Professional Documents

Culture Documents

Template

Uploaded by

Jagdish ModiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Template

Uploaded by

Jagdish ModiCopyright:

Available Formats

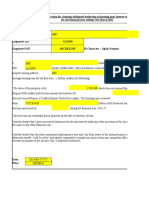

Statement of Computation of Loss from House Property for the Financial Year 20012-13

Employee Code : Name of the Employee Address of The Loaned Property

Amount of Loan taken Name and address of Housing Finance Company or Lender Whether jointly owned Computation :

Rs.__________________/-

Yes

Interest on Housing Loan-taken for purchase or construction Total -

Net Income / (Loss) from House Property I,...(name of the employee) do declare that what is stated above is true to the best of my information and belief and the loan is repaid by me out of income. Signature of the Employee

Date :

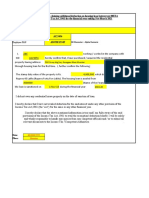

Statement of Computation of Loss from House Property for the financial year 2012-13(to be prepared in respect of each rented property seperately)

Employee Code : Name of the Employee Address of The Loaned Property

Amount of Loan taken Name and address of Housing Finance Company or Lender Nature of property Whether jointly owned Computation :

Rs.

Let-Out Yes

Income From House Property Mentioned above (Gross Annual Value): (Only in case of let-out property: mention the total rent received / receivable during the FY 2011 - 2012) Less : Property Tax paid( only if actually paid during the year)

10,000

1,000

Net Annual value Repairs (@30%) of NAV (not eligible if self occupied) Interest on Housing Loan-taken for purchase or construction Total 2,700

9,000

100,000 102,700

Net Income / (Loss) from House Property I,...(name of the employee) do declare that what is stated above is true to the best of my information and belief and the loan is repaid by me out of income.

(93,700)

Signature of the Employee Date :

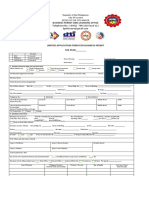

DECLARATION FOR NON-AVAILMENT OF INCOME TAX BENEFITS ON HOUSE PROPERTY and Declaration of repayment of loan by borrower

I, .(mention relationship) of Mr/ Mrs ... Working in HCL Technologies Ltd (Employee Code.) do hereby declare that in respect of the house property for which he/she is claiming tax benefit under Income Income from House Property under Income Tax Act 1961 and wherein I am the joint owner thereof, I am not claiming rebate or relief under the Income Tax Act 1961 for the FY 2012-13 as my spouse/co-owner is assessed to tax in respect of this property/part of this property for which he/she is claiming tax benefits.

Signature of spouse: Date:

I ..(name of the employee)..(ecode) do hereby declare that the repayment in respect of the above home loan for which I am claiming loss under interest on home loan for the year 2012-13 is made by me out of my taxable income.

Signature of the employee: Date:

Declaration for Non-Availment of Income Tax Benefits I, .. wife/ husband/ of Mr/ Mrs , working in HCL Technologies Ltd(ecode.) do hereby declare that in respect of the below mentioned investment for which he/she is claiming tax rebate under Income Tax Act 1961, I am not claiming any rebate or relief whatsoever, under the Income Tax Act 1961 for the Financial Year 2012-2013. Amount(Rs.) LIC Policy Date of Payment Policy / Account Number

PPF account

ULIP

Signature : Date:

Form of declaration to be filed by Landlord who does not have a permanent account number (PAN) Name of Employee:____________________________ SAP Code of Employee:______________ PAN of Employee:_____________

1. Full name of the Landlord ____________________________________________ 2. Address of the Landlord _____________________________________________ 3 Amount of monthly rent ______________________________________

Date: ________________ Place: ________________

____________________ Signature of the Landlord

You might also like

- Template For DeclarationDocument5 pagesTemplate For DeclarationShashank TiwariNo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- 2 Employee Proof Submission (EPS) Form-TemplateDocument13 pages2 Employee Proof Submission (EPS) Form-TemplateAnil GanduriNo ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- House Rent Allowance (HRA) DECLARATION (FY 2021-22) : Self Declaration by EmployeeDocument1 pageHouse Rent Allowance (HRA) DECLARATION (FY 2021-22) : Self Declaration by EmployeesamNo ratings yet

- Income Tax Declaration FormattDocument2 pagesIncome Tax Declaration FormattGopal SudhirNo ratings yet

- HRA DeclarationFormDocument1 pageHRA DeclarationFormmsmr14No ratings yet

- IDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1Document3 pagesIDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1ragupathi.arumugaNo ratings yet

- IT Declaration Form For Let Out PropertyDocument5 pagesIT Declaration Form For Let Out PropertySUPRIYANo ratings yet

- SARALDocument1 pageSARALchintamani100% (2)

- IT DeclarationDocument5 pagesIT Declarationkalpanagupta_purNo ratings yet

- Personal Details: Application No: TFS/PB/BE/ / ..Document4 pagesPersonal Details: Application No: TFS/PB/BE/ / ..Shishir SaxenaNo ratings yet

