Professional Documents

Culture Documents

Cta Eb No. 86

Uploaded by

matinikkiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cta Eb No. 86

Uploaded by

matinikkiCopyright:

Available Formats

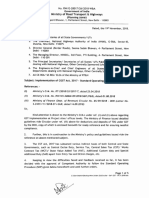

EN BANC [C.T.A. E.B. NO. 86. August 26, 2005.] (C.T.A. CASE NO.

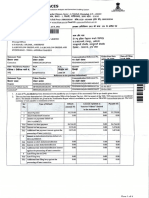

6572) AIR CANADA, petitioner, vs. COMMISSIONER OF INTERNAL REVENUE, respondent. DECISION PALANCA-ENRIQUEZ, J p: Legal Principle Involved: An international airline which has appointed a ticket sales agent in the Philippines and which allocates fares received to various airlines on the basis of their participation in the services rendered, although it does not operate any airplane in the Philippines, is a resident foreign corporation subject to tax on income received from Philippine sources. The Case This is a Petition For Review filed by Air Canada (hereafter "petitioner") under Section 11 of Republic Act No. 9282 (An Act Expanding the Jurisdiction of the Court of Tax Appeals), in relation to Rule 43 of the 1997 Rules of Civil procedure, as amended, which seeks the reversal of the Decision dated December 22, 2004 issued by the First Division of this Court in C.T.A Case No. 6572. The assailed Decision was disposed as follows: "WHEREFORE, premises considered, the Petition For Review is hereby DENIED. SO ORDERED." and the Resolution dated April 8, 2005 denying the Motion For Reconsideration, the dispositive portion of which reads as follows: "WHEREFORE, in view of the foregoing, petitioner's Motion For Reconsideration is hereby DENIED. This Court's Decision of December 22, 2004 is hereby AFFIRMED in all respects. SO ORDERED." THE FACTS Petitioner, Air Canada, a foreign corporation organized and existing under the laws of Canada, was granted an authority to operate as an off-line carrier by the Civil Aeronautics Board (CAB) subject to certain conditions, on April 24, 2000, with said authority to expire on April 24, 2005 (Exhibit "I"). On July 1, 1999, petitioner and Aerotel Ltd., Corporation (hereafter "Aerotel"), entered into a Passenger General Sales Agency Agreement, whereby Aerotel Ltd., Corporation was appointed as petitioner's Passenger General Sales Agent for the territory defined in the said Agreement (Annex "B, Petition for Review). cIHSTC For the taxable quarters covering the 3rd Quarter of the taxable year 2000 up to the 2nd Quarter of the taxable year 2002, petitioner filed and paid its Quarterly and Annual Income Tax Returns On November 28, 2002, petitioner filed its administrative claim for refund with the Bureau of Internal Revenue in the total amount of FIVE MILLION ONE HUNDRED EIGHTY FIVE THOUSAND SIX HUNDRED SEVENTY SIX PESOS AND 77/100 (P5,185,676.77), allegedly representing erroneously paid income taxes from the 3rd quarter of 2000 up to the 2nd quarter of 2002 (Exhibit K). With no response received from the Bureau of Internal Revenue and before it could be barred by prescription, petitioner deemed it proper to elevate its claim to this Court through a Petition for Review filed on November 29, 2002. After trial on the merits, the First Division rendered its assailed Decision on December 22, 2004 in the terms earlier set forth. Not satisfied, petitioner filed a "Motion For Reconsideration", which was denied by the First Division in a Resolution dated April 8, 2005. ISSUES Hence, this Petition For Review raising the following issues: I THE HONORABLE COURT ERRED IN HOLDING THAT PETITIONER IS A RESIDENT FOREIGN CORPORATION SUBJECT TO 32% INCOME TAX ON TAXABLE INCOME UNDER SECTION 28(A)(1) OF THE 1997 TAX CODE. II THE HONORABLE COURT ERRED IN FINDING THAT PETITIONER MAINTAINED A PERMANENT ESTABLISHMENT IN THE PHILIPPINES PURSUANT TO ARTICLE V (2)(I) OF THE RP-CANADA TAX TREATY BY THE APPOINTMENT OF A LOCAL GENERAL SALES AGENT IN THE PHILIPPINES. HESAIT III THE HONORABLE COURT ERRED IN DENYING THE PETITIONER'S CLAIM FOR REFUND OF ERRONEOUSLY PAID INCOME TAX ON GROSS PHILIPPINE BILLINGS BASED ON ITS FINDING THAT PETITIONER IS A RESIDENT FOREIGN CORPORATION SUBJECT TO 32% INCOME TAX ON TAXABLE INCOME UNDER SECTION 28(A)(1) OF THE 1997 TAX CODE. On May 20, 2005, We required respondent to file comment on the petition, within ten (10) days from notice, and also ordered petitioner to submit the Board Resolution and/or Secretary's Certificate authorizing Ms. Divina S. Abad Santos to sign the

