Professional Documents

Culture Documents

Pod 2 Quiz Parts 3 and 4

Uploaded by

fdepianoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pod 2 Quiz Parts 3 and 4

Uploaded by

fdepianoCopyright:

Available Formats

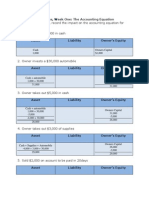

Quiz 1, Part 3

For each of the accounts below, indicate : 1. The type of account : A = ASSET- LIABILITY - OWNERS EQUITY B = LIABILITY C = OWNERS EQUITY Letter a. is done as an example:

Place an X is the proper square:

A. ASSET Example: X x x x x x x x x x x x x x x B. LIAB. C. O/E a. Cash b. Commission Revenue c. Retained Earnings d. Accounts Receivable e. Equipment f. Notes Payable g. Prepaid Insurance h. Revenue i. Utilities Expense j. Land k. Building l. Wages Expense m. Wages Payable n. Drawing o. Service Revenue Example:

PART 4

1. RECORD THE ACCOUNT ON TOP OF THE T ACCOUNT

2. POST THE PROPER DEBIT AND CREDIT Use the accounts provided BELOW: CASH SUPPPLIES ACCOUNTS RECEIVABLE LAND

ACCOUNTS PAYABLE DRAWING SERVICE REVENUE RENT EXPENSE

EXAMPLE: 1. The owner made an investment to of $5,000 cash into the business: 1. Identify accounts 2. post to the accounts Cash 5,000 Capital

2. bought $400 of supplies on account 1. Identify accounts Supplies 400 2. post to the accounts

Accounts Payable

3. bought land for $700 in Cash 1. Identify accounts Cash 700 2. post to the accounts

Land 700

4. Paid $200 to creditor on account 1. Identify accounts Cash 200 2. post to the accounts

Accounts Payable 200

5. The owner withdrew $50 from the business 1. Identify accounts Drawing 50 2. post to the accounts

Cash

6. Paid the rent for the month $900 1. Identify accounts Rent Expense 900 2. post to the accounts

Cash

7. Earned $100 and received cash for services

1. Identify accounts 2. post to the accounts

Cash 100

Servive Revenue

8. earned $200 in service revenue will receive money in 30 days 1. Identify accounts Accounts Receivable 200 2. post to the accounts

Service Revenue

9. collected $200 that was owned. 1. Identify accounts Cash 200 2. post to the accounts

Accounts Receivable

10. purchased $500 in supplies using cash 1. Identify accounts Supplies Expense 500 2. post to the accounts

Cash

11. received cash for accounting fess performed $1,000 1. Identify accounts Cash 1,000 2. post to the accounts

Service Revenue

12. Purchased $575 of Inventory supplies for cash 1. Identify accounts Supplies Expense 575 2. post to the accounts

Cash

13. Paid rents expense $500 used cash 1. Identify accounts Rent Expense 500 2. post to the accounts

Cash

14. The owner took $300 cash for personal use. 1. Identify accounts Drawing 300

Cash

2. post to the accounts

15. Used $600 of supplies inventory for the business 1. Identify accounts Supplies Expense 600 2. post to the accounts

Supplies

16. Received $900 from a customer who owed the company money 1. Identify accounts Accounts Receivable 900 2. post to the accounts

Cash 900

17. Paid $780 for and electric bill cut a check 1. Identify accounts Cash 780 2. post to the accounts

Electric Expense 780

18. Paid wages $6800 to employees for the month 1. Identify accounts Salary Expense 6800 2. post to the accounts

Cash

19. Purchased a desk for the office $690 on account. 1. Identify accounts Supplies 690 2. post to the accounts

Accounts Payable

20. Paid any bill owed on account $400. 1. Identify accounts Accounts Payable 400 2. post to the accounts

Cash

Norma/Natural BALANCE Debit Credit X x x x x x x x x x x x x x x

SUPPLIES EXPENSE ELECTRIC EXPENSE SALARY EXPENSE

5,000

400

Accounts Payable

50

900

Servive Revenue 100

Service Revenue 200

Accounts Receivable 200

500

Service Revenue 1,000

575

500

300

600

Electric Expense

6800

Accounts Payable 690

400

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Pod 8 ExerciseDocument1 pagePod 8 ExercisefdepianoNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Pod 7 Exercise Pod 7Document7 pagesPod 7 Exercise Pod 7fdepianoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Pod 6 Quiz 3Document23 pagesPod 6 Quiz 3fdepianoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Pod 6 Gross Profit ExerciseDocument1 pagePod 6 Gross Profit ExercisefdepianoNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Pod 7 Exercise Pod 7Document7 pagesPod 7 Exercise Pod 7fdepianoNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Pod 5 Exercise 2 of 2 Financials - 2Document1 pagePod 5 Exercise 2 of 2 Financials - 2fdepianoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Pod 8 QuizDocument14 pagesPod 8 QuizfdepianoNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Pod 6 Journal - EntriesDocument3 pagesPod 6 Journal - EntriesfdepianoNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Pod 5 Exercise 3Document4 pagesPod 5 Exercise 3fdepianoNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Pod 5 Exercise 1 or 2 - Financials - Exercise - 1Document1 pagePod 5 Exercise 1 or 2 - Financials - Exercise - 1fdepianoNo ratings yet

- Pod 5 Closing Entries Both 1 and 2Document10 pagesPod 5 Closing Entries Both 1 and 2fdepianoNo ratings yet

