Professional Documents

Culture Documents

Proj

Uploaded by

Pratik GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proj

Uploaded by

Pratik GuptaCopyright:

Available Formats

A Summer Training Report On HDFC HOME LOAN

HOUSING DEVELOPMENT FINANCE CORPORATION LTD (HDFC) SUBMITTED IN THE PARTIAL FULFILLMENT OF THE REQUIREMENT FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION

UNDER THE GUIDANCE OF MR. RAJA SHARMA (Sales Manager) SUBMITTED TO Mrs. Poonam Swami (HOD Management)

SUBMITTED BY Miss Barkha Sharma (MBA 2nd year)

2009 - 2010 DEPARTMENT OF MANAGEMENT PORNIMA COOLEGE Jaipur(Raj.) INDEX S.No. Content CHAPTER ONE INTRODUCTION 1.0.0 Introduction of Organization 1.1.1 Organization business objective 1.1.2 Organization goals 1.1.3 Organization and management 1.1.4 Vision and mission of the organization 1.1.5 Board of directors 1.1.6 Product of HDFC 1.1.7 Awards and accolades 1.1.8 Structure of HDFC home loan 1.1.9 Introduction of HDFC home loan 1.2 Problems of project study CHAPTER TWO PROJECT PROFILE 2.1 Title of project 2.2 Objective 2.3 Significance of the project study PAGE NO. 3 4 5 5 5 6 6 7 8 11 12 17 18 20 22 23

2.4 Scope of the study 2.5 Research Methodology 2.6 Limitations of study CHAPTER THREE FACT AND FINDING 3.1 Fact and Finding CHAPTER FOUR ANALYSIS AND INTERPRETATION 4.1 Structure of HDFC home loan 4.2 Repayment term 4.3 How HDFC decide the loan amount 4.4 Rate of interest home loan 4.5 Benefit provided by HDFC 4.6 How to apply home loan 4.7 Supporting documentation 4.8 Tax benefit provided the home loan 4.9 Concept EMI and pre EMI 4.10 Comparisition of financial Institution 4.11 Costumer satisfaction survey 4.12 SWOT Analysis CHAPTER FIVE CONLUSION 5.1 Conclusion 5.2 Suggestion Annexures Bibliography

26 33 36 47 48 53 54 55 59 60 61 63 64 67 68 70 81 87 88 89 91 92 103

CHAPTER- ONE INTRODUCTION

INTRODUCTION OF ORGANISATION HDFC Bank one amongst the firsts of the new generation, tech-savvy commercial banks of India, was set up in August 1994 after the Reserve Bank of India allowed setting up of Banks in the private sector. The Bank was promoted by the Housing Development Finance Corporation Limited, a premier housing finance company (set up in 1977) of India. HDFC Bank began operations in 1995 with a simple mission to be a World-class Indian Bank. Currently (2007), HDFC Bank has over 600 branches located in over 300 cities of India, and all branches of the bank are linked on an online real-time basis. The bank offers many innovative products & services to individuals, corporate, trusts, governments, partnerships, financial institutions, mutual funds and insurance companies. The bank also has over 1600 ATMs. In the next few months the number of branches and ATMs should go up substantially. The authorised capital of HDFC Bank is Rs.450 crore (Rs.4.5 billion). The paid-up capital is Rs.311.9 crore (Rs.3.1 billion). Net Profit for the year ended March 31, 2007, is Rs 1,141.5 crore (Rs 11.41 billion) compared to Rs 870.8 crore (Rs 8.7 billion) last year. The HDFC Group holds 22.1% of the bank's equity and about 19.4% of the equity is held by the ADS Depository (in respect of the bank's American Depository Shares (ADS) Issue). Roughly 31.3% of the equity is held by Foreign Institutional Investors (FIIs) and the bank has about 190,000 shareholders.

1.1.1- ORGANISATION BUSINESS OBJECTIVES: The primary objective of HDFC is to enhance residential housing stock in the country through the provision of housing finance in a systematic and professional manner, and to promote home ownership. Another objective is to increase the flow of resources to the housing sector by integrating the housing finance sector with the overall domestic financial markets. 1.1.2 - ORGANISATIONAL GOALS: HDFCs main goals are as follows: Develop close relationship with individual households. Maintain its position as the premier housing finance institution in the country. Transform ideas into viable and creative solutions.

Provide consistently high returns to shareholders. To grow through diversification by leveraging off the existing client base. 1.1.3 - ORGANISATION AND MANAGEMENT: HDFC is a professionally managed organization with a board of directors consisting of eminent persons who represent various including finance, taxation, construction and urban policy and development. The board primarily focuses on strategy formulation, policy and control, designed to deliver increasing value to shareholders. 1.1.4 - VISION AND MISSION OF THEORGANIZATION: 1. Vision of HDFC To enhance residential housing stock in the country through the provision of housing in a systematic and professional manner, and to promote home ownership. To increase the flow of resources to the housing sector by integrating the housing finance sector with the overall domestic financial markets. 2. Mission of HDFC Develop close relationships with individual households. Maintain its position as the premier housing finance institution in the country. Transform ideas into viable and creative solutions. Provide consistently high returns to shareholders. To grow through diversification by leveraging off the existing client Base.

1.1.5 - BOARD OF DIRECTORS: Mr. DS Parekh - Chairman Mr. Keshub Mahindra - Vice Chairman Mr. Renu S. Karand - Executive Director Mr. KM Mistry - Managing Director Mr. Shirish B Patel Mr. BS Mehta Mr. DM Sukthankar Mr. DN Gosh Dr. SA Dave

Mr. S Venkitaramanan Mr. Ram S Tarneja Mr. NM Munjee Mr. DM Satwalekar 1.1.6 - PRODUCTS OF HDFC: Home loan Home improvement loan Home extension loan Short term bridging loan Land purchase loan Loans to professional for Non-Residential Premises loan Home equity loans

1.1.7 - AWARDS AND ACCOLADES: Mr. Deepak Parekh, chairman, HDFC Ltd. Conferred with the prestigious Padma Bhushan award.

HDFC receives award for The best presented Accounts of the Institute of Chartered Accountants of India for 2004-05. HDFC Ranked as Indias Third Best Managed Company by FinanceAsia-2005. Mr. Deepak Parekh awarded the Hall of Fame award by outlook money magazine.

HDFC receives the Dream Home award for the best Housing Finance Company for 2004 from outlook Money magazine. Awards galore by HDFC at the 44th ABCI Awards. 5th Best Company to work for India, ranked by Business Today in November 2004. Economic Times Corporate Citizen of the year Award, November 2004. Rated by Deutsche Bank as one of the top 5 banks/Financial Institutions in Asia in October 2004.

Ranked among the Top 20 companies to deliver healthiest returns to shareholders, Outlook Money Magazine-September 2004. 1st Prize at the New York Festivals Gold Midas Awards for Environmental Communication Ad in August 2004.

Features in the Forbes list of Top 20 Leading Indian Companies in May 2004. One of the Top 10 Investor Friendly Companies, ranked by Business Today in March 2004. HDFC Ranked No.3 Indias Best Managed Companies by Finance Asia. Clean Sweep by HDFC at the 43rd ABCI Awards.

National Award for Excellence in Corporate Governance by the Institute of Company Secretaries of India. 2nd Best Company for Corporate Governance in India by The Asset magazine. The Economic Times Lifetime Achievement Award 2003. (For Mr. Deepak Parekh Chairman, HDFC Ltd.) One of the top Ten - Most Admired Companies in India 2003 by Business Barons. One of the Top Ten Most Admired CEOs in India 2003 by Business Barons (For Mr. Deepak Parekh). Indias Second Best Managed Company 2003 by Finance Asia. Indias Biggest Wealth Creator in the banking and financial services by the fourth Business Today Stern Steward Survey. One of the Top Ten Most Respected Companies in India by Business world. Best Managed Financial Institution in Indias by fox Pitt Survey.

