Professional Documents

Culture Documents

ACCA P2 考试复习资料

Uploaded by

Ricky HooiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCA P2 考试复习资料

Uploaded by

Ricky HooiCopyright:

Available Formats

Part one Group Accounts 1.

Basic knowledge for group accounting Major workings W1 group structure Subsidiary IAS 27 Acquisition method control Associate IAS 28 Equity method significant influence Joint Venture IAS 31 Proportion or Equity method joint control W 2 FV of net assets of the subsidiary DOA OSC Reserves Fair adjustments Additional depreciation URP (S to H) Policy Adjustments Total value * DOC ** () () a b Movement acquisition) (post

() () c

*sometimes the question will state this figure in which case the fair value adjustment will become the balancing figure **only relevant to include this here if the asset subject to the fair value adjustment remains at the reporting date i.e. it will not be relevant if it relates to inventory. W3 goodwill calculation There are two methods in which goodwill may be calculated following the update to IFRS 3 (1) Partial goodwill (old method) Cost of investment Less: S% FV of NA at DOA (S%aW2) Goodwill on DOA Less: impairment to date Goodwill on DOC (2) Full goodwill (new method) () ()

Cost of investment Fair value of NCI at DOA FV of NA at DOA W2 Goodwill on DOA Less: impairment to date Goodwill on DOC Or, this can be presented by: Cost of investment Less: S% FV of NA at DOA Goodwill on DOA (Ps share) Fair value of NCI at DOA NCI share of FV of NA at DOA Goodwill on DOA (NCI share) Total goodwill

(a) ()

() ()

IFRS 3 requires that goodwill be subject to an impairment review. The subsidiary is regarded as the cash generating unit. Net assets of the subsidiary at the balance sheet date Plus the unimpaired goodwill (gross up) Carrying value Recoverable amount Impairment loss (total) Cost of investment Cash Deferred cash PV and finance cost Share for share MV Financial instruments MV Contingent consideration FV at the DOA with adjustment for subsequent changes. a) If the change is due to additional information obtained after the acquisition date that affects the facts or circumstances as they existed at DOA, this is treated as a measurement period adjustment and the cost of investment and goodwill are remeasured. b) If changes due to events after the acquisition date Contingent consideration classified as equity shall not be remeasured, and its subsequent settlement shall be accounted for within equity.

Contingent consideration classified as an asset or a liability that : Is a financial instrument and is within the scope of IAS 39 shall be measured at fair value, with any resulting gain or loss recognized either in profit or loss, or in other comprehensive income. Is not within the scope of IAS 39 shall be accounted for in accordance with IAS 37, Provisions, Contingent Liabilities and Contingent Assets, or other IFRSs as appropriate. Issue cost should be deducted from proceeds of issue. (i.e. share premium) not included in the cost of the acquisition. Professional fees and similar incremental costs expense in the I/S

W 4 Non-controlling interest (1) Old method NCI % of FV of NA at DOC NCI%b W2 (2) New method FV of net assets of S at DOC (1 S %) b NCI share of goodwill NCI share of impairment loss Total non-controlling interest NCI in income statement NCI% (PAT URP DEPR) W 5 consolidated reserves (RE + other) calculation The group reserves comprises as follows: 1 Parent company ()

Adjustment, corrections (if any) e.g. URP where the parent is the /() 2 3 seller or transactions the parent company has not yet recorded Less cumulative goodwill impairment losses (P share) ()

Plus the group share of the (adjusted) post acquisition profits of the subsidiary and associate Total

Brief recap on accounting for associates Significant influence 20% -50% Board representation

Associates are equity accounted for in the group accounts. Group balance sheet extract Investment in associate A% of net assets (as adjusted for any depreciation and URP) Plus the goodwill not yet written off

Group income statement extract Income from associate undertakings A% of the profit after tax (as adjusted for any depreciation and URP) Less goodwill impairment loss

() Balances, transactions between the associate and the group companies are not eliminated. URP is eliminated to the extent of group share. IAS 31 Interest in joint ventures Joint venture: a contractual arrangement whereby two or more parties undertake an economic activity that is subject to joint control. Jointly controlled operations Each venture uses its own assets, incurs its own expenses and liabilities, and raises its own finance. IAS 31 requires that the venture should recognise in its financial statements the assets that it controls, the liabilities that it incurs, the expenses that it incurs, and its share of the income from the sale of goods or services by the joint venture. Jointly controlled assets Jointly controlled assets involve the joint control, and often the joint ownership, of assets dedicated to the joint venture. Each venture may take a share of the output from the assets and each bears a share of the expenses incurred.