verification and certification against forum shopping, within five (5) days from receipt thereof. On June 3, 2005, petitioner filed its "Compliance" with the Resolution dated May 20, 2005. Despite the thirty (30) days extension from May 26, 2005 or until June 27, 2005 granted to the respondent within which to file Comment, to date he has failed to file the same. THE COURT EN BANC'S RULING The petition has no merit. The principal issue raised in this Petition is whether or not the revenue derived by an international air carrier from sales of tickets in the Philippines for air transportation, while having no landing rights in the country, constitutes income of said international air carrier from Philippine source, and accordingly, taxable under Section 24(b)(2) of the National Revenue Code (hereafter NIRC"). This issue has already been laid to rest in a number of cases by the Supreme Court, one of which is the landmark case of Commissioner of Internal Revenue v. British Overseas Airways Corporation, 149 SCRA 395, where it categorically ruled that such revenue constitutes taxable income. Petitioner's contention that the revenue derived by it from its sales of tickets in the Philippines on its off-line flights through its local General Sales Agent cannot be subject to income tax because the same is not sourced within the Philippines cannot be sustained. aCHDST In the aforesaid landmark case of Commissioner of Internal Revenue v. British Overseas Airways Corporation, supra, the Supreme Court ruled: "The Tax Code defines "gross income' thus: "'Gross Income' includes gains, profits, and income derived from salaries, wages or compensation for personal service of whatever kind and in whatever form paid, or from profession, vocations, trades, business, commerce, sales, or dealings in property, whether real or personal, growing out of the ownership or use of or interest in such property; also from interests, rents, dividends, securities, or the transactions of any business carried on for gain or profit, or gains, profits, and income derived from any source whatever. . . .. The definition is broad and comprehensive to include proceeds from sales of transport documents. The words 'income from any source whatever' disclose a legislative policy to include all income not expressly exempted within the class of taxable income under our laws.' Income means 'cash received or its equivalent'; it is the amount of money coming to a person within a specific time . . .; it means something distinct from principal or capital. For, while capital is a fund, income is a flow. As used in our income tax law, 'income' refers to the flow of wealth. The records show that the Philippines gross income of BOAC for the fiscal years 1968-69 to 1970-71 amounted to P10,428,368.00. Did such "flow of wealth" come from "sources within the Philippines"? The source of an income is the property, activity or service that produced the income. For the source of income to be considered as coming from the Philippines, it is sufficient that the income is derived from activity within the Philippines. In BOAC's case, the sale of tickets in the Philippines is the activity that produces the income. The tickets exchanged hands here and payments for fares were also made here in Philippine currency. The situs of the source of payments is the Philippines. The flow of wealth proceeded from, and occurred within, Philippine territory, enjoying the protection accorded by the Philippine government. In consideration of such protection, the flow of wealth should share the burden of supporting the government. A transportation ticket is not a mere piece of paper. When issued by a common carrier, it constitutes the contract between the ticket-holder and the carrier. It gives rise to the obligation of the purchaser of the ticket to pay the fare and the corresponding obligation of the carrier to transport the passenger upon the terms and conditions set forth thereon. The ordinary ticket issued to members of the traveling public in general embraces within its terms all the elements to constitute it a valid contract, binding upon the parties entering into the relationship. ADaSET True Section 37(a) of the Tax Code, which enumerates items of gross income from sources within the Philippines, namely: (1) interest, (2) dividends, (3) service, (4) rentals and royalties, (5) sale of real property, and (6) sale of personal property, does not mention income from the sale of tickets for international transportation. However, that does not render it less an income from sources within the Philippines. Section 37, by its language, does not intent the enumeration to be exclusive. It merely directs that the types of income listed therein be treated as income from sources within the Philippines. A cursory reading of the section will show that it does not state that it is an all-inclusive enumeration, and that no other kind of income may be so considered." The above ruling was adopted in toto in the subsequent case of Commissioner of Internal Revenue vs. Air India and the Court of Appeals, 157 SCRA 648, holding that the revenue derived from its sales of airplane tickets through its agent Philippine Air Lines, Inc., here in the Philippines must be considered taxable income, and in the case of Commissioner of Internal Revenue vs. American Airlines, Inc. and the Court of Appeals, 180 SCRA 276, it was likewise declared that for the source of income to be considered as coming from the Philippines it is sufficient that the income is derived from activities with in this country regardless of the absence of flight operations within the Philippine territory (Commissioner of Internal Revenue vs. Japan Air Lines, Inc. and the Court of Tax Appeals, 202 SCRA 451). Verily, petitioner is a resident foreign corporation under Section 22 of the NIRC of 1997, which states: "SEC. 22. xxx Definitions. When used in this Title: xxx xxx

