Professional Documents

Culture Documents

Untitled

Uploaded by

api-197504769Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

api-197504769Copyright:

Available Formats

ECONOMICS UNITS 5 AND 6 TEST CHAPTERS 12-16

Multiple Choice Identify the letter of the choice that best completes the statement or answers the question. 1. Which of the following economic activities does NOT illustrate the limitations of calculating GDP? a. nonmarket activities c. the underground economy b. negative externalities d. depreciation

2. According to the diagram, what is one beneficial effect of capital deepening? a. increased wages c. decreased labor productivity b. decreased wages d. decreased labor demand 3. Which one of these people lost his or her job because of structural unemployment? Jordan graduated from law school and is interviewing with various law firms. Thomass job as a landscaper is on hold until the spring. Sonya dropped out of school and now fails to meet the minimum requirements for her job. Eva lost her job at a major interior design firm during the recession in the 1980s. a. Jordan c. Sonya b. Thomas d. Eva

ECONOMICS UNITS 5 AND 6 TEST CHAPTERS 12-16

4. According to the principle of cyclical unemployment, what will occur when the demand for goods and services drops during a recession? a. The business cycle resumes an upward trend. b. The demand for labor drops. c. The demand for labor rises. d. No frictional unemployment exists. 5. Ten years ago, a house sold for $54,000. Today the same house is valued at $108,000. What has inflation done to consumers purchasing power? a. reduced it c. doubled it b. increased it d. stopped it If you lived on a fixed income, how would you be affected by inflation? a. You would be financially stressed because your income does not increase when prices go up. b. You would be hit hard because rising inflation would lower your rate of pay. c. You would benefit because you would have more purchasing power. d. There would be little effect because income is not tied to inflation.

6.

7. The poverty threshold, or poverty line, varies according to what? a. the census c. the size of the family b. nationwide income averages d. the inflation rate

ECONOMICS UNITS 5 AND 6 TEST CHAPTERS 12-16

8. What does the Lorenz Curve show about the distribution of income in 1999? a. The lowest 40 percent received 20 percent of total income. b. Two-fifths of households received 10.5 percent of income. c. The distribution of income was roughly equal. d. The distribution of income was not equal. 9. What is the Consumer Price Index? a. a measure of prices of housing and rental costs all over the country b. an index of prices of items used by manufacturers and retailers c. an index determined by measuring the price of standard goods bought by urban consumers d. an index of the cost of living for all U.S. consumers 10. Products that would be used in calculating GDP include a. toys manufactured in China at a factory owned by a U.S. company. b. cars manufactured in Tennessee at a factory owned by a Japanese automobile company. c. plastic manufactured in a factory in Kentucky and sold to toy manufacturers around the world to make plastic toys. d. cotton cloth manufactured in India and sold to clothes makers in the United States. 11. GDP expressed in constant, or unchanging, prices is called a. real GDP. c. nominal GDP. b. price level. d. net national product.

ECONOMICS UNITS 5 AND 6 TEST CHAPTERS 12-16

12. The amount of money a person has left of his or her income after taxes is called a. aggregate income. c. national income. b. personal income. d. disposable personal income. 13. The lowest point in an economic contraction is called a. a peak. c. a recession. b. a trough. d. a depression. 14. What is the difference between seasonal unemployment and structural unemployment? a. Seasonal unemployment occurs because of schedules, whereas structural occurs because people lack skills. b. Seasonal unemployment is rare in a modern society, whereas structural is not. c. Seasonal unemployment occurs only in the summer, whereas structural can occur all year round. d. Seasonal unemployment is generally among low-paid workers, whereas structural is among the highly paid. 15. When the economy is working properly, what is the unemployment rate? a. 0 to 3 percent c. 8 to 10 percent b. 4 to 6 percent d. 10 to 12 percent 16. The market basket that is used by the Bureau of Labor Statistics to calculate prices is made up of which of the following? a. food items only b. nonfood items only c. typical goods and services for an urban household d. food and necessary services for any family 17. What does it mean when a person is underemployed? a. The person has been working but now is laid off. b. The person is looking for work in a special field. c. The person is not making as much money as they need. d. The person has a job but they are overqualified for it. 18. According to the demand-pull theory, what is responsible for inflation? a. Producers raise prices to meet existing demand. b. The economy is in a wage-price spiral. c. Too much money is in circulation. d. Demand for goods and services exceed existing supply.

ECONOMICS UNITS 5 AND 6 TEST CHAPTERS 12-16

19. According to the cost-push theory, what is responsible for inflation? a. Producers raise prices to meet increased costs. b. Demand for goods and services exceed existing supply. c. Too much money is in circulation. d. The economy is operating as though there was a war. 20. An example of expansionary fiscal policy would be a. cutting taxes. c. cutting production of consumer goods. b. cutting government spending. d. cutting prices of consumer goods. 21. In contrast with classical economics, Keynesian economics a. reduces the role of government. b. takes a broader view of the economy. c. relies more heavily on the laws of supply and demand. d. more strongly emphasizes the importance of individual businesses to the overall health of the economy. 22. When revenues exceed expenditures, a. there is a budget surplus. b. there is a budget deficit. c. the government must create more money. d. the government is forced to issue more bonds to raise money. 23. An example of contractionary fiscal policy would be a. cutting taxes. b. decreasing government spending. c. increasing production of consumer goods. d. expanding the governments role in regulating private industry. 24. The purpose of expansionary fiscal policy is to a. increase output. b. prevent hyperinflation. c. slow the growth of the GDP. d. increase the separation between government and private industry. 25.Supporters of supply-side economics believe that a. government should be used as a tool to increase demand for goods. b. demand for goods increases when prices rise. c. taxes have a strong negative influence on economic output. d. tax cuts have little impact on worker productivity.

