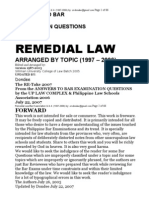

Professional Documents

Culture Documents

Part III. Income Taxation: Nirc)

Uploaded by

paul_jurado18Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Part III. Income Taxation: Nirc)

Uploaded by

paul_jurado18Copyright:

Available Formats

Part III.

Income Taxation

1. The General Principles of Income Taxation in the Philippines 2. Kinds of Income Taxation 3. Items of gross income from sources within the Philippines (Sec. 42 NIRC) 4. Rule on Income Within and Without the Philippines (Sec. 40 NIRC) a. The fifty (50%) per cent rule 5. Income Tax, defined a tax on all yearly profits arising from property, professions, trades, or offices, or as a tax on persons income, emoluments, profits and the life. It is a direct tax. 6. Nature of Income Tax a. It is self assessing or self computed b. It is a national tax c. It is generally regarded as an excise tax because it is actually a levy upon the right to earn an income d. It is a direct tax e. It is a general tax f. It is not covered by the Principle of teritoriality

7. Functions of Income a. To provide large amounts of revenues b. To offset regressive taxes c. To mitigate the evils arising from inequalities in the distribution of income and wealth which are considered deterrents to social progress by a progressive scheme of taxation.

Part IV. The Present Income Tax System of the Philippines

1. The Philippine Income Tax Law a. Historical Background The first income tax law enforced in the Philippines was US Revenue Act of 1913, this was amended by Revenue Act Act of1916 under which the Philippine legislature was authorized to enact its own income tax law. The first Philippine income tax law was Act No. 2833 passed on March 9, 1919 with several amendments kntroduced over the years to make it more effective CA No. 466, the NIRC of June 15, 1939 was passed by the National Assembly codifying all internal revenue laws then in force in the country. In 1977 PD 1158 was enacted consolidating the NIRC of 1939, amendatory laws and decrees into a single code known as the NIRC of 1977. 2. The Purpose and Salient Features of RA 9504

3. Basic Features of our Present Income Tax System (Admu) a. Direct tax tax burden us borne by the income tax recipient upon whom the tax is imposed b. Progressive tax tax rate increases as the tax base increases; direct taxes are to be preferred and as much as possible, indirect taxes should be minimized (Tolentino vs. Secretary of Finance) c. Comprehensive System adopts the citizenship principle, residence principle and the source principle d. Semi-schedular or semi-global tax system certain passive incomes and capital gains are subject to final taxes at preferential rates while all other income are added together to arrive at the gross income and after deducting the sum of allowable deductions, the taxable income is subjected to one set of graduated tax rates for an individual or normal corporate income tax rate for corporations. 4. The Global Income Taxation and the Schedular Income Taxation, Defined/Compared Global Income Taxation A system which taxes all categories of income except certain passive income and capital gains. It prescribes a unitary but progressive rate for the taxable aggregate income and flat rates for certain passive income. The total allowable deductions, Schedular Income Taxation A system employed where the income tax treatment varies and is made to depend on the kind or category of taxable income of the taxable. It has different rates. Separate returns are filed by the

personal and additional exemptions are deducted from the gross income. It is based on the aggregate income from all sources that are not subject to final income tax. The globalized income is subject to a unitary but progressive and graduated rate of 0% to 32% Corporate taxpayers adopt this system. All their income are globalized and taxed at 32%

recipient of the income except for passive income. The income from different sources are not globalized, they are treated separately and are subject to different sets of graduated or flat income. It itemizes the different incomes and provides for varied rate of taxes are applied thereto. It has different rates Individual taxpayers follow this system. Their income from different sources are classified and treated differently.

5. Semi-schedular or semi-global Tax System, defined This was adopted on January 1, 1986 under EO 37. It reduces the range of graduated tax rates applied on the net taxable incomeof self-employed and professionals from 5% to 60% to 0% to 35%, the same set fo tax rates applied on compensation income, but increased the preferential tax rates on capital gains and passive investment incomes. Under this system, the compensation income, busainess or professional income, capital gain and passive income not subject to final tax and other income are added together to arrive at the gross income and after deducting the sum of allowable deductions is subjected to one set of graduated tax rates. The computation of the income tax is global. However, passive investment income subject to final tax and capital gains from the sale or transfer of shares of stocks of a DC and real properties remain subject to different sets of tax rates and covered by different tax returns. The schedular tax system applies to the capital gains and passive incom subject to final tax and preferential tax rates. Our country follows the semi schedular or semi global system. We follow the global tax system insofar as compensation income, business and professional income, capital gains not subject to final tax, passive incomes, and other income not subject to final tax. 6. The difference between Gross Income Taxation and Net Income Taxation Gross Income Taxation The income tax is fixed or computed without allowable deductions Applies to (a) compensation income earners (b) to non resident aliens not engaged in trade or business Net Income Taxation The gross income of the taxpayer is reduced by allowable deductions Applies to (a) self employed taxpayers in business or exercise of profession (b) domestic corp.,

