Professional Documents

Culture Documents

Hantz NASD Acceptance Waiver Consent

Uploaded by

Stephen Boyle0%(1)0% found this document useful (1 vote)

104 views23 pagesA. STATEMENT OF FACTS

1.. Summary

From January 1, 2002 to June 30, 2004 (the wrelevant period"), HFS engaged in

certain fraudulent activities described below by misrepresenting or failing to disclose

material conflicts of interest to customers, thereby violating NASD rules and Sections

17(a)(2) and (3) of the Securities Act of 1933.1

HFS sold financial plans to its customers that recommended the customer

purchase a variety of financial products, such as mutual funds, variable annuities and

insurance products. As described belowt the firm misrepresented to its clients that it and

its employees were "independent" and "objective," HFS claimed that it offered its clients

the opportunity to choose products from a number of different suppliers and stated it was

not captive to one or a few product companies.

In fact, HFS had arrangements with a preferred supplier for each investment

product and received substantial payments from each preferred supplier. It acknowledged

to its preferred suppliers that it was not independent, it had a proprietary sales force, it

could determine what its FAs sokl, and it expected 90 percent of its sales of each

investment product to be the' preferred suppliers' products. In practice, HFS directed the

Section 17(a)(2} of the Securities Act of 1933 (the "Securities Acti provides, in relevant part. that

"It shall be unlawful for any person in the offer or sale of any security ... directly or indirectJy to ... obtain

money or property by means of any untrue statement of a material fact or any omission to state a material

fact necessary in order to make the statements made, in tight of the circumstances under which they were

made, not misleading.- SectJon 17(8)(3) provides that it is unlawful to lIengage in any transaction.

practice. or course of business which operates or would operate as a fraud or deceit upon the purchaser-.

The Supreme Court has held that establishing violations of Sections 17(a)(2) and 17(a)(3) does not

require a showing of seienter. The Court found that the language of §17(8)(2) does not include a scienter

requirement and the language of §17(a)(3) focuses on the effect of particular conduct on members of the

investing public. rather than upon the culpability of the person responsible. Aaron v. SEC, 446 U.S. 680.

696·97 (1980).

Original Title

20050811 Hantz NASD Acceptance Waiver Consent

Copyright

© Public Domain

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA. STATEMENT OF FACTS

1.. Summary

From January 1, 2002 to June 30, 2004 (the wrelevant period"), HFS engaged in

certain fraudulent activities described below by misrepresenting or failing to disclose

material conflicts of interest to customers, thereby violating NASD rules and Sections

17(a)(2) and (3) of the Securities Act of 1933.1

HFS sold financial plans to its customers that recommended the customer

purchase a variety of financial products, such as mutual funds, variable annuities and

insurance products. As described belowt the firm misrepresented to its clients that it and

its employees were "independent" and "objective," HFS claimed that it offered its clients

the opportunity to choose products from a number of different suppliers and stated it was

not captive to one or a few product companies.

In fact, HFS had arrangements with a preferred supplier for each investment

product and received substantial payments from each preferred supplier. It acknowledged

to its preferred suppliers that it was not independent, it had a proprietary sales force, it

could determine what its FAs sokl, and it expected 90 percent of its sales of each

investment product to be the' preferred suppliers' products. In practice, HFS directed the

Section 17(a)(2} of the Securities Act of 1933 (the "Securities Acti provides, in relevant part. that

"It shall be unlawful for any person in the offer or sale of any security ... directly or indirectJy to ... obtain

money or property by means of any untrue statement of a material fact or any omission to state a material

fact necessary in order to make the statements made, in tight of the circumstances under which they were

made, not misleading.- SectJon 17(8)(3) provides that it is unlawful to lIengage in any transaction.

practice. or course of business which operates or would operate as a fraud or deceit upon the purchaser-.

The Supreme Court has held that establishing violations of Sections 17(a)(2) and 17(a)(3) does not

require a showing of seienter. The Court found that the language of §17(8)(2) does not include a scienter

requirement and the language of §17(a)(3) focuses on the effect of particular conduct on members of the

investing public. rather than upon the culpability of the person responsible. Aaron v. SEC, 446 U.S. 680.

696·97 (1980).

Copyright:

Public Domain

Available Formats

Download as PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

104 views23 pagesHantz NASD Acceptance Waiver Consent

Uploaded by

Stephen BoyleA. STATEMENT OF FACTS

1.. Summary

From January 1, 2002 to June 30, 2004 (the wrelevant period"), HFS engaged in

certain fraudulent activities described below by misrepresenting or failing to disclose

material conflicts of interest to customers, thereby violating NASD rules and Sections

17(a)(2) and (3) of the Securities Act of 1933.1

HFS sold financial plans to its customers that recommended the customer

purchase a variety of financial products, such as mutual funds, variable annuities and

insurance products. As described belowt the firm misrepresented to its clients that it and

its employees were "independent" and "objective," HFS claimed that it offered its clients

the opportunity to choose products from a number of different suppliers and stated it was

not captive to one or a few product companies.

In fact, HFS had arrangements with a preferred supplier for each investment

product and received substantial payments from each preferred supplier. It acknowledged

to its preferred suppliers that it was not independent, it had a proprietary sales force, it

could determine what its FAs sokl, and it expected 90 percent of its sales of each

investment product to be the' preferred suppliers' products. In practice, HFS directed the

Section 17(a)(2} of the Securities Act of 1933 (the "Securities Acti provides, in relevant part. that

"It shall be unlawful for any person in the offer or sale of any security ... directly or indirectJy to ... obtain

money or property by means of any untrue statement of a material fact or any omission to state a material

fact necessary in order to make the statements made, in tight of the circumstances under which they were

made, not misleading.- SectJon 17(8)(3) provides that it is unlawful to lIengage in any transaction.

practice. or course of business which operates or would operate as a fraud or deceit upon the purchaser-.

The Supreme Court has held that establishing violations of Sections 17(a)(2) and 17(a)(3) does not

require a showing of seienter. The Court found that the language of §17(8)(2) does not include a scienter

requirement and the language of §17(a)(3) focuses on the effect of particular conduct on members of the

investing public. rather than upon the culpability of the person responsible. Aaron v. SEC, 446 U.S. 680.

696·97 (1980).

Copyright:

Public Domain

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 23

NASD

LETTER OF ACCEPTANCE, WAIVER AND CONSENT

NO. EAF- 0400060001

RE: Hantz Financial Services, Inc., Respondent (CRD No. 46047)

John Hantz, Respondent (CRD No. 1462066)

Pursuant to Rule 9216 of NASD'$ Code of Procedure, Respondents Hantz

Financial Services, Inc. ("HFS" or the "firm") and John Hantz ("Hantz") (collectively,

"Respondents") submit this Letter of Acceptance, Waiver and Consent (NAWe") for the

purpose of proposing a settlement of the alleged rule violations described in Part II

below. This AWe is submitted on the condition that, if accepted, NASD will not bring

any future actions against RespOndents alleging violations based on the same factual

findings.

Respondents understand that:

1. Submission of this AWe is voluntary and will not resolve this matter unless

and until it has been reviewed and accepted by NASD's Department of

Enforcement and National Adjudicatory Council f'NAC") Review

Subcommittee or Office of Disciplinary Affairs ("aDA"), pursuant to NASD

Rule 9216;

2. If this AWe is not accepted, its submission will not be used as evidence to

prove any of the allegations against them; and

3. If accepted:

a. this AWe will become part of Respondents' permanent disCiplinary

records and may be considered in any future actions brought by

NASD or any other regulator against them;

b. this AWe will be made available through NASO's public disclosure

program in response to public inquiries about Respondents'

disciplinary records;

c. NASD may make a public announcement concerning this

agreement and the subject matter thereof in accordance with NASD

Rule 8310 and IM-8310 .. 2: and

d. Respondents may not take any action or make or permit to be

made any public statement

t

including in regulatory filings or

otherwise t denying, directly or indirectly. any allegation in this AWe

or create the impression that the AWe is without factual basis.

Nothing in this provision affects Respondents' testimonial

obligations or right to take legal or factual pOSitions in litigation or

o 0 L ~ 0 5 b I 2 G 10Gb

other legal proceeding in which NASD is not a party.

