Professional Documents

Culture Documents

Accounting For Decision Makers (MBA401) - Model Paper

Uploaded by

tgOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Decision Makers (MBA401) - Model Paper

Uploaded by

tgCopyright:

Available Formats

Master of Business Administration (MBA)

1st Semester Accounting For Decision Makers (MBA 7001)

Instructions to candidates

You are allowed two hours to answer this question paper. You are allowed 10 minutes reading time before the examination begins during which you should read the question paper and, if you wish, highlight and/or make notes on the question paper. However, you will not be allowed, under any circumstances, to open the answer book and start writing or use your calculator during the reading time. You are strongly advised to carefully read ALL the question requirements before attempting the question concerned (that is all parts and/or subquestions). ALL answers must be written in the answer book. Answers or notes written on the question paper will not be submitted for marking. You have to answer 2 QUESTIONS only. Write your candidate number, the paper number and examination subject title in the spaces provided on the front of the answer book. Please indicate the questions you have attempted on the front Right hand Corner of the Answer book Only scientific calculators are permitted.

International College of Business and Technology

Page

Master of Business Administration (MBA)

Model Paper 01.

(a) State the components of the financial statements. (b)State five stake holders of a business organization. (c) Briefly explain the following accounting concepts/assumptions. - Business entity concept. -Money measurement concept. -Historical cost concept.

(d) Hiru PLC has been in the business of manufacturing and sale of biscuits. The following information was extracted from the financial statements of the company for the financial year 2010/2011 Current assets (31st March 2011) Inventories (31st March 2011) Inventories (1st April 2010) Current Liabilities (31st March 2011) Net profit before interest and tax Capital employed as at 01/04/2010 Capital employed as at 31/03/2011 Cost of goods sold Interest Expenditure Income Tax Number of shares in issue as at 31/03,2011 Market price per share as at 31/03/2011 Dividend paid during 2010/2011 final year -Rs.250mn -Rs.120mn -Rs.150mn -Rs.190mn -Rs.96mn -Rs350mn -Rs420mn -Rs.530mn -Rs.18mn -Rs.12mn. - 12,250,000 shares. - Rs.80 -Rs.2 Per share

You are required to compute, 1)Earnings per share 2) Current Ratio 3) Return on capital employed (ROCE) 4) Average inventories holding period 5) Interest cover ratio 6) Dividend payout ratio 7) Price Earnings Ratio

Page

International College of Business and Technology

Master of Business Administration (MBA)

(e).You are working as a Management Trainee in XYZ Plc.XYZ Plc has been in the business of manufacturing and sale of Ice Cream. The following information is made available to you from XYZ Plc.

2010/2011

2009/2010

2008/2009

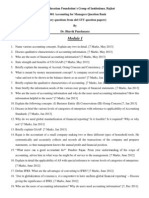

Industry Average. 38%. 26%. 22% 1:2 1:1 60 60 60 4 6.2 48%

Gross profit ratio Net profit ratio Return on capital employed Current ratio Acid test ratio Inventory holding period (days) Debt collection period(days) Creditors payment period(days) Interest cover (times) EPS (Rs.) Gearing ratio

35% 27% 17% 1:4 1:0.7 120 120 20 4.5 12.20 38%

35% 22% 11% 1:3.2 1:0.8 101 90 20 3 9.50 45%

32% (10%) (08%) 1:2.8 1:0.4 60 120 40 0.5 (2.2) 59%

Your Managing Director requests you to analyze the above information and write a detailed report to him detailing the following aspects of the business. -Profitability. -Liquidity -Gearing. -Efficiency of working capital management. Total 50 Marks.

International College of Business and Technology

Page

Master of Business Administration (MBA)

2. (a) What do you understand by an option contract? b) Briefly explain the difference between option contracts and forward contracts ? (c) Mr.Roy is a call writer/seller. Mr.Raj entered into a call contract with Mr. Roy to buy 5000 shares of Maturate plc at the strike price of Rs.20/= per share. This call contract expires on 31st July 2011.Mr.Raj paid Rs.10,000/= to Mr.Roy as the option premium. If the price of a share of maturate PLC drop to Rs.15/= as of 31st July 2011, state the positions of Mr. Roy and Mr. Raj (c) Mr.John (put buyer) purchase a put contract to sell 10000 shares of Udarata PLC to Mr.Travis (put writer)for Rs.50 per share. Mr. John paid a premium of Rs. 10 per share being the option price to Mr.Travis. The put contract will expire on 31st July 2011. Evaluate the position of Mr.John and Mr.Traviss if the share price drops to Rs.30 as of 31st July 2011

(d). State the reason why NPV method is considered as better method of investment appraisal technique when compared with the payback period method.