(c) special aliens (d) non resident foreign corporations A final tax is imposed on the gross amount of specifies types of income, such as interest, royalties, prize, dividend and capital gains

(c) resident corporation and (d) special corporation Where certain deductions are allowed and subtracted from the aggregate of income not to final tax and the tax is computed on the resulting net income therefrom.

7. The Advantages and Disadvantages of Net Income Taxation and Gross Income Taxation Advantages 1. The computation is simple 2. Less discretion is allowed the tax examiners 3. Less probability of connivance between taxpayer and tax examiners 4. Examination and/or investigation of tax returns can be faster or even do away with it 5. Favorable to the authirities because they may be able to collect more taxes 6. If coupled with an effective witholding tax system government is assured to bigger revenue. Disadvantages 1. Taxpayer may derived gross income but suffers net loss 2. Rule on taxation may not be equitable and uniform 3. What could be taxed may not be income but mere return of capital 4. This system may serve as a disincentive to further production and distribution of essential commodities necessary for economic development 5. The government may end up collecting lesser taxes in the absence of audit, because the taxpayers may cheats on the sources of their income. 8. Income Defined (SBC) All such gains or profits from whatever source. It is a flow of services rendered by capital by the payment of money from it or any benefit rendered by a fund of capital in relation to such fund through a period of time. 9. Capital Defined

10. Receipt Defined - It has reference to all wealth that flows into the taxpayer which includes return of capital. 11. Receipt Defined - It has reference to all wealth that flows into the taxpayer which includes return of capital.

TAXABLE INCOME refers to gross income less allowable deductions and/or personal and additional exemptions and health/hospitalization premium allowances.

12.

Forms of Income a. Cash b. Property c. Cash and property combined

13.

Test on the Realization of Income a. Severance test (Theory of separability) Under this theory, in order that income may exist there must be separation of capital and gain. b. Substantial alteration test There must be an exchange of something received which is essentially different from that which was parted to the extent of benefit received (Ex. Land to cash, shares of stocks to cash, etc.) c. Flow of wealth theory Under this theory, taxation is established on a realization, rather than on an accrual basis. The increase in the value of the capital asset are taxed only when the property is sold and the increased value is reflected in a flow of money to the owner, rather than on the basis of annual revaluation of assets d. Doctrine of ownership, command or control of income He who exercises the power to dispose of income shows ownership thereof. The income tax law applies to those who earn or otherwise create the right to receive it and enjoy the benefit of it when paid. e. Doctrine of proprietary interest Where shares of stocks, options or other assets are transferred by an employer to an employee to secure better services they are plainly compensation which is taxable income. f. Claim of right doctrine A taxable gain is conditioned upon the presence of a claim or right to the alleged gain and the absence of a definite unconditional obligation to return or repay that which would otherwise constitute a gain. g. Doctrine of actual receipt of income

h. Doctrine of constructive receipt of incom

The withdrawl this year of the deposits in court pertaining to last years rental income is not sufficient justification for the non declaration of said income last year, since the deposit was resorted to by the lessee due to the refusal of the lessor to accept the same, and the tenants were at fault. CONSTRUCTIVE RECEIPT OF INCOME defined This refers to a case when an income is credited to the account of, or set apart for a taxpayer and which may be drawn by him at any time without any substantial limitations or conditions upon which payment is to be made. Once credited or set apart said amount is already taxable to the person. i. Doctrine of involuntary conversion of property (ADMU) This is a doctrine provided for in US Jurisprudnce (Herver vs Helvering) and was adopted by the BIR in several of its rulings This doctrine states that if property (as a result of its destruction, in whole or in part, theft or seizure, or an exercise of the power of requisition or condemnation or the threat of imminence thereof) is compusorily or involuntarily converted into property similar to the property so expanded in the acquisiotion of other property, or in the establishment of a replacement fund, no gain or loss shall be recognized. If any part of the money is not so expended, the gain shall be recognzed, but in an amount not in excess of the money so expended. j. Doctrine of cash equivalent

14. a. b. c. d. e. 15.