IAS 31 requires that the venture should recognise in its financial statements it share of the joint assets, any liabilities incurred, income and expenses in the joint venture.

Jointly controlled entities A jointly controlled entity is a corporation, partnership, or other entity in which two or more venturers have an interest, under a contractual arrangement that establishes joint control over the entity. Each venture usually contributes cash or other resources to the jointly controlled entity. Those contributions are included in the accounting records of the venture and recognised in the venturers financial statements as an investment in the jointly controlled entity. IAS 31 allows two treatments of accounting for an investment in jointly controlled entities except as noted below: Method 1: proportionate consolidation Under proportionate consolidation, the balance sheet of the venture includes its share of the assets and its share of the liabilities. The income statement of the venture includes its share of the income and expenses of the jointly controlled entity. Method 2: equity method of accounting Procedures for applying the equity method are the same as those described in IAS 28 investments in associates. Transactions between a venture and a joint venture Balances, transactions between the JV and the group companies are not eliminated. URP is eliminated to the extent of group share. 2. Complex group structures A vertical group A 60% B 70% C In this illustration: A controls B and B controls C.

As A controls B, it also controls Bs holdings in other companies. Hence, B and C are subsidiaries of A as they are controlled by A.

Company C is often called a sub-subsidiary. In a vertical group, use the group structure to determine the status of investments. The key is to identify control relationships The parent controls its subsidiaries holdings in other companies but does not control associate holdings. The date of acquisition by A is the date on which A gains control. If B already held C, treat B and C as being acquired on the same day. The group structure is vital always identify this first and determine the status of investment. Also look carefully at dates to identify when the parent obtained control. Effective group interest Using the earlier group structure: A owns 60% if B and B owns 70% of C So A has an effective group interest in C of 60%*70% = 42% NCI own 58% of C

Mixed group The group is structure in manner where both the ultimate parent and a subsidiary have an interest on another entity. For example H 60% S 30% T is a subsidiary of H controls 30% directly and 30% indirectly via its interest in S. thus 60% is controlled. Consolidation is performed in a single stage using the consolidation percentages. S group share Minority share T group share Direct 30% 60% 40% 30% T

Indirect 60%of 30% 18% Minority share Step acquisition

48% 52%

a. control is achieved through two or more transactions The principles to be applied are: A business combination occurs only in respect of the transaction that gives one entity control of anther The identifiable net assets of the acquire are remeasured to their fair value on the date of acquisition Non-controlling interests are measured on the date of acquisition under one of the two options permitted by IFRS 3 Goodwill is measured as: Consideration transferred to obtain control Plus Amount of non-controlling interest (using either option) Plus Fair value of previously-held equity interest Less Fair value of the identifiable net assets of the acquire b. transactions between parent and non-controlling interests Once control has been achieved, further transactions whereby the parent entity acquires further equity interests from non-controlling interests, or disposes of equity interests but without losing control, are accounted for as equity transactions (i.e. transactions with owners in their capacity as owners) it follows that: The carrying amount of the controlling and non-controlling interests are adjusted to reflect the changes in their relative interests in the subsidiary; Any difference between the amount by which the non-controlling interests is adjusted and the fair value of the consideration paid or received is recognised directly in equity and attributed to the owners of the parent and;

There is no consequential adjustment to the carrying amount of goodwill, and no gain or loss is recognised in profit or loss.

3. Disposal a. loss of control IAS 27 details the adjustments made when a parent losses control of a subsidiary, based on the date when control is lost: Derecognise the carrying amount of assets (including goodwill), liabilities and noncontrolling interests; Recognise the fair value of consideration received; Recognise any distribution of shares to owners; Recognise the fair value of any residual interest; Reclassify to profit or loss any amounts (i.e. the entire amount, not a proportion) relating to the subsidiarys assets and liabilities previously recognised in other comprehensive income as if the assets and liabilities had been disposed of directly; and Recognise any resulting difference as a gain or loss in profit or loss attributable to the parent b. Transactions between parent and NCI Same principle as step acquisition (equity transaction) c. Full disposal Calculate gain or loss by comparing FV of consideration received, and FV of NA at date of disposal plus unimpaired goodwill 4. Foreign currency Individual company stage Functional and presentational currencies The functional currency is the currency of the primary economic environment where the entity operates, in many cases this will be the local currency. An entity should consider the following factors in determining its functional currency: The currency than mainly influences sales prices for goods and services

The currency of the country whose competitive forces and regulations mainly determine the sales price of goods and services The currency that mainly influences labour, material and other costs of providing goods and services.