(e) NM PLC is considering manufacturing a new product. The cost of machinery required for this purpose is Rs.1, 000,000/= , and useful life of the machinery is six years. Scrap value of machinery is Rs.200, 000/=..Cost of the capital of the company is 12%.All sales and expenses are expected to be in cash. Sales per year is Rs.600, 000/= , and expenses per year is Rs.420,000/= including depreciation. Assume sales and expenses are constant over the first six years. Ignore inflation and taxation. i) ii) Using the NPV technique, advice whether the company should accept this project? Compute the IRR of the project?

(Total 50 marks)

Page

International College of Business and Technology

Master of Business Administration (MBA)

3. (a) Briefly explain what you understand by, 1. Relevant cost 2. Sunk cost 3. Fixed cost. 4. Variable cost.

(b). the following information is available to you from Good luck PLC. Present Production and sales Selling price per unit Variable cost per unit -Direct Material -Direct Labour -Variable overhead Fixed cost -500,000 units -Rs 40 -Rs.12 -Rs.8 -Rs.5 -Rs.600, 000

You are required to compute 1. Breakeven point (in unit) 2. Margin of safety (in unit) 3. Number of units to be sold to earn a net profit of Rs.1, 000,000 for the year.

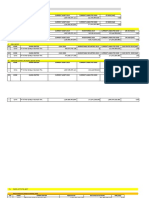

(c)Largest PLC makes two products by using the same Raw material. However Raw material supply is limited to 1200 Kgs per month. Details pertaining to individual products are given below. Product Big small. Contribution per unit (Rs) Raw materials required to produce 1 unit Maximum demand per month (units) 50 5kg 80 70 14kg 120 40 8kg 70 Product Medium Product

International College of Business and Technology

Page

Advice the company as to the quantity of each product to be produced in order to maximize profits?

Master of Business Administration (MBA)

d) TOYO PLC is currently negotiating with an outside supplier regarding outsourcing the device big that it manufactures. The company currently manufactures 20,000 units of device big per annum. The cost incurred to produce 20,000 units is as follows. TOTAL COST IN Rs. (20,000 UNITS) Direct material 500,000 Direct labour 375,000 Variable manufacturing Overhead 50,000 Fixed manufacturing overhead 150,000 Share of non manufacturing fixed overhead 120,000 ---------1,195,000 ===== The above costs are expected to remain unchanged in the foreseeable future period if Auto PLC continues to manufacture the device big The outside supplier has offered to supply 20,000 units of device big at a price of Rs.50/= per unit. If Auto plc outsources the supply of device big, the direct labour force currently employed in producing the device will be redundant. However, no redundancy cost needs to be incurred as they can be deployed in other division of the company. Direct material and variable overhead costs are avoidable if the supply of device big is outsourced. However fixed overhead costs will remain unchanged. You are required to, advice management, whether Auto PLC should produce device big in house or outsource the supply to the outside supplier.

International College of Business and Technology

Page

You might also like

- Baf211 Cost and Management Accounting I Course Outline PDFDocument3 pagesBaf211 Cost and Management Accounting I Course Outline PDFLinked Business SolutionsNo ratings yet

- Far450 Fac450Document8 pagesFar450 Fac450aielNo ratings yet

- Report Into Management Accounting Practices at UnileverDocument7 pagesReport Into Management Accounting Practices at UnileverItz Mee ShahNo ratings yet

- Far450 Fac450Document9 pagesFar450 Fac450aielNo ratings yet

- Principles of Management Series Test 1 Question PaperDocument1 pagePrinciples of Management Series Test 1 Question PaperKailas Sree Chandran0% (1)

- Corporate Finance Current Papers of Final Term PDFDocument35 pagesCorporate Finance Current Papers of Final Term PDFZahid UsmanNo ratings yet

