Professional Documents

Culture Documents

Aircraft Finance Guide 2012

Uploaded by

rajah418Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aircraft Finance Guide 2012

Uploaded by

rajah418Copyright:

Available Formats

2012 Edition

INSIDE:

Sponsored by DVB Bank SE

AVITAS: MARKET OVERVIEW

DVB: ON THE HISTORY AND

FINANCING OF THE 777 AND A330

VEDDER PRICE: LOWERING RISK

ON PRE-DELIVERY PAYMENTS

IBA: EXAMINING THE TRENDS IN

ENGINE LEASE RATES

Finance guide 2012 cover rough 6b_Layout 1 17/08/2011 12:35 Page 1

AFG Yearbook 2012.indd 1 07/09/2011 13:52

The leading specialist in

international transport finance

www.dvbbank.com

Frankfurt/Main Hamburg London Cardiff Rotterdam Bergen

Oslo Piraeus Zurich Singapore Tokyo New York Curaao

DVB resized_DVB resize 26/07/2011 11:58 Page 1

AFG Yearbook 2012.indd 2 07/09/2011 13:52

2 GENERAL MARKET OVERVIEW:

THE RECOVERY TAKES HOLD

The aviation industry is recovering from the downturn

but recent woes have reminded us of the need to take

stock, forecast and evaluate. Introducing this years expert

analysis, Adam Pilarski, SVP at Avitas gives his overview of

the market.

8 STATE OF THE NATION:

LESSORS ASSESS THE MARKET

Paris orders, the sale of RBS, market saturation and the

introduction of Basel III aircraft lessors have much to

contend with. Mary-Anne Baldwin spoke to lessors on

these and other subjects.

16 LESSOR RANKING DATA

Aircraft lessors managed portfolios ranked by estimated

value.

22 PARTNERING FOR SUSTAINABLE GROWTH:

HOW LESSORS, AIRLINES AND OEMS CAN

WORK TOGETHER

Todays airlines understand the benets that leasing can

deliver yet lessors must adapt to meet airlines growing

needs for exible nancing tools and customised solutions.

Ray Sisson, president and CEO, AWAS provides his views.

28 FINANCING THE 777 FAMILY

Few large aircraft programmes have enjoyed the fairytale

success of the 777. Airlines commented that the 747 was

too big or that the 767-300ER was too small. The 777

was welcomed as just right. Simon Finn, SVP, aviation

nance at DVB Bank gives his detailed nancial analysis

of the aircraft type.

36 FINANCING THE A330

Next year will be the 20th anniversary of the A330s rst

ight. With a competitor and successor taking shape, now

seems a good time to review the fortunes of this popular

aircraft and to ask what its future holds. Simon Finn, SVP of

aviation at DVB Bank investigates.

42 LOWERING RISK IN PRE-DELIVERY

TRANSACTIONS

The claw-back risk is of importance to everyone involved

in pre-delivery (PDP) transactions yet few understand its

risk or how it might affect a transaction. Cameron Gee,

shareholder at Vedder Price, de-mysties the claw-back

risk in the US.

46 HOW THE PRICE OF OIL IS

FUELLING ATM EFFICIENCY

Paolo Carmassi, president of Honeywell EMEAI, explains

how the price of jet fuel is making it important for airlines

to adopt new ATM technologies to improve their operating

efciency.

50 THE FUTURE OF ANCILLARY REVENUES

The US Department of Transportation (DOT) recently called

for airlines to provide in-depth reports on ancillary fees.

Raphael Bejar, CEO of Airsavings gives his views on the

matter.

54 ECAS: A MAJOR ASSET FOR THE

SALE OF ATRS ABROAD

Few doubt the magnitude of Export Credit Agencies (ECAs)

role in nancing commercial aircraft throughout the last

downturn, yet few mention their impact with regard to small

aircraft. ATR speaks out.

58 IRELANDS TAX ADVANTAGES

It is estimated that about 83bn ($117) worth of aircraft

are managed from Ireland. Why? Because of Irelands

extensive tax treaty network. Ailish Finnerty and Caroline

Devlin, both partners at Arthur Cox, explain the reasons for

Irelands allure.

63 DOING BUSINESS WITH CHINA:

THE RISKS AND REWARDS

China is a crucial aviation partner yet it is also notoriously

secretive and a potential threat to the Wests aerospace

sector. Are we playing with the enemy, or allowing caution

to hold us back? Scott Hamilton reports.

68 ENGINE LEASING UPDATE

More engine leasing companies have entered the market

and many airlines were either unwilling or unable to ofoad

spare engines in the last recession. Alex Derber looks at

the consequences.

74 TRENDS IN ENGINE LEASE RATES

As the market rises from the ashes of another recession

it is time for the analysts to assess the damage. Dr. Stuart

Hatcher, head of valuations and modelling at IBA Group

plays his part in the assessment as he evaluates engine

lease rates.

80 CURRENT TRENDS IN THE USED

AIRCRAFT MARKET

Over the years, there have been several signicant trends

in the evolution of used aircraft dispositions. Pete Seidlitz,

president of Bristol Associates, examines the changes.

86 CARGO CONVERSION:

CHOOSING THE RIGHT TIME

Deciding to convert passenger aircraft to freighters is

an important economic move that involves several key

variables. These can make yes compelling or no the

only option. Chris Kjelgaard reports.

92 ANATOMY OF A SUCCESSFUL NARROWBODY

FREIGHTER FLEET START-UP

Building a new freighter fleet is a complicated process.

At its heart is selecting the right aircraft for the job. Kevin

Casey, president of Pemco looks at some of the things

cargo operators may consider when expanding their eet.

96 FINANCING AIRCRAFT SPARES

Component OEMs encouraged airlines to nance spares

through costly initial provisioning (IP) programmes. That

was until two things changed it. John Avery, director of

supply chain services and Ian Malin, treasurer and chief

investment ofce at AJ Walter explain.

100 THE UK BRIBERY ACT:

DONT GET CAUGHT OUT

In certain circumstances, payments help things happen.

But the UKs new Bribery Act will make what seems a

normal course of action, an illegal one. Richard Mumford,

partner and head of the dispute division at ASB Law, a

specialist in aviation law, explains.

106 AIRCRAFT TRANSACTIONS

Full listing of transactions for Boeing and Airbus passenger

aircraft, 1H 2011

EDITOR

Mary-Anne Baldwin

mary-anne.baldwin@ubmaviation.com

STAFF WRITERS

Alex Derber

aderber@ubmaviation.com

PRODUCTION & DESIGN

The Magazine Production Company

Dean Cook

deancook@magazineproduction.com

FRONT COVER DESIGN

Kalven Davis

kalven.davis@ubmaviation.com

CIRCULATION MANAGER & E-EDITOR

Paul Canessa

paul.canessa@ubmaviation.com

INTERNATIONAL MEDIA SALES MANAGER

Alan Samuel

alan.samuel@ubmaviation.com

PUBLISHER & SALES DIRECTOR

Simon Barker

simon.barker@ubmaviation.com

GROUP PUBLISHER

Anthony Smith

anthony.smith@ubmaviation.com

AIRCRAFT FINANCE GUIDE 2012

The Aircraft Finance Guide (Print) ISSN 2044-8015 (Online) ISSN

2044-8023 is published annually in September by UBM Aviation

Publications Ltd.

Airline Fleet Management (Print) ISSN 1757-8833 (Online) ISSN

1757-8841. (USPS 022-324) is published bi-monthly, in January,

March, May, July, September and November by UBM Aviation

Publications Ltd.

Distributed in the USA by SPP c/o 95, Aberdeen Road, Emigsville,

PA 17318-0437, USA.

Periodicals postage paid at Emigsville, PA, USA.

POSTMASTER: send address changes to:

Airline Fleet Management (AFM)

c/o SPP P.O. Box 437 Emigsville, PA 17318, USA.

AFM UK annual subscription cost is 150.00 GBP.

AFM Overseas annual subscription cost is 170.00 GBP or $300

USD. AFM single copy cost is 25.00 GBP (UK) or $50.00 USD

(Overseas). Aircraft Finance Guide single copy cost is 55.00 GBP

(UK) or $110.00 USD (Overseas)

All subscription records are maintained at:

UBM Aviation Publications Ltd.

7th Floor, Ludgate House, 245 Blackfriars Road,

London, SE1 9UY, UK.

All subscriptions enquiries to:

Paul Canessa: paul.canessa@ubmaviation.com

Tel: +44 (0) 207 579 4873

Fax: +44 (0) 207 579 4848

Website: www.ubmaviationnews.com

Front cover sponsored by: DVB Bank

Printed in England by: Pensord

Distribution/Mailing: Flostream UK

The Aircraft Finance Guides and AFM magazine, part of UBM

Aviation Publications Ltd, have used its best efforts in collecting and

preparing material for inclusion in these publications but cannot

and does not warrant that the information contained within these

publications are complete or accurate, and does not assume and

hereby disclaims, liability to any person for any loss or damage

caused by errors or omissions in either the Aircraft Finance Guide

or in AFM, whether such errors or omissions result from negligence,

accident or any other cause.

