Professional Documents

Culture Documents

Pod 6 Quiz 3

Uploaded by

fdepianoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pod 6 Quiz 3

Uploaded by

fdepianoCopyright:

Available Formats

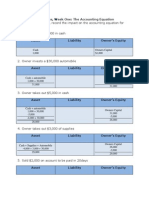

Jackie Grant Accounting 1- QUIZ 3 Part 1 Step 1. Prepare the following entries Step 2.

Post the entries to the trial balance Step 3. Create the final trial balance

1 The Company Used up $3,000 of supplies 2 There was $1,000 of prepaid rent expired. 3 There was $4,000 of prepaid insurance used 4 The Company recorded $2,000 of depreciation expense 5 Salaries for the month incurred both not paid equal $5,000 Account ENTRY 1 Supplies Expense Supplies ENTRY 2 Rent Expense Prepaid Rent ENTRY 3 Insurance Expense Prepaid Insurance ENTRY 4 Depreciation Expense Accumlated Depreciation Salary Expense Salary Payable 2,000 4,000 1,000 Debit 3,000

ENTRY 5

5000

AC #

ACCOUNT TITLE

Open Trial Balance DEBIT CREDIT

ADJUSTMENTS DEBIT

CREDIT

10 11 12 13 17 18 21 31 41 51 52 53 54 55

CASH BUILDING ACCUMULATED DEPRECIATION SUPPLIES PREPAID RENT PREPAID INSURANCE SALARY PAYABLE HART CAPITAL SALES RENT EXPENSE SUPPLIES EXPENSE INSURANCE EXPENSE SALARY EXPENSE DEPRECTION EXPENSE TOTALS (DEBITS MUST EQUAL CREDITS)

$ $

10,000 20,000 $ 5,000 $ $ $ $ $ $ $ 75,000 25,000 200,000 $ $ $ $ $ 1,000 3,000 4,000 5,000 2,000 $ 15,000 $ 15,000 $ 2,000 3,000 1,000 4,000 5,000

$ $ $

25,000 50,000 100,000

$ $ $ $ $ $

10,000 15,000 5,000 30,000 40,000

305,000 $ 305,000 $ $

PART 2

There was no opening balance in the Capital Account in the beginning Prepare the Financials for December 2007 Use the Schedules provided below TRIAL BALANCE CASH ACCOUNTS RECEIVABLE SUPPLIES ACCOUNTS PAYABLE NOTES PAYABLE R U HAPPY CAPITAAL R U HAPPY DRAWING SERVICE FEES ADVERTISING EXPENSE RENT EXPENSE UTILITIES EXPENSE MISCELLANEOUS EXPENSE TOTAL Debit $ 3,400 $ 7,500 $ 3,000 Credit

$ $ $ $ 1,000 $ $ 1,100 $ 1,800 $ 1,500 $ 200 $ 19,500

500 1,000 10,000 8,000

19,500

RU HAPPY INCOME STATEMENT FOR THE YEAR ENDED 12/31/07 Revenue: Service Revenues (fees from trial bal?) Expenses: Rent Expense Utilities Expense Advertising Expense Miscellanous Expense TOTAL EXPENSES NET INCOME 1,800 1,500 1,100 200

RU HAPPY STATEMENT OF OWNERS EQUITY FOR THE YEAR ENDED 12/31/07 R U Happy, Captial (from Trial Balance) Add Net income LESS R U Happy Drawing R U Happy Capital as of 12/31/07 10,000 3,400 -1,000 12,400

RU HAPPY BALANCE SHEET DECEMBER 31, 2007 Assets: Cash Accounts Recieveable Supplies TOTAL ASSETS Liabilities Accounts Payable Notes Payable TOTAL LIABILITIES Owners Equity RU Happy Capital (as of 12/31 from statement of owners equity) PLUS Total Liabilibities (from above)

PART 3

CLOSING ENTRIES Create the four closing entries from the TRIAL BALANCE Below:

