Professional Documents

Culture Documents

Direct Taxes Circular

Uploaded by

ratiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Direct Taxes Circular

Uploaded by

ratiCopyright:

Available Formats

10/ 18/ 12

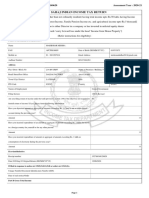

D R T TAXES C R U I EC I C LAR - Sec. 80G

SECTION 8OG l DONATIONS TO CERTAIN FUNDS, CHARITABLE INSTITUTIONS, ETC. [CORRESPONDING TO SECTION 15B OF THE 1922 ACT AND SECTION 88 OF THE 1961 ACT (BEFORE) 1-4-1968] 524. Donations made in kind - Whether eligible for deduction - Position from assessment year 1964-65 onwards Attention is invited to Boards Letter F. No. 69/83/59-IT, dated 14-3-1960, on the above subject, stating that the benefit of section 15B of the 1922 Act may be given also in a case where an assessee makes a donation out of his stock-in-trade. The Board are advised that strictly legally, donations made in kind are not covered under section 15B of the 1922 Act, under which provisions, rebate is admissible only with regard to any sums paid ... as donations. The above expression contemplates donations only in the shape of money payment and not donations in kind. The instructions, contained in Boards Letter F. No. 69/83/59/IT, dated 14-3-1960 may, accordingly, be treated as cancelled. Rebate of tax under section 15B section 88 may, therefore, be allowed only in respect of cash donations from the assessment year 1964-65 onwards. Letter : F. No. 10/111/63-IT(A-I), dated 17-1-1964.1 525. Whether donations can qualify for deduction even if these do not come out of income chargeable to tax A question has been raised whether donations can qualify for rebate even if these do not come out of the income chargeable to tax. The Boards view has been that rebate under section 88 is not dependent upon the condition that the contribution must have specially come out of income which is chargeable to tax. Even if the contribution is made out of the assessees non-taxable income, the rebate under section 88 would be allowed to the extent of the income chargeable to tax. There is also nothing in section 88 which may show that the donation should have come out of the taxable income of the year in which rebate is being claimed. Thus, even if the donations were paid out of another years income or out of income which was not includible in the assessment of the current year, the rebate under section 88 would still be available to the assessee. Letter : F. No. 45/313/66-ITJ(61), dated 2-12-1966. 526. Whether deduction under the section is allowed from income of registered firms and only resultant net income is distributed for assessment in partners cases 1. The Allahabad High Court have held in their judgment dated 24-3-1971 in the case of CIT v. Bharat Bhandar [1974] 94 ITR 315 that rebate under sections 84 and 88 should be allowed to a registered firm as well as its partners. The Board has accepted the decision and has decided that the law as laid down by the Allahabad High Court should be applied to all cases covered by sections 15B/ 15C of the 1922 Act, and by the corresponding sections 88/84 of the 1961 Act, before their deletion by the Finance (No. 2) Act, 1967 with effect from April 1, 1968. Instructions apprising the departmental officers of this legal position had been issued on July 19, 1971. 2. Sections 84 and 88 of the 1961 Act were deleted by the Finance (No. 2) Act, 1967 with effect from April 1, 1968 and substituted by sections 80G and 80J replacing the system of tax rebate by a system of deduction in assessable income. After April 1, 1968, therefore, under the aforesaid new provisions, the deduction as

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t 1/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

prescribed has to be allowed from the income of registered firms and only the resultant net income distributed for assessment in the partners cases. Circular : No. 123 [F. No. 279/112/73-ITJ], dated 31-10-1973. 527. Whether insurance company is eligible for deduction in respect of donation made by it to an institution or a fund 1. A question has arisen whether an insurance company, whose income is computed under section 44, read with the First Schedule, is eligible for rebate under section 88 in respect of donations made by it to any institution or fund fulfilling the conditions laid down in that section. 2. Section 44 is concerned only with the computation of income in the case of insurance business. Section 88 comes into play after the income has been computed as contemplated in section 44 and in accordance with the rules contained in the First Schedule. After the total income has been so determined, law lays down that in calculating the tax liability, rebate of income-tax should be given in respect of the donations made by an assessee as contemplated under section 88. Such a deduction from tax has to be given in the case of all the assessees including the insurance companies in the absence of any specific prohibition in the Act in this regard. The Board are accordingly advised that it would not be legal to refuse to grant the rebate of income-tax contemplated under section 88 in respect of donations made by insurance companies provided, of course, the amount of donation is paid out of the income of the company of the year in question. Letter : F. No. 16/38/64-IT(B), dated 24-10-1964. 528. Fund/institution recognised under section 10(23C)(iv)/(v) - Whether recognition under section 80G is automatic The Board had occasion to consider whether the recognition under section 80G of the Income-tax Act is automatic in the case of a fund or an institution notified by the Central Government under section 10(23C) (iv)/(v). The Board is of the view that this is not so. Recognition for purposes of section 80G is available when the fund or institution satisfies all the five conditions listed under section 80G(5). There may be instances of funds or institutions notified under section 10(23C)(iv)/(v) not fulfilling some of the conditions of section 80G(5). Explanation 3 to section 80G lays down that for the purpose of the section charitable purpose does not include any purpose the whole or substantially the whole of which is of a religious nature, whereas such institution may be notified under section 10(23C)(v). Circular : No. 416 [F. No. 176/11/84-IT(A-I)], dated 11-4-1985. 529. Donations to National Defence Fund [sub-clause (i) of clause (a) of sub-section (2)] by way of contributions by employees through pay-sheets - Certificate from employer stating total amount of deductions should be accepted as sufficient proof It has been represented to the Board that some employers have decided to deduct contributions to the National Defence Fund every month from the pay of their employees through the pay-sheets and the amounts so deducted would be sent in lump sum for credit to the National Defence Fund. In such cases, the National Defence Fund would issue only one receipt for the lump sum paid by the employer. It has been suggested that a certificate from the employer stating the total amount of deductions made during the year should be accepted as a sufficient proof by the Income-tax Officer for the purposes of allowing a rebate to the employees. The Board have decided to accept the suggestion subject to the condition that at the end of the year the employer shows the total contributions paid by each employee in the remarks column of the annual return under section 206, and

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t 2/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

supports it with a statement showing the total contributions credited to the National Defence Fund in each month and the number and date of the receipts given by the National Defence Fund. It has also decided that employers should be permitted to take into consideration the rebate admissible to employees on account of donations to the National Defence Fund deducted through the pay-sheets in calculating the amount of income-tax and super tax to be deducted at source from the pay of each employee. This permission may be granted by the Commissioner of Income-tax on the employer satisfying him that he has made a regular arrangement for depositing the money deducted from the employees into the National Defence Fund within seven days of such deduction. Letter : F. No. 81/60/62-IT, dated 11-12-1962. 530. Donations by co-operative societies to National Defence Fund [sub-clause (i) of clause (a) of sub-section (2)] - Whether apportionment of donations between chargeable income and exempt income justified It has been represented to the Board that several co-operative societies have made liberal contributions to the National Defence Fund. In most cases, only a part of their income is taxable on account of the exemptions given by section 81. The question has been raised whether the donations made by such co-operative societies to the National Defence Fund should be apportioned between the chargeable income and the exempt income. Attention is, in this connection, invited to the contrast between the wording used in section 87(1)(a) regarding rebate on the life insurance premia and section 88 regarding rebates on donations for charitable purposes. In the former section, rebate is admissible only in respect of amounts paid out of the income chargeable to tax. There is no such restriction in the latter section. Therefore, there is no legal justification for apportioning the amount of the donation between the chargeable income and the exempt income. Where the donation does not exceed the income chargeable to tax, no attempt should be made to apportion the donation between the chargeable and non-chargeable income. A suggestion has been made that exemption should be given to donations made by co-operative societies to the National Defence Fund even when the amounts are paid out of the past reserves contained in the common good fund. This suggestion has not been accepted by the Board as an exemption can be given only in respect of an amount which is a part of the assessable income of the year. Letter : F. No. 69/94/62-IT, dated 14-1-1963. 531. Donations by tea companies to Prime Ministers Drought Relief Fund [sub-clause (iii) of clause (a) of subsection (2)] - Whether apportionment of donations between chargeable income and exempt income justified It has been represented to the Board that several tea companies have made liberal contributions to the Prime Ministers Drought Relief Fund. As only 40 per cent of the income of tea companies is liable to tax under rule 8 of the Income-tax Rules the question has been raised whether the donations made by the tea companies to the Prime Ministers Drought Relief Fund should be apportioned between the chargeable income and the exemption income. Attention in this connection is invited to the difference between the wording used in section 87(1)(a) regarding rebate on life insurance premia and section 88 [as it stood before 1-4-1965] regarding rebates on donations for charitable purposes. In the former section rebate is admissible only in respect of amounts paid out of the income chargeable to tax. There is no such restriction in the latter section. Therefore, the Board are advised that there is no justification for apportioning the amount of the donations between the chargeable income and the exempt income. Where the donation does not exceed the income chargeable to tax, no attempt should be made to apportion the donation between the chargeable and non-chargeable income. Letter : F. No. 16/5/67-IT(A-I), dated 5-4-1967.

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t 3/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

JUDICIAL ANALYSIS EXPLAINED IN - In Goodricke Group Ltd. (No. 1) v. CIT [1994] 72 Taxman 226 (Cal.), it was observed that circular makes it quite clear that there will not be any apportionment of the deduction under section 80G between the income chargeable under the Act and the agricultural income chargeable under the relevant Agricultural Income-tax Act. 532. Donation to Prime Ministers National Relief Fund [sub-clause (iiia) of clause (a) of sub-section (2)] Money order coupons to be treated as sufficient evidence of donation Under the provisions of section 8OG deduction is allowable as spelt out in the said section on the sums paid by an assessee to the Prime Ministers National Relief Fund. With a view to helping the donors to remit amounts of the donations to the Fund, the money orders addressed to the Prime Ministers National Relief Fund have been exempted from payment of money order commission. Taking the advantage of this facility a large number of persons have sent their contributions to the fund through money orders. In the cases of persons who have sent their donations through the money orders, the money order coupons duly receipted by the Confidential Assistant-cum-Accounts Officer, Prime Ministers Secretariat, may be treated as sufficient evidence of the donations having been made to the fund for purposes of allowing deduction under section 80G. Circular : No. 178 [F. No. 176/82/75-IT(A-I)], dated 23-9-1975. 533. Any other fund or any institution [sub-clause (iv) of clause (a) of sub-section (2)] - Donation to whom is eligible for deduction as well as exemption from gift-tax NOTIFICATION 1 Donations made to the Indian Council for Africa will qualify for exemption under section 88 in the hands of the donors up to the limits specified therein. The donations will also be exempt from gift-tax. Letter : F. No. 69/22/63-IT, dated 28-9-1963. NOTIFICATION 2 The Association of Principals of Technical Institutions (India) Building Fund, Delhi Polytechnic, Lothian Road, Delhi, has been constituted with the aim of developing technical education in the country. Donations to the fund are entitled to exemption in the hands of the donors under section 88 subject to the limits specified therein. The donations will also be exempt from gift-tax. Letter : F. No. 69/13/62-IT, dated 20-7-1962. NOTIFICATION 3 A National Foundation for Teachers Welfare under the Charitable Endowments Act, 1890, has been set-up by the Ministry of Education vide their Notification No. F. 17/90/61-A-III, dated 25-6-1962. It has been decided that donations to the National Foundation for Teachers Welfare shall be entitled to exemption in the hands of the donors under section 88 subject to the limits specified therein. The donation will also be exempt from gift-tax. Letter : F. No. 69/34/62-IT, dated 11-7-1962. 534. Notified educational institutions for purposes of sub-clause (iiif) of clause (a) of section 80G Educational institution No.

