Professional Documents

Culture Documents

BAC, Nor NB Holdings Is A Successor To Countrywide Financial Corp or CW Home Loans Inc.

Uploaded by

Tim BryantOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BAC, Nor NB Holdings Is A Successor To Countrywide Financial Corp or CW Home Loans Inc.

Uploaded by

Tim BryantCopyright:

Available Formats

Case 2:10-cv-07275-MRP -MAN Document 91-1 #:2353

Filed 03/25/11 Page 1 of 21 Page ID

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

SETH ARONSON (S.B. #100153) saronson@omm.com MATTHEW W. CLOSE (S.B. #188570) mclose@omm.com OMELVENY & MYERS LLP 400 South Hope Street Los Angeles, CA 90071-2899 Telephone: (213) 430-6000 Facsimile: (213) 430-6407 JONATHAN ROSENBERG (admitted pro hac vice) jrosenberg@omm.com WILLIAM J. SUSHON (admitted pro hac vice) wsushon@omm.com OMELVENY & MYERS LLP 7 Times Square New York, NY 10036 Telephone: (212) 326-2000 Facsimile: (212) 326-2061 Attorneys for Defendants Bank of America Corporation and NB Holdings Corporation UNITED STATES DISTRICT COURT CENTRAL DISTRICT OF CALIFORNIA STICHTING PENSIOENFONDS ABP, Plaintiff, v. COUNTRYWIDE FINANCIAL CORPORATION, et al., Defendants. Case No. 2:10-CV-07275 MRP (MANx) BANK OF AMERICA CORPORATION AND NB HOLDINGS CORPORATIONS MEMORANDUM OF POINTS AND AUTHORITIES IN SUPPORT OF THEIR MOTION TO DISMISS THE FIRST AMENDED COMPLAINT Hearing Date: Time: Judge: Courtroom: June 27, 2011 11:00 a.m. Hon. Mariana R. Pfaelzer 12

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 #:2354

Filed 03/25/11 Page 2 of 21 Page ID

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 IV. B. 2. A. I. II. III.

TABLE OF CONTENTS Page INTRODUCTION........................................................................................... 1 STATEMENT OF FACTS.............................................................................. 3 ARGUMENT .................................................................................................. 5 The Successor Liability Claim Against BAC Should Be Dismissed Because ABP Has Not Alleged Facts Sufficient to Establish a De Facto Merger ................................................................ 5 1. Delaware Law Applies to Any Effort to Disregard CFCs Corporate Form........................................................................... 5 The De Facto Merger Doctrine Does Not Apply ................... 8 a. b. The FAC Fails to Allege a De Facto Merger................... 8 The New York MBIA Case Should Not Be Followed ......................................................................... 12

The FACs Allegations Against NB Are Deficient ............................ 14

CONCLUSION ............................................................................................. 15

-i-

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 #:2355

Filed 03/25/11 Page 3 of 21 Page ID

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

TABLE OF AUTHORITIES Page CASES Argent Classic Convertible Arbitrage Fund L.P. v. Countrywide Financial Corp., No. CV 07-07097 MRP (MANx) (C.D. Cal.) .............................................passim Ashcroft v. Iqbal, 129 S. Ct. 1937, 173 L. Ed. 2d 868 (2009) ........................................................ 14 Bell Atlantic Corp. v. Twombly, 550 U.S. 544, 127 S. Ct. 1955, 167 L. Ed. 2d 929 (2007) ................................. 15 Binder v. Bristol-Myers Squibb, Co., 184 F. Supp. 2d 762 (N.D. Ill. 2001).......................................................... 8, 9, 13 Booking v. General Star Management Co., 254 F.3d 414 (2d Cir. 2001) ............................................................................... 12 Bryant, Griffith & Brunson, Inc. v. General Newspapers, Inc., 178 A. 645 (Del. Super. 1935) ........................................................................... 14 Case Financial, Inc. v. Alden, No. Civ. A. 1184-VCP, 2009 WL 2581873 (Del. Ch. Aug. 21, 2009) .................................................................................................... 10 Chan v. Society Expeditions, Inc., 123 F.3d 1287 (9th Cir. 1997) .............................................................................. 6 Coleman v. Corning Glass Works, 619 F. Supp. 950 (W.D.N.Y. 1985) ................................................................... 11 In re Countrywide Corp. Shareholders Litigation, Consolidated C.A. No. 3464-VCN, 2009 WL 846019 (Del. Ch. Mar. 31, 2009) .................................................................................................... 13 Fletcher v. Atex, Inc., 68 F.3d 1451 (2d Cir. 1995) ............................................................................... 11 Fountain v. Colonial Chevrolet Co., C.A. Nos. 86C-JA-117, 85C-DE-88, 1988 WL 40019 (Del. Super. Apr. 13, 1988)............................................................................................... 10, 11

-iiBAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 #:2356

Filed 03/25/11 Page 4 of 21 Page ID

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

TABLE OF AUTHORITIES (continued) Page Huynh v. Chase Manhattan Bank, 465 F.3d 992 (9th Cir. 2006) ................................................................................ 6 Kalb, Voorhis & Co. v. American Financial Corp., 8 F.3d 130 (2d Cir. 1993) ................................................................................... 12 Kamen v. Kemper Financial Services, Inc., 500 U.S. 90, 111 S. Ct. 1711, 114 L. Ed. 2d 152 (1991) ..................................... 6 LaSalle National Bank v. Vitro S.A., 85 F. Supp. 2d 857 (N.D. Ill. 2000).................................................................... 12 Lewis v. Ward, 852 A.2d 896 (Del. 2004)................................................................................... 13 In re Lindsay, 59 F.3d 942 (9th Cir. 1995) .................................................................................. 5 Maine State Retirement System v. Countrywide Financial Corp., Case No. 10-cv-00302-MRP-MANx (C.D. Cal. Nov. 4, 2010)........................... 3 MBIA Insurance Corp. v. Countrywide Home Loans, Inc., Index No. 602825/08 (Sup. Ct., N.Y. Co. Apr. 27, 2010) .....................12, 13, 14 In re McKesson HBOC, Inc. Securities Litigation, 126 F. Supp. 2d 1248 (N.D. Cal. 2000)..................................................6, 8, 9, 13 Powerup of Southeast Louisiana, Inc. v. Powerup U.S.A., Inc., No. 94-1441, 1994 WL 543631 (E.D. La. Oct. 5, 1994) ..................................... 7 In re Syntex Corp. Securities Litigation, 95 F.3d 922, 926 (9th Cir. 1996) .......................................................................... 3 United States v. Bestfoods, 524 U.S. 51, 118 S. Ct. 1876, 141 L. Ed. 2d. 43 (1998) ...................................... 5 United States v. Kimbell Foods, Inc., 440 U.S. 715, 99 S. Ct. 1448, 59 L. Ed. 2d 711 (1979) ....................................... 6

-iii-

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 #:2357

Filed 03/25/11 Page 5 of 21 Page ID

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

TABLE OF AUTHORITIES (continued) Page U.S. Fidelity & Guaranty Co. v. Petroleo Brasileiro S.A.-Petrobras, No. 98 Civ. 3099 (THK), 2005 WL 289575 (S.D.N.Y. Feb. 4, 2005)....................................................................................................... 13

STATUTES 15 U.S.C. 78aa ........................................................................................................ 5

REGULATIONS 17 C.F.R. 210.3A-02............................................................................................. 10

