Professional Documents

Culture Documents

2011 State of Medical Marijuana Markets Executive Summary

Uploaded by

James CampbellCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2011 State of Medical Marijuana Markets Executive Summary

Uploaded by

James CampbellCopyright:

Available Formats

THE STATE OF THE MEDICAL MARIJUANA MARKETS 2011

I AR

J UA N A M

A

RK

DIC A L

E T S 2 0 11

@2010 Shutterstock, All Rights Reserved.

SponSored by

ME

See Change Strategy is an independent financial news and information firm committed to finding opportunity and growth in unique new markets. See Change Strategy delivers value by providing critical insight, in-depth knowledge and market-moving data to investors, business owners and entrepreneurs.

See Change Strategys report on medical marijuana markets is published annually. Annual subscription: $1,150. Reproduction in whole or in part (including inputting into a computer or online) is prohibited except by permission of See Change Strategy. Executive and Editorial Office: See Change Strategy, 3616 John Carroll Dr., Olney, MD 20832. Information has been obtained from sources believed to be reliable. There is a possibility of human or computer error by our sources, See Change Strategy, or other. See Change Strategy does not guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. Nothing in this report constitutes financial or legal advice.

Table of ConTenTS

The State of the Medical Marijuana Markets 2011

1. 2. 3. 4. 5. 6. 7. 8. 9.

Executive Summary ... ... ... ... ... ... ... ... ... ... ... ... ... .page 5 Scope and Methodology ... ... ... ... ... ... ... ... ... ... ... page 11 National Market ... ... ... ... ... ... ... ... ... ... ... ... ... ... page 15 Federal Policy ... ... ... ... ... ... ... ... ... ... ... ... ... ... ...page 23 State Markets ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... page 31 Cultivation ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... page 59 Product Development ... ... ... ... ... ... ... ... ... ... ... ... page 67 Dispensary ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... page 75 Financing.. ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ...page 83

2010 Darrin Harris Frisby, All Rights Reserved

ChapTer 1

exeCuTive SuMMary

2010 Darrin Harris Frisby, All Rights Reserved

or many decades, all marijuana transactions in the United States were conducted under implicit or explicit prohibition. Recently, however, states have moved to legalize marijuana for medical purposes, as well as implement regulations for organizations which produce and distribute marijuana. In the last two years, the federal government has signaled its tacit acceptance of these state actions. This has produced the first de facto legal U.S. marijuana market in modern times. This emerging market presents unique opportunities to entrepreneurs and investors as well as unique risks. To examine both, See Change Strategy has produced this report, The State of the Medical Marijuana Markets 2011.

exeCuTive SuMMary

A nascent national medical marijuana industry, fueled by legalization in 15 states plus the District of Columbia, is in the midst of unprecedented development and growth. See Change has conducted a first-of-its-kind analysis of these emerging markets. See Change concludes:

Despite this, marijuana use has continued. The black market for marijuana has thrived with an annual market size estimated at $18 billion. Since 1996, marijuana proponents have pushed for individual states to recognize marijuana as a treatment for a range of illnesses. New medical research and changing public opinion have propelled these efforts. Over the past 15 years, led by California, 15 states plus the District of Columbia have adopted laws permitting some form of marijuana consumption or distribution for medical use. These laws have been adopted by public referendums as well as legislation. In late 2009, the U.S. Justice Department instructed federal prosecutors in states with medical marijuana laws not to prioritize prosecuting individuals and businesses complying with state laws. These conditions have combined to produce the first legal marijuana markets in modern times

A national market for medical marijuana is worth $1.7 billion in 2011 and could reach $8.9 billion in five years. Two states, California and Colorado, dominate this nascent industry, combining to represent 92% of the wholesale and retail sales across the country. California enjoys the largest market size at $1.3 billion, while Colorado hosts the fastest growing and most business-friendly market.

There are 24.8 million potential patients eligible for medical marijuana under current state laws. Medical marijuana businesses face significant challenges including unfavorable tax status and downward pricing pressure but can expect high growth driven by rising new patient adoption. State regulations and federal policy uncertainty are the largest determinants of market activity and investment around the country.

Background

In 1970, capping decades of policy, Congress placed marijuana in Schedule I of the Controlled Substances Act, declaring its high potential for abuse and stating that it was without therapeutic value. This move cemented marijuanas de facto prohibition.