This publication may not be reproduced or copied in whole or in

part by any means without the express permission of UBM Aviation

Publications Ltd. Airline Fleet Management is a licensed trademark

of UBM Aviation Publications Ltd. All trademarks used under license

from UBM Aviation Publications Ltd.

19992011, UBMAviationPublicationsLtd. All rightsreserved.

1 AIRCRAFT FINANCE GUIDE 2012

The leading specialist in

international transport finance

www.dvbbank.com

Frankfurt/Main Hamburg London Cardiff Rotterdam Bergen

Oslo Piraeus Zurich Singapore Tokyo New York Curaao

DVB resized_DVB resize 26/07/2011 11:58 Page 1

AFG Yearbook 2012.indd 1 07/09/2011 13:52

2 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

T

HE ECONOMIC DOWNTURN THAT BEGAN in late 2007

was, from a global perspective, the most severe downturn

since World War II. The recession was largely triggered by a

nancial crisis in the US that spread quickly to other advanced

economies, particularly in Europe.

World passenger traffic dropped 1.5 per cent in 2009 yet

moving into 2010, passenger traffic growth was positive

across all world regions with particularly strong results in

Asia-Pacic. The Middle East, Latin America and Africa had

much lower bases but year-on-year growth was good. Moving

into 2011, world revenue per kilometer (RPK) trafc growth

is forecast at 5.2 per cent, largely due to the difcult year-on-

year comparisons but also due to the slightly lower forecasts of

economic growth and higher oil prices.

In order to stabilise the nancial industry and stave off further

economic damage, the US, UK, and several other European

countries approved bank bailout plans. Figure 2 displays

historic and forecasted GDP growth from 2007 to 2012 by major

world regions. As is shown, after a miserable 2009, positive

economic growth was estimated for all major regions in 2010

but forecasts for 2011 show slowed growth in the three major

regions of Europe, North America, and Asia.

General market overview:

The recovery takes hold

The aviation industry is recovering well from the downturn, cargo gures have been rising since 2010, and

airline protability is increasing. The industrys recent woes however, have reminded us all of the need to

take stock, forecast and evaluate. Introducing this years market analysis by the experts, Adam Pilarski,

SVP at Avitas gives his general overview of the market.

Figure 1: source, ICAO and AVITAS forecasts

Figure 2: source World Bank for historic data, AVITAS forecasrs for 2011 & 2012

AFG Yearbook 2012.indd 2 07/09/2011 13:52

3 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

OIL AND AIRLINE PROFITABILITY

Between 2000 and 2010, fuel accounted for between 13 and

33 per cent of an airlines total industry costs. The peak of

33 per cent occurred in 2008 when the price per barrel (pb)

reached $147 before subsequently falling to a low of around

$40pb in 2009 as the global recession deepened. As shown in

Figure 3, fuel prices climbed steadily from 2009 to 2010; by

the end of 2010, it was around $90pb. More recently, spot fuel

prices have measured close to $100pb due partially to unrest

in several Middle Eastern countries and differences between

the oil output gures of members of the Organisation of the

petroleum exporting countries (OPEC).

Figure 3 Source: US Department of Energy, June 2011.

Avitas forecasts that oil prices will remain between $80 to

$100pb for the remainder of the year. While we foresee that

in the long-term there will be signicantly lower oil prices,

these developments will not occur for a number of years. In

the meantime, high oil prices will have a signicant impact

on industry profitability. The International Air Transport

Association (IATA) estimates that each $1 increase in the

average annual fuel price leads to a $1.6bn reduction in airline

protability.

As shown in Figure 4, the most recent downturn is notable

not only for the level of nancial losses but also for its truly

global impact. While the post-9/11 downturn was primarily felt

by US carriers, this latest recession had a global reach. In both

2008 and 2009, airlines in the three most developed markets

North America, Europe, and Asia experienced signicant

losses. During 2010, the situation improved considerably with

overall industry protability reaching $18bn. Carriers in North

America earned a combined net profit of $4.1bn; European

airlines earned $1.9bn; and operators in the Asia- Pacic region

reported total net prots of $10bn. However, a series of events

over recent months have led most observers to signicantly

downgrade their outlook for 2011.

IATA considerably lowered its most recent estimates

regarding airline profitability. First published in June 2011,

IATA predicted aggregate prots would hit $8.6bn for the year,

however it now forecasts a much more modest $4bn. This

compares to an aggregate prot of $18bn in 2010. The aviation

authority said that increased fuel prices, the natural disasters

in Japan and political upheaval in North Africa and the Middle

East had all combined to generate a much more negative

outlook for the industry.

Figure 4 Source: ATA, ICAO and IATA.

NARROWBODIES

The decision by Airbus to go ahead with the A320 neo a range of new designs intended

to act as replacements for the A319, A320 and A321 has resulted in an important

development in the commercial narrowbody jet market.

In December 2010, the manufacturer launched the A320 neo programme with entry into

service (EIS) expected in late 2015. Shortly after announcing the programme, it began

booking orders. These reached unexpectedly high levels at the Paris Air Show (PAS),

such that by the end of June 2011, total orders and commitments for the A320 neo family

surpassed 1,000.

Airbus says the aircraft option will deliver a 15 per cent fuel saving compared with

existing aircraft and will have a 95 per cent airframe commonality with existing aircraft in

the family. There will also be a choice of engines; CFM Internationals (CFMI) Leap-X or

Pratt & Whitneys (P&W) PW1100G. Airbus will also install its wingtip devices, Sharklets,

as a standard feature and will upgrade its cabin.

In July, Boeing offered to re-engine its 737 for its cash-cow customer, American Airlines (AA).

It was the rst time Boeing agreed to deliver a counterpart to the neo, recently announced as

the 737 Max. It was a reaction to Airbus attempt to win AA as its customer with a competitive

$6bn nancing deal.

Of further note is the development of the C919 by Chinas COMAC. Aimed squarely at

the A320 and 737-800 market. The aircraft will accommodate 170 to 190 passengers and

will feature the Leap-X engine. First ight is scheduled for 2014 with EIS due two years

later. Orders to date have come primarily from operators in China, although COMAC has

also received a small number of commitments from GECAS and was reported to have had

discussions with Ryanair.

The Russian MS21 aircraft is also a potential competitor in that market segment. It will

be powered by the new P&W engine. Bombardiers CSeries narrowbody aircraft is smaller,

has enjoyed modest sales and is expected to y in 2012.

Figure 5 Source: OAG Aviation

AFG Yearbook 2012.indd 3 07/09/2011 13:52

4 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

WIDEBODIES

Following lengthy delays, Boeing now plans to deliver the rst

787 to its launch customer, ANA, in 3Q 2011 more than

eighteen months after its first flight. The programme is far

behind schedule but with more than 800 rm orders booked

so far, it is already a success for the manufacturer. The aircraft

is available in two versions: the 787-800, which carries 242

passengers and the 787-900, which carries 280 passengers.

The competing product from Airbus the A350XWB is

scheduled to y for the rst time in 2012 with EIS the following

year. The A350 is also a success having secured almost 600 rm

orders to date.

The A380 has now been in commercial service for more than

three years although its orderbook remains relatively modest

and somewhat concentrated.

Boeing will deliver the rst 747-8F later in 2011 to its launch

operator Cargolux. The maiden ight of its passenger variant

occurred in March 2011 with the rst delivery taking place in

2012. With rm orders at around 100 units, the 777 freighter is

also establishing a convincing presence.

Online Aircraft Values

Run specific aircraft values for over 35,000 commercial aircraft

using a serial number or registration, or run over 150 generic

aircraft types. With an annual subscription, you have unlimited

access 24/7, ensuring a quick pay back of your investment.

Key features:

Base, Current and Future Values (including Future Market Values)

Soft and Distress Values

Full-life maintenance adjustments

Custom inflation rates for values and maintenance adjustments

Serial or Registration number look up

Detailed specification adjustment options

Export to Excel

Professionally printed output

Portfolio Monitoring Service

With Portfolio Monitoring, it has never

been easier to track and monitor your

values. By using the import tool to load

up to 1,500 individual aircraft into multiple

folders, you are able to allocate your fleet

according to your classifications (e.g., by region,

aircraft type, lessee, equity vs debt, and

owned vs managed). You can easily

run different value scenarios and

export them to Excel.

Online Engine Values

Run maintenance-adjusted current and future engine values

for over 130 commercial jet engines.

Key features:

Quick selection by Manufacturer/Engine type

Differentiate between First Run and Mature engines

Bare, Partial or Full QEC options

Enter customized Overhaul and LLP information for an

adjusted value

Export to Excel

Call 703.476.2300 today for a free demonstration.

For more information about our online values, please visit www.AVITAS.com,

email info@avitas.com or call +1.703.476.2300 (US), +44.173.784.3756 (UK)

Values Anywhere, Anytime at AVITAS.com

Project2_Layout 1 26/08/2011 16:15 Page 1

Figure6 Source: OAG Aviation

AFG Yearbook 2012.indd 4 07/09/2011 13:52

Online Aircraft Values

Run specific aircraft values for over 35,000 commercial aircraft

using a serial number or registration, or run over 150 generic

aircraft types. With an annual subscription, you have unlimited

access 24/7, ensuring a quick pay back of your investment.