- Tutorial 2 EC306 Solution PDFDocument7 pagesTutorial 2 EC306 Solution PDFRoite BeteroNo ratings yet

- MEF Accounting Question BankDocument5 pagesMEF Accounting Question BankbhfunNo ratings yet

- CH 1 Consolidation (SOFP)Document25 pagesCH 1 Consolidation (SOFP)ranashafaataliNo ratings yet

- Assignment - Market StructureDocument5 pagesAssignment - Market Structurerhizelle19No ratings yet

- Chapter 2 - Project SelectionDocument50 pagesChapter 2 - Project SelectionPraveen SharmaNo ratings yet

- Marketing Management Question Paper 2Document1 pageMarketing Management Question Paper 2Jeevan PradeepNo ratings yet

- Chapter 08 Developing An Effective Ethics ProgramDocument14 pagesChapter 08 Developing An Effective Ethics Programfbm2000No ratings yet

- Individual AssignmentDocument4 pagesIndividual AssignmentFeyisa AyeleNo ratings yet

- Assignment: TopicDocument12 pagesAssignment: TopicAthul RNo ratings yet

- Marketing Research On Bath SoapDocument25 pagesMarketing Research On Bath SoaphkelaskarNo ratings yet

- Planning chapter outlines goals, plans, and strategiesDocument36 pagesPlanning chapter outlines goals, plans, and strategiesVương Anh100% (1)

- Production & Operation ManagementDocument13 pagesProduction & Operation Managementmadhvendra99No ratings yet

- Cost Accounting MCQs and ProblemsDocument5 pagesCost Accounting MCQs and ProblemsEnbathamizhanNo ratings yet

- Assignment - Technology Management)Document22 pagesAssignment - Technology Management)Pankaj Agarwal50% (6)

- LATEXX-AnnualReport2010 (1.9MB)Document90 pagesLATEXX-AnnualReport2010 (1.9MB)Wen HanNo ratings yet

- Operations Management Assignment PDFDocument4 pagesOperations Management Assignment PDFanteneh tesfaw0% (2)

- Case Study, Market StructureDocument3 pagesCase Study, Market StructureNayyar Kalim67% (3)

- BB202 Business Math Group AssignmentDocument2 pagesBB202 Business Math Group AssignmentEricKHLeaw100% (1)

- Question Bank Mba Iii Sem FT 301C Strategic Management Unit's Name No. of QuestionsDocument51 pagesQuestion Bank Mba Iii Sem FT 301C Strategic Management Unit's Name No. of QuestionsTanmay SinhaNo ratings yet

- DSQT1004 Business Statistics Course OverviewDocument9 pagesDSQT1004 Business Statistics Course OverviewAchmadAkbar0% (1)

- Solution Far450 UITM - Jan 2013Document8 pagesSolution Far450 UITM - Jan 2013Rosaidy SudinNo ratings yet

- MKT Exam QuestionsDocument5 pagesMKT Exam QuestionsDivine Daniel100% (2)

- (84650977) Variance Accounting Case Study - PD1Document24 pages(84650977) Variance Accounting Case Study - PD1Mukesh ManwaniNo ratings yet

- Final Assignment Marketing ManagementDocument5 pagesFinal Assignment Marketing ManagementCaroline FrisciliaNo ratings yet

- FinancialManagement MB013 QuestionDocument31 pagesFinancialManagement MB013 QuestionAiDLo50% (2)

- Anna University MBA Strategic Management Important QuestionsDocument1 pageAnna University MBA Strategic Management Important QuestionsAbhinayaa SNo ratings yet

- Chapter 7 SPREADSHEET MODELSDocument46 pagesChapter 7 SPREADSHEET MODELSkeithNo ratings yet

- Advanced Marketing Research RevisedDocument5 pagesAdvanced Marketing Research RevisedSumit AhujaNo ratings yet

- Questions: Temesgen - Worku@aau - Edu.etDocument3 pagesQuestions: Temesgen - Worku@aau - Edu.etHoney HoneyNo ratings yet

- Demand Analysis Question BankDocument3 pagesDemand Analysis Question BanknisajamesNo ratings yet

- MGT4216 Individual Assignment - QuestionDocument2 pagesMGT4216 Individual Assignment - QuestionSu Jiun SoonNo ratings yet