An Industry Flowers

Since marijuana remains a Schedule I substance, doctors cannot legally prescribe marijuana to patients. Instead, most states dictate that doctors may only recommend marijuana to patients with qualifying illnesses. To receive that marijuana, patients have not gone to traditional pharmacies or hospitals. Instead,

2010 Darrin Harris Frisby, All Rights Reserved

Nine other states and the District of Columbia with medical marijuana laws have or are forming active markets. Arizona, Michigan and Washington are particularly well-positioned as the industry matures in the next few years.

exeCuTive SuMMary

are generally reactive to existing market conditions. These states include Michigan, Montana, New Mexico, Oregon and Washington.

regulATiON-leD STATeS are places where business activity is being determined by the pace and efforts of regulators to define and control a market. These states include Arizona, the District of Columbia, Maine, New Jersey and rhode island.

2010 Darrin Harris Frisby, All Rights Reserved

First-of-its-Kind Operator Survey

As part of its analysis, See Change conducted a first-ofits-kind survey of more than 300 retail and wholesale operators in states with an active medical marijuana market. This survey revealed:

63% have been in business for less than a year.

Owners range from the unsophisticated to the highly experienced.

patients choose one of three methods to receive the marijuana, depending on state law and personal preference:

34% cite regulatory compliance, not customer demand or securing supply, as the number one challenge.

24% cite securing financing as the most pressing business challenge.

They can grow marijuana themselves.

They can designate a caregiver, normally an individual allowed to grow marijuana for a certain number of people. They can assign this right and/or visit a company or cooperative organization that provides marijuana to patients.

This third option has proven to be the most popular method of receiving marijuana among customers as well as the key driver of business growth in this industry. Today, medical marijuana markets exist in 12 of the 15 states plus the District of Columbia where medical marijuana is legal. Emerging markets, excluding the more developed in California and Colorado, fall into one of two categories:

Opportunities and Risks

The growing acceptance of medical marijuana is providing business operators and investors with unprecedented opportunities. See Change expects these markets to enjoy 99% growth in the next five years just in existing markets, with more than 20 potential new markets opening. However, investment and business development will continue to be dampened until the federal government definitively changes its position on the legality of medical marijuana. Demand for marijuana has produced a number of business opportunities. Wholesale marijuana cultivation and retail distribution are the primary business opportunities. Other entrepreneurs are providing marijuana infused products including edibles, tinctures and salves. Development and sales of smoking and non-smoking paraphernalia for consumption are on the rise. Less obvious but

MArkeT-leD STATeS are places where entrepreneurs began conducting business prior to statewide regulation and guidance. Subsequent regulations

exeCuTive SuMMary

Photo Courtesy of SPARC

significant business opportunities have emerged in ancillary businesses including software development, insurance products, hydroponic equipment, security services, editorial products, advertising and real estate, to name a few. Businesses face significant risk and hurdles. The possession and distribution of marijuana remains illegal under federal law. Many businesses operate with the ever-present risk of being shut down or experiencing a property seizure without notice. Many businesses cannot make standard deductions for business expenses and have difficulty securing standard banking and financial services. The industry suffers from inadequate capital investments, lack of experienced executives and operators, changing local regulations and interactions with illegal marijuana markets.

You might also like

- Specify The Types of Country Risks That Pharmaceutical Firms Face in International BusinessDocument7 pagesSpecify The Types of Country Risks That Pharmaceutical Firms Face in International BusinessSakura Miii86% (7)

- Brigada Pabasa MOU TemplateDocument3 pagesBrigada Pabasa MOU TemplateNimfa Payosing Palmera100% (10)

- A Snapshot of Demand For Adult-Use Cannabis in IllinoisDocument27 pagesA Snapshot of Demand For Adult-Use Cannabis in IllinoisTodd FeurerNo ratings yet

- UntitledDocument11 pagesUntitledapi-84308185No ratings yet

- Cannabis Business and Organization Sign On Letter To House JudiciaryDocument5 pagesCannabis Business and Organization Sign On Letter To House JudiciaryMikeLiszewskiNo ratings yet

- Hemp Oil HustlersDocument31 pagesHemp Oil HustlersJames CampbellNo ratings yet

- Lutz vs. Araneta, G.R. No. L-7859 December 22, 1955 (FULL CASE)Document4 pagesLutz vs. Araneta, G.R. No. L-7859 December 22, 1955 (FULL CASE)Sharliemagne B. BayanNo ratings yet