Key features:

Base, Current and Future Values (including Future Market Values)

Soft and Distress Values

Full-life maintenance adjustments

Custom inflation rates for values and maintenance adjustments

Serial or Registration number look up

Detailed specification adjustment options

Export to Excel

Professionally printed output

Portfolio Monitoring Service

With Portfolio Monitoring, it has never

been easier to track and monitor your

values. By using the import tool to load

up to 1,500 individual aircraft into multiple

folders, you are able to allocate your fleet

according to your classifications (e.g., by region,

aircraft type, lessee, equity vs debt, and

owned vs managed). You can easily

run different value scenarios and

export them to Excel.

Online Engine Values

Run maintenance-adjusted current and future engine values

for over 130 commercial jet engines.

Key features:

Quick selection by Manufacturer/Engine type

Differentiate between First Run and Mature engines

Bare, Partial or Full QEC options

Enter customized Overhaul and LLP information for an

adjusted value

Export to Excel

Call 703.476.2300 today for a free demonstration.

For more information about our online values, please visit www.AVITAS.com,

email info@avitas.com or call +1.703.476.2300 (US), +44.173.784.3756 (UK)

Values Anywhere, Anytime at AVITAS.com

Project2_Layout 1 26/08/2011 16:15 Page 1

AFG Yearbook 2012.indd 5 07/09/2011 13:52

6 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

GE Aviation

OnPoint is GEs consultative approach to aviation services

that focuses on meeting each customers goals and needs.

Through OnPoint, we offer exible solutions that lower

cost of ownership and deliver world-class support with

unparalleled operational excellence.

To learn more, visit www.geaviation.com/onpoint.

Tailored services with your specic business

requirements and nancial needs in mind.

67416_onpoint_solns_afg_yrbk.indd 1 8/22/11 1:46 PM

REGIONAL JETS

Figure 7 shows the trend in orders and deliveries for regional

jet aircraft since 1990. The two main manufacturers of 50-

seat aircraft Bombardier and Embraer both enjoyed

considerable success in the market in the 1990s and 2000s. In

recent years, however, the dynamics changed dramatically as

the older regional jets aged further and came towards the end

of their leases. More attention is now given to larger aircraft

in the 70 to 90 seat class and notably in addition to the two

traditional manufacturers in Russia and Japan.

Embraer followed from the success of programmes such as the

ERJ145 to develop its family of EJets. These small aircraft are

purpose built and capable of accommodating between around

70 and 120 passengers (depending on the variant). Each of

the models in the E170, E175, E190 and E195 range have an

established and signicant market presence particularly the

E190 and E195, which have a substantial backlog of rm orders.

Similarly, Bombardiers CRJ100 and CRJ200s remain in

widespread use, mainly by North American and European

operators, but are now falling out of favour to the advantage

of their larger siblings in the CRJ700 and CRJ900 families. The

largest version, the CRJ1000, entered commercial service in

December 2010.

From Japan, the MRJ series will offer a 70 to 80 seat and an

80 to 90 seat variant. Orders have already been secured from

ANA and Trans States Airlines with its maiden ight expected

to take place in 2012. The aircraft will feature Pratt & Whitneys

PW1200G geared turbofan engines.

The Russian manufacturer Sukhoi has produced the

Superjet 100, which ew for the rst time in May 2008 with

the rst delivery in April 2011. This will also offer a range of

designs within the 80 to 100 seat size class and is expected

to sell well to local carriers, although it has also secured

orders in Thailand, Italy and Mexico to date. The aircraft will

feature Powerjet engines jointly built by Saturn of Russia and

SNECMA.

Finally, the Chinese manufacturer COMAC has designed the

ARJ21, an aircraft offering 70 to105 seats (depending on the

variant). The aircraft is very similar to the DC9 in terms of general

conguration and is equipped with General Electrics CF34-10A

engines, aimed to be a selling point to operators outside China.

However, to date, the only commitment from outside the country

has been from GECAS, which ordered ve units.

Overall, the commercial aviation industry appears to be on

track toward the next peak in the market cycle, which AVITAS

forecasts to occur in 2017. The peak in the economic cycle

(which typically precedes the market peak) is forecast to be in

2013. However, the recent industry recession and the global

nancial crisis led to a severe tightening of liquidity for aircraft

nancing. The volume of nancial support provided by export

credit agencies (ECAs) will also begin to decrease at some point.

Of further concern are political uncertainties in the Middle

East, which are contributing to rising oil prices, thus depressing

worldwide trafc through the yield mechanism.

The next decade should bring wide changes to the operating

landscape, something that will affect aircraft manufacturers.

Bombardier and Embraer will face challenges in winning

further orders for regional jets as new players from Japan, China

and Russia are likely to have a significant impact on market

dynamics. Also, two new major widebody designs the 787

and A350 should be in commercial service within the next

two years and both have substantial order backlogs to be met.

Airbus has said it plans to deliver the first A320 neo in late

2015. Boeing will be close behind with its re-engine option, the

737 MAX. The aircraft will offer a seven per cent advantage

in operating costs over future competing aircraft, Boeing said.

Boeing forecasts global demand for more than 23,000 aircraft

in the 737s market segment over the next 20 years at a value

of nearly $2trn. The 737 MAX has already won 496 orders.

Deliveries are expected to begin in 2017, two years after Airbus

rolls out its A320 neo.

Figure 7 Source: OAG Aviation

AFG Yearbook 2012.indd 6 07/09/2011 13:52

GE Aviation

OnPoint is GEs consultative approach to aviation services

that focuses on meeting each customers goals and needs.

Through OnPoint, we offer exible solutions that lower

cost of ownership and deliver world-class support with

unparalleled operational excellence.

To learn more, visit www.geaviation.com/onpoint.

Tailored services with your specic business

requirements and nancial needs in mind.

67416_onpoint_solns_afg_yrbk.indd 1 8/22/11 1:46 PM

AFG Yearbook 2012.indd 7 07/09/2011 13:52

8 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE

W

EVE CLEARED THE APEX OF the financial gale

though weve yet to clear all the debris and wreckage.

The used aircraft market is yet to recover fully and bank

lending has not returned to pre-crisis levels. However,

much has been tided. ILFC was nationalised, CIT Aerospace

entered and exited Chapter 11 and AerCaps freefalling share

price has risen.

Next Royal Bank of Scotland (RBS), which is 83 per cent

owned by the UK government, is to sell its aviation arm having

waiting for the maelstrom of the downturn to clear.

But which lessor will be able to ingest a company the size

of RBS Aviation? Following the Paris Air Show in June, BOC,

GECAS and owner of AWAS, Terra Firma, announced interest

in buying the company. ICBC and HKAC are also thought

to be contenders yet Avolon has been barred from Bidding.

Norman Liu, president and CEO of GECAS, said: Its of a size

that youd need pretty deep pockets. And remember that they

have an orderbook of some 100 planes, so the manufacturer

needs to be comfortable with whoever assumes those Or

else it would be some kind of piecemeal solution that might

make it more palatable.

Paris orders, the sale of RBS Aviation, market saturation and the introduction

of Basel III aircraft lessors have much to contend with. New and market-

leading lessors spoke to Mary-Anne Baldwin at the Paris Air Show on these

and other subjects. Plus, we give you low-down on who is moving and who is

losing with portfolio value data from Ascend.

State of the nation:

Lessors assess the market

AFG Yearbook 2012.indd 8 07/09/2011 13:52

9 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

According to data from Ascend which ranks lessors by their

portfolio value, RBS slipped two places to fth place and its

combined portfolio value (comprising both stored and in

service managed aircraft) fell $173.3m year-on-year. GECAS

and ILFC are the largest lessors remaining at rst and second

place respectively, however ILFCs combined value fell by

$5487.85m.

I know our balance sheet is growing and if we didnt sell

wed be growing even faster, says Liu. He adds that the

company tries to invest $6.5bn in assets each year and it must

invest $5.5bn just to stay at which is an enormous amount

compared to other guys out there. The net growth is about

$1bn in rough numbers but on a portfolio of $50bn thats not

a lot.

Robert Martin, CEO of BOC Aviation similarly told AirFinance

Journal that BOC would consider buying the company given

the right economics. However, he told AFM at the air show:

Its up to the UK government this is a nationalised bank

(RBS, parent of RBS Aviation) where the state has taken

majority shareholding, so the state must decide. In terms of

BOCs clout, it ranks sixth the same as in 2010 however its

combined portfolio value has risen by $783.7m.

Looking at other lessors that feature high in the rankings,

AerCap rose seven places to third, increasing its combined

portfolio value by $1838.4m year-on-year. CIT held its place at

fourth, and Babcock & Brown dropped two place to seven and

AWAS was up one to number eight.

Of particular note was Macquarie, which rose ve places to

10 and saw its portfolio value climb by $1312.45m. Boeing

Capital Corporation (BCC) dropped a signicant seven places

just making the top table at number 20. Its managed portfolio

value fell $503.95m.

