Professional Documents

Culture Documents

Louderback C6 TF&MC

Uploaded by

Inocencio TiburcioOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Louderback C6 TF&MC

Uploaded by

Inocencio TiburcioCopyright:

Available Formats

CHAPTER 6: OPERATIONAL AND FINANCIAL BUDGETING True-False F 1. A just-in-time manufacturer does NOT need a sales budget. T 2.

A flexible budget allowance is NOT especially useful for budgeting discret ionary costs. F 3. The purchases budget is prepared before the sales budget because the compa ny cannot estimate what it will sell until it has some idea of what will be on h and. F 4. The longer the time period covered by a budget, the more useful the budget will be for controlling operations. F 5. A purchases budget is normally prepared after the company has forecast how much cash it will have available to pay for purchases. F 6. Imposed budgets are exceptionally ambitious goals not likely to be achieve d without making fundamental changes in the way a job is done. F 7. A JIT manufacturer that maintains no inventory doesn't need a cash disburs ements budget. F 8. The budget for a retailer is likely to be more complex than that for a man ufacturer because a retailer has a wider variety of customers. F 9. The increasing public demand for accountability from governmental and othe r not-for-profit organizations has resulted in an increased use of incremental b udgeting. T 10. Line-by-line budget authorization is common in governmental units. Multiple Choice A 1. The starting point in preparing a comprehensive budget is a. the sales forecast. b. the cash budget. c. the budgeted income statement. d. the flexible expense budget. D 2. Budgets are related to which of the following management functions? a. Planning. b. Control. c. Performance evaluation. d. All of the above. D 3. Which of the following should be used to forecast sales? a. Regression analysis. b. The scatter diagram. c. The judgment of the most experienced managers. d. Whatever method produces the most accurate forecast. A 4. A critical factor for using indicator methods to forecast sales is a. the availability of a forecasted value for the indicator. b. an upward trend in the value of the indicator. c. governmental collection of data for computing and reporting the value o f the indicator.

d. the availability of an indicator that covers the entire country. D 5. Which of the following equations can be used to budget purchases? (BI = b eginning inventory, EI = ending inventory desired, CGS = budgeted cost of goods sold) a. Budgeted purchases = CGS + BI - EI b. Budgeted purchases = CGS + BI c. Budgeted purchases = CGS + EI + BI d. Budgeted purchases = CGS + EI - BI B 6. A flexible budget is a. one that can be changed whenever a manager so desires. b. adjusted to reflect expected costs at the actual level of activity. c. one that uses the formula total cost = cost per unit x units produced. d. the same as a continuous budget. B 7. The use of flexible (as opposed to static) budget allowances is LEAST impo rtant for which of the following? a. Costs of the production department. b. Costs of the general accounting department. c. Costs of the product shipping department. d. Costs of the material receiving department. D 8. Budgets set at very high levels of performance (i.e., very low costs) a. assist in planning the operations of the company. b. stimulate people to perform better than they ordinarily would. c. are helpful in evaluating the performance of managers. d. can lead to low levels of performance. C 9. Inventory policy is most critical in the budgeting of a. sales. b. cost of goods sold. c. purchases. d. expenses. A 10. Budgeting expenditures by purpose is called a. program budgeting. b. zero-based budgeting. c. line budgeting. d. flexible budgeting. C 11. Which of the following is a difference between a static budget and a flexi ble budget? a. A flexible budget includes only variable costs, a static budget include s only fixed costs. b. A flexible budget includes all costs, a static budget includes only fix ed costs. c. A flexible budget gives different allowances for different levels of ac tivity; a static budget does not. d. None of the above. A 12. A static budget is most appropriate for a department a. with only fixed costs. b. with only variable costs. c. with mostly mixed costs. d. with any of the above characteristics. D 13. Which of the following is NOT an advantage of budgeting? a. It requires managers to state their objectives. b. It facilitates control by permitting comparisons of budgeted and actual

results. c. It facilitates performance evaluation by permitting comparisons of budg eted and actual results. d. It provides a check-up device that allows managers to keep close tabs o n their subordinates. B 14. An a. b. c. d. imposed budget is the same as a static budget. can lead to poor performance. is best for planning purposes. eliminates the need for a sales forecast.