1.1.8 - Structure of HDFC Home Loan: HDFC Home Loans has a well developed formal structure. The structure is as follows: THE CHIRMAN MANGING DIRECTOR DIRECTOR EXECUTIVE BRANCH MANAGER SENIOR MANAGER MANAGER ASSISTANT OFFICERS TRAINEES BRANCH MANAGER SENIOR MANAGER MANAGER ASSISTANT OFFICERS TRAINEES

BRANCH MANAGER SENIOR MANAGER

ASSISTANT OFFICERS TRAINEES BRANCH MANAGER SENIOR MANAGER MANAGER ASSISTANT OFFICERS TRAINEES

1.1.9 - INTRODUCTION OF HDFC LOAN: S helter is a basic human need. Secured ownership of a house can raise the welfare of the household. But housing development has been slow in India because housing is a large investment, it required long term finance. Housing is the basic human needs of the society. It is closely linked with process of overall socio-economic development of a country. India, being a highly populated country, there is a great need and scopes for the development of housing sector, unfortunately for some reason or the other, the housing sector in India has remained underdeveloped in the past, however, it is hoped that there would be improvement in the near future. Housing Finance is a growing industry. There is a substantial gap between demand and supply and is persisting for a very long period. According to an estimate by the National Building Organization, the cumulative shortage of total dwelling houses in the country by the end of 1991 was 31 millions. This future estimates organization that the demand of houses will be around 4.5 million units, leaving a gap of one million housing units annually. Hence, based upon this estimate the cumulative shortage of housing may reach to 41 million units by the end of the century. Presently, funds require per house dwelling shelter are so high that the individual savings is not adequate to meet the expenditure of house building. As a result, there is great demand for external housing finance. Housing was given due priority in 1998 When a National policy was announced. The policy reflected the thrust that housing was not merely consumption expenditure but also a productive investment which would provide economic activity in the country beside this; the policy also envisaged that an impetus given to housing would stimulate economic development through certain of substantial employment opportunity. Consequently, the institute mechanism for housing was strengthened by the establishment

of National Housing Bank (NHB) by the reserve Bank of India. The setting of the National Housing Bank marked the new era in housing finance as a new fund-based financial service in the country. A large number of financial institutions / companies in the public, private and the joint sector entered in this field. For example, Life Insurance Corporation of India and General Insurance Corporation came with various schemes for financing the housing unit. In 1970, Housing And Urban Development Corporation (HUDCO), a wholly government owner enterprise, was setup with the objective of housing and urban development as well as infrastructure development. After that in 1977, another corporation named Housing Development Finance Corporation (HDFC) was set up in Pvt. Sector. To strengthen the finance in this sector, an apex level institution named National Housing Bank was set up in 1998 under the separate Housing Bank Act 1987. Various nationalized and other banks also set up housing finance companies as their subsidiaries such as Canfin Homes Ltd., GIC Grih Vitta Ltd., LIC Housing Finance Ltd., PNB housing Finance Ltd., SBI Home Finance Ltd., etc. today there are more than 350 companies operating in the organized sector, out of which the National Housing Bank for refinance recognizes 22.

The housing finance industry can be broadly classified into two categories namely formal (organized) and informal (unorganized) sector. The formal sector, which companies of various public and private sector institution, normally finances around 50 percent of the total funds required in the housing industry. On the other hand, informal sector comprising of household savings, disposal of existing property, borrowing from friends, relatives and money lenders, etc., meets around 50 percent funds requirement of this industry. The housing sector plays an important role in the economic development of the country. Every rupee invested in housing adds 78 paise to the GDP. Over 269 industries are directly or indirectly dependent on the housing sector. There is an estimated shortage of 20 million housing units in the country with an estimated investment requirement of over Rs 1500 billion. In this context it is important to note that that the organized housing finance industry barely accounts for 30% of the home loans disbursed in the country.

HOME LOANS IN INDIA - PRESENT SCENARIO In the last few years, housing loan scenario in India has changed drastically. It has taken a front seat and people are looking forward to owning their own houses. It is no more a dream that required lifetime saving and a difficult decision to make. Today the new home purchase loan is much easily available and is much cheaper than what was available earlier. Banks are now everywhere and the schemes are implemented even in villages and smaller towns. The housing loans are popular there too, however, the activity of building flats is little slow. It would not be wrong to say that there has been a boom in the home loan market and with this boom; there is also a boom in the number of home loan mortgage brokers in India. The main reason for this boom in home loan market is the change in government policies. It is our governments motivation that the home loan interest rates in India have fallen considerably. Lot many banks are offering home loans and this is available at low EMIs (Equated monthly Instalments). High EMIs are now a thing of past. Today lending rate is in the range of 7.5 to 15 %. Again, there are different types of home loans available today. The interest rate available is also of two different types. One is the fixed rate loan and the other is the floating rate loan. In the fixed rate loan, whatever interest is fixed on the start of loan is carried on for the complete period. However, in the other one, the interest rate is not fixed and as the interest rate goes up or low the effect is directly transferred to

the person who is taking the loan. In the last few years the floating interest rate has been a favourite among most of the people taking home loans. There is also a trend to opt for home construction loan. This loan is available to those who want to design their homes according to their requirement and taste. In other words, this loan is meant for those who themselves want to construct their new home. As shared earlier, taking a loan is not a difficult task. However, before taking a loan, one must realize that the relationship with the bank will be for a longer period usually 15 to 20 years so one must ensure faith and integrity in bank. Apart from low rate of interest, the bank should also provide some value added services. The other thing is to look into is the property that is to be brought. Making sure that the builder has all sanctions and facility to build a good building is very important.

HOUSING DEVELOPMENT FINANCE CORPORATION (HDFC) HDFC offer the loan for buying, constructing, extending, or renovation and home equity loan. HDFC also finance for land purchase from approval agencies to enable you to construct a home of your choice. Your can buy a self- contained flat in an existing or proposed co-operative society in an apartment, owners association or even an independent single family or multifamily bungalow or house. HDFC also provide the farcicality of refinance of your house, if you have already start the construction.

1.2 - INTRODUCTOIN TO PROBLEMS OF PROJECT STUDIED: Determine the major causes of cost under runs and overruns of ADB projects assess the contribution of each major factor to cost variations, particularly non-robust project cost estimations at loan appraisal 3recommend ways to improve the reliability of cost estimates, and to streamline guidelines to address and share the risk of unpredictable changes in project costs To improve estimation of processes for project costs, it is essential that adequate resources, in both time and money, be allocated to conduct the required analyses. Better project design and cost estimates can be expected to lead to smoother implementation, fewer loan cancellations, and more positive results from loan portfolios. Improved estimates of project costs is possible with (i) more rigorous consideration of inflation and depreciation factors in the estimates; (ii) more thorough consideration of sectoral and country experiences with cost variations; (iii) estimating and verifying the real commitment to training and institutional development components; and (iv) more realistic estimation (ireless underestimation) of civil works components of projects, as well as operation and maintenance components. Better estimates may, paradoxically, lead to more projects with cost overruns. This may require a simpler and quicker process for preparation of supplementary loans, and a more sympathetic ADB attitude toward their approval. Paying more attention to project administration will reduce cost under runs and overruns. Projects mired in implementation problems should be reviewed early, with a view to possible cancellation of part of the loan. The interests of executing agencies to avoid such cancellations should be weighed against the borrowers' interests in reducing the debt burden. Savings can then be used for purposes that yield a return, rather than being tied up non-productively. Savings in contingencies could be reduced by providing an option to the government/executing agency not to borrow for contingencies (in some projects, the government has exercised such an option).

