Professional Documents

Culture Documents

United Phosphorus: Performance Highlights

Uploaded by

Angel BrokingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

United Phosphorus: Performance Highlights

Uploaded by

Angel BrokingCopyright:

Available Formats

2QFY2013 Result Update | Agrichemical

October 23, 2012

United Phosphorus

Performance Highlights

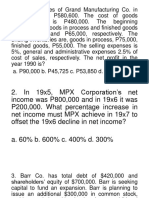

Y/E March (` cr) Net sales Other income Gross profit Operating profit Net profit 2QFY2013 1,802 80 862 272 120 1QFY2013 2180 69 1039 353 203 % chg (qoq) (17.4) 0.0 (17.0) (22.8) (41.0) 2QFY2012 1721 75 943 256 68 % chg (yoy) 4.7 6.7 (8.6) 6.5 76.0

BUY

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Net Debt (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Agrichemical 5,390 1,677 0.7 169/105 164597 2 18,710 5,691 UNPO.BO UNTP@IN

`124 `170

12 Months

Source: Company, Angel Research

For 2QFY2013, United Phosphoruss (UPL) revenue grew by 4.7% yoy to `1,802cr and net PAT grew by 76.0% to `120cr. The management has maintained its positive revenue guidance of 15% for FY2013 and OPM guidance at 18-20%. In spite of factoring in conservative numbers, the stock is quoting at an attractive valuation of 7.0x FY2014E EPS; hence, we maintain our Buy rating on the stock. Robust net profit growth: UPL reported consolidated revenues of `2,180cr, registering a growth of 4.7% yoy. Volumes contracted 2%, the price increased by 5% while the balance 2% was contributed by a favorable impact of exchange. On the operating front, the company reported a flat EBITDA margin at 15.1%, (14.8% in 2QFY2012). However, on account of a 57.2% yoy dip in the interest expenditure, the net profits came in at Rs120cr, registering a growth of 76.0%. Outlook and valuation: We expect UPL to post a CAGR of 10.0% and 18.4% in its sales and PAT over FY2012-14, respectively. At the current valuation of 7.0x FY2014E EPS, the stock is attractively valued. Hence, we maintain our Buy recommendation on the stock with a revised target price of `170.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 28.0 25.0 38.2 8.8

Abs. (%) Sensex UPL

3m 10.9

1yr 11.5

3yr 11.3

(2.5) (17.3) (24.8)

Key financials (Consolidated)

Y/E March (` cr) Total revenue % chg Adj. profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2011 5,805 7.3 552 0.6 19.3 12.0 9.9 1.5 16.4 16.7 1.2 6.1

FY2012E 7,655 31.9 561 1.6 16.5 12.2 9.7 1.3 14.2 16.1 1.0 6.2

FY2013E 8,421 10.0 695 23.8 16.5 15.0 7.9 1.2 15.6 15.0 0.9 5.2

FY2014E 9,263 10.0 787 13.2 16.5 17.0 7.0 1.0 15.5 15.3 0.7 4.4

Sarabjit Kour Nangra

+91-22-3935 7800 ext. 6806 sarabjit@angelbroking.com

Please refer to important disclosures at the end of this report

United Phosphorus | 2QFY2013 Result Update

Single digit top-line growth

UPL reported consolidated revenues of `1,802cr, registering a growth of 4.7% yoy. Volumes contracted 2%, the price increased 5% while the balance 2% was contributed by a favorable impact of exchange. According to the regions, the main growth came in from the EU where revenues increased by 22.1%. The rest of world (RoW) revenues increased by 22.1%. On the other hand, Latin America registered a 17% growth. USA and India on the other hand de-grew by 9% and 14% respectively.

