Professional Documents

Culture Documents

Pod 4 Quiz - 2

Uploaded by

fdepianoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pod 4 Quiz - 2

Uploaded by

fdepianoCopyright:

Available Formats

ACCOUNTING ONE Quiz Number 2

NAME________________________________________ Andrew Bennert DATE____________________

PART 1

JOURNALIZING TRANSACTIONS

Bob's lawn Mower Repairs is owned and operated by Bob Decrane. Using the list of accounts below, journalize the following transactions:

CASH SUPPLIES REPAIR EQUIPMENT ACCOUNTS PAYABLE

DECRANE CAPITAL DECRANE DRAWING REPAIR REVENUE RENT EXPENSE

JUNE JUNE JUNE JUNE JUNE JUNE JUNE

1 1 3 4 21 29 30

Decrane invested $10,000 cash into the business Paid shop rent for June $800 Bought repair equipment on account, $3,000 Bought supplies for cash $400 received cash from repair of lawn mower, $80 Decrane withdrew $50 for personal use Paid $1,000 on account to creditors

DATE 1-Jun

ACCOUNT TITLE Cash Decrane Capital Owner Investment Rent Expense Cash Paid Shop Rent Repair Equipment Accounts Payable Bought Repair Equipment on Account Supplies Cash Paid Cash for Supplies Cash Repair Revenue Received Cash for Service Decrane Drawing Cash Owner Withdrawal Accounts Payable Cash Paid Cash on Account

DEBIT 10,000

CREDIT 10,000

1-Jun

800 800 3,000 3,000 400 400 80 80 50 50 1,000 1,000

3-Jun

4-Jun

21-Jun

29-Jun

30-Jun

PART 2

JOURNALIZE, POST, AND TRIAL BALANCE

RECORD THE FOLLOWING TRANSACTIONS, POST TO THE GENERAL LEDGER AND PREPARE A TRIAL BALANCE FOR HART IMPROVEMENT CO.

USE ONLY THE ACCOUNTS LISTED IN THE GENERAL LEDGER

JULY 1 John Hart invested $20,000 cash, equipment valued at $10,,000 and a truck costing $5,000 into his business 5 Bought additional equipment costing $5,000 on account 11 Paid $1,000 to creditors on account 20 Sold $7,000 of Equipment for cash 29 Sold $10,00 and received cash

GENERAL JOURNAL DATE 1-Jul Cash ACCOUNT TITLE AC. # 11 31 17 31 18 31 17 21 21 11 11 17 11 41 10,000 10,000 7,000 7,000 1,000 1,000 5,000 5,000 5,000 5,000 10,000 10,000 DEBIT 20,000 20,000 CREDIT

Hart Capital Owner Investment 1-Jul Equipment Hart Capital Owner Investment 1-Jul Truck Hart Capital Owner Investment 5-Jul Equipment Accounts Payable Purchased Equipment on Account 11-Jul Accounts Payable Cash Paid Cash on Account 20-Jul Cash Equipment Sold Equipment for Cash 29-Jul Cash Sales Sales Income Received Cash

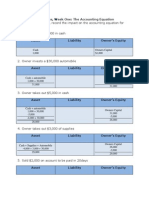

GENERAL LEDGER CASH DATE 1-Jul 11-Jul 20-Jul 29-Jul NO. 11 ITEM DEBIT 20,000 7,000 10,000 CREDIT 1,000 27,000 37,000 DEBIT BALANCE 20,000 CREDIT BALANCE 1,000

EQUIPMENT DATE 1-Jul 5-Jul 20-Jul

NO. 17 ITEM DEBIT 10,000 5,000 CREDIT DEBIT BALANCE 10,000 15,000 CREDIT BALANCE

7,000

7,000

TRUCK DATE 1-Jul

NO. 18 ITEM DEBIT 5,000 CREDIT DEBIT BALANCE 5,000 CREDIT BALANCE

ACCOUNTS PAYABLE DATE ITEM 5-Jul 11-Jul

NO. 21 DEBIT 1,000 CREDIT DEBIT BALANCE 5,000 1,000 CREDIT BALANCE 5,000

HART CAPITAL DATE ITEM 1-Jul 1-Jul 1-Jul

NO. 31 DEBIT CREDIT DEBIT BALANCE 20,000 10,000 5,000 CREDIT BALANCE 20,000 30,000 35,000

SALES DATE 29-Jul

NO. 41 ITEM DEBIT CREDIT DEBIT BALANCE 10,000 CREDIT BALANCE 10,000

TRIAL BALANCE AC # 11 17 18 21 31 41 CASH 15,000 EQUIPMENT 5,000 TRUCK 1,000 ACCOUNTS PAYABLE 35,000 HART CAPITAL 10,000 SALES TOTALS (DEBITS MUST EQUAL CREDITS) 58,000 (CONTINUED) 58,000 58,000 58,000 49,000 49,000 10,000 35,000 5,000 4,000 5,000 7,000 8,000 ACCOUNT TITLE DEBIT 37,000 CREDIT 1,000 DEBIT 36,000 CREDIT