B 15. Prohibiting managers from overspending budget allowances a. improves company performance. b. can harm company performance. c. eliminates the need for comparisons of budgeted and actual amounts. d. usually reduces the need to prepare a cash budget. B 16. Which of the following will occur if X Co.'s actual sales in May are lower than its budgeted sales for that month? a. X won't have enough cash to cover bills requiring payment in May. b. X's actual inventory at the end of May will be higher than budgeted. c. X's actual purchases in June will be higher than budgeted. d. All of the above. C 17. JIT manufacturers are more likely than conventional manufacturers to a. use static budget allowances for manufacturing costs. b. prepare production budgets without a sales forecast. c. budget unit production equal to budgeted unit sales. d. experience budget variances. A 18. If cash receipts from customers are greater than sales, which of the follo wing is most likely to be true? a. The balance of accounts receivable will decrease. b. The company's outstanding debt will decrease. c. The company's cash balance will increase. d. The company will show a profit. C 19. A cash budget is NOT prepared until a company has a. obtained a commitment from its bank that cash will be available as need ed. b. prepared the pro forma balance sheet. c. prepared its purchases budget. d. determined that enough cash is available to meet dividend payments. A 20. Which of the following is LEAST likely to be affected if unit sales for th is month are lower than budgeted? a. Production for this month. b. Production for next month. c. Cash receipts for next month. d. Inventory at the end of this month. B 21. "Incremental budgeting" refers to a. line-by-line approval of expenditures. b. setting budget allowances based on prior year expenditures. c. requiring top management approval of increases in budgets. d. using incremental revenues and costs in budgeting. B 22. The principal DISADVANTAGE of line budgeting is a. it can only be used by not-for-profit entities. b. it limits the flexibility of managers to accomplish the entity's object

ives. c. it works only in conjunction with zero-based budgeting. d. none of the above. A 23. The cash receipts budget a. requires a sales forecast. b. requires a purchases or production budget. c. is prepared after the cash disbursements budget. d. has none of the above characteristics. C 24. The type of company most likely to run short of cash during the year is on e with a. little seasonality. b. high contribution margin percentage. c. high seasonality and rapid sales growth. d. relatively low fixed costs. D 25. If a. b. c. d. a company is earning a profit, its cash balance is increasing. its monthly cash disbursements will be stable. its inventory is increasing. it might have to borrow money.

A 26. One difference between budgeting in for-profit and not-for-profit entities is that not-for-profit entities usually a. budget expenses before revenues. b. don't need a cash budget. c. are less likely to use incremental budgeting. d. use computer software-packages to facilitate the budgeting process. D 27. To a. b. c. d. prepare its cash disbursements budget, a company uses information from its balance sheet at the end of the prior period. its purchases budget. its capital budget. all of the above sources.

B 28. Just-in-time manufacturers are more likely than conventional manufacturers to a. prepare production budgets without a sales forecast. b. budget materials purchases equal to the current month's needs for produ ction. c. budget unit production for the month at greater than budgeted unit sale s for the month. d. experience cash shortages. .

You might also like

- MAS 8 Short-Term Budgeting and Forecasting FOR UPLOADDocument10 pagesMAS 8 Short-Term Budgeting and Forecasting FOR UPLOADJD SolañaNo ratings yet

- CIS 335 Final Exam FallDocument5 pagesCIS 335 Final Exam FallLogisticDudeNo ratings yet

- Chap 4 OmDocument18 pagesChap 4 OmGetie Tiget0% (1)

- MIS Midterms QUIZ 2 (Key)Document26 pagesMIS Midterms QUIZ 2 (Key)Don Erick BonusNo ratings yet

- Ch4-Budgetary ControlDocument13 pagesCh4-Budgetary ControlBinish JavedNo ratings yet

- Internal Controls and Computer Based Information Systems (CBISDocument22 pagesInternal Controls and Computer Based Information Systems (CBISAbas NorfarinaNo ratings yet

- C. Update Valid Vendor File: Multiple-Choice Questions 1Document8 pagesC. Update Valid Vendor File: Multiple-Choice Questions 1DymeNo ratings yet

- Quiz 1 - AnswersDocument6 pagesQuiz 1 - Answersseanjustine100% (1)

- Chapter 20Document19 pagesChapter 20Leen AlnussayanNo ratings yet

- Process Strategy ChapterDocument15 pagesProcess Strategy ChapterDeN Z100% (2)

- Quiz Production CycleDocument2 pagesQuiz Production CycleAira Jaimee GonzalesNo ratings yet

- Chapter 1 Quiz ExampleDocument10 pagesChapter 1 Quiz ExampleVictor GarciaNo ratings yet

- Case Study 2 Coca ColaDocument2 pagesCase Study 2 Coca ColaSushil BhavsarNo ratings yet

- Optimizing Supply Chain FlowsDocument44 pagesOptimizing Supply Chain Flowsvaibhav kumar Khokhar0% (1)