Exhibit 1: Sales performance

2,400 2,100 1,800 1,500 1,721 1,872 2,119 2,180 1,802

Exhibit 2: Growth break-up

6 5 4 3

(%)

(` cr)

1,200 900 600 300 0 2QFY2012 3QFY2012 4QFY2012 1QFY2013 2QFY2013

2 1 0

(1) (2) (3)

Exchange impact Realisation

(2)

Volume

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 3: Volume and realisation break-up (yoy)

40 35 30 25 31 31

(%)

20 15 10 5 0 (5) 2QFY2012 3QFY2012 4QFY2012 1QFY2013 Realisation Volume (2) 2QFY2013 8 4 4 12 5 4 5

Source: Company, Angel Research

EBITDA margin remains steady

During 2QFY2013, UPL on the operating front, reported a flat EBITDA margin at 15.1%, (14.8% in 2QFY2012). For FY2013, the management expects an OPM of 18-20%.

October 23, 2012

United Phosphorus | 2QFY2013 Result Update

Exhibit 4: EBITDA margin trend

20 19 18 17 16

(%)

15 14 13 12 11 10

16 15

16

16 15

2QFY12

3QFY12

4QFY12

1QFY13

2QFY13

Source: Company, Angel Research

Adj. net profit grew by 76.0% yoy

While the OPM came in flat, however, on account of a 57.2% yoy dip in the interest expenditure, the net profit came in at Rs120cr, registering a growth of 76.0% yoy.

Exhibit 5: Adjusted PAT trend

250 205 200 150 113 100 50 0 2QFY12 3QFY12 4QFY12 Adj PAT 1QFY13 % YoY 2QFY13 68 203 180 160 140 120 100 80 60 40 20 0 (20) (40)

(` cr)

Source: Company, Angel Research

October 23, 2012

(%)

120

United Phosphorus | 2QFY2013 Result Update

Investment arguments

Innovators dominant in the off-patent space Generic firms in a sweet spot

The global agrichem industry, valued at US$40bn (CY2008), is dominated by the top six innovators, viz Bayer, Syngenta, Monsanto, BASF, DuPont and Dow, which enjoy a large market share of the patented (28%) and off-patent (32%) market. Pertinently, the top six innovators also enjoy a large share of the off-patent market due to high entry barriers for pure generic players. Thus, one-third of the total pie worth US$13bn (controlled by the top six innovators through proprietary off-patent products) provides a high-growth opportunity for larger integrated generic players such as UPL.

Generic segments market share to increase

Generic players have been garnering a high market share, increasing from 32% levels in 1998 to 40% by 2006-end. The industry registered a CAGR of 3% over 1998-2006, while generic players outpaced the industry with a CAGR of 6%. Going ahead, given the opportunities and a drop in the rate of new molecule introduction by innovators, we expect generic players to continue to outpace the industrys growth and increase their market share in the overall pie. Historically, the global agrichem players have been logging growth in-line with global GDP. Going ahead, over CY2009-11E, the global economy is expected to grow by 34%. Assuming this trend plays out in terms of growth for the agrichem industry and the same rate of genericisation occurs, the agrichemical generic industry could log in 6-8% yoy growth during the period and garner a market share of 44-45%.

A global generic play

UPL figures among the top five global generic agrichemical players, with presence across major markets, including the US, EU, Latin America and India. Given the high entry barriers by way of high investments, entry of new players is also restricted. Thus, amidst this scenario and on account of having a low-cost base, we believe UPL enjoys an edge over competition and is placed in a sweet spot to leverage the upcoming opportunities in the global generic space.

October 23, 2012

United Phosphorus | 2QFY2013 Result Update

Outlook and valuation

Over the last few years, the global agriculture sector has been rejuvenating/reviving on the back of rising food prices. Food security is also a top priority for most governments; reducing food loss is one of the easiest ways to boost food inventory. Hence, we believe agrichemical companies would continue to do well in the wake of heightened food security risks, and strong demand is likely to be witnessed across the world. Overall, we expect the global agrichemical industry to perform well from here on. However, generics are expected to register a healthy growth due to a) increasing penetration and wresting market share from innovators and b) patent expiries worth US$3bn4bn (2007) over 2009-14. We estimate UPL to post a 10.0% and 18.4% CAGR in sales and PAT, respectively, over FY2012-14. The stock is trading at an attractive valuation of 7.1x FY2014E EPS. Hence, we maintain our Buy recommendation on the stock with a target price of `170.