The presentation currency is the currency in which the entity presents its financial statements and this can be different from the functional currency, particularly if the entity in question is a foreign owned subsidiary. It may have to present its financial statements in the currency of the parent company. Even though that is different from their every day trading currency. Individual transactions in a foreign currency At transaction date: At the spot exchange rate on the date the transaction occurred; or Using an average rate over a period of time providing the exchange rate has not fluctuated significantly. At subsequent balance sheet dates: Foreign currency monetary items (debtors, creditors, cash, loans) must be translated using the closing rate. Foreign currency non-monetary items (fixed assets, investments, stock) are not retranslated Exchange differences are recognized in income.

Group stage Where there is an overseas subsidiary that has a functional currency which is a local currency, prior to consolidation it will need to be translated into using the closing rate method. Closing rate method The balance sheet of the overseas entity is translated using the closing rate. The income statement items are translated at the average rate for the period.

Exchange differences in the group accounts With the closing rate method the group percentage of the exchange difference is dealt with in reserves.

6. Cash Flow statement Details see book

Part two summary of IAS and IFRS 1. IAS 10 events after the balance sheet date Post balance sheet events: an event which occurs after the year end but before the FS are approved. If it gives the new evidence on condition which existed at the year end, then adjusting PBSE apply relevant accounting treatment. If it gives new evidence on condition which did not exist at the year end, but impacts going concern assumption, then adjust. If it does not impact the going concern, then disclose in nature and estimate of financial effect. 2. IAS 37 provisions, contingent liabilities and contingent assets Provisions: only provide if obligation legal or constructive; probable transfer of economic benefit resulting from a past event; can be reliably measured Contingent liability: potential liability, assess likelihood of liability, remote ignore, possible disclose, probable disclose/provide Contingent asset: potential asset, assess likelihood of asset, remote ignore, possible ignore, probable disclose

Provision: A liability of uncertain timing or amount Measurement of provisions Best estimate this means: Provisions for one-off events (restructuring, environmental clean-up, settlement of a lawsuit) are measured at the most likely amount Provisions for large populations of events (warranties, customer refunds) are measured at a probability-weighted expected value. Both measurements are at discounted present value using a pre-tax discount rate that reflects the current market assessments of the time value of money and the risks specific to the liability. Remeasurement They should be reviewed at each balance sheet date and adjusted to reflect the current best estimate If it is no longer probable that an outflow of resources will be required to settle the obligation, the provision should be reversed. Restructurings Restructuring provisions should be accrued as follows: Sale of operation: accrue provision only after a binding sale agreement Closure or reorganisation: accrue only after a detailed formal plan is adopted and announced publicly. A board decision is not enough. Future operating losses: provisions should not be recognised for future operating losses, even in a restructuring Restructuring provision on acquisition (merger): accrue provision for terminating employees, closing facilities, and eliminating product lines only if announced at acquisition and, then only if a detailed formal plan is adopted 3 months after acquisition. Restructuring provisions should include only direct expenditures caused by the restructuring, not costs that associated with the ongoing activities of the enterprise. Onerous contracts

The least net cost should be recognised as a provision. The least net cost is lower of the cost of fulfilling the contract or of terminating it and suffering any penalty payments. Debit entry When a provision (liability) is recognised, the debit entry for a provision is not always an expense. Sometimes the provision may form part of the cost of the asset. Examples: obligation for environmental cleanup when a new mine is opened or an offshore oil rig is installed. Contingent liabilities It requires that enterprises should not recognise contigent liabilities but should disclose them, unless the possibility of an outflow of economic resources is remote. Contingent assets Contingent assets should not be recognised but should be disclosed where an inflow of economic benefits is probable. Non-current assets 3. IAS 16 Property, plant and equipment Recognition Meet definition of asset Owner occupied asset with physical existence

Major inspection or overhaul costs They can be treated as a separate component of the asset, they will be depreciated over the period up until the next overhaul date Initial measurement They should be initially recorded at cost. Cost includes all costs necessary to bring the asset to working condition for its intended use. Measurement subsequent to initial recognition IAS 16 permits two accounting models: Cost model