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

Notification Date

4/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Lady Amritbai Daga College for Women, Nagpur

SO 2846

21-9-1999

535. Procedure to be followed by voluntary organisations or associations and local bodies which are desirous of being included in list of institutions approved by Government of India for receiving donations for family planning purposes that qualify for deduction [sub-clause (vii) of clause (a) of sub-section (2)] 1. As you are aware, the National Population Policy Statement provides, inter alia, that full rebate will be allowed in the income-tax assessment for amounts given as donation for family planning purposes. This has been made possible under section 80G(2)(a)(vii). The rebate is limited to the qualifying limits as prescribed in section 80G(4). 2. Such donations can be made to : a. the Central Government; b. the State Governments/Union territories; c. any such local authority, institutions or associations as may be approved in this behalf by the Central Government. 3. Organisations or associations which are desirous of being included in the list of institutions approved by the Government of India for receiving donations that qualify for income-tax rebate under section 80G(2)(a)(vii) should a. be registered as a society under the Societies Registration Act; b. be registered as a charitable institution under section 12A(a); c. give an application to the O.S. Division, Deptt. of Family Planning, Government of India requesting the Government of India to approve them for the purpose of receiving donations; d. give an undertaking that they would utilise the donations solely for promoting family planning and that they would submit a statement of account after every six months to the O.S. Division, Deptt. of Family Planning, Government of India through the State Governments concerned. 4. Where an organisation is engaged not only in family planning activities but also in other activities, it should form a separate institution for family planning work registered under the Societies Registration Act and the Income-tax Act for the purpose of receiving such donations. 5. They should submit a report every year to the O.S. Division, Department of Family Planning, Government of India through the State Governments concerned explaining how the donations received have been utilised for family planning purpose. 6. The receipts to be issued to the donors for donations should clearly indicate, the names and addresses of the donors and the facts that the amounts were received for the purposes of promoting family planning. This is necessary to enable the donors to claim exemption under section 80G(2)(a)(vii). As regards the voluntary institutions or associations or local bodies that are approved by the Central Government for receiving such donations, separate notifications regarding such institutions will be issued by the Department of Revenue and Banking, Government of India. 7. The following organisations have so far been approved by the Government of India for purposes of section 80G(2)(a)(ii): (1) Family Planning Association of India. (2) Red Cross Society of India. Letter : No. W. 110421/1/77-C & G (FP), dated 5/11-1-1977.

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t 5/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

536. 100 per cent tax relief for donations made to Chief Ministers Earthquake Relief Fund, Maharashtra In the wake of the unfortunate earthquake which caused wide-spread devastation in certain areas of Maharashtra in the month of September, 1993, the Government of India has issued a Press Note informing the general public that all donations made to the Chief Ministers Earthquake Relief Fund, Maharashtra, will qualify for 100% deduction, without any ceiling. 2. It was also stated in the Press Note that all donations made to the Chief Ministers Relief Fund for earthquake relief, prior to the setting up of the fund mentioned in para 1 above, would also qualify for 100% deduction. 3. The Board have been receiving queries from various quarters as to whether the Drawing and Disbursing Officers can allow 100% deduction of the aforesaid donations from salaries, under section 80G of the Incometax Act, 1961, while computing the tax liability of the employees who make such donations. The Board have decided that the D.D.Os can do so in the case of all donors upon being satisfied about the amount donated and the evidence of its receipt by the Fund. 4. In cases where the employees of an organisation make donations to the aforesaid Fund(s) through their employers, that is, by deduction from their pay through the pay bill, it is quite possible that the amounts so deducted would be sent in lump sum to the fund and the fund would issue only one receipt for the same to the employer. In such cases the employer shall furnish to the Fund a list showing the names and designations of the donors, and the amount donated individually, alongwith the cheque for the lump sum donation and have the list countersigned by the Fund. Besides, allowing 100% deduction at his level, wherever permissible, the employer should issue a certificate to the concerned employees stating the amount of deduction made, the number and date of the pay bill, and the number and date of the cheque by which the lump sum amount including the donation made by the concerned employee(s) was paid to the Fund, so that the same could be filed by the concerned employees with their returns of income, if necessary. 5. There would be no upper ceiling for the purpose of deduction in respect of the amount donated to the funds mentioned in paras 1 and 2 above. It may, however, be noted that no deduction will be allowed if the sum donated is less than Rs. 250. Circular : No. 678, dated 10-2-1994. 537. 100 per cent deduction to be granted from total income while calculating tax for the purpose of TDS for contributions made to A.P.C.Ms Cyclone Relief Fund Under the provisions of section 80G of the Income-tax Act, 1961, contributions made to the A.P.C.Ms Cyclone Relief Fund have been made fully exempt from tax, and can hence be taken as a deduction from total income. The Board is of the view that the said deduction can be made from total income while computing the tax to be deducted at source. Circular : No. 752, dated 26-3-1997. 538. Submission of certificate for claiming deduction under section 80G in respect of donations made by an employee to the National Defence Fund, the Army Central Welfare Fund, the Indian Naval Benevolent Fund, the Air Force Central Welfare Fund In view of the unforeseen and unavoidable developments taking place in Kargil and nearby areas, employees of Central Govern ment, State Governments, Public Sector undertakings, Private Sector Companies and Corporations, and local authorities are making donations to the National Defence Fund and other funds, as

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

referred to above, set up by the Central Government/Armed Forces of the Union, through their respective

6/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

referred to above, set up by the Central Government/Armed Forces of the Union, through their respective employers/organisations. An employee who is making such donations is eligible to claim deduction under section 80G of the Income-tax Act, 1961 on the basis of the certificate issued by the recipient organisation. However, it may not be possible for every employee to obtain a certificate in respect of donations made through their organisa since the contributions to the fund(s) will be made in the form of a consolidated cheque. It is, tion therefore, clarified that the claim in respect of such donations as indicated above will be admissible under section 80G of the Income-tax Act, 1961, on the basis of the certificate issued by the DDO/Employer, in this behalf. Circular : No. 777, dated 1-7-1999. 539. Submission of certificate for claiming deductions in respect of donations made by an employee to the Prime Ministers National Relief Fund, the Chief Ministers Relief Fund and the Lieutenant Governors Relief Fund In view of the occurrence of unforeseen national calamities of immense magnitude like the Orissa Cyclone, employees of the Central Government, State Government, Public Sector Undertakings, Private Sector Companies and Corporations, and local authorities are making donations to the Prime Ministers Relief Fund, the Chief Ministers Relief Fund or the Lieutenant Governors Relief Fund through their respective employers/organisations. An employ who is making such donations towards these funds is eligible to claim ee deduction under section 80G of the Income-tax Act, 1961. However, it may not be possible for every employee to obtain separate certificates in respect of donations made to such funds since the contributions made to these funds will be in the form of a consolidated cheque. It is, hereby, clarified that the claim in respect of such donations as indicated above will be admissi under section 80G of the Income-tax Act, 1961 on the basis of ble the certificate issued by the DDO/Employer in this behalf. Circular : No. 782, dated 13-11-1999. 540. 100% tax exemption to Orissa Cyclone Relief donations made to Prime Ministers Relief Fund and Chief Ministers Relief Fund The Government has clarified that donations made to the Prime Ministers Relief Fund and Chief Ministers Relief Fund are 100% exempt from tax. Those wishing to donate for the Orissa Cyclone Relief operations may make donations to any of the two funds and avail of 100% tax exemption on such donations. PIB Press Release, dated 11-11-1999. 541. Submission of certificate for claiming deductions under section 80G in respect of donations made by an employee to the Prime Ministers National Relief Fund, the Chief Ministers Relief Fund and the Lieutenant Governors Relief Fund In view of the occurrence of unforeseen national calamities of immense magnitude like the Gujarat earthquake employees of the Central Government, State Government, Public Sector Undertakings, Private Sector Companies and Corporations, and local authorities are making donations to the Prime Ministers Relief Fund, the Chief Ministers Relief Fund or the Lieutenant Governors Relief Fund through their respective employers/organisations. An employee who is making such donations towards these funds is eligible to claim deduction under section 80G of the Income-tax Act, 1961. However, it may not be possible for every employee to obtain separate certificates in respect of donations made to such funds since the contributions made to these funds will be in the form of a consolidated cheque. It is hereby, clarified that the claim in respect of such donations as indicated above will be admissible under section 80G of the Income-tax Act, 1961 on the basis of the certificate issued by the DDO/Employer in this behalf.