OTHER AUTHORITIES ACCOUNTING STANDARDS CODIFICATION, Topic 810 Consolidation, 810-10-15-10 ( Fin. Accounting Standards Bd. 2009)....................................... 10 RESTATEMENT (SECOND) OF CONFLICT OF LAWS 302 (1971) ............................. 6, 7 RODMAN WARD, JR., ET AL., FOLK ON DELAWARE GENERAL CORPORATION LAW 251.4 (4th ed. 2001) .......................................................... 8 15 WILLIAM MEADE FLETCHER ET AL., FLETCHER CYCLOPEDIA OF THE LAW OF PRIVATE CORPORATIONS 7124 (perm. ed., rev. vol. 1990) ................ 11

-iv-

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 #:2358

Filed 03/25/11 Page 6 of 21 Page ID

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

Defendants Bank of America Corporation (BAC) and NB Holdings Corporation (NB) have joined in the Countrywide Defendants motion to dismiss the First Amended Complaint (FAC).1 BAC and NB write separately here to address Plaintiffs attempt to hold them liable as successors to Countrywide Financial Corporation (CFC) and Countrywide Home Loans, Inc. (CHL), respectively. I. INTRODUCTION The complaint in this case includes another flawed attempt to hold BAC responsible for its Countrywide subsidiarys liabilities, solely because BAC acquired that subsidiary in a forward-triangular merger, well-recognized as legitimate under Delaware law, thereafter engaged in transactions with that subsidiary in exchange for valuable consideration, and conducted standard integration activities. But this complaint, like another against BAC that this Court dismissed, Argent Classic Convertible Arbitrage Fund L.P. v. Countrywide Financial Corp., No. CV 07-07097 MRP (MANx) (C.D. Cal.), fails to allege the elements of a de facto merger necessary to overcome the bedrock rule that a parent corporation is not liable for its subsidiarys conduct.2 In Argent, as here, the plaintiff argued that BAC was liable as successor for CFCs alleged pre-acquisition securities-law violations. The FAC here relies on the same theory and many of the same allegations that this Court rejected in Argentnamely, that BAC de facto merged with CFC because, among other things, (i) BAC acquired CFC through a merger with a BAC subsidiary; (ii) that subsidiary transferred CFC assets to BAC; Concurrent with filing this motion, BAC and NB filed a separate Joinder in the Countrywide Defendants Motion to Dismiss the First Amended Complaint, which was filed March 25, 2011. Exhibit references are to the Exhibits to the March 25, 2011 Declaration of Matthew W. Close in Support of Defendants Request for Judicial Notice in Support of Their Motion to Dismiss the First Amended Complaint and are cited as Ex. __. 2 See Omnibus Order, Argent Classic Convertible Arbitrage Fund, L.P., Case No. CV 07-07097 MRP (MANx) (C.D. Cal. Mar. 19, 2009) (Argent, slip op.) (Ex. 1).

1

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

1

Case 2:10-cv-07275-MRP -MAN Document 91-1 #:2359

Filed 03/25/11 Page 7 of 21 Page ID

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

and (iii) BAC implicitly assumed all of CFCs liabilities by allegedly expressly agreeing to undertake certain specific CFC liabilities.3 This Court dismissed Argents claim against BAC with prejudice under the longstanding rule that a parent does not assume an acquired subsidiarys preacquisition liabilities.4 Even assuming the broadest possible set of exceptions to this longstanding rule, the Court held that the complaint failed to state a claim against BAC because: the complaint did not allege that BAC and CFC had acted in bad faith to prejudice Countrywides creditors; BAC did not expressly or implicitly assume liability for CFCs alleged pre-acquisition securities-law violations; and there was no suggest[ion] that [BAC] has de facto merged with Countrywide.

The FAC suffers from the same defects and should likewise be dismissed. ABP has attempted to obfuscate the facts by omitting its previous allegation regarding the mechanics of CFCs forward-triangular merger with a wholly-owned subsidiary of BAC. (See Complaint (Compl.) 23 ([O]n July 1, 2008, Defendant CFC completed a merger with Red Oak Corporation . . . , a whollyowned subsidiary of Bank of America.).) But this Court can and should take judicial notice of the January 11, 2008 merger agreement, which makes this fact plain. Argent, slip op. at 1 n.1 (Ex. 1 at 3). Thus, this Courts ruling in Argent and the rule deeply ingrained in American jurisprudence still control, and the acquiring BAC subsidiary (Red Oak Merger Corporation (Red Oak), which was subsequently renamed Countrywide Financial Corporation) still maintains its independent corporate existence and remains solely responsible for CFCs alleged pre-acquisition actions. As in Argent, ABPs bid to impose liability on BAC fails

3 4

(Compare FAC 22336 with Argent, slip op. at 79.) Argent, slip op. at 7 (Ex. 1 at 9).

2

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 #:2360

Filed 03/25/11 Page 8 of 21 Page ID

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

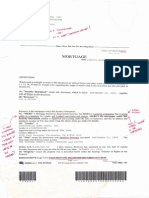

because the FAC does not allege facts sufficient to invoke the de facto merger exception to this well-established rule. The FAC should also be dismissed as to NB because it contains only a single conclusory allegation that NB is a successor to Countrywide Home Loans, Inc. (CHL). The FAC merely alleges that NB purchased certain CHL assets and that NB was created to facilitate BACs acquisition of CFC. But this is not sufficient to establish that NB de facto merged with CHL, or any other entity. Accordingly, the FAC should also be dismissed as to NB. II. STATEMENT OF FACTS5 The FAC alleges that BAC acquired CFC in a merger that closed on July 1, 2008 (FAC 223), but omits how that transaction came to pass. That transaction occurred under a January 11, 2008 Agreement and Plan of Merger by and between Countrywide Financial Corporation, Bank of America Corporation, and Red Oak Corporation (the Merger Agreement), in which CFC agreed to merge with and into Red Oak, a BAC subsidiary. After the July 1, 2008 closing, Red Oak was renamed Countrywide Financial Corporation, as the merger agreement required. (Countrywide Fin. Corp., Quarterly Report (Form 10-Q) at 5 (Aug. 11, 2008) (Countrywide 10-Q) (Ex. 2 at 26); BAC, Registration Statement (Form S-4) at 59 To avoid repetition, BAC incorporates by reference the facts in the Factual Background section of the Countrywide Defendants Memorandum of Points and Authorities in Support of Motion to Dismiss the First Amended Complaint, which was filed March 25, 2011. BACs supplemental facts are drawn from (i) the FAC, and (ii) BACs and Countrywides SEC filings, including the Merger Agreement, which was attached as Appendix A to BACs May 28, 2008 Form S-4 Registration Statement (Ex. 4). When deciding a motion to dismiss, a court may consider the complaint and documents whose contents are alleged in a complaint and whose authenticity no party questions, but which are not physically attached to the pleading. In re Syntex Corp. Sec. Litig., 95 F.3d 922, 926 (9th Cir. 1996). And as this Court recently recognized, it may take judicial notice of public documents filed with the Securities and Exchange Commission. See Order re: Mot. to Dismiss Am. Class Action Consol. Compl. at 1 n.1, Maine State Ret. Sys. v. Countrywide Fin. Corp., Case No. 10-cv-00302-MRP-MANx (C.D. Cal. Nov. 4, 2010) (Pfaelzer, J.) (Ex. 3 at 1). Here, the FAC references both the merger between CFC and Red Oak and the asset transfer between CFC and BAC, and so the content of BACs public filings, whose authenticity cannot be questioned, are alleged in the FAC.