Exhibit 6: Key assumption

FY2013E Sales growth EBITDA margin Tax rate

Source: Company, Angel Research

FY2014E 10.0 16.5 20.0

10.0 16.5 20.0

Exhibit 7: P/E band

300 250 200 150 100 50 0

Mar-05

Mar-06

Mar-07

Mar-08

Mar-09

Mar-10

Mar-11

Mar-12

Sep-04

Sep-05

Sep-06

Sep-07

Sep-08

Sep-09

Sep-10

Sep-11

9.0x

Source: Company, Angel Research

11.0x

13.0x

15.0x

17.0x

October 23, 2012

Sep-12

United Phosphorus | 2QFY2013 Result Update

Background

United Phosphorus (UPL) is a global generic crop protection, chemicals and seeds company. The company is fully backward and forward integrated by taking advantage of the consolidation opportunities within the agrochemical industry. UPL is the largest Indian agrochemical company and has revenue of about US$1.3mn in March2011.

Profit & Loss Statement (Consolidated)

Y/E March (` cr)) Net Sales Other operating income Total operating income % chg Total Expenditure Net Raw Materials Other Mfg costs Personnel Other EBITDA % chg (% of Net Sales) Depreciation& Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Recurring PBT % chg Extraordinary Expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) Add: Share of earnings of asso. Less: Minority interest (MI) Prior period items PAT after MI (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg FY09 4,802 129 4,931 35.4 3,987 2,451 885 479 172 945 53.2 19.7 193 752 62.0 15.2 292 42 8 502 20.8 (10) 492 27 5.5 465 20 2 27 456 466 25.3 9.7 10.6 10.6 (37.4) FY10 5,290 118 5,408 9.7 4,461 2,954 839 502 166 947 0.2 17.9 215 732 (2.6) 13.5 145 34 6 621 23.8 (23) 598 81 13.6 517 19 6 3 526 549 17.9 10.4 12.5 12.5 17.9 FY11 5,761 137 5,805 7.3 5,018 2,902 1,191 515 410 1,111 17.3 19.3 214 897 22.5 15.5 312 214 32 678 9.2 5 664 73 11.0 591 (23) 10 558 552 0.6 9.6 12.0 12.0 (4.3) FY12 7,534 121 7,655 31.9 6,288 4,058 1,267 686 277 1,246 12.2 16.5 292 1,075 19.9 14.0 415 109 14 769 13.3 18 751 128 17.0 623 (35) 5 27 556 561 1.6 7.5 12.2 12.2 1.6 FY13E 8,585 164 8,421 10.0 7,165 4,624 1,443 782 316 1,420 14.0 16.5 339 1,246 15.9 14.8 422 109 12 933 21.3 933 187 20.0 746 (37) 5 9 695 695 23.8 8.1 15.0 15.0 23.8 FY14E 9,427 164 9,263 10.0 7,868 5,078 1,585 858 347 1,559 9.8 16.5 360 1,364 9.5 14.7 422 109 10 1,051 12.7 1,051 210 20.0 841 (40) 5 9 787 787 13.2 8.3 17.0 17.0 13.2