Account title

Trial Balance Debit Credit Cash $ 20,000 Accounts Receivable $ 25,000 Merchandise inventory $ 83,000 Office Supplies $ 21,000 Prepaid Rent $ 18,000 Store Equipment $ 42,000 Accum Depreciation $ Accounts Payable $ Salaries Payable Ted Johnson Capital $ Ted Johnson Drawing $ 4,000 Sales $ Travel Expense $ 2,000 Booze Expense $ 3,000 Supplies Expense Purchases $ 85,000 Advertising Expense $ 1,000 Purchase Discount Transportation In $ 9,000 Hot Fudge Sunday Exp $ 2,500 Depreciation Exp Office Supplies Exp Rent Exp Salary Exp $ 12,000 Utilities Exp. $ 1,000 TOTAL $ 328,500 $

12,000 21,500 135,000 160,000

328,500

Closing Entry Number One Debit 1 Service Revenue (sales above) Income Summary Closing entry Number Two Debit 2 Income Summary Travel Expense Booze Expense Purchases Advertising Transportation Hot Fudge Sundae Expense Salary Expense Utilities Expense 115,500 2,000 3,000 85,000 1,000 9,000 2,500 12,000 1,000 Credit 160,000 160,000 Credit

Closing entry Number Three Debit 3 Income Summary Ted Johnson Capital 44,500 44,500 Credit

Closing entry Number Four

Debit

Credit

4 Ted Johnson Capital Ted Johnson Drawing

4,000 4,000

Part 4

Post the entries created in the previous problem to only the T accounts listed below

TED JOHNSON CAPITAL 4,000 135,000 44,500 175,500 BALANCE

TED JOHNSON DRAWING 4,000 Balance 0 INCOME SUMMARY ACCOUNT expenses Closed to capital 115,500 44,500 160,000 sales 44,500 Net Income because revenues > expenses 4,000

Part 5

The Balance Sheet for ABC Company is listed below. Calculate the ratios in the boxes provided:

Cash Accounts Receivable Prepaid Rent Supplies Total Assets

$ 3,000 $ 4,000 $ 5,000 $ 6,000 $ 18,000

Accounts Payable Salary Payable Total Debt Stockholders Equity Total Liabilities and Equity

A. Current Ratio Total Current Assets Total Current Liabilities 18,000 7,000

B. Debt Ratio Total Liabilities Total Assets .39 = 7,000 18,000

Current Ratio= 2.58 =

Debt Ratio =

Part 6

Using the T accounts given below, record the selected transactions.

(Not all T accounts per transactions may have to be used)

BUYERS ENTRIES

Nov. 1 2007 Merchandise/ Inventory 1-Nov 12,000 Purchased $12,000 merchandise on account, Term 1/10, N/30, FOB Shipping Point

Accounts Payable 11/1 12,000

Cash

Nov. 2 2007 Merchandise/ Inventory 1-Nov 2-Nov 12,000 60

Paid the transportation charge of $60

Accounts Payable 11/1 12,000

Cash

Nov. 6 2007 Merchandise/ Inventory 1-Nov 2-Nov 12,000 11/6 60 Nov. 10 2007 Merchandise/ Inventory 1-Nov 12,000 11/6 2,000 2-Nov 60 11/10 100 Bal $9,960 2,000

Return $2,000 of the merchandise bought on November 1

Accounts Payable 6-Nov 2,000 11/1 12,000

Cash

Paid the balance due from November 1st and 6th.

Accounts Payable 6-Nov 10-Nov Bal. 2,000 11/1 12,000 10,000 0

Cash

Balance $9,960

Seller's Entries

Nov. 1 2007 Sold $12,000 merchandise on account (Total cost for this sale equals $8,000). Terms 1/10, N30, FOB Shipping Point I HOPE THIS IS OKAY- I FOUND IT CONFUSING THE OTHER WAY Nov. 6 2007 Received $2,000 of merchandise that was returned to the company. Nov. 10 2007 Received the balance due from November 1st and 6th.