This option should be given only when the borrower has demonstrated its capacity and commitment to finance contingencies when they arise. Periodic updating of cost estimates will help in timely assessment of loan savings. Consistent with ADB's new thrust toward results-based management, standard operating loan administration procedures should require the executing agencies to annually update project cost estimates, which ADB would review thoroughly. This would probably require dedicated resources of qualified ADB staff and consultants. No single entity may own more than 10% of the units in a project. "Entity" includes an individual partnership, corporation, limited liability company, limited liability partnership, joint venture, investor group or other natural or legal person qualified to hold an interest in real property. The 10% restriction does not apply when the ownership of less than three units would disqualify an otherwise eligible project. HUD recognized that the 10% cap on the number of units that may secure FHA insured mortgages in a given project can place a small regime at a disadvantage, since only a few units will invoke the limit. Accordingly, a twotiered system was established. For condominium projects having more than 30 units, no more than 10% of the units may have FHA insured loans at any given time. Condominium projects consisting of 30 units or less can have up to 20% of the units encumbered by FHA insured mortgages under the spot loan rule. Individual units in the project must be owned in fee simple or be an eligible leasehold interest. The project's legal documents must provide for undivided ownership of common areas by unit owners. By virtue of this ownership, unit owners must have the right to use all facilities and unrestricted common elements. Control of the common areas of the project must have been turned over to the unit owners association for at least one year. The condominium project must be complete. There should be no ongoing or anticipated addition of any units, common elements, and/or facilities. At least 51% of the units in the project must be owner-occupied. At least 90% of the units in the project must have been sold. HDFC finances up to a maximum of 85% of the cost of the property inclusive of agreement value, stamp duty and registration charges. HDFC's Home Improvement Loan facilitates internal and external repairs and other structural improvements. HDFC finances up to 85% of the cost of renovation (100% for existing customers). For Land Purchase Loan, HDFC finances up to 85% of the cost of the land. The repayment options are flexible and customized to suit the individual needs of the customers. While repaying the loan amount customers can choose from Fixed Rate of Interest or Floating Interest Rate.

CHAPTER-TWO PROJECT PROFILE

PROJECT TITLE

HDFC HOME LOAN

HOUSING DEVELOPMENT FINANCE CORPORATION LTD (HDFC)

2.2- OBJECTIVES OF PROJECT: The objectives involved with this project is to help the potential customer to realize his/her long cherished dream of owning a home through loans offered by HDFC by making it a hassle free, customer friendly and a transparent product

to provide some unbeatable benefits to its customer through a comparative analysis of such product offered by other companies And by incorporating all the feasible salient features which can go along with product keeping in mind the ethics and wellness of huge customer base, various segments already linked to HDFCs network and the company policies.

2.3 - SIGNIFICANCE OF THE PROJECT: BENEFIT FOR THE CUSTOMER: With an HDFC Home Loan, you can bring to live the house of your dreams. You could built a selfcontained flat in an existing or proposed co- operative society, in an apartment owners association or even an independent single- family or multi-family bungalow or row house as well as a house that you like anywhere in India HDFC Home Loans are easy to arrange and can be customized according to your needs and repayment capability. 1. Set up repayment facility: The objective of SURF is to provide the customer with a repayment schedule, which is linked to his expected growth in income. It also helps a customer get a larger amount of loan as compared to the loan under the normal housing loan. The customer can avail of a higher amount of loan and pay lower EMIs in the initial years. Subsequently, the repayment is accelerated proportionately with the assumed increase in his income. The EMIs will be increased in stages 2. Balloon payment plan: Balloon Payment is an enhancement tool, which helps in increasing the loan eligibility of the customer without increasing the EMI by assigning securities like National Savings Certificate (NSC), LIC policies etc to HDFC. The present value of the maturity amount of assigned securities is combined with the loan amount to arrive at the enhanced loan eligibility. Under this facility, the EMI is calculated on the net loan amount (i.e. total loan less the present value of the maturity value of the securities). 3. Flexible installment plan: This product offers a customized solution to suit the needs of customers whose repayment capacity is likely to alter during the term of the loan. The loan is structured in such a way that the EMI is higher during the initial years and subsequently decreases in the latter part proportionate to the reduced income of the customer. 4. Variable loan scheme: Customer has a choice to pay some part of loan under fixed rate option and rest of adjustable rate scheme.HDFC also provide the facility to increase the EMI amount to accelerate the repayment of the loan. 5. Land Purchase Loan:

Be it land for a dream house, or just an investment for the future, HDFC Land Purchase Loan is a convenient loan facility to purchase land. HDFC finances up to 70% of the cost of the land (Conditions Apply). Repayment of the loan can be done over a maximum period of 10 years. 6. Home Improvement Loan: HIL facilitates internal and external repairs and other structural improvements like painting, waterproofing, plumbing and electric works, tiling and flooring, grills and aluminium windows. HDFC finances up to 85% of the cost of renovation (100% for existing customers.

Ensure that all veterans are given an equal opportunity to buy homes with Home loan assistance, without regard to their race, colour, religion, sex, handicap, familial status or national origin. No down payment (unless required by the lender, the purchase price is more than the reasonable value of the property as determined by VA, or the loan is made with graduated payment features); A negotiable fixed interest rate competitive with conventional mortgage interest rates; The buyer is informed of the estimated reasonable value of the property; Limitations on closing costs; An assumable mortgage. However, for loans closed on or after March 1, 1988, the assumption must be approved in advance by the lender or VA. Generally, this involves a review of the creditworthiness of the purchaser (ability and willingness to make the mortgage payments). Be sure to see the section entitled "Loan Repayment Terms"; Long amortization (repayment) terms: Right to prepay without penalty (lenders may require that any partial prepayments be in the amount of at least 1 monthly instalment of principal or 4200, whichever is less); For houses inspected by VA during construction, a warranty from the builder and VA assistance in trying to obtain the builder's cooperation in correcting any justified construction complaint. Forbearance (leniency) extended to worthy VA homeowners experiencing temporary financial difficulty

2.4 - SCOPE OF THE PROJECT: These are following many types of home loan in the scope of project: A person seeking investments for house or a property opts for Home Loans for a variety of purposes ranging from construction to renovation. The Housing Finance Companies (HFCs) now offer individuals with various alternatives to choose from while buying a home loan. And the availability of Home Loans offered is as varied as their requirements. 1. Home Purchase Loans: This is the basic home loan for the purchase of a new home. 2, Home Construction Loans: This loan is available for the construction of a new home on a said property. The documents that are required in such a case are slightly different from the ones you submit for a normal Housing Loan. If you have purchased this plot within a period of one year before you started construction of your house, most HFCs will include the land cost as a component, to value the total cost of the property. In cases where the period from the date of purchase of land to the date of application has exceeded a year, the land cost will not be included in the total cost of property while calculating eligibility. 3. Home Improvement Loans: These loans are given for implementing repair works and renovations in a home that has already been purchased, for external works like structural repairs, waterproofing or internal work like tiling and flooring, plumbing, electrical work, painting, etc. One can avail of such a loan facility of a home improvement loan, after obtaining the requisite approvals from the relevant building authority. 4. Home Extension Loans: An extension loan is one which helps you to meet the expenses of any alteration to the existing building like extension/ modification of an existing home; for example addition of an extra room etc. One can avail

of such a loan facility of a home extension loan, after obtaining the requisite approvals from the relevant municipal corporation. 5. Home Conversion Loans: This is available for those who have financed the present home with a home loan and wish to purchase and move to another home for which some extra funds are required. Through a home conversion loan, the existing loan is transferred to the new home including the extra amount required, eliminating the need for pre-payment of the previous loan. 6. Land Purchase Loans: This loan is available for purchase of land for both home construction or investment purposes. 7. Stamp Duty Loans: This loan is sanctioned to pay the stamp duty amount that needs to be paid on the purchase of property. 8. Bridge Loans: Bridge Loans are designed for people who wish to sell the existing home and purchase another. The bridge loan helps finance the new home, until a buyer is found for the old home. 9. Balance Transfer Loans: Balance Transfer is the transfer of the balance of an existing home loan that you availed at a higher rate of interest (ROI) to either the same HFC or another HFC at the current ROI a lower rate of interest. 10. Refinance Loans: Refinance loans are taken in case when a loan for your house from a HFI at a particular ROI you have taken drops over the years and you stand to lose. In such cases you may opt to swap your loan. This could be done from either the same HFI or another HFI at the current rates of interest, which is lower. 11. Loans to NRIs: This is tailored for the requirements of Non-Resident Indians who wish to build or buy a home or property in India. The HFCs offer attractive housing finance plans for NRI investors with suitable repayment options. HDFC DECIDES THE LOAN AMOUNT: The repayment capacity as determined by HDFC will help to decide how much we can borrow. Repayment capacity takes into consideration factors such as Income of the customer. Age of the customer Qualification of the customer Number of dependents Spouses income Assets of the customer Liabilities of the customer Stability Continuity of occupation Saving history

And, of course, HDFC main concern is to make sure that you can comfortably repay the amount you borrow.