- From: To:: Annexure-ADocument3 pagesFrom: To:: Annexure-AAnilNo ratings yet

- Loan Application Form Indian BankDocument10 pagesLoan Application Form Indian BankPrathameshNo ratings yet

- INCOME TAX DECLARATIONDocument6 pagesINCOME TAX DECLARATIONSandeep KatrevulaNo ratings yet

- UplDocument11 pagesUplTara YoungNo ratings yet

- Tax Declaration FormatDocument1 pageTax Declaration FormatrameshbabumeelaNo ratings yet

- Circular / Office OrderDocument10 pagesCircular / Office OrderrockyrrNo ratings yet

- Self-Declaration For Claiming Additional Deduction On Housing Loan Interest U/s 80EE For The Financial Year Ending 31st March 2022Document2 pagesSelf-Declaration For Claiming Additional Deduction On Housing Loan Interest U/s 80EE For The Financial Year Ending 31st March 2022srikanthNo ratings yet

- Hemarus Industries Income Tax Declaration Form SummaryDocument4 pagesHemarus Industries Income Tax Declaration Form SummaryShashi NaganurNo ratings yet

- IT Proof Submission Format 2011-12Document18 pagesIT Proof Submission Format 2011-12Manu PanickerNo ratings yet

- Income Tax Declaration FormDocument1 pageIncome Tax Declaration Formdiwakar1978No ratings yet

- Afcan Reply 133Document1 pageAfcan Reply 133rajorajisunnyNo ratings yet

- Self Declaration From ShareholderDocument2 pagesSelf Declaration From ShareholderSimul MondalNo ratings yet

- INDEMNITY BOND For IEPF Manjeet SinghDocument2 pagesINDEMNITY BOND For IEPF Manjeet SinghGupta MukeshNo ratings yet

- Axis Mutual Fund - Lumpsum FormDocument3 pagesAxis Mutual Fund - Lumpsum FormPushpakVanjariNo ratings yet

- Business Taxation MBA III 566324802Document5 pagesBusiness Taxation MBA III 566324802mohanraokp2279No ratings yet

- Contract Agreement, Chartered Accountant-2011Document3 pagesContract Agreement, Chartered Accountant-2011Babamani DharNo ratings yet

- 49 BPDocument74 pages49 BPsamNo ratings yet

- Common Application Form for Equity Oriented SchemesDocument2 pagesCommon Application Form for Equity Oriented SchemesARVINDNo ratings yet

- Camfil Air Filtration India Private Limited Tax Declaration Form For The Financial Year 2018-19Document3 pagesCamfil Air Filtration India Private Limited Tax Declaration Form For The Financial Year 2018-19सौरव डेNo ratings yet

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghNo ratings yet

- Income Tax Declaration FormDocument3 pagesIncome Tax Declaration Formnagrat27No ratings yet

- ADW - Declaration For 80EEDocument1 pageADW - Declaration For 80EEabbajpai38No ratings yet

- IT 2 MARKS Q& ADocument5 pagesIT 2 MARKS Q& Adhanalakshmis0310No ratings yet

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantNo ratings yet

- Declaration/Undertaking To Be Taken From Supplier (On His Letter Head)Document1 pageDeclaration/Undertaking To Be Taken From Supplier (On His Letter Head)Mehul SinghNo ratings yet

- Haryana Vidyut Prasaran Nigam LimitedDocument10 pagesHaryana Vidyut Prasaran Nigam Limitedaloo leoNo ratings yet

- Taxguru - In-Claiming HRA What To Do If Landlord Do Not Have PANDocument3 pagesTaxguru - In-Claiming HRA What To Do If Landlord Do Not Have PANmass1984No ratings yet

- Declaration For 80EEADocument1 pageDeclaration For 80EEAdeepak68567% (3)

- NEFT Mandate: Sign Here Sign HereDocument1 pageNEFT Mandate: Sign Here Sign HereRushi VaghasiyaNo ratings yet

- Neft Mandate20170221 072043Document1 pageNeft Mandate20170221 072043chetan2112No ratings yet

- Income Tax Declaration Form 2012-13Document2 pagesIncome Tax Declaration Form 2012-13asfsadfSNo ratings yet

- Declaration of GST Non-EnrollmentDocument2 pagesDeclaration of GST Non-EnrollmentftasindiaNo ratings yet

- Business Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Document2 pagesBusiness Permit and Licensing Office: Telephone No. (+6342) - 788-2316 Local 111Ren Michelle Villaverde PaleracioNo ratings yet

- Form No.16: Part ADocument3 pagesForm No.16: Part AYogesh DhekaleNo ratings yet

- Form 16 of ANIT SINGHDocument5 pagesForm 16 of ANIT SINGHAnit SinghNo ratings yet

- Self-Declaration/ Undertaking by Principal EmployerDocument2 pagesSelf-Declaration/ Undertaking by Principal Employergst nitinNo ratings yet

- Taxation Short Questions AnswersDocument4 pagesTaxation Short Questions AnswersSheetal IyerNo ratings yet

- Enrolment Form For SIP/ Micro SIPDocument4 pagesEnrolment Form For SIP/ Micro SIPmeatulNo ratings yet

