputstvo Za Pisanje IndustrijaDocument2 pagesUputstvo Za Pisanje IndustrijaNeko PlusNo ratings yet

- An Exploratory Study of Marketing, Logistics, and Ethics in Packaging InnovationDocument22 pagesAn Exploratory Study of Marketing, Logistics, and Ethics in Packaging InnovationNeko PlusNo ratings yet

- 01 17Document36 pages01 17Neko PlusNo ratings yet

- SalacuseDocument20 pagesSalacuseNoor Atikah NoordinNo ratings yet

- DownloadDocument36 pagesDownloadNeko PlusNo ratings yet

- Vidar ScheiDocument20 pagesVidar ScheiNeko PlusNo ratings yet

- 1905918Document37 pages1905918Florescu Marian CristianNo ratings yet

- 10 Principles of Monetary Brand ValuationDocument32 pages10 Principles of Monetary Brand ValuationarchanashengalNo ratings yet

- ACCT505 Quiz #2 SolutionsDocument9 pagesACCT505 Quiz #2 SolutionsMilton MightyNo ratings yet

- FAR510 JUNE 2015 QUESTIONSDocument8 pagesFAR510 JUNE 2015 QUESTIONSazila aliasNo ratings yet

- Financial Management:: Understanding Financial Statements, Taxes, and Cash FlowsDocument102 pagesFinancial Management:: Understanding Financial Statements, Taxes, and Cash FlowsArgem Jay PorioNo ratings yet

- Answer Sheet v-1 24052014Document7 pagesAnswer Sheet v-1 24052014psawant77No ratings yet

- Akuntansi Account ReceivableDocument8 pagesAkuntansi Account Receivablem habiburrahman55No ratings yet

- Chapter Four: Adjusting Entries and The Work SheetDocument102 pagesChapter Four: Adjusting Entries and The Work SheetReijen InciongNo ratings yet

- FNDACT1 - H-04 - Adjusting Process Illustrative ProblemDocument6 pagesFNDACT1 - H-04 - Adjusting Process Illustrative ProblemKing BelicarioNo ratings yet

- Acc 101 Financial Accounting and Reporting 1Document16 pagesAcc 101 Financial Accounting and Reporting 1cybell carandangNo ratings yet

- Understanding Financial Statements /TITLEDocument26 pagesUnderstanding Financial Statements /TITLEMARC BENNETH BERIÑANo ratings yet

- Magnit Sales Growth and Store Expansion 2013-2015Document50 pagesMagnit Sales Growth and Store Expansion 2013-2015Nikolay MalakhovNo ratings yet

- 7110 Y10 SP 2Document20 pages7110 Y10 SP 2mstudy123456No ratings yet

- Form - X: Plot No 116-117 & 65-66, Part-A, Mie, Bahadurgarh, Distt - Jhajjar (Haryana)Document11 pagesForm - X: Plot No 116-117 & 65-66, Part-A, Mie, Bahadurgarh, Distt - Jhajjar (Haryana)Varun MalhotraNo ratings yet

- Global company's profit, sales and expenses over 6 periodsDocument68 pagesGlobal company's profit, sales and expenses over 6 periodsfereNo ratings yet

- Model Maintanacfe Under TMACS Act 1995 PDFDocument13 pagesModel Maintanacfe Under TMACS Act 1995 PDFPunit TiwariNo ratings yet

- S K Construction Trading 2021Document3 pagesS K Construction Trading 2021SPM CONSTECHNo ratings yet

- Fac1502 Exam Pack Exam Pack With AnswersDocument175 pagesFac1502 Exam Pack Exam Pack With AnswersPortia MokoenaNo ratings yet

- Manufacturing Financial CostingDocument15 pagesManufacturing Financial CostingJoeFSabaterNo ratings yet

- Gitman IM Ch08Document17 pagesGitman IM Ch08Ahmad RahhalNo ratings yet

- Amalgamation Accounting MethodsDocument19 pagesAmalgamation Accounting MethodsDipen Adhikari0% (1)

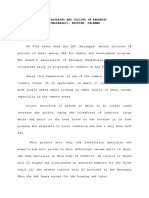

- Hog Fattening and Selling in Barangay Magbabadil, Aborlan, PalawanDocument16 pagesHog Fattening and Selling in Barangay Magbabadil, Aborlan, PalawanShimmeridel EspañolaNo ratings yet

- Current LiabilityDocument21 pagesCurrent LiabilityMuhammad HarisNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument38 pagesFinancial Statement Analysis: K R Subramanyam John J WildMar SihNo ratings yet

- Revision Exercise For FCQ 1Document10 pagesRevision Exercise For FCQ 1Dilfaraz KalawatNo ratings yet

- Project Report On SupertechDocument71 pagesProject Report On SupertechAnkur Shukla75% (4)

- FAR - Accounting For Partnership Liquidation 1Document9 pagesFAR - Accounting For Partnership Liquidation 1MiseñoraNo ratings yet