- Inventory Mangement - Final PartDocument25 pagesInventory Mangement - Final PartMostafa Salah ElmokademNo ratings yet

- CH 13Document20 pagesCH 13zyra liam stylesNo ratings yet

- Assignment Week 1Document6 pagesAssignment Week 1Naveen TahilaniNo ratings yet

- Budgeting Quiz 2: Multiple Choice Identify The Choice That Best Completes The Statement or Answers The QuestionDocument17 pagesBudgeting Quiz 2: Multiple Choice Identify The Choice That Best Completes The Statement or Answers The Questionaldrin elsisuraNo ratings yet

- Managerial Accounting Multiple Choice QuestionsDocument4 pagesManagerial Accounting Multiple Choice Questionsmobinil1100% (1)

- COST ACCOUNTING FUNDAMENTALSDocument11 pagesCOST ACCOUNTING FUNDAMENTALSEmmanual CheeranNo ratings yet

- Brewer 6e Practice Exam SolutionsDocument4 pagesBrewer 6e Practice Exam Solutionsreal johnNo ratings yet

- Test Bank Chapter 6: Procurement Multiple Choice Questions (Correct Answers Are Bolded)Document14 pagesTest Bank Chapter 6: Procurement Multiple Choice Questions (Correct Answers Are Bolded)montherNo ratings yet

- Chopra Book ReviewDocument3 pagesChopra Book ReviewShawkat Tanveer RahmanNo ratings yet

- At 3 Completing-The-Audit XDocument6 pagesAt 3 Completing-The-Audit XKim PeriaNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument9 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionCHAU Nguyen Ngoc BaoNo ratings yet

- TBChap 005Document36 pagesTBChap 005Yonatan WadlerNo ratings yet

- Operations Management: For Competitive AdvantageDocument47 pagesOperations Management: For Competitive AdvantagedurgaselvamNo ratings yet

- Objectives of Production Planning and ControlDocument2 pagesObjectives of Production Planning and ControlDutt Amit100% (2)

- French Motor Car Co. Ltd. Workers Union Vs. French Motor Car Co. LtdDocument3 pagesFrench Motor Car Co. Ltd. Workers Union Vs. French Motor Car Co. Ltdabhishekchhabra362No ratings yet

- StudentDocument62 pagesStudentIzzy BNo ratings yet

- Activity Based CostingDocument42 pagesActivity Based CostingHaseeb Ali100% (4)

- The Revenue Cycle: Sales To Cash Collections: FOSTER School of Business Acctg.320Document37 pagesThe Revenue Cycle: Sales To Cash Collections: FOSTER School of Business Acctg.320Shaina Shanee CuevasNo ratings yet

- D) Just-In-Time Logistics .: Unit 4 - Inventory ManagementDocument10 pagesD) Just-In-Time Logistics .: Unit 4 - Inventory ManagementAjay KareNo ratings yet

- FAT MCQsDocument3 pagesFAT MCQsnajane100% (1)

- Forecasting Topic 6Document6 pagesForecasting Topic 6Ahmed Munawar100% (1)

- Budgetary Control System and Inventory Management - Research Study - 150075041Document3 pagesBudgetary Control System and Inventory Management - Research Study - 150075041aarohi bhattNo ratings yet

- Cost and Management Accounting Multiple Choice QuestionsDocument38 pagesCost and Management Accounting Multiple Choice QuestionsCLAUDINE MUGABEKAZINo ratings yet

- Master Production ScheduleDocument2 pagesMaster Production ScheduleklintNo ratings yet

- OM3 CH 01 Goods, Services, AndOperationsManagementDocument11 pagesOM3 CH 01 Goods, Services, AndOperationsManagementGanessa RolandNo ratings yet

- CH 12Document25 pagesCH 12zyra liam styles0% (2)

- Example 4Document3 pagesExample 4dimash209100% (1)

- 1203847102847Document6 pages1203847102847xjammerNo ratings yet

- Part I. Write Letter "A" If The Statement Is Correct and "B" If The Statement Is Incorrect On The Space Provided. (0.5point Each)Document4 pagesPart I. Write Letter "A" If The Statement Is Correct and "B" If The Statement Is Incorrect On The Space Provided. (0.5point Each)temedebereNo ratings yet

- Auditing CIS EnvironmentsDocument10 pagesAuditing CIS EnvironmentsJesz Montenegro FullNo ratings yet

- CAATSDocument2 pagesCAATSTseke0% (1)