- Pod 5 2 of 2 Closing Entries Exercise 2Document1 pagePod 5 2 of 2 Closing Entries Exercise 2fdepianoNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Pod 5 1 of 2 Closing Entries Exercise 1-7Document1 pagePod 5 1 of 2 Closing Entries Exercise 1-7fdepianoNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Pod 4 Trial Balance ProblemDocument2 pagesPod 4 Trial Balance ProblemfdepianoNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Pod 3 MyTie Journal EntriesDocument2 pagesPod 3 MyTie Journal EntriesfdepianoNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Pod 4 Quiz - 2Document1 pagePod 4 Quiz - 2fdepianoNo ratings yet

- Pod 2 Journal - EntriesDocument2 pagesPod 2 Journal - EntriesfdepianoNo ratings yet

- Pod 2 Exercises-2Document9 pagesPod 2 Exercises-2fdepianoNo ratings yet

- Pod 1 The Accounting Equation-1Document3 pagesPod 1 The Accounting Equation-1fdepianoNo ratings yet

- Chaman Lal Setia Exports Ltd fundamentals remain intactDocument18 pagesChaman Lal Setia Exports Ltd fundamentals remain intactbharat005No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bunkering Check List: Yacht InformationDocument3 pagesBunkering Check List: Yacht InformationMarian VisanNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Royalty-Free License AgreementDocument4 pagesRoyalty-Free License AgreementListia TriasNo ratings yet

- SyllabusDocument4 pagesSyllabusapi-105955784No ratings yet

- Enerflex 381338Document2 pagesEnerflex 381338midoel.ziatyNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Excavator Loading To Truck TrailerDocument12 pagesExcavator Loading To Truck TrailerThy RonNo ratings yet

- Beams On Elastic Foundations TheoryDocument15 pagesBeams On Elastic Foundations TheoryCharl de Reuck100% (1)

- Group 4 HR201 Last Case StudyDocument3 pagesGroup 4 HR201 Last Case StudyMatt Tejada100% (2)

- 3 Intro To Ozone LaundryDocument5 pages3 Intro To Ozone LaundrynavnaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- 2006-07 (Supercupa) AC Milan-FC SevillaDocument24 pages2006-07 (Supercupa) AC Milan-FC SevillavasiliscNo ratings yet

- Khadi Natural Company ProfileDocument18 pagesKhadi Natural Company ProfileKleiton FontesNo ratings yet

- Proposal Semister ProjectDocument7 pagesProposal Semister ProjectMuket AgmasNo ratings yet

- Haul Cables and Care For InfrastructureDocument11 pagesHaul Cables and Care For InfrastructureSathiyaseelan VelayuthamNo ratings yet

- DHPL Equipment Updated List Jan-22Document16 pagesDHPL Equipment Updated List Jan-22jairamvhpNo ratings yet

- Introduction To Succession-1Document8 pagesIntroduction To Succession-1amun dinNo ratings yet

- Qatar Airways E-ticket Receipt for Travel from Baghdad to AthensDocument1 pageQatar Airways E-ticket Receipt for Travel from Baghdad to Athensمحمد الشريفي mohammed alshareefiNo ratings yet

- AHP for Car SelectionDocument41 pagesAHP for Car SelectionNguyên BùiNo ratings yet

- Difference Between OS1 and OS2 Single Mode Fiber Cable - Fiber Optic Cabling SolutionsDocument2 pagesDifference Between OS1 and OS2 Single Mode Fiber Cable - Fiber Optic Cabling SolutionsDharma Teja TanetiNo ratings yet

- Erp and Mis Project - Thanks To PsoDocument31 pagesErp and Mis Project - Thanks To PsoAkbar Syed100% (1)

- Material Properties L2 Slides and NotesDocument41 pagesMaterial Properties L2 Slides and NotesjohnNo ratings yet

- New Installation Procedures - 2Document156 pagesNew Installation Procedures - 2w00kkk100% (2)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

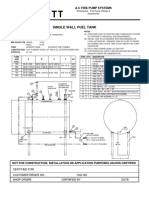

- Single Wall Fuel Tank: FP 2.7 A-C Fire Pump SystemsDocument1 pageSingle Wall Fuel Tank: FP 2.7 A-C Fire Pump Systemsricardo cardosoNo ratings yet

- OBHR Case StudyDocument8 pagesOBHR Case StudyYvonne TanNo ratings yet

- Mapping Groundwater Recharge Potential Using GIS-Based Evidential Belief Function ModelDocument31 pagesMapping Groundwater Recharge Potential Using GIS-Based Evidential Belief Function Modeljorge “the jordovo” davidNo ratings yet

- Abb Drives: User'S Manual Flashdrop Mfdt-01Document62 pagesAbb Drives: User'S Manual Flashdrop Mfdt-01Сергей СалтыковNo ratings yet

- Spouses Mariano Z. Velarde and Avelina D. VELARDE, Petitioners, vs. COURT OF Appeals, David A. RAYMUNDO and GEORGE RAYMUNDO, RespondentsDocument11 pagesSpouses Mariano Z. Velarde and Avelina D. VELARDE, Petitioners, vs. COURT OF Appeals, David A. RAYMUNDO and GEORGE RAYMUNDO, RespondentsRobyn JonesNo ratings yet

- Compilation of CasesDocument121 pagesCompilation of CasesMabelle ArellanoNo ratings yet

- International Convention Center, BanesworDocument18 pagesInternational Convention Center, BanesworSreeniketh ChikuNo ratings yet

- 2CG ELTT2 KS TitanMagazine Anazelle-Shan PromoDocument12 pages2CG ELTT2 KS TitanMagazine Anazelle-Shan PromoJohn SmithNo ratings yet

- Resume Ajeet KumarDocument2 pagesResume Ajeet KumarEr Suraj KumarNo ratings yet