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t 7/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Circular : No. 7/2001, dated 21-3-2001. 542. Institution or association notified under sub-clause (vii) of clause (a) of sub-section (2) for the purposes of deduction of donation (to be utilised for the purposes of promoting family planning) thereto Institution/Association No. Baroda City Family Welfare Fund Arulmigu Mariamman Temple, Udemalpet 6017 6018 Notification Date 11-10-1984 11-10-1984

543. Donations for renovation or repair of notified temple, mosque, gurdwara, church or other place to be of historic, archaeological or artistic importance or to be place of public worship [clause (b) of subsection (2)] Places No. Sri Meenakshi Sundareswar Temple, Madurai Sri Jambukeswarar and Sri Akhilandeswari Temple, Tiruvanaikoil, Tiruchirapalli Distt., Madras State Sri Nachiar (Sri Andal) and other temples under the Sri Nachiar Devasthanam, Srivillputhur, Madras State Sri Devarajaswamy Devasthanam Temple, Little Kanchipuram, Madras State Sri Sangameswarar Temple, Bhavani, Coimbatore District, Madras State Sri Kanyaka Parameswari Devasthanam and Charities, Kotwal Market, Madras Shri Jagannath Temple, Puri Church of Bom Jesus, Goa Dargah Khwaja Moinuddin Chisti, Ajmer Gurdwara Harmandir Saheb, Amritsar Jama Masjid, Delhi Jama Masjid, Bombay Kali Temple, Kalighat, Calcutta Mount Mary Shrine, Bandra, Bombay Shri Padmanabhaswami Temple, Trivandrum SO 1974 19-6-1965 SO 2573 SO 2806 Notification1 Date 6-8-1962 17-9-1963

SO 2869

5-10-1963

SO 2575 SO 2681 SO 3801 SO 1337

18-7-1964 27-7-1964 24-10-1964 15-4-1965

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

8/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Shri Kashi Vishwanath Temple, Varanasi Shri Dwarkadhish Temple, Dwarka Shri Venkateswara Temple, Tirupathi Shri Ramanatha Swami Temple, Rameshwaram Shri Bhramaramba Malikharjunaswami Devasthanam, Srisailam, District Kurnool, Andhra Pradesh Shri Dattatreya Temple, Ghangapur, District Gulbarga, Mysore Sri Kasiviswanathaswamy Temple, Tenkashi, Madras State Shri Bhadrachala Seetaramalaya Temple, Bhadrachalam. Sri Lakhmi Narasimha Swamy Devasthanam, Ahobilam Village, Allagadda Taluk, District Kurnool, Andhra Pradesh Sri Poovnanathaswamy Temple, Kovilpatti, Tirunelveli District, Madras State Sri Brihadiswaraswami Temple, Thanjavur, Madras State Shree Rama Vaikunth Temple, Pushkar (Ajmer) St. Pauls Cathedral, Ambala (Punjab) St. Andrews Church, Calcutta Sri Nataraja Temple, Chidambaram, Madras State Shamlaji Temple, Shamlaji Taluka, Bhiloda, District Sabarkantha (Gujarat) Sri Chandra Choodeswara Swamy Temple, Hosur, Salem District, Madras State Shri Kaleshwaraswami Temple, Kaleshwaram (v), Manthani Taluk, Karimnagar District, Andhra Pradesh Sri Madurakali Amman Temple (Siruvachuri.), Perambalur Taluk, Tiruchirapaili Distt., Madras Sri Subramaniaswami Temple, Kumarayalur,

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 1975

26-6-1965

SO 2353 SO 2597 SO 2598 SO 2800

19-7-1965 7-8-1965 9-8-1965 30-8-1965

SO 2876 SO 3047 SO 3140 SO 3429 SO 3626 SO 171 SO 2289 SO 2290 SO 3277

9-9-1965 20-9-1965 25-9-1965 22-10-1965 18-11-1965 5-1-1966 14-7-1966 14-7-1966 13-10-1966

SO 372 SO 1466

11-1-1967 6-4-1967

9/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Madras State Shri Purshotamaperumal Temple, Nangoor, Madras Shri Parthasarathy Swamy Devasthanam, Triplicane, Madras Sri Mogileswara Swamy Temple Trustee Board, Mogili, Andhra Pradesh Sri Narasimhaswami Devasthanam Temple, Namakkal, Salem Distt., Madras State Sri Ranganathaswamy Temple, Sreerangapatna, Mandya District Sri Srikanteswaraswamy Temple, Nanjangud, Mysore District Sree Melai Mahadeswaraswamy Temple, Kollegal Taluk, Mysore District Sree Subramanyaswamy Temple, Ghati Doddaballapur Taluk, Bangalore (Rural) District Sri Anjaneyaswamy Temple, Mulbagal, Kolar District Sree Virupaksha Temple, Hampi, Hospet Taluk, Bellary District Sree Pralayakalada Veerabhadraswamy Temple, Gavipuram, Bangalore District Sri Dharamasamvardhinisametha Sri Kailasanathaswami Temple, Kambarasanpettai, Tiruchirapalli, Madras State Shri Swaminatha Swami Temple, R.K Puram, New Delhi Birla Mandir, New Delhi Gauri Shankar Mandir, Delhi Hanuman Mandir, New Delhi Jain Mandir, Delhi Moti Masjid, Red Fort, Delhi Dargah Hazrat Khwaja Nizamuddin Aulia,

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 1739

28-4-1967

SO 1740 SO 1741 SO 2570

28-4-1967 8-5-1967 5-7-1967

SO 257

20-7-1967

SO 2571

20-7-1967

SO 2572

20-7-1967

SO 4160

16-11-1967

SO 751

13-2-1968

10/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Delhi St. James Church, Delhi Methodist Church, Delhi Cathedral Church of the Redemption, New Delhi Gurdwara Sis Ganj, Delhi Gurdwara Rakabganj, New Delhi Astakshari Kshetram, Badrinath, Uttar Pradesh Sri Subramaniyaswamy Devasthanam, Tiruthani, Madras State Sri Tirukachinambigal and Sri Varadarajaperumal Devasthanam, Poonamallee (Madras), Madras State Temple of Shri Mangesh at Priol, Goa Shri Badrinath and Kedarnath Temples Gurdwara Bangla Sahib, Delhi Gurdwara Mata Sundri Ji, Delhi Gurdwara Dam Dama Sahib, Delhi Gurdwara Moti Bagh Sahib, Delhi Gurdwara Bala Sahib, Delhi Gurdwara Nanak Piao, Delhi Gurdwara Majnu Tilla, Delhi Shri Mahadeva Temple Valiasala, Kerala Sri Kamakshi Amman and Sri Ekambaranathaswami Temple, Sadhurangapatnam, Chingleput Distt., Madras Sri Arunachaleswara Devasthanam, Trivaninnamalai Shri Devanathaswamy Temple, Cuddalore Shri Shantesh Maruti Devasthan, Hirekerur Distt., Dharwar Shri Satya Ganana Sabai, Vadalar, Cuddalore Distt. Sri Balasarduleeswarar Temple, Nellorepet, Gudiyattam, North Arcot Distt.

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 1375 SO 4090 SO 542 SO 1949 SO 3069

4-4-1968 29-10-1968 22-1-1969 12-5-1969 19-7-1969

SO 137

14-10-1969

159 SO 736

8-12-1969 2-2-1970

92 SO 2321 SO 2391 SO 16 SO 630

5-6-1970 5-6-1970 9-6-1970 23-10-1970 26-10-1970

11/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Shri Athmanathaswamy Temple, Avadayarkoil, Arantangi Taluk, Thanjavur Distt. Sri Krishna Temple, Guruvayur Sri Kalyana Ranganathaswamy Temple, Thirunagari, Sirkali Thirupapuliyur Sri Pataleeswarar Temple, Cuddalore Shri Drighvishuji Ka Mandir, Bharatpurgate, Mathura Shri Veer Bhaddeswarji Ka Mandir, Gali Beer Panch, Mathura Shree Sidhi Vinayak Temple, Sarasbagh Shree Deva Deveswar Temple, Parvati Shree Vishnu Narayan Temple, Parvati Shree Kartik Swami Temple, Parvati Shree Mrutyunjayeshwar Temple, Kothrud Shree Dasabhuja Ganapathi Temple, Yarandavanda Thiruvali Sri Lakshmi Narasimha Perumal Sannadhi, P.O. Thiruvali, Taluk Sirkali, District Tanjore Sri Siddalingeswara Temple, Tumkur Distt., Mysore Shri Ram Temple, Chaphal, District Satara, Maharashtra Shree Trimbakeshwara Temple, Trimbak, District Nasik Sri Adhi Jagannatha Perumal Temple, Tiruppullani, Ramanathapuram Distt. Dargah Hazrath Syed Mardan-e-Gaib, Sunni, Shivasamudram Shri Anandavalli Sametha Sundaravarada Perumal Temple, Uttiramerur, Chingleput Distt. Sheth Pestonji Kalabhai Vakil Kadmi Atash Behram (Fire Temple), Surat

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 153

12-11-1970

SO 692 SO 3725 SO 3492

31-12-1970 8-7-1971 26-7-1971

SO 3493

26-7-1971

SO l79

19-10-1971

SO 2389

10-11-1971

SO 2457 SO 3204 SO 3131 SO 4029 SO 4030 202 SO 4032

17-1-1972 18-7-1972 3-8-1972 26-8-1972 7-9-1972 10-10-1972 18-10-1972

12/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Sri Ram Mandir, Bajrangpuri, Lodi Road, New Delhi Ubrangala Shree Mahadeva Parvathi and Kudkuli Shri Durga Parameshwari Temples, Ubrangala Village, Kasargod Taluk, P.O. Kumbdaje Shri Mahalasa Narayani Temple, Verna, Goa Sri Thiruvateeswar Temple, Triplicane, Madras-5 Sri Sivasailanathaswamy Temple, Sivasailam, Tirunelveli District Shri Selva Vinayagar Temple, Madras Shri Sammeda Shikharji Teerth Kshetra Digamber Jain Temples at footend on Parasvanath Hills Digamber Jain Temples of Shree Vasupujya Teerthankar at Champapuri Shree Digamber Jain Temples at Pavapuri Shree Digamber Jain Temples at Girnar Hills near Junagadh in the State of Gujarat in India The colossal ancient Digamber Jain Monumental monolithic revered hold statue (Image) of Shree Gomateshwar Swami (i.e. Shree 1008 Bhubali Bhagwan) at the peak of the Vindhyagiri Hills, (Podabetta) (and even otherwise styled at Indragiri Hills) and other Digamber Jain Temple therein and the number of other Digamber Jain ancierty Temples at the nearby Chandragiri Hills at Shravanbelgola in the District of Hassan in the State of Mysore in India The ancient Digamber Jain Temples at Muktagiri, in the Distt. of Amrawati, in the State of Maharashtra in India (or in the Distt. of Baitul in the then State of Madhya Pradesh in India Shri Ananthapadmanabhaswamy Temple, Kasargod, Cannanore Shri Kalamegaperumal Temple, Thirumohur, Madurai Distt.