Respondents also understand that their experience in the securities jndustry and

disciplinary histories may be factors that will be considered in deciding whether to

accept this AWC. This experience and history is as follows:

HFS has been an NASD member since 1999. Its principal offices are

(ocated in Southfield, Michigan. It has 16 branch offices in Michigan and

Ohio, and approximately 270 registered representatives. HFS has no

relevant formal disciplinary history.

John Hantz, age 43, has been registered as an associated person of an

NASD member since 1986. He is currently registered 8S a General

Securities Representative (Series 7) and a General Securities Principal

(Series 24). John Hantz founded HFS in 1998, and currently serves as its

President, CEO and Director. He owns 65% of HFS' parent company, the

Hantz Group ("HG'). He has no relevant formal disciplinary history.

I.

WAIVER OF PROCEDURAL RIGHTS

Respondents specifically and voluntarily waive the following rights granted under

NASD's Code of Procedure:

A. To have a Formal Complaint issued specifying the allegations against

them;

B. To be notified of the Formal Complaint and have the opportunity to answer

the allegations in writing;

C. To defend against the allegations in a disciplinary hearing before a

hearing panel, to have a written record of the hearing made, and to have a

written decision issued; and

D. To appeal any such decision to the NAC and then to the U.S. Securities

and Exchange Commission ("SEC") and a U.S. Court of Appeals.

Further, Respondents specifically and voluntarily waive any right to claim bias or

prejudgment of the General Counsel, the NAC. or any member of the NAC, in

connection with such person's or body's participation in discussions regarding the terms

and conditions of this AWe, or other consideration of this AWe .. including acceptance or

rejection of this AWe.

Respondents further speciftc8l1y and voluntarily waive any right to claim that a

person violated the ex parte prohibitions of Rule 9143 or the separation of functions

Page 2 of 22

prohibitions of Rule 9144, in connection with such personts or body's participation in

discussions regarding the terms and conditions of this AWe, or other consideration of

this AWe. including its acceptance or rejection.

II ..

ACCEPTANCE AND CONSENT

HFS and John Hantz hereby accept and consent, without admitting or denying

the allegations or findings. and solely for the purposes of this proceeding and any other

proceeding brought by or on behalf of NASD. or to which NASD is a party. prior to a

hearing and without an adjudication of any issue of law or fact, to the entry of the

following findings by NASD:

A. STATEMENT OF FACTS

1.. Summary

From January 1, 2002 to June 30, 2004 (the wrelevant period"), HFS engaged in

certain fraudulent activities described below by misrepresenting or failing to disclose

material conflicts of interest to customers, thereby violating NASD rules and Sections

17(a)(2) and (3) of the Securities Act of 1933.

1

HFS sold financial plans to its customers that recommended the customer

purchase a variety of financial products, such as mutual funds, variable annuities and

insurance products. As described below

t

the firm misrepresented to its clients that it and

its employees were "independent" and "objective," HFS claimed that it offered its clients

the opportunity to choose products from a number of different suppliers and stated it was

not captive to one or a few product companies.

In fact, HFS had arrangements with a preferred supplier for each investment

product and received substantial payments from each preferred supplier. It acknowledged

to its preferred suppliers that it was not independent, it had a proprietary sales force, it

could determine what its FAs sokl, and it expected 90 percent of its sales of each

investment product to be the' preferred suppliers' products. In practice, HFS directed the

Section 17(a)(2} of the Securities Act of 1933 (the "Securities Acti provides, in relevant part. that

"It shall be unlawful for any person in the offer or sale of any security ... directly or indirectJy to ... obtain

money or property by means of any untrue statement of a material fact or any omission to state a material

fact necessary in order to make the statements made, in tight of the circumstances under which they were

made, not misleading.- SectJon 17(8)(3) provides that it is unlawful to lIengage in any transaction.

practice. or course of business which operates or would operate as a fraud or deceit upon the purchaser-.

The Supreme Court has held that establishing violations of Sections 17(a)(2) and 17(a)(3) does not

require a showing of seienter. The Court found that the language of 17(8)(2) does not include a scienter

requirement and the language of 17(a)(3) focuses on the effect of particular conduct on members of the

investing public. rather than upon the culpability of the person responsible. Aaron v. SEC, 446 U.S. 680.

69697 (1980).

Page 3 of 22

vast majority of its sales of each product, up to 95%, to its preferred supplier in each

product category. .

HFS' revenue sharing arrangements differed from most other firms'. In some

instances, the firm collected marketing fees from its preferred suppliers that were

substantially higher than the fees received by most finns in the industry. HFS collected

almost $970,000 from the various preferred suppliers in 2002, almost $1.5 million in 2003,

and almost $1.8 million in 2004. By the end of 2004, the revenue sharing payments

gradually rose to account for 7% of HFS' total revenues, thereby becoming an increasingly

important component of the finn's business.

The payments HFS received from its preferred suppliers were a substantial factor

in the firm's decision to select, recommend and sen those suppliers' products. For

example, in 2002, HFS learned that one mutual fund company, which had been its

preferred supplier for several years, was no tonger willing to pay it. HFS loki the mutual

fund supplier it would stop selling that supplier's mutual funds and would switch the firm's

existing business to other mutual fund companies. HFS proceeded to negotiate a revenue

sharing arrangement with a new preferred supplier. Sales of the old preferred suppliers

product plummeted while the sales of the new suppliers funds soared. Moreover, HFS

transferred more than $20 million in assets from other mutual fund suppliers to the new

preferred supplier at NAV. To provide an incentive for the HFS FAs to effect these

switches, the new preferred supplier gave HFS and its F As special cash compensation in

the form of a payment of 50 basis points on each transfer. HFS customers were not told

about this special cash payment.

During portions of the relevant period, as part of its overall financial planning

process with its clients, HFS also recommended that thousands of its customers refinance

their homes through Tranex Financial Services, Inc. (nTranex"). Although the firm

disclosed a general relationship with Tranex, HFS failed to adequately disclose that HFS'

parent company owned and controlled Tranex, thereby making Tranex an affiliate of HFS.

Furthermore, HFS paid a fee that amounted to 25% of the net yield spread that Tranex

earned on the Joan to FAs who recommended the mortgage refinance loans and referred

mortgage customers to Tranex. HFS did not disclose the fact or amount of this

compensation to customers.

In addition. HFS sold limited partnership products to customers who did not meet

the minimum suitability requirements on net worth or income established by the issuer,

the State of Michigan, or HFS. HFS also distributed a sales brochure without obtaining

the required review from NASD's Advertising Regulation Department. Finally, HFS and

John Hantz failed to adequately supervise and the firm failed to maintain adequate

supervisory systems to ensure compliance with the federal securities laws and NASD

rules.

Page 4 of 22

2. Background

HFS is dually registered as a broker dealer and an investment advisor. Its 270

registered personnel work in sixteen branches in Michigan and three in Ohio. John Hantz,

its President, CEO, and principal owner. had been a top producer and Midwest Regional

Manager with a large, nationa" financial-planning finn before he founded HFS in 1998.

HFS charges its clients $300 to $2,500 to prepare a detailed financial plan. Based

upon the interviews with and information provided by the clients. HFS FA's recommend

that customers purchase various securities products (mutual funds, variable annuities, real

estate direct participation programs/limited partnerships, and variable universal life) and

other financial products (including mortgage loans, fixed annuities, life insurance, disability

insurance and long tenn care insurance). HFS sells both its plans and its financial

products through registered representatives, known internally as Financial Advisors

("FAs"). The FAs, who are employees of the finn, generally are hired with little or no

industry experience and learn to do business according to the Hantz model.

3. HFS Made Misrepresentations about its "Independence"

In speaking with potential customers. HFS' FAs generally portrayed themselves

as "independent" financial consultants. HFS' FAs generally began their initial client

interviews with potential clients by closely following a detailed script in HFS' First Year

Training Manual:

I would like to give you a little background on myself. First of a", as I may

or may not have mentioned to you I am an independent financial

consultant. Do you know what that means? To be an independent

financial consultant means a lot more freedom and flexibility to offer 8

number of different products and s9IVices without being captive to one or

a few product companies. It allows me to better service my clients to help

them reach their financial goals because there is more objectivity.

[Emphasis addedj.

In its primary sales brochure entitled "More Choices - More Results", which it

typicalty provided to customers, HFS stressed-its ability to offer "choices from a multitude

of services and products." In an advertisement published in Fall 2000, HFS claimed to sell

"the most comprehensive array of products available in the market today," and in a

February 2003 advertisement, it claimed to offer "individually designed financial plans and

a wide range of investment products. II

The firm's assertions in its sales brochure, these advertisements, and the FAs'

claims to customers, were misleading because HFS' product offerings were in essence

limited to the preferred suppliers' products for each type of investment.