3

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

5

Case 2:10-cv-07275-MRP -MAN Document 91-1 #:2361

Filed 03/25/11 Page 9 of 21 Page ID

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

(May 28, 2008) (BAC S-4) (Ex. 4 at 291); Argent, slip op. at 1 n.1. (Ex. 1 at 3).) To this day, CFC remains a separate, wholly-owned subsidiary of BAC. The FACs claims concern alleged misconduct by CFC and its subsidiaries in mortgagebacked-securities offerings that occurred between January 25, 2005, and November 29, 2007, long before CFC merged into BACs subsidiary. The FAC nevertheless alleges that BAC de facto merged with CFC. It bases this conclusion on the following allegations: CFCs former website now redirects to Bank of Americas website (FAC 227); BAC has . . . taken responsibility for the pre-merger liabilities of CFC, CHL, CSC and CCM, including restructuring loans and reaching settlement agreements and paying to resolve other litigation arising from misconduct such as predatory lending allegedly committed by CFC (FAC 230); A BAC-Countrywide transaction after the July 2008 forwardtriangular merger: On November 7, 2008, CFC transferred substantially all of its assets to [BAC] (FAC 225); CFC ceased filing its own financial statements in November 2008, and its assets and liabilities are now instead included in [BACs] financial statements (FAC 225); Many former Countrywide locations, employees, assets, and business operations now continue under the Bank of America Home Loans brand (FAC 226; see also id. 228 (alleging that Countrywide Bank accounts converted to Bank of America accounts)); and BACs Form 10-K lists CCM and CSC as BAC subsidiaries (FAC 226).

These allegations closely track Argents asserted bases for successor liability against BAC, which included that (i) CFC transferred substantially all of its assets to BAC in November 2008; and (ii) BAC was integrat[ing] CFCs business and operations. Argent, slip op. at 8 (Ex. 1 at 10). The FAC also names as a defendant NB, a wholly-owned BAC subsidiary. But the FACs sole allegations concerning NB are that (i) NB was created for the

4

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 Filed 03/25/11 Page 10 of 21 Page ID #:2362

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

sole purpose of facilitating the acquisition of CFC; and (ii) CHL sold substantially all of its assets to NB on July 3, 2008. (FAC 21, 229.) The FAC contains no allegation that NB de facto merged with any entity. III. ARGUMENT A. The Successor Liability Claim Against BAC Should Be Dismissed Because ABP Has Not Alleged Facts Sufficient to Establish a De Facto Merger.

It is an iron-clad principle of corporate law, deeply ingrained in our economic and legal systems, that a parent corporation . . . is not liable for the acts of its subsidiaries. United States v. Bestfoods, 524 U.S. 51, 61, 118 S. Ct. 1876, 1884, 141 L. Ed. 2d. 43, 56 (1998) (internal quotation marks omitted).6 CFC is a wholly-owned BAC subsidiary. Thus, as this Court has previously recognized, BAC cannot be liable for CFCs pre-acquisition torts unless an exception to this rule applies. See Argent, slip op. at 7 (Ex. 1 at 9). The FAC fails to allege facts that would trigger any such exception. 1. Delaware Law Applies to Any Effort to Disregard CFCs Corporate Form.

Delaware law governs ABPs vicarious liability claims against BAC for CFCs alleged pre-merger misconduct. This Court has federal question jurisdiction over this case because the FAC asserts claims under the Securities Exchange Act, which gives rise to exclusive federal jurisdiction. See 15 U.S.C. 78aa. Thus, the court should apply federal . . . choice of law rules. In re Lindsay, 59 F.3d 942, 948 (9th Cir. 1995) (collecting cases). Because there is no federal common law of successor liability, the question of whether BAC may be held liable as an alleged successor to CFC requires application and incorporation of state law.7 See Kamen

6 7

Unless otherwise specified, all citations are omitted and all emphasis is added. In Argent, this Court declined to opine on the choice of law question because the complaint there did not explain on which transactions its allegations are based, leaving BAC and the Court with no notice as to which states law should govern. Argent, slip op. at 8 n.6 (Ex. 1 at 10). The Court therefore analyzed Argent under the broadest possible set of exceptions and concluded that BAC could not be

5

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 Filed 03/25/11 Page 11 of 21 Page ID #:2363

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

v. Kemper Fin. Servs., Inc., 500 U.S. 90, 98, 111 S. Ct. 1711, 1717, 114 L. Ed. 2d 152, 165 (1991) (The presumption that state law should be incorporated into federal common law is particularly strong in areas in which private parties have entered legal relationships with the expectation that their rights and obligations would be governed by state-law standards.); see also United States v. Kimbell Foods, Inc., 440 U.S. 715, 73940, 99 S. Ct. 1448, 1464, 59 L. Ed. 2d 711, 73031 (1979) (In structuring financial transactions, businessmen depend on state commercial law to provide the stability essential for reliable evaluation of the risks involved. . . . [T]he prudent course is to adopt the readymade body of state law as the federal rule of decision until Congress strikes a different accommodation.). Under the Restatement (Second) of Conflict of Lawswhich guides federal choice of law decisions, see Huynh v. Chase Manhattan Bank, 465 F.3d 992, 997 (9th Cir. 2006) (Federal common law follows the approach outlined in the Restatement (Second) of Conflict of Laws.); Chan v. Socy Expeditions, Inc., 123 F.3d 1287, 1297 (9th Cir. 1997) (same)the Court must thus look to the law of the state with the most significant relationship to the dispute. See RESTATEMENT (SECOND) OF CONFLICT OF LAWS 302(1) (1971) (RESTATEMENT). And in determining the rights and liabilities of a corporation, the state of incorporation is considered to have the most significant relationship, except in unusual circumstances. Id. 302(2) (The local law of the state of incorporation will be applied . . . except in the unusual case where, with respect to the particular issue, some other state has a more significant relationship to the occurrence and the parties.). Consistent with the Restatement, the Court should apply the law of the state of incorporation in an action seeking to disregard a defendants corporate form, and that is the alleged successors state of incorporation. See In re McKesson HBOC, Inc. Sec. Litig., 126 F. Supp. 2d 1248, 127677 (N.D. Cal. 2000) (applying liable as CFCs successor under a de facto merger theory. Id. at 8 n.6, 9 (Ex. 1 at 10, 11).

6

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 Filed 03/25/11 Page 12 of 21 Page ID #:2364

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

law of the state of alleged successor in interest to assess de facto merger claim); see also Powerup of Southeast Louisiana, Inc. v. Powerup U.S.A., Inc., No. 94-1441, 1994 WL 543631, at *2 (E.D. La. Oct. 5, 1994) (applying law of parents state of incorporation to veil-piercing claims because parent is a Canadian corporation, and if it has designed its structure according to the law under which it is incorporated, this court should respect that expectation). As the comments to Section 302 note, the state of incorporations laws should govern any matters peculiar to corporations. See RESTATEMENT 302 cmt. a. Nothing is more peculiar to a corporation than questions arising from a merger, a uniquely corporate transaction, or efforts to disregard the corporate form. See Powerup, 1994 WL 543631, at *2 (Section 302 addresses choice of law for issues of liability that are unique to the corporate structure, such as those that would pierce the corporate veil.) Applying Section 302 to de facto merger claims is therefore necessary to promote certainty, as it ensures that a single states law will apply to any and all liability questions arising from a particular corporate transaction or series of transactions or efforts to disregard the corporate form. See RESTATEMENT 302 cmt. e (Application of the local law of the state of incorporation will usually be supported by those choice-of-law factors favoring the needs of the interstate and international systems, certainty, predictability and uniformity of result, protection of the justified expectations of the parties and ease in the application of the law to be applied. . . . In addition, many matters involving a corporation cannot practicably be determined differently in different states. Examples of such matters . . . include . . . mergers, consolidations, and reorganizations . . . .); see also id. ([I]t would be impractical to have matters . . . which involve a corporations organic structure . . . governed by different laws.). Were the law otherwise, it would throw corporate transactions into disarray, as no acquirer would know which states law would govern its obligations as a targets alleged successor. Powerup, 1994 WL 543631, at *2 (Concern for the

7

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 Filed 03/25/11 Page 13 of 21 Page ID #:2365

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

expectations of parties and minimizing adverse consequences of multiple legal standards argues strongly in favor of the law of the alleged successors state of incorporation). Here, the FAC alleges a de facto merger between two Delaware corporationsBAC and CFCbased predominantly on a July 1, 2008 forward triangular merger and a November 7, 2008 asset transfer from CFC to BAC. (See FAC 22325.) More precisely, each of the three corporate entities involved in the relevant transactionspre-acquisition CFC, Red Oak (since renamed CFC), and BACare (or were) Delaware corporations. (See BAC S-4 at A-1 (Ex. 4 at 335).) Accordingly, Delaware law applies to ABPs de facto merger claims. 2. The De Facto Merger Doctrine Does Not Apply. a. The FAC Fails to Allege a De Facto Merger.