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 937 SO 260

25-11-1972 28-11-1972

SO 607 291 297 300

24-1-1973 8-2-1973 21-2-1973 23-2-1973

SO 301

24-2-1973

SO 993 SO 994

26-2-1973 27-2-1973

13/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Kadri Shri Manjunatha Temple, Mangalore Sri Kalahateeswara Swami Devasthanam, Srikalahasti (AP) Koniyamman Temple, Coimbatore Shri Vedantha Desikar Devasthanam, Madras Sri Murudeswarar Veeranarayanaperumal Temple, Kodumudi, Erode Taluk, Coimbatore Distt. Shri Devi Karumariamman, Thirukkoil, Madras Shri Raja Rajeswari Temple, Madras Sri Durga Malleshwaraswami Varla Devasthanam, Vijayawada Shri Kanchi Kamakshi Amman Debasthanam, Big-Kancheepuram, Tamil Nadu Lord Subramania Temple, Chedda Nagar, Pestom Sagar, Chembur, Bombay-89 Shree Koodal Manickom Temple, Irinjalakuda, Kerala Shri Bhuvarahaswamy Temple, Srimushnam, South Arcot Distt. Sri Avanashi Lingeswarar Temple, Avanashi, Coimbatore Distt. Jain Swetamber Panchayati Temple, Calcutta Sri Biligirirangaswamy Temple, Biligirirangana Hills, Yelandur Taluk, Mysore State, Karnataka Nanded Sikh Gurudwara Sachkhand Sri Hazur Abchalnagar Sahib Arulmigu Meenakshisundreswarar Tirukoil Temple, Madurai Shri Krishna Janam Bhoomi Mathura1 Shree Wadakkunnathan Temple, Trichur Sri Annapurna Devi Mandir, Varanasi Sri Parthasarathyswamy Devasthanam, Triplicane, Madras Sri Peria Vachan Pillai Temple, Senganur,

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 1595 SO 1837 SO 1838 SO 1839 375

21-4-1973 30-4-1973 4-5-1973 18-5-1973 11-6-1973

389 SO 2572 SO 2861 SO 2862 SO 3145 SO 649 SO 739 SO 826 SO 827 SO 1097

23-6-1973 5-7-1973 17-8-1973 27-8-1973 30-8-1973 4-2-1974 8-2-1974 18-2-1974 21-2-1974 23-3-1974

SO 1440 661 SO 1979 SO 684 SO 2480 707 732

17-4-1974 27-6-1974 6-7-1974 20-7-1974 12-8-1974 20-8-1974 5-10-1974

14/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Tamil Nadu Shri Dandayuthapani Swami Temple, Palani, Madurai Distt., Tamil Nadu Shri Anjaneya Swami Temple, Gopichettipalayam, Coimbatore Distt., Tamil Nadu Shri Chaurasi Ghante Mandir, Bazar Sitaram, Delhi Yadgari Asthan Sriman Sant Sangat Singh Ji Maharaj Kamaliawale, Patiala Sri Masilamaniswarar Temple, Vada Thirumallaivayal, Saidapet Taluk Sri Eachanari Vinayagar Temple (Koil), Coimbatore District, Tamilnadu Sri Vyagarapuraswarar Temple, Thiruppulivanam, Chingleput District Sri Kalyana Venkateswara Perumal, Temple Illupur, Kulathur Taluk, Pudukottai District, Madras Sri Devarajaswamy Devasthanam, Kancheepuram, Madras Sri Madhurakali Amman Temple, Siruvachur, Perambaur Taluk, Tiruchy District, Madras Thirumoozhikulam Shree Lakshmana Perumal Temple, Ankamali, Kerala Sri Vaidyanatha Swamy Temple, Madavarvilagam, Srivilliputtur, Ramanathapuram District, Tamilnadu Shri Durgiana Temple, Amritsar Shri Sankara Narayana Swamy Temple Sankara Nainar Koil, Tirunelveli District, Madras Shri Madhavaperumal Temple, Mylapore, Madras Sri Subramaniaswamy Temple, Kumaravayalur, Tiruchy District, Tamilnadu St. Pauls Cathedral, Chowringhee Road,

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

764 769

26-10-1974 8-11-1974

SO 503 SO 504 819 822 830 833

6-12-1974 6-12-1974 15-1-1975 22-1-1975 4-2-1975 6-2-1975

834 835

6-2-1975 6-2-1975

SO 928 863

6-2-1975 31-3-1975

SO 1672 SO 884

21-4-1975 28-4-1975

SO 894 SO 1979 SO 2262

12-5-1975 17-5-1975 21-5-1975

15/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Calcutta Sri Ranganatha Paduka Ashram, R.K. Puram, New Delhi Shri Kasi Kamakoteeswarar Mandir, Varanasi St. Johns Church, 2/1 Counsel House Street, Calcutta Sri Lakshminarasimhaswamy Temple, Ponvilainthakalathur Sri Mangalanathaswamy Temple, Thiru Uthira Kosamangai, Ramanathapuram Taluk and Distt. Balram Mandir, Calcutta Gurudwara Dukh Niwaran Sahib, Haibowal Kalan, District Ludhiana Shri Vengeeswarar Alagapperumal and Nagathamman Temple, Kodambakkam, Madras Sri Kalahastheeswaran Swami, Thirukoil, Dindigul, Tamilnadu Sri Athinathar Alwar Temple, Alwarthirunagari, Tirunelveli Distt. Shri Veeranarayana Perumal Temple, Kuruhai Kavalappan P.O., Tiruchy District Kanjirappalli Shri Ganapathiar Koil and Sastha Koil, Kanjirappalli, Kottayam District, Kerala State Shree Samed Shikharjee Tirath Parasnath, Bihar Arulmigu Lakshminarasimhaswamy Devasthanam, Solinghur, North Arcot District Sri Mukteswara and Kaleswareswamy Temple at Kaleswaram (AP) Sri Lakshminarasimhaswamy Temple, Palayasivaram Village & Post, Chingleput District Mulbagal Sri Anjaneyaswamy Temple, Mulbagal, Kolar District (Karnataka) Sri Patala Nageswara Swamy Devalaya

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 4054 SO 4748 SO 4749 SO 5285 SO 662 SO 884 SO 885 SO 1019

23-7-1975 13-8-1975 13-8-1975 29-10-1975 6-12-1975 31-12-1975 31-12-1975 6-1-1976

SO 1302 SO 1623 SO 1525 SO 1678

12-2-1976 12-2-1976 15-3-1976 28-3-1976

SO 1679 SO 1680 SO 2146 SO 2217

28-3-1976 28-3-1976 21-4-1976 20-5-1976

SO 2356 SO 3109

10-6-1976 19-7-1976

16/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Punaruddhana Sangham, Giddalur (AP) Sri Lakshminarasimha Swamy Temple at Devarayana Durga, Tumkur District (Karnataka) Sri Bhavanarayana Swamy and Sree Somewara Swamy Temples, Baptala (AP) Shri Parthasarathy Kshetra Bharana Sangam, Guruvayur, Kerala Shri Dhyneshwar Maharaj Sansthan, Alandi Devachi, Poona Shri Digamber Jain Atishya Kshetra, Shri Mahaveerji, Rajasthan Tirumala Tirupati Devasthanam, Tirupati (AP) - Temple of Shri Venkateswaraswami on Tirumala Hills with the sub-temples of : - Sri Varahaswami - Sri Choodikaduthanancharamma - Sri Bedi Hanumantharayaswami - Sri Kshetrapalaka - Sri Dova Bashyakarlu - Sri Anjaneyaswami (in front of Sri Venkateswaraswami) - Temple of Sri Govindarajaswami at Tirupati with the sub-temples of : - Sri Saley Nancharamma - Sri Chhodikodutha Nancharamma - Sri Modal Alwar - Sri Chakrath Alwar - Sri Mandhurakavi Alwar - Sri Anjaneyaswami (near Dhawajasthambham) - Sri Anjaneyaswami (near Pedda Bugga) - Sri Manavala Mahamuni - Sri Nammalawar - Sri Vedantha Desikulu

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t 17/ 34

SO 3110

19-7-1976

SO 3524 SO 3525 SO 4675 SO 4676

29-7-1976 11-8-1976 18-10-1976 18-10-1976

SO 3

2-11-1976

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

- Sri Woolu Alwar - Sri Tirumala Nambi - Sri Bhashyakarlu No. II - Sri Tirumangai Alwar - Sri Kurath Alwar - Sri Sanjeewarayaswami - Temple of Sri Kothandaramaswami at Tirupati - Temple of Sri Kapileswaraswami at Tirupati - Sri Padamavathis Temple at Tiruchanur with sub-temples of : - Sri Krishnaswami - Sri Suryanarayanaswami - Sri Sundarajaswami - Sri Kalyana Venkateswaraswami - Temple at Narayanavanam - Sri Venkateswaraswami Temple at Mangapuram - Sri Vedanarayanaswami Temple at Nagalapuram - Temples at Rishikesh : - Sri Chandramouleeswaraswami Temple - Sri Venkateswaraswami Temple Shree Digambar Jain Barha Mandir, Ladnun (Rajasthan) Sholavandan Arulmigu Janaga Narayana Perumal Temple, Sholavandan, Madurai Distt. Sri Swaminathaswamy Devasthanam, Swamimalai, Kumbakonam Taluk Bappanad Shri Durgaparameswari Temple, Mulki (S.K.) Karnataka Arulmighu Srinivasan Perumal Temple, Malayadivaram, Dindigul, Madurai Distt., Tamilnadu Sd Kodanda Ramaswamy Temple, Vontimitta

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 3

2-11-1976

SO 65 SO 66 SO 67 SO 68 SO 69

15-11-1976 18-11-1976 18-11-1976 27-11-1976 27-11-1976

SO 637

3-1-1977

18/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

(P.O.) Sidhout Taluk, Cuddapah Distt., Andhra Pradesh Sri Kalinga Nardhana Perumal Temple, Oothukadu Village, Papanasam Taluk, Thanjavur Distt., Tamilnadu Sri Venugopala Swami Temple Devasthanam Kizhanatham, Tirunelveli Distt., Tamilnadu Sri Sakthi Vinayaga Temple Kalinga Colony1 Shri Kalyanavenkataramanaswamy Temple, Thanthonimalai, Karur-5, Tiruchy Distt. Shri Cherpalacheri Ayyappankavu Jeernodharana Samithi, Cherpalacheri, Palghat Shri Gajanan Maharaj Sansthan, Shegaon Arulmigu Sri Kamakshi Amman and Vaikundaperumal Temple, Mangadu, Sriperumbudur Taluk, Chingleput Distt. Arulmigu Azhagia Nambi Rayar Temple at Thiruppurngudi, Nanguneri Taluk, Tirunelveli Distt., Tamilnadu Sri Janardhana Temple, Yermal, Udipi Taluk Shree Shantadurga Lakshmi Narsinv Sankhalyo Sansthan, Sancoale, Marmagoa, Goa Sri Parthasarathy Perumal Temple, Parthanpalli, Radhanallur, Sirkali Taluk, Tanjore Distt., Tamilnadu Arulmigu Kottai Mariamman Koil, Dindigul, Madurai Distt. Shri Arulmigu Sethunarayana Perumal Temple, Watrap, Srivilliputhur Taluk, Ramanathapuram Distt. Sri Veeraraghavaswami Temple, Tiruvallur, Chingleput Distt. 1Sri Vaikuntanathaperumal Temple, Nangur P.O. via Mangamadam, Srikali Taluk, Tanjore Distt. Sri Ekambaranathar Temple, Big