Part 3

Step 1. Prepare the following entries Step 2. Post the entries to the trial balance Step 3. Create the final trial balance

1 The Company Used up $3,000 of supplies 2 There was $1,000 of prepaid rent expired. 3 There was $4,000 of prepaid insurance used 4 The Company recorded $2,000 of depreciation expense 5 Salaries for the month incured both not paid equal $5,000 Account Supplies Expense Supplies Rent Expense Prepaid Rent ENTRY 3 Insurance Expense Prepaid Insurance Depreciation Expense Accu. Deperciation Salary Expense Salary Payable Debit 52 13 51 17 53 18 55 12 54 21 3,000 3,000 1,000 1,000 4,000 4,000 2,000 2,000 5,000 5,000 Credit

ENTRY 1

ENTRY 2

ENTRY 4

ENTRY 5

AC # 10 11 12 13 17 18 21 31 41 51 52 53 54 55 CASH BUILDING

ACCOUNT TITLE

Open Trial Balance DEBIT CREDIT

ADJUSTMENTS DEBIT CREDIT

Closing Trial Balance DEBIT CREDIT

$ 10,000 $ 20,000 $ $ 25,000 $ 50,000 $100,000 $ $ 75,000 25,000 5,000 $ $ $ $ $ 2,000 3,000 1,000 4,000 5,000

$ 10,000 $ 20,000 $ $ 25,000 $ 50,000 $ 100,000 $ $ $ 7,000 3,000 1,000 4,000

ACCUMULATED DEPRECIATION SUPPLIES PREPAID RENT PREPAID INSURANCE SALARY PAYABLE HART CAPITAL SALES RENT EXPENSE SUPPLIES EXPENSE INSURANCE EXPENSE SALARY EXPENSE DEPRECTION EXPENSE TOTALS

$ 80,000 $ 25,000 $ 200,000

$ 200,000 $ 10,000 $ 15,000 $ 5,000 $ 30,000 $ 40,000 $305,000

(DEBITS MUST EQUAL CREDITS)

$ $ $ $ $ $ 305,000

1,000 3,000 4,000 5,000 2,000 $ 15,000

$ 11,000 $ 18,000 $ 9,000

$ 35,000 $ 42,000 $ 320,000 $ 320,000

$ 15,000

You might also like

- Pod 7 Exercise Pod 7Document7 pagesPod 7 Exercise Pod 7fdepianoNo ratings yet

- Pod 8 ExerciseDocument1 pagePod 8 ExercisefdepianoNo ratings yet

- Pod 8 QuizDocument14 pagesPod 8 QuizfdepianoNo ratings yet

- Pod 5 Exercise 3Document4 pagesPod 5 Exercise 3fdepianoNo ratings yet

- Pod 6 Quiz 3Document23 pagesPod 6 Quiz 3fdepianoNo ratings yet

- Pod 7 Exercise Pod 7Document7 pagesPod 7 Exercise Pod 7fdepianoNo ratings yet

- Pod 6 Journal - EntriesDocument3 pagesPod 6 Journal - EntriesfdepianoNo ratings yet

- Pod 6 Gross Profit ExerciseDocument1 pagePod 6 Gross Profit ExercisefdepianoNo ratings yet

- Pod 5 Closing Entries Both 1 and 2Document10 pagesPod 5 Closing Entries Both 1 and 2fdepianoNo ratings yet

- Pod 5 2 of 2 Closing Entries Exercise 2Document1 pagePod 5 2 of 2 Closing Entries Exercise 2fdepianoNo ratings yet

- Pod 5 Exercise 2 of 2 Financials - 2Document1 pagePod 5 Exercise 2 of 2 Financials - 2fdepianoNo ratings yet

- Pod 5 1 of 2 Closing Entries Exercise 1-7Document1 pagePod 5 1 of 2 Closing Entries Exercise 1-7fdepianoNo ratings yet

- Pod 5 Exercise 1 or 2 - Financials - Exercise - 1Document1 pagePod 5 Exercise 1 or 2 - Financials - Exercise - 1fdepianoNo ratings yet

- Pod 4 Trial Balance ProblemDocument2 pagesPod 4 Trial Balance ProblemfdepianoNo ratings yet