Delaware courts have, except in very limited circumstances, rejected the concept of de facto merger. RODMAN WARD, JR., ET AL., FOLK ON DELAWARE GENERAL CORPORATION LAW 251.4 (4th ed. 2001). Delaware law recognizes a de facto merger only where an asset sale (1) amounts to a merger between the purchaser and the seller; and (2) was engineered to disadvantage shareholders or creditors. McKesson, 126 F. Supp. 2d at 1277 (observing that the de facto merger doctrine does not apply unless the transaction has been structured to disadvantage creditors or shareholders) (applying Delaware law); Binder v. Bristol-Myers Squibb, Co., 184 F. Supp. 2d 762, 76970 (N.D. Ill. 2001) (In only a few instances involving sales of assets have Delaware courts applied the doctrine of de facto merger and only then for the protection of creditors or stockholders who have suffered by reason of failure to comply with the statute governing such sales.) (quoting Heilbrunn v. Sun Chem. Corp., 150 A.2d 755, 758 (Del. 1959)). In a transparent attempt to avoid the basic principle of corporate law stated by the U.S. Supreme Court in Bestfoodsthat parents are not liable for their subsidiaries liabilities (see p. 5, supra)ABP omits from its allegation concerning

8

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 Filed 03/25/11 Page 14 of 21 Page ID #:2366

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

BACs July 1, 2008 acquisition of CFC that this transaction was a forward triangular merger in which CFC merged into a BAC subsidiary, Red Oak. (FAC 223.) ABP focuses instead on a subsequent sale of assets by CFC to BAC in November 2008. (See FAC 225.) But ABP omits to mention, as contemporaneous public SEC filings make clear, that BAC acquired these assets from CFC in exchange for valuable consideration totaling billions of dollars, including the assumption of substantial liabilities and guarantees. (See BAC, Current Report (Form 8-K) 8.01 (Nov. 10, 2008) (Ex. 5 at 459).) The critical and dispositive point is that there is no allegation that this transaction was designed to disadvantage stockholders or creditors. Thus, as a matter of Delaware law, the FACs de facto merger claim must be dismissed. See McKesson, 126 F. Supp. 2d at 1277 (reverse triangle merger does not effect a de facto merger unless structured to disadvantage creditors or shareholders); see also Argent, slip op. at 8 (Ex. 1 at 10) (concluding that an allegation concerning the same asset transferthat BAC had purchased, for consideration, substantially all Countrywide assetswas insufficient to impose successor liability on BAC). Unable to allege any disadvantage to shareholders or creditors, ABP instead attempts to dress up its successor liability claims with colorful quotes and allegations concerning ordinary integration activities that follow any acquisition. But these additions cannot salvage the FAC: Rebranding: Retiring Countrywides brand and redirecting its website to BACs site (FAC 22628) does not amount to a de facto merger because such superficial changes do not determine whether a de facto merger has occurred. See Binder, 184 F. Supp. 2d at 771 (holding that Delaware law only recognizes a de facto merger where a transaction is designed to disadvantage creditors and involves 1) a transfer of all assets of the transferor corporation to the transferee corporation, 2) payment made in stock directly to the shareholders of the transferor corporation causing them to become shareholders in the transferee corporation, and

9

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 Filed 03/25/11 Page 15 of 21 Page ID #:2367

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

3) an agreement for the transferee corporation to assume all the debts and liabilities of the transferor corporation up until the time of merger). Using CFC Assets, Employees, Locations and Operations and Consolidating Financial Results: Other events that necessarily follow from BACs acquisition of CFC assetssuch as converting Countrywide customer accounts to Bank of America accountsalso fail to make out a de facto merger claim. See Fountain v. Colonial Chevrolet Co., C.A. Nos. 86C-JA-117, 85C-DE-88, 1988 WL 40019, at *78 (Del. Super. Apr. 13, 1988) (concluding that defendant was not liable as successor where it stepped into asset sellers shoes and continued its operations). As this Court has recognized, such activities include BACs integration of CFCs former locations, employees, assets and business operations. Argent, slip op. at 8 (Ex. 1 at 10) (rejecting allegation that BAC has begun integrating some Countrywide operations as insufficient to impose successor liability). Similarly, the FACs allegation that BAC consolidated CFCs financial results into BACs public filings (FAC 225) is irrelevant. BAC was required to include CFCs financial results as part of BACs consolidated financial statements once CFC became a BAC subsidiary. See 17 C.F.R. 210.3A-02(a) (Generally, registrants shall consolidate entities that are majority owned and shall not consolidate entities that are not majority owned.); ACCOUNTING STANDARDS CODIFICATION, Topic 810 Consolidation, 810-10-15-10(a) ( Fin. Accounting Standards Bd. 2009) (All majority-owned subsidiariesall entities in which a parent has a controlling financial interestshall be consolidated.). This provides no support for imposing successor liability on BAC. See Case Fin., Inc. v. Alden, No. Civ. A. 1184-VCP, 2009 WL 2581873, at *4 (Del. Ch. Aug. 21, 2009) (holding parent corporation filing consolidated financial statements with the SEC, which include [subsidiary corporations] results did not satisfy Delaware laws substantial burden for disregarding the corporate form).

10

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 Filed 03/25/11 Page 16 of 21 Page ID #:2368

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

Explicit Assumption of Certain Liabilities: The FAC alleges that BAC had agreed to assume CFCs liabilities for alleged predatory lending practices (which BAC did not) by pa[ying] to resolve litigation arising from such misconduct. (FAC 230-34.) Allegations that BAC settled certain CFC litigation or took on other liabilities are inadequate to establish BACs vicarious liability. As this Court recognized in dismissing Argent, merely undertaking to pay some of an acquired subsidiarys liabilities does not imply that the acquiring company will pay all the subsidiarys liabilities. Argent, slip op. at 8 (Ex. 1 at 10) (dismissing successor liability claim because [n]othing properly before the Court suggests that BofA has done more than expressly assume some liabilities in consideration of the acquisition of CFC assets); Fountain, 1988 WL 40019, at *78 (holding that payment of certain liabilities did not imply that successor would pay all of its predecessors liabilities); see also 15 WILLIAM MEADE FLETCHER ET AL., FLETCHER CYCLOPEDIA OF THE LAW OF PRIVATE CORPORATIONS 7124 (perm. ed., rev. vol. 1990). Nor can Plaintiffs rely on loose public statements from BAC representatives to establish a de facto merger. The statements that Plaintiff has highlighted are not formal assumptions of liabilities. Instead, they are vague statements that well clean it up or well pay for the things Countrywide did. (FAC 231.) Statements of this sort cannot supply the basis for a de facto merger claim. 15 FLETCHER, supra, 7124. Other statements on which Plaintiff relies include vague allusions to combining Countrywides operations with BACs. (See FAC 224.) They are equally flawed as a basis for imposing successor liability. See, e.g., Fletcher v. Atex, Inc., 68 F.3d 1451, 1460 (2d Cir. 1995) (rejecting argument that loose statements in promotional pamphlets, informal statements in an annual report, and other documents warranted disregarding a subsidiarys corporate form and holding parent liable); Coleman v. Corning Glass Works, 619 F. Supp. 950, 956 (W.D.N.Y. 1985) (Although plaintiff has pointed to certain loose

11

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 Filed 03/25/11 Page 17 of 21 Page ID #:2369

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

language in [Parents] Annual Reports about its merger with [subsidiary], the defendant has conclusively established that the merger referred to was actually between [subsidiary] and [another subsidiary], one of [the Parent corporations] wholly owned and separately incorporated subsidiaries.); cf. LaSalle Natl Bank v. Vitro, S.A., 85 F. Supp. 2d 857, 86566 (N.D. Ill. 2000) (finding statements regarding how a company portrays itself insufficient for personal jurisdiction). Accordingly, the FAC fails to allege facts sufficient to establish BACs liability as a successor to CFC. b. The New York MBIA Case Should Not Be Followed.