- Legal Research Law JournalDocument12 pagesLegal Research Law JournalPauline Eunice Sabareza LobiganNo ratings yet

- Chardan Capital On Cannabis MarketDocument8 pagesChardan Capital On Cannabis MarketotteromNo ratings yet

- Field of Greens Executivesummary r14 6Document24 pagesField of Greens Executivesummary r14 6api-106870593100% (3)

- Marijuana Research PaperDocument11 pagesMarijuana Research PaperJack DohertyNo ratings yet

- How to Finance a Marijuana BusinessFrom EverandHow to Finance a Marijuana BusinessRating: 4 out of 5 stars4/5 (2)

- Marketing Cannabis: OnlineDocument27 pagesMarketing Cannabis: OnlineAnonymous 5IYvKfuNo ratings yet

- Legalization of Medical Marijuana: Executive SummaryDocument9 pagesLegalization of Medical Marijuana: Executive Summaryapi-317014106No ratings yet

- Mu Market StudyDocument46 pagesMu Market StudyJim PeckhamNo ratings yet

- Bis Business ReportDocument7 pagesBis Business Reportapi-457704614No ratings yet

- Marketing ProjectDocument36 pagesMarketing ProjectGauri KawaleNo ratings yet

- Decriminalizing Marijuana and The Effects On The United StatesDocument42 pagesDecriminalizing Marijuana and The Effects On The United StatesjoelawtonivNo ratings yet

- Pharmaceutical Industry: General Environment Analysis Jonathan Horton Arkansas State UniversityDocument7 pagesPharmaceutical Industry: General Environment Analysis Jonathan Horton Arkansas State UniversityjonNo ratings yet

- Choice of The MarketDocument3 pagesChoice of The MarketVipul GoyalNo ratings yet

- East Coast Medical Marijuana UpdateDocument5 pagesEast Coast Medical Marijuana UpdateBen FullerNo ratings yet

- Growing Pains: Medical Marijuana Entrepreneurs Navigate Legal Gray AreasDocument3 pagesGrowing Pains: Medical Marijuana Entrepreneurs Navigate Legal Gray Areasphcorner loydiNo ratings yet

- Part 2 - LobbyingDocument2 pagesPart 2 - Lobbyingalexander stellerNo ratings yet

- Research Paper - Marijuana LegalizationDocument11 pagesResearch Paper - Marijuana Legalizationapi-549132156No ratings yet

- IBISWorld Med Pot Growth StudyDocument29 pagesIBISWorld Med Pot Growth StudyNews-PressNo ratings yet

- ArcView Marijuana Markets Executive SummaryDocument24 pagesArcView Marijuana Markets Executive SummaryMonterey BudNo ratings yet

- 2017 Budget - Pharma Rep Licensing SummaryDocument3 pages2017 Budget - Pharma Rep Licensing SummaryThe Daily LineNo ratings yet

- UntitledDocument2 pagesUntitledLaura CerónNo ratings yet

- This new Public Citizen report reveals how major U.S. drug companies and their Washington, D.C. lobby group, the Pharmaceutical Research and Manufacturers of America (PhRMA), have carried out a misleading campaign to scare policy makers and the public.Document144 pagesThis new Public Citizen report reveals how major U.S. drug companies and their Washington, D.C. lobby group, the Pharmaceutical Research and Manufacturers of America (PhRMA), have carried out a misleading campaign to scare policy makers and the public.Joao SoaresNo ratings yet

- Legaliztion of Marijuana'Document2 pagesLegaliztion of Marijuana'ANA ROSE CIPRIANONo ratings yet

- Cannabis Consumer Demographics and BehaviorDocument22 pagesCannabis Consumer Demographics and BehaviorFra LanNo ratings yet

- 2011 Bakersfield High 1NC Argues Legalizing Marijuana Would Boost EconomyDocument1 page2011 Bakersfield High 1NC Argues Legalizing Marijuana Would Boost Economyparkercoon97No ratings yet

- Final August 31 Coalition Letter To Governor HochulDocument3 pagesFinal August 31 Coalition Letter To Governor HochulTony LangeNo ratings yet

- Thesis Statement: Florida Should Legalize MarijuanaDocument6 pagesThesis Statement: Florida Should Legalize MarijuanaPaul WahomeNo ratings yet

- Pharmaceutical Marketing - Time For ChangeDocument8 pagesPharmaceutical Marketing - Time For ChangeFabio PellimNo ratings yet