CAN AN INDIVIDUAL APPLY FOR A LOAN TO REPAY A HOUSING LOAN OF ANOTHER BANK/HOUSING FINANCE COMPANY: Yes, an individual can avail of HDFC home loan to repay a loan of his employer or another bank/housing finance company. APPLICANT AND CO-APPLICANT TO THE LOAN: Home Loans can be applied for either individually or jointly. Proposed owners of the property will have to be co-applicants. However, the Co-applicants need not be co- owners.

RATE OF INTEREST THEY ARE CHARGING (FLOATED): Salaried person Business man : 11% : 11.25%

RATE OF INTEREST THEY ARE CHARGING (FIXED): HOME LOAN : 13.25%

Retail prime lending rate: 14 % (Revised April, 2007) For Resident Indians, in the fixed rate category, HDFC offers loans at the rate of 13.25%. In the floating/adjustable rate category, loans are given at a rate of 11 -11.25% ADJUSTABLE RATE HOME LOAN: Loan under Adjustable Rate is linked to HDFC's Retail Prime Lending Rate (RPLR). The interest rate on the loan will be revised every three months from the date of first disbursement, if there is a change in RPLR, the interest rate on the loan will change. However, the EMI on the home loan disbursed will not change. If the interest rate increases, the interest component in an EMI will increase and the principal component will reduce resulting in an extension of term of the loan, and vice versa when the interest rate decreases. FEES AND OTHER CHARGES: A processing and administration fees is 0.5% on loan amount is to be payable along with the submission of application form. For the pre-payment, charges are 2% for early redemption on fixed rate home loan scheme. However under the adjustable rate scheme 2% will be charge only in case of commercial refinance. 1. Set up repayment facility: The objective of SURF is to provide the customer with a repayment schedule, which is linked to his expected growth in income. It also helps a customer get a larger amount of loan as compared to the loan under the normal housing loan. The customer can avail of a higher amount of loan and pay lower EMIs in

the initial years. Subsequently, the repayment is accelerated proportionately with the assumed increase in his income. The EMIs will be increased in stages 2. Balloon payment plan: Balloon Payment is an enhancement tool, which helps in increasing the loan eligibility of the customer without increasing the EMI by assigning securities like National Savings Certificate (NSC), LIC policies etc to HDFC. The present value of the maturity amount of assigned securities is combined with the loan amount to arrive at the enhanced loan eligibility. Under this facility, the EMI is calculated on the net loan amount (i.e. total loan less the present value of the maturity value of the securities). 3. Flexible installment plan: This product offers a customized solution to suit the needs of customers whose repayment capacity is likely to alter during the term of the loan. The loan is structured in such a way that the EMI is higher during the initial years and subsequently decreases in the latter part proportionate to the reduced income of the customer. 5. Variable loan scheme: Customer has a choice to pay some part of loan under fixed rate option and rest of adjustable rate scheme. HDFC also provide the facility to increase the EMI amount to accelerate the repayment of the loan. 6. Land Purchase Loan: Be it land for a dream house, or just an investment for the future, HDFC Land Purchase Loan is a convenient loan facility to purchase land. HDFC finances up to 70% of the cost of the land (Conditions Apply). Repayment of the loan can be done over a maximum period of 10 years. 7. Home Improvement Loan: HIL facilitates internal and external repairs and other structural improvements like painting, waterproofing, plumbing and electric works, tiling and flooring, grills and aluminium windows. HDFC finances up to 85% of the cost of renovation (100% for existing customers.

2.5 REASERCH METHODOLOGY OF PROJECT: The study of housing finance companies is not an easy job. For such study a considerable amount of secondary data was required, personal interview with the main HFCs managers were done. These interviews were the great source of knowledge. Much information like HFCs organization background and overview was collected through internet and official websites of the companies. Other things like eligibility for taking loan, amount of loan, duration of loan, interest rate, EMI and other related forms and conditions were given in the companys brochures. Necessary information regarding housing finance as things to be noted before taking loan and benefits of housing loan, calculating EMI and pre EMI were collected through Internet, In this report both type of data primary and secondary are used.

DATA COLLECTION: Collection of data was done with the help of personal interview, with the managers and counselors and other staff members of main HFCs. But the answers of many question were in the company literature and brochures of the schemes and related particulars.

III. Sampling:

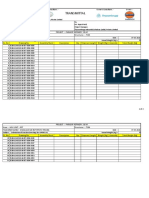

The sampling shall be from the officer involves in the field and will be interview to gather the data related to the project. Sampling Unit : Senior executive Sample size : 10 Geographical location : Delhi I. Source of primary data collection; The data collection in two methods are used in collection of primary data for marketing research project (I). interviews methods: (a) Telephone interview: No. of Customer No. of question Home loan Complete Satisfy (Customer) Satisfy (Customer) NO/YES 100 600 80 10 10 200 1200 165 20 15 (b). personal interview: No. of Customer No. of question Home loan Complete Satisfy (Customer) Satisfy (Customer) NO/YES 200 1200 140 18 22 200 1200 165 20 15

(III) Questionnaire methods: No. of Customer No. of question Home loan Complete Satisfy (yes/no) Satisfy (yes/no) NO 100 1200 80 15 05 II. Sources of primary data collection: The data collection in two methods are used in collection of primary data for marketing research project (A). internal sources: (I). sales records (II). Credit records (III). Internal reports (B). External sources: (A). published (I). Directories (II). Periodicals (III). Financial records (IV). Statistical sources (B). Commercial (I). demographic data (II). Store audit data (III). Diary panel data (IV). Advertising explosive data

2.6 - LIMITATIONS OF PROJECT STUDY: The following limitations these are project studies: (1.) A high-cost home loan shall be subject to the following limitations: (a) 1. No lender may make, provide, or arrange a high-cost home loan with a prepayment penalty unless the lender offers the borrower a loan without a prepayment penalty, the offer is in writing, and the borrower initials the offer to indicate that the borrower has declined the offer. The lender shall disclose the discount in rate received in consideration for a high-cost home loan with the prepayment penalty; and 2. If a borrower declines an offer required in paragraph (a)1. of this subsection, the lender may include a prepayment penalty schedule. No prepayment penalty shall be assessed against the borrower following the third anniversary date of the mortgage or sixty (60) days prior to the date of the first interest rate reset, whichever is less. No prepayment penalty shall exceed three percent (3%) for the first year, two percent (2%) for the second year, and one percent (1%) for the third year of the outstanding balance of the loan; but in no event shall a prepayment penalty be assessed against a borrower refinancing with the mortgage loan company that funded the mortgage; (b) A high-cost home loan may not contain a provision which permits the lender, in its sole discretion, to accelerate the indebtedness. This provision does not apply when repayment of the loan has been

