Professional Documents

Culture Documents

Pod 3 MyTie Journal Entries

Uploaded by

fdepianoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pod 3 MyTie Journal Entries

Uploaded by

fdepianoCopyright:

Available Formats

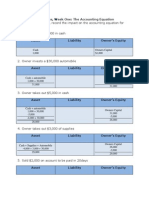

Accounting Exercises, Week Three: MyTie Journal Entries Create the following journal entries for MyTie company:

Jan. 1 Record the payment for $3,600 representing 12 months of prepaid insurance. Jan. 2 Paid the landlord 6 months of rent in advance. Monthly rent equals $1,500 per month. Jan 31. Record the use of one month of insurance Jan. 31 Record the use of one month of rent. Feb 1. Purchased a $36,000 truck for cash. The truck is expected to last 36 months. Feb 28 Record one month of Deprecation on the $36,000 truck. Feb 28. Record the use of one month of insurance Feb 28 Record the use of one month of rent. Feb 28 Record Februarys electric bill $500 to be paid next month. Feb 28 Record $2,000 of Revenue earned for February however not received. March 1 Received 6 months of revenue in advance total $600. March 31 Company earns 1 month of revenue received from March 1st.

Date Jan. 1

Account Prepaid Insurance (300 x 12) Cash Paid Insurance In Advance Jan. 2 Prepaid Rent (1,500 x 6) Cash Paid Rent in Advance Jan. 31 Insurance Expense (3,600 x 1/12) Prepaid Insurance To Record Insurance Expense Jan. 31 Rent Expense (9,000 x 1/6) Prepaid Rent To Record Rent Expense Feb. 1 Truck Cash Purchased Truck Feb. 28 Depreciation Expense Truck Accumulated depreciation Truck To Record Depreciation on Truck Feb. 28 Insurance Expense (3,600 x 1/12) Prepaid Insurance To Record Insurance Expense Feb. 28 Rent Expense (9,000 x 1/6) Prepaid Rent To Record Rent Expense Feb. 28 Electric Expense Accounts Payable Electric Expense February Feb. 28 Accounts Receivable Service Revenue To Accrue Service Revenue Mar. 1 Cash Unearned Service Revenue Collected Revenue in Advance Mar. 31 Unearned Service Revenue (600 x 1/6) Service Revenue To Record Service Revenue That Was Collected In Advance

Debit 3,600

Credit 3,600

9,000 9,000 300 300 1,500 1,500 36,000 36,000 1,000 1,000 300 300 1,500 1,500 500 500 2,000 2,000 600 600 100 100

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Employee Engagement: The Key To Realizing Competitive AdvantageDocument33 pagesEmployee Engagement: The Key To Realizing Competitive Advantageshivi_kashtiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Citibank Performance EvaluationDocument9 pagesCitibank Performance EvaluationMohit Sharma67% (6)

- Recruitment AgreementDocument5 pagesRecruitment AgreementTricia GrafiloNo ratings yet

- Rosemont Hills Montessori College: Business Ethics and Social ResponsibilityDocument5 pagesRosemont Hills Montessori College: Business Ethics and Social ResponsibilityCherrielyn Lawas100% (1)

- ISO 14001 2015 Upgrade ChecklistDocument10 pagesISO 14001 2015 Upgrade ChecklistDariush Rumi100% (1)

- EOQ ModelDocument41 pagesEOQ ModelAbhijeet Agarwal100% (1)

- Pod 7 Exercise Pod 7Document7 pagesPod 7 Exercise Pod 7fdepianoNo ratings yet

- Pod 8 ExerciseDocument1 pagePod 8 ExercisefdepianoNo ratings yet

- Pod 7 Exercise Pod 7Document7 pagesPod 7 Exercise Pod 7fdepianoNo ratings yet

- Pod 8 QuizDocument14 pagesPod 8 QuizfdepianoNo ratings yet

- Pod 6 Quiz 3Document23 pagesPod 6 Quiz 3fdepianoNo ratings yet

- Pod 5 Exercise 2 of 2 Financials - 2Document1 pagePod 5 Exercise 2 of 2 Financials - 2fdepianoNo ratings yet

- Pod 5 Exercise 3Document4 pagesPod 5 Exercise 3fdepianoNo ratings yet

- Pod 6 Journal - EntriesDocument3 pagesPod 6 Journal - EntriesfdepianoNo ratings yet

- Pod 5 Closing Entries Both 1 and 2Document10 pagesPod 5 Closing Entries Both 1 and 2fdepianoNo ratings yet