Accounts Recieveable 1-Nov 12,000 6-Nov 2,000 10-Nov 100 10-Nov 9,900 Accounts Receivable 6-Nov 10-Nov

Sales Revenue 2,000 100 balance 1-Nov

balance 0

Cost of Goods Sold 1-Nov balance 8,000 6,600 6-Nov 1,340

Sales Discount Inventory/Merchandise 6-Nov 1,340 1-Nov balance Cash 10-Nov balance 9,900 9,900 8,000 6,600

Credit 3,000

1,000

4,000

2,000

5000

Closing Trial Balance DEBIT CREDIT

$ $

10,000 20,000 $ 7,000

$ $ $

22,000 49,000 96,000 $ $ $ 80,000 25,000 200,000

$ $ $ $ $ $ $

11,000 18,000 9,000 35,000 42,000 $ 312,000 $ 312,000

8,000

-4,600 3,400

3,400 7,500 3,000 13,900

500 1,000 1,500

12,400 1,500 13,900

$ $ $ $ $

3,000 4,000 7,000 11,000 18,000

Cash

Cash 11/2 60

Cash 11/2 60

Cash 11/2 60 11/10 9,900 Balance $9,960

12,000

9,900

You might also like

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- ACCT 2001 Exam 2 Review ProblemsDocument11 pagesACCT 2001 Exam 2 Review Problemsdpa7020No ratings yet

- Chapter 1Document13 pagesChapter 1JacobMauckNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Full Name: Mai Thị Loan Class: 12KT201: Accounting ExercisesDocument9 pagesFull Name: Mai Thị Loan Class: 12KT201: Accounting Exercisesthanhyu13No ratings yet

- Project 2 Workbook AB 1 Wendell PayneDocument11 pagesProject 2 Workbook AB 1 Wendell PayneshirazasadNo ratings yet

- Accounting Sample QuestionsDocument6 pagesAccounting Sample QuestionsScholarsjunction.comNo ratings yet

- Homework QuestionsDocument17 pagesHomework QuestionsANo ratings yet

- Year End Adjustments - Accruals & Prepayments: Woods, Chapter 28 Thomas, Chapter 13Document58 pagesYear End Adjustments - Accruals & Prepayments: Woods, Chapter 28 Thomas, Chapter 13Hendry Heng Wei XiangNo ratings yet

- Exercise Advanced Accounting SolutionsDocument14 pagesExercise Advanced Accounting SolutionsMiko Victoria Vargas75% (4)

- An Introduction To Accounting Module F1Document30 pagesAn Introduction To Accounting Module F1Jason Fry100% (1)

- ACC100 Midterm - Winter 2012 - FINAL SOLUTION - StudentDocument7 pagesACC100 Midterm - Winter 2012 - FINAL SOLUTION - Studentseville240% (1)

- Basic Financial Statements: SolutionsDocument19 pagesBasic Financial Statements: SolutionsPrramakrishnanRamaKrishnanNo ratings yet

- BU127 Quiz Q&aDocument14 pagesBU127 Quiz Q&aFarah Luay AlberNo ratings yet

- 1P91+F2012+Midterm Final+Draft+SolutionsDocument10 pages1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyNo ratings yet

- Correct Response Answer ChoicesDocument11 pagesCorrect Response Answer ChoicesArjay Dela PenaNo ratings yet

- Accounting Cycle ProblemDocument13 pagesAccounting Cycle Problemapi-300305341No ratings yet

- Eshetu Gelagay Ind Ass Acc - For ManagersDocument12 pagesEshetu Gelagay Ind Ass Acc - For ManagersabiyNo ratings yet

- Statement of Cash FolwDocument57 pagesStatement of Cash FolwmibshNo ratings yet

- Cambridge International Examinations General Certificate of Education Ordinary Level Principles of Accounts Paper 1 Multiple Choice October/November 2003 1 Hour 15 MinutesDocument12 pagesCambridge International Examinations General Certificate of Education Ordinary Level Principles of Accounts Paper 1 Multiple Choice October/November 2003 1 Hour 15 MinutesMERCY LAWNo ratings yet

- To Make The Necessary Entries and Calculate The Gain or LossDocument5 pagesTo Make The Necessary Entries and Calculate The Gain or LossMaryam IkhlaqeNo ratings yet