- Pod 3 MyTie Journal EntriesDocument2 pagesPod 3 MyTie Journal EntriesfdepianoNo ratings yet

- Pod 2 Quiz Parts 3 and 4Document8 pagesPod 2 Quiz Parts 3 and 4fdepianoNo ratings yet

- Pod 1 The Accounting Equation-1Document3 pagesPod 1 The Accounting Equation-1fdepianoNo ratings yet

- Pod 2 Journal - EntriesDocument2 pagesPod 2 Journal - EntriesfdepianoNo ratings yet

- Pod 2 Exercises-2Document9 pagesPod 2 Exercises-2fdepianoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- HTGC 2013 Annual ReportDocument246 pagesHTGC 2013 Annual Reportemirav2No ratings yet

- PB1.3 CH1 Using NumbersDocument22 pagesPB1.3 CH1 Using NumbersGadgetGlitchKillNo ratings yet

- Cost of Debt Cost of Preferred Stock Cost of Retained Earnings Cost of New Common StockDocument18 pagesCost of Debt Cost of Preferred Stock Cost of Retained Earnings Cost of New Common StockFadhila HanifNo ratings yet

- Anglais 1Document3 pagesAnglais 1idilmiNo ratings yet

- Module-1.1 PUBLIC FINANCEDocument5 pagesModule-1.1 PUBLIC FINANCEPauline Joy Lumibao100% (2)

- Semester 4Document3 pagesSemester 4Ram KrishnaNo ratings yet

- Irrevocable Power of AttorneyDocument6 pagesIrrevocable Power of AttorneyAlpesh ThakkarNo ratings yet

- Risk Aversion, Neutrality, and PreferencesDocument2 pagesRisk Aversion, Neutrality, and PreferencesAryaman JunejaNo ratings yet

- 2022 Student Information LeafletDocument2 pages2022 Student Information LeafletNileena Rajan Product DesignNo ratings yet

- PBD Cluster 27Document48 pagesPBD Cluster 27Datu Puwa MamalacNo ratings yet

- Internship Report 2020Document45 pagesInternship Report 2020Naomii HoneyNo ratings yet

- DCFValuation JKTyre1Document195 pagesDCFValuation JKTyre1Chulbul PandeyNo ratings yet

- ABC analysis inventory classificationDocument10 pagesABC analysis inventory classificationSunnyPawarȜȝNo ratings yet

- Vol 1Document366 pagesVol 1pantzaf7513No ratings yet

- A Study On Brand Image of Icici Prudential Life Insurance LTDDocument44 pagesA Study On Brand Image of Icici Prudential Life Insurance LTDRanjit PandaNo ratings yet

- Answer Formula Edited XDocument176 pagesAnswer Formula Edited Xmostafa motailqNo ratings yet

- Talavera Senior High School: Municipal Government of Talavera Talavera, Nueva EcijaDocument32 pagesTalavera Senior High School: Municipal Government of Talavera Talavera, Nueva Ecijaanthony tabudloNo ratings yet

- Chapter 5 Practice QuestionsDocument5 pagesChapter 5 Practice QuestionsFarah YasserNo ratings yet

- The Rise and Fall of Global Trust Bank CaseDocument3 pagesThe Rise and Fall of Global Trust Bank CasemohitNo ratings yet

- Accounting Quick Lesson1Document1 pageAccounting Quick Lesson1listenkidNo ratings yet

- Negotiable Instruments Law DigestsDocument4 pagesNegotiable Instruments Law DigestsJay-ar Rivera BadulisNo ratings yet

- RMC No. 18-2021Document2 pagesRMC No. 18-2021Marvin Coming MoldeNo ratings yet

- 6 - Power of AttorneyDocument2 pages6 - Power of AttorneyJahi100% (4)

- What Is A Journal Entry in AccountingDocument20 pagesWhat Is A Journal Entry in AccountingIc Abacan100% (1)

- 5 RCBC Savings V Odrada DigestDocument1 page5 RCBC Savings V Odrada DigestDamienNo ratings yet

- Beda Notes - Credit TransactionsDocument18 pagesBeda Notes - Credit TransactionsMaan ElagoNo ratings yet

- The Optimal Timing of Investment Decisions. DraftDocument36 pagesThe Optimal Timing of Investment Decisions. DraftpostscriptNo ratings yet

- BCG Forage Core Strategy - Telco (Task 2 Additional Data)Document9 pagesBCG Forage Core Strategy - Telco (Task 2 Additional Data)Fadil JauhariNo ratings yet

- United States Court of Appeals, Third CircuitDocument12 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Axis Bank LTD CVDocument4 pagesAxis Bank LTD CVPrayagraj PradhanNo ratings yet