ABP has apparently included these vicarious liability allegations in an effort to fit this case within the New York trial courts opinion in MBIA Insurance Corp. v. Countrywide Home Loans, Inc., Index No. 602825/08 (Sup. Ct., N.Y. Co. Apr. 27, 2010) (MBIA, slip op.) (Ex. 6), another case in which a plaintiff seeks to hold BAC liable as CFCs successor. (See FAC 236 (citing MBIA).) In that case, the New York court erroneously concluded that the plaintiff had adequately alleged a de facto merger between BAC and CFC. The MBIA court rejected this Courts well-reasoned Argent opinion, characterizing it as containing little discussion and offer[ing] nothing . . . to follow. MBIA, slip op. at 1112 (Ex. 6 at 65657). The MBIA decision is not controlling, however, and should not be followed for at least two reasons. First, the court in MBIA mistakenly applied New York law instead of Delaware law, without any choice of law analysis or explanation.8 In so doing, it A proper choice of law analysis under New Yorks choice of law rules would have required dismissal of MBIAs successor liability claims against BAC. This is because New York law could apply in MBIA only if there were not an actual conflict between the laws invoked by the parties. Booking v. Gen. Star Mgmt. Co., 254 F.3d 414, 419 (2d Cir. 2001). If a conflict between New York law and Delaware law arose, then New York choice of law rules would require the MBIA court to apply Delaware law because it was BACs state of incorporation. See Kalb, Voorhis & Co. v. Am. Fin. Corp., 8 F.3d 130, 132 (2d Cir. 1993) (The law of the state of incorporation determines when the corporate form will be

12

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

8

Case 2:10-cv-07275-MRP -MAN Document 91-1 Filed 03/25/11 Page 18 of 21 Page ID #:2370

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

viewed the July 1, 2008 forward triangular merger pejoratively,9 without taking into account (i) established Delaware law recognizing forward triangular mergers as commonplace and legitimate, Lewis v. Ward, 852 A.2d 896, 906 (Del. 2004) ([T]riangular mergers are common and have a myriad of legitimate justifications.), and (ii) the Delaware law cases refusing to apply the de facto merger doctrine in the triangular merger and de jure merger context, McKesson, 126 F. Supp. 2d at 127677 (refusing to find de facto merger in triangular merger transaction); Binder, 184 F. Supp. 2d at 76970 (concluding that a triangular merger did not result in de facto merger with acquirers parent). The New York court likewise failed to consider the March 31, 2009 finding by the Delaware Chancery Court that the consideration BAC paid in the July 1, 2008 merger was fair. In re Countrywide Corp. Sholders Litig., Consolidated C.A. No. 3464-VCN, 2009 WL 846019, at *14 (Del. Ch. Mar. 31, 2009) ([T]here is precious little doubt that the consideration received by the Countrywide shareholders was anything other than at least fair.). The New York court also failed to acknowledge the $16.6 billion in value that BAC provided as part of the consideration for substantially all of CFCs assets, and the case law holding that an asset sale for value cannot form the basis disregarded and liability will be imposed on shareholders.); U.S. Fid. & Guar. Co. v. Petroleo Brasileiro S.A.-Petrobras, No. 98 Civ. 3099 (THK), 2005 WL 289575, at *5 (S.D.N.Y. Feb. 4, 2005) (The question of successor liability in this proceeding . . . should be governed by the law of . . . the jurisdiction of the relevant entities incorporation.). Thus, in evaluating which law to apply to MBIAs de facto merger claim, the court had two choices: (i) apply New York law because it was identical to Delaware law (in which case New York law would require a showing of intent to disadvantage CFCs shareholders or creditors), or (ii) apply Delaware law because it differed from New York law in requiring an intent allegation and Delaware had a greater interest in the dispute. In either case, the MBIA court should have required an allegation that the asset transfer from CFC to BAC was engineered to harm CFCs shareholders and creditors. 9 MBIA, slip op. at 13 (Bank of America acquired Countrywide financial . . . through an all-stock transaction involving a Bank of America subsidiary that was created for the sole purpose of facilitating the acquisition of Countrywide.).

13

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 Filed 03/25/11 Page 19 of 21 Page ID #:2371

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

for a de facto merger claim. Bryant, Griffith & Brunson, Inc. v. Gen. Newspapers, Inc., 178 A. 645, 648 (Del. Super. 1935) (holding that [a] corporation buying the property and assets of another corporation is not liable for the sellers debts). Second, even apart from the choice of law issue, the MBIA claim should still have been dismissed because the complaint failed to satisfy the other de facto merger factors. For example, the court concluded that the plaintiff had adequately alleged that BAC had assumed CFCs liabilities ordinarily necessary for the uninterrupted continuation of CFCs business. MBIA, slip op. at 1314 (Ex. 6 at 65859). But this conclusion rested solely on an allegation that BAC had retired the Countrywide brand and redirected Countrywides website to BACs website. Id. at 14 (Ex. 6 at 65859). Retiring brands and redirecting websites has nothing to do with assuming day-to-day liabilities. As discussed above, these steps are merely superficial changes attendant to integrating an acquired business. They provide no basis for successor liability. See pp. 910, supra. If the rule were otherwise, successor liability would be the norm rather than the rare exception. The New York courts conclusion that these allegations satisfied the de facto merger test, even under New York law, was not correct. B. The FACs Allegations Against NB Are Deficient.

The FAC should be dismissed as to NB. The FAC seeks to impose liability on NB as CHLs successor based solely on an allegation that NB acquired certain unspecified CHL assets. (See FAC 21, 229.) As discussed above, and as this Court made clear in Argent, merely purchasing assets from an affiliated corporation does not impute liability to the acquiring company. See p. 9, supra; Argent, slip op. at 7 (Ex. 1 at 9) ([A] parent does not assume an acquired subsidiarys pre-acquisition liabilities, even if the parent purchases assets of the subsidiary). And the FACs unsupported conclusions that NB is a successor to Defendants CHL or a shell entit[y] are inadequate to survive a motion to dismiss. Ashcroft v. Iqbal, 129 S. Ct. 1937, 1949, 173 L. Ed. 2d 868, 884 (2009) ([t]hreadbare

14

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 Filed 03/25/11 Page 20 of 21 Page ID #:2372

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

recitals of the elements of a cause of action, supported by mere conclusory statements cannot survive a motion to dismiss); Bell Atl. Corp. v. Twombly, 550 U.S. 544, 555, 127 S. Ct. 1955, 1965, 167 L. Ed. 2d 929, 940 (2007) ([O]n a motion to dismiss, courts are not bound to accept as true a legal conclusion couched as a factual allegation.). IV. CONCLUSION ABP concedes that after BAC acquired CFC, CFC continues to exist as a separately-incorporated subsidiary. Thus, absent allegations that provide an exception to the deeply ingrained legal doctrine prohibiting plaintiffs from holding BAC liable for CFCs pre-acquisition torts, BAC cannot be liable as CFCs successor. ABP relies on the same allegations that this Court has already rejected in denying Argents bid to hold BAC liable for CFCs alleged wrongdoing: (i) CFCs November 2008 asset transfer to BAC, (ii) BACs subsequent integration of CFC personnel, assets, operations and financial results into BAC, and (iii) BACs limited assumption of specific CFC liabilities. Thus, just as in Argent, the FAC here fails to plead successor liability, and the claims against BAC should be dismissed.