- PROJECT MANAGEMENT FINAL EXAM-shubham.033Document7 pagesPROJECT MANAGEMENT FINAL EXAM-shubham.033Jæy SäwärñNo ratings yet

- E-marketing Strategy TCEO FrameworkDocument4 pagesE-marketing Strategy TCEO FrameworkNary Gurbanova0% (1)

- Sample Level 2 Operations Management ExamDocument23 pagesSample Level 2 Operations Management ExamAnonymous d6Etxrtb100% (3)

- Monopoly Versus Perfect Compitition in PakistanDocument33 pagesMonopoly Versus Perfect Compitition in PakistanZahid Nazir83% (12)

- Southeast University: Assignment For Final Exam Course Code: MGT3125/315 Course Title: Human Resource ManagementDocument8 pagesSoutheast University: Assignment For Final Exam Course Code: MGT3125/315 Course Title: Human Resource ManagementAbir HasanNo ratings yet

- Sample Final Exam Accounting (Aug 2012 ISB 2.1 and 2.2)Document5 pagesSample Final Exam Accounting (Aug 2012 ISB 2.1 and 2.2)Michael DavisNo ratings yet

- Model Question Paper of IBDocument5 pagesModel Question Paper of IBazam49100% (1)

- MBADocument5 pagesMBAYawar AbbasNo ratings yet

- MKT Assignment (MKT Strategy)Document9 pagesMKT Assignment (MKT Strategy)Fahim RajNo ratings yet

- Final Question Paper - Question Bank - Production and Operations Management - MBA 025Document5 pagesFinal Question Paper - Question Bank - Production and Operations Management - MBA 025Dr Rushen Singh80% (5)

- Financial Reporting BriefDocument6 pagesFinancial Reporting BriefSabina NadeemNo ratings yet

- BBA Core Principles of ManagementDocument14 pagesBBA Core Principles of ManagementSubrataTalapatraNo ratings yet

- Managerial Economics Assignment Biruk TesfaDocument13 pagesManagerial Economics Assignment Biruk TesfaBirukee ManNo ratings yet

- eco 文書Document19 pageseco 文書Cindy LamNo ratings yet

- Concept and The Technques of Project ManagementDocument10 pagesConcept and The Technques of Project ManagementMichael NdegwaNo ratings yet

- Evans Berman Answers and ExercisesDocument67 pagesEvans Berman Answers and ExercisesAlishba Kaiser100% (3)

- Maths Primary 1Document13 pagesMaths Primary 1NgocNo ratings yet

- Final Exam Project PlanningDocument4 pagesFinal Exam Project Planningarchie tNo ratings yet

- BA5207-Marketing Management PDFDocument11 pagesBA5207-Marketing Management PDFSsc FoundationsNo ratings yet

- Business Strategy Mid Term Short AnswersDocument4 pagesBusiness Strategy Mid Term Short AnswersMonil ChhedaNo ratings yet

- M1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon SessionDocument20 pagesM1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon Sessionkarunkumar89No ratings yet

- Strategic Corporate Finance - Re-Examination AssignmentDocument5 pagesStrategic Corporate Finance - Re-Examination AssignmentSukrit NagpalNo ratings yet

- AssigmentDocument8 pagesAssigmentnonolashari0% (1)

- 2010 Pakistan USBDocument5 pages2010 Pakistan USBtgNo ratings yet

- Strategy+ +for+websiteDocument38 pagesStrategy+ +for+websiteUsman SafdarNo ratings yet

- 4471 Lecture 2Document30 pages4471 Lecture 2carray de silvaNo ratings yet

- MBA Exam Strategic ManagementDocument10 pagesMBA Exam Strategic Managementtg67% (3)

- The Academic Collocation List: 40+ POS-Tagged CollocationsDocument42 pagesThe Academic Collocation List: 40+ POS-Tagged CollocationsMuhammad Ashraf100% (8)

- Ir 1.2 Growth Strategy Slides Rivers 1303 PPT Tcm13-86707Document16 pagesIr 1.2 Growth Strategy Slides Rivers 1303 PPT Tcm13-86707Tariq ZebNo ratings yet

- Referencing Guidlines1Document32 pagesReferencing Guidlines1tgNo ratings yet

- HSBC's Global Banking Reach and CultureDocument8 pagesHSBC's Global Banking Reach and CulturetgNo ratings yet