Page 5 of 22

In confidential presentations sent to firms HFS was considering as potential

preferred partners, HFS conceded that it was not independent and that it did not behave

like ordinary "independent broker/dealer firms," (t wrote:

uThe [Hantz Group] Business Model is unique in the financial planning industry. In

many respects, it is almost the complete opposite of the traditional Independent

Broker/Dealer business model."

In several presentations to preferred suppliers, HFS boasted: "Because it knows its role as

a product distributor, HG is the best firm in the nation at selling proprietary product."

Elsewhere, it described its goal of being the "best controlled distribution company in the

worid at selling their partners products". HFS said that product manufacturers could utilize

. HFS' brokers as their own "proprietary sales force" and expect those brokers to sell the

"proprietary" products 90% of the time.

In fact, HFS selected one "Preferred Supplier" in each product category and then

delivered almost all of its sales to that supplier:

Product Cateaory

Mutual Funds

Variable Annuities

Fixed Annuities

WL Insurance

Term Life Insurance

Disability Insurance

REITs

long-Term Care Insur.

Preferred Supplier

Mutual Fund Company X

VA Company A

Fixed Annuity Company J

Insurance Company N

lnsurance Company N

Insurance Company M

Limited Partner Company C

Insurance Company C

% o'SII'I

84.54 %

96.45

%

92.83 %

99.45 %

81.97 %

80.71 %

94.95 %

84.63%

While claiming to be independent. objective, and freety able to offer the products of

a number of different suppliers, HFS was effectively acting as the proprietary sales arm for

specifIC product manufacturers. HFS did not disclose to its customers that it was, in

essence, recommending the products of only one preferred supplier in each product

category I although the average investor would have considered that information to be

material.

4. HFS' Revenue Sharing Arrangements Presented Undisclosed Conflicts of

Inte .... t

a. HFS Negotiatad Extraordinary Revenue Sharing Arrangements

With several of its preferred suppliers, HFS did not simply accept the marketing

fees that were being offered by those companies. It negotiated persistently with them to

2

The sales figures for Mutual Fund Company X cover the period July 1. 2003 (the quarter when

Mutual Fund Company X first became the mutual fund preferred supplier) to September 30,2004. Later,

approximately 95 percent of HFS' fund sales were of Company Xs fund.

Page 6 of 22

maximize the amount of marketing fees in return for the agreement to maximize sales of

those supptiers' products. As HFS directed inaeasing volumes of business to its preferred

suppliers, it sometimes re-opened negotiations and sought even higher levels of marketing

fees. Eventually. HFS secured several revenue sharing arrangements that \\I8re

significantly higher, for several important product categories, than the fees normally paid in

the industry, especially when compared to fees paid to firms of HFS' size and asset base:

Product Category Preferred Supplier Recent Revenue Sharing

Payments

Mutual Funds Mutual Fund Company X 45 bps on new sales

5 bps on aged assets

Variable Annuities VA Company S 25-35 bps on new sales

Fixed Annuities Fixed Company J

on the product)

bps on new sales

limited Partnerships limited Partner Company C 50 bps on new sales

Variable Universal Insurance Company N 9 % of target premiums

Life

Disability Insurance Insurance M 60 % of first year premiums

Long Term Care Insurance Company C Varying scale based on client age

Insurance

These agreements allowed HFS to collect a steadily increaSing amount of money

from marketing fees:

2002.. $ 968,772-

2003 - $ 1,487.772

2004 - $ 1.838.691

Total- $ 4,295,235

HFS' marketing fees accounted for a significant percentage of its overall revenues

- 5% in 2002, 6% in 2003, and 7% in 2004. The revenues were also important to the

firm's profitability. For example, without its marketing fees, HFS' net profits in 2002 would

have fallen from $1.026,374 to only $57,602. B"ecause of the magnitude of these fees,

revenue sharing arrangements became an increasingly critical component of the finn's

business concept.

b. HFS' Business Structure Maximized Its Revenue Sharing

Opportunities

HFS designed its structure and procedures to allow it to focus its sales effort on the

products of its preferred suppliers. In a confidential marketing presentation it made to its

preferred suppliers, HFS asserted:

Since HG's entire sales force are employees. not independent

contractors, HG can dictate how they do business .... Unlike

independent broker/dealer finns, almost all of HG's new hires come

Page 7 of 22

from outside the industry. so HG can train them to do business its

way.

An official who worked for a preferred supplier sent an internal e-mail describing HFS'

system as follows: "Hantz has strong control over the reps which can be manipulated

based upon the best deal and the best timing that can be derived."

On the rare occasions when HFS hired an experienced person, it required the new

FA to undergo a Mdetox" program to re-educate the FA on how to do business according to

the Hantz business model. HFS brought in representatives from the preferred suppliers to

train its FAs on all the positive features of that suppliers products. The FAs received little

or no training-regarding the products of non-preferred suppliers. and were discouraged

from speaking with the wholesalers who could have offered them educational information

about alternative products.

HFS subjected its new FAs to very close supervision, especially during their first

year of employment. Managers routinely tested the FAs on how well they had memorized

their sales scripts. The superVisors trained them on which products to recommend to their

customers, and helped them to become comfortable with the preferred suppliers' products,

but only those products. HFS' supervisors and employees also discouraged new FAs

from recommending the products of non-preferred suppliers during weekly "case study"

peer review meetings.

Many of HFS' 270 FAs conducted littia or no due diligence to determine which

financial products were most appropriate to recommend to their clients. Instead, they

relied almost entirely on two top managers who analyzed the many product choices and

selected what was deemed to be the best supplier in each product category. The FAs

then recommended the chosen products, based almost entirely upon the selections made

by a small group of management personnel. The F As and customers were encouraged to

focus on general concepts of financial planning and long term goals. They were not

encouraged to focus on other factors, such as the specific costs or features of a given

product. or the performance of that product in comparison to the products offered by other

product suppliers. Hantz Group's confidential Business Plan stated:

Product performance is de-emphasized .... Goal Orientation -

Identiftes long-term goals and de-emphasizes need for 'best

investment product.' [The HFS business m o d e ~ appeals to

consultants who believe that specific product choices are less

important than the planning process.

Etsewhere in its confidential Business Plan I HG described that its goal was to

develop "'ncreased Share of Wallet - Increased wallet-share initially and over time. More

accounts per client. Larger account size." Once HFS developed a client. it aggressively

sought new opportunities to eam income by offering a widening spectrum of financial

products - car insurance. home insurance. life insurance, mortgage refinancing, tax

planning, estate planning, and other financial products.

Page 8 of 22

c. HFS Selected Ita Preferred Suppliers Basad In Substantial Part Upon

the Suppliers' Willingness to Pay Marketing Fees, Presenting an

Undisclosed Conflict of Interest

During the relevant period. HFS switched from one preferred supplier to another in

only the mutual fund area. A substantial factor in HFS's decision to pick its new preferred

suppliers was the suppliers' willingness to pay marketing fees. When HFS dropped that

preferred supplier. sales of that supplier's products plummeted. When HFS seleded the

new preferred supplier and that firm began paying marketing fees. sates of that suppliers

products soared.

HFS sold the mutual funds of Mutual Fund Company 0 ("Company 0") from 1998

to 2002, when HFS discovered that that preferred supplier had stopped paying marketing

fees. HFS told Company 0 that unless it paid HFS the marketing fees supposedly owed,

HFS would stop sending Company 0 new business and move current assets out of

Company O's funds.

When Company 0 did not resume marketing fee payments. HFS stopped

recommending the sale of Company D's funds to new customers and sales of Company

O's funds decreased substantially. Later, after HFS had negotiated a new revenue

sharing agreement with Mutual Fund Company X ("Company X"), HFS named

Company X as its new preferred supplier. Once that new agreement was signed. sales

of Company X's funds skyrocketed t while sales of the old preferred supplier's funds fell,

until over 90 percent of HFS' mutual fund sales were of Company X's funds. HFS also

recommended that more than 2000 of its existing mutual fund customers transfer their

existing mutual fund holdings to Company X.