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 808

25-1-1977

SO 1361 SO 1362 SO 2092 SO 2277 SO 2591 SO 3008

5-3-1977 25-3-1977 16-4-1977 28-4-1977 11-5-1977 29-6-1977

SO 3386

7-7-1977

SO 3388 SO 3389

29-7-1977 4-8-1977

SO 3524

14-9-1977

SO 3891 SO 405

17-10-1977 19-11-1977

SO 112 SO 113

28-11-1977 28-11-1977

SO 114

28-11-1977

19/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Kanchipuram, Chingleput Distt., Tamilnadu Sri Varadaraja Perumal Temple, Thirumenikoodam, Nangur P.O. via Mangamadam, Sirkali Taluk, Tanjore Distt. Sri Kudamadakoothar Temple, Nangur P.O. via Mangamadam, Sirkali Taluk, Tanjore Distt. Sri Pallikonda Ranganathaswami Temple, Nangur P.O. via Mangamadam, Sirkali Taluk, Thanjavur Distt. Sri Rajagopalaswami Temple, Kavalambadi, Nangur Post, Sirkali Taluk, Tanjore Distt. Sri Madha Perumal Temple, Keelachalai, Nangur P.O. via Mangamadam, Sirkali Taluk, Tanjore Distt. Shri Pallikondeswara Swami Temple Renovation Committee, Surathapalli Village, Chittoor Distt., Andhra Pradesh Shri Manikeswar Mahadev Mandir, New Road, Cochin Sri Ananthapadmanabhaswamy Temple, Gandhinagar, Adyar, Madras St. Francis Cathedral, Ernakulam Shri Laxminaracinva Devalaya, Velinga Mardol, Goa2 Sri Vasishteshwarar Temple, Thittai, Thanjavur Distt. Shri Kallalagar Temple, Alagar Koil, Melur Taluk, Madurai Distt., Tamilnadu Sansthan Sri Deo Ganpatipule Sree Vellat Puthur Kshethra Samrakshanna Samithi, Perintamanna Sri Audikesava Perumal Sri Bashyakaraswami Temple, Sriperumbudur Sri Karaneeswarar Temple, Saidapet, Madras Valanjambalam Devi Temple Arulmigu Ranganathaswami Temple, Madras SO 293 28-11-1977

SO 589

16-12-1977

SO 590

16-12-1977

SO 591 SO 592

16-12-1977 26-12-1977

SO 593

26-12-1977

SO 594 SO 982 SO 983 SO 1397 SO 1402 SO 1788 SO 2467 SO 2469 SO 2400 SO 2587 SO 2593 SO 3686

3-1-1978 6-2-1978 14-2-1978 3-3-1978 31-3-1978 27-4-1978 31-5-1978 14-6-1978 15-6-1978 18-7-1978 24-7-1978 31-7-1978

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

20/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Trikkanand Triyambakeswara Temple, Pallikkare Arulmighu Lakshminarasimhaswamy Temple, Polur, North Arkot Distt. Sri Arappaleeswarar Temple, Kollimalai, P.O. Salem Distt., Tamilnadu Sri Pandurangaswamy Temple, Venkatachala Chetty Street, Triplicane, Madras Sri Naganathaswamy Temple, Thirunageswaram, Kumbakonam Talu, Tanjore District Sri Marundeeswarar Temple, Tiruvanmiyur, Madras Sri Ramanasramam, Tiruvannamalai, Tamilnadu Armenian Church, Calcutta Thiruvenkatachalapathy Kshetra Samithy, Thiruvenkatam, Guruvayur Sri Ayyappa Temple, Hardwar Sri Kasi Vishwanatha Swami Temple, St. Thomas Mount, Madras Shri Tulja Bhawani Mandir Trust, Tuljapur Sri Prasanna Venkatesa Perumal Sannidhi, Velukudi, Mannargudi Taluk, Tanjore Distt., Tamilnadu Sri Venkatesa Perumal Koil and Sri Kailasanathswami Koil, Varagur, Tamilnadu Gurudwara Shri Hem Kunt Sahib, Chamoli, U.P. Shri Navnit Krishna Mandir, Palace Road, Cochin Ammachiavadu Moorthi Temple, Quilon Panniyanikara Sree Durga Dhagavathy Temple, Panniyanikara, Calicut Arulmigu Kapaleeswarar Temple, Mylapore, Madras Puthur Sri Durga Temple, Puthiangadi, Calicut Kannanthur Sri Thodakukkin Devasthan,

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 3585 SO 226 SO 579 SO 2486 SO 3015 SO 3016 SO 2932 SO 2933 SO 3017 SO 3310 SO 3311 SO 3649 SO 722

4-10-1978 21-11-1978 30-12-1978 15-1-1979 15-1-1979 31-1-1979 31-1-1979 7-2-1979 7-4-1979 7-6-1979 7-6-1979 3-9-1979 18-1-1980

SO 917 SO 84 SO 3117 SO 996 SO 3123 SO 3027 SO 3121 SO 3277

14-2-1980 19-3-1980 3-4-1980 19-6-1980 1-7-1980 25-9-1980 1-10-1980 9-10-1980

21/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Balepuni Village, Dakshina Kannada. Mandir Shri Govind Devji, Jaipur Shri Kantheshwara Temple, Kantheshwara, Dakshina Kannada, Karnataka Arulmigu Venkatachalapathy Temple, Krishnapuram (attached to Arulmigu Nelliappar Temple, Tirunelveli) Sri Harsabha Vimochanaperumal Temple, Kandiyur, Thanjavur Distt. (Tamilnadu) Shri Balamurugan Thirukkoil, Rathnagiri, N.A. Distt. Sri Srinivasa Perumal Temple, Egmore, Madras Arulmigu Kasi Viswanathaswamy Temple, Appakudal, Tamilnadu Mambra Mahadeva Temple, P.O. Erayamkudi, Trichur Distt. (Kerala) Thirikkavu Durga Bhagawathy Temple, Ponnami, Malapuram Distt., Kerala Shri Rajagopalaswamy Kulasekara, Alwar Temple, Mannarkoil, Ambasamudram Taluk, Tirunelveli Distt. Arulmigu Palamuthirssolai Murugan Temple, 5 Vallabbhai Road, Chockikulam, Madurai Sri Lakshmi Venkataramana Swamy Temple, Mysore Amangudi Arulmigu Kailasanathar Temple, Ammangudi, Tamilnadu Mudappilavu Maha Vishnu Temple, Trichur, Kerala Arulmigu Brahadambal Temple, Thirukogernamy, Pudukottai, Tamilnadu Mandir Shree Ganeshji, Moti Dungri, Jaipur Arulmigu Thayumanaswami Temple, Tiruchy Arulmigu Kondathukaliamman Temple, Pariyur Gopichettipalayam, Tamilnadu Sree Subramaniaswamy Temple, Pollachi,

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 819 SO 597 SO 598

21-11-1980 21-11-1980 28-11-1980

3756 SO 1010 SO 521 SO 1017 SO 1018 SO 1019 SO 1020

5-12-1980 5-12-1980 31-12-1980 22-1-1981 22-1-1981 30-1-1981 30-1-1981

SO 1084 3866 3867 SO 1924 3920 SO 1925 SO 3279 SO 1891 3956

12-2-1981 19-2-1981 19-2-1981 10-3-1981 31-3-1981 20-4-1981 24-4-1981 12-5-1981 14-5-1981

22/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Tamilnadu Shree Ram Mandir, Matunga, Bombay Arulmigu Sthala Sayana Perumal Temple, Mamallapuram Sri Amareswara Swamy Temple, Amravati Sri Dwarkadhishji Mandir, Bet, Gujarat Madaji Shree Vadukunda Shiva Kshetram, Cannanore Sri Gangadhareswarar Temple, Purasawalkam, Madras Shri Jainsingh Balaji Venkateshwaraswamy Devasthanam, Gudimalkapur, Hyderabad Arulmigu Kallapiranswamy Temple, Srivaikuntam, Tirunelveli Distt. Sri Ninra Narayana Perumal Devasthanam, Thiruthangal Palliarakavu Bhagawathy and Siva Temple, Ayakkad, Palghat Distt. Sree Shanmuga Subraya Temple, Shambooru, D.K. Distt. Sree Thirumanthamkunnu Bhagwathy Devaswom, Angadipuram, Palghat District Shri Venkatesa Devasthan, Fanaswadi, Bombay Sri Narayana Perumal Temple, Nangur P.O., Thanjavur Distt. Sri Darbhanvaneswara Swami Temple, Thirunallaru P.O. (Karaikal Region) Sri Mazhileeswarar and Shri Ponnachiamman Temple, Perumthalaiyur Sri Thirukameswar Temple, Villanur, Pondicherry Ammathiruvadi Temple, Urakam Village, Trichur Distt., Kerala Sree Siva-Vishnu Temple, T. Nagar, Madras Sree Vadakunnathan Temple, Trichur Sri Mallikarjuna Swami Temple, Amenpura

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

3973 SO 2440 SO 2565 SO 2441 SO 2570 SO 3287 SO 3288 SO 1 SO 2 SO 267 SO 413 SO 271 SO 650 SO 274 SO 651 SO 939 SO 1811 4575 SO 3158 SO 3159 SO 3425

25-5-1981 4-6-1981 11-6-1981 3-7-1981 4-8-1981 29-9-1981 29-9-1981 5-11-1981 5-11-1981 17-11-1981 2-12-1981 2-12-1981 7-12-1981 16-12-1981 30-12-1981 21-1-1982 12-3-1982 17-4-1982 24-4-1982 24-4-1982 28-6-1982

23/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Village, Medak Distt. (AP) Sri Lakshmi Narasimhaswamy Devasthanam, Kediri Shri Valarolinathar-Vadivudayamman Temple of Vairavanpatti, Ramnad Distt., Tamilnadu Agneeswara Mahadevar Temple, Trivandrum Shri Venugopalaswamy Temple, Kunnavakkam, Chingleput, Tamilnadu Shri Martand Deo Sansthan, Jejuri, Maharashtra Sri Lakshmi Venkatesaraswamy Temple, Devuni Cuddapah . Arulmigu Kasiviswanathaswamy Thirukoil, Tankasi, Tirunelveli Distt. Sri Prasanna Venkatesa Perumal Temple, Ulundurpet Taluk, South Arcot Distt., Tamilnadu Chennai Sree Kalikambal Kamateswarar Temple, Madras Shri Vedanarayana Perumal Temple, Musiri Taluk, Tiruchy Distt., Tamilnadu Shri Lakshmi Narasimhaswamy Temple, Gorvanhalli, Hindupur Taluk, Anantpur Distt., AP Sri Sabarimala Temple, Kerala Sree Ayyappa Temple, Madras Adi Kadalai Sree Krishna Temple, P.O. Kadalai, Cannanore, Kerala Arulmigu Ellamman Temple, Periamet, Madras Sri Venkatachalapathy Swamy Temple, Oppiliyappan Koil, Tirunageswaram P.O., Tamilnadu Shri Subramaniaswamy Thirukoil, Thiruchendur, Tamil Nadu Sri Prasanna Venkateswara Swamy Temple, Secunderabad Arulmigu Sundara Vardaraja Perumal Koil,

