Professional Documents

Culture Documents

CA Agro v. CA

Uploaded by

d2015memberOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CA Agro v. CA

Uploaded by

d2015memberCopyright:

Available Formats

CA Agro-Industrial Development Corp v. CA and Security Bank & Trust Company (1993) Davide, Jr., J.

Facts:

CA Agro (through its President, Aguirre) bought 2 parcels of land from Sps Pugao for P350k. It paid P75k as downpayment, covered by 3 postdated checks. The terms of their agreement were: o Titles will be transferred upon full payment o The owners copies of the titles will be deposited in a safety deposit box with any bank o The titles can only be withdrawn by upon their joint signatures They rented a safety deposit bank from Security Bank and signed a contract of lease with the bank. It contained the conditions: o #13: bank is not a depositary of the contents and does not have possession or control of them o #14: bank assumes no liability Both were given renters keys and a guard key remained in the possession of the bank. The safety box has 2 keyholes, and both the renter and guard keys are needed to open it. Later on, a certain Mrs. Ramos offered to buy from CA Agro (the buyer in the orig Agreement) the 2 lots to a profit of P100 per sq mtr. Thats a total P280k for the entire property. Mrs. Ramos demanded the execution of a deed of sale. So, CA Agro and Pugao went to the bank and when the box was opened, the titles were not there. Because of the delay in the title transfer, Mrs. Ramos withdrew her offer. CA Agro claims for the loss of expected profit from the bank. CFI Pasig held in favour of the bank. So did the CA. CA says the relationship is lessor-lessee

Issue/Held: Is the bank liable? NO Is the contractual relation between a commercial bank andanother party in a contract of a rent of a safety deposit box wrt the contents, one of bailor-bailee, or lessor-lessee? BAILOR-BAILEE Ratio:

The contract for the rent of the safety deposit box is not an ordinary contract of lease as defined in Article 1643 (bec the full and absolute possession and control of the safety deposit box was not given to the renters) BUT it is also not fully described that it is a contract of deposit. It is a special kind of deposit. SC agrees with CA Agro that under American Jurisprudence, the prevailing rule is that the relation between a bank renting out a safe deposit and the customer wrt the contents of the box is one of bailor-bailee, the bailment being for hire and mutual benefit. In Philippine jurisdiction, we adopt the American prevailing rule bec it is clear from our statute: Sec 27 Gen Banking Act: o Banking institutions other than building and loan associations may perform the following services: (a) Receive in custody funds, documents, and valuable objects, and rent safety deposit boxes for the safeguarding of such effects. xxx o The banks shall perform the services permitted under subsections (a), (b) and (c) of this section as depositories or as agents The primary function is still within the parameters of a contract of deposit (receiving in custody of funds, docs, etc). The renting out of the safety deposit boxes is not independent from, but in conjunction with, this principal function. A contract of deposit may be entered into orally or in writing and, pursuant to Article 1306: o The parties may establish stipulations, clauses, terms and conditions as they may deem convenient, provided they are not contrary to law, morals, good customs, public order or public policy. In this case, the depositary's responsibility for the safekeeping of the objects deposited in the case at bar is governed by Title I, Book IV of the Civil Code (Obligations). o The depositary would be liable if it is found guilty of fraud, negligence, delay or contravention of the tenor of the agreement. o In the absence of any stipulation, that of a good father of a family is to be observed. So, any stipulation exempting the depositary from liability arising from the loss of the thing deposited bec of fraud, negligence or delay would be void bec it is contrary to law and public policy. the contract with the bank #13 and #14 are void #13 is wrong in saying it has no control or possession because the safe box is in the banks premises and under its absolute control & bank keeps the guard key. Petition should be dismissed, not bec of grounds stated by the CA but bec no competent proof was presented to show that the bank was aware of the agreement between the 2 parties that the title could only be withdrawn upon both of their signatures. Also, no evidence that loss was bec of fraud or negligence of the respondent Bank.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- RCBC v. Royal CargoDocument2 pagesRCBC v. Royal Cargod2015memberNo ratings yet