- Accounting 101 - Final Exam Part 4Document15 pagesAccounting 101 - Final Exam Part 4AuroraNo ratings yet

- 7110 w03 QP 1Document12 pages7110 w03 QP 1mstudy123456No ratings yet

- Financial Accounting Lecture EssentialsDocument105 pagesFinancial Accounting Lecture Essentialsmukesh697No ratings yet

- Accounting Week 1Document4 pagesAccounting Week 1Muhammad Fikri MaulanaNo ratings yet

- Uses of Accounting Information and The Financial Statements - SolutionsDocument31 pagesUses of Accounting Information and The Financial Statements - SolutionsmacfinpolNo ratings yet

- Chapter 10 HW, Quiz, Practice ProblemsDocument48 pagesChapter 10 HW, Quiz, Practice Problemsj lo100% (1)

- Accounting Q and ADocument20 pagesAccounting Q and Afirehiwotmisganaw3No ratings yet

- Financial AccountingDocument9 pagesFinancial AccountingAnonymous VmhXGNlFyNo ratings yet

- For The Past Several Years Shane Banovich Has Operated A PDFDocument2 pagesFor The Past Several Years Shane Banovich Has Operated A PDFAnbu jaromiaNo ratings yet

- Orie 3150 HW1 Fa17Document5 pagesOrie 3150 HW1 Fa17Carl WeinfieldNo ratings yet

- Chapter 3 Review Problems With SolutionsDocument13 pagesChapter 3 Review Problems With Solutionsaby251188No ratings yet

- ExerciseDocument4 pagesExerciseICS TEAM50% (2)

- SMCH 12Document101 pagesSMCH 12FratFool33% (3)

- Week 3Document14 pagesWeek 3John PerkinsNo ratings yet

- Intro To Financial Accounting CourseraDocument10 pagesIntro To Financial Accounting CourseraSirius BlackNo ratings yet

- Accounting CH 3Document49 pagesAccounting CH 3mad76857700No ratings yet

- A A P F S: Djusting Ccounts AND Reparing Inancial TatementsDocument39 pagesA A P F S: Djusting Ccounts AND Reparing Inancial TatementsBoo LeNo ratings yet

- What Is AccountingDocument8 pagesWhat Is AccountingBaischenarizah AbdulNo ratings yet

- Dennis DePugh Accounting212Document14 pagesDennis DePugh Accounting212John Perkins0% (1)

- 1101AFE Accounting Principles - Workshop Chapter 2: Page 1 of 4Document4 pages1101AFE Accounting Principles - Workshop Chapter 2: Page 1 of 4张兆宇No ratings yet

- ACC121 FinalExamDocument13 pagesACC121 FinalExamTia1977No ratings yet

- Review Sessiokkbk 1 TEXTDocument6 pagesReview Sessiokkbk 1 TEXTMelissa WhiteNo ratings yet

- Chapter 6 - Receivables and Inventory-2Document35 pagesChapter 6 - Receivables and Inventory-2vamcareerNo ratings yet

- Week5 Stepbytep Je Postng TBDocument22 pagesWeek5 Stepbytep Je Postng TBAngel BambaNo ratings yet

- CH 05Document4 pagesCH 05vivienNo ratings yet

- Practice Exam 1gdfgdfDocument49 pagesPractice Exam 1gdfgdfredearth2929100% (1)

- Chapter 2 - The Accounting CycleDocument36 pagesChapter 2 - The Accounting CycleAlan Lui50% (2)

- Excercise Sheet Lectures 1 and 2 Spring 2022Document16 pagesExcercise Sheet Lectures 1 and 2 Spring 2022Mohamed ZaitoonNo ratings yet

- SSGPDocument60 pagesSSGPElaika DomingoNo ratings yet

- T1.Tutorials 1 Introduction To Fin STMDocument4 pagesT1.Tutorials 1 Introduction To Fin STMmohammad alawadhiNo ratings yet

- MBA 503 - Exam 1Document6 pagesMBA 503 - Exam 1Harshitha AnudeepNo ratings yet

- Review of Ch 1 & 2 Key ConceptsDocument46 pagesReview of Ch 1 & 2 Key ConceptsBookAddict721No ratings yet