Page 9 of 22

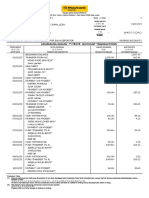

In

C

o

=

u

as

IIJ

c

l!

t-

'0

...

.!

E

::s

Z

2500

2000

1500

1000

500

o

HFS 2003 Sales of Products of

Mutual Fund Company X

Month

Marketing support agreement between HFS and Mutual Fund Company X became effective July 21,

2003. There were 12 transactions before July 21 and 45 transactions on or after July 21.

By November 2003, based on HFS' impressive volume of saies

l

Company X granted

HFS an improved revenue sharing arrangement that allowed HFS to collect 45 basis

pOints on sales and 5 basis pOints on assets (instead of the 27 basis points that had

previously been paid by Company X). The terms of this deal were among the most

generous found anywhere in the industry.

5. HFS' FAa Received Compenaation For Directing Busine.s to an Affiliated

Mortgage Company. Creating a Conflict of Interest

Hantz Group, HFS' parent company, acquired Tranex in approximately 1999.

Tranex is a licensed Michigan mortgage broker that originates residential loans for its

customers. HG replaced most of the Tranex loan officers who had previously originated

its mortgage loans and began using the HFS FAs as Tranexs exclusive sales arm. After

receiving extensive training, the HFS FAs began handling many of the various duties of

the former loan officers, such as educating the homeowners about mortgage product

options, taking mortgage applications, disseminating the various mandatory HUD

Page 10 of 22

disclosure forms, and collecting the necessary documentation required at loan closings.

Tranex employees subsequently handled the underwriting, credit analysis, and loan

decision, and attended the actual closing.

In retum for recommending a mortgage loan to their clients, and then handling

many of the various mortgage-related tasks. HFS paid the FAs referral fees that equaled

25% of the net yield spread that Tranex eamed for originating and closing the mortgage

loans. In some instances this compensation accounted for as much as a quarter of the

FAs' annual income. These fees gave the FAs incentive to recommend mortgage

refinancing to their clients. It also provided them with a financial incentive to recommend a

mortgage loan from Tranex, instead of from competing mortgage brokers or lenders. This

financial incentive presentedHFS and its FAs with a conflict of interest.

6. HFS Misrepresented or Failed to Adequately Disclose Material Facta About

its RelationshIp with Ita Preferred Suppliers and With Tranex

a. HFS Did Not Disclose to Its FAa or Its Cnents Its Exclusive

Relationships With Its Preferred Suppliers or the Marketing Fee

Arrangements

Despite the actual conflicts of interest described above, HFS did not disclose: a)

that it had selected preferred suppliers; b) that it was directing substantially all of its

business to those suppliers; or c) that those preferred suppliers were paying Significant

marketing fees to HFS with the understanding that HFS would direct most of its business

to them. HFS actions gave rise to a conflict of interest. but the firm did not provide its

clients with disclosure that would enable the clients to make suffiCiently educated

decisions about how to handle the conflict.

HFS' clients could not learn from the FAs that HFS was coJtecting marketing fees

because the firms management did not tell the FAs that the finn was receiving the fees.

HFS management opted not to inform the FAs about the revenue sharing arrangements.

because management did not believe the information was relevant or necessary for FA's.

Only a handful of HFS' top managers knew anything about the revenue sharing program.

HFS also failed to mention any specific information about the marketing fee

arrangements in the written disclosure documents it routinely provided to its clients. The

finn presented each of its clients with a Financial Planning Agreement and a Form ADV-

Part 11.3 Although these documents contained numerous disclosures relating to

compensation, they notably failed to include specifics about the revenue sharing

arrangements. HFS did not disclose to its clients that it had preferred suppliers, or specify

the tenns andlor amounts of compensation the firm was collecting.

3

Form ADV is the Uniform Application for Investment Advisor Registration- that investment

advisory firms file with the SEC and/or state securities regulators to disclose details about their business

operations. HFS distributed Part II of this form to its clients at the time they first entered into a planning

agreement. and made it avaifable at other times as well.

Page 11 of 22

b. Neither HFS Nor its FA. Adequately Disclosed to Clients or Regulators

that the F As Were Working for a Cloaely Affiliated Company and

Receiving Fee. For Recommending and Referring CUents to Tranex

HFS either misrepresented or did not adequately disclose to customers its FAs'

relationship with Tranex. tn written disclosures to clients from 2002 to 2004, HFS stated

that "no referral fees of any kind were being paid by either' Tranex or HFS to the HFS FAs.

Beginning in April 2004, HFS stated: UNo referral fees of any kind will be paid by either

Tranex or the Hantz Group for said referrals. II This failed to disclose the fees paid to the

HFS FAs in connection with the Tranex mortgage referrals.

The 2004 disclosure document also mischaracterized the role that the HFS FAs

played in the mortgage (oan process: "Once an introduction [of the customer to Tranex] is

made, Tranex representatives then handle the application, mortgage approval and closing

process." In fact, the FAa remained a main point of contact with the customers from loan

application through loan closing. and played a critical role throughout the process.

. When Tranex sold mortgages to customers who were recommended by an

affiliated business, federal law required that the mortgage customers receive a written

document (an Affiliated Business Arrangement Disclosure Statement) disclosing the

affiliation between Tranex and the company providing the mortgage referral. The Affiliated

Business Arrangement Disclosure Statement was specifically designed to disclose the

nature of the relationship between the affiliates and to reveal the amount or percentage of

the referral fee that was being paid. Neither HFS nor Tranex provided this required

disclosure to customers until September 2003.

Michigan's mortgage regulators sent a letter to Tranex in October 2002 asking

whether HFS officials were conducting mortgage business. Tranex's reply letter stated

that the HFS employees were not engaged in mortgage brokerage activity. The letter also

suggested that Tranexs customers were receiving the Affiliated Business Arrangement

Disclosure Statement at a time when they were not. Finally, Tranex did not disclose to

Michigan mortgage regulators that HFS FAs were receiving compensation from HFS for

mortgage referrals.

Moreover, even though the HFS F As were conducting the face-to-face interviews

and taking the mortgage applications, they avoided signing as the "interviewer' and left the

Signature line blank pursuant to a firm policy:

ONLY TRANEX EMPLOYEES may sign a mortgage

application as interviewer. This means that if you are an advisor of

HFS, you are not to sign a mortgage application. It must be signed

by [a Tranex employee] .... THIS IS A SERIOUS COMPLIANCE

ISSUE. [Emphasis in original].

Page 12 of 22

Clients were not provided with sufficient disclosures to alert them about the close

affiliation between HFS and Tranex and the resulting conflicts of interest. If HFS' clients

had fully understood the financial incentives the F As were receiving for recommending a

Tranex mortgage. they would have considered the FAs' recommendations more

cautiously.

7. HFS and John Hantz Failed to Establish and Follow an AdequatD Supervisory

System to Monitor the Revenue Sharing Arrangements and the Related

Disclosures

HFS failed to adequately supervise its FAs who had a) suggested to investors

that they and their firm were Ilindependent"; b) failed to disclose that HFS was selling

almost exclusively the products of its preferred suppliers; and c) failed to disclose that

the preferred suppliers were paying significant marketing fees to HFS that created a

financial incentive to promote the products of its preferred suppliers. HFS also failed to

establish, maintain and enforce supervisory systems and procedures reasonably

designed to prevent the FAs and the firm from engaging in the activities discussed

above.

As examples, HFS' procedures contained no provisions requiring officials to

monitor what the firm and its FAs told customers- about revenue sharing arrangements,

HFS' "independence'" or HFS' freedom to offer products from a wide range of product

suppliers. Finally, the firm failed to establish adequate procedures designed to

detennine whether the product companies had made appropriate disclosures in their

product prospectuses and statements of additional information about the revenue

sharing arrangements that had been reached with HFS.

Because John Hantz owned more than 650/0 of HFS' parent company, Hantz

Group, he received the majority of the financial benefits that were generated by HFS'

undisclosed revenue sharing arrangements. Furthermore, as HFS' President, CEO.

and Director, John Hantz directly supervised the firm's revenue sharing program. He

failed to adequately monitor the firm's revenue sharing activities or its disclosures

regarding the conflicts of interest described herein. John Hantz did not adequately

. ensure that HFS maintained and enforced the supervisory procedures and systems

described herein. As a result, John Hantz failed to adequately supervise HFS' activities

with respect to its revenue sharing program.