- Product and Service Design and Process SelectionDocument38 pagesProduct and Service Design and Process Selectioneslam hamdyNo ratings yet

- Non - Life Insurance - 6Document29 pagesNon - Life Insurance - 6Legese TusseNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument19 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionKang ChulNo ratings yet

- MCQ Unit 5 EABDDocument33 pagesMCQ Unit 5 EABDDr-Ambrish SharmaNo ratings yet

- Practice Multiple Choice For Internal ControlDocument5 pagesPractice Multiple Choice For Internal ControlJn Fancuvilla LeañoNo ratings yet

- Chap 010Document107 pagesChap 010sucusucu3No ratings yet

- MSQ-01 - Standard Costs and Variance AnalysisDocument14 pagesMSQ-01 - Standard Costs and Variance Analysismimi supasNo ratings yet

- Management Science 1107 - Midterms AnswersDocument4 pagesManagement Science 1107 - Midterms AnswersHans DelimaNo ratings yet

- EOQ Is A Point Where: Select Correct Option: Ordering CostDocument5 pagesEOQ Is A Point Where: Select Correct Option: Ordering CostKhurram NadeemNo ratings yet

- Question Bank - Management Accounting-1Document5 pagesQuestion Bank - Management Accounting-1Neel Kapoor50% (2)

- QuantiDocument72 pagesQuantilouvelleNo ratings yet

- Vipul Final McqsDocument606 pagesVipul Final McqsVipulNo ratings yet

- 3Document2 pages3yes yesnoNo ratings yet

- Operational and Financial BudgetingDocument16 pagesOperational and Financial BudgetingEnola HolmesNo ratings yet

- Operational and Financial Budgeting: Multiple ChoiceDocument16 pagesOperational and Financial Budgeting: Multiple ChoiceNaddieNo ratings yet

- ADocument2 pagesAInocencio TiburcioNo ratings yet

- Here I Am To WorshipDocument6 pagesHere I Am To WorshipInocencio TiburcioNo ratings yet

- From The Inside OutDocument24 pagesFrom The Inside OutInocencio TiburcioNo ratings yet

- Nanay at AnakDocument5 pagesNanay at AnakInocencio TiburcioNo ratings yet

- Accounting Materials Chapter 9 Short-Term Non-Routine DecisionsDocument13 pagesAccounting Materials Chapter 9 Short-Term Non-Routine DecisionsInocencio Tiburcio33% (3)

- Organic Gardening Tips for a Healthy Homegrown HarvestDocument3 pagesOrganic Gardening Tips for a Healthy Homegrown HarvestInocencio TiburcioNo ratings yet

- Chicken OathDocument16 pagesChicken OathInocencio TiburcioNo ratings yet

- Test Bank TOCDocument1 pageTest Bank TOCAkai Senshi No TenshiNo ratings yet

- Henry Sy's Success StoryDocument3 pagesHenry Sy's Success StoryInocencio Tiburcio71% (7)

- Chapter 5 (2) CVPDocument11 pagesChapter 5 (2) CVPInocencio TiburcioNo ratings yet

- Chapter 17Document9 pagesChapter 17Aiko E. LaraNo ratings yet

- Receivables ManagementDocument5 pagesReceivables ManagementInocencio TiburcioNo ratings yet

- The Hyundai GroupDocument6 pagesThe Hyundai GroupInocencio Tiburcio67% (3)

- Chapter 6 Mas Short Term BudgetingDocument18 pagesChapter 6 Mas Short Term BudgetingLauren Obrien67% (3)

- Capital BudgetingDocument24 pagesCapital BudgetingInocencio Tiburcio100% (2)

- Daimle BenzDocument1 pageDaimle BenzInocencio TiburcioNo ratings yet

- Chapter 8Document10 pagesChapter 8Christine GorospeNo ratings yet

- MAS Compilation of QuestionsDocument21 pagesMAS Compilation of QuestionsInocencio Tiburcio67% (3)

- HongenDocument3 pagesHongenInocencio TiburcioNo ratings yet

- ResDocument11 pagesResInocencio TiburcioNo ratings yet

- HICOM Case Analysis for Management 18Document6 pagesHICOM Case Analysis for Management 18Inocencio Tiburcio100% (1)

- IFRCDocument3 pagesIFRCInocencio TiburcioNo ratings yet

- Mgt-302 (Final Project Report)Document22 pagesMgt-302 (Final Project Report)ShihabAkhandNo ratings yet

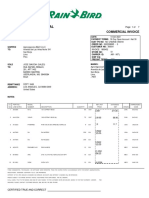

- Rain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Document7 pagesRain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Alejandra JamboNo ratings yet