(H) the term 'resident foreign corporation' applies to a foreign corporation engaged in trade or business within the Philippines.

(I) the term 'non resident foreign corporation' applies to a foreign corporation not engaged in trade or business within the Philippines." There are no specific criteria as to what constitutes "doing" or "engaging in" or "transacting" business. Each case must be judged in the light of the prevailing environmental circumstances. The term implies a continuity of commercial dealings and arrangements, and contemplates, to that extent, the performance of acts or works or the exercise of some of the functions normally incident to, and in progressive prosecution of commercial gains or for the purpose and object of the business organization (The Mentholatum Co., Inc. vs. Anacleto Mangaliman, et al., 72 Phil. 524). In order that a foreign corporation may be regarded as doing business within a state, there must be continuity of conduct and intention to establish a continuous business, such as the appointment of a local agent, and not one of a temporary character (Commissioner of Internal Revenue vs. British Overseas Airways Corporation, supra). Petitioner, during the periods claimed, constituted and maintained Aerotel as its General Sales Agent in the Philippines, under a Passenger General Sales Agency Agreement. The General Sales Agent was engaged, among others, in selling and issuing petitioner's air passenger services, as well as, filing of all necessary tax returns and paying the tax thereon in its behalf. These activities were in exercise of the functions which are normally incident to, and are in progressive pursuit of, the purpose and object of its organization as an international air carrier. There is no doubt that petitioner was "engaged in" business in the Philippines during the period covered by the claim. Accordingly, it is a resident foreign corporation subject to tax upon its total net income received in the preceding taxable year from all sources within the Philippines (Section 28 (A) (1) of the NIRC of 1997, as amended). Considering therefore that petitioner is a resident foreign corporation doing business in the Philippines, pursuant to Section 28(A)(1) of the NIRC of 1997, as amended, it shall be subject to an income tax equivalent to 32% of the taxable income derived from its sale of passage documents here in the Philippines. Having received income while engaged in business and utilizing the resources available to it within the Philippines, and considering that it is not a tax exempt corporation, petitioner cannot claim that it is not liable to the regular income tax of 32% of its taxable income here. It cannot escape tax liability from the clear provisions of the law. We therefore find no reason to overturn the factual findings of the First Division of this Court, which in fine states: "In addition, under the RP-Canada Tax Treaty, more particularly Article V and Article VII, it is clear that petitioner's gross revenues are taxable in the Philippines. To quote the pertinent provisions of the tax treaty: Article VII Business Profits (1) The profits of an enterprise of a Contracting State shall be taxable only in that State unless the enterprise carries on business in the other Contracting State through a permanent establishment situated therein. If the enterprise carries on or has carried on business as aforesaid, the profits of the enterprise may be taxed in the other State but only so much of them as are attributable to: (a) That permanent establishment; (b) Sales of goods or merchandise of the same or similar activities of the same or similar kind as those affected, through that permanent establishment. Article V PERMANENT ESTABLISHMENT (a) For the purpose of this Convention, the term 'permanent establishment' means a fixed place of business in which the business of the enterprise is wholly or partly carried. (b) The term 'permanent establishment' shall include especially: (i) a place of management (ii) a branch (iii) an office (iv) a factory (v) a workshop (vi) a mine, quarry, or other place of extraction of natural resources (vii) a building or construction site or supervisory activities in connection therewith, where such activities continue for a period more than six months (viii) an assembly or installation project which exists for more than three months (ix) premises used as a sales outlet (x) a warehouse, in relation to a person providing storage facilities for others. (Emphasis supplied) By the very provisions of the said Tax Treaty, it is evident that petitioner is taxable on its gross revenues sourced within the Philippines. It bears emphasis that by the provisions itself, 'an enterprise carrying on a business or enterprise in the Philippines through a permanent establishment' is subject to tax in the Philippines. Petitioner, by the appointment of the local General Sales Agent, in which petitioner uses its premises as an outlet where sales of tickets are made, petitioner is deemed to have had established a permanent establishment covered under the RP-Canada Tax Treaty. Petitioner cannot argue the fact that it maintains an agent responsible for sales of tickets for its various flights. ICTcDA Verily, petitioner is a resident foreign corporation subject to income tax here in the Philippines." In sum, all of petitioner's assigned errors failed in the light of jurisprudence and law. WHEREFORE, premises considered, the instant petition is hereby DENIED DUE COURSE, and accordingly, DISMISSED for lack of merit. SO ORDERED. Ernesto D. Acosta, P.J., Lovell R. Bautista, Erlinda P. Uy and Caesar A. Casanova, JJ., concur. Juanito C. Castaeda, Jr. J., voluntarily inhibited.