- Pod 6 Gross Profit ExerciseDocument1 pagePod 6 Gross Profit ExercisefdepianoNo ratings yet

- Pod 5 2 of 2 Closing Entries Exercise 2Document1 pagePod 5 2 of 2 Closing Entries Exercise 2fdepianoNo ratings yet

- Pod 5 Exercise 1 or 2 - Financials - Exercise - 1Document1 pagePod 5 Exercise 1 or 2 - Financials - Exercise - 1fdepianoNo ratings yet

- Pod 5 1 of 2 Closing Entries Exercise 1-7Document1 pagePod 5 1 of 2 Closing Entries Exercise 1-7fdepianoNo ratings yet

- Pod 4 Quiz - 2Document1 pagePod 4 Quiz - 2fdepianoNo ratings yet

- Pod 4 Trial Balance ProblemDocument2 pagesPod 4 Trial Balance ProblemfdepianoNo ratings yet

- Pod 2 Exercises-2Document9 pagesPod 2 Exercises-2fdepianoNo ratings yet

- Pod 1 The Accounting Equation-1Document3 pagesPod 1 The Accounting Equation-1fdepianoNo ratings yet

- Pod 2 Quiz Parts 3 and 4Document8 pagesPod 2 Quiz Parts 3 and 4fdepianoNo ratings yet

- Pod 2 Journal - EntriesDocument2 pagesPod 2 Journal - EntriesfdepianoNo ratings yet

- Issues and Challenges of Indian Aviation Industry: A Case StudyDocument7 pagesIssues and Challenges of Indian Aviation Industry: A Case StudyJayant KumarNo ratings yet

- Navarro2019HowMNEsGovRelAreasOperateinBrazil BM1904 050Document14 pagesNavarro2019HowMNEsGovRelAreasOperateinBrazil BM1904 050Newhame DagneNo ratings yet

- Lecture 12 Contemporary Management Concepts and Techniques PDFDocument18 pagesLecture 12 Contemporary Management Concepts and Techniques PDF石偉洛No ratings yet

- Banks Customer Satisfaction in Kuwait PDFDocument77 pagesBanks Customer Satisfaction in Kuwait PDFpavlov2No ratings yet

- Si 2Document4 pagesSi 2seraNo ratings yet

- Accounting and Management Problems of SmallDocument128 pagesAccounting and Management Problems of SmallelohoNo ratings yet

- College of Accountancy Final Examination Acctg 207A InstructionsDocument5 pagesCollege of Accountancy Final Examination Acctg 207A InstructionsCarmela TolinganNo ratings yet

- Interview Base - Knowledge & PracticalDocument39 pagesInterview Base - Knowledge & Practicalsonu malikNo ratings yet

- Industrial Goods Principles of MarketingDocument3 pagesIndustrial Goods Principles of MarketingAlwapNo ratings yet

- Chap 7Document20 pagesChap 7Ika ChillayNo ratings yet

- Group 4 Tofu DRAFTDocument79 pagesGroup 4 Tofu DRAFTHenessy ReinNo ratings yet

- Kumpulan Quiz UAS AkmenDocument23 pagesKumpulan Quiz UAS AkmenPutri NabilahNo ratings yet

- Investor Relations StrategyDocument10 pagesInvestor Relations Strategysembalap29No ratings yet

- BOM and Yes Bank..Document23 pagesBOM and Yes Bank..kunalclad41No ratings yet

- Training ReportDocument17 pagesTraining ReportprabhatNo ratings yet

- SampledatafoodsalesDocument10 pagesSampledatafoodsalesMunish RanaNo ratings yet

- Abm Quiz No. 1Document2 pagesAbm Quiz No. 1nilo bia100% (1)

- Characteristics of Successful Employer Brands PDFDocument17 pagesCharacteristics of Successful Employer Brands PDFengmostafa_2007No ratings yet

- What Is The Software Development Life CycleDocument3 pagesWhat Is The Software Development Life CycleRizwan AhmadNo ratings yet

- Marketing Management With Dr. Rizwan Ali: The University of LahoreDocument21 pagesMarketing Management With Dr. Rizwan Ali: The University of LahoreAqib LatifNo ratings yet

- Dewar, J. International-Project-FinanceDocument559 pagesDewar, J. International-Project-FinanceFederico Silva DuarteNo ratings yet

- Chapter 3Document3 pagesChapter 3Mariya BhavesNo ratings yet

- Final Cadbury Project 1Document66 pagesFinal Cadbury Project 1Purva Srivastava70% (10)

- CH 04Document14 pagesCH 04Elizabeth EscobedoNo ratings yet