Revaluation model

The revaluation model Upwards revaluation reserves unless reverses previous decrease Downwards income statements unless reverses previous increase May transfer differences between new and old depreciation from RR to RE On disposal, transfer remaining balance of RR to RE. The transfer to retained earnings should not be made through the income statement. 4. IAS 36 impairment of assets Impairment. An asset is impaired when its carrying amount exceeds its recoverable amount. Recoverable amount. The higher of an assets fair value less costs to sell (sometimes called net selling price) and its value in use. Value in use. The discounted present value of estimated future cash flows expected to arise from the use of the asset. Asset are tested for impairment annually An intangible asset with an indefinite useful life An intangible asset not yet available for use Goodwill acquired in a business combination

Indications of impairment External sources Market value declines Negative changes in technology, markets, economy, or laws Increases in market interest rates Company stock price is below book value

Internal sources Obsolescence or physical damage Asset is part of a restructuring or held for disposal Worse economic performance than expected

Recognition of an impairment loss The impairment loss is an expense in the income statement (unless it relates to a revalued asset where the value changes are recognised directly in equity). Adjust depreciation for future periods

Cash-generating units The impairment loss is allocated to reduce the carrying amount of the assets of the unit (group of units) in the following order: Specifically impaired assets Goodwill Reduce the carrying amounts of the other assets of the unit (group of units) pro rata on the basis The carrying amount of an asset should not be reduced below the highest of: Its fair value less costs to sell (if determinable); Its value in use (if determinable); Zero

Reversal of an impairment loss The increased carrying amount due to reversal should not be more than what the depreciated historical cost would have been if the impairment had never been recorded. Reversal of an impairment loss is recognised as income in the income statement. Adjust depreciation for future periods Reversal of an impairment loss for goodwill is prohibited

5. IAS 40 investment property Investment property is property (land or a building or part of a building or both) held (by the owner or by the lessee under a finance lease) to earn rentals or for capital appreciation or both. Initial measurement Investment property is initially measured at cost, including transaction costs.

Measurement subsequent to initial recognition IAS 40 permits enterprises to choose between: A fair value model A cost model

IAS 40 notes that this highly unlikely for a change from a fair value model to a cost model. Fair value model Investment property is remeasured at fair value at each year end with gains or losses are taken to I/S. 6. IFRS 5 non-current assets held for sale and discontinued operation Held-for-sale classification. In general, the following conditions must be net for an asset (disposal group) to be classified as held for sale: Management is committed to a plan to sell The asset is available for immediate sale An active program to locate a buyer is initiated The sale is highly probable, within 12 months of classification as held for sale (subject to limited expectations) The asset is being actively marketed for sale at a sales price reasonable in relation to its fair value Actions required to complete the plan indicate that it is unlikely that plan will be significantly changed or withdrawn A decision made after the year-end but before the accounts are approved that a non-current asset or disposal group is held for sale is a non-adjusting event. Measurement Non-current assets or disposal groups that are classified as held for sale are measured at the lower of carrying amount and fair value less costs to sell. Assts should be presented as a current asset in the balance sheet. Non-depreciation. Non-current assets or disposal groups that are classified as held for sale shall not be depreciated.

Key provisions of IFRS 5 relating to discontinued operations: Classification as discontinuing. A discontinued operation is a component of an entity that either has been disposed of or is classified as held for sale, and: Represents a separate major line of business or geographical area of operations, Is part of a single co-ordinated plan to dispose of a separate major line of business or geographical area of operations, or Is a subsidiary acquired exclusively with a view to resale

Income statement presentation The sum of the post-tax profit or loss of the discontinued operation and The post-tax gain or loss on the disposal of the assets (or disposal group) Detailed disclosure of revenue, expenses, pre-tax profit or loss, and related income taxed is required either in the notes or on the face of the income statement in a section distinct from continuing operations. No retroactive classification. IFRS 5 prohibits the retroactive classification as a discontinued operation, when the discontinued criteria are met after the balance sheet date. 7. IAS 38 intangible assets Recognition meet definition Purchased separately License Quota Franchise

Should be measured at cost Purchased as part of business combination Goodwill=consolidation fair value of net assets at date of acquisition other identifiable assets and liabilities separately account for (see group account)