You might also like

- BIR Ruling (DA-145-07) March 8, 2007Document3 pagesBIR Ruling (DA-145-07) March 8, 2007Raiya AngelaNo ratings yet

- ITAD Ruling 102-2002 May 28, 2002Document5 pagesITAD Ruling 102-2002 May 28, 2002Aine Mamle TeeNo ratings yet

- Cir V. Philippine Airlines, Inc. (2009) : PartiesDocument3 pagesCir V. Philippine Airlines, Inc. (2009) : PartiesAila AmpNo ratings yet

- Philamlife V Cta Case DigestDocument2 pagesPhilamlife V Cta Case DigestAnonymous BvmMuBSwNo ratings yet

- Limpan Investment Corporation v. Commissioner of Internal RevenueDocument1 pageLimpan Investment Corporation v. Commissioner of Internal RevenueEmmanuel YrreverreNo ratings yet

- China Banking Corporation Vs Commissioner of Internal RevenueDocument6 pagesChina Banking Corporation Vs Commissioner of Internal Revenuemarc bantugNo ratings yet

- Javier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesDocument7 pagesJavier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesRean Raphaelle GonzalesNo ratings yet

- Collector V USTDocument4 pagesCollector V USTBigs BeguiaNo ratings yet

- Western Minolco v. CommissionerDocument2 pagesWestern Minolco v. CommissionerEva TrinidadNo ratings yet

- Island Power Corporation V CirDocument2 pagesIsland Power Corporation V Cirralph_atmosfera100% (1)

- CIR V Vda. de PrietoDocument2 pagesCIR V Vda. de PrietoSophiaFrancescaEspinosa100% (1)

- Philippine National Oil Company Vs CaDocument2 pagesPhilippine National Oil Company Vs Cajohn vidadNo ratings yet

- CIR V CTA Smith Kilne & Fresh OverseasDocument2 pagesCIR V CTA Smith Kilne & Fresh OverseasGRNo ratings yet

- 3-Cir VS LealDocument3 pages3-Cir VS LealRenEleponioNo ratings yet

- Philamlife Vs Cta Case DigestDocument2 pagesPhilamlife Vs Cta Case DigestEllen Glae DaquipilNo ratings yet

- Javier v. AnchetaDocument1 pageJavier v. AnchetaGSSNo ratings yet

- CIR v. Tours Specialist Inc.Document2 pagesCIR v. Tours Specialist Inc.Gyrsyl Jaisa GuerreroNo ratings yet

- CIR vs. Lednicky (1964)Document1 pageCIR vs. Lednicky (1964)Emil BautistaNo ratings yet

- CIR Vs General FoodsDocument4 pagesCIR Vs General FoodsMonaVargasNo ratings yet