THE NEW WAVE

As the larger lessors have been re-couping or

planning to sell, new entrants have come in to

scavenge what deals they can but according

to John Higgins, CEO of Avolon, there is room

enough for all. I dont think theres been a death

of the mega-lessor [a subject talked about across

the industry] just a lot of market opportunity and

people like ourselves have been able to step in

and satisfy that market demand.

In late June, Innity Aviation Capital announced

itself to the market. The new nance and leasing

company is a joint venture (JV) between Perella

Weinberg and three aviation industry veterans:

Richard Baudouin, co-founder of Aviation Capital

Group, and Khawer Ali and Jerrold Rosen, both

principals at KJ Aviation Services.

John Higgins, CEO of Avolon

AFG Yearbook 2012.indd 9 07/09/2011 13:52

10 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE

Innity has already acquired its rst three aircraft, pre-owned

737NGs, which are currently leased to a major airline. It said

in a statement that it intended to invest further in jet and

turboprop aircraft, engines and other related assets as well as

mezzanine loans.

David Schiff, Partner at Perella Weinberg, stated his reasons

for joining the new venture. Recent disruptions in the airline

and aircraft leasing industries have resulted in significant

opportunities to provide needed liquidity and financing

solutions to airlines, leasing companies, and other owners of

aircraft and equipment.

Despite newcomers detecting signicant opportunities, others

namely established lessors have complained that there is not

enough capacity in the market. However, the success of Avolon,

and even more so of Air Lease Corporation (ALC), proves

otherwise. ALC raised $802.5m in its initial public offering (IPO)

in April. It sold 30.3 million at $27.56, four per cent higher than

the IPO price. Avolon has raised $3bn in capital since May 2010,

ordered 12 new 737-800NGs, eight new A320s and completed

sale and leaseback and portfolio transactions for over 60 aircraft.

Its base-case business plan, says Higgins, is to build a portfolio

of about $6bn over the next two years.

A converse criticism is that new lessors have been pricing

up the sale and leaseback market. To this, Higgins responds:

I have the insight so I can say with certainty that we havent

bid up, but clearly I cant make that information public, were a

private company.

What others believe is under-cutting, Higgins says is dexterous

negotiations. When airlines award a mandate they dont

award the mandate purely on the basis of economics when

I sit in front of an airline we trade off a number of things; our

experience, low risk, the economics, our understanding of a

particular operator and how they like to structure a lease in a

particular way.

Ive heard the commentary. But we are winning a small

percentage of the deals we bid on because we are very

disciplined... We dont want to do whatever deal is on the

market and then look back in a few years and say how did

we turn out to have 50 per cent of our book in this country?

However, he admits that when he sees a deal that fits his

portfolio the gloves may come off, chosing to be more

competitive if bidding for a deal in one region more consistent

with its portfolio build-up.

As a lessor that has a low cost of funding, BOC Aviation has

few concerns about what its CEO, Martin, sees as the natural

rise of the new entrant leasing company. When youre a new

company you have to rush to get critical mass and were very

happy to help them do that, well sell them aircraft with leases

attached to get them going. We sold to ALC in the early days

and to others, so we dont see them as a threat actually we

need new players because no one party can do the amount of

capital expenditure that is going in this cycle.

AFG Yearbook 2012.indd 10 07/09/2011 13:52

11 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

MEETING COMMITMENTS

Despite airline bankruptcies and route cuts, the top lessors have generally

kept their aircraft on lease. BOC boasts that it has not had an aircraft off

lease for ve years (it currently has 175 aircraft) and according to a report

written by Goldman Sachs which was released in May, only three lessors

had aircraft returned. ILFC had two of its 933 aircraft grounded when its

Indonesian customer ceased operators, however one of the two aircraft was

quickly re-leased. Other early returns included Aircastle and AerCap, which

had aircraft in the Middle East and Africa, both of which were affected by

political unrest.

Going forward however, high fuel prices appear to be putting pressure

on ILFCs customers. There were 17 customers ying 77 ILFC aircraft that

were two or more months late on their lease payments, up from 11 customers

in 1Q 2010While competitors have been able to re-lease aircraft quickly

and for relatively little cost after accounting for security and maintenance

deposits, more distressed customers could put pressure on lease rates in the

next few quarters. ILFC had 49 scheduled lease maturities at the beginning of

2011 and 137 in 2012, the report also said.

ILFC, a wholly-owned subsidiary of American International Group (AIG),

has so far entered into 114 lease commitments in 2011 and placed its rst

aircraft orders since 2007. Its CEO, Henri Courpron said, Airlines are

acknowledging ILFCs nancial strength and the appeal of our portfolio and

order book.

In the year-to-date, ILFC ordered 100 A320neo family aircraft and 33 737-

800s and has raised considerable nance. It secured a term loan facility for

$1.5bn and an unsecured bank revolver for $2bn. The company also raised

$2.25bn in unsecured public debt and tendered for $1.75bn in

bond maturities in 2012 and 2013.

ILFC is scheduled to take delivery of four new 737-800s worth

an estimated $175m this year. Its a light schedule, says

Goldman Sachs report, and it will allow ILFC to direct more of

its cash ow toward debt repayment.

In a similar recent report by Goldman Sachs, this time on

AWAS, it wrote: AWAS took a large ($292.7m) write-down to

its eet book value in 2009 after it concluded that the nancial

crisis had permanently impaired the value of much of its eet.

Since then, it has made relatively small adjustments to its eet,

and the aircraft it has sold have been at prices close to or above

book value. The current market value of the eet with no leases

attached is approximately $4.4bn, according to Ascend, which

is about $1.1bn or 20 per cent below the book value of $5.5bn.

We think this method of valuation probably understates the

actual value of the eet when leases are taken into account, and

we do not expect signicant write-downs in book value from

AWAS in the future.

The report estimated AWAS book value as being closer

to market value than that of some of its competitors most

notably ILFC. ILFC wrote down 155 aircraft by $1.5bn in 2010

and it may take up to $300m per year in further impairments.

Ascends valuation of AWAS eet is approximately 26 per cent

less than book value, says Goldman Sachs.

AFG Yearbook 2012.indd 11 07/09/2011 13:52

12 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

whaL happens when

you comblne:

More Lhan 23 years of

commlLmenL Lo Lhe

avlauon lndusLry .

wlLh unmaLched Lechnlcal

& asseL managemenL

experuse .

and a dynamlc growLh

plauorm wlLh scale,

global reach &

exlblllLy .

Innovanve Av|anon

I|nance So|unons

for Cur Customers.

www.awas. com

Project1_Layout 1 11/05/2011 12:38 Page 1

BURGEON OR BURST: BASEL III AND THE ASU

Martin admits he has renegade views on the market, as was

evident from BOCs lack of orders during the Paris Air Show.

While orders from other lessors were mounting, Martin

asserted that the industry is in a bubble. In 2007 we said there

was a bubble and a year later the bubble burst, he recalls.

We sat out and watched in 2007we were the guys who at

the bottom of the cycle picked up $2.5bn of equipment in the

space of three months. He plans to do this same this time.

The reason why were seeing a bubble this time is the launch

of the neo but frankly how people can say what the fleet is

going to look like in eight years time when you consider what

happened in the eight years from 2001 to 2009 Im amazed. In

reality, these (the orders made at Paris) are just options because

people put down a very small amount on them. These planes

still need 95 per cent of their nancing secured.

We believe that having gone through the bottom of the cycle

the amount of capital expenditure in dollar terms will go up

dramatically over the next three years. He cites a number of

reasons for this, rstly the 787, which is soon to start delivery

after a delay of three years. Then there is the roll-out of the 747-

800 and an increase in production rates for the A320 family,

737NG family and A330 family.

He notes the disparity between this increase in capital

expenditure and the low supply of money. On the latter side he

lists the Greek crisis, the EUs advice that European banks leave

aviation nancing, and the signicantly higher cost of export

credit pricing.