- Chapter 4 5 6Document4 pagesChapter 4 5 6nguyen2190No ratings yet

- Prepared by:-CA Priyanka SatarkarDocument31 pagesPrepared by:-CA Priyanka Satarkarnick1425No ratings yet

- Adjustments For Final AccountsDocument39 pagesAdjustments For Final AccountsJainBhupendraNo ratings yet

- Lecture # 1Document34 pagesLecture # 1Arooj khalidNo ratings yet

- Week 2 - Ch.1 Accounting Equation and Financial Statements-W12-SlidesDocument9 pagesWeek 2 - Ch.1 Accounting Equation and Financial Statements-W12-SlidesKumar AbhishekNo ratings yet

- Ch3 For Myself v2 AccountingDocument83 pagesCh3 For Myself v2 AccountinglamdamuNo ratings yet

- Pod 7 Exercise Pod 7Document7 pagesPod 7 Exercise Pod 7fdepianoNo ratings yet

- Pod 5 2 of 2 Closing Entries Exercise 2Document1 pagePod 5 2 of 2 Closing Entries Exercise 2fdepianoNo ratings yet

- Pod 8 ExerciseDocument1 pagePod 8 ExercisefdepianoNo ratings yet

- Pod 8 QuizDocument14 pagesPod 8 QuizfdepianoNo ratings yet

- Pod 5 Closing Entries Both 1 and 2Document10 pagesPod 5 Closing Entries Both 1 and 2fdepianoNo ratings yet

- Pod 6 Gross Profit ExerciseDocument1 pagePod 6 Gross Profit ExercisefdepianoNo ratings yet

- Pod 6 Journal - EntriesDocument3 pagesPod 6 Journal - EntriesfdepianoNo ratings yet

- Pod 7 Exercise Pod 7Document7 pagesPod 7 Exercise Pod 7fdepianoNo ratings yet

- Pod 5 Exercise 3Document4 pagesPod 5 Exercise 3fdepianoNo ratings yet

- Pod 5 Exercise 1 or 2 - Financials - Exercise - 1Document1 pagePod 5 Exercise 1 or 2 - Financials - Exercise - 1fdepianoNo ratings yet

- Pod 5 Exercise 2 of 2 Financials - 2Document1 pagePod 5 Exercise 2 of 2 Financials - 2fdepianoNo ratings yet

- Pod 2 Exercises-2Document9 pagesPod 2 Exercises-2fdepianoNo ratings yet

- Pod 5 1 of 2 Closing Entries Exercise 1-7Document1 pagePod 5 1 of 2 Closing Entries Exercise 1-7fdepianoNo ratings yet

- Pod 4 Trial Balance ProblemDocument2 pagesPod 4 Trial Balance ProblemfdepianoNo ratings yet

- Pod 4 Quiz - 2Document1 pagePod 4 Quiz - 2fdepianoNo ratings yet

- Pod 3 MyTie Journal EntriesDocument2 pagesPod 3 MyTie Journal EntriesfdepianoNo ratings yet

- Pod 2 Journal - EntriesDocument2 pagesPod 2 Journal - EntriesfdepianoNo ratings yet

- Pod 2 Quiz Parts 3 and 4Document8 pagesPod 2 Quiz Parts 3 and 4fdepianoNo ratings yet

- Pod 1 The Accounting Equation-1Document3 pagesPod 1 The Accounting Equation-1fdepianoNo ratings yet

- ACFrOgC3ap IsdwuxtEJ5MGSg 6Co9vDg1-DSyHV2glL1tO WWhGCRh-t7 ASS BNnVcP81mcNrzk0aEBZuDa-iEDL638Dofbm7MKfW-SmIfrCeQZBWuTSl3az1drvYDocument4 pagesACFrOgC3ap IsdwuxtEJ5MGSg 6Co9vDg1-DSyHV2glL1tO WWhGCRh-t7 ASS BNnVcP81mcNrzk0aEBZuDa-iEDL638Dofbm7MKfW-SmIfrCeQZBWuTSl3az1drvYjleafe8957No ratings yet