- Intro to Web Dev, PHP & MySQL Chapter 1Document44 pagesIntro to Web Dev, PHP & MySQL Chapter 1tgNo ratings yet

- Database SOL QueryDocument1 pageDatabase SOL QuerytgNo ratings yet

- CHAPTER 15: SINGLE ENTRY ACCOUNTINGDocument12 pagesCHAPTER 15: SINGLE ENTRY ACCOUNTINGPaula Bautista100% (2)

- Advanced Final 2018 2019 2eDocument10 pagesAdvanced Final 2018 2019 2eFlorenzOpingaNo ratings yet

- Company History of ACCDocument12 pagesCompany History of ACCHemant SharmaNo ratings yet

- Personal Financial Planning 14th Edition Billingsley Test BankDocument56 pagesPersonal Financial Planning 14th Edition Billingsley Test BankBen Williams100% (36)

- Tugas Rasio WilmarDocument7 pagesTugas Rasio WilmarMuslim HabibieNo ratings yet

- Chap 003Document38 pagesChap 003MichaelFraserNo ratings yet

- Blaine Kitchenware 3Document8 pagesBlaine Kitchenware 3Chris100% (1)

- 2014 AFR NatlGovt Volume IDocument244 pages2014 AFR NatlGovt Volume IErron ParazoNo ratings yet

- PET Plastic Waste Recycling Business Plan Presentaton - 2020Document23 pagesPET Plastic Waste Recycling Business Plan Presentaton - 2020sylvester ekpenNo ratings yet

- Leverage NotesDocument9 pagesLeverage NotesAmit PandeyNo ratings yet

- Annual Report PT. TBT 2019Document119 pagesAnnual Report PT. TBT 2019fajarNo ratings yet

- 20150827161213912.12.prof. Bharati R. HiremathDocument23 pages20150827161213912.12.prof. Bharati R. HiremathMuhammed Rafee100% (1)

- Pharmeasy DRHP SummaryDocument18 pagesPharmeasy DRHP SummaryAyush PansariNo ratings yet

- Accounting DictionaryDocument26 pagesAccounting Dictionarymizo208950% (2)

- AFAR Corporate LiquidationDocument4 pagesAFAR Corporate LiquidationAndres, Rebecca PaulaNo ratings yet

- Chapter 02Document11 pagesChapter 02Saad mubeenNo ratings yet

- Debt equity ratios and financial performance over 5 yearsDocument1 pageDebt equity ratios and financial performance over 5 yearsAbdulAzeemNo ratings yet

- Project Report - FinalDocument62 pagesProject Report - FinalRizwan LodhiNo ratings yet

- Guide To Case AnalysisDocument12 pagesGuide To Case AnalysisNguyễn Hương GiangNo ratings yet

- Procedure for Acquisition Legal PerspectiveDocument40 pagesProcedure for Acquisition Legal PerspectiveHemantVermaNo ratings yet

- ThesisDocument72 pagesThesisRaja SekharNo ratings yet

- Accounting Conservatism and Board of Director CharacteristicsDocument27 pagesAccounting Conservatism and Board of Director CharacteristicsZhang PeilinNo ratings yet

- FSAP Wal-Mart Data and TemplateDocument44 pagesFSAP Wal-Mart Data and TemplateJose ArmazaNo ratings yet

- Stone Container Case DiscussionDocument6 pagesStone Container Case DiscussionAvon Jade RamosNo ratings yet

- Lnvestor Updates (Company Update)Document35 pagesLnvestor Updates (Company Update)Shyam SunderNo ratings yet

- Business Plan: Mobisoft LTDDocument27 pagesBusiness Plan: Mobisoft LTDKayihura Marie PauleNo ratings yet

- ACTBFAR Partnership 1Document22 pagesACTBFAR Partnership 1gab mNo ratings yet

- Term Sheet EquityDocument8 pagesTerm Sheet EquitygargramNo ratings yet

- Annual Report 2016-Part 1Document258 pagesAnnual Report 2016-Part 1Khandaker Amir EntezamNo ratings yet

- Module 5 - Cost of CapitalDocument5 pagesModule 5 - Cost of Capitaljay-ar dimaculanganNo ratings yet