AIRCRAFT LESSOR - TOP 20 RANKING LIST

Aircraft Operating

Lessor A300 A310

A320

Family A330/40 A380

737

(CFM) 737 (NG) 747 757 767 777 CRJs

ERJ 135-

195 MDS Others

Combined

number of

aircraft

GECAS 3 S 3 IS

467 IS,

13 S

46 IS, 1 S

227 IS,

21 S

397 IS,

2 S

26 IS 22 IS, 8 S 70 IS, 4 S 35 IS, 1 S

233 IS,

32 S

149 IS,

12 S

34 IS, 4 S 33 IS, 2 S 1845

ILFC 5 IS, 1 S 3 IS, 1 S

370 IS,

16 S

121 IS,

2 S

77 IS, 4 S

197 IS,

6 S

14 IS, 2 S 64 IS, 1 S 53 IS, 1 S 70 IS, 1 S 8 IS, 1 S 1017

AerCap 1 IS

153 IS,

11 S

28 IS 41 IS, 3 S 25 IS 7 IS, 2S 6 IS 2 IS 5 IS 6 IS, 1 S 291

CIT Aerospace 1 IS

122 IS,

2 S

23 IS 11 IS, 70 IS, 2 S 11 IS 8 IS 1 IS 1 IS 252

RBS Aviation

Capital

118 IS,

2 S

2 IS

106 IS,

2 S

2 IS 9 IS, 4S 245

BOC Aviation 71 IS 6 IS 1 IS 64 IS 1 IS 19 IS 162

Babcock &

Brown Aircraft

Management

I S 81 IS, 4 S 8 IS

37 IS,

11 S

111 IS 5 IS 27 IS, 1 S 6 IS, 1 S 7 IS 8 IS, 1S 309

AWAS 1 IS 49 IS, 3 S 18 IS 1 IS 52 IS, 7 S 34 IS 7 IS 7 IS 19 IS, 1 S 1 IS 11 IS, 2 S 3 IS 203

Aviation Capital

Group

75 IS,

12 S

3 IS 37 IS, 9 S 76 IS, 5 S 3 IS, 3 S 7 IS, 1 S 9 IS, 5 S 5 IS 215

Macquarie

AirFinance

1 IS 72 IS, 5S 9 IS 12 IS, 2 S 51 IS 1 IS 4 IS, 3 S 1 IS 4 IS 2 IS 2 IS 124

Aircastle Advisor 1 IS 25 IS, 5 S 20 IS 15 IS, 2 S 29 IS, 1 S 13 IS, 1 S 10 IS 12 IS 1 IS 1 IS 129

Doric Asset Finance

& Verwaltungs

6 1S 3 IS 11 IS 6 IS 26

ICBC Leasing 17 IS 8 IS 2 IS, 1 S 11 IS 9 IS 7 IS 7 IS 62

MC Aviation

Partners/

Mitsubishi

Corporation

21 IS, 1 S 8 IS 5 IS 19 IS 4 IS 17 IS 2 IS 9 IS 86

Amentum Capital 13 IS, 2 S 7 IS, 1 S 13 IS 2 IS 6 IS 1 IS 4 IS 49

CDB Leasing 15 IS 14 IS 11 IS 1 IS, 4 S 3 IS 2 IS 2 IS 1 IS 54

Hong Kong Aviation

Capital

31 IS 12 IS 10 IS 4 IS, 1 S 2 IS 2 IS 6 IS 2 IS 70

DAE Capital 16 IS 11 IS 16 IS 5 IS 48

SMFL Aircraft

Capital

22 IS 5 IS 2 IS 31 IS, 1 S 2 IS 4 IS 77

Boeing Capital Corp 1 IS 17 IS, 4 S 5 IS 1 IS 32 IS 8 IS 28 IS, 1 S

101 IS,

26 S

224

Add a large amount of excess demand for money to a

restricted supply of money, and why would you be placing

large speculative orders? Its better to wait and nance this large

amount of cap-ex thats going to come through.

Avolons Higgins however, is confident that airlines and

lessors will continue to nd nancing though it may be a little

harder. Of particular impact will be Basel III, a new regulation

on the lending practises of banks, which will be gradually

introduced from 2013, and the Aircraft sector Understanding

(ASU), which from 2012 will support wider lending by

increasing the cost of export credit agencies (ECA) loans.

I think banks will continue to be very active in lending to

both airlines and lessors because fundamentally, aircraft are

good assets. I think on the technical level of how Basel III is

implemented there might be a slight shift down in the overall

tenor of lending (to below 10 years as opposed to 12) but Im

not expecting a shock factor from Basel III.

Liu of GECAS says: I dont think spreads will get much

tighter because of Basel III and return on equity. Bank equity

levels are going up in general, which means pricing will have

to go up. They (spreads) are not going to drop that much further

because of the regulatory requirements of [the] ASU theres

a lot of hullabaloo about it, but Im like, its relatively mild.

The ASU will affect lessors on varying levels. GECAS for

example, relies on its parent company for funding rather than

ECA or Ex-Im support. We tried an Ex-Im just to give it a whirl

when funding costs were different but now it doesnt make a lot

of sense, says Liu. However, lessors like Avolon, which hopes

AFG Yearbook 2012.indd 12 07/09/2011 13:52

whaL happens when

you comblne:

More Lhan 23 years of

commlLmenL Lo Lhe

avlauon lndusLry .

wlLh unmaLched Lechnlcal

& asseL managemenL

experuse .

and a dynamlc growLh

plauorm wlLh scale,

global reach &

exlblllLy .

Innovanve Av|anon

I|nance So|unons

for Cur Customers.

www.awas. com

Project1_Layout 1 11/05/2011 12:38 Page 1

AFG Yearbook 2012.indd 13 07/09/2011 13:52

14 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

Advanced aircraft f leet solutions to the world

We offer flexible fleet solutions

to our airline customers.

Our priority is to ensure that an assortment of top-quality aircraft and engine

selections are incorporated into our fleet options. Thus, ILFC can provide the most

flexible solutions for our airline customers. We work with the airframe and engine

manufacturers to offer the best value and product support packages. Our team

always stays abreast of the latest advances in aircraft technologies.

Meet our Fleet Planning team.

ilfc.com/fleet

to secure ECA and Ex-Im nancing by the end of year if only,

says Higgins to diversify its funding sources will be affected.

But the higher cost of ECA loans should mean airlines will

step back from purchasing and towards leasing aircraft,

bringing an overall positive affect to the market. If the market

continues to evolve the way we see it evolving I think there

will be increased demand for leasing as airlines will be

looking for alternatives to the ASU structure, says Higgins.

Maybe theyll do more debt nancing and capital nancing

and I would expect the new ASU to drive demand in operating

leasing but who knows what broader macro environment

well be in. The new ASU may be a more expensive product

than the previous version but it may be that theres high

demand for it at the time due to extraneous factors.

Its very simple, asserts BOCs Martin. When you put

the price of something up, the demand for it should fall but

that doesnt seem to tie with production. Most airlines order

aircraft when they see their revenue start to go up. They dont

think about the nancing side until the pre-delivery payments

start two years ahead of delivery. People havent considered

that the cost of nancing is going up.

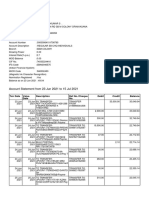

LESSOR RANKING BY MANAGED VALUE

Aircraft operating lessor Est. value in-service aircraft [$m] Est. value stored aircraft [$m] Combined value [$m] 2010 Combined value [$m]

GECAS 34,564.60 962.35 35,526.95 34,950.21

ILFC 27,168.00 695.05 27,863.05 33,350.90

AerCap 6,955.35 219.8 7,175.15 5,335.75

CIT Aerospace 6,623.40 81.6 6,705.00 6,272.35

RBS Aviation Capital 6,369.60 108 6,477.60 6,650.90

BOC Aviation 6,249.90 N/A 6,249.90 5,466.20

Babcock & Brown Aircraft Management 5,756.10 149.3 5,905.40 6,027.45

AWAS 4,409.60 72 4,481.60 4,156.45

Aviation Capital Group 4,253.90 277.8 4,531.70 4,423.85

Macquarie AirFinance 3,738.55 61.55 3,800.20 2,487.75

Aircastle Advisor 3,278.65 149.35 3,428.00 3,037.90

Doric Asset Finance & Verwaltungs 2,743.60 N/A 2,743.60 2,350.35

ICBC Leasing 2,680.80 5.7 2,664.50 N/A

MC Aviation Partners/Mitsubishi Corporation 2,571.25 21 2,592.25 2,605.90

Amentum Capital 2,393.75 131.3 2,525.05 2,216.65

CDB Leasing 2,268.15 48.75 2,316.90 N/A

Hong Kong Aviation Capital 2,177.60 19.5 2,197 2,332.00

DAE Capital 2,069.25 N/A 2,069.25 1,854.70

SMFL Aircraft Capital 1,991.10 23.5 2,014.60 1,625.05

Boeing Capital Corp 1,984.60 272.95 2,257.55 2,761.50

According to Higgins, manufacturers production rates are the key

driver of stability in the industry. He says that despite hearing a

variety of opinions of the matter he has faith the OEMs will get it right.

Manufacturers, through this most recent cycle, have demonstrated

ability and a discipline around production rates which wasnt the same

in other down cycles Whereas they make announcements with real

intent about increased production rates and timelines, if the market

circumstances were to change I think the manufacturers would change.

Martins view however, like much of his market analysis, differs from

other lessors. Boeing and Airbus are not necessarily looking at overall

market supply and demand, they are just doing what their shareholders

want which is to produce the maximum number of aircraft.

Manufacturers sell aircraft to every customer who comes to buy aircraft,

rather like selling cars A lot of people who used to lease aircraft are now

buying them, and thats not because they can afford them, because then

they have to go back to a lessor to do a sale and leaseback. So the dynamics

of the market are changing. We are seeing a lot of aircraft coming onto the

market to replace aircraft that are coming off their rst leases so seven to

12 years old.

Because the manufacturers didnt cut their supply during the

downturn there has been a relative excess of aircraft coming into the

market compared to demand and at the same time weve had airline

consolidation with very little start-up [airline] activity the utilisation

of aircraft has gone up and weve needed less aircraft. What that means is

theres been aircraft thrown out of the market at an earlier age short-term

unemployed if you like.