accelerated by default, pursuant to a due-on-sale provision, or pursuant to some other provision of the loan documents unrelated to the payment schedule; (c) A high-cost home loan may not contain a scheduled payment that is more than twice as large as the average of earlier scheduled payments. This provision does not apply when the payment schedule is adjusted to the seasonal or irregular income of the borrower; (d) A high-cost home loan may not contain a payment schedule with regular periodic payments that cause the principal balance to increase; (e) A lender may not charge a borrower any fees to modify, renew, extend, or amend a high-cost home loan or to defer any payment due under the terms of a high-cost home loan, unless the fees are less than one-half (1/2) of any fees that would be charged for a refinance or unless the borrower is in default and it is in the borrowers best interest; (f) A lender may not make a high-cost home loan unless the borrower has been provided the following notice or a substantially similar notice, in writing, not later than the time that notice provided by 12 C.F.R. (c), as amended from time to time, is required: NOTICE TO BORROWER IF YOU OBTAIN THIS LOAN, THE LENDER WILL HAVE A MORTGAGE ON YOUR HOME. YOU COULD LOSE YOUR HOME AND ANY MONEY YOU PUT INTO IT IF YOU DO NOT MEET YOUR OBLIGATIONS UNDER THE LOAN. MORTGAGE LOAN RATES AND CLOSING COSTS AND FEES VARY BASED ON MANY FACTORS, INCLUDING YOUR PARTICULAR CREDIT AND FINANCIAL CIRCUMSTANCES, YOUR EMPLOYMENT HISTORY, THE LOAN-TO-VALUE REQUESTED AND THE TYPE OF PROPERTY THAT WILL SECURE YOUR LOAN. THE LOAN RATE AND FEES COULD ALSO VARY BASED ON WHICH LENDER OR BROKER YOU SELECT. YOU SHOULD SHOP AROUND AND COMPARE LOAN RATES AND FEES. (h)A lender may not make a high-cost home loan unless the lender reasonably believes at the time the loan is consummated that one (1) or more of the borrowers, when considered individually or collectively, will be able to make the scheduled payments to repay the loan based upon a consideration of their current and expected income, current obligations, current employment status, and other financial resources, other than the borrower's equity in the dwelling which secures repayment of the loan. A borrower shall be presumed to be able to make the scheduled payments to repay the loan if, at the time the loan is consummated: 1. The borrower's total monthly debts, including amounts owed under the loan, do not exceed fifty percent (50%) of the borrower's monthly gross income as verified by the credit application, the borrower's financial statement, a credit report, financial information provided to the lender by or on behalf of the borrower, or any other reasonable means; 2. The loan has been approved by an automated underwriting service offered by FNMA or Freddie MAC; 3. The lender verifies and documents that the borrower has liquid assets equal to fifty percent (50%) of the principal loan amount; or 4. The borrower has sufficient residual income as defined in the guidelines established in 38 C.F.R. 36.4337(e) and United States Veterans Administration form 26-6393; (i)If the proceeds of the high-cost home loan are used to refinance an existing high-cost home loan held by the same lender as note holder, the lender may not directly or indirectly finance: 1. Any prepayment fees or penalties payable by the borrower; or 2. Points and fees, excluding those provided for in 12 C.F.R. 226.4(c)(7), which in the aggregate are in excess of four percent (4%) of the total amount financed; (j)A lender or mortgage loan broker may not, within one (1) year of the consummation of a high-cost home loan, charge a borrower points and fees in connection with a high-cost home loan if the proceeds of the high-cost home loan are used to refinance an existing high-cost home loan on which points were charged. A lender may not, at any time, charge a borrower points and fees in addition to those allowed by 12 C.F.R. 226.4(c)(7) if the proceeds of the high-cost home loan are used to refinance an existing highcost home loan, on which points were charged, held by the same lender as note holder. However, points and fees in accordance with this section may be charged on any proceeds of a high-cost home loan which are in excess of the amount refinanced on the existing high-cost home loan;

(k)A lender may not pay a contractor under a home-improvement contract from the proceeds of a highcost home loan other than by an instrument payable to the borrower or jointly to the borrower and the contractor, or at the election of the borrower, through a third-party escrow agent in accordance with terms (l)A lender shall not refinance, replace, or consolidate a zero interest rate or low interest rate loan made by a governmental or nonprofit lender with a high-cost home loan. For purposes of this paragraph, a low interest rate loan is defined as a loan that carries a current interest rate that is two (2) percentage points or more below the current yield on United States Treasury securities with a comparable maturity; (m)A lender shall not finance single premium credit life, credit accident, credit health, credit disability, or credit loss of income insurance in connection with a high-cost home loan; (n) Lender shall not make a high-cost home loan unless the lender has made available to the borrower a videotape, or other similar audio-video media format such as DVD or CD, approved by the Office of Financial Institutions, which explains the borrower's rights and responsibilities with regard to this section or high-cost home loans. A lender shall have available for viewing at least one (1) copy of the video in the principal office and each branch office of the lender; (o)A lender shall not make a high-cost home loan subject to a mandatory arbitration clause that is oppressive, unfair, unconscionable, or substantially in derogation of the rights of consumers. Arbitration clauses that comply with the standards set forth in the Statement of Principles of the National Consumer Dispute Advisory Committee of the American Arbitration Association in effect on June 24, 2003, shall be presumed not to violate this subsection; (p) Lender shall not charge a late payment fee on a high-cost home loan except in accordance with the following: Payment past due or ten dollars ($10), whichever is greater; 1. The late payment fee may not be in excess of five percent (5%) of the amount of th 2. The loan documents must specifically authorize the late payment fee; 3. The late payment fee may only be assessed for a payment past due fifteen (15) days or more; and 4. The late payment fee may only be charged once with respect to a single late payment; (q)A lender may not charge a borrower a fee for the first request of each calendar year for a written payoff calculation. Thereafter, for each subsequent request in a calendar year, the lender may charge a reasonable fee not to exceed in excess of ten dollars ($10) or actual costs, whichever is greater, per request for a written payoff calculation on a high-cost home loan by a borrower in a calendar year; (r)A lender shall not initiate a foreclosure or other judicial process to terminate a borrower's interest in residential real property subject to a high-cost home loan without first providing the borrower, at least thirty (30) days prior to the initiation of any process, written notice of default and of the borrower's right to cure. The notice shall include a statement of the amount needed to be paid by the borrower in order to cure the default and the date by which the payment is due to cure the default. If the amount needed to be paid will change during the thirty (30) day notice period, the notice shall provide information sufficient to enable a calculation of the daily change; (s)A lender shall not recommend or encourage default on an existing loan or other debt in connection with the closing of a high-cost home loan that refinances all or a portion of the existing loan or debt; (t)A lender shall not make a high-cost home loan that does not require an escrow account for taxes and insurance; (u)A lender shall not process the application to make a high-cost home loan if the proceeds shall be used, in whole or in part, to repay the principal of an existing loan secured by the borrower's principal dwelling that is not a high-cost home loan, without first requiring the borrower to obtain housing counselling by a HUD-approved counsellor; (v)A lender shall not make a high-cost home loan that allows the borrower, for any part or all of the term of the loan, to make payments that are applied only to interest and not to principal; (w)A lender shall provide timely notice to the borrower of any material change in the terms of a high-cost home loan if the change is made after an application has been taken but before the closing of the loan. Notice shall be deemed timely if given not later than three (3) days after the lender has learned of the change or twenty-four (24) hours before the high-cost home loan is closed, whichever is earlier. If the lender discloses a material change more than three (3) days after learning of the change but still twentyfour (24) hours before the high-cost home loan is closed, it will not be liable for penalties or forfeitures if the lender cures in time for the borrower to avoid any damage;