Factors that determines the Imposition of Philippine Income Tax Citizenship (citizenship principle) Residence (Residence principle) Source of income (source principle) Kind of tax Place where service was rendered Kinds of Income Tax under RA 8424 a. Graduated Income tax on individuals 1. Net income tax 2. Gross incometax b. Normal corporate income tax on corporations c. Final witholding tax system on certain passive investment income paid to residents

d. Final witholding tax on income payments made to non residents e. Capital gains tax on sale or exchage of real property classified as a capital asset f. Branch profit remittance tax g. Tax on improperly accumulated earning of corporations h. Fringe benefit tax on fringe benefits of supervisory or managerial employees i. Preferential rates or special rates of income tax on individuals or corporations j. Minimum corporate income tax k. Optional corporate income tax 16. Imposition of Philippine Income Tax a. On net income 1. The worldwide income of a resident citizen 2. Non resident citizen on his income earned within the Philippines 3. OCW and Seamen on their income earned within the Phils 4. Resident alien on his income earned within the Phils 5. Non resident alien engaged in trade or business on his income earned within the Philippines 6. Worldwide income of a domestic corp 7. Foreign corporation engaged in trade or business on its income earned within the Philippines b. On gross income 1. Special Aliens on his income earned within the Philippines, 2. Non resident alien not engaged in trade or business on his income earned within the Phils 3. Non resident foreign corporation not engaged in trade or business on its income derived from Phil sources c. As a final tax 1. Certain passive income (interest, royalties, prizes and other winnings 2. Cash and property dividents 3. Capital gains from sale of domestic shares of stocks 4. Capital gains from sale of real properties classified as capital assets located in the Philippines 17. Possible Source of Income for Tax Purpose

SOURCE it refers to the activity, property or labor that gave rise or produced the income, or the oriin of the income a. Those derived from labor or service b. Those derived from capital c. Those derived from both labor and capital d. Those derived from sale, exchange of property 18. Classification of Income as to Source

a. Income from within the Philippines interests on bonds/notes, dividents; compensation for labor or services; rentals and royalties from property; gains, profits and income from sale of real and/or personal property b. Income from outside of the Philippines interest; dividends; compensation for labor or services; renals or royalties; gains, profits and income from sale of real or personal property c. Income from sources partly within and partly without the Philippines, such as gains,profits and income from transportation or other services rendered partly within and partly outside the country; sale of personal property produced within and sold outside or vice versa d. Professional income e. Business income f. Passive income g. Capital gains or income from sale or disposition of capital asset h. Income from whatever source 19. Income from whatever source derived defined All income not expressly excluded or exempted from the class of taxable income, irrespective of the voluntary or involuntary action of the taxpayer in producing the said income, and regardless of the source of the income, is taxable. 20. Imputed income defined These are income in kinds given to income earners as part of their compensation for services rendered, such as: meals, rice subsidy, living quarters,etc COMPENSATION INCOME all kinds of compensation for services rendered as a result of an ee-er . they include-salaries, wages, fees, commissions, honoraria, bonuses, tips, allowances for transportation, representation and entertainment; amount services as an award for special services or fruitful suggestions to the er-fringe benefits; christmas gifts based upon fixed % pf salaries; commissions whether fixed or based of certain % of profit; amounts received for refraining from renderig services, premiums on life insurance paid by er on the life of an ee and others on account of labor performed to ee. 21. Income exempt from tax

22. Methods that may be used by the CIR to determine taxable income

Part V. Taxable Income

1. Taxable income, defined (ADMU) The pertinent items of gross income specified in this code, less the deductions and/or personal and aditional exemptions, if any, authorized for such types of income by this code or other special laws. 2. Requisites for income to be taxable

3. Taxpayers subject to net income tax under a. Sec 24A1a b. 24Aib c. 24Aic d. 25Ai e. 27A f. 27B g. 28A 4. Net income defined Gross income less allowable deductions and exemptions 5. Taxpayers subject to gross income tax (Sec 32 A NIRC)

6. Gross Income defined All income, gain or profit subject to tax, whether the same is realized from legal or illegal activities. Unless exempt under the constitution, tax treaty or statute, or considered mere return of capital

7. Gross Compensation Income defined

8. What Constitutes other benefits

9. Passive incomes subject to final tax (Sec 24 B, C and D NIRC)

You might also like

- Income Tax NotesDocument28 pagesIncome Tax NotesEL Filibusterisimo Paul CatayloNo ratings yet