- Contract ExampleDocument2 pagesContract ExamplePUTERA IDAMANNo ratings yet

- BPI v. IAC & Sps CanlasDocument1 pageBPI v. IAC & Sps Canlasd2015memberNo ratings yet

- Luzon Stevedoring v. PSCDocument2 pagesLuzon Stevedoring v. PSCd2015memberNo ratings yet

- Zialcita-Yuseco v. SimmonsDocument1 pageZialcita-Yuseco v. Simmonsd2015memberNo ratings yet

- Best Short StoriesDocument3 pagesBest Short Storiesd2015memberNo ratings yet

- Traders Royal Bank v. CADocument1 pageTraders Royal Bank v. CAd2015memberNo ratings yet

- Francisco v. Toll Regulatory BoardDocument3 pagesFrancisco v. Toll Regulatory Boardd2015memberNo ratings yet

- De Gala v. de GalaDocument2 pagesDe Gala v. de Galad2015memberNo ratings yet

- Servicewide Specialists v. CADocument2 pagesServicewide Specialists v. CAd2015memberNo ratings yet

- Recentes v. CFIDocument1 pageRecentes v. CFId2015memberNo ratings yet

- Tuason v. ZamoraDocument1 pageTuason v. Zamorad2015member100% (1)

- Sealand v. CADocument2 pagesSealand v. CAd2015memberNo ratings yet

- Villareal v. RamirezDocument2 pagesVillareal v. Ramirezd2015memberNo ratings yet

- PAMECA v. CADocument2 pagesPAMECA v. CAd2015member83% (6)

- Korea Exchange Bank v. FilkorDocument2 pagesKorea Exchange Bank v. Filkord2015memberNo ratings yet

- Fue Leung V IACDocument2 pagesFue Leung V IACd2015memberNo ratings yet

- Ursal v. CTADocument1 pageUrsal v. CTAd2015member100% (1)

- ACME Shoe v. CADocument1 pageACME Shoe v. CAd2015memberNo ratings yet

- Lemi v. ValenciaDocument2 pagesLemi v. Valenciad2015memberNo ratings yet

- People v. JolliffeDocument1 pagePeople v. Jolliffed2015memberNo ratings yet

- Sps Dalion v. CADocument1 pageSps Dalion v. CAd2015memberNo ratings yet

- Global Business Holdings v. SurecompDocument2 pagesGlobal Business Holdings v. Surecompd2015member100% (1)

- Alzate v. AldanaDocument1 pageAlzate v. Aldanad2015memberNo ratings yet

- Diolosa v. CADocument1 pageDiolosa v. CAd2015memberNo ratings yet

- 02 Evangelista v. JarencioDocument2 pages02 Evangelista v. Jarenciod2015memberNo ratings yet

- Security Bank v. CuencaDocument2 pagesSecurity Bank v. Cuencad2015memberNo ratings yet

- Secuya v. de SelmaDocument1 pageSecuya v. de Selmad2015memberNo ratings yet

- Quelnan v. VHFDocument2 pagesQuelnan v. VHFd2015memberNo ratings yet

- SAMPLE Memo of Written Arguments U S 314 CRPC in DV CaseDocument19 pagesSAMPLE Memo of Written Arguments U S 314 CRPC in DV CaseAshish Shakya100% (1)

- DigestDocument4 pagesDigestJames PerezNo ratings yet

- New Case DigestDocument9 pagesNew Case DigestReyrhye RopaNo ratings yet

- WorkingDocument3 pagesWorkinghaseebNo ratings yet

- HB 1582Document3 pagesHB 1582WSETNo ratings yet

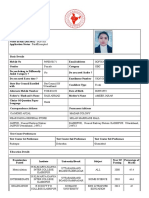

- APPLICATION FOR ALL INDIA BAR EXAMINATION AIBE-XVII - Preview ApplicationDocument2 pagesAPPLICATION FOR ALL INDIA BAR EXAMINATION AIBE-XVII - Preview ApplicationMOHD AFZANo ratings yet