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 3160 SO 3353 SO 3354 SO 3355 SO 4173 SO 4174 SO 4175 SO 628

7-7-1982 2-8-1982 2-8-1982 2-8-1982 21-9-1982 22-9-1982 22-9-1982 29-9-1982

SO 629 SO 240 SO 241

30-9-1982 17-11-1982 17-11-1982

SO 630 SO 631 SO 3049 SO 3050 SO 3051

17-11-1982 17-11-1982 22-3-1983 22-4-1983 22-4-1983

SO 3125 SO 3126 SO 2731

4-5-1983 4-5-1983 28-5-1983

24/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Madras Shree Dholi Satiji Mandir, Fatehpur, Rajasthan Sri Ambikapatheeswarar Temple, Kil Ambi Village, Kancheepuram, Tamilnadu Shri Kothanda Ramaswami Sri Anjaneya Swami Temple, Ammapet, Thanjavur Distt., Tamilnadu Sri Krishnaswamy Temple, Ravipuram, Cochin Sri Arulmigu Marghabandu Swamy Temple, Virinjipuram, North Arcot District, Tamil Nadu Shree Dhandhan Sati Dadiji Temple, Dhandhan, Distt. Sikar, Rajasthan Shri Charbhujanath Temple, Metracity, Distt. Nagpur, Rajasthan Shree Prasanna Veeranjaneya Swamy Temple, Bangalore Sri Kundeshuwara Temple, Kundapura, Karnataka Eravadi Sastha Temple, Eravadi Taluk, Tirunelveli Distt., Tamilnadu1 Shri Tiruvikramaswamy Devasthanam Temple, Tirukoilur, Tamilnadu Ilayathakudi Sri Kailasanathaswamy and Nithyakalyani Amman Temple, Karaikudi Sri Velukkai Azhagiya Singa Perumal Temple, Kancheepuram, Tamilnadu Shri Karumari Thripurasundari Temple, Madras Shri Vaishno Devi Ji situated in the Trikuta Hill in Jammu Shri Raghunath Ji Temple Complex, Jammu Shri Ranbireshwar Temple, Jammu Shri Amarnath Ji Shrine in Kashmir Shrine of Bhagwati Khirbhawani situated in village Tulamulla in Kashmir Shrine of Bhagwati Sharika near Hari Parbat

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t 25/ 34

SO 2732 SO 185 SO 4590

28-5-1983 19-9-1983 26-11-1983

SO 4591 SO 80 SO 409 SO 1553 SO 503 SO 801 SO 923 SO 924 SO 925 SO 926 SO 1037

26-11-1983 27-12-1983 11-1-1984 17-1-1984 23-1-1984 25-2-1984 3-3-1984 3-3-1984 3-3-1984 3-3-1984 8-3-1984

SO 1207

26-3-1984

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Fort, Srinagar Pattupurackal Bhagavathi Temple, Ernakulam Shri Venkateswara Swamy Devasthanam(Temple), Dwaraka Thirumala, West Godawari District, Andhra Pradesh Shri Ramachandramoorthy Swamy Temple, Thanjavur Arulmigu Katchaleeswarar Temple, Armenian Street, Madras Arulmigu Sundaraja Perumal Temple, Chingleput District Sri Pandava Duta Perumal Temple, Kancheepuram, Tamilnadu Sri Ulagalantha Perumal Temple, Kancheepuram, Tamilnadu Shri Triketeswara Swamy Devasthanam, Ketappa-konda Village, Narasaraepet Taluk, Guntur District Arulmigu Mariamman Temple, Udamalpet Subramanya Temple, Pariharapuram, Ramanatukara (Kerala) Arulmigu Rajagopalaswamy Temple, Mannargudi, Thanjavur Distt., Madras Arulmigu Thiagarajaswami Thirukkoyil Temple, Thiruvarur Sri Swayam Prakasa Eswarar Temple, Kattummannar Koil, Tamil Nadu Sri Sarangapani Swamy Temple, Kumbakonam, Tamil Nadu Sri Arulmigu Kumarakottam Subramaniaswamy Koil Rajagopuram Nirmana, Kancheepuram Arulmigu Arasaleaswarar Temple, Ozundiappattu, Vanur Taluk (Tamil Nadu) Shri Mahishamardini Temple, Neelaver Karnataka) Arulmigu Ilanji Kumarar Temple, Ilanji, Tenkasi Taluk

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 1557 SO 2089

11-4-1984 30-5-1984

5863 5886 5887 5888 5889 5890

12-6-1984 28-6-1984 28-6-1984 28-6-1984 28-6-1984 28-6-1984

SO 3410 5977 SO 3835 SO 147 SO 1202 SO 1209 SO 1478

11-9-1984 13-9-1984 24-9-1984 16-11-1984 2-1-1985 22-2-1985 26-2-1985

SO 3080 SO 3167 SO 3168

18-4-1985 1-5-1985 7-5-1985

26/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Arulmigu Sankarameshwarar and Bagampriyal Temple, Tuticorin Arulmigu Karaneeswarar Temple, No. 16, Karaneeswarar Koil Street, Mylapore, Madras Arulmigu Sengalamman Trirukkoil, Sembulivaram, Solavaram Sri Raja Rajeshwara Temple, Taliparamaba Shri Mullavananatha Swami Temple, Tirukarugavur, Papanasam Taluk, Thanjavur Distt. Sri Virupakasha Vidyaranya Mutt Samasthanam, Hospet Shri Dharmalingesawarar Temple, Sarvamangala Nagar, Madras Sri Sokkanathaswamy Temple, Dharapuram, Tamil Nadu (Madras) Sri Athmanathasamy Temple at Thirupperunthurai, Tamil Nadu Sri Valleeswarar Temple/Devasthanam at Mylapore, Madras Arulmigu Madhorupagan Iraipani Mandram, Tamil Nadu Sri Mahisha Mardini Temple St. Marys Church, Madras Shri Arulmigu Mariamman Temple, Karuvalur, Coimbatore Shri Chakrapaniswami Temple, Kumbakonam Late Ervad D.B. Mehtas Zoroastrian Anjuman Atash Adaran Arulmigu Mariamman Vinayagar Temple at Sulakkal, Coimbatore Sri Giriraja Kannigalambal Sametha Srijalanatheswara, Alayam Arulmigu Sundareswara Swamy Temple Valamarkottai, Thanjavur Sree Lakshmi Narasimha Navaneetha Krishna

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 3970 SO 4817

16-7-1985 26-7-1985

6347 SO 4675 SO 4754

31-7-1985 22-8-1985 9-9-1985

SO 5507 SO 5508 SO 961 SO 1543 SO 1542 6640 SO 1958 SO 1959 SO 2398 SO 3163 3164 SO 3591 SO 3638 SO 3639 SO 3594

30-10-1985 6-11-1985 6-2-1986 3-3-1986 3-3-1986 4-4-1986 4-4-1986 4-4-1986 8-5-1986 27-5-1986 28-5-1986 1-8-1986 1-8-1986 1-8-1986 4-8-1986

27/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Temple at Nanganallur, Madras Palayam Sri Maha Ganapathy Temple, Palayam, Trivandrum Sri Suryanarayana Devasthana Maroli, Mangalore Arulmigu Subramaniaswamy Temple, Kumaravayalur, Trichy Distt. Sri Audikesava Perumal Peyalwar Temple, Mylapore, Madras Sree Iringanners Maha Siva Kshetram, Calicut Thrikkakara Kshetra Kshema Samithi, Cochin Temple of Bhagwan Parshwanath, Bhadrawati (Distt. Chandrapur), Maharashtra Mujungavu Sree Parthasarati Krishna Deva Temple, Kasaragod District (Kerala) Sri Ramaswamy Temple, Thiruvangad, Tellicherry (Kerala) Sri Kasi Viswanathar Temple and Sri Alagirtinathar Temple, Salem District (Tamil Nadu) Wadia Fire Temple (Wadiaji Atash Behram), Bombay St. Patricks Cathedral, Pune Arulmigu Sri Srinivasa Perumal Tirukoil, Nachiarkoil, Tanjore District Sri Mahaganapathy Temple, Chathapuram, Palghat Arulmigu Mundagakkanni Amman Temple, Mylapore, Madras Arulmigu Subramania Swamy, Tirukkoil, Tirupparankundram Arulmigu Madarjuneswaraswamy Temple, Pettaivaithalai Kanipura Sri Gopalakrishna Temple, Kumbla Chakkamkulangara Siva Temple, Tripunithura Shri Venugopala Devaswom Temple,

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 3595 SO 3598 SO 3599 SO 100 6974 SO 517 SO 739 SO 740 SO 1113 SO 1114

4-8-1986 14-8-1986 14-8-1986 15-10-1986 20-10-1986 30-12-1986 12-1-1987 20-1-1987 26-2-1987 26-2-1987

SO 1115 SO 2174 SO 1977 SO 1978 SO 2585 SO 2473 SO 2636 7481 SO 2822 SO 3461

23-3-1987 31-3-1987 19-5-1987 19-5-1987 3-8-1987 4-8-1987 10-8-1987 18-8-1987 27-8-1987 17-9-1987

28/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Purakkad Shri Thotadrinather Deivanayaga Perumal Temple, Nanguneri Arulmigu Jagannatha Perumal and Thirumazhisai Alwar Temple, Thirumazhisai, Tamil Nadu Sri Subrahmanya Swamy Temple, Ulsoor, Bangalore Arulmigu Pranava Vyarapureeswarar Thirukoil, Omampuliyur, Kattumannarkoil Taluk Arulmigu Thillai Amman Koil, Chidambaram Sri Laxminarsimha Swamy Temple Arulmigu Pathanjaleeswarar Devasthanam, Kalnattam Puliyur, Kattumannarkoil Taluk, South Arcot Distt. Sri Souriraja Perumal Temple, Thirukkannapuram, Nannilam Taluk, Tanjore Distt. Arulmigu Kolanjiappar Thirukoil, Vridhachalam Sri Swetharanyeswaraswamy Temple, Thiruvengadu, Tanjavur District Arulmigu Balasubramaniaswamy Temple Pugazhimalai Velayudham Palayam, Trichy District Sitaramji Temple, Varadaraj Temple, Hanuman Temple and Mahadev Temple, Hyderabad and Shri Ranganath Temple, Pushkar (AP) Arulmigu Sri Varasidhi Vinayagar Koil, Nungambakkkm, Madras Sri Dhenupureeswarar Temple, Patteeswaram Trikkangode Sri Randumoorthy Temple Sri Kamakala Kameswarar Devasthanam Triplicane, Madras SO 2219 9-5-1988 SO 2958 SO 7877 18-9-1987 25-4-1988