- PAPER INDUSTRIES CORPORATION OF THE PHILIPPINES (PICOP) v. CA, CIR and CTA, G.R. Nos. 106949-50 (1995)Document2 pagesPAPER INDUSTRIES CORPORATION OF THE PHILIPPINES (PICOP) v. CA, CIR and CTA, G.R. Nos. 106949-50 (1995)Elaine Belle OgayonNo ratings yet

- CIR Vs MeralcoDocument2 pagesCIR Vs MeralcoSherry Mae Malabago100% (1)

- Gancayco Vs CollectorDocument1 pageGancayco Vs CollectorDPMPascuaNo ratings yet

- CIR v. Proctor & GambleDocument4 pagesCIR v. Proctor & GambleRem SerranoNo ratings yet

- 13.d CIR vs. CA and BPI (G.R. No. 117254 January 21, 1999) - H DigestDocument1 page13.d CIR vs. CA and BPI (G.R. No. 117254 January 21, 1999) - H DigestHarleneNo ratings yet

- Ramnani v. CTADocument6 pagesRamnani v. CTAhellomynameisNo ratings yet

- Cir V Itogon-Suyoc MinESDocument2 pagesCir V Itogon-Suyoc MinESkeloNo ratings yet

- Plaridel Surety & Ins Co v. CIR 21 SCRA 1187Document1 pagePlaridel Surety & Ins Co v. CIR 21 SCRA 1187Kyle DionisioNo ratings yet

- ITAD Ruling No 018-09Document11 pagesITAD Ruling No 018-09Peggy SalazarNo ratings yet

- CIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Document1 pageCIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Mini U. SorianoNo ratings yet

- Collector V USTDocument4 pagesCollector V USTCamille Britanico100% (1)

- 40 Nippon Life V CIRDocument2 pages40 Nippon Life V CIRMae SampangNo ratings yet

- MARUBENI CORPORATION vs. COMMISSIONER OF INTERNAL REVENUE AND COURT OF TAX APPEALSDocument3 pagesMARUBENI CORPORATION vs. COMMISSIONER OF INTERNAL REVENUE AND COURT OF TAX APPEALSDkNarcisoNo ratings yet

- CIR v. Juliane Baier-Nickel - SUBADocument2 pagesCIR v. Juliane Baier-Nickel - SUBAPaul Joshua Torda SubaNo ratings yet

- Kuenzle v. CIRDocument2 pagesKuenzle v. CIRTippy Dos Santos100% (2)

- Cir v. GoodrichDocument7 pagesCir v. GoodrichClaudine Ann ManaloNo ratings yet

- CIR vs. Burroghs, G.R. No. 66653, June 19, 1986Document1 pageCIR vs. Burroghs, G.R. No. 66653, June 19, 1986Oro ChamberNo ratings yet

- Digests 1Document5 pagesDigests 1Jopet EstolasNo ratings yet

- CHAN LINTE v. Law UnionDocument3 pagesCHAN LINTE v. Law Unionchappy_leigh118No ratings yet

- Vegetable Corp. V TrinidadDocument1 pageVegetable Corp. V TrinidadLouNo ratings yet

- Malayan Insurance Company, Inc., vs. St. Francis Square Realty CorporationDocument2 pagesMalayan Insurance Company, Inc., vs. St. Francis Square Realty CorporationnanyerNo ratings yet

- People v. CastanedaDocument3 pagesPeople v. CastanedaAiken Alagban LadinesNo ratings yet

- Garrison v. CADocument2 pagesGarrison v. CAershakiNo ratings yet

- M. Construction and Interpretation I. Cir vs. Puregold Duty Free, Inc. G.R. NO. 202789, JUNE 22, 2015Document3 pagesM. Construction and Interpretation I. Cir vs. Puregold Duty Free, Inc. G.R. NO. 202789, JUNE 22, 2015Marry LasherasNo ratings yet

- Henderson V CollectorDocument3 pagesHenderson V CollectorViolet ParkerNo ratings yet

- CIR Vs Glenshaw Glass CoDocument2 pagesCIR Vs Glenshaw Glass CoMCNo ratings yet

- Fernandez Hermanos Vs CirDocument2 pagesFernandez Hermanos Vs CirKim Lorenzo CalatravaNo ratings yet

- CM Hoskins V CIRDocument2 pagesCM Hoskins V CIRSui100% (4)

- 4 7 2 Cir Vs Coa LDocument13 pages4 7 2 Cir Vs Coa LKing BautistaNo ratings yet