(x)A lender shall not make a high-cost home loan without verifying the borrower's income and financial resources through tax returns, payroll receipts, bank records, or other similarly reliable documents, whether provided directly by the borrower or through a third party with the borrowers permission; and (y)A lender shall not make a high-cost home loan without verifying the borrower's reasonable ability to pay all scheduled payments of principal, interest, real estate taxes, homeowner's insurance, and mortgage insurance premiums, as applicable. For loans in which the interest rate may vary, the reasonable ability to repay shall be determined based upon the following: 2. "Total points and fees payable by the consumer at or before the loan closing" does not include real estate related fees paid to third parties if the charge is reasonable, the creditor receives no direct or indirect compensation in connection with the charge, and the charge is not paid to an affiliate of the creditor. Real estate related fees include: a. Fees for title examination, abstract of title, title insurance, property survey, and similar purposes; b. Fees for preparing loan-related documents, such as deeds, mortgages, and reconveyance or settlement documents; c. Notary and credit report fees; d. Property appraisal fees or fees for inspections to assess the value or condition of the property if the service is performed prior to closing, including fees related to pest infestation and flood hazard determinations; and e. Amounts required to be paid into escrow or trustee accounts if the amounts would not otherwise be included in the finance charge . 3."Total points and fees payable by the consumer at or before the loan closing" means all amounts payable by a borrower at or before the closing of a home loan, excluding any interest or time-price differential due at closing on the loan proceeds and includes: a. All mortgage broker fees, including fees paid by the consumer directly to the broker, fees paid by the consumer to the creditor for delivery to the broker, and yield spread premiums paid by the creditor to the broker; b. Any amount payable under an add-on or discount system of additional charges: c. Service, transaction, activity, and carrying charges that exceed similar charges on a non-credit account; d. Points, loan fees, assumption fees, finder's fees, and similar charges; e. Appraisal, investigation, and credit report fees when service is provided by the lender or an affiliate and not by a third party; f. Charges imposed on a creditor by another person for purchasing or accepting the borrower's obligation, if the borrower is required to pay the charges in cash, as an addition to the loan obligation, or as a deduction from loan proceeds; g. Premiums or other charges for credit life, accident, health, or loss-of-income insurance, or debtcancellation coverage, whether or not the debt-cancellation coverage is insurance under applicable law; or h. Closing agent fees charged by a third party, but only if the lender requires the particular services for which the borrower is charged and the lender requires the important. (a) Time and Payment Limitation. Except as otherwise provided in this Article, no licensee making a loan pursuant to G.S. 53-173 shall enter into any contract of loan under this Article providing for any scheduled repayment of principal more than 25months from the date of making the contract if the cash advance is six hundred dollars (600.00) or less; more than 37 months from the date of making the contract if the cash advance is in excess of six hundred dollars ($600.00) but not in excess of fifteen hundred dollars ($1,500); more than 49 months from the date of making the contract if the cash advance is in excess of fifteen hundred dollars ($1,500) but not in excess of two thousand five hundred dollars ($2,500); or more than 61 months if the cash advance is in excess of two thousand five hundred dollars ($2,500). Every loan contract shall provide for repayment of the amount loaned in substantially equal instalments, either of principal roof principal and charges in the aggregate, at approximately equal periodic intervals of Time. Nothing contained herein shall prevent a loan being considered a new loan because the proceeds of the loan are used to pay an existing contract. (b) No Assignment of Earnings. A licensee may not take an assignment of

Earnings of the borrower for payment or as security for payment of a loan. An assignment of earnings in violation of this section is unenforceable by the assignee of the earnings and is revocable by the borrower. A sale of unpaid earnings made in consideration of the payment of money to or for the account of the seller of the earnings is deemed to be loan to the seller by an assignment of earnings. (c) Limitation on Default Provisions. An agreement between a licensee and a borrower pursuant to a loan under this Article with respect to default by the borrower is enforceable only to the extent that (i) the borrower fails to make a payment as required byte agreement, or (ii) the prospect of payment, performance, or realization of collateral insignificantly endangered or impaired, the burden of establishing the prospect of a significant endangerment or impairment being on the licensee. (d) Prohibitions on Discrimination. No licensee shall deny any extension of credit or discriminate in the fixing of the amount, duration, application procedures or other terms or conditions of such extension of credit because of the race, color, religion, national origin, sex or marital status of the applicant or any other person connected with the transaction. (e) Limitation on Attorney's Fees. With respect to a loan made pursuant to the Provisions of G.S. 53-173, the agreement may not provide for payment by the borrower of attorney fees. (f) No Real Property as Security. No licensee shall make any loan within this State which shall in any way be secured by real property. (g) Deceptive Acts or Practices. No licensee shall engage in any unfair method of competition or unfair or deceptive trade practices in the conduct of making loans to borrowers pursuant to this Article or in collecting or attempting to collect any money alleged to be due and owing by a borrower. 1. You must be an eligible veteran who has available home loan entitlement (except in the case of an interest rate reduction refinancing loan); 2. The loan must be for an eligible purpose; 3. You must occupy or intend to occupy the property as your home within a reasonable period of time after closing the loan; 4. You must have enough income to meet the new mortgage payments on the loan, cover the costs of owning a home, take care of other obligations and expenses, and still have enough income left over for family support (a spouse's income is considered in the same manner as the veteran's); and 5. You must have a good credit record. One of the biggest advantages that home equity loans offer is the deductibility of the interest rate. However, many debtors don't fully recognize the limitations that are set on these deductions and how proper allocation of such loans can qualify them for the deductions. There are two types of mortgage loan interests. The first one is the interest from home acquisition debt which is used to buy, build, or substantially improve a house. The second one is the home equity debt which is not used to buy or build a home. The intent and actual use of the loan dictates how the loan is treated for income tax purpose.

CHAPTER- THREE FACT AND FINDINGS

3.1 FACT AND FINDINGS: HDFC offer the loan for buying, constructing, extending, or renovation and home equity loan. HDFC also finance for land purchase from approval agencies to enable you to construct a home of your choice. Your can buy a self- contained flat in an existing or proposed co-operative society in an apartment, owners association or even an independent single family or multifamily bungalow or house. HDFC also provide the farcicality of refinance of your house, if you have already start the construction. A PPTA exercise is followed by an ADB loan fact-finding mission, during which ADB project staff, consultants, and government counterparts finalize a proposed projects scope, components, implementation arrangements, and budget. Attention also is given to detailed assessment of the economic, financial, social, and other expected benefits and impacts, associated risks, and specific assurances or other conditions for ADB support. During loan fact-finding, the projects design and monitoring framework is finalized, with careful attention to the anticipated impact and performance targets. For the Western Basins project, Mr. Panella scheduled the loan fact-finding mission to immediately follow the final tripartite meeting. In this way, members of the fact-finding mission were able to meet with key members of the PPTA consultant team to discuss project details. Rather than depending only on the PPTA materials, the fact-finding mission was able to directly discuss the findings and recommendations of the PPTA exercise. Joint site visits also allowed PPTA consultants and their government counterparts to explain project design features, including the proposed rehabilitation of different types of irrigation structures, the nature of civil works required, modalities for undertaking such work to bolster rather than undermine traditional community institutions, and range of related activities. Capacity development needs were also discussed. The output of the loan fact-finding is a draft project and loan document that is left with the government for comment. This serves as the basis for a report and recommendation of the President that is reviewed at a formal ADB management review meeting, where interdepartmental comments on a proposed project are considered and potential problems or areas that might need further confirmation with the government are identified. 1. Housing Finance Sector: Against the milieu of rapid urbanization and a changing socio-economic scenario, the demand for housing has grown explosively. The importance of the housing sector in the economy can be illustrated by a few key statistics. According to the National Building Organization (NBO), the total demand for housing is estimated at 2 millions units per year and the total housing shortfall is estimated to be 19.4 million units, of which 12.76 million units is from rural areas and 6.64 million units from urban areas. The housing industry is the second largest employment generator in the country. It is estimated that the budgeted 2 million units would lead to the creation of an additional 10 million man-years of direct employment and another 15 million man-years of indirect employment. Having identified housing as a priority area in the ninth Five Year Plan (1997-2002), the National Housing Policy has envisaged an investment target of Rs. 1,500 billion for this sector. In order to achieve this investment target, the Government needs to make low cost funds easily available and enforce legal and regulatory reforms. 2. Home Loan Purchase or Mortgage Refinance: Buy a home or refinance your existing loan for a better rate or cash... Many of these lenders and brokers offer thousands of different loan programs and may be able to qualify you for more than you ever thought possible! Get a better interest rate, cash out, switch to a fixed or adjustable rate, and find more favourable loan terms than you may currently have 3. Home Equity Loans and Home Improvement Loans: Consolidate Your Debts into one lower interest rate payment! Use your home equity to make home improvements! Get fast cash For ANY Reason 4. Government Assisted FHA and VA Loans: FHA Loans (Federal Housing Administration): FHA loans may ease first-time buying with lower down payments, easy qualifying and the acceptance of closing costs from a gift. VA Loans (Veterans