- Tsigemariam BelaynehDocument96 pagesTsigemariam BelaynehadamNo ratings yet

- Timex - Marketing MixDocument11 pagesTimex - Marketing MixHimanMohapatra100% (1)

- July 2018 Bank Voucher Range I Part1400Document1 pageJuly 2018 Bank Voucher Range I Part1400Farhan PhotoState & ComposingNo ratings yet

- Breakfast is the Most Important Meal: Starting a Pancake House BusinessDocument28 pagesBreakfast is the Most Important Meal: Starting a Pancake House BusinessChristian Lim100% (1)

- Valeura Hse Management System PDFDocument19 pagesValeura Hse Management System PDFAbdelkarimNo ratings yet

- 2023.02.09 CirclesX PetitionDocument161 pages2023.02.09 CirclesX Petitionjamesosborne77-1100% (2)

- Swot AnalysisDocument4 pagesSwot AnalysisJhoanna Marie Algabre BejarinNo ratings yet

- Comparative Study of Operating Cycle Wih Reference To Manufacturing CompaniesDocument18 pagesComparative Study of Operating Cycle Wih Reference To Manufacturing Companies1921 Kanu ChauhanNo ratings yet

- Costing for FDLC JDE and brightERP ProjectsDocument4 pagesCosting for FDLC JDE and brightERP ProjectsanoopNo ratings yet

- Contract de Comodat-EngDocument2 pagesContract de Comodat-EngteodoraNo ratings yet

- BlackRock 2023-2024 Portfolio Management Job DescriptionDocument8 pagesBlackRock 2023-2024 Portfolio Management Job Descriptionharikevadiya4No ratings yet

- Standard Costs and Variance Analysis PDFDocument3 pagesStandard Costs and Variance Analysis PDFMister GamerNo ratings yet

- Mini Project II Instructions Segmentation and RegressionDocument6 pagesMini Project II Instructions Segmentation and RegressionSyed Anns Ali0% (1)

- Develop Business in Rural Areas With The Help of Digital PlatformsDocument30 pagesDevelop Business in Rural Areas With The Help of Digital PlatformsMd Tasnim FerdousNo ratings yet

- Finance, Marketing & HR courses in MBA 2nd yearDocument28 pagesFinance, Marketing & HR courses in MBA 2nd yearGaneshRathodNo ratings yet

- Investment Practice ProblemsDocument14 pagesInvestment Practice ProblemsmikeNo ratings yet

- SME Masterplan 2012-2020 Executive SummaryDocument132 pagesSME Masterplan 2012-2020 Executive SummaryMuhammad FadilNo ratings yet

- 12 Kaplan India Site Cpa ReviewDocument8 pages12 Kaplan India Site Cpa Reviewpsuresh_reddyNo ratings yet

- Case InstructionsDocument4 pagesCase InstructionsHw SolutionNo ratings yet

- Free SWOT Analysis Template MacDocument1 pageFree SWOT Analysis Template MacGirish Des ManchandaNo ratings yet

- Legal Opinion Johnsan Blue Industrial Suspension AmendmentDocument2 pagesLegal Opinion Johnsan Blue Industrial Suspension AmendmentRudiver Jungco JrNo ratings yet

- Amazon in Emerging Markets CaseDocument36 pagesAmazon in Emerging Markets CaseSpandan BhattacharyaNo ratings yet

- Jio January Invoice Receipt-Arvind Kumar SharmaDocument4 pagesJio January Invoice Receipt-Arvind Kumar SharmaArvind SharmaNo ratings yet

- JO - AkzoNobel - Intern HSE HDocument2 pagesJO - AkzoNobel - Intern HSE HudbarryNo ratings yet

- Problem Solving: 1. Relay Corp. Manufactures Batons. Relay Can Manufacture 300,000 Batons A Year at ADocument2 pagesProblem Solving: 1. Relay Corp. Manufactures Batons. Relay Can Manufacture 300,000 Batons A Year at AMa Teresa B. CerezoNo ratings yet

- CostDocument39 pagesCostJames De Torres CarilloNo ratings yet

- SAP Agricultural Contract ManagementDocument14 pagesSAP Agricultural Contract ManagementPaulo FranciscoNo ratings yet

- Bank Company Act - 1991: ATM Tahmiduzzaman, FCS EVP & Company SecretaryDocument21 pagesBank Company Act - 1991: ATM Tahmiduzzaman, FCS EVP & Company Secretarysaiful2522No ratings yet