Professional Documents

Culture Documents

GovCuomo Letter 12-21-2012

Uploaded by

liz_benjamin6490Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GovCuomo Letter 12-21-2012

Uploaded by

liz_benjamin6490Copyright:

Available Formats

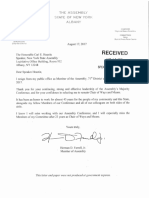

December 21, 2012 The Honorable Andrew M.

Cuomo Governor of New York State NYS State Capitol Building Albany, NY 12224 Dear Governor Cuomo, The people of New York are working to recover from the devastation left in Hurricane Sandy's wake. But as you know, much remains to be done. While some tragic losses can't be mended, we can - and should - do our best to rebuild, to limit the suffering inflicted and the displacement endured, and to do our best to prevent such destruction from natural disasters in the future. In that spirit, I am sure that citizens of New York who faced untold damages on the morning of October 30, were happy to see their Governor fighting for federal disaster relief. In the many weeks since Hurricane Sandy made landfall, you have been in Washington, D.C. lobbying the White House and members of Congress to provide disaster relief assistance for your state. Unfortunately, with this Congress nothing is guaranteed - despite the fact that natural disasters know no political affiliation. The Senate's $60.4 billion Hurricane Sandy relief bill slogs along at an excruciatingly slow pace. For many New Yorkers, the longer they wait to receive those funds, the more their pain is prolonged. You seem to understand this and have been increasing the pressure on Congress to act having been quoted recently saying that "There is no Plan B. Plan B is to go back to Plan A." However, it is curious for you to say this considering that New York does in fact have a Plan B for disaster relief: stop refunding the New York State stock transfer tax. With each purchase of stock, New York collects a tiny tax - pennies per share. New York State then instantly rebates 100% of the tax back to Wall Street. Each year, because of this arcane process, New York loses out on $16 billion of revenue. In the vacuum left by Congress, tapping this could be a significant stopgap measure to help New Yorkers begin to recover - and to recover now: A source of funds. And the ongoing revenue from a stock transfer tax could be used to start the process of establishing storm surge barriers, bulkheads, levees, dikes, and beach strengthening with sand dunes to limit the impact of future hurricanes. I hope you will consider this proposal more seriously this time. New York can't wait. Sincerely,

Ralph Nader P.O. Box 19367 Washington, D.C. 20036 202-387-8030 info@csrl.org

Governor-Elect Andrew Cuomo Church Street Station P.O. Box 683 New York, NY 10008 December 30,2010 Dear Governor-Elect Cuomo: The conditions where many regular New Yorkers live are grim. Poverty, unemployment, home foreclosures, and small business bankruptcies keep growing. On the other side of the tracks, the top twenty-five hedge fund managers recorded an average of $1 billion each, or over $80 million each a month in 2009. Quite a quick rebound on the backs of American taxpayers and privileged tax policies. Low-moderate and middle-income New Yorkers already pay a higher percentage of family income in state and local taxes than do the richest one percent of New Yorkers! The Fiscal Policy Institute wrote in April: "Essential services like fire departments and schools, recession-buffering social safety net programs like homeless prevention and senior services, and critical infrastructure systems like hospitals, roads and mass transit all face severe cutbacks. Surprisingly, there is a simple way to eliminate the $10 billion state deficit and prevent tens of thousands of layoffs and large service cutbacks. What most New Yorkers do not know is that for about a century there has been a tiny state stock transfer tax on purchases of securities. Last year, this tax, similar to ones imposed in 30 other countries, amounted to about $16 billion. Amazingly, since 1979, this tax has been instantly rebated by New York State back to the brokers or clearinghouses who paid it. A 100% rebate every year for the bailed out industry that caused the recession and its immense human damage. Today and everyday New Yorkers pay a 7 or 8 percent sales tax on necessities that they buy in stores. Big buyers of derivatives, for example, pay no sales tax. That is not fair. Obviously the stock exchanges and their brokers wield big political power. Flush with arrogance, bailouts and profits, they have no shame. Mr. Cuomo, think of the deprivation, suffering and unemployment you can prevent by simply keeping the stock transfer tax that the state collects as it did sixty years ago. Sincerely Yours,

Ralph Nader P.O. Box 19312 Washington, DC 20036

You might also like

- Gov Cuomo Approves Prosecutorial Misconduct Commission Bill....Document1 pageGov Cuomo Approves Prosecutorial Misconduct Commission Bill....liz_benjamin6490No ratings yet

- IDC Leader Jeff Klein Legal Memo Re: Sexual Harassment Allegation.Document3 pagesIDC Leader Jeff Klein Legal Memo Re: Sexual Harassment Allegation.liz_benjamin6490No ratings yet