Internally generated intangibles Internally generated goodwill no recognition Development of brands, mastheads, publishing titles and customer lists costs incurred on these items should be written off. Research and development Research income statements as an expense Development should be recognised if, and only if, an enterprise can demonstrate all of the following: The technical feasibility Its intention to complete and use or sell it Its ability to use or sell the intangible asset The intangible asset will generate probable future economic benefits. The availability of adequate technical, financial and other resources to complete the development and to use or sell the intangible asset Measured reliably

Amortisation Finite useful life amortise over that life. Normally the straight-line method should be used with a zero residual value Indefinite useful life not be amortised, but tested for impairment annually

8. leases Classification of leases A leases is classified as a finance lease if it transfers substantially all the risks and rewards incident to ownership. All other leases are classified as operating leases. Classification is subjective and is made at the inception of the lease. Whether a lease is a finance lease or an operating lease depends on the substance of the transaction rather than the form. Indicators may be: The lease transfers ownership of the asset to the lessee by the end of the lease term

The lessee has the option to purchase the asset at nominal value The lease term is for the major part of the economic life of the asset At the inception of the lease, PVMLP/FV > 90% The lease assets are of a specialised nature such that only the lessee can use them without major modifications being made The lessee has the ability to continue to lease for a secondary period at a rent that is substantially lower than market rent

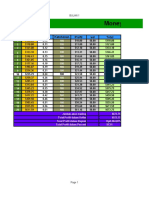

In classifying a lease of land and buildings, land and buildings elements would normally be separately. The land element is normally classified as an operating lease unless title passes to the lessee at the end of the lease term. The building element is classified as an operating or finance lease by applying the classification criteria in IAS 17. Accounting by lessees The following principles should be applied in the financial statements of lessees: Finance lease Step 1 Capitalise using lower of PVMLP and fair value Dr Non current assets Cr Finance lease obligation Step 2 Depreciate over shorter of lease term and useful economic life Step 3 Calculate interest charges and outstanding liability Rentals in advance Period Yr 1 Yr 2 I/S depr b/f 1000 900 * 100 Interest 10% 100 90 rent (200) (200) c/f 900 790

Finance charge

B/S NCA

* 110

NCL finance lease obligation 790 CL finance lease obligation

Operating lease, the lease payments should be recognised as an expense in the income statement over the lease term on a straight-line basis, unless another systematic basis is more representative of the time pattern of the users benefit. Incentives for the agreement of a new or renewed operating lease should be recognised by the lessee as a reduction of the rental expense over the lease term, irrespective of the incentives nature or form, or the timing of payments. Accounting by lessors The following principles should be applied in the financial statements of lessors: Finance lease The lessor should record a finance lease in the balance sheet as a receivable, at an amount equal to the net investment in the lease, normally no sale is recognised The lessor should recognised finance income and If the lessor is a manufacturer or dealer, there is a sale should be recognised

Operating lease Should be presented in the balance sheet of the lessor according to the nature of the asset. Lease income should be recognised over the lease term on a straight-line basis Incentives for the agreement of a new or renewed operating lease should be recognised by the lessor as a reduction of the rental income over the lease term, irrespective of the incentives nature or form, or the timing of payments. Initial direct costs Initial direct costs are costs that are directly attributable to negotiating and arranging a lease, for example, commissions, legal fees and premiums. Both lessees and lessors may incur these costs.

Finance lease

Costs incurred by lessee Costs incurred by lessor Add to amount recognised as Include in initial measurement an asset; depreciate over of receivable; reduce income assets useful life receivable over lease term Treat as part of lease rentals, Add to carrying amount of expense over lease term on leased asset; expense over straight line basis lease term on same basis as lease income

Operating lease

Sale and leaseback transactions For a sale and leaseback transaction that result in a finance lease, the asset is recognised as a non-current asset before and after the sale, so no sale can have taken place. it is treated as a secured loan under framework. So : Continue to recognise the original asset at its original cost (less depreciation) Credit the proceeds of the sale to a finance lease liability account.

However, under IAS 17, this can be recognised as a sale with gain deferred over lease term and loss recognised in I/S, and then a finance lease. For a transaction that results in an operating lease treat as a sale NBV= 1000 Selling =FV <FV price <FV FV = 1500 Recognise gain of 500 Recognise gain of 200 Loss of 100 is amortised over lease term to increase future lease expense if the rent is lower than market price. >FV 1700 Otherwise, recognise 100 loss immediately in IS Recognise 500 gain in IS immediately excess above FV of 200 is amortised over lease term to decrease future lease expense If the fair value at the time of the transaction is less than the carrying amount a loss equal to the difference should be recognised immediately.