In terms of leasing older used aircraft Higgins says: I wouldnt say theres

an absence of competition in that space. He notes that other lessors,

namely Aircastle, have stated their intent to buy older aircraft. In the case of

Aircastle, eight- to 15-years-old.

While Avolon has a particularly young eet, just 1.6-years-old on average,

he says the company is not averse to buying older models. We dont have

a binary policy of we dont do used airplanes. He adds that the company

has bought aircraft as old as ve years and because of its relationships with

airlines it has had a number of opportunities to buy more. The decision

will come down to risk adjusted returns and only after looking at the

nancial and maintenance risks and technological obsolescence will it

make a decision.

AFG Yearbook 2012.indd 14 07/09/2011 13:52

Advanced aircraft f leet solutions to the world

We offer flexible fleet solutions

to our airline customers.

Our priority is to ensure that an assortment of top-quality aircraft and engine

selections are incorporated into our fleet options. Thus, ILFC can provide the most

flexible solutions for our airline customers. We work with the airframe and engine

manufacturers to offer the best value and product support packages. Our team

always stays abreast of the latest advances in aircraft technologies.

Meet our Fleet Planning team.

ilfc.com/fleet

AFG Yearbook 2012.indd 15 07/09/2011 13:52

16 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

AAR Aircraft Sales & Leasing 149.25 In Service 20 1 2 1 1 1

AAR Aircraft Sales & Leasing 22.65 Stored 2 2

AELIS Group 0.95 In Service 1

AerCap 6955.35 In Service 66 7 6 2 1 153 28 5 6

AerCap 219.8 Stored 3 2 11 1

AerGlobe 12.6 In Service 3

AerGlobe 11 Stored 3

Aergo Capital 73.8 In Service 27 10

Aergo Capital 34.3 Stored 14 16

Aerolease International 81.8 In Service 4

Aerolease International 50.5 Stored 5

Aeron Aviation Corp 0.1 In Service

Aerospace Management Capital 58.8 In Service 4

Aerospace Management Capital 29.4 Stored 2

Aerostar Leasing 55.35 In Service 5 1

Aerostar Leasing 10.65 Stored 1

Aerovista 6.5 In Service 4

Air Lease Corporation 1994.55 In Service 22 1 4 22 3

Air Lease Corporation 46.8 Stored 1

Air Transport Leasing 1 In Service 1

Air Transport Leasing 4.1 Stored 1 1

Airbus Asset Management 219.75 In Service 6 8

Airbus Asset Management 20.5 Stored 4

Aircastle Advisor 3278.65 In Service 44 13 10 12 1 1 25 20 1

Aircastle Advisor 111.7 Stored 3 1 5

Aircraft Asset Management 234.35 In Service 1 7

Aircraft Asset Management 23.05 Stored 1

Aircraft Financing and Trading 12 In Service

Aircraft Financing and Trading 7 Stored

Aircraft Leasing & Management 886.9 In Service 23 2 10 8 4

Aircraft Leasing & Management 38.6 Stored 1 5 1

Aircraft Purchase Fleet 1429.55 In Service 53 10

Aireet Credit Corp 53.7 In Service

Aireet Credit Corp 67.5 Stored 3

Airlease International 1.5 In Service

Airlease International 2.05 Stored

Airline Capital Leasing 0.65 In Service 2

Airline Capital Leasing 4.7 Stored 1 1

ALAFCO & Novus Aviation 237.75 In Service 1 1 3 3 1

ALAFCO 1578.8 In Service 16 4 1 27

ALAFCO 96.95 Stored 3

Alandia Air 2.7 In Service

Alandia Air 5.7 Stored

Aldus Aviation 319.3 In Service 16

Alpstream 99.45 In Service 3

Alpstream 74.4 Stored 2

Amentum Capital 2393.75 In Service 13 2 6 13 7 1 4

Amentum Capital 131.3 Stored 2 1

Apollo Aviation Group 113.7 In Service 11 1 1 2 2 1

Apollo Aviation Group 89.7 Stored 5 3 2 2

Archway Aviation 58.1 In Service 3

ASL Aviation 254.9 In Service 5 5 15 1

Aurora Aviation Group 6.7 In Service 2

Aurora Aviation Group 4.2 Stored 1

Manager Value Status 737 747 757 767 777 A300 A310

A320

Family

A330

A340 A380

ATR42

ATR72 CRJs ERJs MDs

AFG Yearbook 2012.indd 16 07/09/2011 13:52

17 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

Automatic 46.5 In Service 3

Avation Plc 18 In Service

Avequis 344.15 In Service 7 4

Aviaco Traders International 3.7 In Service

Aviation Capital Group 4253.9 In Service 113 3 7 75 3 9

Aviation Capital Group 277.8 Stored 14 3 1 12 5

Aviation Leasing Group 38.7 Stored 2

Avico 39 In Service 1 2

Avion Aircraft Trading 189 In Service 6

Avline 7.4 In Service

Avmax Aircraft Leasing 112.95 In Service 7

Avmax Aircraft Leasing 41 Stored 3

Avolon 550.15 In Service 1 1 11

AWAS 4409.6 In Service 86 7 7 19 1 49 19 11

AWAS 72 Stored 7 1 3 2

BAE Systems 324.9 In Service 1 1

BAE Systems 118 Stored

Banc of America 643.55 In Service 13 5 1 2 7

Bank of Communications Finance 45 In Service 2

Bavaria International 257.6 In Service 10

Bavaria International 13.2 Stored 3 1

BBAM 6321.05 In Service 148 5 27 6 7 81 8 8

BBAM 149.3 Stored 11 1 1 1 4 1

BCI Aircraft Leasing 346.8 In Service 16 4 4 3 5

BCI Aircraft Leasing 7.75 Stored 4

Bluepoint Aviation 4 In Service 1

BOC Aviation 6249.9 In Service 65 1 19 71 6

Boeing Capital Corp 1984.6 In Service 22 1 32 8 1 2 28

Boeing Capital Corp 272.95 Stored 4 1

Bombardier Capital Leasing 10.9 In Service

Brihar Corporation 5.7 In Service 1

Business Aviation Services 11.3 In Service 2

Business Aviation Services 5.65 Stored 1

Capital Aircraft 0.3 In Service

Capital Aircraft 0.2 Stored

Capital Lease Aviation 65.9 In Service 3

Cara Capital Corp 1.45 In Service 5

Cara Capital Corp 1.05 Stored 3

Cargo Aircraft Management 410.05 In Service 2 30

Cargo Aircraft Management 99 Stored 1 8

CDB Leasing Company 2268.15 In Service 11 1 3 2 16 14 2 1

CDB Leasing Company 48.75 Stored 4

Changjiang Leasing Company 149.4 In Service 4 1

China Aircraft Leasing 247.7 In Service 8

CIT Aerospace 6623.4 In Service 81 11 8 1 1 122 23 1

CIT Aerospace 81.6 Stored 2 2

CIT Leasing Corp 27.55 In Service 2

Compass Capital Corp 27.45 In Service 1 4

Compass Capital Corp 1 Stored 1

CSDS Aircraft Sales & Leasing 4.7 Stored 1

DAE Capital 2069.25 In Service 16 5 16 11

DEFAG Leasing 68.2 In Service 1

Deutsche Bank 27.5 In Service 11

Deutsche Bank 11.8 Stored 1

Manager Value Status 737 747 757 767 777 A300 A310

A320

Family

A330

A340 A380

ATR42

ATR72 CRJs ERJs MDs

AFG Yearbook 2012.indd 17 07/09/2011 13:52

18 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

Deutsche Structured Finance 46 In Service 3 1 1

Deutsche Structured Finance 10.7 Stored 2

Doric Asset Finance 2743.6 In Service 6 6 3 11

Dornier Aviation 2.3 In Service

Dornier Aviation 4.6 Stored

ECC Leasing 167.7 In Service 23

ECC Leasing 110.85 Stored 12

Erik Thun 139.05 In Service 8

European Capital Corporation 0.3 Stored 2

FGL Aircraft Ireland 53.75 In Service 2 1

First Greenwich Kahala 81.5 In Service 7 1 4 10

First Greenwich Kahala 9.5 Stored 2 1

Fortis Aircraft 2.8 In Service 1

GA Finance Services 12.6 In Service 1 1

GECAS 34564.6 In Service 624 26 22 70 40 3 474 27 3 233 156 34

GECAS 962.35 Stored 23 8 4 1 3 13 1 32 12 4

GK MDT Services 22.45 In Service 4

Global Aircraft Leasing Partners 0.25 In Service 1

Global Aircraft Leasing Partners 0.25 Stored 1

Global Aviation Asset Mgmt 1046.2 In Service 17 22 3

Global Aviation Asset Mgmt 20.3 Stored 1

Global Aviation Leasing 2.75 In Service 2

Global Aviation Leasing 0.7 Stored

Global Knafaim Leasing 132.1 In Service 1 4 4 2 1 5

Global Knafaim Leasing 19.5 Stored 1

GMT Global Republic Aviation 271.25 In Service 5 11

GMT Global Republic Aviation 75.75 Stored 3 3

GOAL 598.3 In Service 2 2 1 10 6

GOAL 6.4 Stored 1