October 23, 2012

United Phosphorus | 2QFY2013 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Preference Capital Reserves& Surplus Shareholders Funds Minority Interest Total Loans Other Long term liabilities Long Term Provisions Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill / Intangilbles Investments Long Term Loan & Adv. Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Others Total Assets 3,302 2,049 1,252 124 473 433 4,117 554 738 2,825 1,623 2,494 4,777 3,210 1,920 1,290 41 482 761 4,324 1,578 469 2,277 1,462 2,863 5,437 3,947 2,174 1,773 57 548 823 220 4,777 700 587 3,490 2,890 1,886 5,307 4,687 2,605 2,082 306 1,141 795 259 5,671 1,566 326 3,780 2,240 3,432 8,014 4,987 2,944 2,043 306 1,141 795 295 6,568 1,890 371 4,307 2,550 4,019 8,598 5,287 3,303 1,983 306 1,141 795 324 7,528 2,391 408 4,729 2,802 4,726 9,274 88 2,585 2,673 10 2,134 (40) 4,777 88 2,904 2,992 14 2,419 11 5,437 92 3,634 3,726 18 1,497 (8) 5,307 92 4,081 4,173 250 3,245 301 51 (6) 8,014 92 4,660 4,752 255 3,245 301 51 (6) 8,598 92 5,331 5,423 260 3,245 301 51 (6) 9,274 FY09 FY10 FY11 FY12 FY13E FY14E

October 23, 2012

United Phosphorus | 2QFY2013 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Less: Other income Direct taxes paid Cash Flow from Operations (Inc.)/ Dec. in Fixed Assets (Inc.)/ Dec. in Investments Inc./ (Dec.) in loans and adv. Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY09 492 193 (924) (83) (322) (414) (36) (450) (480) (51) 1,148 617 (155) 709 554 FY10 598 215 655 (81) 1,387 175 (328) (153) (285) (77) 152 (210) 1,024 554 1,578 FY11 664 214 99 (73) 904 (753) (62) (815) 312 922 (103) (455) 676 (878) 1,578 700 FY12 751 292 (680) (128) 235 (989) 29 (961) 1,747 (116) (41) 1,591 866 700 1,566 FY13E 933 339 (263) (187) 822 (300) (300) (116) (83) (198) 324 1,566 1,890 FY14E 1,051 360 (206) (210) 994 (300) (300) (116) (77) (193) 501 1,890 2,391

October 23, 2012

United Phosphorus | 2QFY2013 Result Update

Key Ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value DuPont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WCcycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.) 0.6 1.6 2.6 0.2 0.6 5.0 (0.0) (0.0) 2.9 0.2 0.7 2.6 0.1 0.4 3.0 0.0 0.0 3.2 1.6 103 77 84 112 1.7 91 85 80 111 1.6 76 87 96 78 1.8 78 79 66 74 1.7 87 87 70 85 1.8 89 89 71 86 17.4 20.1 19.0 14.3 23.4 19.4 16.7 19.2 16.4 16.1 22.8 14.2 15.0 21.5 15.6 15.3 22.7 15.5 15.2 94.5 1.5 21.8 8.1 0.5 28.9 13.5 86.4 1.5 18.0 5.9 0.4 22.4 15.5 89.0 1.5 20.2 14.2 0.3 21.8 14.0 83.0 1.6 18.6 14.5 0.4 20.1 14.8 80.0 1.5 17.6 10.4 0.4 20.2 14.7 80.0 1.6 18.5 10.4 0.4 21.6 10.6 10.6 15.0 1.5 60.8 12.5 12.5 17.4 2.0 68.1 12.0 12.0 16.6 2.0 81.2 12.2 12.2 18.5 2.5 90.4 15.0 15.0 22.4 2.5 102.9 17.0 17.0 24.8 2.5 117.4 11.2 7.9 1.9 1.3 1.7 8.4 1.7 9.5 6.8 1.7 1.7 1.3 7.2 1.3 9.9 7.1 1.5 1.7 1.2 6.1 1.3 9.7 6.4 1.3 2.1 1.0 6.2 1.0 7.9 5.3 1.2 2.1 0.9 5.2 0.9 7.0 4.8 1.0 2.1 0.7 4.4 0.7 FY09 FY10 FY11 FY12 FY13E FY14E