1500 1200 900

9. IAS 12 income taxes Temporary difference. A difference between the carrying amount of an asset or liability and its tax base. The tax base is the amount attributed to an asset or liability for tax purpose. Taxable temporary difference. A temporary difference that result in amounts that are tax deductible in the future when the carrying amount of the asset if recovered or the liability is settled. ( carrying value > tax base) Deductible temporary difference. A temporary difference that will result in amounts that are tax deductible in the future when the carrying amount of the asset is recovered or the liability is settled. ( carrying value < tax base) Permanent difference. Expense in the income statements are not allowable expenditure for tax purposes, so the increase in tax charge has to be accepted. Such as fines and penalty, entertainment to customers. Recognition of deferred tax The general principle in IAS 12 is that deferred tax liabilities should be recognised for all taxable temporary differences unless the deferred tax liability arises from goodwill for which amortizations not tax deductible A deferred tax asset should be recognised for all deductible temporary differences unless exceptions above also apply The carrying amount of deferred tax assets/liabilities should be reviewed at each balance sheet date with difference to FS Deferred tax should be provided for on revaluation in equity because revaluation is accounted in equity Temporary differences may arise on a business combination because carrying value will be increased/decreased to fair value and tax base remains same Full provision rather than nil or partial provision is made for deferred tax Deferred tax assets and liabilities should not be discounted

IAS 12 allows a deferred tax asset to be recognised for the carry forward of unused tax losses to the extent that it is probable that there will be sufficient future taxable profits to enable the loss relief to be used.

Deferred tax calculation General Asset liability Carrying value (NBV) () Tax base /nil ()/nil Temporary difference /() /()

Deferred tax liability: CV> tax base with taxable temporary differences Deferred tax asset: CV< tax base with deductible temporary differences Closing deferred tax = temporary difference * tax rate ( go to B/S) Change in deferred tax = closing deferred tax opening deferred tax (go to I/S) Relates to equity if the related items are recognised in the equity For asset tax base is the future tax relief For liability tax base is CV less future tax relief 10. IAS 33 earning per share EPS = profit after tax and preference dividend/ weighted average number of shares Basic EPS Fresh issue/issue market price Bonus issue Current year Previous year full Time apportion the number of No restatement required shares No time apportionment Restate: Last years EPS *no. of shares of shares before after bonus/no. Right issue bonus Time apportion the number of Restated shares. Share before the rights also Last years EPS* TERP/CRP

at

required for number of shares

multiply by: *CRP/TERP (CRP is the cum rights price which will be given in the question. TERP is the theoretical ex-rights price, this will have to be calculated) Fully diluted EPS This calculation takes into account all the potential shares that will arise in the future. This calculation is done to warn the shareholders of the impact on the EPS due to these shares. Most dilutive basis No comparative figure adjustment

Convertible bonds/loan notes The fully diluted EPS will be affected by: Earnings this will increase due to the post tax savings in interes WANS this will increase due to the conversion factor

Share options The fully diluted EPS will be affected by the increase in the number of shares. The extra number of shares= number of options * FV- OP/FV FV = fair value of the share price OP= option price/exercise price of the shares Retrospective adjustments If a bonus share issues after year end but before date of approval of financial statements. EPS should be based on the new number of shares issues. (as well as bonus factor of rights issue) i.e. EPS is restated for current and previous year. Basic and diluted EPS are also adjusted for the effects of errors and adjustments resulting from changes in accounting policies, accounted for retrospectively. 11. IAS 19 Employee benefits

Defined contribution plans Company pays fixed contributions into the fund Company has no legal or constructive obligation to make further payment if the fund suffers under-performance Investment risk is borne by employees No further risk for employer

Accounting treatment for DCS Recognise contribution payable in IS as incurred Normally base on employees compensation level

Defined benefit plans Company creates a constructive obligation to provide the agreed amount of benefits to current and retired employees at retirement Ultimate benefits/pension are defined and contribution payable is variable (link to final salary) Investment risk is borne by employer and no risk for employees

Accounting for defined benefit scheme Scheme assets FV with investment returen Scheme liabilities PV with interest cost