Guggenheim Aviation Partners 1089.6 In Service 7 5 17 7 4 3 6

Guggenheim Aviation Partners 28.15 Stored 1 1

Hong Kong Aviation Capital 2177.6 In Service 10 4 2 2 31 12 6

Hong Kong Aviation Capital 19.5 Stored 1

Hong Kong International 526.75 In Service 4 8

Hwa-Hsia Leasing 68.6 In Service 2 3 1

ICBC Leasing 2680.8 In Service 13 9 7 17 8 7

ICBC Leasing 5.7 Stored 1

Icelandic Aircraft Mgmt 6 In Service

Icelease 26.3 In Service 1 3

Icelease 5.6 Stored 2

ILFC 27168 In Service 274 14 64 53 70 5 3 370 121 8

ILFC 695.05 Stored 10 2 1 1 1 1 1 16 2

Intrepid Aviation Group 22.9 In Service 3

Investec Global Aircraft Fund 442.45 In Service 4 1 4 2

ITC-Leasing 0.45 In Service 2

ITC-Leasing 0.2 Stored 1

ITOCHU AeroTech 235.35 In Service 6 1 3

Jackson Square Aviation 822.8 In Service 13 1 8

Jet Trading And Leasing 41.25 In Service 1 1 3

Jet Trading And Leasing 9.3 Stored 2 3

JetFleet Management Corp 86 In Service

JetFleet Management Corp 26.95 Stored

Jetlease 2.5 In Service 1

Jetlease 2.5 Stored 1

Manager Value Status 737 747 757 767 777 A300 A310

A320

Family

A330

A340 A380

ATR42

ATR72 CRJs ERJs MDs

AFG Yearbook 2012.indd 18 07/09/2011 13:52

19 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

Jetran International 12.25 In Service 2

Jetran International 55 Stored 2 1 9

Jetscape 655.87 In Service 7 2 23

Jetscape 24 Stored 1 1

JT Power 3.75 In Service 2

JT Power 16.25 Stored 3 2

KAL Aviation 1.85 In Service 10

KAL Aviation 0.5 Stored 3

KG Aircraft Leasing 5.75 In Service 1

KJ Aviation Services 29.25 In Service 5

KV Aviation 12 In Service 3

Largus Aviation 55.05 In Service 1

Lease Corporation International 920.05 In Service 2 1 2 1 7

Lionhart Aviation Limited 104.8 In Service 4

Macquarie AirFinance 3738.55 In Service 63 1 4 1 4 1 72 9 2 2

Macquarie AirFinance 61.55 Stored 2 5

Magellan Group 1.8 In Service

Magellan Group 5.9 Stored 1

Mass Lease 42.2 In Service

Mass Lease 19.8 Stored

MC Aviation /Mitsubishi 2571.25 In Service 24 4 17 2 21 8 9

MC Aviation /Mitsubishi 21 Stored 1

MCC Financial Corp 1.8 In Service

MDT (UK) 16.8 In Service 1

Midair 4.75 Stored 1

Mitsui Bussan Aerospace 249.75 In Service 4 1 5 11

MK Aviation 12.6 In Service 2

Nordic Aviation Capital 901.05 In Service 10 1 76 4

Nordic Aviation Capital 41.25 Stored 5

Northern Lights Leasing 3.5 Stored 2

Novus Aviation 330.75 In Service 4 1 3 2 1 4

Novus Aviation 10.6 Stored 2

Nuomova 31.65 In Service 8 1

Ofer Aviation 167.9 In Service 4 2

Omega Air 0.1 Stored

ORIX Aviation 1419.15 In Service 36 3 7 1 35 6 2

ORIX Aviation 31.25 Stored 4 3

Pacic AirFinance 38 In Service 2 5

Pacic Coast Group 0.7 In Service

Palm Aviation 7 Stored

Pearl Aircraft Corporation 2.5 Stored 1

Pembroke Group 1899.9 In Service 22 2 8 13 4 2 1

Pembroke Group 21.2 Stored 1

Pembroke & Aircraft Financing 6.7 In Service

Pembroke & Aircraft Financing 10.2 Stored

Penerbangan Malaysia Berhad 946.5 In Service 17 12 4 1 9

Phoenix Aircraft Leasing 32.7 In Service 2 2 1

Phoenix Aircraft Leasing 4.8 Stored 1 2

Plane Business 6.2 In Service 1

Power Aircraft Services 4.25 In Service 1

Power Aircraft Services 2 Stored 2

Q Aviation 309.55 In Service 3 2 3 4 4

RAK Leasing 0.5 Stored 1

Raytheon Aircraft Credit 43.3 In Service

Manager Value Status 737 747 757 767 777 A300 A310

A320

Family

A330

A340 A380

ATR42

ATR72 CRJs ERJs MDs

AFG Yearbook 2012.indd 19 07/09/2011 13:52

20 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

FINANCING THE WORLD'S FLEET, ONE AIRLINE AT A TIME

Over $3 billion of committed aircraft purchases since 2010

Jackson Square Aviation is one of the world's

fastest growing privately-held aviation capital

provider, with a fleet of over 70 new and

committed next generation aircaft, serving

multiple airlines throughout the world.

Operating leases Finance leases

Engine finance Pre-delivery payments

Acquisition of three

Boeing 737-800s

Sale/leaseback of two

2010 Airbus A319-100s

Sale/leaseback of two

2011 Boeing 737-800

deliveries

Sale/leaseback of five

2011 Boeing 737-800

deliveries

Sale/leaseback of

three 2011 Airbus

A320-200 deliveries

with PDP funding

Sale/leaseback of four

Boeing 737-800

deliveries and one 2008

Airbus 319-100

Sale/leaseback of one

2010 Airbus A320-200

delivery and one 2010

A319-100 delivery

PDP funding of four

2011 Airbus A320-200

deliveries and sale/

leaseback of two 2008

Airbus A319-100s

Sale/leaseback of one

2011 Boeing 777-300ER

delivery and three

2011 Airbus A320-200

deliveries

Sale/leaseback of two

2011 Airbus A330-300

deliveries

Sale/leaseback of

seven 2011-2012 Airbus

A320-200 deliveries

with PDP funding

Sale/leaseback of

three 2011 Boeing

B777-300ER deliveries

C

M

Y

CM

MY

CY

CMY

K

JSA_Update_PrintAd_July2011_Update_Final_UBM.pdf 7/11/11 5:16:13 PM

Raytheon Aircraft Credit 16.65 Stored

RBS Aviation Capital 6369.6 In Service 106 118 2 2 9

RBS Aviation Capital 187.15 Stored 2 2 4

Regional Aviation 0.8 Stored 1

Regional One 7.5 In Service 3

Regional One 11.55 Stored

Rockton Management 4.4 In Service 1

RPK Capital Management 44.2 In Service 3 2 1 3

Runway Asset Management 5.95 In Service 6

Runway Asset Management 1.9 Stored 2

Saab Aircraft Leasing 196.1 In Service

Saab Aircraft Leasing 50.15 Stored

Sahaab Leasing 318.25 In Service 11

Santos Dumont Aircraft Mgmt 506.35 In Service 11 1 2 2

Santos Dumont Aircraft Mgmt 19 Stored 1

Sberbank Leasing 74.35 In Service 6 1

Sberbank Leasing 67.5 Stored 2

Sean Ho Aircraft Leasing 40.2 In Service 2

Showa Leasing 453.75 In Service 2 7 10 1 5

Sigma Aircraft Management 18 In Service 4

Sky Holding 492.15 In Service 5 1 14 4 1 10 12

Sky Holding 77.4 Stored 17 4 2 7

Skytech-AIC 116.7 In Service 2

SkyWorks Leasing 1159.45 In Service 5 4 33 10 19 5 32

SkyWorks Leasing 137 Stored 1 4 20

SMFL Aircraft Capital 1991.1 In Service 33 2 32 5 4

SMFL Aircraft Capital 23.5 Stored 1

Sojitz Aircraft Leasing 109.3 In Service 11

Sojitz Aircraft Leasing 11.8 Stored 1

Sumitomo Mitsui 425.7 In Service 1 1 8 1 2

Sverigeyg Leasing 5.7 In Service

TAT Leasing Services 175.35 In Service 16

Ten Forty Corp 2 In Service

The Essence Group 5.4 In Service

The Flightstar Group 1 Stored 2

Tiger Aircraft Trading 34.7 Stored 17

Titan Aviation Leasing 14.15 In Service 1

Unconrmed 505.5 In Service 8 1 10 1 1

Universal Asset Management 71 In Service 1 4 6

Universal Asset Management 85.35 Stored 5 4 7

VEB-Leasing 306.15 In Service 1 3 2 4

Veling 371.9 In Service 6 3 4 2

Vietnam Aircraft Leasing 83.5 In Service 5

Volito Aviation Services 584.8 In Service 15 2 27 1

Volito Aviation Services 7.9 Stored 1 1

VTB-Leasing 467 In Service 12 3 5 3 9 2

Vx Capital Partners 155.05 In Service 2 10 2 9

Vx Capital Partners 4.6 Stored 1

Waha Leasing 45 In Service 2

Waha Leasing 2.75 Stored 1

World Star Aviation 84.5 In Service 20 2 2 1 1

Wor ld Star Aviation 35.6 Stored 19 2 2 1

Manager Value Status 737 747 757 767 777 A300 A310

A320

Family

A330

A340 A380

ATR42

ATR72 CRJs ERJs MDs

AFG Yearbook 2012.indd 20 07/09/2011 13:52

FINANCING THE WORLD'S FLEET, ONE AIRLINE AT A TIME

Over $3 billion of committed aircraft purchases since 2010

Jackson Square Aviation is one of the world's

fastest growing privately-held aviation capital

provider, with a fleet of over 70 new and

committed next generation aircaft, serving

multiple airlines throughout the world.