- Court Ruling On Legislative Compensation Commission.Document19 pagesCourt Ruling On Legislative Compensation Commission.liz_benjamin6490No ratings yet

- John Cahill's New Job.Document1 pageJohn Cahill's New Job.liz_benjamin6490No ratings yet

- Mailer For Democratic 37th SD Candidate Shelley MayerDocument2 pagesMailer For Democratic 37th SD Candidate Shelley Mayerliz_benjamin6490No ratings yet

- U.S. v. Kevin Schuler Plea AgreementDocument5 pagesU.S. v. Kevin Schuler Plea Agreementliz_benjamin6490No ratings yet

- 2019StateoftheStateBook 2Document356 pages2019StateoftheStateBook 2liz_benjamin6490No ratings yet

- 340 Local Elected Officials Write in Support of Fusion Voting in NYDocument10 pages340 Local Elected Officials Write in Support of Fusion Voting in NYliz_benjamin6490No ratings yet

- 62 - Opinion 2.4.19, Grant Hoyt MTDDocument24 pages62 - Opinion 2.4.19, Grant Hoyt MTDliz_benjamin6490No ratings yet

- Onondaga Co Comptroller Bob Antonacci To Run For State SenateDocument2 pagesOnondaga Co Comptroller Bob Antonacci To Run For State Senateliz_benjamin6490No ratings yet

- U.S. v. Christopher Collins Et Al Indictment 18 CR 567Document30 pagesU.S. v. Christopher Collins Et Al Indictment 18 CR 567WGRZ-TVNo ratings yet

- GOP 37th SD Candidate Samard Khojasteh Letter To Committee Members.Document2 pagesGOP 37th SD Candidate Samard Khojasteh Letter To Committee Members.liz_benjamin6490No ratings yet

- 2019StateoftheStateBook 2Document356 pages2019StateoftheStateBook 2liz_benjamin6490No ratings yet

- Sen. Brad Hoylman Asks Gov. Andrew Cuomo To Veto Hymn Bill.Document3 pagesSen. Brad Hoylman Asks Gov. Andrew Cuomo To Veto Hymn Bill.liz_benjamin6490No ratings yet

- Letter 5-9-18Document2 pagesLetter 5-9-18Nick ReismanNo ratings yet

- NYC DSS Letter To Broome Co.Document4 pagesNYC DSS Letter To Broome Co.liz_benjamin6490No ratings yet

- NY - Nassau County Survey Polling Memorandum 10-27-2017-2Document3 pagesNY - Nassau County Survey Polling Memorandum 10-27-2017-2liz_benjamin6490No ratings yet

- IDC Leader Jeff Klein Requests JCOPE Investigation Into Forcible Kissing Claim.Document1 pageIDC Leader Jeff Klein Requests JCOPE Investigation Into Forcible Kissing Claim.liz_benjamin6490No ratings yet

- Martins Backer Calls For B of E Probe of Curran Campaign.Document1 pageMartins Backer Calls For B of E Probe of Curran Campaign.liz_benjamin6490No ratings yet

- Vetoes Issued by Gov. Andrew Cuomo, October 2017Document18 pagesVetoes Issued by Gov. Andrew Cuomo, October 2017liz_benjamin6490No ratings yet

- McLaughlin Responds To Assembly Action Against Him.Document2 pagesMcLaughlin Responds To Assembly Action Against Him.liz_benjamin6490No ratings yet

- Letter of Resignation From The Senate - Andrea Stewart CousinsDocument1 pageLetter of Resignation From The Senate - Andrea Stewart CousinsNick ReismanNo ratings yet

- Nassau County Tracking Memo F10.30.17Document1 pageNassau County Tracking Memo F10.30.17liz_benjamin6490No ratings yet

- Skelos Corruption Decision Overturned.Document12 pagesSkelos Corruption Decision Overturned.liz_benjamin6490No ratings yet

- Official Denny Farrell Resignation Letter.Document1 pageOfficial Denny Farrell Resignation Letter.liz_benjamin6490No ratings yet

- NYPIRG's 2017 Session Review.Document5 pagesNYPIRG's 2017 Session Review.liz_benjamin6490No ratings yet

- Albany Money Machine June 2017Document5 pagesAlbany Money Machine June 2017liz_benjamin6490No ratings yet

- Rauh vs. de Blasio DecisionDocument13 pagesRauh vs. de Blasio Decisionliz_benjamin6490No ratings yet

- Senate Dems Analysis of Lulus Paid To Non-Committee Chairs.Document5 pagesSenate Dems Analysis of Lulus Paid To Non-Committee Chairs.liz_benjamin6490No ratings yet