- 2018 - PAL vs. CIRDocument2 pages2018 - PAL vs. CIRJimcris HermosadoNo ratings yet

- Cir vs. FilinvestDocument4 pagesCir vs. FilinvestAlphaZuluNo ratings yet

- Gutierrez v. CIR - SubaDocument1 pageGutierrez v. CIR - SubaPaul Joshua SubaNo ratings yet

- Conwi v. Court of Tax Appeals, G.R. No. 48532, August 31, 1992Document6 pagesConwi v. Court of Tax Appeals, G.R. No. 48532, August 31, 1992zac100% (1)

- Phil Refining Co Vs CA - Fernandez Hermanos Inc Vs CIRDocument2 pagesPhil Refining Co Vs CA - Fernandez Hermanos Inc Vs CIRPatrick RamosNo ratings yet

- Kuenzle Vs CIRDocument2 pagesKuenzle Vs CIRHaroldDeLeon100% (1)

- 11 NDC V CIRDocument3 pages11 NDC V CIRTricia MontoyaNo ratings yet

- Marcelo Steel Corporation vs. Collector of Internal RevenueDocument2 pagesMarcelo Steel Corporation vs. Collector of Internal RevenuesakuraNo ratings yet

- Air PhilDocument3 pagesAir Phildeuce scriNo ratings yet

- 180scra 274 (GR 67938) Cir vs. American AirlinesDocument4 pages180scra 274 (GR 67938) Cir vs. American AirlinesRuel FernandezNo ratings yet

- CIR Vs Air IndiaDocument8 pagesCIR Vs Air IndiaThremzone17No ratings yet

- South African Airways v. CIRDocument8 pagesSouth African Airways v. CIRLeidi Chua BayudanNo ratings yet

- RR 20-01Document5 pagesRR 20-01matinikkiNo ratings yet

- RR 19-86Document29 pagesRR 19-86matinikkiNo ratings yet

- RR 30-03Document8 pagesRR 30-03matinikkiNo ratings yet

- RR 16-05Document32 pagesRR 16-05matinikki100% (1)

- RR 18-01Document7 pagesRR 18-01JvsticeNickNo ratings yet

- RR 16-99Document6 pagesRR 16-99matinikkiNo ratings yet

- RR 16-02Document5 pagesRR 16-02matinikkiNo ratings yet

- RR 16-86Document2 pagesRR 16-86matinikki100% (1)

- RR 19-02Document2 pagesRR 19-02matinikkiNo ratings yet

- RR 15-02Document5 pagesRR 15-02matinikkiNo ratings yet

- RR 16-08Document5 pagesRR 16-08matinikkiNo ratings yet

- RR 10-98Document2 pagesRR 10-98matinikkiNo ratings yet

- RR 20-02Document2 pagesRR 20-02matinikkiNo ratings yet

- RR 14-77Document1 pageRR 14-77matinikkiNo ratings yet

- RR 10-13Document5 pagesRR 10-13matinikkiNo ratings yet

- RR 10-08Document30 pagesRR 10-08matinikki100% (1)

- RR 14-00Document6 pagesRR 14-00matinikkiNo ratings yet

- RR 12-01Document6 pagesRR 12-01matinikkiNo ratings yet

- RR 13-98Document13 pagesRR 13-98matinikkiNo ratings yet

- RR 14-01Document9 pagesRR 14-01matinikkiNo ratings yet

- RR 10-76Document4 pagesRR 10-76matinikkiNo ratings yet

- RR 2-98Document41 pagesRR 2-98matinikki100% (2)

- RR 12-98Document3 pagesRR 12-98matinikki100% (1)

- RR 14-02Document9 pagesRR 14-02matinikkiNo ratings yet

- RR 13-99Document10 pagesRR 13-99matinikkiNo ratings yet

- RR 6-08Document19 pagesRR 6-08matinikkiNo ratings yet

- RR 19-86Document29 pagesRR 19-86matinikkiNo ratings yet

- RR 10-10Document4 pagesRR 10-10matinikkiNo ratings yet

- RR 10-02Document5 pagesRR 10-02matinikkiNo ratings yet

- RR 9-98Document5 pagesRR 9-98matinikkiNo ratings yet

- MCQ Taxes Tax Laws and Tax AdministrationDocument4 pagesMCQ Taxes Tax Laws and Tax AdministrationImthe OneNo ratings yet