- Pharma 2020 PWC ReportDocument32 pagesPharma 2020 PWC ReportBrand SynapseNo ratings yet

- Chronic Controversy The Economics of Regulation and Prohibition of MarijuanaDocument33 pagesChronic Controversy The Economics of Regulation and Prohibition of MarijuanaPreston PatilloNo ratings yet

- Legalization of MarijuanaDocument1 pageLegalization of MarijuanaLaura CerónNo ratings yet

- annotated-international 20connections 20paper 20 232Document3 pagesannotated-international 20connections 20paper 20 232api-709406220No ratings yet

- Biggest Challenges For The Cannabis Industry in 2021Document6 pagesBiggest Challenges For The Cannabis Industry in 2021Gia KhangNo ratings yet

- Marc Kealey's Solutions in Drug Plan ManagementDocument18 pagesMarc Kealey's Solutions in Drug Plan ManagementMarc KealeyNo ratings yet

- Personal ProjectDocument2 pagesPersonal Projectdorukaktas78No ratings yet

- Ap Gopo PresentationDocument20 pagesAp Gopo Presentationapi-343859940No ratings yet

- Case 5 ContempotaryDocument5 pagesCase 5 ContempotaryKaur BrarNo ratings yet

- Updated Report CiplaDocument5 pagesUpdated Report Ciplanitzr7No ratings yet

- Growing Marijuana for Beginners: The Essential Steps to Growing Your Own MarijuanaFrom EverandGrowing Marijuana for Beginners: The Essential Steps to Growing Your Own MarijuanaNo ratings yet

- Legal Pot Could Bring $262M in New Tax RevenueDocument6 pagesLegal Pot Could Bring $262M in New Tax RevenueWXYZ-TV Channel 7 DetroitNo ratings yet

- Chronically Criminal: Shielding The Public From MJNADocument14 pagesChronically Criminal: Shielding The Public From MJNAPublicPublisherNo ratings yet

- Summary Brief Regulation of Marijuana Promotion in The US: An Exploratory Study and Framework To Address Policy IssuesDocument2 pagesSummary Brief Regulation of Marijuana Promotion in The US: An Exploratory Study and Framework To Address Policy Issuesrst126No ratings yet

- LTL 2Document8 pagesLTL 2July Rose LamagNo ratings yet

- Why Should We LegalizeDocument11 pagesWhy Should We Legalizetine yapNo ratings yet

- Final Project Example Might Help 2115Document22 pagesFinal Project Example Might Help 2115raymondNo ratings yet

- Pharmaceutical Policy Action PlanDocument9 pagesPharmaceutical Policy Action Planapi-581236671No ratings yet

- Adrian Rodriguez RecmaryjDocument5 pagesAdrian Rodriguez Recmaryjapi-458386247No ratings yet

- HLTH 308 Group Assignment 1Document9 pagesHLTH 308 Group Assignment 1api-681327493No ratings yet

- Monyka Ic Paper 2Document3 pagesMonyka Ic Paper 2api-291451260No ratings yet

- Legalizing Marijuana BenefitsDocument6 pagesLegalizing Marijuana BenefitsCamryn SandovalNo ratings yet

- Meinart LetterDocument6 pagesMeinart Letter420leaksNo ratings yet

- Updated Colorado Marijuana Industry Bulletin: Reports of Licensees Making RecommendationsDocument2 pagesUpdated Colorado Marijuana Industry Bulletin: Reports of Licensees Making RecommendationsMichael_Lee_RobertsNo ratings yet

- Marijuana_ebookDocument17 pagesMarijuana_ebookmedialine22No ratings yet

- Case Study 2Document2 pagesCase Study 2Zainab ShehzadiNo ratings yet

- 2015 IRS 280e Audit Policy - Medical MArijuanaDocument8 pages2015 IRS 280e Audit Policy - Medical MArijuanaJames CampbellNo ratings yet

- Carruthers and Robertson: First Victims of Michigan Court of Appeals Newest Assault On PatientsDocument2 pagesCarruthers and Robertson: First Victims of Michigan Court of Appeals Newest Assault On PatientsJames CampbellNo ratings yet

- Michigan HB 4209 As Passed by Senate 09/08/2016Document62 pagesMichigan HB 4209 As Passed by Senate 09/08/2016James CampbellNo ratings yet

- Beck V Commissioner (T.C. Memo 2015-149)Document21 pagesBeck V Commissioner (T.C. Memo 2015-149)James CampbellNo ratings yet