8. HFS Received and Old Not Ensure Adequate Disclosure of Special Ca.h

Compensation

In approximately July 2003, HFS entered into an agreement with Mutual Fund

Company X that allowed HFS to transfer its clients from the funds of other mutual fund

families into Company X mutual funds at net asset value ("NAV"). Since there wourd be

no sales commissions paid to the HFS FAs for moving clients to Company X mutual

funds at NAVt HFS and Company X entered into an agreement that allowed the FAs to

receive 50 bps on gross sales for all money transferred into Company X mutual funds at

Page 13 of 22

I

NAV. The special deaJ lasted from July 21 t 2003 to January 21 t 2004. Company X did

not grant this same deal to other broker-dealers who sold its mutual funds.

Company XIS payment to HFS and its FAs constituted "special cash

compensation" under NASD Rule 2830(1). Company X's prospectuses and statements

of additional information ("SAts") did not adequately disclose the special cash

compensation paid to HFS in three respects: they never mentioned HFS by name;

they did not indicate that Company X was paying special cash compensation to the HFS

FAs for their NAV transfers, but not to other firms; and they did not disclose the

tldetails" of the special cash compensation arrangements, such as the specific basis

points or dollar amounts that were being paid to the HFS FAa.

HFS, Written Supervisory Procedures Manual ( .. the WSP Manual") stated that

HFS would not enter into special cash compensation arrangements unless such

arrangements were adequately disclosed in the fund's prospectuses and SAls.

Moreover, the WSPs required HFS to ensure such disclosure was made before HFS

would accept special cash compensation.

HFS failed to follow the provisions of its WSPs and failed to comply with NASD

Conduct Rule 2830(1). Accordingly t HFS' clients who received recommendations to

transfer assets from their existing mutual funds to the funds of Company X were not

alerted to a potentially significant conflict of interest. The clients had no way of knowing

that the FAs who recommended the NAV transfers had received special cash

compensation that amounted to an economic incentive to recommend the transfer.

9. HFS Sold Limited Partnerships to Customers Who Did Not Meet Certain

Minimum Suitability Requirements

During the relevant period

l

when HFS recommended limited partnerships to its

clients, it overwhelmingly recommended and sold a product offered by one preferred

supplier, Limited Partner Supplier C (ULP Supplier CII). These products could only be sold

to investors who satisfied the minimum suitability requirements in: a) LP Supplier C's own

prospectus; b) the State of Michigan's guidelines for limited partnerships; and c) HFS'

Registered Rep Manual dated April 18

1

2003 ('he RR Manual"), Because it failed to

follow these guidelines, however, HFS sold limited partnerships to customers who did not

have sufficient assets or income to meet these minmum suitability thresholds.

While HFS made 808 total sales of these limited partnership products, at least 19

(2.4%) of those sales were made to clients who failed to meet LP Supplier Cts minimum

suitability requirements that they have either a) a minimum annual income of $45,000 and

a minimum net worth of $45,000 (excluding home, furnishings and personal automobiles);

or b) a minimum net worth of $150,000 (excluding home. furnishings and personal

automobiles).

At least 51 of HFS' 808 clients (6.30/0) who purchased LP Supplier C limited

partnerships failed to meet Michigan's suitability requirements that they have a) an annual

Page 14 of 22

gross income of at least $60,000 and a net worth (not including home, furnishings and

personal automobiles) of at least $60,000: or b) a net worth (not including home,

fumishings and personal automobiles) of at least $225,000.

At least 537 of HFS' 808 clients (66.5%) who purchased LP Supplier C limited

partnerships failed to comply with the requirement in the HFS procedures that they have at

a minimum $1 ,000,000 net worth.

HFS calculated the net worth of its clients by including the value of a clienrs home,

furnishings and automobiles. Michigan and LP Supplier C calculated their minimum net

worth thresholds by excluding the value of these three items. Therefore. HFS was unable

to provide its supervisors with a means of properly detennining whether its FAs were

recommending the sale of limited partnerships to customers for whom they were not

suitable. HFS' failure to adopt and implement appropriate procedures for unifonnly

calculating net worth therefore led to the recommendations that did not meet the various

. suitability reqUirements, and management's inability to prevent the violations.

10. HFS Failed to Obtain NASD's Review of Its Discovery Interview Brochure

HFS routinely distributed a tri ... fold Discovery Interview Brochure to all its clients and

potential clients from 1998 through 2004. This brochure suggested that HFS offered

"More Choices" and a "full range of financial services and products." It also suggested that

HFS offered "choices from a multitude of services and products to meet every investment

need." Prior to November 2004 .. the finn failed to file this brochure with the NASD

. Advertising Regulation . Department. As a resurt, HFS never obtained the review required

under NASD Conduct Rule 2210(c)(2)(A).

B. VIOLATIONS

1. HFS Made Claims of 'Independence": Violations of Sections 17(8)(2)

and 17(a)(3)" oftha Securities Act of 1933 and NASD Conduct Rule 2110 I

.. Section 17(8)(2) of the securities Act of 1933 (the "Securities Acr) provides. in relevant part, that

lilt shall be unlawful for any person in the offer or sale,of any security ... directly or indirectly to ... obtain

money or property by means of any untrue statement of a material fact or any omission to state a material

fact necessary in order to make the statements made, in light of the circumstances under which they were

made, not misleading. Section , 7(a)(3) provides that It is unlawful to -engage in any transaction.

practice, or course of business which operates or would operate as a fraud or deceit upon the purchase"-.

The Supreme Court has held that establishing violations of Sections 17(8)(2) and 17(a)(3) does not

require a showing of scienter. The Court found that the language of 17(a)(2) does not include a scienter

requirement and the language of 17(a)(3) focuses on the effect of particular conduct on members of the

investing public, rather than Lipon the culpability of the person responsible. Aaron v. SEC. 446 U.S. 680,

696-97 (1980).

NASD Conduct Rule 2110 provides: "A member, in the conduct of his business, shan observe

high standards of commercial honor and just and equitable principles of trade. "

Page 15 of 22

As described above, HFS engaged in fraudulent activity when it encouraged its

FAs to suggest to clients that both they and the firm were "independent", anot captive to

one or a few product companies". and free to offer a number of different products.

These statements were misleading, and in violation of Sections 17(a)(2) and 17(a)(3) of

the Securities Act and NASD Conduct Rule 2110.

2. HFS Entered into Revenue Sharing Arrangements that Created

Conflicts of Intereat, Without Disclosing the Arrangements to Its Cilents:

Vlolatlona of Sections 17(8)(2) and 17(8)(3)' of the Securities Act and NASD

Conduct Rule 2110

As described above, HFS engaged in fraudulent activity when it failed to inform

its clients that it sold almost exclusively the products of certain preferred suppliers and

that HFS selected those suppliers based in substantial part upon those firms'

willingness to pay significant marketing fees. HFS' clients were not informed that HFS

had a financial incentive to promote the products of its preferred suppliers or that HFS

was taking its own financial interest into account when deciding which products to

recommend to its customers. These omissions of material facts constituted a violation

of Sections 17(a)(2) and 17(a)(3) of the Securities Act and NASD Conduct Rule 2110.

3. HFS and John Hantz Failed to Establish and Follow an Adequate

Supervisory System to Monitor Its Revenue Sharing Arrangements and Related

DI.clo.ures: Vlolationa of NASD Conduct Rule 3010' and 2110 .

As described above, HFS and John Hantz did not adequately supervise the firm's

employees with respect to HFS' revenue sharing activities. They also failed to adopt,

follow or enforce a supervisory system that adequately covered these activities. No

system was in place to prevent the firm and its FAs from a} suggesting to investors that

they and their firm were "independent"; b) famng to disclose that HFS sold almost

exclusively the products of its preferred suppliers; and c) failing to disclose that the

preferred suppliers were paying significant marketing fees to HFS that created a

financial incentive to promote the products of preferred suppliers.

I Section 11(a)(2) of the Securities Act of 1933 (the "Securities Act-) provides. in relevant part. that

lilt shall be unlawful for any person in the offer or sale of any security ... directly or Indirectly to .. , obtain

money or property by means of any untrue statement of a material fact or any omission to state a material

fact necessary in order to make the statements made. in light of the circumstances under which they were

made. not misleading.- Section 17(a)(3) provides that it is unlawful to -engage in any transaction,

practice. or course of bUSiness which operates or would operate 8S a fraud or deceit upon the purchaser".