- Secret Trust Theories EssayDocument4 pagesSecret Trust Theories Essayshahmiran99No ratings yet

- Legal EthicsDocument17 pagesLegal EthicsMagdalena TabaniagNo ratings yet

- MadHCRenganathanstreetregularisation OrderDocument21 pagesMadHCRenganathanstreetregularisation OrderVenkatasubramanian KrishnamurthyNo ratings yet

- Insurance-Code-Of-The-Philippines 2Document4 pagesInsurance-Code-Of-The-Philippines 2Kahayag 00No ratings yet

- Causes of Child LabourDocument3 pagesCauses of Child LabourreshmabhurkudeNo ratings yet

- Rodriguez Vs PeopleDocument2 pagesRodriguez Vs PeopleT Cel MrmgNo ratings yet

- Instant Download Introduction To The Human Body 10th Edition Tortora Test Bank PDF Full ChapterDocument15 pagesInstant Download Introduction To The Human Body 10th Edition Tortora Test Bank PDF Full Chapteralantamtdpd86100% (9)

- Complaint Form Level 2Document3 pagesComplaint Form Level 2Bua NyohNo ratings yet

- JULY 1983) Book Reviews 111: I.C.L.Q. 597) - But, Far From Being Only Retrospectively Oriented, The "Revisiting" Aims at ADocument2 pagesJULY 1983) Book Reviews 111: I.C.L.Q. 597) - But, Far From Being Only Retrospectively Oriented, The "Revisiting" Aims at APlannerNo ratings yet

- 5 Legal Concepts of Law.Document2 pages5 Legal Concepts of Law.Ahmad Faris90% (10)

- Chapter III of Companies Act - Prospectus & Allotment of SecuritiesDocument11 pagesChapter III of Companies Act - Prospectus & Allotment of SecuritiesJohn AllenNo ratings yet

- RUSTICO ABAY, JR. and REYNALDO DARILAG vs. PEOPLE OF THE PHILIPPINES, (G.R. No. 165896, September 19, 2008.)Document2 pagesRUSTICO ABAY, JR. and REYNALDO DARILAG vs. PEOPLE OF THE PHILIPPINES, (G.R. No. 165896, September 19, 2008.)Eileithyia Selene SidorovNo ratings yet

- Contract Law 616 Review Quiz 2 2019Document15 pagesContract Law 616 Review Quiz 2 2019wootenr2002No ratings yet

- Fortis Dulos AffidavitDocument18 pagesFortis Dulos AffidavitLeigh EganNo ratings yet

- Plaintiff-Appellant Vs Vs Defendant-Appellee Claro M. Recto Damasceno Santos Ross, Selph, Carrascoso & JandaDocument10 pagesPlaintiff-Appellant Vs Vs Defendant-Appellee Claro M. Recto Damasceno Santos Ross, Selph, Carrascoso & Jandamarites ongtengcoNo ratings yet

- G.R. No. 76118 Central Bank V TriumphDocument9 pagesG.R. No. 76118 Central Bank V TriumphRache BaodNo ratings yet

- Chapter 1 - Tour of The HorizonDocument114 pagesChapter 1 - Tour of The HorizonCarmina CastilloNo ratings yet

- Igcse Global Perspectives Law and Criminality NotesDocument29 pagesIgcse Global Perspectives Law and Criminality Notesrohan100% (1)

- Activity Design Barangay and SK Election 2023Document2 pagesActivity Design Barangay and SK Election 2023Jazel Grace Sale LadicaNo ratings yet

- Opposition To The Motion - Prac Court IDocument4 pagesOpposition To The Motion - Prac Court IAngel DeiparineNo ratings yet

- Case Digest NIL - Without Rigor YetDocument3 pagesCase Digest NIL - Without Rigor YetKik EtcNo ratings yet

- Breach of Fiduciary DutyDocument5 pagesBreach of Fiduciary DutyMasterChief West100% (2)

- Criminal Law Practice Packet 2010Document32 pagesCriminal Law Practice Packet 2010Brooke Stagner-Bryant100% (1)