Professional Documents

Culture Documents

Simple Tricks To Claim Business Gift Expenses

Uploaded by

tyrelee19Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Simple Tricks To Claim Business Gift Expenses

Uploaded by

tyrelee19Copyright:

Available Formats

Tax liabilities can easily burn a hole in your pockets.

Fortunately, there are s everal tax credits and deductions that you can claim to reduce your tax burden. Do you know that by claiming deductions on business gifts, you can significantly reduce your tax liabilities? Take the help of a proficient tax service to subst antiate business gifts. Tax help - When filing a tax return a business can deduct ordinary and necessary expenses paid or incurred in carrying on any trade or business. The expense mus t be reasonable and must be helpful to the business. Gifts by individuals to co-workers are normally considered nondeductible persona l expenses. However, employee achievement awards ($400 limit) and qualified plan awards are not subject to the $25 limitation when filing a tax return. Gifts to a business client, customer or contact can be deductible business expen ses. However, the maximum deduction for gifts to any individual is $25 per year (IRS tax Code Sec. 274(b)). A gift is any item that is excluded from income unde r Code Sec. 102. Gifts that cost $4.00 or less, as well as promotional items, ar e not subject to the $25 limitation. Substantiation According to the CA tax board taxpayers filing a tax return must be able to subs tantiate certain business expenses by adequate records or sufficient evidence to take them as a deduction. Substantiation is required for business gifts, as wel l as traveling, lodging and entertainment expenses, because they are considered more susceptible to abuse. For more tax help information see - IRS Tax Code Sec. 274 - d. For tax filing of business gifts, IRS regulations require that tax services and tax filing individuals substantiate the following elements of the gift for tax r elief on a return: - Amount (the cost to the taxpayer) - Time (the date of the gift) - Description of the gift - Business purpose - the business reason for the gift, or the nature of the busi ness benefit derived or expected to be derived as a result of the gift. - Business relationship - occupation or other information relating to the recipi ent, including name, title and other designation, sufficient to establish the bu siness relationship to the taxpayer through IRS tax services. The IRS provides tax help for substantiation rules in Treasury Reg. 1.274-5T(c). The taxpayer must maintain and produce, on request, "adequate records" or "suff icient evidence" that corroborate the taxpayer's own statement. Written evidence has "considerably more probative value" than oral evidence alone. While a conte mporaneous log is not required, written evidence is more effective the closer in time it relates to the expense. Support by sufficient documentary evidence is h ighly credible. Sufficient evidence A taxpayer that does not have adequate IRS tax records may establish an element by other sufficient evidence, such as the taxpayer's written or oral statement w ith specific, detailed information, and other corroborative evidence. A descript ion of a gift shall be direct evidence, such as a detailed statement by the reci pient or documentary evidence otherwise required as an adequate record. If the taxpayer loses records through circumstances beyond the taxpayer's contro l, the taxpayer may substantiate the deduction by reasonably reconstructing his expenditures before tax filing. Adequate records Adequate records include an account book, diary, log, statement of expenses or s imilar records, as well as documentary evidence, which in combination establish each element of the expense. However, according to the CA tax board it is not ne cessary to record information that duplicates information on a receipt. The reco rd should be prepared at or near the time of the expenditure, according to the C A tax board when the taxpayer has full present knowledge of each element. A stat

ement, such as a weekly log, submitted by an employee to his employer in the reg ular course of good business practice is considered an adequate record. An adequate record of business purpose generally requires a written statement of business purpose. However, the degree of substantiation will vary depending on the facts and circumstances. Additional tax help is available from the IRS or a local tax services company.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- OCA Circular No. 90 2018Document18 pagesOCA Circular No. 90 2018alfieNo ratings yet

- Rene Borrels Non-Suit Without Prejudice 03.23.23Document3 pagesRene Borrels Non-Suit Without Prejudice 03.23.23KBTXNo ratings yet

- Non Institutional Correction 2023Document183 pagesNon Institutional Correction 2023Nestor Jr. IsadaNo ratings yet

- Fishermen's Finest Motion To InterveneDocument13 pagesFishermen's Finest Motion To InterveneDeckbossNo ratings yet

- Uploads PDF 196 SP 166695 01192021Document8 pagesUploads PDF 196 SP 166695 01192021Brian del MundoNo ratings yet

- Senate Power to Punish Witnesses for ContemptDocument2 pagesSenate Power to Punish Witnesses for ContemptJomar Teneza100% (1)