The Supreme Court has held that establishing violations of Sections 17(a)(2) and 17(8)(3) does not

require a showing of scienter. The Court found that the language of 11(a){2) does not include a scienter

requirement and the language of 17(8)(3) focuses on the effect of particular conduct on members of the

investing public. rather than upon the culpability of the person responsible. Aaron v. SEC. 446 U.S. 680.

6 9 6 ~ 9 1 (1980). .

7 NASD Conduct Rule 3010 required members to assign responsibility for each aspect of its

business to an appropriately registered prinCipaL Assigned supervisors are required to reasonably

supervise activities under their purview. Rule 3010 also requires each member to establish both

supervisory systems and written supervisory procedures specifically tailored to the member's business

that address the activities of its registered and associate persons.

Page 16 of 22

John Hantz. by serving as HFS' President, CEO, Director, and primary owner.

had ultimate responsibility for the firms supervisory failures. As a result, HFS and John

Hantz violated NASD Conduct Rules 3010 and 2110.

4. HFS Received Undisclosed Special Cash Compensation for NA V

Transfers of Mutual Funds - Violations of NASD Conduct Rules 2830(1). 3010 and

2110

As described above. HFS arranged for Mutual Fund Company X to pay special

cash compensation to the FAs for NAV transfers. These payments were not disclosed

in Company X's prospectuses or related documents, as required by NASD Conduct

Rule 2830(1).8 HFS did not have supervisory procedures to confinn that the required

prospectus reviews were conducted, as required by NASD Conduct Rule 2830(1). As a

result, HFS violated NASD Conduct Rules 2830(1)" 3010 and 2110.

5. HFS' Buslneas Practices-in the Mortgage Are. Generated

Undisclosed Conflicts of Interest - Violations of NASD Conduct Rule 2110

HFS failed to adequately disclose the fact that the FAs received referral fees as

compensation for recommending their clients to the affiliated mortgage subsidiary. As a

result, HFS violated NASD Conduct Rule 2110.

6. HFS Sold Limited Partnerships to Clients Who Did Not Meet the

Suitability Requirements - Violations of NASD Conduct Rules 2310,' 3010 and

2110

As described above, HFS sold limited partnerships to customers who did not

meet the minimum suitability requirements (in terms of assets and/or income) as laid out

in the product supplier's prospectus, the State of Michigan regulations. and HFSt

Registered Representative Manual. As a result, HFS violated'NASD Condud Rules

2310 and 2110. Furthermore, HFS did not have adequate procedures in place to allow

supervisory personnel to know whether a client had sufficient net worth to purchase the

limited partnership product. As a result, HFS violated NASD Conduct Rule 3010.

8

NASD Conduct Rule 2830(1) provides: MNo member shall accept any cash compensation from an

offeror unless such compensation is described in the current prospectus of the investment company.

When special cash compensation arrangements are made available by an offeror to a member, which

arrangements are not made available on the same terms to all members who distribute the investment

company securities of the offeror, a member shall not enter into such arrangements unless the name of

the member and the details of the arrangements are disclosed in the prospectus."

"

NASD Conduct Rule 2310 - Recommendations to Customers (Suitability): (a) In

recommending to a customer the purchase. sale or exchange of any security. a member shall have

reasonable grounds for believing that the recommendation is suitable for such customer upon the basiS of

... his financial situation and heeds. (b) Prior to the execution of a transaction recommended ... a

member shari make reasonable efforts to obtain information concerning .. , (1) the customers financial

status ... and (4) such other information used or considered to be reasonable by such member or

registered representative in making recommendations to the customer.

Page 17 of 22

7. HFS Failed to Obtain the Nece.sary Review of an Advertisement -

Violations of NASD Conduct Rules 2210 10 and 2110

HFS distributed its Discovery Interview Brochure for almost six years without

submitting it to the NASD Advertising Regulation Department for its review and

comment. As a result, HFS violated Conduct Rules 2210 and 2110.

c. SANCTIONS

Respondent John Hantz consents to the imposition. at a maximum. of the

following sanctions:

1. A censure;

2. A fine in the amount of $25,000; and

3. A suspension from acting in a supervisory capacity with any NASD

member for a period of thirty (30) days.

Respondent Hantz Financial Service., Inc. also consents to the imposition. at a

maximum. of the following sanctions:

1. a censure;

2. a fine in the amount of $675.000.

Respondent Hantz Financial Services Inc. further consents to undertake the

following:

a. HFS shan place and maintain on its public website within 15 days of the date of

Notice of Acceptance of this AWC disclosures regarding

(i) its preferred supplier relationships, including:

(a) the existence of the preferred suppliers;

(b) the names of the preferred supplier firms and the products for whom

they serve as the preferred supplier;

(c) the amount of revenue sharing payments that HFS receives from each

of the preferred suppliers based on a reasonable estimate from historical

experience, expressed in basis points or doUars;

(d) the total amount of revenue sharing payments (expressed in dollars)

that HFS receives annually. starting with the amount received in 2005 as

of the date of Notice of Acceptance of this AWe and updated each year

thereafter;

(e) that the equity owners of the Firm may benefit financially from the

revenue sharing payments HFS receives; and

(f) that HFS does not generally receive revenue sharing payments from

non-preferred suppliers; and

10

NASD Conduct Rule 2210(c)(2)(A) provides that advertising and sales literature conceming

registered investment companies (including mutual funds) must be filed with NASO"s advertising

department within 10 days of the date of first use.

Page 18 of 22

(ii) the details of the relationship between HFS and Tranex Financial

Services, Inc., including

(a) the common ownership and control;

(b) the specific tasks conducted by the HFS FAs in the mortgage loan

process;

(c) the fact that the F As receive 25% of the net yield spread that Tranex

earns on the mortgage loans referred by the FAs.

b. HFS shall send the information contained in paragraph a above:

(i) to its current customers within 90 days from the date of Notice of

Acceptance of this AWe: and

(ij) to new customers upon the opening of an account.

c. HFS shall devise and implement within 90 days of the date of Notice of

Acceptance of this AWC a policy and set of procedures to ensure that HFS is

complying with its obligations under this AWe, the federal securities laws, and

NASD rules.

d.' HFS shall devise and implement within 90 days of Notice of Acceptance of this

AWC a 'policy and set of procedures for training its FAs regarding

(i) disclosures of the financial incentives that

(a) HFS receives from its preferred suppliers; and

(b) the FAs receive for mortgage referrals toTranex; and

(ii) disclosures to customers regarding the lIindependence" of HFS and/or its

FAs.

e. HFS shall retain, within 60 days of the date of Notice of Acceptance of this AWC,

the services of an Independent Consultant not unacceptable to NASD Staff. The

Independent Consultant ("IC") shall, at HFS' expense, review and make

recommendations concerning the adequacy of HFS' policies, procedures and

disclosures as they relate to the matters described in this AWC.

f. Within 120 days of the Notice of Acceptance of this AWC, The IC shall prepare a

written report and present it to HFS and NASD staff. The report shall outline the

steps already taken by HFS to address the issues discussed in the AWe. If

necessary. the report should recommend further steps that need to be taken,

including any recommendations regarding changes that may be necessary to

HFS' supervisory and compliance procedures and systems or recommendations

for the adoption of revised disclosures relating to the matters discussed in this

AWC.

g. Within 30 days after delivery of the le's report, HFS shall either adopt all

recommendations made by the Ie or, if it determines that a recommendation is

unduly burdensome or impractical, propose an altemative procedure designed to

achieve the same objective. HFS shall submit such proposed alternatives in

Page 19 of 22

writing to the IC and the NASD staff. Within thirty days of receipt of any

proposed alternate procedure. the Ie shall: (i) reasonably evaluate the

alternative procedure and detennine whether it will achieve the same objective

as the IC's original recommendation; and (ii) provide HFS with a written decision

reflecting his or her determination. HFS will implement the Ie's ultimate

determination with respect to any proposed alternative procedure and must adopt

all recommendations deemed necessary and appropriate by the IC.

h. Within 45 days of receiving the ICs report or the IC's written decision reflecting

his or her determination as to proposed alternative procedures, HFS shan adopt

and implement all recommendations made by the IC. HFS shall also send a

written letter to NASD staff confirming the steps it has taken to (i) address the

various concerns described in this AWC; and (ii) fully implement the ICs

recommendations.