SO 2507

9-5-1988

SO 2508

9-5-1988

SO 2509 SO 2510 SO 2511

9-5-1988 9-5-1988 9-5-1988

SO 2512 SO 2220 7994

10-5-1988 11-5-1988 2-6-1988

SO 2221

2-6-1988

SO 2222 SO 2750 SO 2749 SO 2754

2-6-1988 19-7-1988 19-7-1988 22-8-1988

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

29/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Arulmigu Swarna Pureeswarar Swamy Temple, Sembanar Koil, Tamil Nadu Sri Kumaraswamy Temple, Hanmunthanagar, Bangalore Shree Santari Bhagwati Devasthan, Aldona Bardex, Goa Thalayakkulam Sree Durga Keshtra Temple, Kuzhur, Kerala Arulthiru Devi Karumari Amman Thirukkoil Thiruverkadu, Madras Jal Phiroj Clubwala Dar-E-Mehar (Fire Temple), Madras Sri Saptharishiswara Swamy Temple, Thiruthalaiyur (Tamil Nadu) Sri Kari Varadaraja Perumal Temple, Madras Arulmigu Balasubramanyaswamy Devasthanam, Uttiramerur, Tamil Nadu Arulmigu Vedagireeswarar Temple, Thirukkalukundram, Tamil Nadu Arulmigu Manakula Vinayager Thirukoil (Temple), Pondicherry Arulmigu Veerateswarar Temple, Keelaiyur, Tamilnadu (i) Sri Amirthakadeswaraswamy Devasthanam (ii) Sri Sattanathaswamy Devasthanam and (iii) Sri Velur Devasthanam Sri Navansetheswaraswamy Temple, Sikkal, Tamil Nadu Sri Parimala Renganathar Temple, Thiruvindalour, Mayiladurthurai, Tamil Nadu Kothandaramaswamy Temple, Madurantakam, Tamil Nadu 1Shree Sowmyanarayana Perumal Temple, Thirukoshtiyur, Tamil Nadu Sri Magara Nedunkuzhaikathar Temple, Tamil Nadu

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

8096 SO 3579 SO 5 SO 566 SO 517 SO 8427 SO 8447

5-9-1988 17-10-1988 15-11-1988 5-1-1989 9-1-1989 8-8-1989 6-9-1989

SO 1329 SO 1330 8633 SO 2524 SO 2525

20-3-1990 30-3-1990 12-4-1990 30-7-1990 31-7-1990

SO 402 SO948 SO 1345 SO 2554 SO 2553 SO 3136

29-12-1990 25-2-1991 18-4-1991 3-9-1991 3-9-1991 19-11-1991

30/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Arulmigu Narambunathaswamy Temple, Thiruppu daimarudur, Tamil Nadu Arulmigu Viruthagiriswarar emple, Vriddhachalam,Tamil Nadu Arulmigu NadiammanTemple, Pattukottai,Thanjavar, Tamil Nadu Sri PrasannaVenkatachalapathy Temple,Gunaseelam, Musire Taluk,Trichy District, Tamil Nadu Sri VenkatachalapathyTemple, Cheranmaha Devi,Tamil Nadu Arulmigu Adulya Nadeswarar Temple, Arakanda allur, Thirukoilur, Tamil adu Ananthapuram Sree Krishna Swamy Temple, Kerala Shree Tulsibag Temple, Pune Arulmigu Ramanathaswamy Temple, Rameswaram, Tamil Nadu Arulmigu Kallalagar Thirukkoil, Alagarkoil, Madurai District, Tamil Nadu Fire Temple of Sardar Sorabji Ratanji Patels Trust Fund, Pune Zarthoshti Anjuman Atash Beheram Fund, Bombay Sri Sarangapani Swami Temple, Kumbakonam, Tamil Nadu Sri Veera Bhadra Swami and Durga Papanaseswara Swamy Temple, Lepakshi, Anantapur Sri Ranganatha Perumal Temple, Thiruneermalai, Madras Thali Mahavishnu Temple, Azhinhilam, Malappuram Distt., Kerala Sri Venkateswara Mandir Society, New Delhi Sri Thirunarayana Swamy Temple, Malkote, Bangalore Sri Raghavendra Swamy Mutt, Mantralayam Kancheepuram Gandhi Road Cloth Merchants Chatra Dharma Pasipalana Mahamai Sanga Sri Prasanna Venkatachalapathy Temple, Tamil Nadu Shri Omkareshwar Temple Trust, Mandhata,

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

SO 1202 SO 1059 SO 1296 SO 1886

26-2-1992 4-3-1992 26-3-1992 27-5-1992

SO2727 SO2785 SO10

14-9-1992 21-9-1992 30-11-1992

SO738 SO916 SO 1469(E) SO 1470(E) SO1804(E) SO7 SO2660

17-3-1993 18-3-1993 17-5-1993 1-6-1993 9-7-1993 4-11-1993 11-11-1993

SO 770 SO 941 9545 SO 171 SO 1467 SO 1468 SO1469 SO1734

9-12-1993 9-3-1994 18-5-1994 11-1-1995 29-1-1996 20-2-1996 3-4-1996 23-5-1996

31/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Madhya Pradesh Ariyakudi Ilbiranlngadamudayan Temple 10382 Managed by Ariyakudi Perumal Trust, [F.No. 176/27/97-IT(A-I)] Ariyakudi, Tamil Nadu Sri Vedapureeswarer Temple and for SO 1876 Varadarajaperumal Temple, Pondicherry Sri Sundaravaradaraja Perumal Temple, Tamil SO 2578 Nadu Arulmigu Thiruvaleeswarar Temple Madras SO 228 Sir Jonsetjee Tejeebhoy First Baaronets 10575 Poona Fire Temple Fund, Bombay [F.No. 176/16/95-IT(A-I)] Arulmigu Thatheeswarar Thirukoil 10729 [F.No. 176/18/98-IT(A-I)] Adhanoor Sri Ranganathaswamy Temple SO 412 Adhanoor, Thanjavur Distt. Tamil Nadu Sri Nandaneshwara Temple, Karnataka SO 589 Thunavoor Mahak Shethram, Thuravoor, SO 1822 Kerala Arulmigu Atcheeswarar Temple, Kanchipuram, 11044 Tamil Nadu [F. No. 176/12/99-IT (AI)] Sri Ranganathaswamy Temple, Triuchirapalli 11098 [F. No. 176/22/99-IT (AI)] SO 1680 SO 195 SO 737 SO777 SO 1488

9-7-1997

24-7-1997 3-10-1997 20-1-1998 6-4-1998 22-10-1998 14-1-1999 18-2-1999 9-6-1999 24-8-1999

4-10-1999

Arulmigu Sree Subramanya Swamy Temple, Thirupparankundram, Madurai Shri Mahakaleshwar Mandir Samity, Ujjain Radhakrishna Mandir, Calcutta Ganeshji Mandir, Delhi Arulmigu Nellaippar and Arultharum Khanthimathi Ambal Thirukovil Temple, Tamil Nadu *Sri Sarbamangala Trust, Board Burdwan Ernakulam Kshetra Ksherma Ernakulam, Kerala Sri Sri Auniaty Satra Majuli, Assam Samithi,

4-10-1999 12-1-2000 22-3-2000 28-3-2000 27-6-2000

SO 2021 SO1002 324/2001 [F. No. 176/15/2001-IT (A-I)] 96/2003 [F.No. 176/27/2003-IT (A-I) 212/2003 [F.No. 176/24/2001-IT (A-I)

7-9-2000 11-5-2001 17-10-2001

Sri Sri Sarbamangala Trust Board, Burdwan

30-4-2003

Vanamamalai Mutt Nanguneri, Tamil Nadu

4-9-2003

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

32/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Sri Devarajaswamy Temple, Kancheepuram, 93/2004 Tamil Nadu [F.No. 176/23/2001-IT(AI)] Attukal Bhagavathy Temple Trust, P.B. No. 205/2004 5805, Attukal, Thiruvanathapuram [F.No. 176/07/2004-IT (A-I)] 544. Notified games and sports under section 80G, Explanation 4

11-3-2004

29-7-2004

In exercise of the powers conferred by Explanation 4 to section 80G of the Income-tax Act, 1961 (43 of 1961), the Central Govern hereby specifies the following games and sports for the purposes of the said ment section in respect of the assessment year 2003-04 and subsequent assessment years, namely : (i) Cricket (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) (x) (xi) (xii) (xiii) (xiv) (xv) (xvi) (xvii) (xviii) (xix) (xx) (xxi) (xxii) (xxiii) (xxiv) (xxv) Hockey Football Tennis Golf Rifle Shooting Table Tennis Polo Badminton Swimming Athletics Volley ball Badminton Wrestling Basket ball Kabaddi Weight lifting Gymnastics Boxing Squash Chess Bridge Billiards Cycling Yatching

Notification : No. SO 1246(E), dated 29-11-2002.