15

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

Case 2:10-cv-07275-MRP -MAN Document 91-1 Filed 03/25/11 Page 21 of 21 Page ID #:2373

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

As for NB, the FAC pleads nothing but a bald allegation that NB acquired certain CHL assets. This claim is even weaker than the FACs allegations against BAC, and it should therefore also be dismissed. Dated: March 25, 2011 Respectfully submitted, SETH ARONSON JONATHAN ROSENBERG WILLIAM J. SUSHON MATTHEW W. CLOSE OMELVENY & MYERS LLP

By: /s/ Matthew W. Close Matthew W. Close Attorneys for Defendants Bank of America Corporation and NB Holdings Corporation

16

BAC AND NBS MEMO ISO MTD 2:10-CV-07275 MRP (MANx)

You might also like

- Memorandum of Points and Authorities in Support of Its Motion For Partial Summary Judgment Dismissing All Claims Against JPMCDocument48 pagesMemorandum of Points and Authorities in Support of Its Motion For Partial Summary Judgment Dismissing All Claims Against JPMCmeischerNo ratings yet

- Petition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)From EverandPetition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)No ratings yet

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1151From EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1151No ratings yet

- Petition for Extraordinary Writ Denied Without Opinion– Patent Case 94-1257From EverandPetition for Extraordinary Writ Denied Without Opinion– Patent Case 94-1257No ratings yet

- Bank of America VP Deposition on Kirby Foreclosure CaseDocument25 pagesBank of America VP Deposition on Kirby Foreclosure CaseRazmik BoghossianNo ratings yet

- William Roberts Vs America's Wholesale Lender Appellant's OpeningDocument23 pagesWilliam Roberts Vs America's Wholesale Lender Appellant's Openingforeclosurelegalrigh100% (1)

- Motion For Sanction of Dismissal With Prejudice-Robot Signers-Fraud On The CourtDocument10 pagesMotion For Sanction of Dismissal With Prejudice-Robot Signers-Fraud On The Courtwinstons2311100% (1)

- 1903 How Does MERS WorkDocument3 pages1903 How Does MERS WorkpattigheNo ratings yet

- Bipartisan Solutions For Housing Finance Reform?Document141 pagesBipartisan Solutions For Housing Finance Reform?Scribd Government DocsNo ratings yet

- WaMu Settlement Date ExtensionDocument1 pageWaMu Settlement Date ExtensionForeclosure FraudNo ratings yet

- The Deconstruction of Kriegel v. Mers, Green Tree Servicing, LLC Federal National Mortgage AssociationDocument32 pagesThe Deconstruction of Kriegel v. Mers, Green Tree Servicing, LLC Federal National Mortgage AssociationGeorge BabcockNo ratings yet

- Robo-Signing Gems VIIIDocument34 pagesRobo-Signing Gems VIIIizraul hidashiNo ratings yet

- Order Granting in Part Cross-Motion For Summary JudgmentDocument14 pagesOrder Granting in Part Cross-Motion For Summary JudgmentPaul GrecoNo ratings yet

- William Roberts Vs America's Wholesale Lender APPELLEES' RESPONSE BRIEFDocument142 pagesWilliam Roberts Vs America's Wholesale Lender APPELLEES' RESPONSE BRIEFforeclosurelegalrighNo ratings yet

- Bank of America Rico Complaint Oct 2010 - Includes Countrywide - Robosigners-MersDocument26 pagesBank of America Rico Complaint Oct 2010 - Includes Countrywide - Robosigners-Mers83jjmackNo ratings yet

- Hooker V Northwest Trustee Mers Bank of America Order On Motion To Dismiss 5 11Document16 pagesHooker V Northwest Trustee Mers Bank of America Order On Motion To Dismiss 5 11Demetrius HankinsNo ratings yet

- Hooker V Northwest Trustee DEFs Declaration 31 Jan 2011Document4 pagesHooker V Northwest Trustee DEFs Declaration 31 Jan 2011William A. Roper Jr.100% (1)

- GCR Nims Amicus BriefDocument148 pagesGCR Nims Amicus BriefRussinator100% (1)

- Case# RIC - 10024960Document158 pagesCase# RIC - 10024960Albert ThomasNo ratings yet

- In Re WalkerDocument28 pagesIn Re Walkerzulu333No ratings yet

- Veritext Reporting Company 212-267-6868 516-608-2400Document121 pagesVeritext Reporting Company 212-267-6868 516-608-240083jjmack67% (3)

- Training Bulletin 2008-06 FinalDocument1 pageTraining Bulletin 2008-06 FinalLoretta SmithNo ratings yet

- List of Licensees Exempt from Civil Code 2923.52Document1 pageList of Licensees Exempt from Civil Code 2923.52Propertywizz0% (1)

- Giannasca FARII 08-21-2020 Final As FiledDocument61 pagesGiannasca FARII 08-21-2020 Final As FiledRussinatorNo ratings yet

- A Collection of NY Judge Arthur SchackDocument3 pagesA Collection of NY Judge Arthur Schackwinstons2311100% (1)

- 153 Memorandum of LawDocument30 pages153 Memorandum of Lawlarry-612445No ratings yet

- Oregon Judge Voids Foreclosure Sale June 2011Document7 pagesOregon Judge Voids Foreclosure Sale June 201183jjmackNo ratings yet

- BankUnited Fraud - Albertelli Law S Wrongful Foreclosure ActionDocument22 pagesBankUnited Fraud - Albertelli Law S Wrongful Foreclosure ActionAlbertelli_LawNo ratings yet

- Merscorp, Inc. Rules of Membership: Vfebruary2012 1Document47 pagesMerscorp, Inc. Rules of Membership: Vfebruary2012 1Annemieke TennisNo ratings yet

- In The United States Bankruptcy Court For The District of DelawareDocument20 pagesIn The United States Bankruptcy Court For The District of DelawaredrpcashNo ratings yet

- Deposition of Erica Johnson SeckDocument55 pagesDeposition of Erica Johnson SeckStopGovt WasteNo ratings yet

- Affidavit by Erika Lance of Nationwide Title Clearing Support Protective Order (D.E. 173-MRS V JPMC - 15-00293)Document3 pagesAffidavit by Erika Lance of Nationwide Title Clearing Support Protective Order (D.E. 173-MRS V JPMC - 15-00293)larry-612445No ratings yet

- m3 JP Morgan Chase Stated in A Fed m3 CT It Is Not Successor in Interest To Wamu Loans and Lawerence Nardi Confirms 10-30-2017Document4 pagesm3 JP Morgan Chase Stated in A Fed m3 CT It Is Not Successor in Interest To Wamu Loans and Lawerence Nardi Confirms 10-30-2017api-321082827No ratings yet

- House Hearing, 110TH Congress - J o U R N A L and History of LegislationDocument420 pagesHouse Hearing, 110TH Congress - J o U R N A L and History of LegislationScribd Government Docs100% (1)

- 2018-01-17 Ruling Clarifies Statute of Limitations, Damages in Foreclosure CasesDocument3 pages2018-01-17 Ruling Clarifies Statute of Limitations, Damages in Foreclosure Casesdbush1034No ratings yet