October 23, 2012

United Phosphorus | 2QFY2013 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

UPL No Yes No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

October 23, 2012

10

You might also like

- Paper 2 Study MaterialDocument328 pagesPaper 2 Study MaterialGF BF100% (1)

- Chapter 7Document9 pagesChapter 7Coursehero PremiumNo ratings yet

- Midterm Reviewer Cost AccountingDocument14 pagesMidterm Reviewer Cost AccountingPrecious AnneNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Cost Accounting Test Bank CKDocument12 pagesCost Accounting Test Bank CKLeo Tama67% (9)

- Ahuna Inc - Problem 37-B Chapter 3, PG 137Document4 pagesAhuna Inc - Problem 37-B Chapter 3, PG 137Tooba Hashmi100% (1)

- OM Assignment - Decision Tree Using NPVDocument5 pagesOM Assignment - Decision Tree Using NPVNick SolankiNo ratings yet

- Heineken Beer CASE STUDYDocument47 pagesHeineken Beer CASE STUDYSaurabh Chaudhari100% (1)

- Entrep. Module 10... Grade 12 BezosDocument13 pagesEntrep. Module 10... Grade 12 Bezosadrian lozano0% (1)

- United Phosphorus: Performance HighlightsDocument12 pagesUnited Phosphorus: Performance HighlightsAngel BrokingNo ratings yet

- United Phosphorus Result UpdatedDocument11 pagesUnited Phosphorus Result UpdatedAngel BrokingNo ratings yet

- UPL, 30th January 2013Document11 pagesUPL, 30th January 2013Angel BrokingNo ratings yet

- Britannia: Performance HighlightsDocument11 pagesBritannia: Performance HighlightsAngel BrokingNo ratings yet

- GSK Consumer, 21st February, 2013Document10 pagesGSK Consumer, 21st February, 2013Angel BrokingNo ratings yet

- Britannia 2QFY2013RUDocument10 pagesBritannia 2QFY2013RUAngel BrokingNo ratings yet

- Colgate 2QFY2013RUDocument10 pagesColgate 2QFY2013RUAngel BrokingNo ratings yet

- United Spirits 4Q FY 2013Document10 pagesUnited Spirits 4Q FY 2013Angel BrokingNo ratings yet

- Rallis India: Performance HighlightsDocument10 pagesRallis India: Performance HighlightsAngel BrokingNo ratings yet

- Aurobindo, 1Q FY 2014Document11 pagesAurobindo, 1Q FY 2014Angel BrokingNo ratings yet

- Dishman Pharmaceuticals: Performance HighlightsDocument10 pagesDishman Pharmaceuticals: Performance HighlightsAngel BrokingNo ratings yet

- Market Outlook 19th April 2012Document7 pagesMarket Outlook 19th April 2012Angel BrokingNo ratings yet

- Dr. Reddy's Laboratories: Performance HighlightsDocument11 pagesDr. Reddy's Laboratories: Performance HighlightsAngel BrokingNo ratings yet

- Dr. Reddy's Laboratories Result UpdatedDocument11 pagesDr. Reddy's Laboratories Result UpdatedAngel BrokingNo ratings yet

- Cadila Healthcare: Performance HighlightsDocument12 pagesCadila Healthcare: Performance HighlightsAngel BrokingNo ratings yet

- Indoco Remedies: Performance HighlightsDocument11 pagesIndoco Remedies: Performance HighlightsAngel BrokingNo ratings yet

- Indoco Remedies Result UpdatedDocument11 pagesIndoco Remedies Result UpdatedAngel BrokingNo ratings yet

- Infosys Result UpdatedDocument15 pagesInfosys Result UpdatedAngel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- Infosys: Performance HighlightsDocument15 pagesInfosys: Performance HighlightsAtul ShahiNo ratings yet