Operating leases Finance leases

Engine finance Pre-delivery payments

Acquisition of three

Boeing 737-800s

Sale/leaseback of two

2010 Airbus A319-100s

Sale/leaseback of two

2011 Boeing 737-800

deliveries

Sale/leaseback of five

2011 Boeing 737-800

deliveries

Sale/leaseback of

three 2011 Airbus

A320-200 deliveries

with PDP funding

Sale/leaseback of four

Boeing 737-800

deliveries and one 2008

Airbus 319-100

Sale/leaseback of one

2010 Airbus A320-200

delivery and one 2010

A319-100 delivery

PDP funding of four

2011 Airbus A320-200

deliveries and sale/

leaseback of two 2008

Airbus A319-100s

Sale/leaseback of one

2011 Boeing 777-300ER

delivery and three

2011 Airbus A320-200

deliveries

Sale/leaseback of two

2011 Airbus A330-300

deliveries

Sale/leaseback of

seven 2011-2012 Airbus

A320-200 deliveries

with PDP funding

Sale/leaseback of

three 2011 Boeing

B777-300ER deliveries

C

M

Y

CM

MY

CY

CMY

K

JSA_Update_PrintAd_July2011_Update_Final_UBM.pdf 7/11/11 5:16:13 PM

AFG Yearbook 2012.indd 21 07/09/2011 13:52

Partnering for

sustainable growth:

How lessors, airlines

and OEMs can work together

22 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE

Todays airlines understand the benets and options that leasing can deliver. Whether it is to provide eet

exibility, nancial portfolio management, or to hedge against technical obsolescence, leasing is a strong

part of an operators toolbox. Yet in order to meet airlines growing needs for exible nancing tools and

customised solutions, lessors must adapt to offer a fuller range of services. Ray Sisson, president and

CEO, AWAS provides his views.

AFG Yearbook 2012.indd 22 07/09/2011 13:53

23 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE

T

HE AVIATION INDUSTRY IS DYNAMIC and always

evolving. Airlines, for example, have evolved from the

core ag carriers and regionals of the past, into mega-merged

global players, budget carriers, and hybrid airlines, all of

which are expanding rapidly from their continental roots.

The method by which airlines acquire aircraft has also

evolved. Today approximately 40 per cent of the worlds

active commercial eet is leased and it is estimated that the

gure will grow to over 45 per cent by 2015 and almost 48

per cent by 2020. Manufacturers project that in order to meet

demand the worlds eet will need to double by 2030. As

such, the importance of leasing has never been so great.

LEASING AS A GROWTH TOOL

The global economy has returned to a phase of

moderate but steady growth, now airlines and

lessors must evolve so that they are better able to

handle inevitable market shocks and to optimise

their business models for long-term protability.

Leasing has also become more popular because of myriad

post-recession policies that have significantly restricted

airlines access to more traditional funding sources

such as the capital markets and bank financing. Basel III

requirements and the tightening of Export Bank credit

further impact on this issue.

In a progressive relationship a lessor assists a customer with its

eet renewal by re-deploying assets that are no longer optimal to its

needs But in order to accomplish this, a lessor must have the scale,

reach and relationships to be able to shufe or grow a portfolio.

AFG Yearbook 2012.indd 23 07/09/2011 13:53

24 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

Lufthansa Techniks Aircraft Leasing and Trading Support (ALTS) is the fast, professional service that takes over

when a leased aircraft changes operators. We handle the full spectrum of checks and modifcation work, including

design, cabin furnishings and repainting all the way up to the necessary inspections and approvals.

In short, we take care of all the technical and administrative tasks of aircraft leasing for you, whether youre the lessor

or the lessee. Lets talk about it!

Lufthansa Technik AG, Marketing & Sales

E-mail: marketing.sales@lht.dlh.de

www.lufthansa-technik.com/leasing

Call us: +49-40-5070-5553

The shortest distance

between two owners?

Ask us.

More mobility for the world

239_210x278_LeasingLack_AircratFinanceGuide_ICv2_RZ01.indd 1 03.08.2011 11:09:53 Uhr Lufthansa Technik 0911.indd 1 18/08/2011 16:14

We often talk to our customers

about their fleets, work to

understand their unique operation

and develop long-term relationships

so that we can meet their needs and

anticipate their future requirements.

Customers tell us that they believe

their fleets should be a balanced

mix of leased and owned assets

with a percentage customised to meet the specic model of an

individual organisation.

An example of this type of progressive relationship is when a

lessor assists a customer with its eet renewal by re-deploying

assets that are no longer optimal to its needs. The asset is

handed to another more suitable customer and the former is

supplied with an asset more in keeping with its needs. But in

order to accomplish this, a lessor must have the scale, reach

and relationships to be able to shufe or grow a portfolio.

Another tool for airlines is the sale and leaseback model.

This is growing in importance as many customers have

placed signicant pipeline orders for newer more fuel-efcent

aircraft. With fuel cost being the single greatest operating

drain on an airlines bottom-line, access to modern aircraft

that can reduce fuel-burn by 10 to 25 per cent is critical to

sustained protability.

DRIVE FOR NEXT GEN TECHNOLOGIES

Airlines have seen the future and they have responded

by ordering a part of it. These orders promise to deliver

significantly lower operating and maintenance costs and

enhance fleet performance. The combination of next

generation airframes and new engine options are critical to

improving airlines operational efciency as well as providing

signicant environmental benets.

A mass of new assets will enter the market leaving the older

ones to be re-deployed. Airlines will need lessors to provide

creative solutions to manage their eet renewal programmes

and the nancing of new aircraft and sale and leasebacks will

play a pivotal role in this.

However, many of these aircraft will not be delivered until

two to five years time, perhaps longer and that is just for

existing orders. A large number of airlines are still looking

to upgrade and replace airframes of 20-years or older that

have become inefcient or are deemed unsuitable for further

investment due to low book values.

Airlines require aircraft that can be delivered in the near-term

and can still offer a 10 to 20 per cent operational benet versus

the aircraft they replace. By having a pipeline of efficient,

modern aircraft available, lessors can provide more immediate

solutions to customers who may not have delivery slots for

some time to come.

Ray Sisson, president

and CEO, AWAS

AFG Yearbook 2012.indd 24 07/09/2011 13:53

Lufthansa Techniks Aircraft Leasing and Trading Support (ALTS) is the fast, professional service that takes over

when a leased aircraft changes operators. We handle the full spectrum of checks and modifcation work, including

design, cabin furnishings and repainting all the way up to the necessary inspections and approvals.

In short, we take care of all the technical and administrative tasks of aircraft leasing for you, whether youre the lessor

or the lessee. Lets talk about it!

Lufthansa Technik AG, Marketing & Sales

E-mail: marketing.sales@lht.dlh.de

www.lufthansa-technik.com/leasing

Call us: +49-40-5070-5553

The shortest distance

between two owners?

Ask us.

More mobility for the world

239_210x278_LeasingLack_AircratFinanceGuide_ICv2_RZ01.indd 1 03.08.2011 11:09:53 Uhr Lufthansa Technik 0911.indd 1 18/08/2011 16:14 AFG Yearbook 2012.indd 25 07/09/2011 13:53

26 AIRCRAFT FINANCE GUIDE 2012

AIRCRAFT FINANCE GUIDE AIRCRAFT FINANCE GUIDE

The goal should always be to provide flexible access to

the right technology. Another way to do this is for lessors to

collaborate with the manufacturer to jointly evaluate and create

a customised package for the customer. The manufacturers

have a unique set of tools at their disposal, which when

combined with a lessors services can deliver a more potent and

effective overall solution.

There is also a great opportunity for lessors and OEMs to work

more closely on airframe development. A lessor has a unique

perspective on what the customer wants and how eets evolve

over time. Together, we can help optimise a programme that

will be successful today and for many years to come.

UNDERSTANDING THE METAL

Providing a exible nancing option is critical but a lessors

ability to understand the aircraft, provide technical expertise

and consultation to an airline will be of even greater importance

as fleets expand and house new technologies. We are often

asked to partner with our customers to evaluate potential

options, appraise current aircraft performance and plan for eet

modernisation. A lessors ability to provide this level of value-