Actuarial assumptions Wages inflation (final salary) Average working life Investment return Interest cost

Recognition of actuarial gains and losses Arises on the revaluation of the pension funds assets and liabilities (effects of changes in actuarial assumption)

Recognise in OCI Recognise in IS Corridor approach if accumulated unrecognised actuarial G/L B/F exceeds greater of 10%: -FV of scheme assets b/f -PV of scheme liabilities b/f The excess will be spread over the expected average remaining working life to I/S explanation Current service cost Accounting Double entry Dr IS Cr liability

treatment The increase in the Operating cost actuarial expected from liability to arise employee

service in the current Interest cost period The increase in the Financial actuarial arising unwinding from of the the item Dr asset Cr IS Dr IS Cr liability item Dr IS Cr liability

liability adjacent to interest

discount Expected return on Expected increase in Financial assets the schemes assets Past service costs (if The increases in the Operating cost any) actuarial liability related to employees service in the prior period but arising in the current period as a result of the to, introduction of, or improvement retirement benefits

the market value of adjacent to interest

Format of employment benefits calculation Opening balance Prior yr adjustment Restated balance Expected return Interest cost Current service cost Past service cost Contribution Benefit paid Actuarial G/L Closing balance Presentation in SFP Scheme assets c/f Scheme liabilities c/f Net assets/liabilities Unrecognised actuarial G/L- b/f Recognised in I/S () Occurred in the year Unrecognised actuarial G/Lc/f Net pension Cash flow statement Reconciliation of operating profit to cash generated from operating activities Add back: net pension cost Less: pension cash contribution 12. IFRS 2 share-based payment Definition of share-based payment A share-based payment is a transaction in which the entity receives or acquires goods or services either as Consideration for its equity instruments or () /() Scheme assets /() Scheme liability /() /() /() IS

()

/()

By incurring liabilities for amounts based on the price of the entitys shares or other equity instruments of the entity. The accounting requirements for the share-based payment depend on how the transaction will be settled, that is, by the issuance of equity, cash, equity or cash.

13. Financial instruments There are four categories of financial assets Financial fair value assets at Held to maturity Loans and receivables Available assets for sale through investments

profit or loss These are held for These are quoted These are loans that This category is the company has default category

trading or elected to company investments the

be classified in this in redeemable debt made and do not have category. Derivatives instruments that the a quoted price. are always classified company will not be as held for trading selling unless they are maturity. effective hedges There are two categories of financial liabilities At fair value through the profit and loss Measured at amortised cost before

These are held for trading and derivatives This category is the default category and unless they are effective hedges. includes trade creditors, debt instruments issued and deposits from customers Initial measurement A financial asset or liability should initially be recognised at cost, the fair value of the consideration given or received for it. Transaction costs when buying assets are capitalised (except for financial assets at fair value with through the profit and loss)

How are financial assets subsequently measured on the balance sheet? Assets Financial Held to Loans Liabilities and Available for At fair value Measured at sale assets through profit Amortised cost On loss the On the amortised and cost the Amortised

assets at fair maturity value through investments profit or loss On the Amortised balance sheet cost at fair value with and gains losses

receivables

balance sheet balance sheet cost at fair value at fair value with and being gains with losses and gains losses

immediately recognised through profit the and

immediately the and

recognised in recognised reserves, but through recycled income disposal to profit

loss account.

on loss account

Impairment The impairment requirements apply to the following financial assets: Loans and receivables Held-to-maturity investments Available-for-sale financial assets Investments in unquoted equity instruments whose fair value cannot be reliable measured.

The only category of financial asset that is not subject to testing for impairment is financial assets at fair value through profit and loss. Since any decline in value for such assets is recognised immediately in profit and loss. For loans, receivables, and held-to-maturity investments, impaired assets are measured at the present value of estimated future cash flows, discounted using the original effective interest rate of the financial asset. 14. IAS 18 revenue recognition Recognition of revenue when selling goods

The seller has transferred to the buyer the significant risks and rewards of ownership The seller retains neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold The amount of revenue can be measured reliably It is probable that the economic benefits associated with the transaction will flow to the seller The costs incurred or to be incurred in respect of the transaction can be measured reliably.