- 2013 US Conference of Mayors Resolution On Medical CannabisDocument4 pages2013 US Conference of Mayors Resolution On Medical CannabisJames CampbellNo ratings yet

- 2014 DEA: Four Decades of Impeding and Rejecting ScienceDocument16 pages2014 DEA: Four Decades of Impeding and Rejecting ScienceJames CampbellNo ratings yet

- 2014-IRSAC-Excerpt-Marijuana PractitionersDocument6 pages2014-IRSAC-Excerpt-Marijuana PractitionersJames CampbellNo ratings yet

- What Exactly Is IRS Code Sec 280eDocument2 pagesWhat Exactly Is IRS Code Sec 280eJames CampbellNo ratings yet

- 2015 FDIC Letter FIL-5-2015 Providing Banking ServicesDocument2 pages2015 FDIC Letter FIL-5-2015 Providing Banking ServicesJames CampbellNo ratings yet

- FinCEN Guidance On Marijuana-Related BusinessesDocument7 pagesFinCEN Guidance On Marijuana-Related BusinessesHuffPost PoliticsNo ratings yet

- CHART: IRS Spending On ConferencesDocument1 pageCHART: IRS Spending On ConferencesJames CampbellNo ratings yet

- Legal Cannabis Dispensary Taxation: A Textbook Case of Punishing Law-Abiding Businesses Through The Tax CodeDocument4 pagesLegal Cannabis Dispensary Taxation: A Textbook Case of Punishing Law-Abiding Businesses Through The Tax CodeJames CampbellNo ratings yet

- Energy Conservation Strategies For GreenhousesDocument16 pagesEnergy Conservation Strategies For GreenhousesJames CampbellNo ratings yet

- Michigan House Judiciary Committee Hearings On HB4271, HB5104, SB660Document3 pagesMichigan House Judiciary Committee Hearings On HB4271, HB5104, SB660James CampbellNo ratings yet

- MACPA Michigan Tax ConferenceDocument8 pagesMACPA Michigan Tax ConferenceJames CampbellNo ratings yet

- 280EReform New EnglandDocument1 page280EReform New EnglandJames CampbellNo ratings yet

- MACPA Agribusiness ConferenceDocument8 pagesMACPA Agribusiness ConferenceJames CampbellNo ratings yet

- 2013 State of The State of Michigan by State Budget DirectorDocument35 pages2013 State of The State of Michigan by State Budget DirectorJames CampbellNo ratings yet

- IRS Publication 3 Armed Forces Tax GuideDocument30 pagesIRS Publication 3 Armed Forces Tax GuideJames CampbellNo ratings yet

- 2013 The New Politics of Marijuana LegalizationDocument17 pages2013 The New Politics of Marijuana LegalizationJames CampbellNo ratings yet

- NCIA Membership ApplicationDocument1 pageNCIA Membership ApplicationJames CampbellNo ratings yet

- 2013 Tax Planning For Marijuana DealersDocument35 pages2013 Tax Planning For Marijuana DealersJames CampbellNo ratings yet

- Benefit Expenses: How The Benefit Corporation's Social Purpose Changes The Ordinary and NecessaryDocument41 pagesBenefit Expenses: How The Benefit Corporation's Social Purpose Changes The Ordinary and NecessaryJames CampbellNo ratings yet

- MACPA Management Information & Business ShowDocument12 pagesMACPA Management Information & Business ShowJames CampbellNo ratings yet

- IRS Rev Proc 2013-15 - 2013 Individual Brackets and Inflation Adjusted Tax LimitsDocument12 pagesIRS Rev Proc 2013-15 - 2013 Individual Brackets and Inflation Adjusted Tax LimitsJames CampbellNo ratings yet

- IRS Criminal Investigation Annual ReportDocument28 pagesIRS Criminal Investigation Annual ReportJames CampbellNo ratings yet

- Comparison of The Generation Gap in ManagementDocument1 pageComparison of The Generation Gap in ManagementJames CampbellNo ratings yet

- IRS Criminal Investigation TechniquesDocument22 pagesIRS Criminal Investigation TechniquesJames CampbellNo ratings yet

- Circle of DistributionDocument3 pagesCircle of DistributionJames CampbellNo ratings yet

- A Good NovelDocument64 pagesA Good NovellalaNo ratings yet

- The Hidden History of The Second AmendmentDocument96 pagesThe Hidden History of The Second AmendmentAsanij100% (1)