- March Fundraising Invite For Assemblyman Lavine's Nassau Co Exec RunDocument2 pagesMarch Fundraising Invite For Assemblyman Lavine's Nassau Co Exec Runliz_benjamin6490No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Budget 1980 81 EDocument30 pagesBudget 1980 81 EMonilal SNo ratings yet

- 1NC T-Substantial---1NC Interpretation---a “substantial increase” requires at least a 20% increase in funding or regulationDocument9 pages1NC T-Substantial---1NC Interpretation---a “substantial increase” requires at least a 20% increase in funding or regulationWilliam CheungNo ratings yet

- Analyzing the financial environment and cash management practices of Capital Development Authority (CDADocument11 pagesAnalyzing the financial environment and cash management practices of Capital Development Authority (CDAMuhammad ShabbirNo ratings yet

- Karthika.m.reji Finance Assignment.Document12 pagesKarthika.m.reji Finance Assignment.Rama NathanNo ratings yet

- A BrewpubDocument3 pagesA Brewpubjhanzab50% (4)

- Executive Summary: Municipality of Sta. MonicaDocument6 pagesExecutive Summary: Municipality of Sta. MonicaGenevieve TersolNo ratings yet

- Macroeconomic Theory and Policy for an Open EconomyDocument61 pagesMacroeconomic Theory and Policy for an Open EconomySayan MitraNo ratings yet

- The Promises and Pains in Procurement Reforms in The PhilippinesDocument59 pagesThe Promises and Pains in Procurement Reforms in The PhilippinesKatindig CarlNo ratings yet

- SITXFIN004 - Student Assessment v2.0Document15 pagesSITXFIN004 - Student Assessment v2.0Heloisa GalesiNo ratings yet

- Obligation RequestDocument8 pagesObligation RequestNoemi San AntonioNo ratings yet

- Revised Theorical Literature & Financial Literacy OnlyDocument14 pagesRevised Theorical Literature & Financial Literacy OnlyHara DoNo ratings yet

- Qizz 1,2,4Document60 pagesQizz 1,2,4Đào Duy TúNo ratings yet

- Dadole v. COADocument9 pagesDadole v. COAElaine Chesca0% (1)

- EVAT Law Explained - Philippines Tax Reform Act of 2005Document2 pagesEVAT Law Explained - Philippines Tax Reform Act of 2005peanut47100% (2)

- BC Liberal 2001 PlatformDocument12 pagesBC Liberal 2001 PlatformNRF_VancouverNo ratings yet

- Money MattersDocument11 pagesMoney MattersVinay RuttalaNo ratings yet

- EMA 756 Public Financial Management: Size of Government ImplicationsDocument24 pagesEMA 756 Public Financial Management: Size of Government ImplicationsShimi HanabeeNo ratings yet

- DCF N Non DCFDocument36 pagesDCF N Non DCFNikita PorwalNo ratings yet

- A Guide To Municipal Financial Management For CouncillorsDocument165 pagesA Guide To Municipal Financial Management For CouncillorslittleconspiratorNo ratings yet

- Full 2014 2015 PDFDocument282 pagesFull 2014 2015 PDFFarjana Hossain DharaNo ratings yet

- Financial AdministrationDocument322 pagesFinancial AdministrationAbhijit Jadhav91% (57)

- Barangay Annual Budget Checklist TemplateDocument4 pagesBarangay Annual Budget Checklist TemplateSaphire DonsolNo ratings yet

- Introduction to Government Accounting and the Philippine Budget ProcessDocument20 pagesIntroduction to Government Accounting and the Philippine Budget ProcessLaong laan100% (1)

- CV-Shiferaw Bejie EtichaDocument3 pagesCV-Shiferaw Bejie EtichaShiferaw BejieNo ratings yet

- Subsidy Vs Voucher in EducationDocument4 pagesSubsidy Vs Voucher in Educationikutmilis0% (1)

- Indirect CostsDocument2 pagesIndirect CostsAngie Fer.No ratings yet

- 2016.11.23 Responsive Records - Part 2Document190 pages2016.11.23 Responsive Records - Part 2DNAinfoNewYorkNo ratings yet

- Macro AssignmentDocument11 pagesMacro AssignmentLemi TayeNo ratings yet

- Mater's Dissertation, Nsonkwa Nehlie-Lois Asaba 2Document297 pagesMater's Dissertation, Nsonkwa Nehlie-Lois Asaba 2Nsonkwa AsabaNo ratings yet

- Investment Cashflow SensitivityDocument33 pagesInvestment Cashflow SensitivityBabar AdeebNo ratings yet