i. HFS shall cooperate fully with the Ie and shall provide him or her with access to

HFS' files, books, and records, as reasonably requested by the IC. HFS will also

provide the Ie with access to the employees, contractors and affiliates of HFS

and its affiliated companies.

j. To ensure the independence of the IC. HFS:

(i) shall not have the authority to terminate the Ie, without the prior written

approval of NASD Staff; ,

(ii) shall compensate the Ie, and persons engaged to assist the ICt for seNices

rendered pursuant to this AWe at their reasonable and customary rates;

(iii) shall not be in and shall not have an attorney-client relationship with the Ie

and shall not seek to invoke the attorney-client privilege or any other doctrine or

privilege to prevent the Ie from transmitting any information, reports, or

documents to NASD staff.

k. To further ensure the independence of the Ie. HFS shall require the Ie to enter

into an agreement that provides that. for the period of the engagement and for a

period of two years from completion of the engagement, the IC shall not enter

into any employment, consultant, attorney-cUent, auditing or other professional .

relationship with HFS, or any of its present or former affiliates. directors, officers,

employees, or agents acting in their capacity. Any firm with which the IC is

affiliated in performance of his or her duties under this AWC shall not, without

prior written consent of NASD Staff, enter into any employment, consultant,

attorney-client, auditing or other profeSSional relationship with HFS, or any of its

present or former affiliates, directors, officers, employees, or agents acting in

their capacity as such for the period of the engagement and for a period of two

years after the engagement.

J. For good cause shown, and upon receipt of a timely application from the Ie or

HFS, NASD staff may extend any of the procedural dates set forth above.

Page 20 of 22

III.

OTHER MATTERS

A. HFS and John Hantz understand that they may aHach a Corrective Action

Statement to this AWC that is a statement of demonstrable corrective steps

taken to prevent future misconduct. Respondents understand that they may not

deny the charges or make any statement that is inconsistent with the AWC in this

Statement. This Statement does not constitute factual or legal findings by NASD.

nor does it reflect the views of NASD or its staff.

B. John Hantz agrees to pay the monetary sanctions imposed on him within ten

days of the notice of acceptance of this AWC.

C. HFS agrees to pay the monetary sanctions imposed on it within the timeframes

outlined in the installment payment plan approved by NASO staff and the

National Adjudicatory Council.

D. HFS and John Hantz specifically and voluntarily waive any right to claim that they

are unable to paYt now or at any time hereafter, any monetary sanction imposed

in this matter.

The undersigned certify on behalf of HFS and John Hantz that they have read and

understand all of the provisions of this AWe and have beeh given a full opportunity to

ask questions about it, and that no offer, threat, inducement, or promise of any kind.

other than the terms set forth herein, has been made to induce them to submit it.

Hantz Financial SeNices, Inc.

Date ~ ,

By:

Name: ~ '*"'H:

Title: ec--C

z::,

l

Date John Hantz

Page 21 of 22

Reviewed by:

Hertz, Schram sa Saretsky, P.C.

1760 South Telegraph Road - Suite 300

Bloomfield Hills, MI '48302..()183

Counsel for Respondents Hantz Financial Services I Inc. and John Hantz

Accepted by NASD:

Date

Page 22 of 22

ATTACHMENT

CORRECTIVE ACDON STATEMENT

Hantz Financial Services, lnc.("HFS") is in the process of draflina a brochure for review

by NASD's Advertisina Regulation Department. The purpose of this brochure is to

infom our clients of some of the critical disclosure issues that financial services firms

face today and the potential conflicts of interest issues that may arise from certahl

relationships between HFS and its product providers. It is our desire for these issues aDd

relationships to be adequately disclosed and transparent to our cJients. This brochure will

detail the types of relationships that the Hantz Group, Inc. ("HOt') and HFS have with

various product providers. It will fully disclose that BPS receives compensation, in

differing forms and amounts, based upon various arrangements with each product

suppJier (including prefen-ed product suppliers). These disclosures will supplement the

agreed upon requirements contained in the AWe at pages 18 and 19 (Section C(aXi) and

(U.

HFS bas accepted, waived and consented in the A we at page 18 (Section 87) to a

finding that it failed to obtain the necessary review of an advertisement in violation of

Conduct Rules 2210 and 2110. On June 20, 2005, BPS received notice from NASD's

Advertising Regulation Department that the 1Ji .. fold brochure that was the subject of the

violation was reviewed. by the NASD with the following comment: "the material

submitted appears to be consistent with applicable standards."

This Corrective AdioD StatelDeDt .. ..bmltted by ReapoDdeat. It does Dot

eo titute f a ~ t a . l or leaat bdlD. by NASD

t

Bor does It reRett tile view 1 of tile

NASD or Itt staff.

You might also like

- Demolition Agenda: How Trump Tried to Dismantle American Government, and What Biden Needs to Do to Save ItFrom EverandDemolition Agenda: How Trump Tried to Dismantle American Government, and What Biden Needs to Do to Save ItNo ratings yet

- Asahi Metal Industry Co. v. Superior Court of California (1987Document16 pagesAsahi Metal Industry Co. v. Superior Court of California (1987El G. Se ChengNo ratings yet

- Civic Development Group Inc FTC 2010 Complaint Incuding Scott Pasch Aka J. Henry ScottDocument76 pagesCivic Development Group Inc FTC 2010 Complaint Incuding Scott Pasch Aka J. Henry ScottBadgeFraudNo ratings yet

- FRIA With ConclusionDocument8 pagesFRIA With ConclusionNrnNo ratings yet

- CFTR v. Mass Media Marketing, Inc., 297 F.3d 1321, 11th Cir. (2002)Document7 pagesCFTR v. Mass Media Marketing, Inc., 297 F.3d 1321, 11th Cir. (2002)Scribd Government DocsNo ratings yet

- Contracts Case DigestsDocument33 pagesContracts Case DigestsTerry FordNo ratings yet

- Eden Hannon & Company v. Sumitomo Trust & Banking Company, Eden Hannon & Company v. Sumitomo Trust & Banking Company, 914 F.2d 556, 4th Cir. (1990)Document13 pagesEden Hannon & Company v. Sumitomo Trust & Banking Company, Eden Hannon & Company v. Sumitomo Trust & Banking Company, 914 F.2d 556, 4th Cir. (1990)Scribd Government DocsNo ratings yet

- Saudia vs. Rebesencio, Et Al. Case DigestDocument3 pagesSaudia vs. Rebesencio, Et Al. Case DigestMichelle Escudero FilartNo ratings yet

- Fria Output PaperDocument11 pagesFria Output PaperNrnNo ratings yet

- R.A. No. 10142Document32 pagesR.A. No. 10142Jose Marlon Amparado CaumeranNo ratings yet

- Horizon LawsuitDocument15 pagesHorizon LawsuitRobert GarciaNo ratings yet

- FRIADocument13 pagesFRIADanice MuñozNo ratings yet

- Contracts Case DigestsDocument29 pagesContracts Case DigestsMarife Tubilag ManejaNo ratings yet

- 1996 Ann Surv SAfrican L272Document17 pages1996 Ann Surv SAfrican L272SCRUPEUSSNo ratings yet

- Tala Realty Services Corporation Vs CADocument15 pagesTala Realty Services Corporation Vs CALyceum LawlibraryNo ratings yet

- HSBC Vs ShermanDocument4 pagesHSBC Vs ShermanOscar E ValeroNo ratings yet

- Inter-Company AgreementDocument5 pagesInter-Company AgreementD GNo ratings yet

- FRIA NotesDocument11 pagesFRIA NotesDanice MuñozNo ratings yet

- Betty Gabionza and Isabelita Tan vs. Court of Appeals GR No. 161057 September 12, 2008 FactsDocument24 pagesBetty Gabionza and Isabelita Tan vs. Court of Appeals GR No. 161057 September 12, 2008 Factsdwight yuNo ratings yet

- In Re: Lifeusa Holding Inc., Lifeusa Holding, Inc., AppellantDocument21 pagesIn Re: Lifeusa Holding Inc., Lifeusa Holding, Inc., AppellantScribd Government DocsNo ratings yet

- UntitledDocument44 pagesUntitledBrylle Lancelot AbadNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDocument46 pagesBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledPaula Bianca EguiaNo ratings yet