- An Assignment On The Bangladesh Studies: Submitted ToDocument16 pagesAn Assignment On The Bangladesh Studies: Submitted ToTarun Kr Das100% (1)

- Income Tax On Individuals Part 2Document22 pagesIncome Tax On Individuals Part 2mmhNo ratings yet

- Quasi Judicial Funtion of Administrative BodiesDocument18 pagesQuasi Judicial Funtion of Administrative BodiesSwati KritiNo ratings yet

- The CIA How To Think Clearly On DrugsDocument2 pagesThe CIA How To Think Clearly On DrugsClepsa VictorNo ratings yet

- Strict LiabilityDocument11 pagesStrict LiabilityMWAKISIKI MWAKISIKI EDWARDSNo ratings yet

- Summons, Arrest, RemandDocument11 pagesSummons, Arrest, RemandAARTHI100% (1)

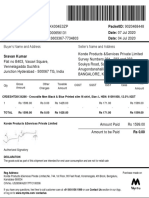

- Gstin Number: Packetid: 9020468448 Invoice Number: Date: 07 Jul 2020 Order Number: Date: 04 Jul 2020Document1 pageGstin Number: Packetid: 9020468448 Invoice Number: Date: 07 Jul 2020 Order Number: Date: 04 Jul 2020Sravan KumarNo ratings yet

- Burma Will Remain Rich, Poor and Controversial': Published: 9 April 2010Document11 pagesBurma Will Remain Rich, Poor and Controversial': Published: 9 April 2010rheito6745No ratings yet

- VI. Bill of Rights - O To TDocument70 pagesVI. Bill of Rights - O To TCourtney TirolNo ratings yet

- Gram PanchayatDocument8 pagesGram PanchayatKishalay ChakmaNo ratings yet

- Telecommunications and Broadcast Attorneys of The Philippines, Inc. v. COMELEC, G.R. No. 132922, (April 21, 1998), 352 PHIL 153-206Document31 pagesTelecommunications and Broadcast Attorneys of The Philippines, Inc. v. COMELEC, G.R. No. 132922, (April 21, 1998), 352 PHIL 153-206Hershey Delos SantosNo ratings yet

- Firearms Protection Act (Review Of)Document63 pagesFirearms Protection Act (Review Of)ArchdukePotterNo ratings yet

- Impact of Corporate Governance in Business OrganisationDocument10 pagesImpact of Corporate Governance in Business Organisationenbassey100% (2)

- 4668-1 SadiaDocument22 pages4668-1 SadiaNabeel zafarNo ratings yet

- WR CSP 21 NameList Engl 021121Document325 pagesWR CSP 21 NameList Engl 021121Mohd BilalNo ratings yet

- To Whomsoever It May ConcernDocument1 pageTo Whomsoever It May ConcernPiyush MishraNo ratings yet

- Delhi AsianAge 2022-11-22Document8 pagesDelhi AsianAge 2022-11-22Hemabh ShivpuriNo ratings yet

- Alcantara V RepublicDocument15 pagesAlcantara V RepublicEzer SccatsNo ratings yet

- Student Activity Permit Approval ProcessDocument1 pageStudent Activity Permit Approval ProcessJorge Erwin RadaNo ratings yet

- 2 Sebastian vs. Morales, 445 Phil. 595Document2 pages2 Sebastian vs. Morales, 445 Phil. 595loschudentNo ratings yet

- Oblicon - Prof. Crisostomo UribeDocument74 pagesOblicon - Prof. Crisostomo UribeMiro100% (4)

- JOSE C. SABERON v. ATTY. FERNANDO T. LARONGDocument4 pagesJOSE C. SABERON v. ATTY. FERNANDO T. LARONGshienna baccayNo ratings yet

- G.R. No. 151857 - Calamba Steel Center Inc. v. Commissioner of Internal RevenueDocument10 pagesG.R. No. 151857 - Calamba Steel Center Inc. v. Commissioner of Internal RevenueLolersNo ratings yet

- Paramedical CouncilDocument2 pagesParamedical CouncilSachin kumarNo ratings yet

- Caroline Lang: Criminal Justice/Crime Scene Investigator StudentDocument9 pagesCaroline Lang: Criminal Justice/Crime Scene Investigator Studentapi-405159987No ratings yet

- Local Government Legislature 2Document8 pagesLocal Government Legislature 2Rasheed M IsholaNo ratings yet