- STARR V BAC CHL BNY-Deposition-Of-Renee-Hertzler-02 19 2010 (Bank Fraud/securities Fraud/bankruptcy Fraud/forgery)Document67 pagesSTARR V BAC CHL BNY-Deposition-Of-Renee-Hertzler-02 19 2010 (Bank Fraud/securities Fraud/bankruptcy Fraud/forgery)Tim Bryant100% (1)

- Amicus Curiae Brief of Pacific Legal Foundation and Center For Constitutional Jurisprudence in Support of Petitioners, Marvin M. Brandt Revocable Trust v. United States, No. 12-1173 (Nov. 22, 2013)Document36 pagesAmicus Curiae Brief of Pacific Legal Foundation and Center For Constitutional Jurisprudence in Support of Petitioners, Marvin M. Brandt Revocable Trust v. United States, No. 12-1173 (Nov. 22, 2013)RHTNo ratings yet

- 11-02-18 US Drops Criminal Probe of Former Country Wide Chief Angelo Mozilo - LATimesDocument4 pages11-02-18 US Drops Criminal Probe of Former Country Wide Chief Angelo Mozilo - LATimesHuman Rights Alert - NGO (RA)No ratings yet

- Got $3.1 Million?? Judge Magner Fines Wells Fargo in Her Scathing Opinion For Wells Fargo Bad Mortgage Servicing ConductDocument21 pagesGot $3.1 Million?? Judge Magner Fines Wells Fargo in Her Scathing Opinion For Wells Fargo Bad Mortgage Servicing Conduct83jjmackNo ratings yet

- Kim V JP Morgan Chase Bank, N.A. - 3.75 Billion of Chase-WAMU Mortgages Are Voidable!!Document38 pagesKim V JP Morgan Chase Bank, N.A. - 3.75 Billion of Chase-WAMU Mortgages Are Voidable!!83jjmackNo ratings yet

- ABCs of Legal Analysis of RMBS SecuritizationsDocument6 pagesABCs of Legal Analysis of RMBS SecuritizationsHenoAlambreNo ratings yet

- Johnnie M. Hayes v. U.S. Bank National Association, 11th Cir. (2016)Document9 pagesJohnnie M. Hayes v. U.S. Bank National Association, 11th Cir. (2016)Scribd Government DocsNo ratings yet

- Dexia Vs JPM Amended ComplaintDocument420 pagesDexia Vs JPM Amended ComplaintZerohedgeNo ratings yet

- Campbell v. Steven J. Baum, MERSCORP Inc. NY CLASS ACTIONDocument17 pagesCampbell v. Steven J. Baum, MERSCORP Inc. NY CLASS ACTIONDinSFLA0% (1)

- SZYMONIAK NOT THE ORIGINAL SOURCE! DID SHE SCREW-OVER MANY OTHERS? FALSE CLAIMS ACT USED IN THIS NEWLY UNSEALED COMPLAINT--LYNN SZYMONIAK, THE FEDERAL GOVERNMENT AND MANY STATE GOVERNMENTS-AUGUST 2013- NAMES ALL THE BIG TIME BANKS---BUT STILL NO RELIEF FOR HOMEOWNERS FIGHTING FOR THEIR HOMES---NO CHAIN OF TITLEDocument145 pagesSZYMONIAK NOT THE ORIGINAL SOURCE! DID SHE SCREW-OVER MANY OTHERS? FALSE CLAIMS ACT USED IN THIS NEWLY UNSEALED COMPLAINT--LYNN SZYMONIAK, THE FEDERAL GOVERNMENT AND MANY STATE GOVERNMENTS-AUGUST 2013- NAMES ALL THE BIG TIME BANKS---BUT STILL NO RELIEF FOR HOMEOWNERS FIGHTING FOR THEIR HOMES---NO CHAIN OF TITLE83jjmackNo ratings yet

- Teil 12 Foreclosure FraudDocument44 pagesTeil 12 Foreclosure FraudNathan Beam100% (1)

- Echeverria, Et Al vs. Bank of America, Urban Lending Solutions and Carlisle & Gallagher: RICO LawsuitDocument72 pagesEcheverria, Et Al vs. Bank of America, Urban Lending Solutions and Carlisle & Gallagher: RICO LawsuitIsabel SantamariaNo ratings yet

- Why IndyMac and OneWest Avoid Loan ModsDocument9 pagesWhy IndyMac and OneWest Avoid Loan Modstraderash1020No ratings yet

- 4closed Homeowner Beats B of A, Voids Sale 4142014Document5 pages4closed Homeowner Beats B of A, Voids Sale 4142014Gene JohnsonNo ratings yet

- S.E.C. Settlement With David Sambol of CountrywideDocument5 pagesS.E.C. Settlement With David Sambol of CountrywideDealBookNo ratings yet

- Douglas D. Brunelle and Renee C. Brunelle v. Federal National Mortgage Association, Green Tree Servicing, Merscorp, Bank of America, Northwest Trustee ServicesDocument90 pagesDouglas D. Brunelle and Renee C. Brunelle v. Federal National Mortgage Association, Green Tree Servicing, Merscorp, Bank of America, Northwest Trustee ServicesChariseB2012No ratings yet

- Anti-SLAPP Law Modernized: The Uniform Public Expression Protection ActFrom EverandAnti-SLAPP Law Modernized: The Uniform Public Expression Protection ActNo ratings yet

- The Declaration of Independence: A Play for Many ReadersFrom EverandThe Declaration of Independence: A Play for Many ReadersNo ratings yet

- The Artificial Dictionary of Secret Words, Secret Code and License Plate Game and Old English: Also Helps with SpellingFrom EverandThe Artificial Dictionary of Secret Words, Secret Code and License Plate Game and Old English: Also Helps with SpellingNo ratings yet

- Lighting the Way: Federal Courts, Civil Rights, and Public PolicyFrom EverandLighting the Way: Federal Courts, Civil Rights, and Public PolicyNo ratings yet

- GSMSC Certificate - Involuntary RevokationDocument2 pagesGSMSC Certificate - Involuntary RevokationTim BryantNo ratings yet

- MWG GuidanceDocument73 pagesMWG Guidancejordimon1234No ratings yet

- Note and Rider 2005Document8 pagesNote and Rider 2005Tim BryantNo ratings yet

- Pinti V Emigrant 2015-Sjc-11742Document44 pagesPinti V Emigrant 2015-Sjc-11742Tim BryantNo ratings yet

- EFF - DocuColor Tracking Dot Decoding GuideDocument6 pagesEFF - DocuColor Tracking Dot Decoding GuideTim BryantNo ratings yet

- Mortgages Notes Deeds and Loans in Crime-Gary MichaelsDocument15 pagesMortgages Notes Deeds and Loans in Crime-Gary MichaelsTim Bryant100% (2)

- Affidavits of Title - EXECUTED - 06 26 2015Document10 pagesAffidavits of Title - EXECUTED - 06 26 2015Tim BryantNo ratings yet

- Extracting Signatures From Bank Checks - 2003Document10 pagesExtracting Signatures From Bank Checks - 2003Tim BryantNo ratings yet

- Print Over SignatureDocument2 pagesPrint Over SignatureTim Bryant100% (2)

- Harmon Notice of Foreclosure Sale - 05 22 2015 - HIGHLIGHTEDDocument10 pagesHarmon Notice of Foreclosure Sale - 05 22 2015 - HIGHLIGHTEDTim BryantNo ratings yet

- Mortgage Page 10 - Line Through SignatureDocument1 pageMortgage Page 10 - Line Through SignatureTim BryantNo ratings yet

- MERS To BAC Assignment 05 11 2011Document1 pageMERS To BAC Assignment 05 11 2011Tim BryantNo ratings yet