- Marico 4Q FY 2013Document11 pagesMarico 4Q FY 2013Angel BrokingNo ratings yet

- United Spirits, 1Q FY 2014Document10 pagesUnited Spirits, 1Q FY 2014Angel BrokingNo ratings yet

- Cipla: Performance HighlightsDocument11 pagesCipla: Performance HighlightsAngel BrokingNo ratings yet

- HUL Result UpdatedDocument11 pagesHUL Result UpdatedAngel BrokingNo ratings yet

- Godrej Consumer Products: Performance HighlightsDocument11 pagesGodrej Consumer Products: Performance HighlightsAngel BrokingNo ratings yet

- Ipca Labs Result UpdatedDocument12 pagesIpca Labs Result UpdatedAngel BrokingNo ratings yet

- Indoco Remedies 4Q FY 2013Document11 pagesIndoco Remedies 4Q FY 2013Angel BrokingNo ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- Infosys Result UpdatedDocument14 pagesInfosys Result UpdatedAngel BrokingNo ratings yet

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingNo ratings yet

- Godrej Consumer ProductsDocument12 pagesGodrej Consumer ProductsAngel BrokingNo ratings yet

- Dabur India 4Q FY 2013Document11 pagesDabur India 4Q FY 2013Angel BrokingNo ratings yet

- GSK Consumer 1Q CY 2013Document10 pagesGSK Consumer 1Q CY 2013Angel BrokingNo ratings yet

- Satyam 4Q FY 2013Document12 pagesSatyam 4Q FY 2013Angel BrokingNo ratings yet

- GSK Consumer: Performance HighlightsDocument9 pagesGSK Consumer: Performance HighlightsAngel BrokingNo ratings yet

- Colgate: Performance HighlightsDocument9 pagesColgate: Performance HighlightsAngel BrokingNo ratings yet

- Asian Paints Result UpdatedDocument10 pagesAsian Paints Result UpdatedAngel BrokingNo ratings yet

- GCPL, 4th February, 2013Document11 pagesGCPL, 4th February, 2013Angel BrokingNo ratings yet

- Ipca Labs Result UpdatedDocument10 pagesIpca Labs Result UpdatedAngel BrokingNo ratings yet

- Cadila Healthcare Result UpdatedDocument12 pagesCadila Healthcare Result UpdatedAngel BrokingNo ratings yet

- Mindtree, 1Q FY 2014Document12 pagesMindtree, 1Q FY 2014Angel BrokingNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument20 pagesMarket Outlook Market Outlook: Dealer's DiaryangelbrokingNo ratings yet

- Britannia 1QFY2013RU 140812Document10 pagesBritannia 1QFY2013RU 140812Angel BrokingNo ratings yet

- Cravatex: Performance HighlightsDocument14 pagesCravatex: Performance HighlightsAngel BrokingNo ratings yet

- Lupin Result UpdatedDocument11 pagesLupin Result UpdatedAngel BrokingNo ratings yet

- GSK Consumer, 2Q CY 2013Document10 pagesGSK Consumer, 2Q CY 2013Angel BrokingNo ratings yet

- Market Outlook 19th January 2012Document8 pagesMarket Outlook 19th January 2012Angel BrokingNo ratings yet

- Marico: Performance HighlightsDocument12 pagesMarico: Performance HighlightsAngel BrokingNo ratings yet

- Dabur India: Performance HighlightsDocument10 pagesDabur India: Performance HighlightsAngel BrokingNo ratings yet

- Dabur India Result UpdatedDocument12 pagesDabur India Result UpdatedAngel BrokingNo ratings yet

- GSK Consumer Result UpdatedDocument9 pagesGSK Consumer Result UpdatedAngel BrokingNo ratings yet

- Dabur India, 31st January 2013Document10 pagesDabur India, 31st January 2013Angel BrokingNo ratings yet

- Lupin Result UpdatedDocument11 pagesLupin Result UpdatedAngel BrokingNo ratings yet