- TAXATION I KEY TERMSDocument58 pagesTAXATION I KEY TERMSDrew RodriguezNo ratings yet

- Introduction To Income Tax Integ REVISED 2022 1Document14 pagesIntroduction To Income Tax Integ REVISED 2022 1brr brrNo ratings yet

- Gross Income 2019Document11 pagesGross Income 2019mysterymieNo ratings yet

- Income Tax: An Introduction to Key ConceptsDocument21 pagesIncome Tax: An Introduction to Key ConceptsPrateek JhanjiNo ratings yet

- Module 4 - Income TaxationDocument6 pagesModule 4 - Income TaxationLumbay, Jolly MaeNo ratings yet

- Computation of Gross IncomeDocument10 pagesComputation of Gross IncomemysterymieNo ratings yet

- Morales Taxation Topic 8 Withholding TaxDocument9 pagesMorales Taxation Topic 8 Withholding TaxMary Joice Delos santosNo ratings yet

- Taxation 1 NotesDocument27 pagesTaxation 1 NotesKate CalansinginNo ratings yet

- Notes On Income TaxationDocument21 pagesNotes On Income TaxationBen Dela Cruz100% (2)

- Income Tax Matatag NotesDocument21 pagesIncome Tax Matatag NotesRicel CriziaNo ratings yet

- Income Tax Rates & ClassificationsDocument216 pagesIncome Tax Rates & ClassificationsalicorpanaoNo ratings yet

- Concept of Income Tax ExplainedDocument27 pagesConcept of Income Tax Explainedsosexyme123No ratings yet

- Income Taxation - LAV Notes122621Document13 pagesIncome Taxation - LAV Notes122621Mil Roilo B EspirituNo ratings yet

- Taxation Chapter 5Document7 pagesTaxation Chapter 5Laurence RomeroNo ratings yet

- BMEC4 NotesDocument13 pagesBMEC4 NotesJiaan HolgadoNo ratings yet

- Gross vs Net Income Tax GuideDocument22 pagesGross vs Net Income Tax GuideJayson Pajunar ArevaloNo ratings yet

- Income TaxDocument21 pagesIncome TaxJericho ValenciaNo ratings yet

- TaxationDocument13 pagesTaxationEmperiumNo ratings yet

- PM REYES NOTES ON INCOME TAXUnder the global tax system, all types of income arelumped together and taxed at graduated rates as asingle taxable incomeDocument88 pagesPM REYES NOTES ON INCOME TAXUnder the global tax system, all types of income arelumped together and taxed at graduated rates as asingle taxable incomejilliankadNo ratings yet

- Effective Tax ManagementDocument19 pagesEffective Tax ManagementMary Kathe Rachel ReyesNo ratings yet

- Tax 1 1ST ActivityDocument12 pagesTax 1 1ST ActivityAngela Nicole Salve ElpaNo ratings yet

- National TaxationDocument18 pagesNational TaxationShiela Joy CorpuzNo ratings yet

- Situs of Taxation Literally Means Place of TaxationDocument19 pagesSitus of Taxation Literally Means Place of TaxationRowie Ann Arista SiribanNo ratings yet

- Tax PresentationDocument21 pagesTax PresentationSumeet TamrakarNo ratings yet

- Chapter 3 Concept of IncomeDocument6 pagesChapter 3 Concept of IncomeChesca Marie Arenal Peñaranda100% (1)

- Taxation ReviewerDocument19 pagesTaxation ReviewerjwualferosNo ratings yet

- Income Taxation Mamalateo NotesDocument19 pagesIncome Taxation Mamalateo Notesclandestine2684100% (1)

- Bac03-Chapter 5Document25 pagesBac03-Chapter 5Rea Mariz JordanNo ratings yet

- INCOME TAX ReviewDocument54 pagesINCOME TAX ReviewKeepy FamadorNo ratings yet

- Direct Taxes Code Bill, 2009: at A GlanceDocument181 pagesDirect Taxes Code Bill, 2009: at A GlanceSanni KumarNo ratings yet

- TAX1 ReviewerDocument97 pagesTAX1 ReviewerAbdulwahid MadumNo ratings yet

- Lesson 1Document10 pagesLesson 1laica cauilanNo ratings yet

- TAX L002 Individual TaxationDocument18 pagesTAX L002 Individual TaxationYuri CaguioaNo ratings yet

- Tax by DimaampaoDocument90 pagesTax by Dimaampaoamun din100% (5)