- Court rules on nullification of title in ejectment caseDocument1 pageCourt rules on nullification of title in ejectment caseNapolyn FernandezNo ratings yet

- European Green Party 11th COUNCIL MEETING Malmö, 16-18th October 2009Document1 pageEuropean Green Party 11th COUNCIL MEETING Malmö, 16-18th October 2009api-26115791No ratings yet

- Music Business PlanDocument51 pagesMusic Business PlandrkayalabNo ratings yet

- 2016-2017 Course CatalogDocument128 pages2016-2017 Course CatalogFernando Igor AlvarezNo ratings yet

- Wonka ScriptDocument9 pagesWonka ScriptCarlos Henrique Pinheiro33% (3)

- Cold ShadowsDocument130 pagesCold ShadowsDrraagh100% (4)

- IMRANADocument4 pagesIMRANAAji MohammedNo ratings yet

- Mx. Gad 2023Document3 pagesMx. Gad 2023Wany BerryNo ratings yet

- The Rocky Mountain WestDocument202 pagesThe Rocky Mountain WestYered Canchola100% (1)

- New Wordpad DocumentDocument2 pagesNew Wordpad DocumentJia JehangirNo ratings yet

- Ola Ride Receipt March 25Document3 pagesOla Ride Receipt March 25Nachiappan PlNo ratings yet

- Festive FeastDocument25 pagesFestive FeastLina LandazábalNo ratings yet

- Personal Values: Definitions & TypesDocument1 pagePersonal Values: Definitions & TypesGermaeGonzalesNo ratings yet

- Pindyck Solutions Chapter 5Document13 pagesPindyck Solutions Chapter 5Ashok Patsamatla100% (1)

- The Left, The Right, and The State (Read in "Fullscreen")Document570 pagesThe Left, The Right, and The State (Read in "Fullscreen")Ludwig von Mises Institute100% (68)

- SimpleDocument3 pagesSimpleSinghTarunNo ratings yet

- Carlos Hidalgo (Auth.) - Driving Demand - Transforming B2B Marketing To Meet The Needs of The Modern Buyer-Palgrave Macmillan US (2015)Document200 pagesCarlos Hidalgo (Auth.) - Driving Demand - Transforming B2B Marketing To Meet The Needs of The Modern Buyer-Palgrave Macmillan US (2015)Marko Grbic100% (2)

- (Julian v. Roberts) The Virtual Prison CommunityDocument233 pages(Julian v. Roberts) The Virtual Prison CommunityTaok CrokoNo ratings yet

- Bautista CL MODULEDocument2 pagesBautista CL MODULETrisha Anne Aranzaso BautistaNo ratings yet

- How To Configure User Accounts To Never ExpireDocument2 pagesHow To Configure User Accounts To Never ExpireAshutosh MayankNo ratings yet

- Grace Song List PDFDocument11 pagesGrace Song List PDFGrace LyynNo ratings yet

- 3.1.bauer Martin-Resistance To New Technology Nuclear Power, Information Technology and Biotechnology 1995Document436 pages3.1.bauer Martin-Resistance To New Technology Nuclear Power, Information Technology and Biotechnology 1995Anonymous 2o0az0zOJNo ratings yet

- PPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerDocument40 pagesPPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerVishwajeet GhoshNo ratings yet

- CPAR and UCSP classes inspire passion for healthcareDocument2 pagesCPAR and UCSP classes inspire passion for healthcareMARIAPATRICIA MENDOZANo ratings yet

- Nifty Technical Analysis and Market RoundupDocument3 pagesNifty Technical Analysis and Market RoundupKavitha RavikumarNo ratings yet

- Usui MemorialDocument6 pagesUsui MemorialstephenspwNo ratings yet

- Asset To LiabDocument25 pagesAsset To LiabHavanaNo ratings yet

- Valuing Human Capital at Infosys Using Lev & Schwartz ModelDocument3 pagesValuing Human Capital at Infosys Using Lev & Schwartz ModelAnchal Jain100% (2)