Recognition of revenue when rendering of service The amount of revenue can be measured reliably It is probable that the economic benefits will flow to the seller The stage of completion at the balance sheet date can be measured reliably The costs incurred, or to be incurred, in respect of the transaction can be measured reliably

Recognition of revenue for interest, royalties, and dividends Interest on a time proportion basis Royalties on an accruals basis with the substance of the relevant agreement Dividends when the shareholders right to receive payment is established.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Checkpoint Exam 2 (Study Sessions 10-15)Document11 pagesCheckpoint Exam 2 (Study Sessions 10-15)Krishna GoelNo ratings yet

- CH 13 5Document2 pagesCH 13 5Meghna CmNo ratings yet

- AFSL Sample Application Aug 2010Document59 pagesAFSL Sample Application Aug 2010Martin PrettyNo ratings yet

- Gemini Solutions: AMC L0 - Session 4Document12 pagesGemini Solutions: AMC L0 - Session 4divya mittalNo ratings yet

- FNCE 391/891 - Corporate Restructuring: Course IntroductionDocument38 pagesFNCE 391/891 - Corporate Restructuring: Course IntroductionJoseph SmithNo ratings yet

- Mgt 401 final term quizDocument63 pagesMgt 401 final term quizJabbar Jamil100% (3)

- Productivity: What Is It?Document8 pagesProductivity: What Is It?Fabiano BurgoNo ratings yet

- Intrinsic vs Relative Valuation MethodsDocument5 pagesIntrinsic vs Relative Valuation MethodsHelio RochaNo ratings yet

- Corporate FinanceDocument99 pagesCorporate FinanceRere MerbolinNo ratings yet

- Balanced Funds Guide - Risk-Return Profiles and Fund TypesDocument19 pagesBalanced Funds Guide - Risk-Return Profiles and Fund TypesInvest EasyNo ratings yet

- 226-Article Text-601-1-10-20210702Document12 pages226-Article Text-601-1-10-20210702Leni NopriyantiNo ratings yet

- Money Management Trading Forex: Hari Modal Lot Ketahanan Profit WD TotalDocument26 pagesMoney Management Trading Forex: Hari Modal Lot Ketahanan Profit WD TotallezanofanNo ratings yet

- Securization and The Global EconomyDocument262 pagesSecurization and The Global EconomyHeeveerson Fonseca100% (1)

- BUSINESS ORGANIZATIONSDocument22 pagesBUSINESS ORGANIZATIONSAnusha ReddyNo ratings yet

- 911 BIZ201 Assessment 3 Student WorkbookDocument7 pages911 BIZ201 Assessment 3 Student WorkbookAkshita ChordiaNo ratings yet

- Examiner's Report: F9 Financial Management June 2018Document10 pagesExaminer's Report: F9 Financial Management June 2018Ngo Vinh AccaNo ratings yet

- ArbitrageDocument3 pagesArbitragemadihasaleems100% (1)

- TBchap 014Document96 pagesTBchap 014DemianNo ratings yet

- Financial Management Training. OKDocument139 pagesFinancial Management Training. OKGina Serafica SocratesNo ratings yet

- Comparison Between Money and Capital Market 2000-With-cover-page-V2Document49 pagesComparison Between Money and Capital Market 2000-With-cover-page-V2Nazeer ahmadNo ratings yet

- Chapter 9 MafinDocument36 pagesChapter 9 MafinReymilyn SanchezNo ratings yet

- Ratio Analysis of Suzlon EnergyDocument3 pagesRatio Analysis of Suzlon EnergyBharat RajputNo ratings yet

- List of Sub-Object Code - 20160322Document135 pagesList of Sub-Object Code - 20160322Julius AlemanNo ratings yet

- Taker: OperatorDocument60 pagesTaker: OperatorThomas PIERRENo ratings yet

- Brokerage Fees (Local & Foreign)Document3 pagesBrokerage Fees (Local & Foreign)Soraya AimanNo ratings yet

- Advanced Valuation Solutions for Company GrowthDocument28 pagesAdvanced Valuation Solutions for Company Growthneoss1190% (1)

- Arrow Et. Al. - 2004Document34 pagesArrow Et. Al. - 2004Ayush KumarNo ratings yet

- 360 ONE Flexicap Fund - LeafletDocument2 pages360 ONE Flexicap Fund - Leafletsalman672003No ratings yet

- Trade PolicyDocument11 pagesTrade PolicyRayhanDenNo ratings yet

- Yta School BBL 301023Document9 pagesYta School BBL 301023aahil.dakoraNo ratings yet