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

33/ 34

10/ 18/ 12

D R T TAXES C R U I EC I C LAR - Sec. 80G

Submission of certificate for claiming deductions under section 80G of the Incometax Act, 1961 in respect of donation made by an employee to the Prime Ministers National Relief Fund, the Chief Ministers Relief Fund and the Lieutenant Governors Relief Fund

Circular No. 2/2005, dated 12-1-2005 In cases where employees make donations to the Prime Ministers National Relief Fund, the Chief Ministers Relief Fund or the Lieutenant Governors Relief Fund through their respective employers, it is not possible for such funds to issue separate certificate to every such employee in respect of donations made to such funds as contributions made to these funds are in the form of a consolidated cheque. An employee who makes donations towards these funds is eligible to claim deduction under section 80G of the Income-tax Act, 1961. It is, hereby, clarified that the claim in respect of such donations as indicated above will be admissible under section 80G of the Income-tax Act, 1961 on the basis of the certificate issued by the Drawing and Disbursing Officer (DDO)/ Employer in this behalf. PRESS NOTE, DATED 12-1-2005 As per Circular No. 2/2005, dated 12th January, 2005, issued by the Central Board of Direct Taxes, it has been clarified that in cases where employees make donations to the Prime Ministers National Relief Fund, the Chief Ministers Relief Fund or the Lieutenant Governors Relief Fund through their respective employers, the claim in respect of such donations will also be admissible under section 80G of the Income-tax Act, 1961 on the basis of the certificate issued by the Drawing and Disbursing Officer (DDO)/Employer in this behalf.

a .n l w i com et axi di . gov. i / D Taxm ann/ i com et axact s/ 2007i act / sec_080g. ht m n a n i t n t

34/ 34

You might also like

- SLS (Speach Level Singing) Manual Interim 2012Document28 pagesSLS (Speach Level Singing) Manual Interim 2012Francois Olivier100% (1)

- Construction Insurance and GuaranteesDocument20 pagesConstruction Insurance and GuaranteesEngineeri TadiyosNo ratings yet

- Cursive Alphabet Flashcards PDFDocument10 pagesCursive Alphabet Flashcards PDFmartageane84767No ratings yet

- CFA - Investment Foundations PDFDocument255 pagesCFA - Investment Foundations PDFFelipe100% (1)

- Faq E-Invoice EnglishDocument57 pagesFaq E-Invoice English9155 Ashwini MetkariNo ratings yet

- Income Not Part of Total Income Full NotesDocument93 pagesIncome Not Part of Total Income Full NotesCA Rishabh DaiyaNo ratings yet

- Grepalife Vs JudicoDocument2 pagesGrepalife Vs Judicojdg jdgNo ratings yet

- National Life Insurance Company and Subsidiaries v. Commissioner of Internal Revenue, 103 F.3d 5, 2d Cir. (1996)Document7 pagesNational Life Insurance Company and Subsidiaries v. Commissioner of Internal Revenue, 103 F.3d 5, 2d Cir. (1996)Scribd Government DocsNo ratings yet

- 19769ipcc It Vol1 Cp7Document60 pages19769ipcc It Vol1 Cp7Joseph SalidoNo ratings yet

- Tax Alert - Delivering ClarityDocument4 pagesTax Alert - Delivering ClarityTanuj AgrawalNo ratings yet

- Income Tax ActDocument4 pagesIncome Tax ActgoborgonesNo ratings yet

- Critical Analysis Amp Issues in Tax Audit Report Amp OI ScheduleDocument6 pagesCritical Analysis Amp Issues in Tax Audit Report Amp OI ScheduleSubrat MohapatraNo ratings yet

- Judgement: Liberty Indiaappellant Commissioner of Income TaxrespondentsDocument7 pagesJudgement: Liberty Indiaappellant Commissioner of Income TaxrespondentsraaziqNo ratings yet

- Deductions From Gross Total Income: HapterDocument20 pagesDeductions From Gross Total Income: HapterJAWED MOHAMMADNo ratings yet

- National Law University Odisha, Cuttack: Direct TaxationDocument17 pagesNational Law University Odisha, Cuttack: Direct Taxationparul priya nayakNo ratings yet

- 16 Deductions Under Chapter ViaDocument89 pages16 Deductions Under Chapter ViabinoygnairNo ratings yet

- 18609cp7 PCC Compsuggans TaxationDocument6 pages18609cp7 PCC Compsuggans TaxationDeepal DhamejaNo ratings yet

- IT Deductions Allowed Under Chapter VI-A Sec 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB Etc - APTEACHERS WebsiteDocument13 pagesIT Deductions Allowed Under Chapter VI-A Sec 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB Etc - APTEACHERS WebsiteKIMS IECNo ratings yet

- 83 ITR 362 106 ITR 119: EditorDocument3 pages83 ITR 362 106 ITR 119: EditorKunwarbir Singh lohatNo ratings yet

- Circular No 70 - NewDocument3 pagesCircular No 70 - NewHr legaladviserNo ratings yet

- Major Changes to Income Tax and Wealth Tax in Budget 2009-2010Document9 pagesMajor Changes to Income Tax and Wealth Tax in Budget 2009-2010Irfan AhmadNo ratings yet

- Article On Approved Gratuity FundDocument7 pagesArticle On Approved Gratuity Fundzubin galaNo ratings yet

- Section 44ADDocument26 pagesSection 44ADDarshan BhalaniNo ratings yet

- Part I: Statutory Update: © The Institute of Chartered Accountants of IndiaDocument41 pagesPart I: Statutory Update: © The Institute of Chartered Accountants of IndiaApeksha ChilwalNo ratings yet

- L-24, DeductionsDocument22 pagesL-24, DeductionsSonu yadavNo ratings yet

- CSDocument26 pagesCSAnjuElsaNo ratings yet

- General Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UDocument67 pagesGeneral Deductions (Under Section 80) : Basic Rules Governing Deductions Under Sections 80C To 80UVENKATESAN DNo ratings yet

- Chapter 2Document9 pagesChapter 2Paym entNo ratings yet

- 51198bos40905 cp4 PDFDocument41 pages51198bos40905 cp4 PDFShubham VyasNo ratings yet

- Know About Changes Introduced in The New ITR-6 Released For Assessment Year 2024-25Document5 pagesKnow About Changes Introduced in The New ITR-6 Released For Assessment Year 2024-25Suman AgarwalNo ratings yet

- Assessment of Companies Coverage and TaxationDocument40 pagesAssessment of Companies Coverage and TaxationMayur RathodNo ratings yet

- Compania General, CTA 4451 August 23, 1993Document10 pagesCompania General, CTA 4451 August 23, 1993codearcher27No ratings yet

- 44ad 2019Document2 pages44ad 2019dipak300pawarNo ratings yet

- Taxation Assignment Budget Proposal 2020Document20 pagesTaxation Assignment Budget Proposal 2020Shivani DuttNo ratings yet

- Commissioner of Income-Tax Vs Vishnu Oil and Dal MillsDocument2 pagesCommissioner of Income-Tax Vs Vishnu Oil and Dal MillsAkanksha BohraNo ratings yet

- Direct Taxes Semester 3 Roll No: 19P0310307: Filing Your Income Tax ReturnDocument5 pagesDirect Taxes Semester 3 Roll No: 19P0310307: Filing Your Income Tax ReturnPriya KudnekarNo ratings yet

- CIT v. HCL Technologies Limited (2018) 404 ITR 719 (SC) : Judicial UpdateDocument17 pagesCIT v. HCL Technologies Limited (2018) 404 ITR 719 (SC) : Judicial UpdateHemanthNo ratings yet

- East African Taxation Law Imposition SummaryDocument14 pagesEast African Taxation Law Imposition SummaryEDWARD BIRYETEGANo ratings yet

- Draft File (Shafin)Document11 pagesDraft File (Shafin)MD Shafin AhmedNo ratings yet

- Amendments FA 2018 Dec2019 PDFDocument14 pagesAmendments FA 2018 Dec2019 PDFYash GargNo ratings yet

- 56212rtpfinaloldnov19 p7Document52 pages56212rtpfinaloldnov19 p7naveen kumarNo ratings yet

- Master of Business Administration - MBA Semester 3 Subject Code - MF0012 Subject Name - Taxation Management 4 Credits (Book ID: B1210) Assignment Set-1 (60 Marks)Document10 pagesMaster of Business Administration - MBA Semester 3 Subject Code - MF0012 Subject Name - Taxation Management 4 Credits (Book ID: B1210) Assignment Set-1 (60 Marks)balakalasNo ratings yet

- DT PDFDocument8 pagesDT PDFKanha KarwaNo ratings yet

- Lecture Notes - Study Module 7 - DeductionsDocument39 pagesLecture Notes - Study Module 7 - Deductionsdata.mvgNo ratings yet

- 31170sm DTL Finalnew-May-Nov14 Cp10Document16 pages31170sm DTL Finalnew-May-Nov14 Cp10gvcNo ratings yet

- Minimum Alternate Tax (MAT) - Section 115JB - Income Tax Act 1961 - Taxguru - inDocument6 pagesMinimum Alternate Tax (MAT) - Section 115JB - Income Tax Act 1961 - Taxguru - inRohit SinghNo ratings yet

- US Internal Revenue Service: 16726503Document29 pagesUS Internal Revenue Service: 16726503IRSNo ratings yet

- Corporate TaxationDocument6 pagesCorporate TaxationSachin NairNo ratings yet

- Set of or Carry-11Document11 pagesSet of or Carry-11s4sahithNo ratings yet

- 34564rtp Nov14 Ipcc-4Document59 pages34564rtp Nov14 Ipcc-4Deepal DhamejaNo ratings yet

- SET 23 24 Detail Guide EDocument20 pagesSET 23 24 Detail Guide ENishan MahanamaNo ratings yet

- Deductions U/S 80C TO 80U: By: Sumit BediDocument69 pagesDeductions U/S 80C TO 80U: By: Sumit BediKittu NemaniNo ratings yet

- Highlights For August 2020: Supreme Court DecisionDocument6 pagesHighlights For August 2020: Supreme Court DecisionshakiraNo ratings yet

- Shri Vedavyas Co Operative Credit Society LTD Vs Income Tax Officer 6aeaa3c543bd92250fef9d363c6aa9 DocumentDocument8 pagesShri Vedavyas Co Operative Credit Society LTD Vs Income Tax Officer 6aeaa3c543bd92250fef9d363c6aa9 Documentbharath289No ratings yet

- 06 A Idt Ammentments 2 in 1Document33 pages06 A Idt Ammentments 2 in 1Venkat RamanaNo ratings yet

- Blog Details Declaration and Payment of Dividend 20Document9 pagesBlog Details Declaration and Payment of Dividend 20Abhinay KumarNo ratings yet

- Asses MentDocument4 pagesAsses MentEngr. Md. Ishtiak HossainNo ratings yet

- Direct Tax-Chit FundDocument27 pagesDirect Tax-Chit FundAbirami VasudevanNo ratings yet

- G.R. No. 108067, January 20, 2000Document8 pagesG.R. No. 108067, January 20, 2000AlexisNo ratings yet

- Question and Answers Ques. No.1) Write Notes On: A.) Taxability of Deep Discount Bond - A Recent Move of The Central Board ofDocument6 pagesQuestion and Answers Ques. No.1) Write Notes On: A.) Taxability of Deep Discount Bond - A Recent Move of The Central Board ofAnamika VatsaNo ratings yet

- Presumptive - Taxation BriefDocument8 pagesPresumptive - Taxation BriefStephan KJNo ratings yet

- 80TTB - Provides Deduction Benefit On Interest Income For Senior CitizensDocument1 page80TTB - Provides Deduction Benefit On Interest Income For Senior CitizensArjun VermaNo ratings yet

- Circular No.59Document6 pagesCircular No.59Hr legaladviserNo ratings yet