Administration Loans): VA Loans are for active, retired or reserve military. They offer very low rates and low or no money down. 5. No Documentation Loans: Get the best financing for the home loan you always wanted. Search for the best rates from lenders who specialize in no documentation loans 6. Turned Down by Another Lender or Broker? Click here because these specialized lenders and brokers may be able to quickly approve you for a home loan even if you've already been turned down! 7. Turned Down by Another Lender or Broker? Click here because these specialized lenders and brokers may be able to quickly approve you for a home loan even if you've already been turned down! 8. Mobile Home Loans: Buying a mobile home? Need financing but not sure if you'll be approved? Click here and get a free quote today! The Congress finds that (1) the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation (referred to in this section collectively as the enterprises), and the Federal Home Loan Banks (referred to in this section as the Banks), have important public missions that are reflected in the statutes and charter Acts establishing the Banks and the enterprises; (2) because the continued ability of the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation to accomplish their public missions is important to providing housing in the United States and the health of the Nations economy, more effective Federal regulation is needed to reduce the risk of failure of the enterprises; (3) considering the current operating procedures of the Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation, and the Federal Home Loan Banks, the enterprises and the Banks currently pose low financial risk of insolvency; (4) Neither the enterprises nor the Banks, nor any securities or obligations issued by the enterprises or the Banks, are backed by the full faith and credit of the United States; (5) An entity regulating the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation should have sufficient autonomy from the enterprises and special interest groups; (6) an entity regulating such enterprises should have the authority to establish capital standards, require financial disclosure, prescribe adequate standards for books and records and other internal controls, conduct examinations when necessary, and enforce compliance with the standards and rules that it establishes; (7) the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation have an affirmative obligation to facilitate the financing of affordable housing for low- and moderate-income families in a manner consistent with their overall public purposes, while maintaining a strong financial condition and a reasonable economic return; and (8) The Federal Home Loan Bank Act should be amended to emphasize that providing for financial safety and soundness of the Federal Home Loan Banks is the primary mission of the Federal Housing Finance Board. MAXIMUM A PERSON CAN BORROW: Land 85% of the project cost Construction 85% of the project cost Commercial 85% of the project cost Renovation 85% of the project cost Purchase house 85% of the project cost LAP 60% of the property value

LOAN AMOUNT: HDFC finances up to a maximum of 85% of the cost of the property inclusive of agreement value, stamp duty and registration charges. HDFC's Home Improvement Loan facilitates internal and external repairs and other structural improvements. HDFC finances up to 85% of the cost of renovation (100% for existing customers). For Land Purchase Loan, HDFC finances up to 85% of the cost of the land.

CHAPTER- FOUR ANALYSIS AND INTERPRETATION

4. ANALYSIS: 4.1 Structure of HDFC home loan: HDFC offer the loan for buying, constructing, extending, or renovation and home equity loan. HDFC also finance for land purchase from approval agencies to enable you to construct a home of your choice. Your can buy a self- contained flat in an existing or proposed co-operative society in an apartment, owners association or even an independent single family or multifamily bungalow or house. HDFC also provide the farcicality of refinance of your house, if you have already start the construction. MAXIMUM A PERSON CAN BORROW: Land 85% of the project cost Construction 85% of the project cost Commercial 85% of the project cost Renovation 85% of the project cost Purchase house 85% of the project cost LAP 60% of the property value LOAN AMOUNT: HDFC finances up to a maximum of 85% of the cost of the property inclusive of agreement value, stamp duty and registration charges. HDFC's Home Improvement Loan facilitates internal and external repairs and other structural improvements. HDFC finances up to 85% of the cost of renovation (100% for existing customers). For Land Purchase Loan, HDFC finances up to 85% of the cost of the land. PROCESS OF SANCTIONING OF LOAN AMOUNT:

Enquires made by the customer. Submission of identification no. (File no.) by the document are found to be satisfactory. The file than undergoes a through legal and technical check-up. Sanctioning of loan after all formalities has been completed. Legal documents are to be submitted and fulfil legal requirements. Final disbursement of cheque. 4.2 - LOAN REPAYMENT TERMS: The repayment options are flexible and customized to suit the individual needs of the customers. While repaying the loan amount customers can choose from Fixed Rate of Interest or Floating Interest Rate. In case of home loans to purchase (fresh/resale) or construct houses. The maximum period of repayment for home improvement loan is 15 years or retirement age, whichever is earlier. For home extension maximum term is 20 years subject to your retirement age. There are multiple payment options likeStep-Up Repayment Facility. Helps young executives take a much bigger loan today based on an increase in their future income, this helps executives buy a bigger home today! Flexible Loan Instalments plan. Often customers, parents and their children, wish to purchase properties together. The parent is nearing retirement and their children have just started working. This option helps such customers combine the incomes and take a long term home loan where in the instalments reduces upon retirement of the earning parent. Tranche Based EMI and, Customers purchasing an under construction property need to pay interest (on the loan amount drawn based on level of construction) till the property is ready. To help customer save this interest, we have introduced a special facility of Tranche Based EMI. Customers can fix the instalments they wish to pay till the time the property is ready for possession. The minimum amount payable is the interest on the loan amount drawn. Anything over and above the interest paid by the customer goes towards Principal repayment. The customer benefits by starting EMI and hence repays the loan faster. Accelerated Repayment Scheme. Accelerated Repayment Scheme offers you a great opportunity to repay the loan faster by increasing the EMI. Whenever you get an increment, increase in your disposable income or have lump sum funds for loan prepayment, you can benefit by 1. Increase in EMI means faster loan repayment 2. Saving of interest because of faster loan repayment 3. You can invest lump sum funds rather than use it for loan prepayment. The return from the investments also gives you the comfort of paying the increased EMI. Automated repayment of Home loan EMI The customer can give standing instructions to replay your Home Loan EMIs directly from your HDFC Bank Savings Account which does away with the cumbersome process of procuring, signing and tracking post- dated cheques. While repaying the loan amount customers can choose from Fixed Rate of Interest or Floating Interest Rate. TYPES OF HOME LOAN: A person seeking investments for house or a property opts for Home Loans for a variety of purposes ranging from construction to renovation. The Housing Finance Companies (HFCs) now offer individuals with various alternatives to choose from while buying a home loan. And the availability of Home Loans offered is as varied as their requirements.

1. Home Purchase Loans: This is the basic home loan for the purchase of a new home. 2, Home Construction Loans: This loan is available for the construction of a new home on a said property. The documents that are required in such a case are slightly different from the ones you submit for a normal Housing Loan. If you have purchased this plot within a period of one year before you started construction of your house, most HFCs will include the land cost as a component, to value the total cost of the property. In cases where the period from the date of purchase of land to the date of application has exceeded a year, the land cost will not be included in the total cost of property while calculating eligibility. 3. Home Improvement Loans: These loans are given for implementing repair works and renovations in a home that has already been purchased, for external works like structural repairs, waterproofing or internal work like tiling and flooring, plumbing, electrical work, painting, etc. One can avail of such a loan facility of a home improvement loan, after obtaining the requisite approvals from the relevant building authority. 4. Home Extension Loans: An extension loan is one which helps you to meet the expenses of any alteration to the existing building like extension/ modification of an existing home; for example addition of an extra room etc. One can avail of such a loan facility of a home extension loan, after obtaining the requisite approvals from the relevant municipal corporation. 5. Home Conversion Loans: This is available for those who have financed the present home with a home loan and wish to purchase and move to another home for which some extra funds are required. Through a home conversion loan, the existing loan is transferred to the new home including the extra amount required, eliminating the need for pre-payment of the previous loan. 6. Land Purchase Loans: This loan is available for purchase of land for both home construction or investment purposes. 7. Stamp Duty Loans: This loan is sanctioned to pay the stamp duty amount that needs to be paid on the purchase of property. 8. Bridge Loans: Bridge Loans are designed for people who wish to sell the existing home and purchase another. The bridge loan helps finance the new home, until a buyer is found for the old home. 9. Balance Transfer Loans: Balance Transfer is the transfer of the balance of an existing home loan that you availed at a higher rate of interest (ROI) to either the same HFC or another HFC at the current ROI a lower rate of interest. 10. Refinance Loans: Refinance loans are taken in case when a loan for your house from a HFI at a particular ROI you have taken drops over the years and you stand to lose. In such cases you may opt to swap your loan. This could be done from either the same HFI or another HFI at the current rates of interest, which is lower. 11. Loans to NRIs: This is tailored for the requirements of Non-Resident Indians who wish to build or buy a home or property in India. The HFCs offer attractive housing finance plans for NRI investors with suitable repayment options. 4.3 - HOW HDFC DECIDES THE LOAN AMOUNT: The repayment capacity as determined by HDFC will help to decide how much we can borrow. Repayment capacity takes into consideration factors such as Income of the customer. Age of the customer Qualification of the customer Number of dependents