- I. Basic Concepts in Income TaxationDocument79 pagesI. Basic Concepts in Income Taxationcmv mendoza100% (1)

- Notes in TaxationDocument13 pagesNotes in Taxationjamaica_maglinteNo ratings yet

- Reviewer Strat TaxDocument11 pagesReviewer Strat Taxregine bacabagNo ratings yet

- TAX1-LagguiRichelle 2Document4 pagesTAX1-LagguiRichelle 2Richelle GraceNo ratings yet

- Advanced Taxation & Fiscal Policy Nov 2011Document7 pagesAdvanced Taxation & Fiscal Policy Nov 2011Samuel DwumfourNo ratings yet

- Lecture 2 - Income TaxDocument13 pagesLecture 2 - Income TaxMasitala PhiriNo ratings yet

- Tax Aspects AssignmentDocument5 pagesTax Aspects AssignmentJohn Klein SantillanNo ratings yet

- Taxes Serve As The Engine For Economic DevelopmentDocument25 pagesTaxes Serve As The Engine For Economic Developmentmark lordaNo ratings yet

- Tax Midterm ReviewerDocument8 pagesTax Midterm ReviewerkarenongsucoNo ratings yet

- 4 17113 Taxation II 2013Document181 pages4 17113 Taxation II 2013Sudhanshu DubeyNo ratings yet

- Basic-Concepts-Ita 1961Document26 pagesBasic-Concepts-Ita 1961Gurpreet Sandhu100% (1)

- Meaning of Tax PlanningDocument5 pagesMeaning of Tax PlanningTanmoy ChakrabortyNo ratings yet

- Taxation Basics & PrinciplesDocument8 pagesTaxation Basics & PrinciplescesalyncorillaNo ratings yet

- Chapter 1: Fundamental Principles of TaxationDocument22 pagesChapter 1: Fundamental Principles of TaxationChira Rose Fejedero NeriNo ratings yet

- Tax Credit System ExplainedDocument43 pagesTax Credit System ExplainedmehdiNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Deed of AssignmentDocument1 pageDeed of Assignmentpaul_jurado18No ratings yet

- Remedial Law Suggested Answers (1997-2006), WordDocument79 pagesRemedial Law Suggested Answers (1997-2006), Wordyumiganda95% (38)

- 1 Frivaldo V COMELECDocument8 pages1 Frivaldo V COMELECpaul_jurado18No ratings yet

- Miaa V City of ParanaqueDocument69 pagesMiaa V City of Paranaquepaul_jurado18No ratings yet

- Phil Ports Authority Vs IloiloDocument12 pagesPhil Ports Authority Vs Iloilopaul_jurado18No ratings yet

- GR No. 170087Document7 pagesGR No. 170087taga_pi7ong_gatangNo ratings yet

- Apex Mining Vs NLRCDocument5 pagesApex Mining Vs NLRCpaul_jurado18No ratings yet

- Napocor V IsabelaDocument10 pagesNapocor V Isabelapaul_jurado18No ratings yet

- Sawajaan Vs CA G.R.141735Document10 pagesSawajaan Vs CA G.R.141735MelvzNo ratings yet

- Freedom of ExpressionDocument2 pagesFreedom of Expressionpaul_jurado18No ratings yet

- Miaa V City of ParanaqueDocument69 pagesMiaa V City of Paranaquepaul_jurado18No ratings yet

- Ichong V HernandezDocument15 pagesIchong V Hernandezpaul_jurado18No ratings yet

- Deed of A Motor VehicleDocument1 pageDeed of A Motor Vehiclepaul_jurado18No ratings yet

- SC Dismisses Case Against Gov Due to ElectionDocument5 pagesSC Dismisses Case Against Gov Due to Electionpaul_jurado18No ratings yet

- The Rule On The Writ of AmparoDocument10 pagesThe Rule On The Writ of AmparocristyjoymacasilNo ratings yet

- Kabataan Vs ComelecDocument5 pagesKabataan Vs Comelecpaul_jurado18No ratings yet

- Insurance NotesDocument9 pagesInsurance Notespaul_jurado18No ratings yet

- U.S v. WadeDocument1 pageU.S v. Wadepaul_jurado18No ratings yet

- Environmental Law SyllabusDocument2 pagesEnvironmental Law Syllabuspaul_jurado18No ratings yet

- Criminal Procedure 1Document29 pagesCriminal Procedure 1lexresitaeNo ratings yet

- Part III. Income Taxation: Nirc)Document10 pagesPart III. Income Taxation: Nirc)paul_jurado18No ratings yet