- For Non-Account Holder BeneficiaryDocument2 pagesFor Non-Account Holder BeneficiarySP CONTRACTORNo ratings yet

- Presentation 1Document12 pagesPresentation 1AGNo ratings yet

- Daulat - Letter From AdvocateDocument4 pagesDaulat - Letter From AdvocatetpworkmumbaiNo ratings yet

- Application Form EMPLOYEES CAR LOAN SCHEME (New/Reconditioned Car)Document4 pagesApplication Form EMPLOYEES CAR LOAN SCHEME (New/Reconditioned Car)assadNo ratings yet

- Final Copy of No Dues Form A On 09.12.2010Document2 pagesFinal Copy of No Dues Form A On 09.12.2010Pankaj Kumar KushwahaNo ratings yet

- Acceptance of Surrender Value PDFDocument1 pageAcceptance of Surrender Value PDFAshish JainNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNo ratings yet

- Exam Az 400 Designing and Implementing Microsoft Devops Solutions Skills MeasuredDocument14 pagesExam Az 400 Designing and Implementing Microsoft Devops Solutions Skills MeasuredJagdish ModiNo ratings yet

- Site Reliability Engineering (SRE) Foundation Course DescriptionDocument3 pagesSite Reliability Engineering (SRE) Foundation Course DescriptionJagdish Modi100% (1)

- Oracle ZFS Storage Appliance Administration: Learn ToDocument3 pagesOracle ZFS Storage Appliance Administration: Learn ToJagdish ModiNo ratings yet

- NG2 K 3 IDocument8 pagesNG2 K 3 IJagdish ModiNo ratings yet

- NetWorker Module For Databases and Applications 8.2 and Service Packs ReleasDocument41 pagesNetWorker Module For Databases and Applications 8.2 and Service Packs ReleasJagdish ModiNo ratings yet

- Exam Az-400: Designing and Implementing Microsoft Devops SolutionsDocument15 pagesExam Az-400: Designing and Implementing Microsoft Devops SolutionsJagdish ModiNo ratings yet

- Exam Az-400: Designing and Implementing Microsoft Devops SolutionsDocument15 pagesExam Az-400: Designing and Implementing Microsoft Devops SolutionsJagdish ModiNo ratings yet

- M 18 Res 01Document44 pagesM 18 Res 01Jagdish ModiNo ratings yet

- Sikka Kaamna Constrution BulletinDocument1 pageSikka Kaamna Constrution BulletinJagdish ModiNo ratings yet

- EmcDocument15 pagesEmcJagdish ModiNo ratings yet

- Ghost 10Document157 pagesGhost 10Jagdish ModiNo ratings yet

- Exporting Nfs File Systems To Unix/Esxi 1Document30 pagesExporting Nfs File Systems To Unix/Esxi 1Jagdish ModiNo ratings yet

- PACT - Detailed Design v1.3Document52 pagesPACT - Detailed Design v1.3Jagdish ModiNo ratings yet

- Veg and Non-Veg Eat TogetherDocument14 pagesVeg and Non-Veg Eat TogetherJagdish ModiNo ratings yet

- Art 2015 Result NoteDocument6 pagesArt 2015 Result NoteJagdish ModiNo ratings yet

- Apeducation Course Registration Form: Please Complete The Form and Send To Your Emc RepresentativeDocument3 pagesApeducation Course Registration Form: Please Complete The Form and Send To Your Emc RepresentativeJagdish ModiNo ratings yet

- M 21 Res 01Document20 pagesM 21 Res 01Jagdish ModiNo ratings yet

- Pal Wal BroucherDocument6 pagesPal Wal BroucherJagdish ModiNo ratings yet

- EMCReplication RP OverviewDocument34 pagesEMCReplication RP OverviewYogendra Kumar GautamNo ratings yet

- Cisco MDS 9000 Family Quick Configuration Guide: Corporate HeadquartersDocument52 pagesCisco MDS 9000 Family Quick Configuration Guide: Corporate Headquartersprashant804No ratings yet

- P T e TDocument1 pageP T e TJagdish ModiNo ratings yet

- Active Directory FundamentalsDocument64 pagesActive Directory Fundamentalskanoop84No ratings yet

- Win2003 Installation GuideDocument22 pagesWin2003 Installation GuideJagdish ModiNo ratings yet

- Powerlink GuideDocument15 pagesPowerlink GuideJagdish ModiNo ratings yet

- SAN Survey Report for Dish NetworkDocument982 pagesSAN Survey Report for Dish NetworkJagdish ModiNo ratings yet

- Mem FSDocument13 pagesMem FSJagdish ModiNo ratings yet

- Faridabad BroucherDocument6 pagesFaridabad BroucherJagdish ModiNo ratings yet

- Itil V3 - 1Document90 pagesItil V3 - 1anish.aroraNo ratings yet

- Itil V3 - 1Document90 pagesItil V3 - 1anish.aroraNo ratings yet

- M 04 Res 01Document22 pagesM 04 Res 01Jagdish ModiNo ratings yet