Spouses income Assets of the customer Liabilities of the customer Stability Continuity of occupation Saving history

And, of course, HDFC main concern is to make sure that you can comfortably repay the amount you borrow. CAN AN INDIVIDUAL APPLY FOR A LOAN TO REPAY A HOUSING LOAN OF ANOTHER BANK/HOUSING FINANCE COMPANY: Yes, an individual can avail of HDFC home loan to repay a loan of his employer or another bank/housing finance company. APPLICANT AND CO-APPLICANT TO THE LOAN: Home Loans can be applied for either individually or jointly. Proposed owners of the property will have to be co-applicants. However, the Co-applicants need not be co- owners. 4.4 - ADJUSTABLE RATE HOME LOAN: Loan under Adjustable Rate is linked to HDFC's Retail Prime Lending Rate (RPLR). The interest rate on the loan will be revised every three months from the date of first disbursement, if there is a change in RPLR, the interest rate on the loan will change. However, the EMI on the home loan disbursed will not change. If the interest rate increases, the interest component in an EMI will increase and the principal component will reduce resulting in an extension of term of the loan, and vice versa when the interest rate decreases. FEES AND OTHER CHARGES: A processing and administration fees is 0.5% on loan amount is to be payable along with the submission of application form. For the pre-payment, charges are 2% for early redemption on fixed rate home loan scheme. However under the adjustable rate scheme 2% will be charge only in case of commercial refinance. RATE OF INTEREST THEY ARE CHARGING (FLOATED): Salaried person Business man : 11% : 11.25%

RATE OF INTEREST THEY ARE CHARGING (FIXED): HOME LOAN : 13.25%

Retail prime lending rate: 14 % (Revised April, 2007)

For Resident Indians, in the fixed rate category, HDFC offers loans at the rate of 13.25%. In the floating/adjustable rate category, loans are given at a rate of 11 -11.25% 4.5- OTHER BENEFIT PROVIDED BY HDFC: HDFC offer various repayment options like 1. Set up repayment facility: The objective of SURF is to provide the customer with a repayment schedule, which is linked to his expected growth in income. It also helps a customer get a larger amount of loan as compared to the loan under the normal housing loan. The customer can avail of a higher amount of loan and pay lower EMIs in the initial years. Subsequently, the repayment is accelerated proportionately with the assumed increase in his income. The EMIs will be increased in stages 2. Balloon payment plan: Balloon Payment is an enhancement tool, which helps in increasing the loan eligibility of the customer without increasing the EMI by assigning securities like National Savings Certificate (NSC), LIC policies etc to HDFC. The present value of the maturity amount of assigned securities is combined with the loan amount to arrive at the enhanced loan eligibility. Under this facility, the EMI is calculated on the net loan amount (i.e. total loan less the present value of the maturity value of the securities). 3. Flexible installment plan: This product offers a customized solution to suit the needs of customers whose repayment capacity is likely to alter during the term of the loan. The loan is structured in such a way that the EMI is higher during the initial years and subsequently decreases in the latter part proportionate to the reduced income of the customer. 4. Variable loan scheme: Customer has a choice to pay some part of loan under fixed rate option and rest of adjustable rate scheme. HDFC also provide the facility to increase the EMI amount to accelerate the repayment of the loan. 5. Land Purchase Loan: Be it land for a dream house, or just an investment for the future, HDFC Land Purchase Loan is a convenient loan facility to purchase land. HDFC finances up to 70% of the cost of the land (Conditions Apply). Repayment of the loan can be done over a maximum period of 10 years. 6. Home Improvement Loan: HIL facilitates internal and external repairs and other structural improvements like painting, waterproofing, plumbing and electric works, tiling and flooring, grills and aluminium windows. HDFC finances up to 85% of the cost of renovation (100% for existing customers. HOW DIFFERENT IS AN HDFC HOMELOAN: Widest range of flexible home loan products. Counselling and advisory services for acquiring property. Special Schemes for group. Balance Transfer Facility. Options to switch between schemes. Network of over 200 outlets and over 28 years of experience. Special rates for HDFC customers (past and present) on all new loans.

4.6 - HOW TO APPLY FOR HOME LOAN: WE CAN CHOOSE ANY OF THE FOLLOWING WAY TO GET THE HOME LOAN: 1. HDFC office locator We have over 200 offices with flexible timings keeping in mind your work timings. The offices are conveniently located at a place closer to you. 2. Call the HDFC home line in your city Sales representatives will reach out for assistance. 3. SMS HDFC HOME to 6767. 4. Apply online.

4.7 - SUPPORTING DOCUMENTS WHICH SHOULD BE SUBMITTED ALONG WITH AN APPLICANT: FOR ALL APPLICANTS: Duly completed application form along with the photograph and signature of all applicants. Photocopies updated bank statement or photocopy of bank pass book (duly completed) of all the applicants for the last six months of both the operating and the salaried documents. Proof of the age and residence. Documents have to be submitted for the same are Passport or Driving License or Election Identity Card or Pan Card Copy of approved drawing of proposed construction / purchase/ extinction / property papers. Agreement for sale deed detailed cost estimate from architect for the property to be purchased / construction / renovation. If a customer have been in his present employment / business for less than a year mention on a separate sheet details of occupation for previous 5 years giving position held, reasons for change and period of the same. Applicant processing by cheque marked payees account only drawn on a bank in city where HDFC has an officer or by DD (payable at par to HDFC). FINANCIAL DOCUMENTS: IF YOU ARE SALARIED INDIVIDUAL Employer certificate (Suggest format enclosed). Latest form 16/ IT return as applicable. Latest salary slip / certificate showing all deductions, retirement age and loan details, if any. Employers profile. If persons job is transferable permanent address where correspondence relating to the application can be mailed. Identity and Residence Proof. Last 6 months bank statements. Processing fee cheque. Detailed cost estimate from architect/engineer for the property to be extended. IF YOU ARE SELF- EMPLOYED PROFESSIOANLS Balance sheet, profit and loss account of the business profession as well as copies of individual income tax return for last three years. A note which highlight the nature of an individual business / profession, form of organization, clients, suppliers etc. Copy of an individual tax challans for the last three years. Copy of advance tax challans.

Updated photo copy of pass book and saving of last 12 months. Application form with photograph. Identity and Residence Proof. Education Qualifications Certificate and Proof of business existence. Processing fee cheque. Detailed cost estimate from architect/engineer for the property to be extended. IF YOU ARE SELF- EMPLOYEED BUSINESSMAN Application form with photograph Identity and Residence Proof. Education Qualifications Certificate and Proof of business existence. Business profile. Last 3 years Income Tax returns. (self and business) Last 3 years Profit /Loss and Balance Sheet. Last 6 months bank statements. (self and business) Processing fee cheque. Detailed cost estimate from architect/engineer for the property to be extended.

4.8 - HOW DOES ONE GET THE TAX BENEFIT ON THE LOAN? There is eligibility for certain tax benefits on principal and interest components of a housing loan under the Income Tax Act, 1961. Moreover, you can get added tax benefits under Sec 24b on repayment of principal amount. Moreover, you can get added tax benefits under Sec 80 C on repayment of principal amount up to Rs. 1, 00,000 p.a. that can further reduce your tax liability by about Rs. 30,000 p.a. DOES THE PROPERTY HAVE TO BE INSURED Yes, it is compulsory to get property insured. WHAT IS THE BASIS OF INTEREST RATE CALCULATION? Home loans interest rate in India is usually calculated either on monthly reducing or yearly reducing balance. In the Monthly reducing system, the principal on which you pay interest reduces every month as you pay your EMI. While in the Annual Reducing system the principal is reduced at the end of the year, thus continuing to pay interest on a certain portion of the principal which you have