- (2010) 2 SLR 0776Document45 pages(2010) 2 SLR 0776Aaron GohNo ratings yet

- Southern Luzon Drug Corp VS DSWD Full CaseDocument15 pagesSouthern Luzon Drug Corp VS DSWD Full CaseRegill Norman SalvacionNo ratings yet

- G.R. No. 199669 Southern Luzon DrugDocument15 pagesG.R. No. 199669 Southern Luzon DrugKresnie Anne BautistaNo ratings yet

- Philam Life v. AnsaldoDocument3 pagesPhilam Life v. AnsaldoSean GalvezNo ratings yet

- 10 Insolvency Law (R.A. No. 10142)Document25 pages10 Insolvency Law (R.A. No. 10142)roigtcNo ratings yet

- Fria and Amla CasesDocument3 pagesFria and Amla CasesdingNo ratings yet

- FATF Consult R 25Document6 pagesFATF Consult R 25laura lopezNo ratings yet

- NASD Fines Hantz Financial For Fraud, Misrepresentations Related To Undisclosed Revenue Sharing ArrangementsDocument2 pagesNASD Fines Hantz Financial For Fraud, Misrepresentations Related To Undisclosed Revenue Sharing ArrangementsStephen BoyleNo ratings yet

- Continental Marketing Corporation v. Securities and Exchange Commission, 387 F.2d 466, 10th Cir. (1967)Document6 pagesContinental Marketing Corporation v. Securities and Exchange Commission, 387 F.2d 466, 10th Cir. (1967)Scribd Government DocsNo ratings yet

- Financial Rehabilitation and Insolvency Act of 2010Document29 pagesFinancial Rehabilitation and Insolvency Act of 2010ethelandicoNo ratings yet

- Special LawsDocument30 pagesSpecial LawsJohn Joseph BeldadNo ratings yet

- PNB vs. Manila Oil Refining: Judgment Notes UnenforceableDocument4 pagesPNB vs. Manila Oil Refining: Judgment Notes UnenforceableElma DulnuanNo ratings yet

- XS1596795358 BaseDocument812 pagesXS1596795358 BaseRajendra AvinashNo ratings yet

- Bank Secrecy & Truth in Lending LawsDocument23 pagesBank Secrecy & Truth in Lending LawsJuliana ChengNo ratings yet

- Courtesy Notice ResponseDocument5 pagesCourtesy Notice ResponseAmerican KabukiNo ratings yet

- SEC v. Keystone Capital PartnersDocument42 pagesSEC v. Keystone Capital PartnersFedSmith Inc.No ratings yet

- Doc. 178 - Plaintiff Reply HSBC Motion To DismissDocument28 pagesDoc. 178 - Plaintiff Reply HSBC Motion To DismissR. Lance Flores100% (1)

- Law On Other Business Transactions 20181Document365 pagesLaw On Other Business Transactions 20181Leonel King0% (1)

- So Ping Bun vs. CADocument3 pagesSo Ping Bun vs. CAZaira Gem Gonzales0% (1)

- REPUBLIC ACT NoDocument36 pagesREPUBLIC ACT NoYlnne Cahlion KiwalanNo ratings yet

- Commercial LawDocument13 pagesCommercial LawlexNo ratings yet

- Barry Honig Vs Riot Blockchain ComplaintDocument13 pagesBarry Honig Vs Riot Blockchain ComplaintTradeHawkNo ratings yet

- LOR PPP - Investment - Ven SBLC - Dragon Destiny 020223Document5 pagesLOR PPP - Investment - Ven SBLC - Dragon Destiny 020223EM CRNo ratings yet

- CB Corp. V. CA Capital Loss Tax CaseDocument6 pagesCB Corp. V. CA Capital Loss Tax CaseVic Cajurao0% (1)

- REFERENCE - OPPT Courtesy Notice (Paper Action) - 06p00Document5 pagesREFERENCE - OPPT Courtesy Notice (Paper Action) - 06p00American KabukiNo ratings yet

- R.A. No. 10142 FRIADocument33 pagesR.A. No. 10142 FRIAMowie AngelesNo ratings yet

- 118125-2000-Arranza - v. - B.F. - Homes - Inc.20210429-12-171w8npDocument16 pages118125-2000-Arranza - v. - B.F. - Homes - Inc.20210429-12-171w8npJohn HamoyNo ratings yet

- Fortune Motors Vs CADocument11 pagesFortune Motors Vs CAJansen OuanoNo ratings yet

- Objection To TWC CH 11 PlanDocument33 pagesObjection To TWC CH 11 PlanTHROnlineNo ratings yet

- Module 2 Tila & AmlaDocument23 pagesModule 2 Tila & AmlaRoylyn Joy CarlosNo ratings yet

- Removal of Attorney for Criminal, Fraudulent PracticesDocument5 pagesRemoval of Attorney for Criminal, Fraudulent Practicesahryah ce'an elNo ratings yet

- FRIADocument82 pagesFRIARaymond RoqueNo ratings yet

- Lawyer ethics rules summaryDocument6 pagesLawyer ethics rules summarygemma acostaNo ratings yet

- La Bugal-B'Laan Vs Ramos (GR No. 127882 December 1, 2004)Document3 pagesLa Bugal-B'Laan Vs Ramos (GR No. 127882 December 1, 2004)Arah Mae BonillaNo ratings yet

- Raising Money – Legally: A Practical Guide to Raising CapitalFrom EverandRaising Money – Legally: A Practical Guide to Raising CapitalRating: 4 out of 5 stars4/5 (1)

- Consumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintFrom EverandConsumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintNo ratings yet

- Detroit Water Equity Full Report Jan 9 2019Document100 pagesDetroit Water Equity Full Report Jan 9 2019Stephen BoyleNo ratings yet

- Who Is William NowlingDocument5 pagesWho Is William NowlingStephen BoyleNo ratings yet

- 2018 Detroit Community Health AssessmentDocument28 pages2018 Detroit Community Health AssessmentStephen BoyleNo ratings yet

- MDHSS Childhood Lead Poisoning Prevention Annual Report 2016Document57 pagesMDHSS Childhood Lead Poisoning Prevention Annual Report 2016Stephen BoyleNo ratings yet

- MetaExpo 2012Document30 pagesMetaExpo 2012Stephen BoyleNo ratings yet

- Michigan Treasury Revenue Consensus FY2013-15Document2 pagesMichigan Treasury Revenue Consensus FY2013-15Stephen BoyleNo ratings yet

- Detroit JARC BrochureDocument2 pagesDetroit JARC BrochureStephen BoyleNo ratings yet

- SoM Tax Commission Air Pollution Exemption Certificates Awarded 8.21.18 - Air - PC - Transfers - 633764 - 7Document38 pagesSoM Tax Commission Air Pollution Exemption Certificates Awarded 8.21.18 - Air - PC - Transfers - 633764 - 7Stephen BoyleNo ratings yet

- Demolition Procurement Process ReportDocument36 pagesDemolition Procurement Process ReportClickon DetroitNo ratings yet

- City of Detroit (MI) Emergency Financial Operational Plan (May, 2013)Document44 pagesCity of Detroit (MI) Emergency Financial Operational Plan (May, 2013)wmartin46No ratings yet

- City of Detroit - Final Financial & Operational Plan 45 Day PlanDocument44 pagesCity of Detroit - Final Financial & Operational Plan 45 Day PlanStephen BoyleNo ratings yet

- Detroit River International Crossing - Crossing AgreementDocument54 pagesDetroit River International Crossing - Crossing AgreementStephen BoyleNo ratings yet

- People's Water Board Kids March PR June 18Document1 pagePeople's Water Board Kids March PR June 18Stephen BoyleNo ratings yet

- Coordination of Housing & Urban Development Appropriations - Detroit EMDocument2 pagesCoordination of Housing & Urban Development Appropriations - Detroit EMStephen BoyleNo ratings yet

- US Census Bureau News - Cinco de Mayo 2013Document5 pagesUS Census Bureau News - Cinco de Mayo 2013Stephen BoyleNo ratings yet

- Intergovernmental Cooperation in Michigan - Policy DialogDocument23 pagesIntergovernmental Cooperation in Michigan - Policy DialogStephen BoyleNo ratings yet

- NSP1 Detroit October-December 2011Document22 pagesNSP1 Detroit October-December 2011Stephen BoyleNo ratings yet

- Who Is Kevyn Orr?Document1 pageWho Is Kevyn Orr?Stephen BoyleNo ratings yet