- Conflicts of Law Memory AidDocument10 pagesConflicts of Law Memory AidDannuel Go UyNo ratings yet

- Gamboa vs Cruz police lineup rulingDocument2 pagesGamboa vs Cruz police lineup rulingpaul_jurado18100% (1)

- Yu Vs Hon. TatadDocument4 pagesYu Vs Hon. Tatadpaul_jurado18No ratings yet

- Social Welfare Leg ChartDocument7 pagesSocial Welfare Leg Chartpaul_jurado18No ratings yet

- Addendum To Sec TransDocument12 pagesAddendum To Sec TransRuther Marc P. NarcidaNo ratings yet

- 2011 Remedial Law NotesDocument166 pages2011 Remedial Law NotesCarl TamNo ratings yet

- PEOPLE V GenosaDocument18 pagesPEOPLE V Genosapaul_jurado18No ratings yet

- RatioDocument20 pagesRatioAkashdeep MarwahaNo ratings yet

- F02 Financial StatementsDocument64 pagesF02 Financial StatementsSrinivas NerallaNo ratings yet

- Georgetown Mock Class - Case StudyDocument14 pagesGeorgetown Mock Class - Case StudyVictorAhluwalia100% (1)

- CFS Session 2 Equity FinancingDocument42 pagesCFS Session 2 Equity Financingaudrey gadayNo ratings yet

- Review QuestionsDocument4 pagesReview QuestionsValentina NotarnicolaNo ratings yet

- Fin.544 Ca 3Document17 pagesFin.544 Ca 3shivam kumar patelNo ratings yet

- ITR-2 Form PDFDocument22 pagesITR-2 Form PDFChandra SekaranNo ratings yet

- Case Study Debt Policy Ust IncDocument10 pagesCase Study Debt Policy Ust IncWill Tan80% (5)

- FERNANDEZ - Solutions For Problem 4-7 BVPSDocument4 pagesFERNANDEZ - Solutions For Problem 4-7 BVPSJeric TorionNo ratings yet

- Kunezle & StreiffDocument3 pagesKunezle & StreiffJanna Robles SantosNo ratings yet

- Chapter 6 Long - Term FinancingDocument8 pagesChapter 6 Long - Term Financinganteneh hailieNo ratings yet

- Privatization of HBLDocument10 pagesPrivatization of HBLUmair HassanNo ratings yet

- Grant Thornton Mauritius Tax Alert The Finance Act 2017Document15 pagesGrant Thornton Mauritius Tax Alert The Finance Act 2017RomiNo ratings yet

- Cint 2021Document94 pagesCint 2021IrenemartinNo ratings yet

- Translation - Quizzer 001Document3 pagesTranslation - Quizzer 001Kenneth Bryan Tegerero TegioNo ratings yet

- Audit of The Capital Acquisition and Repayment CycleDocument20 pagesAudit of The Capital Acquisition and Repayment Cycleputri retno100% (1)

- Financial Management ZainDocument10 pagesFinancial Management Zainnawal zaheerNo ratings yet

- Jindal Stainless Steel Jindal HisarDocument19 pagesJindal Stainless Steel Jindal HisarRaghave ModiNo ratings yet

- Jun18l1-Ep04 QaDocument23 pagesJun18l1-Ep04 Qajuan100% (1)

- Legal GlossaryDocument323 pagesLegal GlossaryDaniel Yustus SidabutarNo ratings yet

- BOROSIL GlasswareDocument86 pagesBOROSIL GlasswareushadgsNo ratings yet

- Income From Other SourcesDocument7 pagesIncome From Other Sourcesshankarinadar100% (1)

- FM QuizDocument34 pagesFM QuizChristopher C ChekaNo ratings yet

- Seminar 11answer Group 11Document115 pagesSeminar 11answer Group 11Shweta SridharNo ratings yet

- Ucsp Unit 4,5, and 6Document20 pagesUcsp Unit 4,5, and 6Mekhailah MalongNo ratings yet

- Explanatory Notes NIRC 1-83 Updated Sept. 1, 2018Document59 pagesExplanatory Notes NIRC 1-83 Updated Sept. 1, 2018alyza burdeosNo ratings yet

- Tax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyDocument1 pageTax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyMuhammad sarfrazNo ratings yet

- Financial Management Chapter ReviewDocument11 pagesFinancial Management Chapter ReviewkarynNo ratings yet

- Black Book Project FinalDocument106 pagesBlack Book Project Finalsanjaysharma1779No ratings yet