- Rallis India Result UpdatedDocument9 pagesRallis India Result UpdatedAngel BrokingNo ratings yet

- Indoco Remedies, 30th January 2013Document11 pagesIndoco Remedies, 30th January 2013Angel BrokingNo ratings yet

- Hul 2qfy2013ruDocument12 pagesHul 2qfy2013ruAngel BrokingNo ratings yet

- Infotech Enterprises: Performance HighlightsDocument13 pagesInfotech Enterprises: Performance HighlightsAngel BrokingNo ratings yet

- Dishman 4Q FY 2013Document10 pagesDishman 4Q FY 2013Angel BrokingNo ratings yet

- EIB Investment Survey 2023 - European Union overviewFrom EverandEIB Investment Survey 2023 - European Union overviewNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Fa2 Mock Exam 2Document10 pagesFa2 Mock Exam 2Iqra HafeezNo ratings yet

- Analysis of Key Financial RatiosDocument31 pagesAnalysis of Key Financial RatiosMaxhar AbbaxNo ratings yet

- Suspense QuestionsDocument15 pagesSuspense QuestionsChaiz MineNo ratings yet

- Valuation of Assets and Liabilities in an AcquisitionDocument2 pagesValuation of Assets and Liabilities in an AcquisitionMelanie SamsonaNo ratings yet

- Homework 2 Managerial AccountingDocument3 pagesHomework 2 Managerial AccountingMartial ATTANo ratings yet

- Financial Analysis of United Plantation Berhad and Jaya Tiasa Holdings BerhadDocument33 pagesFinancial Analysis of United Plantation Berhad and Jaya Tiasa Holdings Berhadwawan100% (1)

- 101-Accounting For Buisness DecisionsDocument268 pages101-Accounting For Buisness DecisionsAkshay GadeNo ratings yet

- Lotus Income StatementDocument6 pagesLotus Income StatementJoseph AsisNo ratings yet

- Analysis For Financial Management 11Th Edition Higgins Solutions Manual Full Chapter PDFDocument36 pagesAnalysis For Financial Management 11Th Edition Higgins Solutions Manual Full Chapter PDFmarcia.tays151100% (14)

- Understanding Long-Lived AssetsDocument14 pagesUnderstanding Long-Lived AssetsmostakNo ratings yet

- Grand Manufacturing net profit calculationDocument10 pagesGrand Manufacturing net profit calculationRichfredlyn Moreno100% (1)

- Different Methods of Ranking Investment ProposalsDocument3 pagesDifferent Methods of Ranking Investment ProposalsPratibha Nagvekar100% (1)

- BAO6504 Lecture 2, 2014Document20 pagesBAO6504 Lecture 2, 2014LindaLindyNo ratings yet

- Crompton GreavesDocument12 pagesCrompton GreavesAngel BrokingNo ratings yet

- 25,860 $1,003,360 $1,003,360 (A) Journalize The Adjusting EntriesDocument5 pages25,860 $1,003,360 $1,003,360 (A) Journalize The Adjusting Entriesmohitgaba19No ratings yet

- Reliance IndustriesDocument32 pagesReliance IndustriesZia AhmadNo ratings yet

- Top Glove Group AssignmentDocument24 pagesTop Glove Group AssignmentvithyaNo ratings yet

- AssignmentsDocument3 pagesAssignmentsVikin JainNo ratings yet

- Cost Analysis Learning ObjectiveDocument14 pagesCost Analysis Learning ObjectiveRohitPatialNo ratings yet

- Fundamentals Accountancy, Business & ManagementDocument14 pagesFundamentals Accountancy, Business & ManagementJoyce OberesNo ratings yet

- UntitledDocument6 pagesUntitledBipin Kumar JhaNo ratings yet

- Financial Reporting (International) : Wednesday 5 June 2013Document9 pagesFinancial Reporting (International) : Wednesday 5 June 2013Ruslan LamievNo ratings yet