- Phil Anthony Pinelli v. United States, 403 F.2d 998, 10th Cir. (1968)Document6 pagesPhil Anthony Pinelli v. United States, 403 F.2d 998, 10th Cir. (1968)Scribd Government DocsNo ratings yet

- Case #3 Jabonette V MonteverdeDocument1 pageCase #3 Jabonette V MonteverdeailynvdsNo ratings yet

- Registration by Stanton D. Anderson, P.C. To Lobby For Puerto Rico Federal Affairs Administration (300304667)Document2 pagesRegistration by Stanton D. Anderson, P.C. To Lobby For Puerto Rico Federal Affairs Administration (300304667)Sunlight FoundationNo ratings yet

- Jo AbellanaDocument7 pagesJo Abellanarachelle baggaoNo ratings yet

- Sample Bylaws With MembersDocument4 pagesSample Bylaws With Membersanon-827000100% (2)

- As 1 (FP)Document20 pagesAs 1 (FP)kwai pengNo ratings yet

- Second Batch of Cases For Digest - Constitutional Law 2 - 1DDocument2,531 pagesSecond Batch of Cases For Digest - Constitutional Law 2 - 1Dalicia galanNo ratings yet

- II. Human Rights, Its Attributes, Origin and The Three GenerationsDocument5 pagesII. Human Rights, Its Attributes, Origin and The Three GenerationsMary Kaye Valerio100% (2)

- Statcon DigestsDocument6 pagesStatcon DigestsKatrina Santander LealNo ratings yet

- Judgment Writing (Judges) - CJ PDFDocument56 pagesJudgment Writing (Judges) - CJ PDFSimu Jemwa100% (2)

- Cases Co OwnershipDocument141 pagesCases Co Ownershipeight_bestNo ratings yet

- Rico by California Families Filed January Thirtith Two Thousand FourteenDocument255 pagesRico by California Families Filed January Thirtith Two Thousand FourteenMarsha MainesNo ratings yet

- Legal Ethics DigestDocument30 pagesLegal Ethics Digestamun dinNo ratings yet

- GABRIEL ABAD V RTC MLA G.R. No. L-65505 October 12, 1987Document2 pagesGABRIEL ABAD V RTC MLA G.R. No. L-65505 October 12, 1987JoanNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Lucknow: Project OnDocument15 pagesDr. Ram Manohar Lohiya National Law University Lucknow: Project OnVijay SinghNo ratings yet

- Stowers V Wolodzko Case 1Document3 pagesStowers V Wolodzko Case 1api-253363411No ratings yet

- Armstrong v. Exceptional Child Center, Inc. (2015)Document30 pagesArmstrong v. Exceptional Child Center, Inc. (2015)Scribd Government DocsNo ratings yet

- 12 Angry MenDocument1 page12 Angry MenHaseeb AhmedNo ratings yet

- Florentino v. RiveraDocument8 pagesFlorentino v. RiveraTopher BalagtasNo ratings yet

- United States v. Santos Jesus Martinez-Torres, United States of America v. Luis Alfredo Martinez-Torres, United States of America v. Epifanio Martinez-Torres, A/K/A "Fanny,", 912 F.2d 1552, 1st Cir. (1990)Document17 pagesUnited States v. Santos Jesus Martinez-Torres, United States of America v. Luis Alfredo Martinez-Torres, United States of America v. Epifanio Martinez-Torres, A/K/A "Fanny,", 912 F.2d 1552, 1st Cir. (1990)Scribd Government DocsNo ratings yet

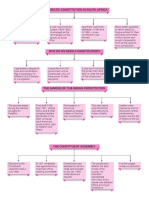

- Flow - Chart - Chapter - 2 DPDocument1 pageFlow - Chart - Chapter - 2 DPDark Devil100% (1)

- Vallarta vs CA: Sale on approval vs sale or returnDocument2 pagesVallarta vs CA: Sale on approval vs sale or returnANTHONY SALVADICONo ratings yet

- Code OF Criminal Procedure 1973: CASE LAW: A.G. V. Shiv Kumar Yadav and AnrDocument12 pagesCode OF Criminal Procedure 1973: CASE LAW: A.G. V. Shiv Kumar Yadav and Anrakshit sharmaNo ratings yet

- Case Digest Iron Steel Vs CADocument2 pagesCase Digest Iron Steel Vs CAEbbe Dy100% (1)