- Module 1 - Module 3 AnswersDocument13 pagesModule 1 - Module 3 AnswersShelleyNo ratings yet

- Investment Income and Expenses: (Including Capital Gains and Losses)Document76 pagesInvestment Income and Expenses: (Including Capital Gains and Losses)Kenny Svatek100% (1)

- Historical Development of of Taxation Principles and Law in KenyaDocument17 pagesHistorical Development of of Taxation Principles and Law in KenyaJustus AmitoNo ratings yet

- Thesis Tax PlanningDocument6 pagesThesis Tax PlanningSomeoneWriteMyPaperForMeBeaumont100% (2)

- Week 1 Principles of Taxation True or FalseDocument4 pagesWeek 1 Principles of Taxation True or FalsekemeeNo ratings yet

- Questions & Answers: Tax Laws in Tanzania.: Publication TLT-01Document11 pagesQuestions & Answers: Tax Laws in Tanzania.: Publication TLT-01Dennis OndiekiNo ratings yet

- 4.c.t.a. Case No. 4451Document8 pages4.c.t.a. Case No. 4451Lord AumarNo ratings yet

- Strategies For Repatriating Profit From ChinaDocument12 pagesStrategies For Repatriating Profit From ChinaRazni Abd RazakNo ratings yet

- Income Tax of Individuals: Income Taxation 5Th Edition (By: Valencia & Roxas)Document19 pagesIncome Tax of Individuals: Income Taxation 5Th Edition (By: Valencia & Roxas)Love FreddyNo ratings yet

- ABSTRACTDocument30 pagesABSTRACTkelvin ruruNo ratings yet

- Agency Cases UpdatedDocument31 pagesAgency Cases UpdatedCarlo John C. RuelanNo ratings yet

- Adobe Scan 14 Feb 2024Document2 pagesAdobe Scan 14 Feb 2024anusha.veldandiNo ratings yet

- GST Act, 2017-SorDocument6 pagesGST Act, 2017-SorMohit NagarNo ratings yet

- Topic 2-Income Taxation-Part 2Document153 pagesTopic 2-Income Taxation-Part 2Jaymee Andomang Os-agNo ratings yet

- CIR vs. GoodyearDocument19 pagesCIR vs. Goodyearanon_614984256No ratings yet

- 5 Marks - House PropertyDocument188 pages5 Marks - House Propertyjashwant yadavNo ratings yet

- Nonresident Alien Engaged in Trade or BusinessDocument2 pagesNonresident Alien Engaged in Trade or BusinessHEARTHEL KATE BUYUCCANNo ratings yet

- Tax MCQsDocument173 pagesTax MCQsHarleen Kaur100% (1)

- DTC Agreement Between France and AustraliaDocument74 pagesDTC Agreement Between France and AustraliaOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Up Taxation Law Reviewer 2017 PDFDocument267 pagesUp Taxation Law Reviewer 2017 PDFManny Aragones100% (3)

- TAX BRIEFING-NEW RegistrantsDocument57 pagesTAX BRIEFING-NEW RegistrantsPcl Nueva Vizcaya100% (3)

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1LhowellaAquinoNo ratings yet

- LegPhilo Midterms DigestsDocument56 pagesLegPhilo Midterms DigestsJam100% (2)

- Cpa Review School of The Philippines ManilaDocument9 pagesCpa Review School of The Philippines ManilaAbraham Marco De Guzman100% (4)

- FABM2 Q2W3 TaxationDocument9 pagesFABM2 Q2W3 TaxationDanielle SocoralNo ratings yet

- ACC 311 Sample Problem General Instructions:: ST ND RD THDocument1 pageACC 311 Sample Problem General Instructions:: ST ND RD THexquisiteNo ratings yet

- By Mike Schüssler, Brenthurst Wealth Consulting Economist, and Elize KrugerDocument11 pagesBy Mike Schüssler, Brenthurst Wealth Consulting Economist, and Elize KrugerzzlesleyzzNo ratings yet

- Accounting Treatment of Spare PartsDocument4 pagesAccounting Treatment of Spare PartsRiddhi JainNo ratings yet

- G.R. No. 182722Document10 pagesG.R. No. 182722Johari Valiao AliNo ratings yet