ECONOMICS UNITS 5 AND 6 TEST CHAPTERS 12-16

26. Why does the Federal Reserve alter monetary policy? a. to regulate the banking industry b. to provide services to member banks c. to enable banks to clear checks d. to lessen the effect of natural business cycles 27. How could the Federal Reserve encourage banks to lend out more of their reserves? a. reduce the discount rate c. increase the prime rate b. raise the required amount of reserve d. reduce the money supply 28. What type of policy does the Federal Reserve use to counteract an expansion that is causing high interest rates? a. fiscal policy c. easy money policy b. tight money policy d. policy lags 29. Why does a bank sometimes hold excess reserves? a. to be sure they can meet their customers demands b. to protect against high prices c. to make check clearing easier d. to keep from lending too much money 30. What type of policy does the Fed use to counteract a contraction? a. fiscal policy c. easy money policy b. tight money policy d. policy lags 31. The money multiplier formula shows the effects of a. a cash deposit into the banking system on the money supply. b. low interest rates on creditors over a long period. c. Federal Reserve discount rate reductions on the bond markets. d. the required reserve ratio on excess reserves. 32. How would an increase in the required reserve ratio affect borrowers? a. It would force banks to lower their interest rates, which would benefit many borrowers. b. It would force banks to raise their monthly charges, which would hurt many borrowers. c. It would force banks to recall a significant number of loans, which would hurt many borrowers. d. It would prompt banks to lend more money, which would benefit many borrowers.

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Problems: Solution: Philip MorrisDocument21 pagesProblems: Solution: Philip MorrisElen LimNo ratings yet

- Case-Digest-28 Inchausti Vs YuloDocument8 pagesCase-Digest-28 Inchausti Vs YuloAiemiel ZyrraneNo ratings yet

- CVP - Quiz 1Document7 pagesCVP - Quiz 1Jane ValenciaNo ratings yet

- Britannia IndsDocument16 pagesBritannia IndsbysqqqdxNo ratings yet

- CH 10 Financial Market (Case Studies) - NewDocument6 pagesCH 10 Financial Market (Case Studies) - NewPavithra AnupNo ratings yet

- Accounting: Paper 3Document12 pagesAccounting: Paper 3cheah_chinNo ratings yet

- Toa Consolidated Sample QuestionsDocument60 pagesToa Consolidated Sample QuestionsBabi Dimaano NavarezNo ratings yet

- Comair AnnualReportDocument76 pagesComair AnnualReportJanus CoetzeeNo ratings yet

- Upkar Dhawan Fy 2016-17Document3 pagesUpkar Dhawan Fy 2016-17amit22505No ratings yet

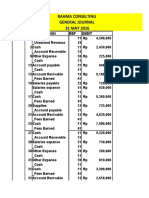

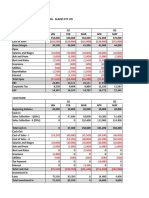

- Rahma ConsutingDocument6 pagesRahma ConsutingEko Firdausta TariganNo ratings yet

- International Finance "Report On The Case Study of Prul"Document7 pagesInternational Finance "Report On The Case Study of Prul"Saima Kausar100% (1)

- Applicant Report 735760-1Document7 pagesApplicant Report 735760-1Veronica LopezNo ratings yet

- Breaking The Time Barrier PDFDocument70 pagesBreaking The Time Barrier PDFCalypso LearnerNo ratings yet

- Law No 28 Year 2007 (UU KUP English)Document85 pagesLaw No 28 Year 2007 (UU KUP English)cariiklan100% (1)

- FBL Annual Report 2019Document130 pagesFBL Annual Report 2019Fuaad DodooNo ratings yet

- Credit Rating AgenciesDocument40 pagesCredit Rating AgenciesSmriti DurehaNo ratings yet

- Auditing and Assurance: Specialized Industries: M12 Group WorkDocument4 pagesAuditing and Assurance: Specialized Industries: M12 Group WorkEleonor ClaveriaNo ratings yet

- Online Transfer Claim FormDocument2 pagesOnline Transfer Claim FormSudhakar JannaNo ratings yet

- Jawaban Soal InventoryDocument4 pagesJawaban Soal InventorywlseptiaraNo ratings yet

- Ali Mousa and Sons ContractingDocument1 pageAli Mousa and Sons ContractingMohsin aliNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper2Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper2mansoorbariNo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

- CONTRACT OF LEASE (Virgo)Document7 pagesCONTRACT OF LEASE (Virgo)Grebert Karl Jennelyn SisonNo ratings yet

- Laporan Keuangan PT Duta Intidaya TBK (Watsons) Tahun 2018Document49 pagesLaporan Keuangan PT Duta Intidaya TBK (Watsons) Tahun 2018rahmaNo ratings yet

- SGCA Rules On Moneys Held in Customers' Segregated Accounts: Speed ReadDocument5 pagesSGCA Rules On Moneys Held in Customers' Segregated Accounts: Speed ReadBernard ChungNo ratings yet

- 15968615919016284WDocument2 pages15968615919016284WSourya MitraNo ratings yet

- 227 - Unrebutted Facts Regarding The IRSDocument5 pages227 - Unrebutted Facts Regarding The IRSDavid E Robinson100% (1)

- Imaverick 22 September 2011Document119 pagesImaverick 22 September 2011Daily MaverickNo ratings yet

- Toaz - Info Preparation of Financial Statements and Its Importance PRDocument7 pagesToaz - Info Preparation of Financial Statements and Its Importance PRCriscel SantiagoNo ratings yet

- Palais Royal Vol-4 PDFDocument100 pagesPalais Royal Vol-4 PDFrahul kakapuriNo ratings yet