- 2015 Copy of Note - HarmonLaw - BryantDocument6 pages2015 Copy of Note - HarmonLaw - BryantTim Bryant100% (2)

- FRB Report - 100517-Clearing Banks As Loan Funders-BONYDocument43 pagesFRB Report - 100517-Clearing Banks As Loan Funders-BONYTim BryantNo ratings yet

- Deutsche Bank National Trust Is Not Registered To Do Business in MADocument1 pageDeutsche Bank National Trust Is Not Registered To Do Business in MATim BryantNo ratings yet

- MA OCR - Mortgage Lending in Licensed Name Only-Summary of Selected Opinion 99-026Document1 pageMA OCR - Mortgage Lending in Licensed Name Only-Summary of Selected Opinion 99-026Tim BryantNo ratings yet

- 2013 Copy of Note - HarmonLaw - BryantDocument6 pages2013 Copy of Note - HarmonLaw - BryantTim BryantNo ratings yet

- Nationstar Poa For HSBC Gsaa Het 2005-15-2014 HcrodDocument7 pagesNationstar Poa For HSBC Gsaa Het 2005-15-2014 HcrodTim BryantNo ratings yet

- GSAA Home Equity Trust 2005-15 / Received Mortgage Assignment 7 Yrs After Closing Date of The Trust.Document1 pageGSAA Home Equity Trust 2005-15 / Received Mortgage Assignment 7 Yrs After Closing Date of The Trust.Tim BryantNo ratings yet

- Bryant Mortgage PG 2Document1 pageBryant Mortgage PG 2Tim BryantNo ratings yet

- BofA To Nationstar 07 30 2013-80 BradfordDocument1 pageBofA To Nationstar 07 30 2013-80 BradfordTim BryantNo ratings yet

- Paths of Notes and Mortgages - Loan 114726037Document24 pagesPaths of Notes and Mortgages - Loan 114726037Tim BryantNo ratings yet

- DBNT Not Registered To Do Business in NYDocument1 pageDBNT Not Registered To Do Business in NYTim BryantNo ratings yet

- Bryant Mortgage 2005 - RODDocument16 pagesBryant Mortgage 2005 - RODTim BryantNo ratings yet

- GSAA HET 2005 15 Not Registered To Do Business in NYDocument1 pageGSAA HET 2005 15 Not Registered To Do Business in NYTim BryantNo ratings yet

- Closing Version Mortgage-Rider 2005 BryantDocument16 pagesClosing Version Mortgage-Rider 2005 BryantTim BryantNo ratings yet

- GSAA HET 2005 15 Not Registered To Do Business in MADocument2 pagesGSAA HET 2005 15 Not Registered To Do Business in MATim BryantNo ratings yet

- GS Mortgage Securities Corp Not Authorized To Do Business in NYDocument1 pageGS Mortgage Securities Corp Not Authorized To Do Business in NYTim BryantNo ratings yet

- A0T0CZ - GSAA Home Equity Trust 2005-15 Bond - 0.437% Until 01-25-2036 - FinanzenDocument3 pagesA0T0CZ - GSAA Home Equity Trust 2005-15 Bond - 0.437% Until 01-25-2036 - FinanzenTim BryantNo ratings yet

- Midterm PtaskDocument4 pagesMidterm PtaskJanine CalditoNo ratings yet

- Network Planning and Design: Originally by Richard Van Slyke, Polytechnic University AdaptedDocument6 pagesNetwork Planning and Design: Originally by Richard Van Slyke, Polytechnic University AdaptedLe ProfessionistNo ratings yet

- Implementing Successful Building Information Modeling - FullDocument254 pagesImplementing Successful Building Information Modeling - Fullannguyen202No ratings yet

- Published WO No. RX 21Document2 pagesPublished WO No. RX 21Jovie Ann SamoranosNo ratings yet

- Learning To Lead Leading To Learn Lesson - Katie AndersonDocument360 pagesLearning To Lead Leading To Learn Lesson - Katie Andersonabc100% (1)

- Build Better Gantt Charts With Teamgantt For Free!: First Sample ProjectDocument10 pagesBuild Better Gantt Charts With Teamgantt For Free!: First Sample ProjectMuhammad Khairul HafiziNo ratings yet

- Final Course Multiple Choice Questions Questions 17 and 35 Have Been Revised. Students Are Advised To Refer The Revised QuestionsDocument13 pagesFinal Course Multiple Choice Questions Questions 17 and 35 Have Been Revised. Students Are Advised To Refer The Revised QuestionsDiwakar GiriNo ratings yet

- OD125549891478426000Document1 pageOD125549891478426000अमित कुमारNo ratings yet

- IBM Oil - Cognos Performance Blueprint Offers Solutions For UpstreamDocument7 pagesIBM Oil - Cognos Performance Blueprint Offers Solutions For UpstreamIBM Chemical and PetroleumNo ratings yet

- Rhonda Resume 2009 - 10Document4 pagesRhonda Resume 2009 - 10rhondabitnerNo ratings yet

- Learning Culture: Implications and ProcessDocument18 pagesLearning Culture: Implications and ProcessSohailuddin AlaviNo ratings yet

- ResumeDocument3 pagesResumeapi-254941492No ratings yet

- Market Segmentation - Geographic SegmentationDocument7 pagesMarket Segmentation - Geographic SegmentationchondongNo ratings yet

- Harmonization of Accounting StandardsDocument10 pagesHarmonization of Accounting Standardskanikakumar80100% (1)

- Foreign Investments in US REDocument25 pagesForeign Investments in US RETony ZhengNo ratings yet

- Mid Term International Payments 2022Document2 pagesMid Term International Payments 2022Nam Anh VũNo ratings yet

- HW 7Document13 pagesHW 7Sheldon_CoutinhoNo ratings yet

- Hargreaves Ch. 11 Bankruptcy FilingDocument24 pagesHargreaves Ch. 11 Bankruptcy FilingNick HalterNo ratings yet

- Agency (Nature)Document8 pagesAgency (Nature)RicmcbolNo ratings yet

- Project Procurement Management: Shwetang Panchal Sigma Institute of Management StudiesDocument30 pagesProject Procurement Management: Shwetang Panchal Sigma Institute of Management StudiesShwetang Panchal100% (3)

- PFRS 8 Segment ReportingDocument3 pagesPFRS 8 Segment ReportingAllaine ElfaNo ratings yet

- PRD Requirements Checklist For Non Trade Supplier Accreditation 2011 1Document1 pagePRD Requirements Checklist For Non Trade Supplier Accreditation 2011 1LouAnn Templo Cabrera100% (1)

- Fabm Notes Lesson 005 008Document13 pagesFabm Notes Lesson 005 008KyyNo ratings yet

- Losyco ProductcataloqueDocument12 pagesLosyco ProductcataloqueRadomir NesicNo ratings yet

- Curriculum Vitae: Raj Kumar Bhattacharjee (Raj)Document15 pagesCurriculum Vitae: Raj Kumar Bhattacharjee (Raj)New Dream TelecomNo ratings yet

- Anbu Employee Welfare Measure Project PPT PresentationDocument12 pagesAnbu Employee Welfare Measure Project PPT PresentationVasanth KumarNo ratings yet

- 79MW Solar Cash Flow enDocument1 page79MW Solar Cash Flow enBrian Moyo100% (1)

- Helen Morton CV 2015Document3 pagesHelen Morton CV 2015api-304529430No ratings yet

- Perceptions of ABM Students on Becoming Young EntrepreneursDocument8 pagesPerceptions of ABM Students on Becoming Young EntrepreneursHoward CullugNo ratings yet

- Essential Worksheets 05Document2 pagesEssential Worksheets 05Daniela MedinaNo ratings yet